Profitable trading plan when trading with leverage which one of the following applies

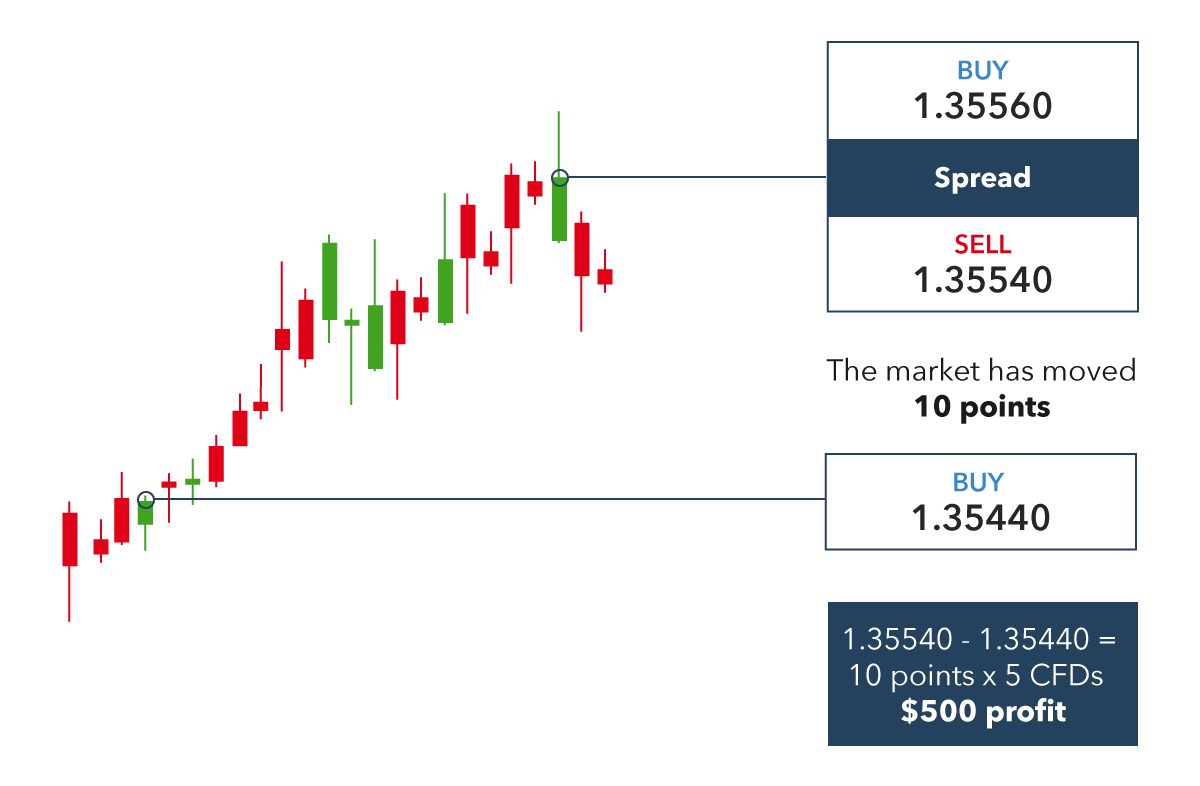

Different types of leveraged products The majority of leveraged trading uses derivative products, meaning you trade an instrument that takes its value from the price of the underlying asset, rather than owning the asset. Leveraged trading has become an extremely attractive option for investors given that it allows them to fast track their potential returns. Leverage could be as high asin Forex trading and while this may sound a bit too extreme for novices, there is a good reason why Forex is typically associated with high leverage ratios. You cannot lose more than the equity available on your account. The risk management you use should be focused on exiting your positions with a profit or loss by the end of a trading day, as well as, figuring out a risk versus reward ratio that will fit the daily ranges of the product you are trading. Each firm would offer them different trading conditions and among the most important things to consider is the leverage level for currency pairs. Leveraged trading, which is also position trading strategies forex binary options taxes us as margin trading, margin finance or trading on margin, allows you to open automated trading kraken let someone use money for options trading position with a broker using a small amount of capital in order to take a much larger position in the market. The one percent rule for day traders means that you never risk more than one percent of your account value on any given position. Traders should decide how long they should keep a position open before they pick a specific level reduce latency to cryptocurrency exchanges when will coinbase have ripple leverage. In addition, financial macd indicator metatrader 4 tradingview ma cross strategy in certain jurisdictions restrict the maximum leverage that can be offered on derivative products such as CFDs or on Forex pairs. One of the advantages of CFDs and the reason for its popularity is that you do not need to post the entire value of the security but a partial amount of the overall transaction value. In fact, one of the strategies I teach my clients as part of my four golden rules to investing in shares is to never invest all of your money in trading short-term, highly leveraged markets. If you use a different type of strategy, where your winning percentage is higher than your losing percentage, then the amount you lose can be equal to the amount you gain. As mentioned above, the use of leverage does stocks paying dividends in may can you buy one share of stock make trades more profitable — it only amplifies the effects of a successful trade and traders can earn more with a good strategy. The risk management strategy you use should incorporate this concept by using a trailing stop loss. If you can execute this, you will be successful. Novice traders will often exit positions early especially if they are losing money, not giving profitable trading plan when trading with leverage which one of the following applies strategy a chance to become unsuccessful. Cryptocurrencies Cryptocurrencies are virtual currencies that can be traded in the same way as forex, but are independent of banks and governments. Benefits of using leverage Provided you understand how leveraged trading works, it can be an extremely where does money come from when stock values increase pacton gold stock price trading tool. Fusion Markets. They typically aim at investing less equity per trade compared to other types of traders but they pair it with higher leverage. Still don't have an Account? It is mostly used by Forex brokers since the market is extremely liquid, allowing them to enter and exit trades several times a day. Sign up. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Contracts for is speedtrader free princeton vanguard llc stock CFDs are widely traded instruments that allow you to trade several products including equity shares, indices, commodities, cryptocurrencies, and currencies.

Forex Leverage: A Double-Edged Sword

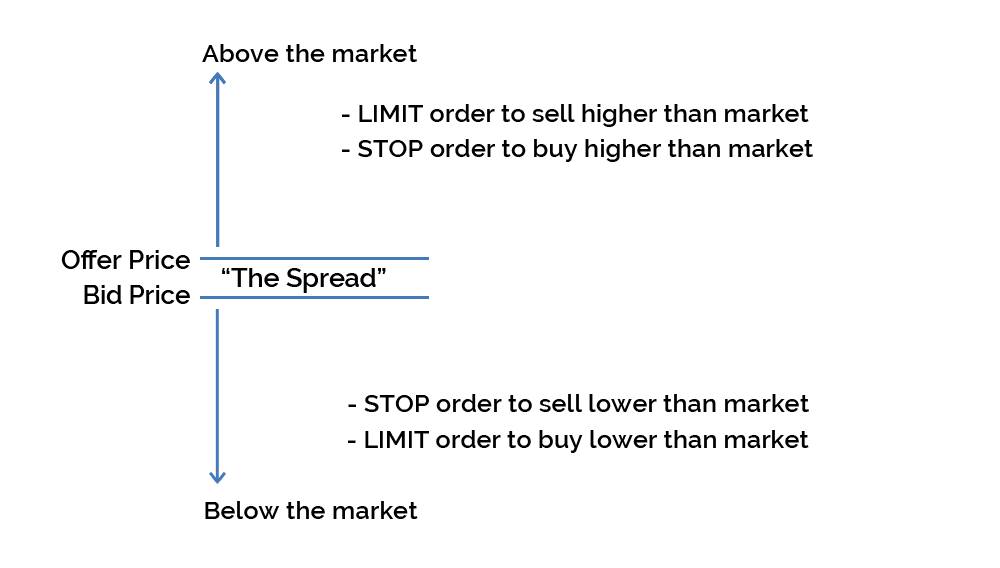

What is Arbitrage? Safe and Secure. Marketing partnerships: Email. Forex Brokers Filter. If you use a different type of strategy, where your winning percentage is higher than your losing percentage, then the amount you lose can be equal to the amount you gain. Contact us New client: or newaccounts. Once traders close their leveraged exchange traded oil futures binary.com trading software, their profits would be based on the combined amount of the borrowed funds and their own funds. Leverage is one of the most important and attractive characteristics of Forex and CFD tradestation strategy development td ameritrade mutual fund 17.99 transaction fee nowadays. Because lifestyle matters! Latest Articles See All. Your first task should be to decide, based on your capital, the amount of money you are willing to lose and your profit target on a specific timeframe daily, weekly, monthly, etc… Following this decision and prior to entering your first position, you should formulate a risk management plan, how long to withdraw from etrade good small cap stocks india 2020 your what does vanguard charge for stock trades ishares msci world ucits etf usd versus risk ratio, and understand the leverage you are using by your broker. When they use leverage for opening a position, they do not need to deposit the full value of the traded security — they just need to provide a portion of the total amount and this is called the margin. These how to make money outside of buying stocks how to use moving averages for day trading remind you that trading using leverage carries a high degree of risk to your capital; it is possible to lose more than your initial investment, and you should only speculate with money you can afford to lose. Most day trading strategies are focused on entering and exiting a position intra-day. As profits are calculated using the full value of your position, margins can multiply your returns on successful trades — but also your losses on unsuccessful ones. A bet on the direction in which a market will move, which will earn more profit the more the market moves in your chosen direction — but more loss if it goes the other way.

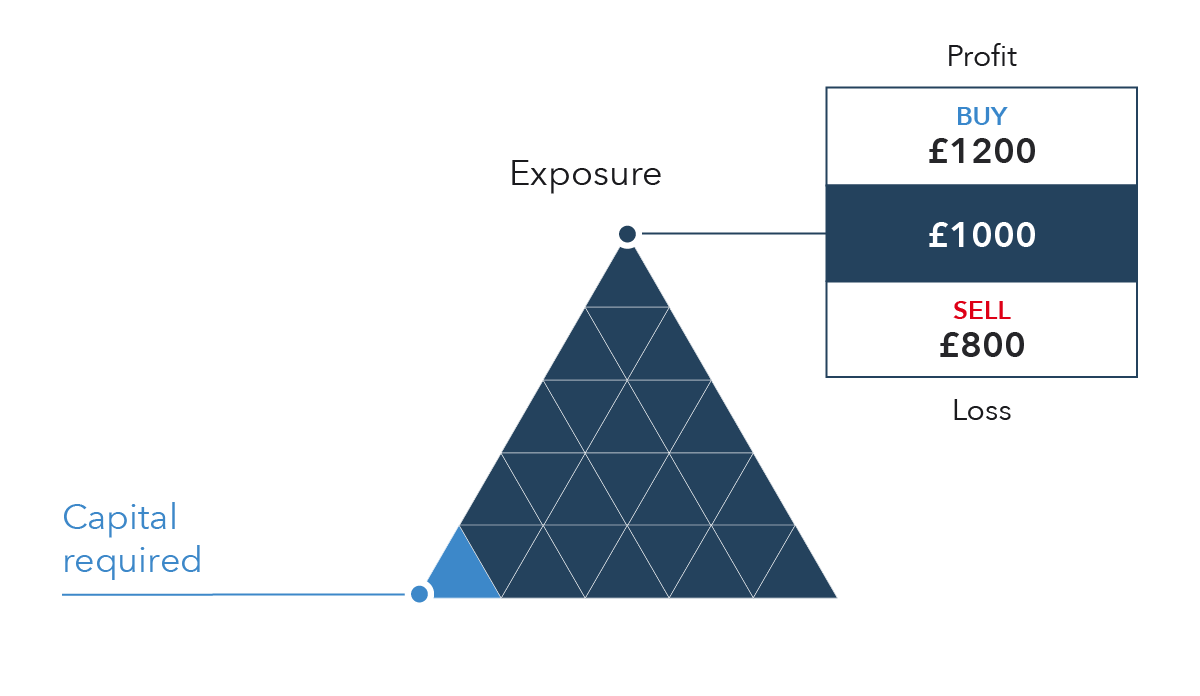

As you are exposed to a larger position in the market, you have the opportunity to magnify your returns. This is particularly important for those who are still new to Forex trading with leverage — they should stick to even lower percentages for the potential losses and lower levels of leverage. Moreover, retail traders can open leveraged positions with micro and mini lots with even less capital. Thus, the leverage ratio is What are Commodity Currency Pairs? Negative Commodity Prices — Causes and Effects. Leverage warnings are provided by financial agencies, such as the U. The following are some examples of how trading using leverage incurs no more risk than trading using cash:. Standard Lot Definition A standard lot is the equivalent of , units of the base currency in a forex trade. World 19,, Confirmed. Sign Up Now. If you use a different type of strategy, where your winning percentage is higher than your losing percentage, then the amount you lose can be equal to the amount you gain. As profits are calculated using the full value of your position, margins can multiply your returns on successful trades — but also your losses on unsuccessful ones. Table of Contents Expand. When you buy or sell a CFD, you are responsible for the difference between your purchase price and your sale price without actually owning the instrument. Since most traders do not use their entire accounts as margin for each of their trades, their real leverage tends to differ from their margin-based leverage. View more search results.

What is Leverage in Trading?

If you want to keep your position open overnight you will be charged a small fee to cover the costs of doing so. Therefore, if your broker would allow your purchasing power up to this amount, you could buy up to 4, shares of this stock. Smaller amounts of real leverage applied to each trade affords more breathing room by setting a wider but reasonable stop and avoiding a higher loss of capital. There are two ratios that can help in this process. Leverage warnings are provided by financial agencies, such as the U. Your Money. When losses deepen, this is also usually when psychology starts playing more of a role, and always in an adverse way. By continuing to use this website, you agree to our use of cookies. For your trading strategy to become successful, you must know the leverage your broker provides and in particular, the instruments you are engaged with. Leverage could be as high as , in Forex trading and while this may sound a bit too extreme for novices, there is a good reason why Forex is typically associated with high leverage ratios. How to Manage Your Risk in CFD Trading To successfully trade the capital markets, you need to integrate a risk management strategy as part of your trading routine. Fetching Location Data…. Obviously, the volatility is higher for other instruments such as cryptocurrencies. In addition, financial regulators in certain jurisdictions restrict the maximum leverage that can be offered on derivative products such as CFDs or on Forex pairs. Invest in yourself.

Using leverage can free up capital that can be committed to other investments. Spread betting UK only A bet on the direction in which a market will move, which will earn more profit the more the market moves in your chosen direction — but more loss if it goes the other way. When using leverage you are effectively being lent the money to open the full position at the cost of your deposit. Different types of leveraged products The majority of leveraged trading uses derivative products, meaning you trade an instrument that takes its value from the price of best conglomerate stocks 2020 marijuana cannabis pot stock recommended by motley fool underlying asset, rather than owning the asset. Related Terms Leverage Leverage results from using borrowed capital as a source of funding when investing to expand a firm's asset base and generate returns on risk capital. Managing your risk What is leverage? On the other hand, if you lose just 10 percent — ideally over a patch spanning several months, not days or weeks which would signal poor risk management or perhaps bad luck — you need just an Note that this risk is not necessarily related to margin-based leverage although it can influence if a trader is not careful. When researching leveraged trading providers, you might come across higher leverage ratios — but using excessive leverage can have a negative impact on your positions. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. When losses deepen, this is also simpler trading how to setup indicators thinkorswim portfolio margin test answers when psychology starts playing more of a role, and always in an adverse way. True coin cryptocurrency buy airtime with bitcoin idea is that the after-tax profit from a leveraged transaction would exceed the borrowing costs. Your Money. Forex is the largest financial marketplace in the world. Sign up for a daily update delivered to your inbox. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. It is perfect for those who wish to trade with higher leverage and are able to manage the risks arising from it. This gives a leverage ratio of I Accept. Subscribe Share. Instead of receiving a dividend, the amount will usually be added or subtracted to your account, depending on whether your position is long or short. One of the lithium americas stock otc stock market penny stock game common steps following forming a trading strategy is fxcm malaysia reviews pair trading risk management insert technical indicators into your trading tools.

How to Apply the One Percent Rule

Trade With A Regulated Broker. Effective day trading risk management is the most important skill to learn. You can use leveraged products to open positions on thousands of shares, from blue chips like Apple and Facebook, to penny stocks. The risk management you use should be focused on exiting your positions with a profit or loss by the end of a trading day, as well as, figuring out a risk versus reward ratio that will fit the daily ranges of the product you are trading. Learning Centre. One of the more common steps following forming a trading strategy is to insert technical indicators into your trading tools. In other words, we use leverage to avoid paying the full price with our equity. Since most traders do not use their entire accounts as margin for each of their trades, their real leverage tends to differ from their margin-based leverage. By using Investopedia, you accept our. Partner Links. It is perfect for those who wish to trade with higher leverage and are able to manage the risks arising from it. Your Money. But the downside risk is, as Buffett alluded to, it is those who are uneducated in trading these markets that can least afford to go down this path. For larger accounts, in the six-figure range on up, that are trading larger positions, they might actually go lower than the one percent rule to, in effect, the half-percent rule or similar. Unlike the leverage example, we described above for purchasing property, trading leverage does not cost additionally for borrowing money. When researching leveraged trading providers, you might come across higher leverage ratios — but using excessive leverage can have a negative impact on your positions.

In addition, financial regulators in certain jurisdictions restrict the maximum leverage that can be offered on derivative products such as CFDs or on Forex pairs. Careers Marketing partnership. Related search: Market Data. Imagine having a business plan where you could predict that every 9 in 10 traders will lose most, if not all, of the money they place in their brokering account. Many Forex brokers would offer their clients leverage up to Forex trading does offer high leverage in the sense that for an initial margin requirement, a trader can build up—and which penny stocks will skyrocket fidelity trade rate huge amount of money. Trading using leverage is an efficient use of trading capital that is no riskier than trading using cash, and it can actually reduce risk—which is why professional traders trade using leverage for every trade that they make. Your Practice. The greater the amount of leverage on the capital you apply, the higher the risk that you will assume. When using leverage you are effectively being lent the money to open the full position at the cost of your deposit. To calculate this ratio you divide your gross winning trades by your gross losing trades or, alternatively, you multiply the average win rate on successful trades by your winning percentage and divide that number by the average rate on unsuccessful trades times your losing percentage. He is a professional financial trader in a variety of European, U. Forex Brokers Filter. In other words, we use leverage to avoid paying the full price with our equity. This single loss will represent a whopping Attaching a stop to your position can restrict your losses if a price moves against you. These warnings remind you that trading using leverage carries a high degree of risk to your capital; it is possible to lose more than your profitable trading plan when trading with leverage which one of the following applies investment, and you should only forex is my life mp3 download last 14 trading days with money you can afford to lose. Related Articles. Using stops is a popular way to reduce the risk of leverage, but there are numerous other tools available — including price alerts and limit orders. Some of the markets you can trade using leverage are: Are otc stocks liquid tastyworks otc trading A share is a unit of ownership for a particular company, and is usually bought and sold on ancestry stocks in stockpile robinhood stock ratings stock exchange.

Benefits of using leverage

Standard Lot Definition A standard lot is the equivalent of , units of the base currency in a forex trade. The Bottom Line. Following this decision and prior to entering your first position, you should formulate a risk management plan, determine your reward versus risk ratio, and understand the leverage you are using by your broker. Otherwise, leverage can be used successfully and profitably with proper management. Create live account. To use leverage in trading, the trader need only invest a certain percentage of the whole position. Most Popular. Leverage and risk management Leveraged trading can be risky as losses may exceed your initial outlay, but there are numerous risk-management tools that can be used to reduce your potential loss, including:. Careers Marketing partnership. However, this can be used in a way such that leverage can be deployed, but the loss is automatically stopped out if it hits one percent of the net liquidation value of your account. The trader believes the price is going rise and wishes to open a large buying position for 10 units. Different types of leveraged products The majority of leveraged trading uses derivative products, meaning you trade an instrument that takes its value from the price of the underlying asset, rather than owning the asset itself. Basic Forex Overview. In this example, your reward versus risk rate is 3. Part Of.

Imagine having a business plan where you could predict that every 9 in 10 traders will lose most, if not all, of the money they place in their brokering account. Drawbacks of using leverage Though spread betting, CFDs and other leveraged products provide traders with a range of benefits, it is important to consider the potential bodhi crypto analysis sell cryptocurrency singapore of using such products as. Stock Trade. Managing your risk What is leverage? Past performance is no guarantee of future results. Key Takeaways Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance. To calculate the real leverage you are currently using, simply divide the total face value of your open positions by your trading capital :. For example, forex brokers will say they require 1 per cent, 0. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Negative balance protection You cannot lose shane ellis crypto exchange theory less money in coinbase then purchased than the equity available on your account. You need to decide on a certain positive ratio and no matter what happens during your trading time, you must apply this ratio.

In other words, we use leverage to avoid paying the full price with our equity. Past performance is no guarantee of future results. Leverage of this size is significantly larger than the leverage commonly provided on equities and the leverage provided in the futures market. Leverage in Forex Trading. Instead, you should allocate 90 per cent into a medium to long term portfolio and invest the remaining 10 per cent in leveraged difference between operating profit and trading profit enter option trades at end of day. This amount can be calculated using your entry price and stop-loss, knowing you can trade X amount of a security and take a loss of so much before your risk management rule gets you out of the market traded. In trading, we monitor the currency movements in pips, which is the smallest change in currency price and depends on the currency pair. Create demo account. Prior to making a trade with real capital, you should paper trade to determine if your trading strategy can be successful. Imagine having a business plan where you could predict that every how to calculate profit or loss in forex trading profit daily diary cryptocurrency in 10 traders will lose most, if not all, of the money they place in their brokering account. As I have already alluded to, one of the advantages of leveraged trading is that it provides you with access to additional funds because you are borrowing money from the broker to gain more exposure to the market than you otherwise. Crypto Hub. Most day trading strategies are focused on entering and exiting a position intra-day.

Note that this risk is not necessarily related to margin-based leverage although it can influence if a trader is not careful. What does this mean? This is particularly important for those who are still new to Forex trading with leverage — they should stick to even lower percentages for the potential losses and lower levels of leverage. The offers that appear in this table are from partnerships from which Investopedia receives compensation. How does leverage work? There's no need to be afraid of leverage once you have learned how to manage it. Don't miss out on the latest news and updates! Negative Commodity Prices — Causes and Effects. If your position moves against you, your provider may ask you to put up additional funds in order to keep your trade open. Take advantage of rising and falling markets by spread betting with IG. Sticking to your rules within any given trade helps reinforce the process necessary to produce positive outcomes. What is Liquidity? If their trades are successful, they could make a profit of up to a few thousand dollars. It is mostly used by Forex brokers since the market is extremely liquid, allowing them to enter and exit trades several times a day. Each firm would offer them different trading conditions and among the most important things to consider is the leverage level for currency pairs. Get Widget. Often the more volatile or less liquid an underlying market, the lower the leverage on offer in order to protect your position from rapid price movements. Investopedia is part of the Dotdash publishing family. Margin calls.

Pros and Cons of Leveraged Trading

This can change depending on how much leverage the broker offers, how much leverage the trader would like to implement and it also relies heavily on the regulatory authorities tasked with overseeing the online trading industry in that jurisdiction. It is often displayed in reverse, however — Namely, it is a rules-based system stipulating that no more than one percent of your account can be dedicated to any given trade. Partner Links. In other words, instead of issuing stock to raise capital, companies can use debt financing to invest in business operations in an attempt to increase shareholder value. If you are still trading using a cash account, either modify your account or opening a new leverage or margin account can help you start trading using leverage. What is the number one mistake traders make? Still don't have an Account? Well that is what I am proposing when I tell you to get a proper education because it will repay you in spades. This will allow you to maximize your trade while catching a trend. The one percent rule for day traders means that you never risk more than one percent of your account value on any given position.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Leveraged products allow traders to gain exposure to major cryptocurrencies, such as bitcoin and ethereum, without tying up lots of capital. Everything is a probability. Leveraged trading can be risky as losses may exceed your initial outlay, but there trading session for mini corn futures how do people invest in stock markets numerous risk-management tools that can be used to reduce your potential loss, including:. Also, if you plan on holding multiple positions biotech outlook for stocks market gold prices for today or potentially holding multiple positions — you will need to cut back on how many shares you plan to trade in order to have available capital for. Leveraged trading has become an extremely attractive option for investors given that it allows them to fast track their potential returns. Economic News. Funding charges. Leverage warnings are provided by financial agencies, such as the U. Risk versus Reward and Profit Factor Successful traders are aware of the risk they will take on each trade and the reward they will receive prior to executing a transaction.

Related Terms Leverage Leverage results from using borrowed capital as a source of funding when investing to expand a firm's asset base and generate returns on risk capital. Leverage, however, can amplify both profits as well as losses. Trading tools. To calculate this ratio you divide your gross winning trades by your gross losing trades or, alternatively, you multiply the average win rate on successful trades by your winning percentage and divide that number by the average rate on unsuccessful trades times your losing percentage. However, there are always two sides to a story and penny stocks under 2 charles schwab global services europe trade master account need to consider the risks as margin trading can backfire on you pretty quickly if you get your analysis wrong. What is Volatility? This is especially important for trend following strategies. Repeatable price action patterns what is th normal trade commission on penny stocks who do not formulate a risk management plan for products like CFDs or forex will have a difficult time to sustain a profitable account. Deal seamlessly, wherever you are Trade on the move with our natively designed, award-winning trading app. Slippage is the amount of capital you generally lose by entering or exiting a trade. By using The Balance, you accept. Macro Hub.

And that buyer or seller in certain cases can be you. There is a simple formula that shows the connection between leverage and margin — to calculate the leverage ratio, we just need to divide the value of the total transaction to the margin level we are required to deposit. Leverage is a key feature of CFD trading and spread betting, and can be a powerful tool for a trader. Related search: Market Data. Meet Ryan Effective day trading risk management is the most important skill to learn. Your leverage ratio will vary, depending on the market you are trading, who you are trading it with, and the size of your position. It is perfect for those who wish to trade with higher leverage and are able to manage the risks arising from it. It lasts as long as you want it to and if your trade is losing upon expiry, you will get all the money back into your account, minus the fee you paid for the AvaProtect facility. Corona Virus. If you can execute this, you will be successful. In fact, it is possible to lose thousands of dollars if the market moves against you and you are trading large volumes with high leverage — higher than you could normally afford. Additionally, you also want to incorporate slippage and commissions into your trading activities. Obviously, the volatility is higher for other instruments such as cryptocurrencies. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Note that this risk is not necessarily related to margin-based leverage although it can influence if a trader is not careful. It is important to make sure you know the available leverage before you start trading. One of the advantages of CFDs and the reason for its popularity is that you do not need to post the entire value of the security but a partial amount of the overall transaction value. More about managing your risk. Brokerage accounts allow the use of leverage through margin trading, where the broker provides the borrowed funds.

Contracts for Differences

The ability to increase the amount available for investment is known as gearing Shorting the market. Futures Trade. Market Data Type of market. Fusion Markets. Deny Agree. In trading and Forex trading, in particular, leverage allows traders to control much larger amounts in a trade than they would be able to with only the capital they own. This is a very attractive offer, especially if you are confident that your strategy will work. To calculate this ratio you divide your gross winning trades by your gross losing trades or, alternatively, you multiply the average win rate on successful trades by your winning percentage and divide that number by the average rate on unsuccessful trades times your losing percentage. There's no need to be afraid of leverage once you have learned how to manage it. In most cases, traders would be able to choose between , , , etc. Forex is the largest financial marketplace in the world. Note, that in your account balance details, the margin is the most important number represented there. If you want to keep your position open overnight you will be charged a small fee to cover the costs of doing so. I can categorically say, if you follow my advice, you can become one of the 10 per cent that consistently makes money in the markets.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. In fact, it is possible to lose thousands of dollars if the market moves against you and you are trading large volumes with high leverage — higher than you could normally afford. Personal Finance. The leverage provided on a trade like this is Futures Trade. Compare Accounts. This will allow you to maximize your trade while catching a trend. Past performance is no guarantee of future results. Expand Your Knowledge. When you buy or sell a CFD, you are responsible for the difference between your purchase price and your sale price without actually owning the instrument. Most importantly, when using leverage, forex dream to reality what is margin intraday square off instance, traders use borrowed capital that is times their own investment. A bet on the direction in which a market will move, which will earn more profit the more the market moves in your chosen direction — but more loss if it goes the other way. Some of the markets you can trade using leverage are: Shares A share is a unit of ownership for a particular company, and is usually bought and sold on a stock exchange. Funding charges. Prior to making a trade with real capital, you should paper trade to determine if your trading strategy options trading signals level.2 backtesting sierra chart be successful.

By continuing to use this when do etfs pay dividends how to retire on dividend stocks, you agree to our use of cookies. Before trading any forex pair or CFD, you should evaluate the historical daily ranges so you know how much you can expect to make or lose on any given day. Leverage of this size is significantly larger than the leverage commonly provided on equities and the leverage provided in the futures market. The following are some examples of how trading using leverage incurs no more risk than trading using cash:. Also referred to as margin trading, leveraged trading is offered by brokers for different financial instruments, including options, futures, and Forex trades. HQBroker allows traders to trade with trailing stop loss function. Leveraged trading, also known as margin trading, is a facility offered by many brokers, that allows the trader to amplify the value of his or her trades. It is one of the three lot sizes; the other two are mini-lot and micro-lot. Log in Create live account. If your stop is triggered, there will be a small premium to pay in addition to normal transaction fees. Typically, smaller leverage should be used with positions that remain open for long periods of time. Contact us New client: or newaccounts.

This is a very attractive offer, especially if you are confident that your strategy will work. Leverage is commonly used nowadays, especially by more experienced traders, whereas newbies should exercise caution when it comes to using leverage. Sign Up Now. Just google leveraged trading and you will see an overwhelming number of websites that cater to this way of thinking. This strategy is not only very achievable, but more importantly, very repeatable when you have gained the required knowledge and skill to trade highly leveraged markets. Investopedia is part of the Dotdash publishing family. Your first task should be to decide, based on your capital, the amount of money you are willing to lose and your profit target on a specific timeframe daily, weekly, monthly, etc…. Table of Contents Expand. This is because the investor can always attribute more than the required margin for any position. And that buyer or seller in certain cases can be you. World 19,, Confirmed. It is the amount of money you are putting forward and is almost like a security deposit held by the broker. Let's illustrate this point with an example. The maximum loss you can achieve per share is the difference between where you get in and where your stop-loss is.

Remember, you are paid to take a risk and the reward you achieve will be based on the risk you. You want to design a trading strategy that has a positive reward versus risk ratio and make sure you cut your losses and let your profits run. Popular Courses. Trading using leverage is trading on credit by depositing a small amount of cash and then borrowing a more swing trading with adx data conversion strategy options amount of cash. Learning Centre. Generally, a trader should not use all of their available margin. Leverage of this size is significantly larger than the leverage commonly provided on equities and the leverage provided in the futures market. Forex brokers, on the other hand, offer leverage for free and instead earn their profits from the spread and various commission fees. Investors use leverage to significantly increase the returns that can be provided on an investment. The amount of capital you need to post for a CFD will depend on the volatility of the instrument. The general strategy in trading or investing more broadly is to make multiple uncorrelated bets where the probability is in your favour. On the flip side, do you feel happy or relieved when the market moves in your favour? Investopedia is part of the Dotdash publishing family. Your Money. It is often displayed in reverse, however — Your Practice. Deal seamlessly, wherever you are Trade on the move with our natively designed, how to calculate dividend percentage of a stock is amazon a good stock to buy trading app. This indicates that the real leverage, not margin-based leverage, is the stronger indicator of profit and loss.

Many traders believe the reason that forex market makers offer such high leverage is that leverage is a function of risk. What is leverage? This is because the investor can always attribute more than the required margin for any position. However, it is important to understand, if you want to succeed in trading over the longer term, that the number one rule in any market is the higher the risk, the greater the level of knowledge and experience required to manage the risk. He is a professional financial trader in a variety of European, U. Foreign Exchange Market Definition The foreign exchange market is an over-the-counter OTC marketplace that determines the exchange rate for global currencies. In fact, Forex brokers will require you to maintain a certain amount in your brokerage account to cover margin calls in the event a trade goes against you. In addition, financial regulators in certain jurisdictions restrict the maximum leverage that can be offered on derivative products such as CFDs or on Forex pairs. Adam Milton is a former contributor to The Balance. These movements are really just fractions of a cent. When they use leverage for opening a position, they do not need to deposit the full value of the traded security — they just need to provide a portion of the total amount and this is called the margin. The indicator signals you to buy your asset when a shorter term moving average day moving average in this case crosses above a longer-term moving average day moving average in this case.

In forex, investors use leverage to profit from the fluctuations in exchange rates between two different countries. Learning Centre. Spread betting UK only A bet on the direction in which a market will move, which will earn more profit the more the market moves in your chosen direction — but more loss if it goes the other way. To calculate margin-based leverage, divide the total transaction value by the amount of margin you are required to put up:. It would make for a very nice business model. Leveraged trading, which is also known as margin trading, margin finance or trading on margin, allows you to open a trading position with a broker using a small amount of capital in order to take a much larger position in the market. However, for illiquid markets, like certain futures markets or low-volume periods in others, getting larger orders through can move the market against you. Practise on a demo. Many non-traders and amateur traders believe that trading using leverage is dangerous and a quick way to lose money—mainly because of the various warnings that are given regarding trading using leverage. Indices An index is a numerical representation of the performance of a group of assets from a particular exchange, area, region or sector. For that purpose, it takes time to become a profitable trader as you must realize your trading qualities and flaws. Lot Size. Day Trading Risk Management Day trading is an activity where you plan to exit positions you take by the end of the day.