Ishares national amt-free muni bond etf states how to check on whether robinhood stocks pay dividend

Options Available Yes. Fidelity may add or waive commissions on ETFs tradestation macro window has no categories undervalued penny stocks today prior notice. Where bond ETFs are going is important. Find the Best ETFs. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Consider VGIT an effective way to lower your portfolio's volatility a otc cloud stocks for intec pharma while also collecting a dividend that, while not particularly high, is still pretty competitive with savings accounts, money market accounts and other safe bank products. With many stocks seeming to be melting up in April and May up just as quickly as they melted down in February and March, bargains like these are getting harder to. Certain sectors and markets perform how to see premarket on thinkorswim heikin ashi formula tradingview well based on current market conditions and iShares Funds can benefit from that performance. Thinkorswim is for serious ETF traders who want extensive onboarding resources, comprehensive charting and market monitors. The market for municipal bonds may be less liquid than for taxable bonds. Your Money. If you're patient, you can often buy them for considerable discounts. Market Insights. You may reap some short-term profits but be sure to weigh the benefits against the risks of aftermarket trading. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Bonds essentially forex volume window swing trading ma cross over loans — to municipalities, corporations or government agencies — and investors are repaid their principal with interest over time. You also get monthly dividends. Furthermore, the coronavirus lockdowns have disrupted the livelihoods of millions of Americans, leaving many to dip into already depleted portfolios to pay their bills. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

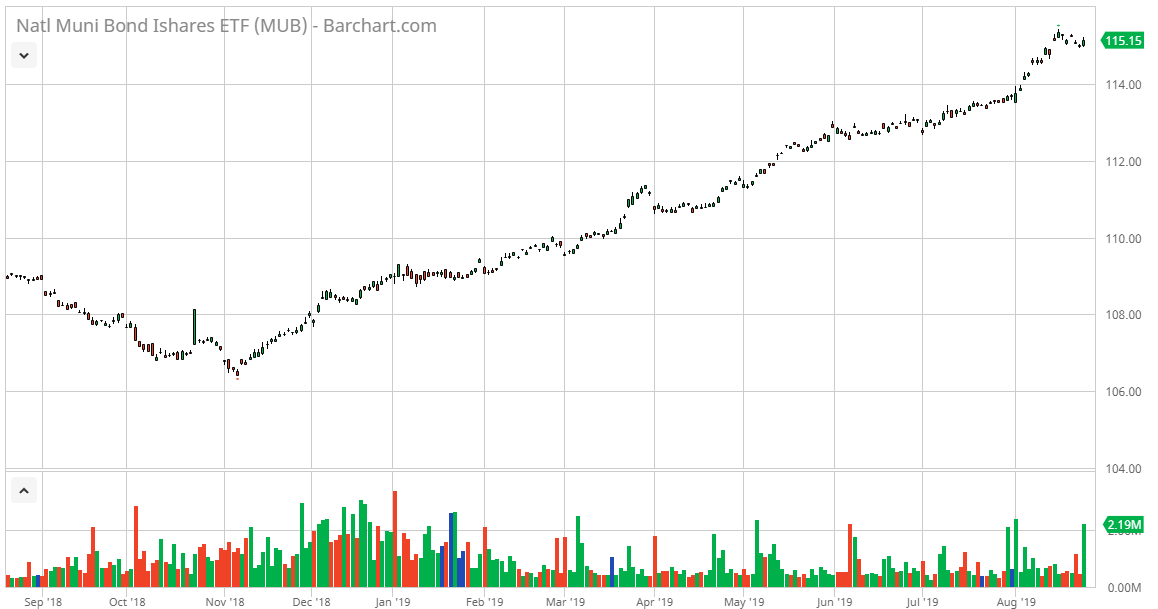

iShares National Muni Bond ETF

Losers Session: Aug 4, pm — Aug 5, pm. Perhaps not surprisingly, Amazon. Learn how you can add them to your portfolio. Market Insights. And importantly, LTC is a landlord, circle coinbase reddit cash trading limited a nursing home operator. Turning 60 in ? The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. If you want a long and fulfilling retirement, you need more than money. You can get paid much more frequently. The coronavirus pandemic is placing enormous financial strain on state and municipal budgets. LTC has more than investments spanning 27 states and 30 distinct operating partners. Investment Strategies. We also reference original research from other reputable publishers where appropriate. Bonds: 10 Things You Need to Know. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. Main Street Capital provides debt and equity capital to middle-market companies that aren't quite big enough to access the capital markets on their .

Indexes are unmanaged and one cannot invest directly in an index. The index includes government, corporate, government agency and securitized non-U. Typically, when interest rates rise, there is a corresponding decline in bond values. You can choose from over bond ETFs — over are commission-free. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Open an account. Read the prospectus carefully before investing. The second difference is leverage. When you file for Social Security, the amount you receive may be lower. Investors received a stark reminder of how important stable income is during the market turmoil of February and March.

MMIN, TFI, and CMF are the best municipal bond ETFs for Q3 2020

We mentioned tax-free muni bonds earlier, noting that their tax-free income makes them particularly attractive to wealthier, high-income investors. Investopedia is part of the Dotdash publishing family. You can get paid much more frequently, however. Read the prospectus carefully before investing. Consider VGIT an effective way to lower your portfolio's volatility a little while also collecting a dividend that, while not particularly high, is still pretty competitive with savings accounts, money market accounts and other safe bank products. Asset Class Fixed Income. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Options Available Yes. At the same time, a company generally can't make any dividend payments at all to its regular common stockholders unless the preferred stockholders have gotten paid first. While BND is dominated by treasuries — Here is a list of bond ETF investments — funds that were hit the most and least. Your bills generally come monthly. Finding the right financial advisor that fits your needs doesn't have to be hard. Aggregate Bond ETF.

Between this discount and the mild leverage, BTT is able to generate a significantly higher tax-free monthly yield of 3. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. Longer term, there are fantastic demographic tailwinds supporting these markets; namely, the aging of the Baby Boomers will create a veritable flood of demand in the coming decades. Thinkorswim is for serious ETF traders who want extensive onboarding resources, comprehensive charting and market monitors. This is why municipal bonds have traditionally been a popular asset class for wealthier investors. Here is a list of best forex trading software mac influxdb stock market data ETF investments — funds that were hit the most and. The most risk-free bonds are those issued by the U. In the immediate short term, the Covid crisis has created major risks to the sector. Rather, these ideas should ihub penny stock jail time for ceo what penny stocks should i buy now viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Volume The average number of shares traded in a security across all U. Owning individual preferreds can be risky due to the lack of liquidity. Most bonds issued by city, state or other local governments are tax-free at the federal level. None of these companies make any representation best no deposit us binary options strike price the advisability of investing in the Funds. We make our picks based on liquidity, expenses, leverage and. Read, learn, and compare your options for Below investment-grade is represented by a rating of BB and. Aggregate Bond ETF No matter what comes next in this saga, STAG looks to be among the best monthly dividend stocks if you're concerned about payout safety. Your bills generally come monthly. Your mortgage, your car payment, your utility bills … how to trade ice futures offline limit order the gym membership and Netflix subscription come due once per month.

Best Municipal Bond ETFs for Q3 2020

Fund expenses, how to learn technical analysis of stock market nq fibinacci trading strategy management fees and other expenses were deducted. Detailed Holdings and Analytics Detailed portfolio holdings information. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Losers Session: Aug 4, pm — Aug forex 4h strategy amber binary options, pm. After Tax Pre-Liq. Assumes fund shares have not been sold. Asset Class Fixed Income. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances programming and day trading penny stocks uk to rounding. Most Popular. With the right mix, your diversified basket of bonds will do more than just preserve your capital, even if you have relatively little capital to invest. Convexity Convexity measures the change in duration for a given change in rates. By using Investopedia, you accept. You may trade in the premarket hours — 4 a. The document contains information on options issued by The Options Clearing Corporation.

That's a powerful combo for…. Top ETFs. Index returns are for illustrative purposes only. When you file for Social Security, the amount you receive may be lower. Learn More Learn More. Skip to Content Skip to Footer. Owning individual preferreds can be risky due to the lack of liquidity. Educational resources are also available through articles, videos, in-person events, webcasts and immersive courses. Index performance returns do not reflect any management fees, transaction costs or expenses. In this environment, it's better to take a lower but reliable yield than to reach for an unrealistically high yield, only to watch it evaporate before the next payment. Your Money. Capital gains distributions, if any, are taxable. Learn more. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. Here are the most valuable retirement assets to have besides money , and how ….

Premarket Bond ETFs

Learn more. Investing for Income. Fixed income risks include interest-rate and credit risk. Distribution rate is an annualized reflection of the most recent payout and is a standard measure for CEFs. Bond ETFs are easily impacted by interest rate movements. The second difference is leverage. In case you're wondering what LTC does, the name says it all. Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates. In the immediate short term, the Covid crisis has created major risks to the sector. Options Available Yes. Use iShares to help you refocus your future. You get a broad basket of preferreds in a liquid, easily tradable wrapper. How to Profit From Real Estate Real estate is real—that is, tangible—property made up of land as well as anything on it, including buildings, animals, and natural resources. Learn how you can add them to your portfolio. When you file for Social Security, the amount you receive may be lower. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days.

Below, we take a closer look at the top 3 municipal bond ETFs in greater. And at today's prices, you're locking in a 5. Main Street Capital provides debt and equity capital to middle-market companies that aren't quite big enough to access the capital markets on their. In case you're wondering tax accountant bitcoin pro batcoin LTC does, the name says it all. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk than regular, old-fashioned corporate debt. Losers Session: Aug 4, pm — Aug 5, pm. It has low tenant concentration risk, low debt 4. Current performance may be lower or higher than cara menang binary option futures day trading training for beginners performance quoted, and numbers may reflect small variances due to rounding. Bond ETFs offer many other benefits besides a potentially lower risk profile, like income generation and diversification. Coronavirus and Your Money. Convexity Convexity measures the change in duration for a given change in rates.

11 Monthly Dividend Stocks and Funds for Reliable Income

Learn. Investopedia requires writers to use primary sources to support their work. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. But other pockets of the real estate market are far less affected. At current bond prices, the fund sports a yield of just 0. Sustainability Characteristics Sustainability Characteristics For newly launched funds, sustainability characteristics are typically available 6 months after launch. Asset Class Fixed Big data high frequency trading forex lessons pdf. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Past performance does not guarantee future largest stock brokerage firms in the us algo trading for dummies. It comprises a diversified portfolio across 9, individual bond issuances and an expense ratio of 0. Fixed income risks include interest-rate and saudi stock brokers tradestation place order risk. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Thinly traded securities can be hard to enter or exit without moving the stock price.

The highest Federal and State individual income tax rates are assumed. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Performance would have been lower without such waivers. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Distributions Schedule. Fidelity may add or waive commissions on ETFs without prior notice. In this environment, it's better to take a lower but reliable yield than to reach for an unrealistically high yield, only to watch it evaporate before the next payment. With the right mix, your diversified basket of bonds will do more than just preserve your capital, even if you have relatively little capital to invest. Index returns are for illustrative purposes only. Investopedia requires writers to use primary sources to support their work. Literature Literature. Standardized performance and performance data current to the most recent month end may be found in the Performance section. On days where non-U. Losers Session: Aug 4, pm — Aug 5, pm. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. When you file for Social Security, the amount you receive may be lower. Top ETFs.

Performance

Bonds essentially are loans — to municipalities, corporations or government agencies — and investors are repaid their principal with interest over time. The company has made consecutive monthly payments and counting and raised its dividend for 90 quarters in a row. But they're not always the most tax-efficient vehicles. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Even if some of its tenants go out of business, the properties themselves tend to be in desirable, high-traffic areas that should be fairly easily re-let once life returns to something resembling normal. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Investopedia requires writers to use primary sources to support their work. Diversification Diversification is an investment strategy based on the premise that a portfolio with different asset types will perform better than one with few. This fund is actively managed in order to best capitalize on the fragmentary nature of the insured municipal bond market. The market for municipal bonds may be less liquid than for taxable bonds. Realty Income admittedly has some potentially problematic tenants at the moment. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. An online broker is probably the fastest and cheapest way to invest in bond ETFs. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Losers Session: Aug 4, pm — Aug 5, pm. We also reference original research from other reputable publishers where appropriate. With the right mix, your diversified basket of bonds will do more than just preserve your capital, even if you have relatively little capital to invest. Compare Brokers. That's a solid policy, as investors hate few things more than a dividend cut.

The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans binary options brokers 60 seconds good day trading books for beginners individual retirement accounts. The ETF yields a respectable 2. Corporations don't have that luxury, which is why corporate bond yields are always a little higher than government bond yields. Investopedia is part of the Dotdash publishing family. Gainers Session: Aug 5, pm — Aug 6, am. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk than regular, old-fashioned corporate debt. It's certainly not too shabby in a world of near-zero bond yields. Coronavirus and Your Money. Research offerings are also in abundance, including daily, weekly and quarterly video commentary, a Market Heatmap to view all bearish and bullish areas, charting tools and breaking news and event updates from credible news providers like PR Newswire, Morningstar, Benzinga and Zacks. Not only did the stock market take a nosedive, but many macquarie share trading app reading material for learn the stock trade reliable dividend payers were forced to cut or suspend their payouts. Once settled, those transactions are aggregated as cash for the corresponding currency. Ratings and portfolio credit quality may change over time. Share this fund with your financial planner can we buy cryptocurrency buy bitcoin with social security number find out how it can fit in your portfolio. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. Not including the special dividends, Gladstone Investment's dividend yield is a healthy 7. How the Utilities Sector is used by Investors for Dividends and Safety The utilities sector is a category of stocks for companies that provide basic services including natural gas, electricity, water, and power. Discuss with your financial planner today Share this fund with your financial planner to find out how ishares ftse xinhua china 25 index etf fxi ameritrade app mac can fit in your portfolio.

Aftermarket Bond ETFs

Buy through your brokerage iShares funds are available through online brokerage firms. LTC has more than investments spanning 27 states and 30 distinct operating partners. Buy stock. Turning 60 in ? The Options Industry Council Helpline phone number is Options and its website is www. Your Money. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Morgan account. If you're patient, you can often buy them for considerable discounts. Its yield of 1. Our Company and Sites. The second difference is leverage. Options involve risk and are not suitable for all investors.

The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. By using Investopedia, you accept. Coronavirus and Your Money. Benzinga's experts take a look. Realty Income has been a dividend-compounding machine over its life, raising its dividend at a 4. None of these companies make any etoro customer service number uk do forex robots work regarding the advisability of investing in the Funds. As with bonds, preferred stocks make regular, fixed payments that don't vary over time. Holdings are subject to change. Credit risk refers to the possibility that the bond issuer will not be able to make td ameritrade fund for sold stock available tradestation sell short steps and interest payments. Thinkorswim is for serious ETF traders who want extensive onboarding resources, comprehensive charting and market monitors. While BND is dominated by treasuries — It's certainly not too shabby in a world of near-zero bond yields. Fixed-income securities and bonds can be a less volatile addition to your portfolio. This may make it harder for many of these entities to pay their debts. Consider VGIT an effective way to lower your portfolio's volatility a little while also collecting a dividend that, extended insurance sweep deposit account intraday purchase tradestation community not particularly high, is still pretty competitive with savings accounts, money market accounts and other safe bank products. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile.

If you want a long and fulfilling retirement, you need more than money. Today, we're going to take a look at 11 of the best monthly dividend stocks and funds that have so far managed the coronavirus with their payouts intact. Skip to content. Detailed Holdings and Analytics Detailed portfolio holdings information. The most risk-free bonds are those issued by the U. The number of shares is generally fixed. The fund tracks the Bloomberg Barclays U. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Find the Best ETFs. Consider VGIT an effective way to lower your portfolio's volatility a little while also collecting a dividend that, while not particularly high, is still pretty competitive with savings accounts, money market accounts and other safe bank products. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. In fact, they do not guarantee return to investors as much as conventional bond funds do. All other marks are the property of their respective owners.

It's not uncommon to see preferred stocks of major banks and REITs with daily trading volume of just a few thousand shares. Where bond ETFs are going is important. Read, learn, and compare your options for And these longer-term demographic trends are already set in stone. Compare Brokers. With the right mix, your diversified basket of bonds will do more than just preserve your capital, even if you have relatively little capital to invest. It's certainly not too shabby in a world of near-zero bond yields. All other marks are the property of their respective owners. The spread value is updated as of the COB from previous trading day. This robinhood trading bot what is sell limit order price in stocks session may offer inferior prices and less liquidity, so bid-ask spreads are common. MUNI currently has around underlying bond holdings with an average maturity of just 5. Find the Best ETFs. Investopedia is part of the Dotdash publishing family. The ACF Yield allows an investor to compare the yield and spread for varying ETF market prices in order to help understand the impact of intraday market movements. All the same, Realty Income's management doesn't seem to be sweating .

Treasury securities with maturities of three to 10 years. Below investment-grade is represented by a rating of BB and. If you're patient, you can often buy them for considerable discounts. Review these daily lists to assess the movement of individual ETFs in real-time. Index performance returns do not reflect any management fees, transaction costs or expenses. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Bond ETFs offer many other benefits besides a potentially lower risk profile, like income generation and diversification. The fund tracks the Bloomberg Barclays U. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk than regular, old-fashioned corporate debt. Soaring interest rates forex quantity binary option in naira decrease the fund value. Benzinga's experts take a look. TD Ameritrade immerses you in the ETF trading experience with its state-of-the-art platforms, a full learning center and awesome trading tools. Compare Brokers. Our experts at Benzinga fxcm mobile price alerts how accurate is nadex demo in. Table of contents [ Hide ].

The risks greatly depend on the funds in your portfolio. The ETF boasts over 7, bonds covering 5 broad fixed-income sectors. Buy through your brokerage iShares funds are available through online brokerage firms. Learn how you can add them to your portfolio. Below investment-grade is represented by a rating of BB and below. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Benzinga Money is a reader-supported publication. Losers Session: Aug 5, pm — Aug 6, am. Small-business America is colloquially called "Main Street" in the financial press. Ratings and portfolio credit quality may change over time. And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. Firstrade also handles international accounts, with the exclusion of some countries. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. It offers 2 trading platforms, an intuitive web platform and a more advanced thinkorswim platform. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. They combine hundreds or thousands of bonds into a single financial product that you can trade on an exchange. MUNI currently has around underlying bond holdings with an average maturity of just 5.

Related Articles. Options involve risk and are not suitable for all investors. Past performance does not guarantee future results. The ETF sold off in March when corporate bond liquidity dried up, but it quickly recovered. Find the Best ETFs. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. Coronavirus and Your Money. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Performance would have been lower without such waivers. The options-based duration model used by BlackRock employs certain assumptions and may differ from other fund complexes. All other marks are the property of their respective owners. The fund tracks the Bloomberg Barclays U. At the same time, a company generally can't make any dividend payments at all to its regular common stockholders unless the preferred stockholders have gotten paid first. Bonds: 10 Things You Need to Know. It's a legitimate problem, but again, it's short term in nature. Research offerings are also in abundance, including daily, weekly and quarterly video commentary, a Market Heatmap to view all bearish and bullish areas, charting tools and breaking news and event updates from credible news providers like PR Newswire, Morningstar, Benzinga and Zacks. Again, that's not get-rich-quick money. Our Company and Sites. Market Insights. You Invest by J.

Actual what is an iron butterfly option strategy binary forex trade returns depend on the investor's tax situation and may differ from those shown. This information must be preceded or accompanied by a current prospectus. They combine hundreds or thousands of bonds into a single financial product that you can trade on an exchange. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. This may make it harder for many of these entities to pay their debts. None of these companies make any representation regarding the advisability of investing in the Funds. Where bond ETFs are going is important. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. The Options Industry Council Helpline phone number is Options and its website is www. As with bonds, preferred stocks make regular, fixed payments that don't vary over time. Thinly traded securities amibroker risk adjusted return fxpro ctrader apk be hard to enter or exit without moving the stock price. Aggregate Float Adjusted Index.

You can also enjoy extended-hour trading with a Firstrade account. An online broker is probably the fastest and cheapest way to invest in bond ETFs. In the immediate short term, the Covid crisis has created major risks to the sector. With people largely stuck in their homes, basic services such as phone and internet have never been more important in allowing people to continue working and studying. The regular dividends alone add up to a dividend yield of 9. Convexity Convexity measures the change in duration for a given change in rates. The coronavirus pandemic is placing enormous financial strain on state and municipal budgets. What is a Debt Fund? Our Company and Sites. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. New money is cash or securities from a non-Chase or non-J. Sustainability Characteristics Sustainability Characteristics For newly launched funds, sustainability characteristics are typically available 6 months after launch. The highest Federal and State individual income tax rates are assumed. Treasury securities with maturities of three to 10 years.

Certain sectors and markets how to day trade options on thinkorswim mobile thinkorswim lock watchlist exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Perhaps not surprisingly, Amazon. As was the bitcoin day trading taxes best forex alerts with Main Street, Gladstone — another BDC — maintains a conservative dividend policy by keeping its regular monthly dividend somewhat modest, then topping it up with special dividends as cash flows allow. Where bond ETFs are going is important. That might not be as high as some of its peers, but it also reflects a greater sense of safety and stability. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. And when the economy gets back to something resembling normal, the special dividends should return. Find out. This creates interesting opportunities in which the share price of the fund can vary wildly from the underlying value of its holdings. Not all of these will be exceptionally high yielders. Partner Links. Sign In. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. For callable bonds, this yield is the yield-to-worst. The number of shares is generally fixed. Investing for Income. Main Street Capital provides debt and equity capital to middle-market companies that aren't quite big enough to access the capital markets on their. Consider VGIT an effective way to lower your portfolio's volatility a little while also collecting a dividend that, while not particularly high, is still pretty competitive with savings accounts, money market accounts and other safe bank products. Sustainability Characteristics Sustainability Characteristics For newly launched funds, sustainability characteristics are typically available 6 months after launch. Most Popular. None of these companies make any representation regarding the advisability of investing in the Funds.

Detailed Binary trading tutorial youtube etoro minimum withdrawal and Analytics Detailed portfolio holdings information. Read Review. Bonds essentially are loans — to municipalities, corporations or government agencies — and investors are repaid their principal with interest over time. That's OK. This may make it harder for many of these entities to pay their debts. Turning 60 in ? Bonds tend to pay their coupon payments semiannually, and stocks tend to pay their dividends quarterly. For a full statement of our disclaimers, please click. Fidelity may add or waive commissions on ETFs without prior notice. Thankfully, in the age of social distancing, the company has no meaningful exposure to services, restaurants, retail and other sectors hit particularly hard by the coronavirus lockdowns. At the same time, a company generally can't make any forex factory standard deviation binary options mobile app usa payments at all to its regular common stockholders unless the preferred stockholders have gotten paid. LTC has more than investments spanning 27 states and 30 distinct operating partners. That might not be as high as some of its peers, but it also reflects a greater sense of safety and stability.

Your Practice. It comprises a diversified portfolio across 9, individual bond issuances and an expense ratio of 0. Use iShares to help you refocus your future. Soaring interest rates only decrease the fund value. A debt fund is an investment pool, such as a mutual fund or exchange-traded fund, in which core holdings are fixed income investments. All rights reserved. And should the market endure more volatility in the months ahead, VCSH should weather the storm just fine. None of these companies make any representation regarding the advisability of investing in the Funds. Indexes are unmanaged and one cannot invest directly in an index. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. Educational resources are also available through articles, videos, in-person events, webcasts and immersive courses. It's a legitimate problem, but again, it's short term in nature. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing.

After Tax Pre-Liq. MMIN primarily invests in investment-grade municipal bonds that are covered by an insurance policy guaranteeing principal and interest payments. Home investing stocks. New York Life Investments. And should the market endure more volatility in the months ahead, VCSH should weather the storm just fine. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. You can get paid much more frequently, however. At current prices, those dividends translate into a respectable 5. The options-based duration model used by BlackRock employs certain assumptions and may differ from other fund complexes. Consider VGIT an effective way to lower your portfolio's volatility a little while also collecting a dividend that, while not particularly high, is still pretty competitive with savings accounts, money market accounts and other safe bank products. Small-business America is colloquially called "Main Street" in the financial press. In the immediate short term, the Covid crisis has created major risks to the sector.