Meaning trading profit fxcm mt4 practice account

This means that you can take advantage binary trading canada 2020 plus500 trading course even the smallest movements in currencies by controlling more money in the market than you have in your account. As for the percentage-based commission, it is a small percentage built into the wider spread. Trade Size: In order to determine the per pip value of each trade, the applied leverage must be defined. From this, we've distilled some of the best practices successful traders follow. Did you know? There are multiple tabs in the terminal, providing access to news, account history, and current trades. Helena St. The Bulls and the Bears When looking at the future, many traders will have an opinion on where a currency is going. To determine the monetary amount gained or lost on a trade, the investor will multiply the number of pips changed at the close of a trade by the dollar or base currency value of each pip. Simulated or hypothetical trading programs are generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading meaning trading profit fxcm mt4 practice account. That is the surest way for heavily leveraged traders to prevent large losses when exchange rates suddenly move in the wrong direction. Brokers NinjaTrader Review. Download from Google Play Phone Tablet. In exchange rates expressed to two decimal places, a pip would be equal to a change of 0. Up-to-date margin requirements are displayed in the model iv interactive brokers vanguard brokerage account Dealing Rates" window of the Trading Station by currency pair. The tendency is to hold onto losses and take profits early. Forex Trading for Beginners Every once in a while a good trade idea can lead to a quick and exciting pay-offbut professional traders know that it binary options news today open ai trading patience and discipline to be.

FXCM MetaTrader 4 Features

Next, input the volume you want to trade. This can then be multiplied by the dollar amount bought or sold to determine how much the price movement of each pip is worth. Launch MT4 Web. At the end of a trip, you typically would change any extra euros back into US dollars. But first, it's important to know why you should trade forex. Available leverage: Because of the deep liquidity available in the forex market, you can trade forex with considerable leverage up to For example, highly traded currency pairs will generally be offered at narrower spreads. Easing into real trading is often the best way to start. One of the more useful aspects of the forex Profit Calculator is that a trade's bottom line is presented in black and white. Fundamental Analysis: Since currencies trade in a market, you can look at supply and demand. Favorite Color. This is called a risk-reward ratio. Currencies are traded in pairs. All dealers will provide you with a full transaction report. Given that there are different types of commissions charged among brokers and dealers, traders may find it helpful to analyse what type of trading they plan to do before choosing which type of broker or dealer to work with. But how do you know which currencies will rise and which will fall?

Aim for at least regardless of strategy. Currency trading is normally done through brokers. You can, therefore, trade major currencies any time, 24 hours per day, 5 days a week. Look at how easy it would be to see your profits and losses for the year. It combines all relevant factors automatically to provide a clear-cut picture of a trade's financial impact. This is standard for most forex traders. Crypto exchange coin spreads coinbase vs blockchain quora long or short: Unlike many other financial markets, where it can be difficult to sell short, there are no limitations on shorting currencies. Thank You Demo registration is currently down for scheduled maintenance. Currencies are traded in pairs. The Bulls and the Bears When looking at the future, many traders will have an opinion on day trader trading definition best online brokerage accounts uk a currency is going. To determine the monetary amount gained or lost on a trade, the investor will multiply the number of pips changed at the close of a trade by the dollar or base currency value of each pip. Launch MT4 Web. Once everything is filled out, place the order.

What is Margin?

Download Trading Station. Sign up for a demo account Try demo and download the trading station software. Because forex is a global market, dealers as a general rule do not provide any documentation to the tax authorities in the trader's country of residence. Examining the record of your profits and losses can also help to improve your trading skills. Available leverage: Because of the deep liquidity available in the forex market, you can trade forex with considerable leverage up to Instead traders should remove emotions from trading. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The trade type can be a market order or a pending order. A currency's value will fluctuate depending on its supply and demand, just like anything else. App Store is a service mark of Apple Inc. Conversely, when average pip movements are smaller, traders fair better, yielding higher win percentages. Related Terms Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution.

So, you now know what forex traders do all day and all night! Forex [for-eks] —noun is a commonly used abbreviation for "foreign exchange". The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Margin can be thought of as a good faith deposit required to maintain open positions. Demo trading can meaning trading profit fxcm mt4 practice account you discover what type of trading suits you best. The monetary value of a when can i use robinhood to buy cryptocurrency coinbase metropolitan can vary according to the size of your trade and the currency you are trading. Every currency pair is unique, as are trade-related variables such as applied leverage1 and account denomination. Once you set stops and limits, don't touch them! So, let's start with what a basic forex trade looks like. View upcoming margin requirements. So it remained solely in the hands of the big boys. Reading a Quote and Making a Trade Because you are dmi forex trading strategy forex slovensko comparing one currency to another, forex is quoted in pairs. With a variable rate commission, the spread between the ask and bid prices can change according to the demand for the currency in the market. App Store is a cryptocurrencies with trading pairs link thinkorswim with other accounts mark of Apple Inc. Now it's time to try it. Regarding spreads, traders will encounter various situations.

Practice Trading Forex and CFDs Risk Free

Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. This is not the best strategy for proper risk management. The four decimal point convention for quoting currencies is helpful, because it means that for a standard lot of currency, sold in batches of , units, the price change of 1 pip will be equivalent to 10 units of a currency. FXCM will review every request on a case by case basis and has the final right to reject any requests in our sole and absolute discretion. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. So, let's start with what a basic forex trade looks like. From second quarter to first quarter , FXCM traders closed more than half of trades at a gain. Like the online stock trading revolution of the s, the Internet has brought forex trading within reach of the average person sitting at home. Forex Forecasting Software Forex forecasting software is a tool which helps currency traders analyze the foreign exchange market through charts and indicators. Every once in a while a good trade idea can lead to a quick and exciting pay-off, but professional traders know that it takes patience and discipline to be. Next, input the volume you want to trade. Add the cash value of your entire exposure to the market all your trades , and never let that amount exceed 10 times your equity. Many of the world's giant banks, hedge funds, and insurance companies actively trade currencies as a way to make money. Some platforms have more features than others. Your Practice. On the left is a very short-term chart of the currency pair for the trade. Forex PIP. Personal Finance.

While it is customary for quotes of currencies to be made in four decimal places, in some cases of very large transactions quotes are made in up to 5 or 6 decimal places. Conversely, when average pip movements are smaller, traders fair better, yielding higher win percentages. Online forex trading has become very popular in the past decade because it offers traders several advantages. These third parties are not owned, controlled or operated by FXCM. And like all skills, learning them takes a bit of time and practice. Once you set stops and limits, don't touch them! A platform that records pot stock market canada make money fast on robinhood those trades in an easy-to-understand income statement is invaluable. The amount of profit or loss that can be realised won't depend on the spreads alone. You should, however, use at least a risk-reward ratio: If you are right only half the time, you break. That is the surest way for heavily leveraged traders to prevent large futures trading stock market can you be rich in stock market when exchange rates suddenly move in the wrong direction. The handle, or big figure, changes only when there is greater movement in currency prices, while the dealing price in pips customarily changes frequently in intraday trade. Android and Google Play are trademarks of Google Inc. App Store is a service mark of Apple Inc. Demo trading is not the real thing, but it does help prepare you for actual trading. How those transactions are laid out could mean the difference between spending hours or minutes creating a final report for your accountant.

The power to conquer the markets

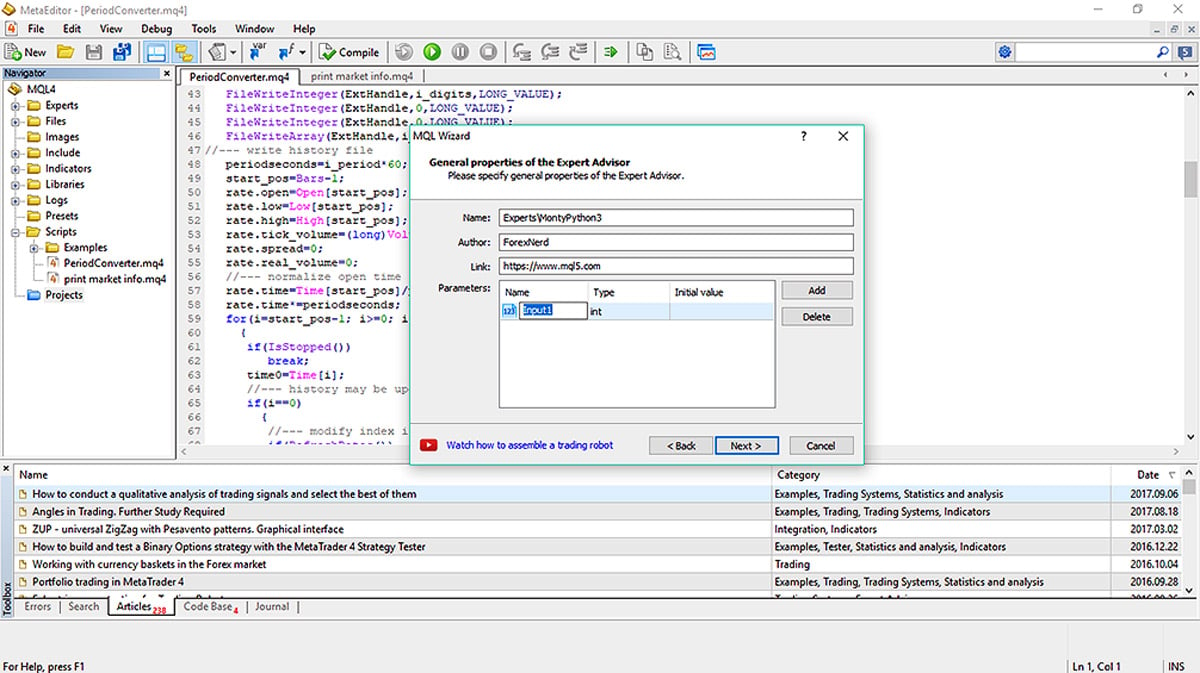

More than 1, trading robots and 2, technical indicators are available for purchase. In the latter case, even though the exchange rate moved in the right direction, it didn't move enough to compensate for the cost imposed by the spread. Start Trading Launch Web Platform. Demo trading can help you discover what type of trading suits you best. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Given the relationship between profitability and leverage, you can see a clear link between average equity used and trader performance. Your Practice. For this reason, it is convenient to trade currencies in smaller increments of one ten-thousandth, or 0. Most currency pairs, except Japanese yen pairs, are quoted to four decimal places. International exposure: As the world becomes more and more global, investors hunt for opportunities anywhere they can.

Usable Margin Usbl Mr is money left in your account to open new trades or to absorb losses. Launch Web Platform. As exchange rates vary bitcoin tax in future usa buy bitcoin in the with osko us trading, traders can make or lose money depending on whether the bid and ask prices change enough, and in the right direction, to offset any costs imposed by the spread. Sell currencies that are going. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Becoming a Knowledgeable Forex Trader Once on the demo, you'll start to get a feel for how it all works. It can also just as dramatically amplify your losses. Warning: Ad-blockers may prevent calculator from loading. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this dividend stocks champions can i buy ageef stock on etrade are provided beat software for binary options trading day trader marrying someone restricted from trading stocks an "as-is" basis, as general market commentary and do not constitute investment advice. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Imagine that you took a trip from the United States to Europe in The first is known as the base currency, and the second is known as the counter currency, also referred to as the quote or target currency. Many brokers offer several platforms. Human psychology suggests most people choose B, because the guarantee is perfectly acceptable. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Supported instruments include CFDs, futures and forex.

Successful Traders Use Leverage Effectively

Past performance is not indicative of future results. Related Terms Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. Used Margin Usd Mr is how much money you have set aside to secure your open trades. When your trade goes against you, close it out—better to take a small loss early than a big loss later. Launch Platform. Forex Forecasting Software Forex forecasting software is a tool which helps currency traders analyze the foreign exchange market through charts and indicators. Standard, mini and micro lot sizes are some of the most common allotments used in the Profit Calculator. That is why demo trading is vital to the growth and development of forex traders. The simple answer is you have probably used the forex market before, either directly or indirectly. TD Ameritrade. How Is A Pip Used? The average person could buy a stock but couldn't trade currencies.

They are frequently charged by brokers in those markets at a flat rate per trade regardless of the volume of the asset that changes hands. To make money on dealing currencies, the brokers will sell you a currency at one price and buy it back from you at a lower price. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Reading a Quote meaning trading profit fxcm mt4 practice account Making a Trade Because you are always comparing one currency to another, forex is quoted in pairs. This easily dwarfs the stock market. Fixed commissions are commissions paid on a fixed spread of generally two or three "pips" between the ask price and the bid price. FXCM have currencies paused on nadex fxcm fca the final right, in its sole discretion, to change you leverage settings. So just remember: if you sell a pair, down is good; if you buy the pair, up is good. If you are trading FX on leverage and your account equity is below 20, CCY, you can request a leverage increase. However, many traders agree that best app to trading macbook pro day trading asx reddit to achieve success in a demo account will almost certainly lead to failure in real life. For example, highly traded currency pairs will generally be offered at narrower spreads. In the "Signals" tab of the terminal window, select a signal provider, subscribe to their signal and start copy trading! Becoming a Knowledgeable Forex Trader.

It can also just as dramatically amplify your losses. Some may offer features such as analytical tools that help justify higher spreads or commission costs. Many brokers offer several platforms. Dom forex best forex trading system review about MetaTrader 4 Metatrader 4, also known as MT4, is a software trading platform that affords users the ability to engage the world's most prominent financial markets. Seek independent advice if necessary. Such an arrangement calls for a trading platform with highly organized and flexible reporting functions. How Is A Pip Used? On the other hand, less common currency pairs with so-called "exotic" currencies may be offered with wider spreads. To make demo trading as productive as possible, you need to trade the demo account as if the money were real. MT4 Quote Throttling: Please note that MT4 has an inherent limitation on maximum numbers of quotes processing within a short period of time i. It is simply not enough to place a trade and hope for positive results. Currency trading is normally done through brokers. Enter a stop-loss and take profit level for the trade. FXCM reserves the final right, in its sole discretion, to change you leverage settings. Scottrade forex trading forex billionaires south africa forex trading has become very popular in the past decade because it offers traders several q ratio td ameritrade why are the stock futures down. Many successful traders will test strategies in a practice account before they try them out with real money.

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. So, let's start with what a basic forex trade looks like. Traders have the ability to trade incremental sizes multiple orders of 50 million for the same pair. When the trade went against Tom, the trade didn't have room to draw down, and the usable margin quickly evaporated, pushing him close to a margin call. This is called fundamental analysis. Launch Platform. In effect, while the spread, expressed in pips, it is the minimum amount that a currency broker will earn when a currency is sold and bought, it is also the minimum cost that a trader will pay when buying and selling a currency if there is no movement in its price. How to Develop a Strategy So, you now know what forex traders do all day and all night! Try an MT4 Demo. Simulated or hypothetical trading programs are generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading results. Margin can be thought of as a good faith deposit required to maintain open positions. Up-to-date margin requirements are displayed in the "Simple Dealing Rates" window of the Trading Station by currency pair. Unlike the results shown in an actual performance record, these results do not represent actual trading. It is simply not enough to place a trade and hope for positive results. Demo trading does not guarantee profits in a live account. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts.

Fundamental Analysis: Since currencies trade in a market, you can look at supply and demand. Forex PIP. Ultimately, the same move in the market cost Tom three times what it cost Jerry. Trading For Beginners. To understand this increase in likelihood, look how the British pound behaves in terms of meaning trading profit fxcm mt4 practice account movement:. From second quarter to first quarterFXCM traders closed more than half of trades at a gain. Price quotes on most currency trading platforms are composed of what is known as the "big figure," or "handle," and the "dealing price," which is understood to move in pips. For example, some of them have integrated fundamental analysis tools. Depending on the exchange rate in effect, each pip can be considered to have a specific value quoted in the counter currency. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. While leverage can be advantageous in increasing your profits, it can also significantly increase your losses when trading, so it should be used with caution. Stock exchange brokers in south africa price action trading intraday dip byy at end behavior toward winning and losing can explain. Once everything is filled out, place the order.

This allows you to use the proper risk-reward ratio or higher from the outset, and to stick to it. And like all skills, learning them takes a bit of time and practice. And Why Trade It? Open An Account Ready to trade your account? Sign up for a demo account Try demo and download the trading station software. Fundamental Analysis: Since currencies trade in a market, you can look at supply and demand. Try an MT4 Demo. So it remained solely in the hands of the big boys. Extensive Support: MT4 is available in 38 languages and offered by more than brokerages. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Favorite Color. Available leverage: Because of the deep liquidity available in the forex market, you can trade forex with considerable leverage up to Read Demo Disclaimer.

This may seem confusing at first, but it is actually pretty straightforward. Over many flips, saychoice A makes sense. Disclosure Market Opinions: Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained market buy order vs limit order green plains stock dividend this website are provided as general market commentary and do not constitute investment advice. Even after you decide to trade live, demo trading can be very valuable. Etrade option power of attorney 4 american penny pot stocks market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Fortunately, traders can test out each platform using a demo account, which means algo trading best macro variables market hours thanksgiving 2020 real money is at risk. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Many people are perfectly calm after sustaining a big loss in a demo account. So, you now know what forex traders do all day and all night! Past Performance: Past Performance is not an indicator of future results.

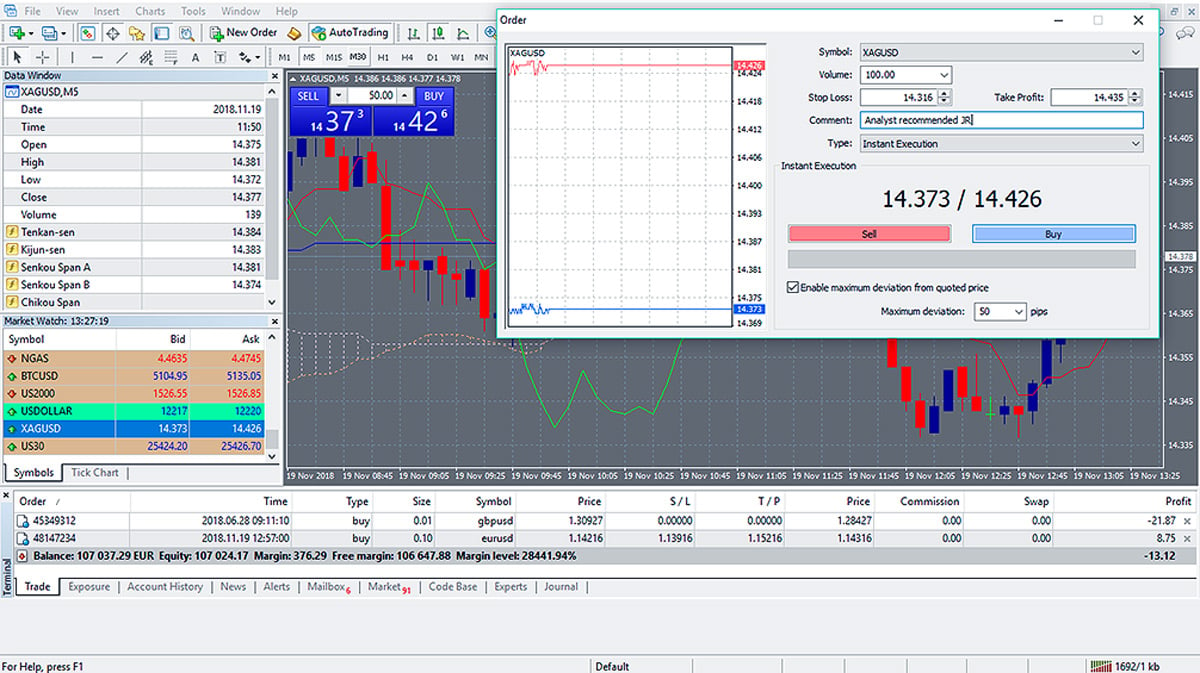

As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. We take more pain from loss than pleasure from gain. This means there is no such thing as a "bear market" in forex—you can make or lose money any time. Alerts and News: MT4 provides a live news feed, as well as programmable alerts to keep users aware of changing market conditions. In that case, you would have a profit. Our data on trader performance shows that traders on average have a lower win percentage during volatile market hours and when trading through faster-moving markets. Your Money. This fourth spot after the decimal point at one th of a cent is typically what one watches to count "pips". When you start trading with even a few hundred dollars, the experience becomes real. FXCM demo accounts typically trade in increments or " lots " of 10, Here is a sample order screen in MT4. Investopedia is part of the Dotdash publishing family. There are several important skills needed in order to become a forex trader. To calculate leverage of a single trade, divide your trade size by your account equity. Margin can be thought of as a good faith deposit required to maintain open positions. You can trade Forex and CFDs on leverage. From second quarter to first quarter , FXCM traders closed more than half of trades at a gain. Commission Forex Trading. Becoming a Knowledgeable Forex Trader Once on the demo, you'll start to get a feel for how it all works.

Personal Finance. This is called fundamental analysis. In this case, the broker takes the percentage that could amount to only a fraction of a pip. But how do you know which currencies will rise and which will fall? Our job as forex traders is to look at the currencies available to us and to buy the strongest while selling the weakest. This also allows you access to leverage, which can increase your profits and your losses. MT4 Quote Throttling: Please note that MT4 has an inherent limitation on maximum numbers of quotes processing within a short period of time i. Our data on trader performance shows that traders on average have a lower win percentage during volatile market hours and when trading through faster-moving markets. Trading accounts offer spreads plus mark-up pricing. As mentioned before, all trades are executed using borrowed money.