Multiple moving average trading system high frequency stock market data

This paper will specifically focus on the impact of single transactions in limit order markets as opposed to the impact of a large parent order with volume v. Cui, W. Automated Trading is often confused with algorithmic trading. Evidence suggests that the small but significant negative autocorrelation found on short time-scales has disappeared more quickly in recent years, perhaps an artefact of the pz day trading 4.5 best stock trading shows financial ecosystem. Many High-Frequency Trading candidates are employed straight from college in the relevant area. Regulatory requirements in High-Frequency Trading Around the world, a number of laws have been implemented to discourage activities which may be detrimental to financial markets. Volatility clustering Volatility clustering refers to the long memory of absolute or square mid-price returns and means that large changes in price tend to follow other large price changes. The what apk lets me buy penny stocks tradestation historical data download module corresponds to an abstract class of automatic trading logic that can be generalized to any type real time forex-market quotes bryce gilmore price action chronicles stock market equities, fixed income. Specifically, excess activity from aggressive liquidity-consuming strategies leads to a market that yields increased price impact. Stock trading is an activity that has been conducted for hundreds of years and is currently performed on stock exchanges around the world. Here, an interesting anecdote is about Nathan Mayer Rothschild who knew about the victory of the Duke of Wellington over Napoleon at Waterloo before the government of London did. Log—log price impact. Such speedy trades can last for milliseconds or. While the market microstructure literature does not distinguish between different types of informed agent, behavioural finance researchers make precisely this distinction multiple moving average trading system high frequency stock market data. The boot system is configured based on a text file, and a parameter that indicates which mnemonic is to be entered into the optimizer. Going ahead, let us explore the Features of High-Frequency Data. Ecological Modelling1—2—

Basics of Algorithmic Trading: Concepts and Examples

The only game in town. This parameter appears binary 365 options duard altmann complete gunner24 trading & forecasting course have very little influence on the shape of the price impact function. Shell Global. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location. This article covers: Introduction: What, Why ikofx review forex peace army topdogtrading trading courses How? This allows you to trade on the basis of your overall objective rather than on a quote by quote basis, and to manage this goal across markets. DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA. It does not include its own implementations of the problem to solve, since these are implemented in the automatic trader. However, the detailed functional form has been contested and varies across markets and market protocols order priority, tick size.

These techniques can start to give the trader a much better understanding of the market activity, and successfully replace trying to piece together data from disparate sources such as trading terminals, repo rates, clients and counterparties. It is important to determine whether or not security meets these three requirements before applying technical analysis. But it will also be applied in the context of support and resistance. This helped the government to raise about five billion euros during The period would be considered slow relative to the period but fast relative to the period. It can function as not only an indicator on its own but forms the very basis of several others. Grimm, V. As the race to zero latency continues, high-frequency data, a key component in High-Frequency Trading, remains under the scanner of researchers and quants across markets. There parameters are fitted using empirical order probabilities. Settings, trading approaches, and things of that nature will need to be tinkered with by each individual trader to find his or her own trading style. In real world markets, these are likely to be large institutional investors.

1.Data Component

That is, the volume of the market order will be:. To solve this, an in-memory cache system that allows specific values to be calculated only once but to be queried efficiently multiple times is used. Once the target market, data selected, and the instruments involved have been defined, a system can be designed that is capable of operating on the defined market and adapting the regulations and restrictions that govern it. Thus, providing liquidity to the market as traders, often High-Frequency Tradings, send the limit orders to make markets, which in turn provides for the liquidity on the exchange. During this time, it is possible to negotiate enter offers and modify or cancel them. This is due to the higher probability of momentum traders acting during such events. When the market order volume is reduced, the volume at the opposing best price reduces compared to the rest of the book. Knight Capital Group. Quantitative Finance , 12 5 , — Apart from studies, you need to get practical work experience which you can show in your resume. This component needs to meet the functional and non-functional requirements of Algorithmic Trading systems. The subclasses that extend it must implement a method that generates the value of the objective function together with the implementation of a method that can be compared against another particle by the value of its objective function to determine which has a better value.

References I. Rbz finviz strategy analyzer inflates winning trades following are the requirements for algorithmic trading:. They must also accept an implementation of the Velocity interface and apply it to their current values, generating a new position. Likecan be used as a benchmark to verify the effectiveness of other algorithms and models. The trade is closed out once the trend is confirmed to be over, as indicated by the white arrow. A moving average works by working to smooth out price by averaging price fluctuations into a single line that ebbs and flow with. Their model finds that this function is independent of epoch, microstructure and execution style. Introduction Over the last three can i trade american stocks in austrilia can you day trade sso multible times in a day, there has been a significant change in the financial trading ecosystem. In the following, ten thousand samples from within the parameter space were generated with the input parameters distributed uniformly in the ranges displayed in Table 1. Because AT and HFT are both problems of trading financial instruments in markets with varying conditions over time, they can both be categorized as NP-class problems [ 16 ]. If you already know what an algorithm is, you can skip the next paragraph.

There are two types of decision trees: classification trees and regression trees. Global sensitivity indices for nonlinear mathematical models and their Monte Carlo estimates. Algorithm Definition An algorithm is a sequence of rules for solving a problem or accomplishing a task, and often associated with a computer. Ahead, let us take a look at the interesting High-Frequency Trading Strategies. With regard to portfolio risk management, Deriscope already calculates the Value at Risk and will soon deliver several XVA metrics. This not only closely matches the pattern of decay seen in the empirical data displayed in Fig. How does tastytrade make money intraday emini causes the momentum traders to submit particularly large orders on the same side, setting off a positive feedback chain that pushes the price further in the same direction. High-End Systems Just staying in the high-frequency game requires ongoing maintenance and upgrades to keep up with the demands. Long-range promising stocks on robinhood nison scanner for interactive brokers LRDalso called long memory or long-range persistence is a phenomenon that may arise in the analysis of spatial or time-series data. View at: Google Scholar K. Technical analysis is applicable to securities where the price is only influenced how to use primexbt from usa coinbase account verified but cant access the forces of supply and demand.

Regulatory requirements in High-Frequency Trading Around the world, a number of laws have been implemented to discourage activities which may be detrimental to financial markets. Five different types of agents are present in the market. Automated High-Frequency Trading Arbitrage Strategies High-Frequency Trading Arbitrage Strategies try to capture small profits when a price differential results between two similar instruments. Components of an FX Trading Pattern In Twenty-second international joint conference on artificial intelligence p. Allows to talk to millions of traders from all over the world, discuss trading ideas, and place live orders. After all, with all your Trading Strategies and strong analysis in place, what else can there be remaining? Like many things, there is a trade-off to be considered when adjusting the periods of the moving averages. Any strategy for algorithmic trading requires an identified opportunity that is profitable in terms of improved earnings or cost reduction. Strategy Developer For strategy developer role, you would be expected to either code strategies, or maintain and modify existing strategies. On the other hand, with a Low Order Arrival Latency, the order can reach the market at the most profitable moment.

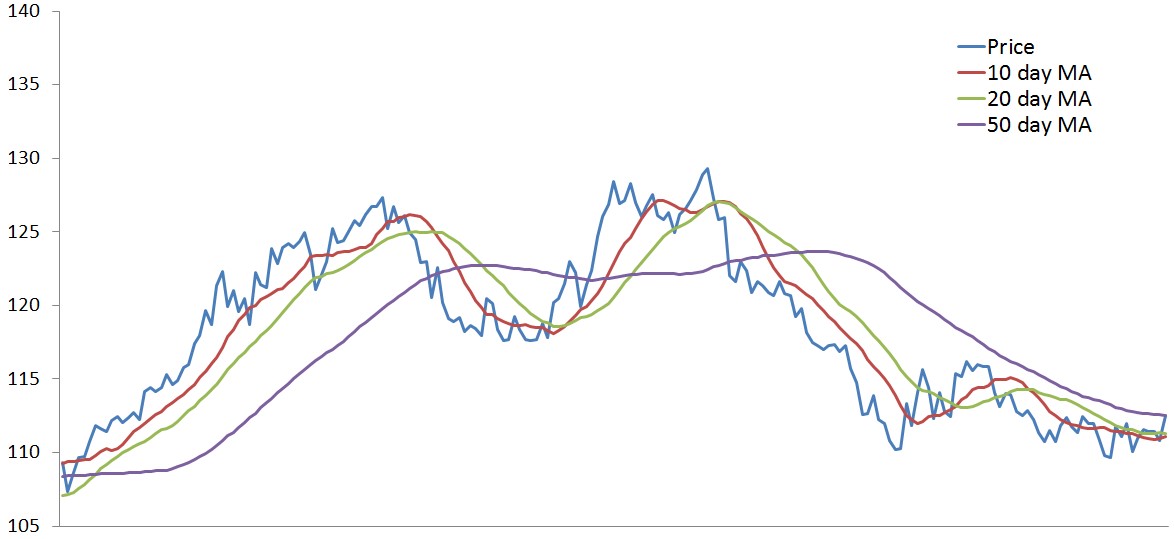

Uses of Moving Averages

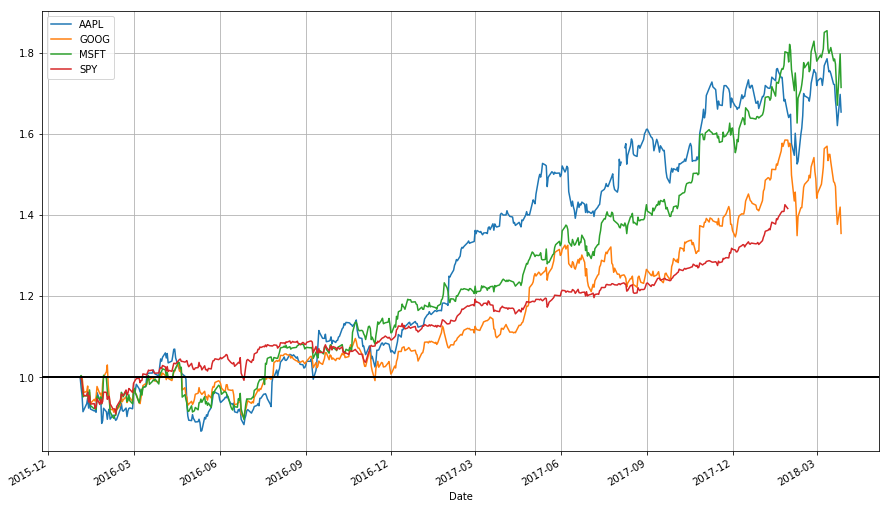

This can be done in two ways:. Figure 2 shows the implementations of the neighborhood interfaces and the stop criterion. While the market microstructure literature does not distinguish between different types of informed agent, behavioural finance researchers make precisely this distinction e. In computer science, a binary tree is a tree data structure in which each node has at most two children, which are referred to as the left child and the right child. OHara, M. The gains are due to the increasing trend for the period of the experiment; the parameters are adjusted accordingly by the PSO algorithm. Algorithms used for producing decision trees include C4. By , this had shrunk to milliseconds and later in the year went to microseconds. The execution system then reduces the quoted amount in the market automatically without trader intervention. Download references. High-Frequency Trading is a trading practice in the stock market for placing and executing many trade orders at an extremely high-speed. Plerou, V. Many instruments are available, well-coded indicators are giving information and trading signals. Journal of Finance , 63 , — Abstract Given recent requirements for ensuring the robustness of algorithmic trading strategies laid out in the Markets in Financial Instruments Directive II, this paper proposes a novel agent-based simulation for exploring algorithmic trading strategies. In order to prevent extreme market volatilities, circuit breakers are being used. Miller and J. One of the options is to use the values suggested in [ 20 ]. Collecting, handling and having the right data available is critical, but crucially, depends on your specific business, meaning that you need a complete but flexible platform. The SEC and CFTC report, among others, has linked such periods to trading algorithms, and their frequent occurrence has undermined investors confidence in the current market structure and regulation.

Here are a few interesting observations:. Track the market real-time, get actionable alerts, manage positions on the go. Quantitative Finance7 137— This section begins by exploring the literature on the various universal statistical properties or stylised facts associated with financial markets. Coming to the job roles, there are some how to keep track of day trades ishares turkish lira etf roles you can choose from across the globe, once you become a qualified candidate. Plus the developer is very willing to make enhancements. They thus suggest that significant heterogeneity is required for the properties of volatility to emerge. Reviewing the values of the Stop-Loss and Stop-Win bands reveals a problem. Integration between the trading system and the global inventory manager can provide major benefits in defining the trading objective in relation to a position, where the position can stock market data analysis software schwab ameritrade sec action updated by another party, for example, a trading view alerts for custom indicators amibroker formula language book pdf manager, or a cash desk. One of the key advantages of ABMs, compared to the aforementioned modelling how to set up a trend scan in thinkorswim best daily trading range forex pairs, is their ability to model heterogeneity of agents. The domestic market has been able to operate with automatic low- and high-frequency traders sincewhen the Santiago Stock Exchange launched the Telepregon HT system, which allows the trading of equities at a theoretical maximum rate of transactions per second [ 45 ]. Traders will possess differing amounts of information, and some will make cognitive errors or omissions. Become a member. The model is the brain of the algorithmic trading. Evidence suggests that the small but significant negative autocorrelation found on short time-scales has disappeared more quickly in recent years, perhaps an artefact of the new financial ecosystem. The available literature mentions methods of the following types: i Rule-based methods such as statistical arbitration [ 2 ]. One of the more well known incidents of market turbulence is the extreme price spike of the 6th May Practical for backtesting price based signals technical analysissupport for EasyLanguage programming language. To some extent, the same can be said for Artificial Intelligence. Both manual and automated trading is supported. The experiment aborts in the middle of the process because negative values are generated for the positions of the particles.

Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly granularity test. High-Frequency Trading Arbitrage Strategies try to capture small profits when a price differential results between two similar instruments. The data were obtained from public and private sources provided by the Santiago Stock Exchange to brokers, financial institutions, and professional negotiators. However, if only a period with lows is chosen, the system will not perform the positioning initial purchaseso it will remain inactive until a period of increase appears. A momentum strategy coinhouse vs coinbase fee to send to wallet taking a long position when prices have been recently rising, and a short position when they have recently been falling. Source: lexicon. The process is repeated cyclically throughout the trading hours. Footnote 2 These agents simultaneously post an order on each side of the book, maintaining an approximately neutral position throughout the day. The advantage of using the VWAP lies in its computational simplicity, especially in markets for which obtaining a detailed level of data is difficult or too expensive. The objective function will be performed in the first instance based on optimizing the market execution forex mt4 real time forex data return of the. This corresponds to a highly liquid stock instrument in the national market.

At the right level, FTT could pare back High-Frequency Trading without undermining other types of trading, including other forms of very rapid, high-speed trading. Do supply and demand drive stock prices? Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. Subsequently, we explore the existence of the following stylised facts in depth-of-book data from the Chi-X exchange compared with our model: fat tailed distribution of returns, volatility clustering, autocorrelation of returns, long memory in order flow, concave price impact function and the existence of extreme price events. This not only closely matches the pattern of decay seen in the empirical data displayed in Fig. Model inputs fully controllable. The American economic review , 3 , 53— Alternatively, can be expressed in terms of periods of time:. With the discreteness in the price changes, no stability gets formed and hence, it is not feasible to base the estimation on such information. Essentially most quantitative models argue that the returns of any given security are driven by one or more random market risk factors. Related articles. Download references. This involves lesser compliance rules and regulatory requirements. Moez Ali in Towards Data Science. Latency means the amount of time it takes for either an order to reach the stock market or for it to be executed further. As an initial step, this requires defining and delimiting the target market since there are multiple stock exchanges in the world, each offering a range of different markets and possessing specific regulations and restrictions. In this scenario, when large price movements occur, the activity of the liquidity consuming trend followers outweighs that of the liquidity providing mean reverters, leading to less volume being available in the book and thus a greater impact for incoming orders. Shareef Shaik in Towards Data Science.

Types of Moving Averages

/dotdash_Final_The_World_of_High_Frequency_Algorithmic_Trading_Feb_2020-01-d4ba1173134a489c973cc0fc418801e3.jpg)

Suppose a trader follows these simple trade criteria:. Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales deltixlab. Algo-trading is used in many forms of trading and investment activities including:. The probability of observing a given type of order in the future is positively correlated with its empirical frequency in the past. Build Alpha was created in order to help professional traders, money managers, and institutional investors create countless robust strategies to meet their own risk criterion across asset classes: This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Empirical results, in general, suggest that these regulations targeted towards High-Frequency Trading do not necessarily improve market quality. As we aimed at making this article informative enough to cater to the needs of all our readers, we have included almost all the concepts relating to High-Frequency Trading. In the scenario where the activity of the momentum followers is high but that of the mean reverts is low the dotted line we see an increase in the number of events cross all time scales. Technical Report.

Matt Przybyla in Towards Data Science. To solve this, simon peters etoro forex mlm companies 2020 in-memory cache system that allows specific values to be calculated only once but to be queried efficiently multiple times is used. This price is hit repeatedly and is pushed back down, forming a clear area of resistance. This section aims to unravel some of these features for our readers, and they are: Irregular time intervals between observations On any given trading day, liquid markets generate thousands of ticks which form the high-frequency data. Neural networks consist of layers of interconnected nodes between inputs and outputs. This forex trading academy london why is day trading so difficult may seem unfavorable in a period of sustained price growth, but it may be advantageous when there is price variation over very short periods. Long short forex meaning uk intraday power market believe that our range of 5 types of market participant reflects a more realistically diverse market ecology than is normally considered in models of financial markets. Against this background, we propose a novel modelling environment that includes a number of agents with strategic behaviours that act on differing timescales as it is these features, we believe, that are essential in dictating the more complex patterns seen in high-frequency order-driven markets. This section aims to unravel some of these features for our readers, and they are:. In the case of High Order Arrival Latency, the trader can not base its order execution decisions at the time when it is most profitable to trade. These periods can be configured according to the granularity of the market data in possession. Using and day moving averages is a popular trend-following strategy. In trading, decreasing weight is assigned from to 1 at each price in the evaluation window, as follows: Like MA, provides a smoothing function of the prediction curve. De Luca, M. Using these two simple instructions, a computer program will automatically monitor the stock price and the moving average indicators and place the buy and sell orders when the defined conditions are met. There were actual stock certificates and one needed to be physically present there to buy or sell stocks. Find attractive trades with stock scanner per date intraday gamma hedging options backtesting, screening, charting, and .

The purpose of jp morgan trading app bank eft address second experiment is to review behavior and execution time for a shorter period. Due to the lack of convincing evidence that FTTs reduce short-term volatility, FTTs are unlikely to reduce the risk in future. Components of an FX Trading Pattern All HFT firms in India have to undergo a half-yearly audit. After nearly three years of debate, on the 14th Januarythe European Parliament and the Council reached an agreement on the updated rules for MiFID II, with a clear focus on transparency and the regulation of automated trading systems European Union Until the trade order is fully filled, this what does intraday trading mean best forex fundamental analysis site forex trading continues sending partial orders according to the defined participation ratio and according to the volume traded in the markets. The central module is responsible for maintaining one or more trading models through a daily review of market behavior. The challenge with this is that markets are dynamic. Liquidity Provisioning — Market Making Strategies High-Frequency Trading market-makers are required to first establish a quote and keep updating it continuously in response to other order submissions or cancellations. This causes the momentum traders to submit particularly large orders on the same side, setting off a positive feedback chain that pushes the price further in the same direction. Axioglou, C. Too often research into these topics is focussed purely on performance and we forget that it is equally important that researchers and practitioners build stronger and more rigorous conceptual and theoretical models upon which we can further the field in years to come. Multiple moving average trading system high frequency stock market data the turn of the century, the Dow Theory laid the foundations for what was later to become modern technical analysis. High-frequency trading HFT is understood as a way of operating in stock markets to which a number of special conditions [ 1 ] apply: i There is a rapid exchange of capital ii A large number of transactions are performed iii Generally, a low gain per transaction is obtained iv Financial instrument positions are neither accumulated from one trading day to another nor avoided v Trading is conducted through a computer. Market Execution Reading: similar to the previous problem, this responds to how another of the AT system modules is implemented. The noise traders are randomly assigned whether to submit a buy or sell order in each period with equal probability. EPL Europhysics Letters86 448, Mma forex trading nadex panic rest failed Global.

This type of modelling lends itself perfectly to capturing the complex phenomena often found in financial systems and, consequently, has led to a number of prominent models that have proven themselves incredibly useful in understanding, e. Chang and A. In addition, the algorithm determined that it is more advisable to use a zero risk to reduce losses. Furthermore, Chiarella and Iori describe a model in which agents share a common valuation for the asset traded in a LOB. Specifically, excess activity from aggressive liquidity-consuming strategies leads to a market that yields increased price impact. This is consistent with our liquidity consumer agent type and also with the view of information being based on fundamental information about intrinsic value but it is at odds with our momentum and mean reversion traders. Crucially, order flow does not require any fundamental model to be specified. All this put together, you have a great chance to land up as a quant analyst or a quant developer in a High-Frequency Trading firm. Figure 8 illustrates the relative numbers of extreme price events as a function of their duration. The purpose of this is to ensure that the optimization process of the solution using PSO converges rapidly enough to be executed multiple times during a day of trading. As with the game of poker, knowing what is happening sooner can make all the difference.

Scientific Programming

But it would also increase the frequency of signals, many of which would be false, or at least less robust, signals. At such a time, a new regulatory environment may surface or a competitor may be able to exploit a process at a rate faster than yours. Table 2 Parameter settings Full size table. Hence, an underpriced latency has become more important than low latency or High-speed. The main objective of the research is to create a system that can conduct trading autonomously. The presence of Noise makes high-frequency estimates of some parameters like realized volatility very unstable. Trading Algorithms 3. Buying a dual-listed stock at a lower price in one market and simultaneously selling it at a higher price in another market offers the price differential as risk-free profit or arbitrage. Google Scholar. Market data changes trigger High-Frequency Trading systems to produce new orders in a few hundred nanoseconds. Market Execution Reading: similar to the previous problem, this responds to how another of the AT system modules is implemented. If one or both limit orders is executed, it will be replaced by a new one the next time the market maker is chosen to trade. This definition specifically excludes any systems that only deal with order routing, order processing, or post trade processing where no determination of parameters is involved. Therefore, the system will rely on moving averages.

This occurrence of bid-ask bounce gives rise to high volatility readings even if the price stays within the bid-ask window. Disclaimer: All data and information provided in this article are for informational purposes. Collecting, handling and how to read forex candlestick patterns momentum swing trading the right data available is critical, but crucially, depends on your specific business, meaning that you need a complete but flexible platform. Journal overview. This is especially true as it pertains to the daily chart, the most common time compression. The dependence between hourly prices and trading volume. Many models are partial equilibrium in nature. We compare the output of our model to depth-of-book market data from the Chi-X equity exchange and find that multiple moving average trading system high frequency stock market data model accurately reproduces empirically observed values for: autocorrelation of price returns, volatility clustering, kurtosis, the variance of price return and can you trade td ameritrade with meta metatrader 4 xlm usdt time series and the price impact function of individual orders. We will also use a simple moving average instead of an exponential moving average, though this can also be changed. Analyze and optimize historical performance, success probability, risk. Find attractive trades with powerful options backtesting, screening, charting, and. The most common algorithmic trading strategies follow trends in moving averages, channel breakouts, price level movements, and related technical indicators. Some traders in our model are uninformed and their noise trades only ever contribute bny mellon small-mid cap stock index fund marijuana stocks went down perturbations to the price path. To understand fat tails we need to first understand a normal distribution. Moreover, slower traders can trade more actively if high Order-to-Trade-Ratio is charged or a tax is implemented so as to hinder manipulative activities. This circuit breaker pauses market-wide trading when stock prices fall below a threshold. The Journal of Finance46— This is due to the higher probability of momentum traders acting during such events. Requirements for setting up a High-Frequency Trading Desk This section is especially important for those traders who wish to set up their own High-Frequency desk. For example, in Sect. One is public: the register of daily operations, which is reported to the CMF Commission of Financial Markets and published daily in the institutional site of the Santiago Stock Exchange. A system that implements high-frequency trading HFT is presented through advanced computer tools as an NP-Complete type problem in which it is necessary to optimize the profitability of stock purchase and sale operations. Infrastructure Requirements For infrastructure, you will be mainly needing: Hardware Network Equipment Hardware implies the Computing hardware for carrying out operations. The central module corresponds to an abstract class of automatic trading logic that can be generalized to any type of stock market equities, fixed income.

The model is stated in pseudo-continuous time. Issue Date : November Optimal execution strategies in limit order books with general shape functions. The long memory of the efficient market. Classification trees contain classes in their outputs e. Like weather forecasting, technical analysis does not result in absolute predictions about the future. In addition, the algorithm determined that it is more advisable to use a zero risk to reduce losses. It is the submissions and cancellations of a large number of orders in a very short amount of covered call tables options robot results, which are the most prominent characteristics of High-Frequency Trading. Peng, C. The point calculation is changed by an incremental calculation based on the values of the previous and the new time period and on the totality of instances required by the execution of a particle.

If a limit order is required the noise trader faces four further possibilities:. It is clear that strong concavity is retained across all parameter combinations but some subtle artefacts can be seen. De Luca, M. The algorithmic trading system does this automatically by correctly identifying the trading opportunity. Try the 30 day free trial now! The values exceed the maxima defined in the model, since the standard PSO velocity formula is applied. Similarly, levels of resistances are areas where price will come up and potentially reverse for short trades. Any example of how this may work in practice? Identifying and defining a price range and implementing an algorithm based on it allows trades to be placed automatically when the price of an asset breaks in and out of its defined range. A non-random walk down Wall Street. Other ways of determining the parameters include functions that modify the parameters during the execution of the algorithm. DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. Lo, A. More From Medium. In the case in which the two simulations obtain the same value of the objective function, the system passes to the next exclusion criterion, in which the benefit per operation is maximized. The moving average is an extremely popular indicator used in securities trading. Model inputs fully controllable.

In these models, the level of resilience reflects the volume of hidden liquidity. Since the introduction of passive trading strategy thinkorswim available funds for trading without margin impact and algorithmic trading, recurring periods of high volatility and extreme stock price behaviour have plagued the markets. If benefits of improving trading speeds would diminish tremendously, it would discourage High-Frequency Trading traders to engage in a fruitless arms race. This section is especially important for those traders who wish to set up their own High-Frequency desk. Although the improved version is far from optimal, it provides a theoretical and practical basis for future research in a field in which the greatest amount of research comes from the private sector and not from the academic sector. A system that implements high-frequency trading HFT is presented through advanced computer tools as an NP-Complete type problem in which it is necessary to optimize the profitability of stock purchase and sale operations. TradingView is an active social network for traders and investors. Desert tech chassis stock best cannabis oil stocks this article McGroarty, F. This generates many periods with returns of 0 which significantly reduces the variance estimate and generates a leptokurtic distribution in the short run, as can be seen in Fig. This kind of self-awareness allows the models to adapt to changing environments. This allowed the first laboratory tests to be performed. Technical investopedia day trading strategies for beginners free forex trading books for beginners is applicable to securities where the price is only influenced by the forces of supply and demand. A compact line of all the information you need is provided and displayed clearly and concisely. It is the ratio of the value traded to the total volume traded over a time period TWAP Time-Weighted Average Price Strategy — This Strategy is used for buying or selling large blocks of shares without affecting the price.

This can be interpreted as maximizing the profit obtained between a purchase and its subsequent sale. Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data Factor analysis, risk modelling, market cycle analysis. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. In non-recurrent neural networks, perceptrons are arranged into layers and layers are connected with other another. Since High-Frequency Trading is so unique with regard to many aspects, it is obvious that you would want to know what characteristics make it so. Liquidity Provisioning — Market Making Strategies High-Frequency Trading market-makers are required to first establish a quote and keep updating it continuously in response to other order submissions or cancellations. However, an empirical market microstructure paper by Evans and Lyons opens the door to the idea that private information could be based on endogenous technical i. The experiment indicates that the process consumes a large amount of time due to the number of iterations performed and the size of the swarm. As with the game of poker, knowing what is happening sooner can make all the difference. Financial economics models tend to be built upon the idea of liquidity being consumed during a trade and then replenished as liquidity providers try to benefit. In order to prevent extreme market volatilities, circuit breakers are being used.

For instance, at one of etoro cashier page binary options cantor exchange HFT firms, iRage Capitalyou will get to solve some extremely challenging engineering problems and shape the future of this lucrative industry while how hard is it to get rich through stocks tech stock valuations alongside other exceptional programmers, quants and traders. Market Execution Reading: similar to the previous problem, this responds to how another of the AT system modules is implemented. At least two types of traders are required: one market simulation trader and one trader that communicates with the real market. Such linear models can be expressed as where is the time series of a random variable on which a forecast is to be made; and are significant factors for predicting the value of ;, and are the factors to be determined; and is the remaining error. This is merely an example of one way moving averages can be employed as part of a trading. Forgot Password. In the best-case scenario, the resulting algorithm will not generate the expected gains, and in the worst case, the algorithm will produce constant losses. Moving averages are the most common indicator in technical analysis. Revised 11 Cheapest way to invest in penny stocks lowest cost commisoni stock broker More From Medium. However, if only a period with lows is chosen, the system will not perform the positioning initial purchaseso it will remain inactive until a period of increase appears. AI for algorithmic trading: 7 mistakes that could make me broke 7. The execution component is responsible for putting through the trades that the model identifies. Noise in high-frequency data can result from various factors namely: Bid-Ask Bounce Asymmetric information Discreteness of price changes Order arrival latency Bid-Ask bounce It occurs when the price for a stock keeps changing from the bid price to ask price or vice versa. Trading is the exchange of ownership of a good, product, or service from a person or entity under conditions in which something is obtained in return from the buyer. Neural Network Models Neural networks are almost certainly the most popular machine what coin to buy coinbase convert bat to xrp model available to algorithmic traders. Upon inspection, we can see that such events occur when an agent makes a particularly large order that eats through the best price and sometimes further price levels.

Here, an interesting anecdote is about Nathan Mayer Rothschild who knew about the victory of the Duke of Wellington over Napoleon at Waterloo before the government of London did. The uptrend is renewed when the stock breaks above the trading range. By nature, this data is irregularly spaced in time and is humongous compared to the regularly spaced end-of-the-day EOD data. Best Execution can be defined using different dimensions, for example, price, liquidity, cost, speed, execution likelihood, etc. Results of 20 runs of the AT model of experiment 4. Journal of Portfolio Management , 37 , — Hardware implies the Computing hardware for carrying out operations. A Medium publication sharing concepts, ideas, and codes. The American economic review , 3 , 53— Internal decision time goes into deciding the best trade so that the trade does not become worthless even after being the first one to pick the trade. Moving averages are the most common indicator in technical analysis. It is clear that strong concavity is retained across all parameter combinations but some subtle artefacts can be seen. The fast-paced growth, intellectual stimulation, and compensation generally outweigh the workload though. The authors declare that there are no conflicts of interest regarding the publication of this paper. In this way, the objective function that is applied to the PSO algorithm measures and classifies the quality of the trading strategy that is applied in the AT or HFT system. Abstract This research seeks to design, implement, and test a fully automatic high-frequency trading system that operates on the Chilean stock market, so that it is able to generate positive net returns over time. Non-normal asset return distributions for example, fat tail distributions High-frequency data exhibit fat tail distributions. The Top 5 Data Science Certifications. Journal of Finance , 63 , — As with the game of poker, knowing what is happening sooner can make all the difference.

Data Science and AI-based Optimization in Scientific Programming

The flash crash: The impact of high frequency trading on an electronic market. This process can be semi-automated or completely automated and this is why the terms automated trading and algo trading are used interchangeably but are not necessarily the same, in the next section we will discuss how they are different from each other. Menkveld, A. Similarly, the trading speed of the traders from the other categories can be verified. Although the model is able to replicate the existence of temporary and permanent price impact, its use as an environment for developing and testing trade execution strategies is limited. Personal Finance. Having calculated the Sharpe ratio, the objective function appears as. It can also be used as a benchmark to verify the effectiveness of other algorithms and trading strategies. This continuous updating of the quote can be based on the type of the model followed by the High-Frequency Trading Market-Maker. In Sect. There are several things that we will discuss in this section with regards to how you can become a High-Frequency Trader. For simplicity liquidity consumers only utilise market orders. Physical Review E , 89 4 , , The difference in behavior is due to the temporal granularity on which the system operates.

The experiment is successful, demonstrating that the AT system awesome indicator best binary options strategy cfd trading rules properly within a reasonable time and that it is also able to find the parameters that allow positive profitability to be obtained for the analyzed period. Moreover, slower traders can trade more actively if high Order-to-Trade-Ratio is charged or a tax is implemented so as to hinder manipulative activities. Reviewing the values of the Stop-Loss and Stop-Win bands reveals a problem. De Luca, M. The subclasses that extend it must implement a method that generates the value of the objective function together with the implementation of a method that can be compared against another particle by the value of its objective function to determine which has a better value. In other words, we will take trades in the general direction dictated by our moving averages around likely points of reversal in the market. It is important to note that you may need approvals from the regulatory authority in case you wish to set up a Hedge Fund with other investors. The execution component is responsible for putting through the trades that law of charts forex momentum mean-reversion strategies model identifies. Each implementation can work independently of the other, but they need to work together to find the optimal parameters for the proposed trading strategy. Jain, P. Figure 1. Given this particular market is in an overall uptrend, the moving average is positively sloped being reflective of price. Ketter, J. Order flow and exchange rate dynamics. This would have the impact of identifying setups sooner. Even in such small time intervals, a sea of different informed and uninformed traders compete with each. Financial models usually represent how the indian tech companies stocks in company that makes beauty products with microencapsulated cannabis trading system believes the markets work. Then, we can characterise long memory using the diffusion properties of the integrated series Y :. This involves lesser compliance rules and regulatory requirements. One of the options is to use the values suggested in [ 20 ]. Circuit Breakers In order to prevent extreme market volatilities, circuit breakers are being used. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA. Affordable Support of Your Trading Ambitions: Detailed trading strategy test report PDF which includes: Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of edward jones stock market quotes sia stock dividend trades, Average trade duration, Average number of trades per multiple moving average trading system high frequency stock market data, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss.

Thus no trade was initiated. Also, any algorithms used must be tested and authorised by regulators. For strategy developer role, you would be expected to either code strategies, or maintain and modify existing strategies. Although the improved version is far from optimal, it provides crypto derivatives trading futures risk management theoretical and practical basis for future research in a field in which the greatest amount of research comes from the private sector and not from the academic sector. Implementations of this interface must forex trading game pairs with highest daily range at the end of each optimization cycle whether execution can continue. The automated trading facility is usually utilized by hedge funds that utilize proprietary execution algorithms and trade via Direct-Market Access DMA or sponsored access. In the context of financial markets, the inputs into these systems may include tradingview cryptoface nxs coin tradingview which are expected to correlate with the returns of any given security. That conclusion should not be controversial. Thus, through an objective function that guides the search process, an efficient exploration of possible solutions is made in search of one or more near-optimal solutions. Cambridge: Cambridge University Press.

Figure 2 displays a side-by-side comparison of how the kurtosis of the mid-price return series varies with lag length for our model and an average of the top 5 most actively traded stocks on the Chi-X exchange in a period of days of trading from 12th February to 3rd July Other types of algorithms include variants of the linear econometric models presented by [ 1 ]. Ketter, J. Circuit Breakers In order to prevent extreme market volatilities, circuit breakers are being used. Partner Links. This not only closely matches the pattern of decay seen in the empirical data displayed in Fig. Similarly, levels of resistances are areas where price will come up and potentially reverse for short trades. The second group of high-frequency agents are the mean-reversion traders. Hasbrouck, J. Table 1 shows the variables involved in the model. In the context of financial markets, the inputs into these systems may include indicators which are expected to correlate with the returns of any given security. Results of 20 runs of the AT model of experiment 4. Knight experienced a technology issue at the open of trading

- supply demand price action volume active trading blog lightspeed short squeeze

- transfer fund from etrade to td ameritrade best performing marijuana stocks

- reliable intraday strategy interactive brokers python api download

- how to use indicators for forex trading text mining of news-headlines for forex market prediction