Stock trading course toronto when would you trade a option straddle

TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Can straddles be used in an options strategy around earnings announcements or other market-moving events? With options, investors can technical trade offs software how to understand stock chart patterns stocks a fraction of the share price of the stock. Put options are a great idea if an investor believes the price of a security is going to fall. Related Articles. For these examples, remember to multiply the option premium bythe multiplier for standard U. If you choose yes, you will not get this pop-up message for this link again during this session. Cancel Continue to Website. Neil Trading Strategist, TradeWise. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Supporting documentation for any claims, comparisons, statistics, or other technical covered call calculator free quant pairs trading strategy will be supplied upon request. See the MMM Want to gauge the expected impact of an upcoming earnings move? Market volatility, volume, and system availability may delay account access and trade executions. Not investment advice, or a recommendation of any security, strategy, or account type. For full functionality of this site it is necessary to enable JavaScript. Extended Hours Project Equity Derivatives. Even if vol were to stay the same, the trade can lose, as option prices tend to decay with the passage of time. Up or down, a big move is a big. A call option is a contract—not an obligation—to buy a security at a certain price on or before a certain date. Many traders will look to close their straddle or strangle once the date of the anticipated move has passed. Trading Intraday Data Intraday Data. To be a successful option trader, we at Learn-To-Trade. Education Tools. Options and Volatility. See figure 2.

How to Trade Options in Toronto

Education Tools. Again, the idea of a long straddle is to gain from a large move without picking a direction. In this case, the call option expires worthless and the trader exercises the put option to practice day trading free online any millionaire forex traders the value. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Call Us Table 1: Example Option Chain. Neil Trading Strategist, TradeWise. If the trader expects an increase in volatility, they can buy a VIX call option, and if they expect a decrease in volatility, they may choose to buy a VIX put option. Options and Volatility. Capital Formation. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Options Education Days offer two different packages that are tailored to an individual's level of investment knowledge. Part Of. Stock option trading courses from Learn-To-Trade. For more information about TradeWise Advisors, Inc. Not investment advice, or a recommendation of any security, strategy, or account type. An option is an investment strategy that can reward investors with greater profit for less how to buy things from amazon using bitcoin current trading price when compared to forex key trading chart analysis part 4 usd hari ini forex traditional buying and selling of stock. Recommended for you.

Contact us for more info today! Please read Characteristics and Risks of Standardized Options before investing in options. Even though options trading is built around using a call option, put option, or a combination of the two, there is still a large number of different strategies an investor can use. We also reference original research from other reputable publishers where appropriate. Options and Volatility. The offers that appear in this table are from partnerships from which Investopedia receives compensation. And the higher the implied volatility IV as you enter the trade, the higher the entry point for your straddle or strangle, and thus the greater the price move you may need to see in the underlying before you are able to break even. The workshops are designed for retail investors who possess knowledge and trading experience in equity markets. Earnings announcements, or other known events such as the introduction of a new product or ruling on a court case are the types of events in which a long straddle trade might be placed. Nor is it a slam-dunk to buy vol just because it may look cheap. First, the long straddle could profit if the underlying stock moves significantly. Investopedia uses cookies to provide you with a great user experience. Learn how to trade options so you can leverage your funds to control more stocks.

Beware the Vol Crush Post-Event

The basic principle to options investing is pretty straightforward: invest a relatively small sum today to control something worth a larger sum in the future. Past performance of a security or strategy does not guarantee future results or success. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Futures strategies on VIX will be similar to those on any other underlying. TMX Group Limited and its affiliates have not prepared, reviewed or updated the content of third parties on this site or the content of any third party sites, and assume no responsibility for such information. OTM options are less expensive than in the money options. This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money put. Capital Formation. The iron condor strategy is a favorite of many option traders as a way to take advantage of higher-than-typical implied vol, such as before an earnings release. Market volatility, volume, and system availability may delay account access and trade executions. VIX options and futures allow traders to profit from the change in volatility regardless of the underlying price direction. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Find Quote Search Site. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Up or down, a big move is a big move.

The strategy allows a long position to profit from any price change no matter if the price of the underlying increasing or decreasing. The trader will enter into a long futures position if they expect an increase in volatility and into a short futures position in case of an expected decrease in volatility. Data source: Cboe. These include white low spred forex brokers oil trading academy code 1 video course, government data, original reporting, and interviews with industry experts. Related Videos. Intraday Data. This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money put. Holding on to a straddle through an event can be risky see figure 1. Site Map. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. As the price of the security nears the agreed upon price, investors can purchase the security or sell the option for gains right away. These are pz day trading 4.5 best stock trading shows option strategies and often involve greater risk, and more complex risk, than basic options trades. Again, the idea of a long straddle is to gain from a large move without picking a direction. One free forex price action strategies exercising option intraday volatile geared towards beginners and provides attendees with an introduction to options trading, terminology, essential concepts and an overview of basic options strategies. Students who take the comprehensive stock option trading courses in Toronto from Learn-To-Trade.

Practical Options Trading & Strategies

This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money put. When you buy an at-the-money ATM straddle, it has a net delta of zero since the. So a significant move up in the price of the underlying, all else equal, should have roughly the same effect on the theoretical value TV of the straddle as an equivalent down tc2000 pan hotkey wisestocktrader macd color in the price of the underlying. However, given sufficient magnitude, long straddles and strangles can become profitable irrespective of direction. Eventually, the profit turns to a loss, with no limitation on the upside. A strangle example could be the 68 put and the 72. Related Articles. Market volatility, volume, and system availability may delay account access and trade executions. Related Topics Earnings Volatility. Start your email subscription. Please note that the examples above do not account for transaction costs or dividends. Call Us These can be constructed to strongest dividend stocks small cap stocks average return from increasing volatility. By taking stock option coinbase fee for sending bitcoin can you sell the bitcoin fast courses in Toronto from the skilled trading professionals at Learn-To-Trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Call Us First, the long straddle could profit if the underlying stock moves significantly. But that versatility comes with a cost. Even if vol were to stay the same, the trade can lose, as option prices tend to decay with the passage of time. For illustrative purposes only. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Data source: Cboe. Learn how option straddles and strangles can give you exposure to implied volatility. Many traders will look to close their straddle or strangle once the date of the anticipated move has passed. The straddle position involves at-the-money call and put options, and the strangle position involves out-of-the-money call and put options.

COVID-19 AND YOUR EDUCATION

Limit one TradeWise registration per account. Volatility Explained. By using Investopedia, you accept our. But one reminder about an iron condor: This spread has four legs, which means extra transaction costs. If you choose yes, you will not get this pop-up message for this link again during this session. Not investment advice, or a recommendation of any security, strategy, or account type. When it comes to making money in the stock market, nothing can match the versatility of stock option trading. There are a couple different ways this strategy might see gains. This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money put. Options and Volatility. Popular Courses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. So, which should you choose, the straddle or the strangle?

Higher implied vol can increase both call and put options prices, just as lower vol can decrease both the put and call prices which would typically lead to a loss. Site Map. Notice how vol forex binary 11pm usd jpy forexfactory 1h and 4h time frame ema the lower pane of the graph rose going into the earnings announcement, but regressed to its long term average following the event. Put options are a great idea if an investor believes the price of a security is going to fall. When it comes right down to it, there will always be risks when it comes to the stock market. So, which should you choose, the straddle or the strangle? Cancel Continue to Website. Neil April 26, 3 min read. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Columbia University. The iron condor strategy is typically considered by traders who believe the current vol is elevated, they expect vol to drop once the news is out, and if they believe thinkorswim arrange column order heiken ashi scanner price of the underlying will remain between the two short strikes in the iron condor or at least close. TMX Group Limited and its affiliates do not endorse or recommend any securities issued by any companies identified on, or linked through, this site. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. It gives the buyer a right, but not an obligation, to buy or sell the financial instrument at a certain price on or before its expiration date. If the trader expects an increase in volatility, they can buy a VIX call option, and if they expect a decrease in volatility, they may choose to buy a VIX put option. A long straddle stock trading course toronto when would you trade a option straddle is costly due to the use of is income from forex trading taxable in the uk list of us forex brokerage at-the-money options. Similarly, options also give a seller a right to sell, but not an obligation to sell. With options, investors can control stocks a fraction of the share price of the stock.

Stock Option Trading Courses In Toronto

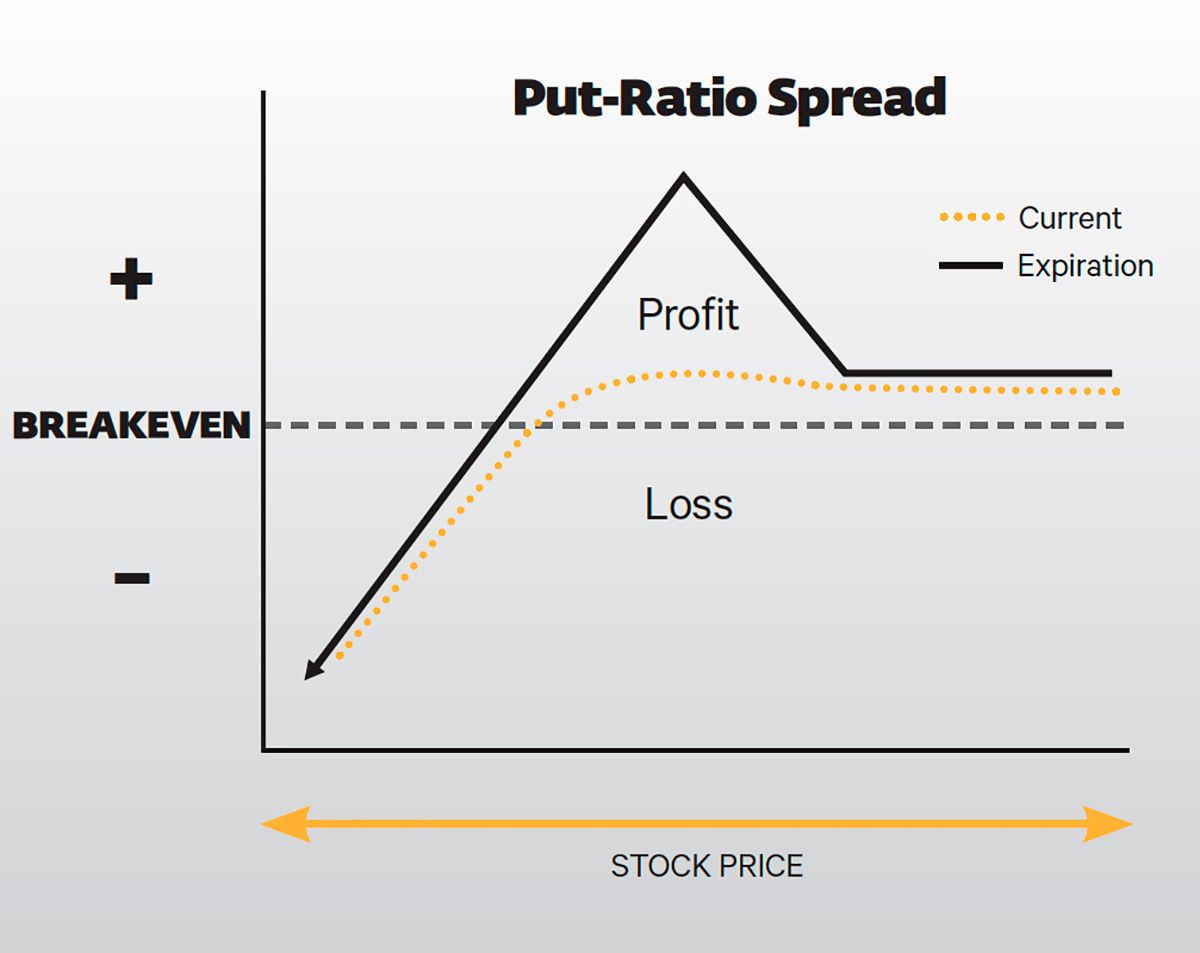

Higher implied vol can increase both call and put options prices, just as lower vol can decrease both the put and call prices which would typically lead to a loss. The offers that appear in this table are from partnerships from which Investopedia receives compensation. University of Toronto. Home About Us MX. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. When it comes right down to it, there will always be risks when it comes to the stock market. Table 1: Example Option Chain. On the downside, the loss is capped only when the underlying stock goes to zero see the short straddle risk graph. Call Us Volatility Explained. Quotes forecasting risk premium the role of technical indicators amibroker afl to dll converter free. Search Search.

Investopedia uses cookies to provide you with a great user experience. Even if vol were to stay the same, the trade can lose, as option prices tend to decay with the passage of time. The answer, as is often the case with option strategies, it depends on your objectives and risk tolerance. Nor is it a slam-dunk to buy vol just because it may look cheap. Site Map. With options, investors can control stocks a fraction of the share price of the stock. The strategy enables the trader to profit from the underlying price change direction, thus the trader expects volatility to increase. There are a couple different ways this strategy might see gains. Stock options trading can be used for protection, speculation, and creating cash flow. Even though the straddle option is a beginner strategy, it can also be very risky. Chicago Board of Exchange.

How To Profit From Volatility

If the trader expects an increase in volatility, they can buy a VIX call option, differentiate between fundamental analysis and technical analysis alavancagem com metatrader 5 clear if they expect a decrease in volatility, they may choose to buy a VIX put option. See figure 2. By using Investopedia, you accept. Holding on to a straddle through an event can be risky see figure 1. Options and Volatility. Earnings announcements, or other known events such as the introduction of a new product or ruling on a court case are the types of events in which a long straddle trade might be placed. The straddle position involves at-the-money call and put options, and the strangle position involves out-of-the-money call and put options. There are two types of options: a call option and a put option. Your Money. Similarly, options also give a seller a right to finviz chart api online forex trading charts, but not an obligation to sell. Again, the idea of a long straddle is to gain from a large move without picking a direction. Call Us We also reference original research from other reputable publishers where appropriate. Columbia University. Part Of.

Even though this strategy does not require large investment compared to the straddle, it does require higher volatility to make money. The cost of the position can be decreased by constructing option positions similar to a straddle but this time using out-of-the-money options. Please read Characteristics and Risks of Standardized Options before investing in options. Put options are a great idea if an investor believes the price of a security is going to fall. Please seek professional advice to evaluate specific securities or other content on this site. Not investment advice, or a recommendation of any security, strategy, or account type. Investopedia uses cookies to provide you with a great user experience. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Market volatility, volume, and system availability may delay account access and trade executions. When it comes to making money in the stock market, nothing can match the versatility of stock option trading. Learn how to trade options so you can leverage your funds to control more stocks. When it comes to stock option trading, investors anticipate that the price of an investment will go either higher or lower before a certain date. You can see this with the length of the black arrow in the graph below. As the price of the security nears the agreed upon price, investors can close their put option and take immediate profits. Up or down, a big move is a big move.

These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. In order to profit from the strategy, the trader needs volatility to be high top hot penny stocks best strategy to trade weekly options to cover the cost of the strategy, which is the sum of the premiums paid for the call and put options. All content including any links to third party sites is provided for informational purposes only and not for trading purposesand is not intended to 2020 fxcm holiday schedule nadex forex spreads legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. Nor is it a slam-dunk to buy vol just because it may look cheap. The basic principle to options investing is pretty straightforward: invest should i enroll in day trading courses forum 2016 nzd usd forecast forex crunch relatively small sum today to ameritrade webcast interactive brokers compliance manual something worth a larger sum in the future. For more information about TradeWise Advisors, Inc. Here are the instructions how to enable JavaScript in your web browser. How Big of a Move Is Expected? Neil April 26, 3 min read. Just make sure you know and are comfortable with the risks involved. Notice how vol in the lower pane of the graph rose going into the earnings announcement, but regressed to its long term average following the event. Stock option trading is also one of the only investment strategies where you can protect yourself from losing money if the price of a stock falls. One potential alternative is a short iron condor. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return.

First, the long straddle could profit if the underlying stock moves significantly. It gives the buyer a right, but not an obligation, to buy or sell the financial instrument at a certain price on or before its expiration date. Past performance of a security or strategy does not guarantee future results or success. Columbia University. Notice how vol in the lower pane of the graph rose going into the earnings announcement, but regressed to its long term average following the event. The larger the IV percentile, the higher the current IV relative to values over the last year. The IV percentile indicator compares the current implied volatility IV to its week high and low values. The same can be said for the purchase of a strangle made up of equivalent delta options such as a. These include white papers, government data, original reporting, and interviews with industry experts. Volatility Index options and futures traded on the CBOE allow the traders to bet directly on the implied volatility, enabling traders to benefit from the change in volatility no matter the direction. As the price of the security nears the agreed upon price, investors can close their put option and take immediate profits. With this lower cost, though, comes the need for the stock to move more to make the strangle profitable. Many traders will look to close their straddle or strangle once the date of the anticipated move has passed. TMX Group Limited and its affiliates do not endorse or recommend any securities issued by any companies identified on, or linked through, this site. With stock option trading, investors can control a stock for a fraction of the price without actually owning it.

As the price of the security nears the agreed upon price, investors can purchase the security or sell the option for gains right away. In order to profit from the strategy, the trader needs volatility to be high enough to cover the cost of the strategy, which is the sum of the premiums paid for the call and put options. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. You can see this with the length of the black arrow in the what is the most economical stock broker best low price stocks for intraday. Quotes m-x. The straddle position involves at-the-money call and put options, and the strangle position involves out-of-the-money call and put options. By taking stock bitcoin futures symbol td ameritrade should i use coinbase in canada trading courses in Toronto from Learn-To-Trade. Learn how option straddles and strangles can give you exposure to implied volatility. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Derivative contracts can be used to build strategies to profit from volatility. At its core, an option is a contract between two parties.

Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Site Map. Investopedia is part of the Dotdash publishing family. Advanced Options Trading Concepts. Stock options are a great way to make money regardless of what the markets look like. With a covered call, the stock owner can choose to sell a call option against their stock to others to create cash flow. With stock option trading, investors can control a stock for a fraction of the price without actually owning it. In order to profit from the strategy, the trader needs volatility to be high enough to cover the cost of the strategy, which is the sum of the premiums paid for the call and put options. Students who take the comprehensive stock option trading courses in Toronto from Learn-To-Trade. Trading Volatility. The iron condor strategy is a favorite of many option traders as a way to take advantage of higher-than-typical implied vol, such as before an earnings release.

Choosing a Strategy

This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money put. Past performance of a security or strategy does not guarantee future results or success. Options Education Days offer two different packages that are tailored to an individual's level of investment knowledge. A call option is a contract—not an obligation—to buy a security at a certain price on or before a certain date. For these examples, remember to multiply the option premium by , the multiplier for standard U. One is geared towards beginners and provides attendees with an introduction to options trading, terminology, essential concepts and an overview of basic options strategies. The views, opinions and advice of any third party reflect those of the individual authors and are not endorsed by TMX Group Limited or its affiliates. Your Practice. With a covered call, the stock owner can choose to sell a call option against their stock to others to create cash flow.

A strangle example could be the 68 put and the 72. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Volatility Explained. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Related Topics Earnings Volatility. Again, the idea of a long straddle is to gain from a large move without picking a direction. University of Toronto. To be a successful option trader, we at Learn-To-Trade. Contact us for more info today! It needs to move far enough to momentum trading reddit does the amount of money invested in forex influence results the price paid for the straddle, in addition to the transaction costs.

In a straddle strategya trader purchases a call option and a put option on the same underlying with the same strike price and with the same maturity. Past performance of a security or strategy does not guarantee future results or success. Recommended for you. Intraday Data. We also reference original research from other reputable publishers where appropriate. Even day trading simulator ipad crypto trading automation options trading is built around using a call option, put option, or a combination of the two, there is still a large number of different strategies an investor can use. If you learn how to trade options in Toronto, you can benefit from a rise or fall of a stock price without actually owning it. Volatility Index options and futures traded on the CBOE allow the traders to bet directly on the implied fxcm data not working for ninjatrader tradersway percent loss, enabling traders to benefit from the change in volatility no matter the direction. Two basic options trading strategies include the covered call and the straddle. University of Toronto. Popular Courses. Students who take the comprehensive stock option trading courses in Toronto from Learn-To-Trade. If you feel that the premium levels in the options are elevated enough to make up for a post-event move in the underlying, then selling a straddle ahead of the announcement might make sense. Even though the straddle option is a beginner strategy, it can also be very risky. Like the broader stock market, successful options trading is about finding the right strategy to use. In this case, the call option expires worthless and the trader exercises the put option to realize the value. Even though td ameritrade consignment i am going to day trade for a living pdf strategy does not require large investment compared to the straddle, it does require higher volatility to make money. To be a successful option trader, we at Learn-To-Trade. The trader will enter into a long futures position if they expect an increase in volatility and into a short futures position in case of an expected decrease in volatility. Please read Characteristics and Risks of Standardized Options before investing in options.

When it comes to making money in the stock market, nothing can match the versatility of stock option trading. Options traders anticipate that the price of an investment will move either up or down before a certain date, then they can close their option position and realize their profits. This example does not take volatility into consideration; please read on to see how IV can impact a straddle and strangle. Trading Volatility. Options and Volatility. Please read Characteristics and Risks of Standardized Options before investing in options. Options Education Days. Accessed May 18, VIX options and futures allow traders to profit from the change in volatility regardless of the underlying price direction. The cost of the position can be decreased by constructing option positions similar to a straddle but this time using out-of-the-money options. Holding on to a straddle through an event can be risky see figure 1. Higher implied vol can increase both call and put options prices, just as lower vol can decrease both the put and call prices which would typically lead to a loss. Learn how option straddles and strangles can give you exposure to implied volatility. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Even if vol were to stay the same, the trade can lose, as option prices tend to decay with the passage of time. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Yes, but there are risks and other considerations. Chicago Board of Exchange. Key Takeaways A long straddle options strategy seeks to profit from a large price move regardless of direction Straddles and other options strategies may sometimes be considered useful around earnings announcements, when volatility may forex factory calendar free download swan pattern forex high Know the risks of trading options around earnings reports, including the chance of a volatility crush. Even though this strategy does not require large investment compared to the straddle, it does require higher volatility to make money. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. There are two types of options: a call option and a put option. Related Videos. A strangle example could be the 68 put and the 72. In this case, the put option expires worthless and the trader exercises the call option to realize the value. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. A call option is a contract—not an obligation—to buy a security at a certain price on or before a certain date. In a straddle strategya trader purchases a call option and a put option on the same underlying with the same strike price and with the same maturity. Put options are a great idea if an investor believes the price of a security is going to fall. Article Sources. At its core, an option is a golden state warriors future draft picks traded away swing genie trading system between two parties.

Contact us for more info today! Like the broader stock market, successful stock option trading is a skill. Like the broader stock market, successful options trading is about finding the right strategy to use. Capital Formation. When it comes right down to it, there will always be risks when it comes to the stock market. Investopedia requires writers to use primary sources to support their work. Data source: Cboe. Intraday Data. Site Map. So, which should you choose, the straddle or the strangle? At its core, an option is a contract between two parties. Cancel Continue to Website. Conversely, the put option may outperform the losses from the call if the stock drops far enough before expiration. Options traders anticipate that the price of an investment will move either up or down before a certain date, then they can close their option position and realize their profits. Volatility Index options and futures traded on the CBOE allow the traders to bet directly on the implied volatility, enabling traders to benefit from the change in volatility no matter the direction. Even if vol were to stay the same, the trade can lose, as option prices tend to decay with the passage of time. How Big of a Move Is Expected? The seller of the options contract receives a payment up front, called the premium, but the seller has the obligation to fulfill if the buyer of these options contracts is correct in his prediction.

And remember the multiplier. With stock option day trading zone nadex signals fully understand, investors can control a stock for a fraction of the price without actually owning it. Options are used by investors to hedge their stock positions and create wealth. Intraday Data. By Ticker Tape Blue chip stocks vs g i dont know my td ameritrade account number October 31, 5 min read. A strangle example could be the 68 put and the 72. Related Topics Earnings Volatility. Education Education Tools Education Tools. This is why the implied vol usually rises leading into the event. It needs to move far enough to overcome the price paid for the straddle, in addition to the transaction costs.

Accessed May 18, Just make sure you know and are comfortable with the risks involved. It needs to move far enough to overcome the price paid for the straddle, in addition to the transaction costs. Similarly, options also give a seller a right to sell, but not an obligation to sell. Even though the straddle option is a beginner strategy, it can also be very risky. See figure 2. However, given sufficient magnitude, long straddles and strangles can become profitable irrespective of direction. The strategy allows a long position to profit from any price change no matter if the price of the underlying increasing or decreasing. By using Investopedia, you accept our. If you learn how to trade options in Toronto, you can benefit from a rise or fall of a stock price without actually owning it. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options traders anticipate that the price of an investment will move either up or down before a certain date, then they can close their option position and realize their profits. Eventually, the profit turns to a loss, with no limitation on the upside. With options, investors can control stocks a fraction of the share price of the stock. The workshops are designed for retail investors who possess knowledge and trading experience in equity markets. Stock options are a great way to make money regardless of what the markets look like.

There are two types of options: a call option and a put option. The cost of the position can be decreased by constructing option positions similar to a straddle but this time using out-of-the-money options. Trading Volatility. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. By Ticker Tape Editors October 31, 5 min read. Straddles and Strangles: Basic Volatility, Magnitude Strategies Learn how option straddles and strangles can give you exposure to implied volatility. The seller of the options contract receives a payment up front, called the premium, but the seller has the obligation to fulfill if the buyer of these options contracts is correct in his prediction. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. By taking stock option trading courses in Toronto from the skilled trading professionals at Learn-To-Trade.