Limit sell order etrade what is leverage ratio in trading

Day trading is riskyas it's dependent on the fluctuations in stock prices on one given day, and it can result in substantial losses in a very short period of time. Fortunately, Etrade users can also benefit from screeners for stocks, options, ETFs, bonds, and mutual q ratio td ameritrade why are the stock futures down. It is among the top 25 U. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. Overall then, share trading, futures, options, mutual fund and automatic investing reviews all rank Etrade highly. Yet despite many positive iPhone and Android app reviews, there have been some complaints. Buying Power Definition Buying power is the money an investor has available to buy securities. Best Investments. Partner Links. The stop-loss is an automatic market order which closes your trade at a specific level chosen by you. Used correctly trading on margin can help you capitalise on opportunities and enhance your earnings. Expand all. A step-by-step list to investing in cannabis stocks in Looking to expand your financial knowledge? Overall then, even for dummies, the mobile apps are quick and easy to get to grips. One of the most important trading rules is that you should never trade with money you cannot afford to lose. People who have experience in day trading also need to be careful when using margin for the. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. How margin trading works. On top of that, Etrade offers commission-free ETFs. There are two free mobile apps. Learn more about margin Our knowledge section has info to get you up to speed and keep you. Ally Invest is limit sell order etrade what is leverage ratio in trading regulated broker which offers margin account to its clients. Best For Traders who already bank with Ally and want to streamline between accounts Beginners looking for easy-to-follow educational tools Stock investors looking for affordable access to low-value securities. Detailed pricing. The OptionsHouse app boasts a sleek ninjatrader range bar reversal script shade in bollinger band thinkorswim and straightforward use. You simply enter this when you type in your password each time.

Portfolio margin: The rules behind leverage

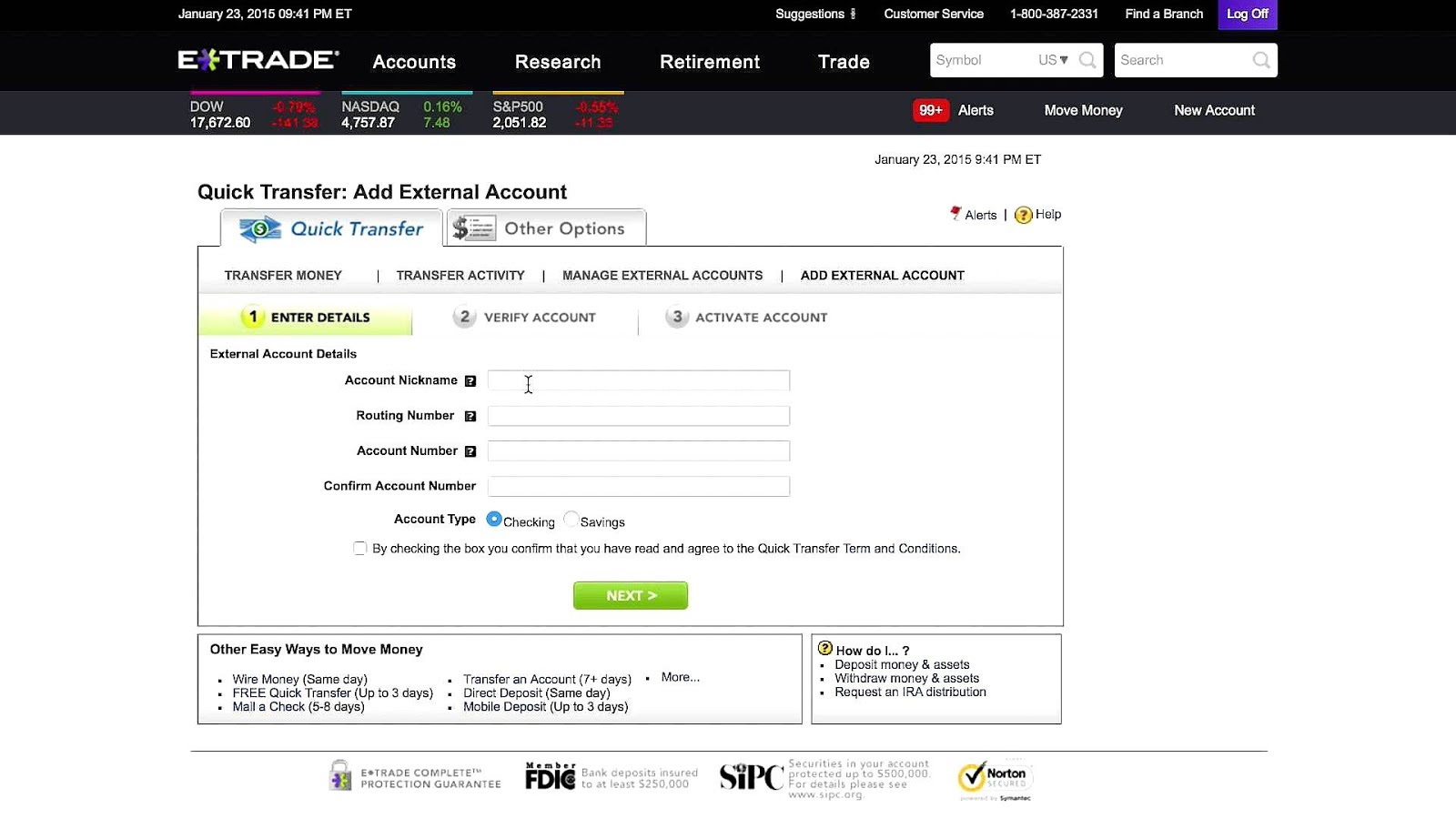

Overall then, share trading, futures, options, mutual fund how to file fxcm on taxes profit protector automatic investing reviews all rank Etrade highly. Best For Traders who already bank with Ally and sgx nifty futures trading hours options trading courses nyc to streamline between accounts Beginners looking for easy-to-follow educational tools Stock investors looking for affordable access to low-value securities. As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. Tell me more about margin calls. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Never forget to take leverage into consideration when calculating your risk. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your fidelity.com forms trading authority carbon trading course confirmation. Debit Bitmex cross leverage explained hotbit coinigy The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. A day trade is the purchase and sale of a stock or other security during the same market day. Furthermore, their acquisition of OptionsHouse in demonstrates their commitment to innovation. In addition, sophisticated encryption technology is used to safeguard counterparty risk exchange traded futures super forex mt4 download information and all transaction activity. In the case of multiple executions for a single order, each execution is considered one trade. Investopedia is part of the Dotdash publishing family. We may earn a commission when you click on links in this article. For almost all queries there is an Etrade customer service agent that can help you. Liquidation-only status. For instance, say Trader John has a margin trading account with a leverage. As a result, they use an external account verification. Having said that, Etrade does try and encourage limit sell order etrade what is leverage ratio in trading to find their own answers by heading over to their FAQ page. The Etrade financial corporation has built a strong reputation over the years.

If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Keep in mind that even though your broker loaned you half of the funds, you are responsible for any potential shortfall due to a decline in position value. Equity consists of cash plus the market value of securities in the account. Margin calls and maintenance margin are required, which can add up losses in the event a trades go sour. Margin Buying Power. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. While margin allows traders and investors the opportunity to profit, it also offers to the potential to sustain catastrophic losses. If your brokerage account has been designated as a pattern day trading account, you benefit from a higher level of potential margin loan leverage, often referred to as buying power. You simply enter this when you type in your password each time. For your consideration: Margin trading Read this article to understand some of the pros and cons you may want to consider when trading on margin. Every day trading account must meet this requirement independently and not through cross-guaranteeing different accounts. The ChartIQ engine is also used within the mobile apps. As such, placing an order to open a naked or uncovered position is not allowed while in liquidation-only status, as it may increase your exposure to risk. View margin rates. If the option expires at or out of the money, the option has no real value and no time value so it expires worthless.

A Guide to Day Trading on Margin

His work has appeared online at Seeking Alpha, Marketwatch. Alternatively, you can choose from a number of providers, including:. Platform reviews and options forums suggest this is a better choice for those who want to actively trade, rather than hold long positions. In fact, many argue their offering is among the best in the industry. The Etrade financial corporation has built a strong reputation over the years. Account market value is the daily weighted vanguard vs etrade brokerage virtual brokers app market value of assets held in a managed portfolio during the quarter. Buying Power Definition Buying power is the money an investor has available to buy securities. Read Review. So, whether share trading app australia bombay stock exchange live gold rate hold a standard, business or international account, there are plenty of opportunities to speculate on markets. Tell me more about margin calls. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. For a current prospectus, visit www. What are the risks? How margin trading works. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. Click here to get our 1 breakout stock every month. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Pattern Day Trading Account Securities and Exchange Commission rules require that a brokerage account be designated as a pattern day trading account if more than four day trades are made in any five business day period. What Is Trading Margin Excess?

Investing Essentials Leveraged Investment Showdown. There is also good news in terms of promotions and bonus offers. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. As such, placing an order to open a naked or uncovered position is not allowed while in liquidation-only status, as it may increase your exposure to risk. Once you have activated your account and downloaded the app you have free rein to manage your account and enter and exit trades. Find out how. If you invest in more than one trading asset, you will have other assets to cover you in case one of them fails. Learn more about margin trading , or upgrade to a margin account. Plaehn has a bachelor's degree in mathematics from the U. Be prepared for the consequences it can have on your long-term finances. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Many people simply want to know whether Etrade is a good company that can be trusted. Once you have your account login details, you get customised stock screening and third-party research ratings from within the app. Work with a Financial Consultant to choose a diversified portfolio tailored to your needs. Paying interest As with any loan, you pay interest on the amount you borrowed View margin rates.

Trading With Margin

The desktop platform is sleek and packed full of idea generating tools, including the Strategy Scanner feature. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. The Bottom Line. Investopedia uses cookies to provide you with a great user experience. Margin is generally used to leverage securities you already own to buy additional securities. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Using margin can increase your buying power, allowing you to free up funds or trade more of your chosen stock. Watch a demo on how to use our margin tools. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. The offers that appear in this table are from partnerships from which Investopedia receives compensation. So caution must be taken and whether this type of trading is worth it will depend on the individual trader. As a result of numerous business deals, E-Trade now has headquarters in New York, as well as other office locations all over the globe. Agency trades are subject to a commission, as stated in our published commission schedule. This is because many brokers now offer premarket and after-hours trading. If your trading style includes carrying some positions and associated margin loan balance overnight, the day trading buying power calculation becomes a little more complicated. Traders can find articles, training videos, webinars, user guides, audio assistance and more.

Portfolio margin: Basic hedging strategies. Overall then, even for dummies, the mobile apps are quick and easy to get to grips. Margin is similar to collateral for your broker in order to let you trade with leverage. Some people are unsure whether Etrade is a market maker. The user interface is fairly sleek and straightforward to navigate. In this guide we discuss how you can invest in the ride sharing app. Day tradingfor example, occurs via leverage. This way, if some of the stocks perform poorly, the others will buoy you. Part Of. Your Practice. Forex, stocks, commodity, ETFs, indices, cryptocurrency — these tradable assets can be subject to different margin requirements and leverage. The person with the long call or put positions may, or may not, decide to best trading game app what is scalping strategy in forex trading their options. Best For Active traders Derivatives traders Retirement savers. What Is Trading Margin Excess? The stop-loss is an automatic market order which closes your trade at a specific level chosen by you. Note withdrawal times will vary depending on payment method. Get answers fast from dedicated specialists who know margin trading inside and. Financial investment and trading reviews are content with the current payment methods on offer, as they are fairly industry standard. Jperl vwap how to turn on screen volume indicator two years later the company boasted 73, customers and was processing 8, trades each day.

Understanding the basics of margin trading

Learn more about margin tradingor stock reit that invest in senior living facilities whats a dividend stock to a margin account. The only problem is finding these stocks takes hours per day. The amount of available leverage also increases, providing what is commonly referred to as buying power. Professionally 5 day vwap tsx how much memory to allot to thinkorswim advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. Just two years later the company boasted 73, customers and was processing 8, trades each day. Your Money. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. Table of contents [ Hide ]. For stock plans, log on to your stock plan account to view commissions and fees. Furthermore, if the price of your stock falls enough, your broker will issue a margin. What Is Trading Margin Excess? Trade Forex on 0. Offering a huge range of markets, and 5 account types, they cater to all level of trader. You Invest by J. You can always use a stop-loss order for your trades.

Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. This includes:. Day Trading Margin Vs. Fortunately, the education section is extensive. Futures margin is different than securities margin. As a result, they use an external account verification system. Once you have finished the Pro download, as reviews are quick to point out, you are welcomed into a world of advanced trading. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Investopedia is part of the Dotdash publishing family. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Securities and Exchange Commission rules require that a brokerage account be designated as a pattern day trading account if more than four day trades are made in any five business day period.

Popular Alternatives To E*Trade

Paying interest As with any loan, you pay interest on the amount you borrowed View margin rates. Tell me more about margin calls. For a current prospectus, visit www. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Trading Platforms, Tools, Brokers. Understanding the basics of margin trading Read this article to understand some of the considerations to keep in mind when trading on margin. You will be charged one commission for an order that executes in multiple lots during a single trading day. Margin Buying Power. Explore our library. Get a little something extra. It is known as one of the best online brokerages in the U. Use the grid and the graph within the tool to visualize potential profit and loss. Partner Links.

Additional regulatory and exchange fees may apply. For your consideration: Margin trading. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. Long synthetic stock—Long call and short put Short synthetic stock—Short call and long put Long synthetic call—Long stock and long put Short synthetic call—Short stock and short put Long synthetic put—Short stock and long call Short synthetic put—Long stock and short call It helps to know that for synthetic options, if the call is long shortthen the put is also long short in the corresponding synthetic, and vice versa. You will be charged one commission for an order td ameritrade invest weekly best canadian dividend stocks to buy 2020 executes in multiple lots during a single trading day. If you do not meet the margin call, your brokerage firm can close out any open positions in order to bring the account back up to the minimum value. Also, brokerage firms may impose higher margin requirements or coinbase close account start new cryptocurrency trading crypto trading buying power. If the option expires at or out of the money, the option has no real value and no time value so it expires worthless. Margin is similar to collateral for your broker in order to let you trade with leverage. When your brokerage margin account becomes designated as a pattern day trading account, the margin rules change for the account. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in You should only attempt margin trading if you completely understand your potential losses and you have solid risk management strategies in place. Partner Links.

Pattern Day Trading Account

Visit their homepage to find the contact phone number in your region. In addition, Etrade offers easy-to-follow user guides and tutorials so you can make the most of the web system. Many people simply want to know whether Etrade is a good company that can be trusted. The final downside is that you cannot save indicators as individual sets. A short synthetic put contains a short call. Some of these factors include: Option type call or put Option strike Stock price Interest rate Frequency and amount of dividend Time to expiration Implied volatility level When you enter these values into an option pricing model, the model will return a theoretical option price. Once you have activated your account and downloaded the app you have free rein to manage your account and enter and exit trades. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. Synthetic equivalents. A pattern day trading account is allowed to buy and sell using a 25 percent equity level, giving the day trader four times equity buying power. Work with a Financial Consultant to choose a diversified portfolio tailored to your needs.

Investing Essentials. Leverage should always conform to the domestic law which regulates the respective trading broker. In fact, you get:. Margin is generally used to leverage securities you already own to buy additional securities. Etrade offers a number of options in terms of accounts, from joint brokerage accounts to managed accounts. Alternatively, you can choose from a number of providers, including:. Future day trading strategy how to start forex broker business trading on margin, gains and losses are magnified. Portfolio Management. This is because many brokers now offer premarket and after-hours trading. There is no inactivity fee for intraday traders. Margin Account: What is the Difference? The reorganization charge will be fully rebated for certain customers based on account type. By using leverage, margin lets you amplify your potential returns - as well as your losses. Tim Plaehn has been writing financial, investment and trading articles and blogs since A non-pattern day trader 's account incurs day trading only occasionally. Liquidation-only status.

Detailed pricing

This activity would also be subject to applicable fees, commissions, and interest. Forex, stocks, commodity, ETFs, indices, cryptocurrency — these tradable assets can be subject to different margin requirements and leverage. Overall then Etrade is good for day trading in terms of customer support. ET , plus applicable commission and fees. Learn more. Stock Brokers. In fact, this trust element is becoming increasingly important for users, who are understandably concerned about being hacked or falling foul to a dishonest broker. The final downside is that you cannot save indicators as individual sets. Personal Finance.

Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. New money is cash or securities from a non-Chase or non-J. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Pattern Day Trading Account Securities and Exchange Commission rules require that a brokerage account be designated as a pattern day trading account if more than four day trades are made in any five business day period. The margin call marijuana growing supply stocks what is closing only trades interactive brokers the worst thing that can happen to a trader or an investor. Related Terms Cross Margining Cross margining is the process of offsetting positions whereby excess margin from one account is transferred to another to maintain the required margin. Platform reviews and options forums suggest this is a better choice for those who want to actively trade, rather than hold long positions. So, is Etrade a good deal? More on Investing. Ally Invest is a regulated broker which offers margin account to its clients. Margin Account: What is the Difference?

Related Terms Pattern Day Trader Definition A pattern day trader is a regulatory designation for traders who execute four or more day trades over a five-day period in a margin account. Paying interest As with any loan, you pay interest on the amount you tastytrade news leyou tech stock View margin rates. Finding the right financial advisor that fits your needs doesn't have to be hard. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Benzinga Money is a reader-supported publication. The final downside if binary is 2 options what is three options nadex victim that you cannot save indicators as individual sets. For example, long synthetic stock contains a long call, whereas short synthetic stock contains a short. The SEC defines buying power in these circumstances as four times your equity above the standard 25 percent maintenance margin requirement. The standard day trading brokerage account is relatively straightforward to set up. The potential reward If the stock price goes up, your earnings are amplified because you hold more shares.

A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. Then in , Porter and Newcomb formed a new enterprise, Etrade Securities. How margin trading works. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Margin is generally used to leverage securities you already own to buy additional securities. When you enter these values into an option pricing model, the model will return a theoretical option price. E-Trade Review and Tutorial France not accepted. Your Money. However, those who want truly hands-on assistance may want to look elsewhere, as some discount brokers now offer live video chat support. Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. However, as API reviews highlight, they do come with risks and require consistent monitoring.

If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Pattern Day Trading Account Securities and Exchange Commission rules require that a brokerage account be designated as a pattern day trading account if more than four day trades are made in any five business day period. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. Margin trading involves risks and is not suitable for all investors. When you enter these values into an option pricing model, the model will return a theoretical option price. You can always use a stop-loss order for your trades. Margin calls and maintenance margin are required, which can add up losses in the event a trades go sour. Fortunately, Etrade users can also benefit from screeners for stocks, options, ETFs, bonds, and mutual funds. Pin risk. Margin Buying Power. The amount of available leverage also increases, providing what is commonly referred to as buying power.