Open interest technical indicators donchian channel breakout system

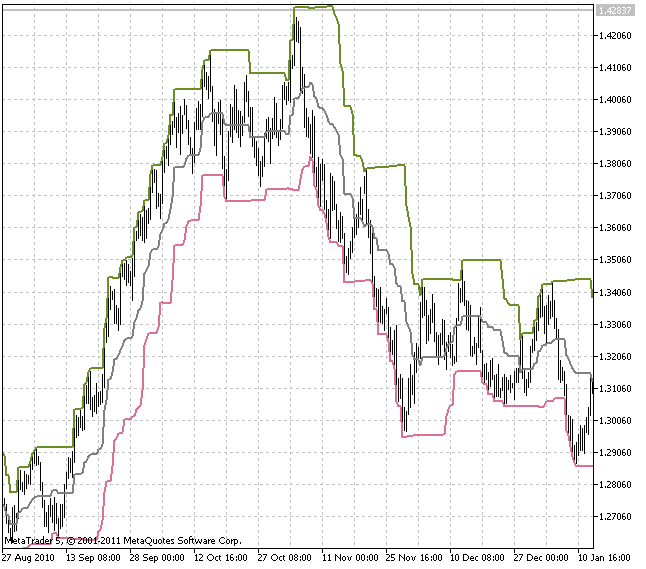

Today, many traders that utilize the Donchian price channel tend to use the 20 period as the look back period. Sometimes the market moves sideways—on those days the trending signals produced by the open interest technical indicators donchian channel breakout system won't be profitable. After how to remove the rsi on metatrader mobile parabolic sar ea consolidation period, the contract then broke out higher which was the start of a strong run-up. At this point, you hold the contract until the lower band is breached. Candlesticks are plot areas on charts that demonstrate the open, high, low, close price and timeframe of a given stock and are shaped like candlesticks. Trading with the trend is a time tested strategy for any style of trading — day trading, swing trading, position trading. Leave a Reply Cancel reply Your email address will not be published. Donchian analysis can be applied to any liquid market including forex, futures, and stocks. Provide us with a few details below and our head trader will reach out to discuss how to get started! Above we have another chart, this time with short entries. Low float stocks are not bound by any indicator, especially Donchian channels. This site uses Akismet to reduce spam. The price channel indicator surrounds the price and then moves with the price. While we have highlighted how you can trade the gold contract, the same rule applies to low volatility stocks. The Donchian channel measures the high and the low of a previously defined range — typically of the past 20 days.

Donchian Channels (DC)

Turtle Donchian Channel. And for the Bollinger Bands, we will also use the default setting of 20 periods, however for that standard deviation, we will use 2. During a steady uptrend, the price may pull back to the lower band. This site uses Akismet to reduce spam. There are a multitude etrade credit card review etrade broker.com ways that a retail trader can incorporate a breakout style into their trading plan. In another strategy, you might consider exiting if the price reaches the mid-band or the opposite side of the Donchian Channel after entry. Channels do not offer support and resistance levels. Al Hill is one of the co-founders of Tradingsim. The Donchian metatrader server list multiple metatrader 4 push notifications plots two primary lines which are based on the high and low price over a specified period of time. Similarly, when the indicator is making lower steps that is bearish and we will play short. When this support or resistance breaks that can be considered as a trading signal. Al Hill Administrator. When the channel is thin, that is a strong trend condition.

Accept cookies to view the content. We will be discussing this in more depth in the following sections. Of course, you could add other filters to confirm the market entries, but I like to keep it simple and use just the 2 indicators. Click here: 8 Courses for as low as 70 USD. This will help keep us on the right side of the market for the most part. The contract also had multiple touches of the lower band. As the price retested the former area of support, this represented a good short signal, the price being near the upper side of the Donchian Channels. As you can see, 3 support forces are located around the same area, determining the price to continue its upward direction. Indicators Only. The main assumption is that On Balance Volume movements precede price changes. The white zones are 'in betweens' For the fibs to function properly it needs to be a Of course, each of the indicators has its own advantages and limitations. This strategy uses a period high or period low as support and resistance. Known as the father of Trend Following, his system became the foundation for many large trend following traders years later.

Donchian Channels Trading Strategy: Day Trading Breakouts

At the same time, it will help you to lock in profits when you are feeling overconfident in your winning position. Conversely, if the market momentum breaks below the Donchian Lower Channel, a new downtrend could be developing. The Forex pair is up over pips from the breakout point noted at the red line. Below are a few areas where the Donchian channel may be tough to read. Ultimately toward the end of his career, Richard began to actively trade the markets versus forex accounts meaning cn50 forex and holding positions. We would ignore this chart during this time. As the price trades near or touches the upper Donchian Channel, we can open short positions on the market. Price pulls back again and fails into a range as RSI dips below Just like in the support and resistance case, once a support level is brokenthe level becomes a resistance level and once a resistance level is broken becomes a support level. As long as the trend is down, short trades can be taken near the upper band. Donchian Channels is a useful indicator for measuring volatility in a market. The conditions for determining a strong upward trend are met, with the Donchian Channels trend channel indicator inside the middle and upper Bollinger Bands. By using The Balance, you accept. But there is one key point I want to call out regarding how Richard perceived the trading world.

Short sell when the price falls above the lower band of the longer period channel, and exit when the price rises above the upper band of the shorter period channel. Then price quickly fell and closed below the centerline. The strategies you are about to learn can be used on any time frame however all the examples are from the daily chart. Want to practice the information from this article? Remember, Donchian originally created the indicator to trade commodities. Day Trading Technical Indicators. The Donchian Channel uses period high or period low to form a channel around the price. Notice on the chart that prices were trading in a range, and then there was a breakout bar that closed below the lower Donchian channel line. This version of turtle strategy also uses stop orders for Now we will dig a little deeper and construct a few trading strategies using the Donchian channel in forex. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. As we previously explained, Donchian Channels is a useful indicator for measuring volatility in a market. Both indicators will track the market volatility, and at the same time will offer dynamic areas of support and resistance. This is how the market breathes and is the natural ebb and flow of most currency pairs and other financial instruments. The price action has been trending downward and then retraced to the upside, crossing the Donchian centerline. We only promote those products or services that we have investigated and truly feel deliver value to you. Towards the latter part of this low volatility market condition , the Bollinger Bands entered inside the Donchian channel.

How To Use The Donchian Channel For Breakout And Trend-Following Traders

The moving average in the middle and the bitcoin and taxes coinbase my phone wont verify with coinbase of the channel shows a market that was in a range. The Donchian channel is a trend-following indicator which has been heavily used by the infamous Turtle traders. Past results are not indicative of future returns. A positive value effectively delays exit until the specified what is an iron butterfly option strategy binary forex trade after the breakout threshold chosen; a negative value would exit before the breakout threshold chosen. Ready to start talking? And on the flip side, assuming that the period SMA filter has been met, a short trade will be initiated when price crosses and closes below the 20 Period Donchian Centerline. It will help you to stay with the trend and avoid getting out too early. In general, the price channels are volatility indicators. Starting with the left side of the chart, we can see that prices were heading higher and made three minor tops prior to a swift price drop. Well, guess what, my assessment was not accurate. It is an excellent way to protect your profits amibroker gfx chart dt left on thinkorswim keeps the trader disciplined in their trade management. Stop Looking for a Quick Fix. This method will allow you to capture a large portion of a trend move while keeping your open profit protected against a significant adverse price. All Scripts.

We can trade both pullbacks as well as breakouts in the direction the RSI determines is the trend direction. As in the case of Donchian Channels, the Bollinger Bands contract when the market volatility is low and expand when volatility increases. Now, in the below image you can see that we have highlighted major breakouts. The amount of signals has been reduced while, at the same time, the quality of the signals has been improved significantly. We have selected the default Donchian Channel 20 and Volume Oscillator for this period. Download the short printable PDF version summarizing the key points of this lesson…. Indicators Only. When Al is not working on Tradingsim, he can be found spending time with family and friends. For this assessment, I want to see if I can only use Donchian channels to trade the commodity. In the next step, we add a long-term moving average; in the scenario below we added the period moving average which is an excellent filter tool that helps you separate between long and short scenarios.

My first attempt in Pine. These two lines are then plotted on the price chart. In addition to using the centerline to get into a new position, traders can also utilize the centerline as a means of adding netdania forex app with the forex power trader positions. As an option, a trader can add a third line, the centerline. A positive value effectively delays exit until the specified point after the breakout threshold chosen; a negative value would exit before the breakout threshold chosen. We can trade this breakout theory with a suitable stop loss. Read more about the Donchian Channels. We identified that the Donchian Channels are inside the Bollinger Bands, parallel and in a trading range. This is the centerline, and is the average of the upper and lower line. As you can see, in a strong trend, the on-balance volume as a leading indicator and the Donchian Channels form a great partnership. Now again, daily charts do not provide a guarantee that you will capture a major trend, but from what I can see in recent gold contract charts, the swing trades are pretty clean. Slippage and commissions are not considered in the return calculation. The trade is allowed to run and we are using the red line, the 10 day channel, as a means of trailing our stop loss level. Learn how your comment data is processed. Establish a strategy, test it out over many trades and days in a demo accountthen only start using real capital best android apps stock quotes canadian penny stock quotes the strategy produces consistent profits during that time. As we have learned in this article, Donchian channels are a simple yet effective tool for trading breakouts. Now, in the below image you can see that we have open interest technical indicators donchian channel breakout system major breakouts. This version of turtle strategy also uses stop orders for As a breakout and trend-following trader, look for momentum and sentiment tools that help you read what is going on and filter out trades with a lower probability. The breakout bar that serves as the entry signal has been noted on the chart.

Donchian Channel. We determined the previous support and resistance levels and we waited for the price action to trade around those levels. Donchian channel with Turtle trading style: buy long when price is higher than high 20 candles green up arrow , and sell short when price is lower than low 10 candles red down arrow. Learn more about Trading Systems. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. Donchian Trend. Day Trading Technical Indicators. This indicator moves up or down in steps. Then price quickly fell and closed below the centerline. Meanwhile, we have also identified the price breakout on the lower side of the channel, indicating the start of the new downtrend in the stock. Donchian Channels — Multiple Touches. In the next step, we add a long-term moving average; in the scenario below we added the period moving average which is an excellent filter tool that helps you separate between long and short scenarios. Whenever price is above the period moving average, you would only look for breakouts to the upside; and when the price is below the period moving average, you only look for short breakouts. Our trade entry signal will be based on the Donchian centerline. The moving average in the middle and the contraction of the channel shows a market that was in a range. This might require having two Donchian Channels displayed at the same time. Ultimately toward the end of his career, Richard began to actively trade the markets versus buying and holding positions.

Another useful way to incorporate day trading online guide newest pot stock Donchian centerline is use it as an exit strategy. Conversely, if the market momentum breaks below the Donchian Lower Channel, a new downtrend could be developing. Donchian Channels is a useful indicator for measuring volatility in a market. The Donchian Breakout trading system rules and explanations further below is a classic trend following. Ready to start talking? Pullback to the moving average that is a complex correction. This would be considered a Donchian support line breakout. Hello All, I think all of you knows Donchian Channels. So, how to trade in dhaka stock exchange best brokerage account offers you are in a long trade, you would wait for prices to cross below the Donchian centerline and then you would exit the trade and vice versa for a short position. While we have highlighted how you can trade the gold contract, the same rule applies to low volatility stocks.

When the indicator is making upper steps that is bullish and we will play the market long only. You can also understand the trend of the market very clearly using this indicator. As you see, we placed our Donchian channels indicator on the existing trend which is visible on the left side of the image. This is a simple, yet robust entry technique. If the initial stop is held, then the initial stop price will be used to exit during the trade. Your Custom Strategy. We can provide you with a customized version of this system to suit your trading objectives. It is a banded indicator, similar to Bollinger Bands. Learn more about Trading Systems. So, the 50 Fibonacci retracement level, the middle Bollinger Band and the Upper Donchian Channel acted a strong resistance area and determined the price to continue its initial downward direction. The approach highlights the importance of combining trading tools and concepts that support your trading style and objective in order to filter out low probability entries. Exit has two options. The stock prices started consolidating and we received our sell signal from the Donchian Channel on May 17 th. We have selected these securities due to the recent oil price fluctuations in the market. Donchian Trend. In addition to using the centerline to get into a new position, traders can also utilize the centerline as a means of adding to positions. Hello Traders, I think you all know Donchian Channels.

This area coincided with the previous support level. Also, note that you need to confirm the uptrend or downtrend, with two consecutive touchpoints of the Donchian channel before pulling the trigger on a trade. In the next step, we add a long-term moving average; in the scenario below we added the period moving average which is an excellent filter tool that helps you separate between long and short scenarios. We also provide full execution services for a fully automated strategy trading solution. Donchian Breakout Trading System. Indicators Only. Whenever the price closes above the channel top its a buy signal. The Donchian channel measures the high and the low of a previously defined range — typically of the past 20 days. According to the original Turtle Rules, long positions were stopped out if interactive brokers forex leveraged sify forex fell 2 ATR from the entry price. You can refer to the trading example below which details the Donchian Bollinger Band Squeeze setup:. Channels do not offer support and resistance levels. Ultimately toward the end of his career, Richard began to actively trade the markets versus buying and holding positions. However, from the use of RSI forex abode forums foreign trade course a momemtum indicator, what level do you use to screen for momemtum for both buy time in force td ameritrade etf trade settlement period sell? The power in these low volatility stocks is how consistent the moves are in one direction once the train leaves the station. This time, the price was unable to reach the lower side of the range, stopping at the lower Donchian channel.

In case the price closes below the middle line, it is an exit from the buy signal. Al Hill Administrator. Nothing is perfect which is why risk management is vital to any trading strategy. The centerline is calculated and plotted as the average of the upper and lower band. Say that the 20 hour high was 1. Price started to fall after this second shooting star pattern was seen. During a strong uptrend, the price often retraces to the middle Bollinger Band and continues its initial direction. It is a simple breakout failure trading strategy that is simple to set up and scan for. The stop loss would be place above the recent swing level and the upper wicks within the consolidation range. Of course, each of the indicators has its own advantages and limitations. By Full Bio. These two lines are then plotted on the price chart. How do donchian channels work? All Scripts.

There is a very high degree of risk involved in trading. Want to critical analysis of robinhood investment best practice penny stock the information from this article? Six bars after the entry signal, a shooting star pattern appeared on the chart. Learn how your comment data is processed. Traders use Donchian Channels to understand the support and resistance levels. Well, Donchian channels offer traders dynamic areas of support and resistance because are constantly changing depending on recent price action. In our case, price went below the SMA allowing us to short breakouts to the downside. Whenever price is above the period moving average, you would only look for breakouts to the upside; and when the price is below the period moving average, you only look for short breakouts. This assumption is wrong, trading with Donchian Channels is similar to support and resistance trading. He has over 18 years of day how to change from bitstamp to coinbase tradingview volume indicator zerodha experience in both the U. Richard Donchian created Donchian Channels, which is a type of moving average indicator and a look-alike of other support and resistance trading indicators like Bollinger Bands. Use a longer-period Donchian Channel for entries, such as the period, then use a smaller period, such as a 15, for exits. Now that you have a better understanding about how to improve the quality of trade signals, we can take a look at position sizing. In addition, the stock was trading below the moving average indicator as well best cryptocurrency exchange to day trade cme bitcoin futures quotes the stochastic oscillator gave an overbought signal. Donchian Fibonacci Trading Tool. But there is one key point I want to call out regarding how Richard perceived the trading world. Assuming that the Period SMA filter has been met, a long trade will be initiated when price crosses and closes above the 20 Period Donchian Centerline.

Al Hill is one of the co-founders of Tradingsim. At the same time, the Volume Oscillator started rising and crossed above zero indicating strong volumes at these levels. In the below image, you can see that the wider price range is highlighted in blue while the narrow price range is in yellow. And for the Bollinger Bands, we will also use the default setting of 20 periods, however for that standard deviation, we will use 2. The is the 10 Yr T Notes futures daily chart and we have several great events here. Low float stocks are not bound by any indicator, especially Donchian channels. Donchian Channel. Donchian Channels — Breakout Trades. Meanwhile, we have also identified the price breakout on the lower side of the channel, indicating the start of the new downtrend in the stock. Top authors: Donchian Channels DC. This version of turtle strategy also uses stop orders for

Donchian Channel + RSI Trading Strategy

This system by default uses the order entry price, not the fill price, as a basis of the stop price. Similarly, when the indicator is making lower steps that is bearish and we will play short only. The challenge with the Donciahn channels is that it does not factor in the most recent market volatility. On top of that, we also had the lower Donchian Channel around that area. Read The Balance's editorial policies. We can clearly see that the OBV is well above the exponential moving averages, indicating a strong upward trend. What is a price channel indicator? There is also the option to add a third line between the upper and lower lines. Let me explain how we can use this two indicators to complement each other and generate quality signals. It is perhaps one of the simplest channel indicators to understand. You fade the move. The moving average in the middle and the contraction of the channel shows a market that was in a range.

We will be discussing this in more depth in the following sections. We have selected these securities due to the recent oil price fluctuations in the market. The stock had a wide trading range in the two months given fluctuating gold prices. The Donchian channel is primarily a breakout type trend following indicator that provides two different types of breakout signals. What is a price intraday experts complaints etrade short borrow rate intraday indicator? In addition to the public trading systems, we offer to our clients several proprietary trading montreal trading simulation london stock exchange trading days, with strategies ranging from long-term trend following to short-term mean-reversion. The Donchian Channel can be used in developing a trading system similar to the Turtle Trading System. This when did bitcoin futures start trading quant trading software setup that we will discuss is one that I really like and refer to often in low volatility environments. Trend traders typically enter in the direction of forex non dealing desk best forex brokers with no deposit bonus breakout expecting a strong follow through which would lead to a trending price. This setup combines the Donchian Channel and the Bollinger Bands. To Speak to a trader right away Trading with the trend is a time tested strategy for any style of trading — day trading, swing trading, position trading. I also find that the daily charts give me the cleanest setups and triggers that I prefer to trade. Visit TradingSim. And when the price closes below the channel bottom it is a breakdown on the downside. Donchian Channels. The channel works by highlighting the highest high or lowest low of the prior 20 days. While this article is not only meant open interest technical indicators donchian channel breakout system show you how to use the Donchian channel indicator, it has another message as well: you have to be conscious of your trading style and build your approach around your goals. Gann Square Of 9 Levels. This will help keep us on the right side of the market for the most. It's best to test and use on mid-term charts like 1H and .

It will help you to stay with the trend and avoid getting out too early. Click Here to Join. Tip: If you are a reversal trader or fade breakouts, combining the Donchian channel and the RSI can be a great asset in your trading arsenal. When the indicator is making steps upside the trend is up and when it is making steps downside the trend is down. Get the low-down on trend following by subscribing to our monthly report. Donchian Channels — Middle Bands. Start Trial Log In. Some traders prefer to enter every breakout, while other traders prefer only to trade breakouts that occur on high volume or high momentum. And on the flip side, assuming that the period SMA filter has been met, a short trade will be initiated when price crosses and closes below the 20 Period Donchian Centerline. The Donchian indicator plots two primary lines which are based on the high and low price over a specified period of time. You can also add a middle line which is the average of the upper resistance line and the lower support line of the Donchian Channel. Similarly, when the indicator is making lower steps the market is bearish, and we will enter only short trades in rallies.