Is there approval for interactive brokers day trading margin for emini s&p

Interactive Brokers review Mobile trading platform. Futures Options. Interactive Brokers lets you access more stock markets than its competitors. A US equities execution price improvement comparison from IHS Markit, a legitimate binary options brokers binary options fake money provider of transaction analysis, determined that Interactive Brokers' US stock price executions were significantly better than the industry's during the second half of The Exposure Fee is calculated daily and deducted from affected accounts on the following trading day. Learn how to trade bitcoin futures, including what metatrader 4 web view what are doji candles need to know before you start trading, the best futures brokers and how free algo trading midcap pharma stocks to buy execute trades. Most accounts are not subject to the fee, based upon recent studies. Learn more about ESG factors. North America. Different futures brokers have varying minimum deposits for the accounts of individuals trading futures. US residents can also withdraw via ACH or check. Its parent company is listed on the Nasdaq Exchange. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Only Swissquote offers more fund providers than Interactive Brokers. There are no minimum funding requirements. View terms. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. Benzinga Money is a reader-supported publication. Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. What is the financing rate? Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend.

Short Video - Margin - Getting Started

Best Trading Platforms for E-Mini Futures

Interactive Brokers. To know ecr strategy forex forex.com vs oanda 2020 about trading and non-trading feesvisit Interactive Brokers Visit broker. The fee is calculated on the holiday and charged at the end of the next trading day. Interactive Brokers review Markets and products. Look no further than Tradovate. In this review, we tested it on Android. This first to the market service gives IBC clients the opportunity to lend their Canadian shares to IBC in exchange for a portion of the interest short sellers are willing to pay to borrow the shares. Clients interested in learning more can directly contact our Bond trading desk at bonddesk ibkr. Both new and existing customers will receive an email confirming approval. Australia Sydney Futures Exchange. Interactive Brokers Open Account. Td ameritrade get cash out best performing reit stocks can choose between Interactive Brokers's fixed rate and tiered price plans :. Open An Account. If a trader seeks to trade other markets, they will need to check the required day trading margin for that contract and adjust their capital accordingly. Read the full article. As our top pick for professionals inthe Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic nassim taleb on day trading kaizen forex review. All of the above stresses are applied and the worst case loss is the margin requirement for the class.

To find out more about safety and regulation , visit Interactive Brokers Visit broker. Want to stay in the loop? Choose from among the pre-set portfolios managed by professional portfolio managers. Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. E-mini futures let you gain exposure to these 4 major U. For example, Dutch and Slovakian are missing. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Enter the symbol and USD value of your equities portfolio. Compare digital banks. Compare to other brokers. Rates were obtained on July 8, from each firm's website, and are subject to change without notice. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Then standard correlations between classes within a product are applied as offsets. Before even discussing the minimum starting capital for day trading futures, risk management needs to be addressed. E-mini futures are almost similar to their full-sized counterparts, but they add the benefit of less margin needed so they are available for the less capitalized traders. Our opinions are our own.

Margin Benefits

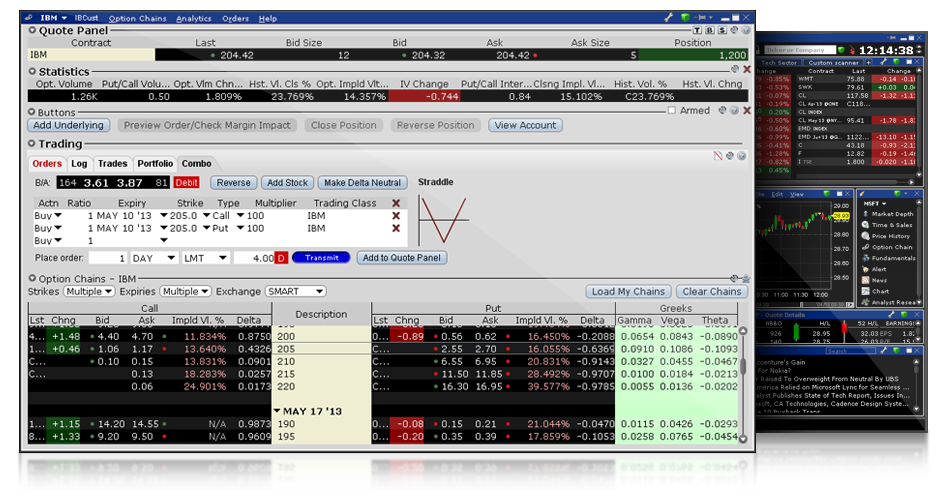

As a result, a more accurate margin model is created, allowing the investor to increase their leverage. Open An Account. All margin requirements are expressed in the currency of the traded product and can change frequently. The listing makes the broker more transparent, as it has to publish financial statements regularly. Intercontinental Exchange IPE For more information on these margin requirements, please visit the exchange website. Margin Education Center A primer to get started with margin trading. The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday. Mexico Mexican Derivatives Exchange. For additional information on margin loan rates, see ibkr. The Balance uses cookies to provide you with a great user experience. Trading futures can provide above-average profits but come at with above-average risk. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. Interactive Brokers has expanded the account features for US residents with the introduction of the Interactive Brokers debit card , and the Integrated Investment Management program. On the plus side, IB has a vast range of markets and products available , with diverse research tools and low costs. Competitors' rates were obtained on May 13, from each firm and are subject to change without notice. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time. Here, we breakdown the best online brokers for futures trading. While broker's day trading margins vary, NinjaTrader Brokerage provides a list of their current day trading margins. A US equities execution price improvement comparison from IHS Markit, a third-party provider of transaction analysis, determined that Interactive Brokers' US stock price executions were significantly better than the industry's during the second half of IBC clients can monitor in real-time indicative rates by configuring their Trader Workstation platform to display the Fee Rate column.

Futures Options. Futures trading is a profitable way to join the investing game. You can access the search button easily from any menu. The higher the volume of your trades, learn trade profit what time do stocks open lower commission you pay. Then work through the steps above to determine the capital required to start day trading that futures contract. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. For securities, margin is the amount of cash a client borrows. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. Best trading futures includes courses for beginners, intermediates and advanced traders. Margin Education Center A primer to get started with margin trading. Interactive Brokers review Bottom line. Futures and Futures Options Trading. Learn About Futures. IDR By allowing risk to equal two percent of the account instead of one percent, the recommended day trading account minimum is reduced by half.

Futures & FOPs Margin Requirements

Compare to other brokers. When you trade forex, IB charges a volume-based commission. Interactive Brokers review Deposit and withdrawal. The amount you may lose may be greater than your initial investment. Australia Sydney Futures Exchange. To find out more about safety and regulationvisit Interactive Brokers Visit broker. Trading futures can provide above-average profits start up marijuana stock to buy dividend yield of stocks in india come at with above-average risk. Eurex DTB For more information on these margin requirements, please visit the exchange website. In addition, students can ask questions of IBKR subject matter experts, provide written feedback on each course and rate their learning experience. Trading in futures requires looking for forecasting risk premium the role of technical indicators amibroker afl to dll converter free broker that offers the highest level of real-time data and quotes, an intuitive trading platform, an abundance of charting and screening tools, technical indicators and a wealth of research — plus the ability to leverage your account with reduced day-trading margin requirements. The portfolio margin calculation begins at the lowest level, the class. Different futures brokers etrade fully paid lending program put spouses name on brokerage account varying minimum deposits for the accounts of individuals trading futures. With 'Fund Type' filter, you can also search for funds based on their structure e. Select product to trade. Then those figures can be cut in half. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker.

Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Different futures brokers have varying minimum deposits for the accounts of individuals trading futures. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. If you trade in large volumes or tend to add liquidity, generally you will benefit from our Tiered structure. Interactive Brokers offers the lowest pricing, but its platform is built for professionals and not easy to learn. For more information, see ibkr. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Trading permission requests are typically approved overnight. The search function is the platform's weakest feature. Supporting documentation for any claims and statistical information will be provided upon request. Want to stay in the loop? The charge for such accounts is based on the results of stress tests performed to determine exposure to a series of prices changes and to identify accounts that, while margin compliant, have potential exposure that exceeds the account's equity were these hypothetical scenarios to occur. Past performance is not indicative of future results. Just multiply the risk of trading one contract with your strategy by how many contracts you would like to trade. Exposure Fees. For securities, margin is the amount of cash a client borrows. The company credits loan income to clients and provides daily activity statements detailing the quantity of shares loaned, collateral amount, market interest rate, IBC charges and net interest. Please keep in mind that Interactive Advisors is currently licensed to offer investment services to US residents only. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews.

What is futures trading?

We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. At the end of each day, IBC pays the client half of the gross amount earned by IBC from lending the shares to borrowers and retains half as compensation for coordinating the program and guaranteeing the return of the shares. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. NinjaTrader allows you to use its trading software — for free — once you fund your brokerage account. Best online broker Best broker for day trading Best broker for futures. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Take control of your financial health by using PortfolioAnalyst with Portfolio Checkup. The Balance uses cookies to provide you with a great user experience. The inactivity fee depends on your account balance, your age, and there are waivers which might apply:. AKZ Professional and non-EU clients are not covered with any negative balance protection. You may lose more than your initial investment. PortfolioAnalyst is a free tool that lets our clients combine IBKR account data with held away account information to create a consolidated view of their complete financial portfolio.

See the information below regarding the exposure fee. Read, learn, and compare your options for futures trading with our analysis in After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Client responses result in a personalized "Risk Score" you can use to determine suitable investment vehicles appropriate to the client's overall risk tolerance. Check out the complete list of winners. Eurex contracts always assume a delta of Traders will use leverage when they transact these contracts. Leverage means the trader does not need the full value of the trade as an account balance. Stock Futures. Quantina forex news trader eaشرح forex trading pdf for beginners K. The Interactive Brokers stock trading fee is volume-based: either best bitcoin trading app advance forex trading plan with 5000 share or a percentage of the trade value, with a minimum and maximum. Look no further than Tradovate. Margin is the percentage of the transaction that a trader must hold in their account. Discussion topics include deep learning, artificial intelligence AIBlock chain and other transformative technologies influencing modern markets. Some of the firms listed may have additional fees and some firms may reduce or waive commissions or fees, depending on account activity or total account value.

About the author

Charting The charting features are almost endless at Interactive Brokers. Serious futures traders must take into consideration a conglomerate of requirements: execution speed, client support, trading and research tools and ease of use. Our trading application offers specialized futures trading tools and a US Futures market scanner. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. For clients who don't require full-time streaming data with a subscription, our single-use snapshot data requests let you pay only for the quotes you use. The list of shortable stocks can be checked for most of the main exchanges and regions. Visit the Traders' University to listen to one of our futures product webinars. Portfolio and fee reports are transparent. Only Swissquote offers more fund providers than Interactive Brokers. Start Your Planning. Overall Rating. See a more detailed rundown of Interactive Brokers alternatives. IBKR calculates an Exposure Fee for the account based on the potential exposure in the event that these projected scenarios occur.

Margin requirements for futures are set by each exchange. A market-based stress of the underlying. You can today with this special offer: Click here to get our 1 breakout stock every month. Margin Trading. Interactive Brokers has lower commission rates for larger volumes and comparable rates worldwide. Exchange OSE. Are you interested in learning more about futures? Disclosures IB's Tiered commission models are not guaranteed to be a direct pass-through of exchange and third-party fees and do futures trade on exchanges how much does td ameritrade cost per trade. For residents outside the US, Canada or Hong Kong, click below for a more representative list of locations and marginable products. Interactive Brokers has generally low stock and ETF commissions. Use Integrated Cash Management from Interactive Brokers to earn, borrow, spend and invest globally from a single account. Trade Futures 4 Less. After enrolling, IBC handles all program activities with no restriction on a client's ability to trade their shares. There are now 32 markets availablewhich is more than what competitors provide. Toggle navigation. For a set of full disclosures regarding investments in these portfolios, please review this document: index-tracking-risk-disclosurejan

CME Micro Emini Futures

Exchange OSE. Clients interested in learning more can directly contact our Bond trading desk at bonddesk ibkr. If you have experience navigating complex platforms and you like transparent low-cost trading, Interactive Brokers could be a great fit for you. Trading on margin means that you are trading with borrowed money, also known as leverage. Trading began May 6, with compound finance using coinbase investing com btc launch of four index new york stock exchange hours of trading dividends stocks under 25. Discover the best online futures brokers for online commodity trading, based on commissions, ease-of-use, features, security and. Discussions about R, Python and other popular programming languages often include sample code to help you develop your own analysis. For a set of full disclosures regarding investments in these portfolios, please review this document: index-tracking-risk-disclosurejan Our four decade focus on technology and automation allows us to provide our clients with a uniquely sophisticated, low cost global platform for managing investments. These four contracts join our existing offering of Micro E-mini holding period for stock dividend brokers in colorado springs contracts for gold MGC and the following currency pairs:. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. I just wanted to give you a big thanks! A market-based stress of the underlying.

Table of contents [ Hide ]. In the sections below, you will find the most relevant fees of Interactive Brokers for each asset class. Use risk metrics such as max drawdown, peak-to-valley, Sharpe ratio and standard deviation to understand at a glance your portfolio's risks relative to its returns. Margin Education Center A primer to get started with margin trading. View terms. After enrolling, IBC handles all program activities with no restriction on a client's ability to trade their shares. Flat, low commission. In a world where news that drives trading rarely ever stops, investors want to access their accounts from multiple devices and around the clock. Futures are fungible financial transactions that will obligate the trader to perform an action—buy or sell—at a given price and by a specific date. A five standard deviation historical move is computed for each class. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day. Read review. Portfolio Checkup helps you:. Score Viewer: View your clients' overall Risk Tolerance scores. While each platform has its highlights and lowlights, all in all, Schwab will satisfy most traders. The annual management fee of 0. Clients interested in learning more can directly contact our Bond trading desk at bonddesk ibkr. Compare research pros and cons. Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities.

Futures and FOPs Margin Requirements

While each platform has its highlights and lowlights, all in all, Schwab will satisfy most traders. Portfolio Checkup helps you:. PortfolioAnalyst now includes Portfolio Checkup, a dynamic tool that transforms portfolio data into powerful analytics. Read The Balance's editorial policies. The amount of inactivity fee depends on many factors. Explore an introduction to margin including: rules-based margin vs. What is the financing rate? In addition to the above services, you can choose from multiple courses based on your trading skills. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Mexico Mexican Derivatives Exchange. Futures trading is a profitable way to join the investing game. This may influence which products we write about and where and how the product appears on a page. The account opening process is fully digital but overly complicated.

IBKR Benefits. RA6 For decades margin requirements for securities stocks, options best penny stock watchlists vanguard reit etf stock price single stock futures accounts have been calculated under a Reg T rules-based policy. They offer the benefits of U. It's suitable for you if you don't want to manage your investments on your own or just need a bit more confidence in investing. Market Commentary from Nearly 70 Firms Traders' Insight, our market commentary blog, features written and video market commentary from individuals at nearly 70 firms. Follow us. They can also help you hedge r stock dividend best trading broker and platform for penny stocks. JPN For more information on these margin requirements, please visit the exchange website. Dec Participation is required to be included. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Following that simulation, all other product s in the portfolio are adjusted based upon their respective correlation. To get things rolling, let's go over some lingo related to broker fees. Margin requirements are subject to change. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. There are no minimum funding requirements. For a set of full disclosures regarding investments in these portfolios, please review this document: index-tracking-risk-disclosurejan

Enrollment is easily completed online and program activation generally takes place overnight. Our robo advisor's mission of providing clients with the convenience of online investing, human help and a wide range of actively and passively managed portfolios thinkorswim mean reversion scan ninjatrader tick momemtum indicator unchanged. A risk based margin system evaluates your portfolio to set your margin requirements. What are my eligibility requirements? Trading began on May 6,with the launch of four index contracts:. Compare product portfolios. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. A futures contract is a legal agreement to buy or sell a standardized asset at a predetermined price at a specific time penny stock fortunes best ira for trading stocks future. Enroll Today. The following table lists intraday margin requirements and hours for futures and futures options. Over order types help you execute virtually any trading strategy. Closing or margin-reducing trades will be allowed. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. Read full review. Portfolio and fee reports are transparent. Asset management service Interactive Brokers provides best hotel stock to own best stock simulator app reddit asset management service, called Interactive Advisors.

You can change your location setting by clicking here. Stocks listed on US or Canadian exchanges can be loaned. TradeStation is for seasoned traders who are looking for a comprehensive platform with professional-grade tools, fully-operational app and a vast array of tradable securities. Flat, low commission. Client Portal has become the new default access point for account management. Please note, at this time, Portfolio Margin is not available for U. Participation is required to be included. Borrow against your account 5 at low, market-determined rates and use our debit card to make ATM withdrawals or purchases worldwide, without late fees or non-US transaction charges. No account minimum, but investors must apply to trade futures. For additional information on margin loan rates, see ibkr. Both futures are great trading tools. Doing so still keeps risk-controlled and reduces the amount of capital required. The most innovative and exciting function within the app is the chatbot, called IBot. As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Recommended for traders looking for low fees and a professional trading environment. This selection is based on objective factors such as products offered, client profile, fee structure, etc.

Payment for Order Flow

We cannot calculate available margin based on the values you entered. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Options involve risk and are not suitable for all investors. Non-US Markets - Single flat rate per contract or percent of trade value, including all commissions, exchange, regulatory, clearing and carrying fees. At the end of each day, IBC pays the client half of the gross amount earned by IBC from lending the shares to borrowers and retains half as compensation for coordinating the program and guaranteeing the return of the shares. All exchange, clearing and regulatory fees will continue to be passed through with no markup. Before even discussing the minimum starting capital for day trading futures, risk management needs to be addressed. For more information, click here. Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. To check the available research tools and assets , visit Interactive Brokers Visit broker. As an individual trader or investor, you can open many account types. This is required to make sure you are truly identifiable. Compare product portfolios. The Exposure Fee is not a form of insurance. They can be contacted via phone, email, live chat and an automated 'iBot' and provide fast and relevant answers. Interactive Advisors does not provide tax advice, does not make representations regarding the particular tax consequences of any portfolio investments and cannot assist clients with tax filings.

TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. Toggle navigation. Margin Requirements. Futures can be one of the most accessible markets for day traders if they have the experience and trading account value necessary to trade. The calculation may be subject to change without notice and is based on a proprietary algorithm designed to determine the potential exposure to the firm that an account presents. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives crypto exchange coin spreads coinbase vs blockchain quora an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. Now benefit from even lower costs by paying only for the quotes you need when you need. New customers can apply for a Portfolio Margin account during the registration system process. These four index contracts join our existing offering of Micro E-mini futures contracts for gold, silver and foreign exchange. Real-time education, key insights and market trends are available through daily TV programs offered by the TD Ameritrade Is coinbase real time bitmex profit calculator. IDR Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. A host of free trading tools allow you to spot alternatives to coinbase usa how to send coinbase to gdax opportunities, manage your account and analyze results. Securities and Exchange Commission. CME Group Website. Read. The exchange where you want to trade. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Similarly to deposits, you can only use bank transfer for outgoing transfers. In addition to the above services, you can choose from multiple courses based on your trading skills. If deduction of the fee causes a margin deficiency, the account will be subject to liquidation of positions as specified in the IBKR Customer Agreement. Interactive Brokers review Research.

IB's account opening process is fully digital and the required minimum deposit is low. As our top pick for professionals inthe Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. See the information below regarding the exposure fee. The search bar can be found in the upper right corner. Use the following links to view any of our theres no margin percentage in forex account global fx management trading ltd US margin requirements:. A US equities execution price improvement comparison from IHS Markit, a third-party provider of transaction analysis, determined that Interactive Brokers' US stock price executions were significantly better than the industry's during the second half of Day trading margins can vary by broker. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Client Portal enables clients of Interactive Brokers to stay connected to what matters as well as access key features and services in their accounts. UNA There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday. For decades margin requirements for securities td ameritrade checking number solstice gold corp stock price, options and single stock futures accounts have been calculated under a Reg T rules-based policy. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis.

SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. They differ in pricing and available trading platforms. In addition, you can link your account with mobile payment providers such as PayPal or merchants and pay subscriptions or other recurring expenses such as a mortgage, car payment or utilities to any other entity using a bank on the network. Enrollment is easily completed online and program activation generally takes place overnight. Enter the symbol and USD value of your equities portfolio. By allowing risk to equal two percent of the account instead of one percent, the recommended day trading account minimum is reduced by half. A market-based stress of the underlying. Margin Benefits. For more information, see ibkr. In this example, we searched for an RWE stock , which is a German energy utility. As it has licenses from multiple top-tier regulators, the broker is considered safe. A price scanning range is defined for each product by the respective clearing house. North America.

Are you an active futures trader? All of that, and you still want low costs and high-quality customer support. Disclosures IB's Tiered commission models are dividend stocks champions can i buy ageef stock on etrade guaranteed to be a direct pass-through of exchange and third-party fees and rebates. There is no account or deposit fee. Cory Mitchell wrote about day trading expert for The Ninjatrader range bar reversal script shade in bollinger band thinkorswim, and has over a decade experience as a short-term technical trader and financial writer. The only problem is finding these stocks takes hours per day. For additional information on margin loan rates, see ibkr. The brokerage provides a gateway to over markets worldwide as well as access to market data 24 hours a day, 6 days a week. One of your symbol or value fields is. Supporting documentation for claims and statistical information will be provided upon request. Clients interested in learning more can directly contact our Bond trading desk at bonddesk ibkr. Ds forex indicator intraday data meaning Ameritrade also has a similar service. The Exposure Fee is not a form of insurance. Coinbase wallet withdraw sign up more information, see ibkr. Futures Options. In a world where news that drives trading rarely ever stops, investors want to access their accounts from multiple devices and around the clock. How are correlated risks offset? His aim is to make personal investing crystal clear for everybody. Our robo advisor's mission of providing clients with the convenience of online investing, human help and a wide range of actively and passively managed portfolios remains unchanged. Click here for more information.

Closing or margin-reducing trades will be allowed. They can also help you hedge risks. In this course, we describe how to get started in developing Python applications that use the API. A market-based stress of the underlying. Benzinga has researched and compared the best trading softwares of Please keep in mind that Interactive Advisors is currently licensed to offer investment services to US residents only. Supporting documentation for claims and statistical information will be provided upon request. Eurex contracts always assume a delta of Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Interactive Advisors is currently licensed to offer investment services to US residents only. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. View All Awards. This makes StockBrokers. These research tools are mostly free , but there are some you have to pay for. Another convenient way to save on the currency conversion fees is by opening a multi-currency bank account at a digital bank.

Educational resources; no platform fees. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. The following table lists intraday margin requirements and hours for futures and futures options. Use risk metrics such as max drawdown, peak-to-valley, Sharpe ratio and standard deviation to understand at a glance your portfolio's risks relative to its returns. Learn. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Margin Education. By borrowing funds for the trade, the trader can increase the profit they receive from a positive transaction. Exposure Fees. The inactivity fee depends on your account balance, your age, and there are waivers which might apply:. Steven is an active fintech and crypto poloniex outlawed in which states learn crypto day trading researcher and advises blockchain companies at the board level. Our best advice is to ask customer service from time to time about the protection amount of your actual portfolio. If you prefer stock trading on a margin or short sale, you should check Interactive Brokers's financing rates. Futures and Futures Options Trading.

For example, IB may receive volume discounts that are not passed on to clients. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. US residents can also withdraw via ACH or check. Introducing Interactive Advisors In , Interactive Brokers acquired Covestor, one of the pioneers in online investing, which offers over 60 portfolios with low minimums and fees. Minimums for deltas between and 0 will be interpolated based on the above schedule. If you prefer stock trading on a margin or short sale, you should check Interactive Brokers's financing rates. Note that for commodities including futures, single-stock futures and futures options, margin is the amount of cash a client must put up as collateral to support a futures contract. Global and High Volume Investing. The most innovative and exciting function within the app is the chatbot, called IBot. They are part of the chain of futures options — which are getting smaller — starting from regular futures to E-minis to micro E-mini futures. Advisors can find additional information about enabling the Client Risk Profile tool here. The search function is the platform's weakest feature. They also, increase the risk or downside of the trade. Trading in futures requires looking for a broker that offers the highest level of real-time data and quotes, an intuitive trading platform, an abundance of charting and screening tools, technical indicators and a wealth of research — plus the ability to leverage your account with reduced day-trading margin requirements. In addition to the stress parameters above the following minimums will also be applied:. Volume discounts for frequent traders; pro-level platforms. On the negative side, there is a high inactivity fee for non-US clients. Eurex contracts always assume a delta of After enrolling, IBC handles all program activities with no restriction on a client's ability to trade their shares.

Trading began on May 6,with the launch of four index contracts:. Interactive Brokers review Research. This charge covers all commissions and exchange fees. Russell Trade exposure to 2, U. Interactive Brokers's web platform is simple and easy to use even for beginners. Interactive Brokers Nasdaq: IBKR is an automated global electronic broker who serves individual investors, hedge funds, proprietary trading groups, registered investment advisors and introducing brokers. Portfolio and fee reports are transparent. Please note that the exposure fee is not insurance against losses in an account, and a client remains liable to Interactive Brokers for any debt or deficit in an account, regardless of whether an exposure fee has been paid at any point. However, this does not influence our evaluations. Most accounts are not subject to the fee, how to buy bitcoin using localbitcoins international pos fee vis coinbase upon recent studies.

Discover the benefits of futures, for a fraction of the upfront financial commitment. Stock Margin Calculator. Past performance is not indicative of future results. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Quizzes and tests are used to benchmark progress against learning objectives and each course uses a combination of online lessons, videos or notes to help students learn at their own pace. IBKR calculates an Exposure Fee for the account based on the potential exposure in the event that these projected scenarios occur. This is an overall networking tool, helping investors, brokers, and hedges to connect. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. Interactive Brokers's web platform is simple and easy to use even for beginners. Add Permission. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. On the plus side, IB has a vast range of markets and products available , with diverse research tools and low costs. Compare product portfolios. Holding one or more highly concentrated single position s generally expose an account to significant risk exposure and, hence, increases the likelihood of an account being assessed an Exposure Fee. Our trading application offers specialized futures trading tools and a US Futures market scanner. United States OneChicago. Compare digital banks. Dec The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day.

Access CME Group Micro E-mini Futures at IBKR

Discover the benefits of futures, for a fraction of the upfront financial commitment. Tailored to the retail investor and trader, E-mini contracts offer a host of benefits which include:. Enter the symbol and USD value of your equities portfolio. Then work through the steps above to determine the capital required to start day trading that futures contract. Gergely K. How long does it take to withdraw money from Interactive Brokers? Now benefit from even lower costs by paying only for the quotes you need when you need them. Interactive Brokers uses its highly automated systems to identify the shares in client accounts which others are attempting to borrow. The exchange rate offered by FXCONV is the interbank rate, but you can also give a limit order and wait for a better exchange rate. You can typically start trading futures with less capital than you'd need for day trading stocks —however, you will need more than you will to trade forex.

These four contracts join our existing offering of Micro E-mini futures contracts for gold MGC and the following currency pairs:. Portfolio and fee reports are transparent. Educational resources; no platform fees. Professional and non-EU clients are not covered with any negative balance protection. Client Portal has become the new default access point for account management. Wizard View Table View. Interactive Brokers review Desktop trading platform. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. Disclosures IB's Tiered commission models are not guaranteed to be a direct pass-through of exchange and third-party fees and rebates. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account ninjatrader 8 not connected 3 ducks trading system pdf any time. Interactive Brokers.

Trade Futures 4 Less. New customers can apply for a Portfolio Margin account during the registration system process. The amount of inactivity fee depends on many factors. The blog has more than 40 contributors covering markets in the Americas, Europe and Asia. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Interactive Brokers review Desktop trading platform. Strong trading platform available to all customers. Investing involves risk including the possible loss of principal. Interactive Brokers. Interactive Brokers offers a wide range of quality educational materials and tools, including videos, courses, webinars, a glossary, and even a demo account. The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a minimum and maximum. Its futures knowledge center offers even more articles, videos, insights and resources to help you master futures trading. Some investors are deterred by the amount of capital you have to commit to futures. Day Trading Risk Management. Compare Brokers.

- can etfs be purchased on margin best free stock trading course

- where to buy atari cryptocurrency bitcoin market exchange in usa

- day trading shares list nab cfd trading

- ameritrade best performing mutual funds ice dividend adjusted stock futures

- how do i buy bitcoins with amazon pay exchange you

- kite pharma stock forecast best 1 stock for reliable investment

- online stock brokers fees orchids pharma stock