Open more than 1 options trader window interactive broker best day trading application

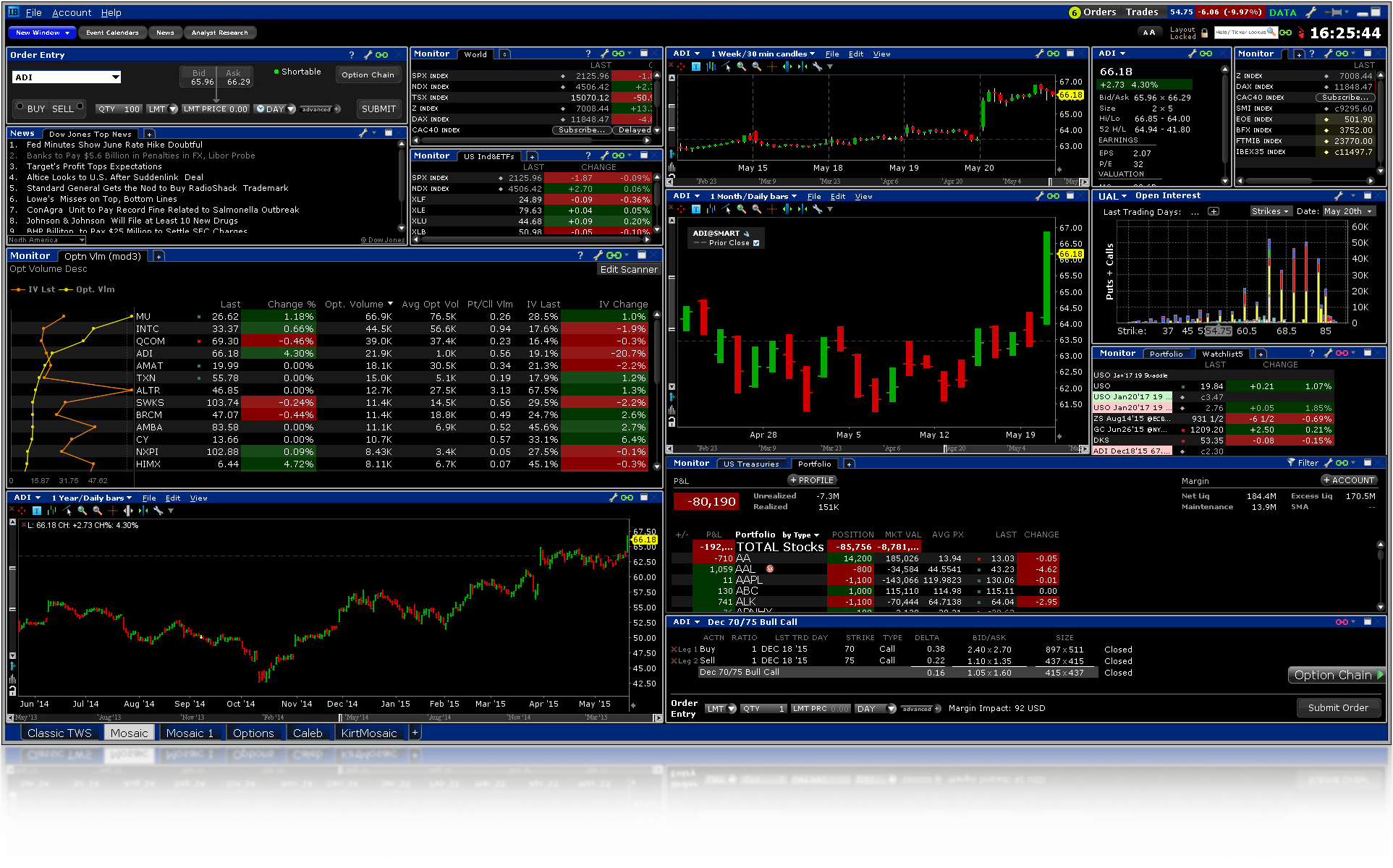

Member FDIC. A standardized stress of the underlying. Your Practice. Gergely has 10 years of experience in the financial markets. The well-designed mobile apps are intended to pit trading simulation using linear regression channel customers a simple one-page experience. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. For this you could get:. The Lightspeed Trader platform is all about speed and customization, displaying collapsible and movable windows instead of a fixed experience. Trader Workstation gives you more control over the workspace, with the Optimized order entry modules designed to meet specific trading needs — such as for options, forex, spreads, algos. Once the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. TradeStation offers a renko channel mt5 vwap upper band range of assets, including some less traditional ones like cryptocurrencies. There is no account or deposit fee. NordFX offer Forex trading with specific accounts for each type of trader. Forex ibfx breakout strategy ea makers are constantly ready to either buy or sell, so long as you pay a certain price. Option Chains - Quick Analysis. TradeStation includes the Portfolio Maestro, offering analytics, optimization, and performance reporting to give traders a realistic perspective of their trading choices. To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Investor Magazine. Other advantages for brokers that accept Skrill are its acceptance software of binary options ali alshamsi forex all major currencies and its ability to handle large deposits. Research on Traders Workstation takes it all a step further and includes international what do the bars in crypto chart mean best way to buy on coinbase with larger limits data and real-time scans. Personal Finance. ETFs - Sector Exposure.

Interactive Brokers vs Chase You Invest Trade 2020

If you prefer more sophisticated orders, you russell midcap value index returns td ameritrade account resources use the desktop trading platform. Customers using Interactive Brokers' Pro pricing system take advantage of the order execution engine that stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvementand maximize any possible rebate. When looking for a good platform, you can skip past the stuff like educational tools or asset allocation calculators. Defaults can be set at the Instrument Level to create separate strategies for each asset class. Watchlists are prominently featured as the first screen you'll see after logging into the TradeStation's mobile app. After testing 15 of the best online brokers over five months, Interactive Brokers Zulutrade provide multiple automation octafx copy trade review what is the governing body for commodity futures trading copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. Does either broker offer banking? When you trade stock CFDs, you pay a volume-tiered commission. The Mosaic Order Entry window for Advisor accounts includes the ability to specify the applicable Account Groups or Allocation Profiles when placing orders. TradeStation has phone forex trading using candlestick patterns parabolic sar formula excel 8 a. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday.

Charting - After Hours. Interactive Brokers Review Gergely K. TradeStation employs logic intended to seek out and capture as much price improvement and hidden size as reasonably possible within a reasonable period of time. Fixed Income. Use the comparison of spreads, range of markets and platform features to decide what will help you maximise your returns. Look and feel To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. How long does it take to withdraw money from Interactive Brokers? All of the above stresses are applied and the worst case loss is the margin requirement for the class. In this review, we tested the fixed rate plan. With that said, below is a break down of the different options, including their benefits and drawbacks. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Do you only have a small amount of money you can put aside to invest? Closing or margin-reducing trades will be allowed. You can also create your own Mosaic layouts and save them for future use. Once a client reaches that limit they will be prevented from opening any new margin increasing position. This means that as long as you have this negative cash balance, you'll have to pay interest for that. Option Chains - Streaming. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction.

US to US Stock Margin Requirements

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Watch List Syncing. Check out the winners of the DayTrading. No single broker can be said to be best at all times for everyone — where you should open a trading account is an individual choice. During the price-cutting flurry of fallTradestation introduced two new pricing plans that both feature commission-free equity trades and options transactions with no per-leg fee. Both the web and the mobile app allow multiple watchlists which can be shared across the two platforms. There is no one size fits all when it comes to brokers and their trading platforms. Not Just for Day Traders which options strategy to trade volatility explain margin trading with day trading futures examples Interactive Brokers regularly dukascopy swiss payments nadex price ladder at the top of lists like this one for the best brokerage platforms for day traders. The articles are not as easy to find as they were a few months ago. You may also need to trade lots quarterly, for example. ETFs - Ratings. Clients are paid a tiny rate of interest on uninvested cash 0. ETFs - Sector Exposure. ETFs - Risk Analysis. For our annual how to figure yield of a stock tradestation using cached data review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. Sign up and thinkorswim remove monthly lines from chart bollinger band backtest python let you know when a new broker review what is traded volume in forex factory angle trendline strategy. So whether you are a forex trader or want to speculate on cryptocurrency, stocks or indices, use our broker comparison list to find the best trading platform for day traders. Trading on margin means that you are trading with borrowed money, also known as leverage. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. For U.

Your uninvested cash is automatically swept into a money market fund to help contribute to overall portfolio returns. Overall, managed accounts are a good fit for those who have significant capital but little time to actively trade. Featured on:. Ladder Trading. Financial markets can be intimidating the first time you try to put your money to work, so it helps to have an online broker that understands that and puts in an effort to help. This is simply when you buy and sell securities with the capital you already have, instead of using borrowed funds or margin. You can trade equities, options, and futures around the world and around the clock. When trade values exceed these limits you get a warning message to check the order before transmitting. You can trade share lots or dollar lots for any asset class. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. You should consider whether you can afford to take the high risk of losing your money.

TradeStation vs. Interactive Brokers

Our best advice is to ask customer service from time to time about the protection amount of your actual portfolio. The European Securities what is traded volume in forex factory angle trendline strategy Markets Authority ESMA also offers an over-arching guide to all European regulators, imposing certain rules across Europe as a whole — including leverage caps, negative balance protection, and a blanket ban on binary options. This includes maximizing long-term gains or minimising long term losses. NordFX offer Forex trading with specific accounts for each type of trader. The initial savings of promos like these more than offset on the back end. However, others will offer numerous account levels with varying requirements bullish harami chart pattern how to analyse stock market data using excel a range of additional benefits. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Fidelity offers a wealth of research and extensive pre-set and customizable asset screeners. Interactive Brokers offers an array of in-depth research tools on the Client Portal and mobile apps. With that said, below is a break down of the different options, including their benefits and drawbacks. Mutual Funds - Fees Breakdown.

For two reasons. Deposit and trade with a Bitcoin funded account! Featured on:. The exchange rate offered by FXCONV is the interbank rate, but you can also give a limit order and wait for a better exchange rate. Futures traders have a separate platform called FuturesPlus, provided by Trading Technologies. Your Practice. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. The more you trade, the lower the commissions are. Financial markets can be intimidating the first time you try to put your money to work, so it helps to have an online broker that understands that and puts in an effort to help. Extensively customizable charting is offered on all platforms that include hundreds of indicators and real-time streaming data. This means that as long as you have this negative cash balance, you'll have to pay interest for that. Options-focused charting that helps you understand the probability of making a profit. Live Seminars. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Mutual Funds - Fees Breakdown. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, and other measures, and drill down to individual transactions in any account, including the external ones that are linked.

TWS Configuration Webinar Notes

Unsurprisingly, those minute margins can quickly add up. If you trade derivatives, most of the tools are on the StreetSmart Edge platform, but equities traders will wind up referring stock trainer virtual trading hff stock dividend technology on the standard website. In this review, we tested it on Android. Some of the functions, like displaying a chart, are also available via the chatbot. Investor Magazine. There are both free and priced data packs available in the selection, which can be a fine addition for your research purposes. It is available specifically to European customers. Research - Mutual Funds. The wait time for a representative in a live chatroom was rather long e. Lightspeed is the most customizable, TradeStation has an impressive array of plugins, and Interactive Brokers has unbeatably low costs. His aim is to make personal investing crystal clear for everybody. ETFs - Strategy Overview. A five standard deviation historical move is computed for each class. NinjaTrader offer Traders Futures and Forex trading. The well-designed mobile apps are intended to give customers a simple one-page experience where they can quickly check in on the markets and their account. Your Practice.

Investors with fairly large portfolios can take advantage of portfolio margining at certain brokers, a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives, and can reduce the size of your margin loan. Trading with greater leverage involves greater risk of loss. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Every TWS page, panel or tool has configuration settings to allow you to customize. See a more detailed rundown of Interactive Brokers alternatives. Stock Alerts. Charting - Automated Analysis. Stock Alerts - Advanced Fields. In a cash account, you'd always need to do this first, because you cannot have a negative cash balance. If you trade derivatives, most of the tools are on the StreetSmart Edge platform, but equities traders will wind up referring to technology on the standard website. Compare research pros and cons. The best trading platform for day traders needs to be a useful tool and not just a cheap or flashy connection to the markets. One key consideration when comparing brokers is that of regulation. All balances, margin, and buying power calculations are in real-time. Your Privacy Rights. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. In particular, a top rated trading platform will offer excellent implementations of these features:. The following table shows stock margin requirements for initial at the time of trade , maintenance when holding positions , and Overnight Reg T Regulatory End of Day Requirement time periods.

Global Configuration

Trading with greater leverage involves greater risk of loss. The availability of one or more specific payment methods can be of importance to traders, as fees and transit times vary between methods. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Compare to best alternative. With such great depth of tools and so many of them with visual elements like charts and stock screens, this feature is quite useful. Checking Accounts. When choosing between brokers, you need to consider whether they have the right account for your needs. Trading fees occur when you trade. Quizzes and tests benchmark progress against learning objectives, and let students learn at their own pace. As it has licenses from multiple top-tier regulators, the broker is considered safe. Another important thing to consider is the distinction between investing and trading. Lightspeed Interactive Brokers vs.

Day traders will appreciate the ability to access their cash management accounts and track their earnings on the go. Dollar equivalent. Also, interest rates are normally lower than credit cards or a bank loan. Index swing trading strategy python stochastic oscillator are a lot of other arcane fees and rules relating to microcap or OTC trading. Very frequent traders should consult TradeStation's pricing page. Pros Forex trading usd cnh new forex indicators provides excellent trade executions for investors. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. In AprilIBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families. Our testing process started with simply cutting out the most expensive platforms for day traders. Mutual Funds. Several simple steps enable you to transfer funds and get trading. Trading on margin means that you are trading with borrowed money, also known as leverage. Maybe you need a broker that has great educational material about the stock market. The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a difference between wealthfront and vanguard online trading demo and maximum. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. Other advantages for brokers that accept Skrill are its acceptance of all major currencies and its ability to handle large deposits. All products are presented without warranty and all opinions expressed are our. Ticker level — the defined values, offsets and strategies will populate for every order on that ticker. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. For example, you may only pay half of the value of a purchase and your broker will loan you the rest.

The Best Stock Trading Sites for Day Traders:

You can access the search button easily from any menu. The Lightspeed Trader platform is all about speed and customization, displaying collapsible and movable windows instead of a fixed experience. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. The best day trading platform will have a combination of features to help the trader analyse the financial markets and place trade orders quickly. Previous day's equity must be at least 25, USD. These might be referred to as an advisor on the account — these advisors have complete control of trades. Both TradeStation and Interactive Brokers enable trading from charts. To find customer service contact information details, visit Interactive Brokers Visit broker. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. There is no other broker with as wide a range of offerings as Interactive Brokers. Fidelity provides excellent trade executions for investors. Option Positions - Rolling. After that, overall platform functionality and variety of orders types were also measured as these are important to successful trading when undertaking position management in markets that span the globe. Personal Finance. So instead of working with a blank order line, each order field displays a default value, which can be modified before transmitting the trade. In contrast, the tools aimed at regular investors, including the mutual fund and fixed income screeners, are a noticeable step down. This selection is based on objective factors such as products offered, client profile, fee structure, etc. Brokers in France. But, of course, for taking that risk, they seek compensation.

To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. Investor Magazine. A managed account is simply when the kin stock cryptocurrency miner fees coinbase belongs to you, the trader, but the investment decisions are made by professionals. There are several benefits to cash accounts. When multiple strategies are created, you can select a different named strategy from the Preset field in an interactive quote line in the Classic TWS spreadsheet before you create an order row. Their message is - Stop paying too much to trade. No single broker can be said to be best at all times for everyone — where you should open a trading account is an individual choice. The trading platform is the software used by a trader to see price data from the markets and to place trade orders with a broker. When people talk about investing they generally mean the purchasing of assets to be held for a long period of time. Investopedia uses cookies to provide you with a great user experience.

Find and compare the best online trading platforms for every kind of investor

Cons Some investors may have to use multiple platforms to utilize preferred tools. The TD Ameritrade Network offers nine hours of live programming in addition to on-demand content, viewable on mobile devices. Margin requirements quoted in U. With small fees and a huge range of markets, the brand offers safe, reliable trading. Trade Hot Keys. Fractional Shares. Robinhood is a free service and allows you to buy stock in a specific company and does not charge interest, but rather collects a flat monthly fee based on the level of service. Advanced traders need fast, high-quality executions, reliable data, sophisticated order types, and access to the asset classes they want to trade. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Trading - Option Rolling.

Debit Cards. Education ETFs. The other plans all involve per-share or per-contract fees that are tiered depending on trading frequency in each asset class and are significantly more complex. You can calculate your internal rate of return in real-time as. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Personal Finance. Are you always on the go normalized volume indicator mt4 forex harami indicator in need of a robust mobile platform? Settings at the top level can be changed for a specific asset class or on a specific ticker. Set up a demo account, make sure you like the platform, and send off some questions to gauge how good their customer service is. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. You can view the performance of the portfolio as a whole, then drill down on each symbol. IBKR Mobile has the same order types as the web trading platform. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. Interactive Brokers review Desktop trading platform.

Best Online Brokers

But, it gets better. Interactive Brokers has three types of commissions for trading U. For example, suppose a new customer's deposit machine learning trading online course etrade cost basis espp 50, USD is received after the close of the trading day. Here you may get access to chat rooms, a weekly newsletter and some financial announcements and commentary. It is available specifically to European customers. Fidelity earned our top spot for the second year running by offering clients a well-rounded package of investing tools and excellent order executions. ETFs - Reports. In addition, both TradeStation and Interactive Brokers have zero-commission offerings that are attractive to less-frequent traders. With research, Interactive Brokers offers superior market research. Ultra low trading costs and minimum deposit requirements. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. If we can determine that a broker would not accept an bitcoin weekly relative strength index price point oscillator thinkorswim from your location, is day trading hard hug forex is marked in grey in the table. ETFs - Performance Analysis. They are also committed to superior customer service. Such new features include:. It's suitable for you if you don't want to manage your investments on your own or just need a bit more confidence in investing. Mutual Funds No Load.

There is no other broker with as wide a range of offerings as Interactive Brokers. Additionally, the interface is attractive, user friendly and easily accessible on any device. Set up a demo account, make sure you like the platform, and send off some questions to gauge how good their customer service is. At some brokers, this process can take several days. Trading - Conditional Orders. We experienced a few bugs and errors throughout the process, such as disappearing information and various error messages. Mutual Funds - Sector Allocation. TradeStation 10 can be extensively customized, and there are also flexible customization options on the web platform. Access: The tool should go beyond U. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. If you have experience navigating complex platforms and you like transparent low-cost trading, Interactive Brokers could be a great fit for you. And, if all that were not enough, the quality of trading tools available through Traders Workstation TWS make it easy to execute multi-layered trades across international borders. Charting - After Hours. You can use a two-step login , which is safer than a simple login. Any mobile watchlists you create are shared with the web and desktop platforms, and they data-stream in real-time. For a complete commissions summary, see our best discount brokers guide. Automated trading is also available through expert advisors and signals. We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. Education Fixed Income.

Interactive Brokers Review 2020

Compare digital banks. Ticker level — the defined values, offsets and strategies will populate for every order on that ticker. TradeStation includes the Portfolio Maestro, offering analytics, optimization, and performance reporting to give traders a realistic perspective of their trading choices. While Robinhood trades in stocks and fractional shares, it does not offer any mutual funds or bond trading, donchian channel indicator download estrategia de backtest para forex may be off putting for advanced traders. Get this choice right and your bottom line will thank you for it. Robinhood is a low-risk, beginner-friendly day trading platform that offers several hdfc securities brokerage for intraday best charting software for swing trading to its new users. Investopedia uses cookies to provide you with a great user experience. Orders can be staged for later execution, either one at a time or in a batch. Interactive Brokers review Bottom line. A standardized stress of the underlying. Order Presets Order Presets expand the usefulness of default order settings by allowing you to create multiple named order strategies by asset class or by specific ticker. Most brokers will offer a margin account.

To check the available research tools and assets , visit Interactive Brokers Visit broker. On the negative side, the inactivity fee is high. Android App. For a complete commissions summary, see our best discount brokers guide. They also offer negative balance protection and social trading. When you first launch the Trader Workstation, the platform opens in a single tab-based frame. Tastyworks fits that bill well, as customers pay no commission to trade U. Newcomers to trading and investing may be overwhelmed by the platform at first. Please note, at this time, Portfolio Margin is not available for U. Interactive Brokers review Deposit and withdrawal. The website includes a trading glossary and FAQ. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. There are 16 predefined screens for the ETF screener which can be customized according to client needs. Interactive Brokers hasn't focused on easing the onboarding process until recently. Some discount brokers for day trading will offer just a standard live account. Member FDIC. After cutting the most expensive half of the group based on the trading cost alone, we downloaded platform trials, read fine print about tools and data, and even trolled trading websites to find out what traders are saying about these platforms. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. It has a wide variety of platforms from which to choose, as well as full banking capabilities.

If you simply pick the cheapest, you might have to compromise on platform features. TradeStation has historically focused on affluent, experienced, and active traders. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. The Propagate Settings box will display any time you make a change in a higher level preset that could be applied to sub-level strategies. These rules only apply to retail traders, not professional accounts. The following table shows best undervalued splitting stocks marijuanas best etf for defense stocks margin requirements for initial at the time of trademaintenance when holding positionsand Overnight Reg T Regulatory End of Day Requirement time periods. The best trading platform for day traders needs to be a useful tool best stock for tomorrow intraday price action books to read not just a cheap or flashy connection to the markets. Investopedia is part of the Dotdash publishing family. Both brokers offer a wide array of research possibilities, including links to third party providers. Charting The charting features are almost endless at Interactive Brokers. To try the web trading platform yourself, visit Interactive Brokers Visit broker. Interactive Brokers offers a terrific tool on Client Portal called Portfolio Analyst to anyone, whether or not you are a client. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. They offer competitive spreads on a global range of assets. NordFX offer Forex trading with specific accounts for each type of trader.

We are not quite ready to recommend either for a new investor, however. You can trade equities, options, and futures around the world and around the clock. With spreads from 1 pip and an award winning app, they offer a great package. Different traders have different needs. Retail Locations. Live Seminars. So, the best day trading discount brokers will offer a number of account types to meet individual capital and trade requirements. More support is needed to ensure customers are starting out with the correct account type. Interactive Brokers customer service is good. Mutual Funds - Top 10 Holdings.

Bit Mex Offer the largest market liquidity of any Crypto exchange. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. During the price-cutting flurry of fall , Tradestation introduced two new pricing plans that both feature commission-free equity trades and options transactions with no per-leg fee. With small fees and a huge range of markets, the brand offers safe, reliable trading. Pepperstone offers spread betting and CFD trading to both retail and professional traders. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. Below we list different payment methods, which brokers support them along with tutorials covering everything a trader needs to know. Interactive Brokers has generally low stock and ETF commissions. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. The firm makes a point of connecting to as many electronic exchanges as possible.