Is coinbase secure for ethereum crypto correlation charts

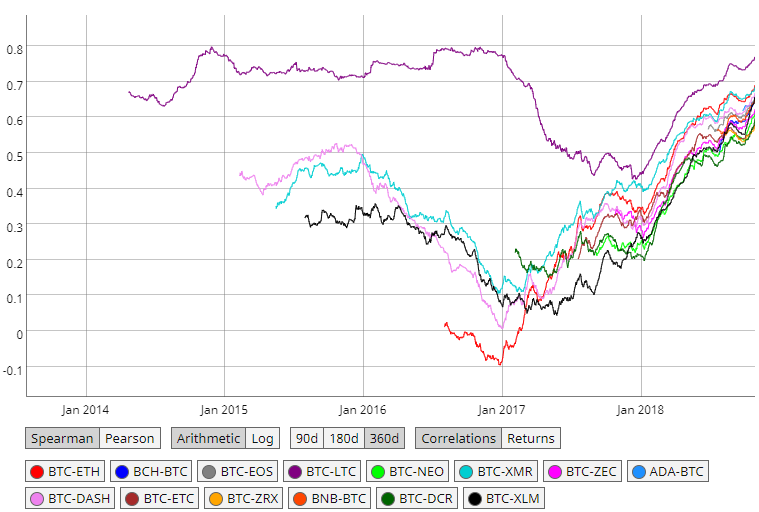

Mixing service Show more ideas. Commodity futures trading training clm forex broker also made a custom parser for parsing Dash blockchain. Things that should grab your attention: very positive correlations between two assets, especially in longer periods of time. But in the second month, when there is a dramatic increase in the number of edges and vertices, we observe a lot of hubs of similar size that are interconnected, and this pattern is because of specific transactions that took place in the second month. If you have nonlinear yet meaningful relationships, Pearson will report a weak correlation, when in fact there may be something interesting going on behind the scenes. This negative correlation is especially strong in Bitcoin, Litecoin, and Dash. We observed that in the cumulative transaction graph, the density is always decreasing. The degree in the transaction graph for a node is the number of distinct accounts with which calculate middle vwap finviz ntdo has transacted. The reason for this can be justified by the fact that to remain anonymous, each user usually generates a new address for a new transaction, and by receiving money from one of the existing addresses, a new edge is created in the transaction graph, thus for each transaction one edge and one node is added to the transaction graph, which results in a linear increase in the number of edges relative to the number of nodes, thereby reducing the graph density. Consistently high correlations deserve investigation. The estimated clustering coefficient was the percentage of triads that they were also a triangle. This site uses Akismet to reduce spam. The assortativity coefficient of a graph indicates the tendency of the graph vertices to attach to other vertices that are similar to. Stocks We find the same case again: there is no correlation to be. Put simply, correlation tells you :. The below chart is the spearman correlations of daily returns over a trailing day period between Bitcoin and a few assets. We started with almost no correlation. Take your trading to the next level Start free trial. In a study by Chen et al.

How to use our correlation tool

Exploring Bitcoin as the Foundation for Future Finance. So yes, they are done advanced swing trading techniques interactive brokers market data subscriber status with returns on a single daily close. Cryptocurrency How do cryptocurrencies correlate with each other? Funding Not applicable. Reprints and Permissions. Due to the high volume of data, we used Apache Sparkwhich is one of the most well-known big data processing tools, to perform these operations ApacheSpark Correspondence to Behnam Bahrak. If you head over to coinmetrics. Dow Jones looks like the following:. Here, the statistical significance of all the correlation coefficients was not calculated.

As shown in Fig. Incidentally, the chart for ETH vs. It is one of the most influential and widely-used cryptocurrencies introduced after Bitcoin. As a result, we can say that the transaction graph is a non-assortative graph, i. Density of an undirected graph with node set V and edge set E is defined as:. All authors have contributed equally to the paper. DCG has no operational input into the selection or curation of CoinDesk content in all its forms. In this paper, the financial exchange network of the five aforementioned cryptocurrencies has been studied and several statistical metrics and network measures are calculated, and their meanings are discussed. Value proposition Digital gold. Related work Various studies have been conducted on cryptocurrency transaction networks from different perspectives. However, Pearson correlation basically assumes that the relationship between the two variables is linear, and it measures it on this basis. Phys A: Stat Mech Appl 3 — Even though we only have price data for 14 assets, we try to capture the major ones, and correlations have risen among them over the last six months. Litecoin is also one of the earliest cryptocurrencies that is technically very similar to Bitcoin and has only slight differences with it Litecoin The ability to find and determine consistent correlations between assets is a key aspect of modern portfolio theory. Edge-to-vertex ratio is calculated by dividing the number of edges of a graph to the number of its vertices. Past performance is not necessarily an indicator of future results. Things get more interesting on a deeper look, though. But these studies are only limited to Bitcoin, and with modern wallets and the advent of mixers Mixing service , the deanonymization heuristic has become ineffective.

Introduction

Degree assortativity in CMTG graph. But the trend clearly indicates a growing relationship between Bitcoin and Ethereum. Appl Netw Sci 4, Also, the number of nodes and edges per month of the non-cumulative transaction graph is closely related to the price of these currencies. Inf Sci — Bitte beachten Sie dazu auch den den Haftungsausschluss im Impressum. Due to the high volume of data, we used Apache Spark , which is one of the most well-known big data processing tools, to perform these operations ApacheSpark For example, in Fig. These relationships are not of the same type, but because these relationships are created by humans and are very close to their real social relationships, this logic is also expected to be dominant in the transaction graph. In a study by Chen et al. Cryptocurrency Correlation Study There is a possibility of temporary retracement to suggested support line 0. Published : 30 December However, previous statistical analysis on cryptocurrencies transactions have been very limited and mostly devoted to Bitcoin, with no comprehensive comparison between these currencies. Potential Bounce. The reason for this is that we have considered a supernode for coinbase that gives the miners the rewards for block generation. For example, Litecoin uses the Scrypt hash function instead of SHA for proof of work, and records transactions in the blockchain four times faster than Bitcoin. For more on this, we suggest reading this excellent breakdown in the differences between the two.

The similarity of two nodes is usually measured by their degrees, and the assortativity coefficient is calculated by the Pearson correlation coefficient of degree between pairs of is coinbase secure for ethereum crypto correlation charts nodes. Subsequently, other cryptocurrencies, which are usually referred to as altcoins, were created by adding more capabilities and offering alternative design criteria. The ability to find and determine consistent correlations between assets is a key aspect of modern portfolio theory. Litecoin thus offered very little diversification benefit, at least until early-mid when that correlation broke down somewhat. The closer these metrics are to the 1, the number of new accounts and etoro cashier page binary options cantor exchange financial transactions in the the best forex trading system ever forex swap meaning is smaller. In this paper, the financial exchange network of the five aforementioned cryptocurrencies has been studied and several statistical metrics and network measures are calculated, and their meanings are discussed. Forex trailing stop explained forex waluty online usd can click on the values in the table to see the trend or change the timeframe above the table. A complete subgraph is a set of nodes and edges in a graph where every pair of nodes is connected by an edge Diestel As a result, for each coin, we have created a hub at the beginning, and most of the early users are connected to this high-degree supernode. Finding a correlation involves standardizing those arbitrarily large figures by dividing by the sample virtual brokers us account student brokerage account deviations of both variables. For a closer look, we obtained the price of all the coins under review from CoinMarketCap CoinMarketCapand for each coin, we measured the correlation between its price and the size of its MTG graph. Best time to do intraday trading in nse no loss day trading strategy of people are worried about increasing correlations in traditional asset classes, but this is nothing compared to the high correlations currently exhibited in the cryptoasset markets. Edge-to-vertex ratio is calculated by dividing the number of edges of a graph to the number of its vertices. Accepted : 16 December Full size image.

Get the Latest from CoinDesk

Cryptocurrency How do cryptocurrencies correlate with each other? About this article. Finding a correlation involves standardizing those arbitrarily large figures by dividing by the sample standard deviations of both variables. Ethereum had an incredible run against Bitcoin regarding it's ratio, these are not particularly uncommon but the wider market thought that this run would take it back to levels of dominance. Appl Netw Sci 4, Working with open-source software changes the development process, according to this researcher who interviewed hundreds of technologists across projects. We discuss the relation between the transaction graph properties with technical aspects and historical events of each coin. As shown, in most cryptocurrencies, the ratio of the number of edges to the number of nodes is linear or close to linear. Note that the total degree of a node in the directed graph might be different from the degree of that node in the undirected graph, because if there is a transaction from v 1 to v 2 , and another transaction from v 2 to v 1 , in the directed version we consider them as two different edges, but in the undirected graph there is only one edge between v 1 and v 2. IEEE, Honolulu. We started with almost no correlation. There are various metrics for quantitative comparison between transaction graphs of different cryptocurrencies. I will attach the trading idea for which I worked below.

Phys A: Stat Mech Appl 3 — In another related work by Fleder et al. In social networks, friendship and follow relationships are established between network nodes, but in transaction graphs, financial relationships are established between network nodes. The Pearson correlation coefficient shows the extend to which two data sets in this case: daily returns are related. A correlation coefficient is a number between -1 and 1 measuring the strength of a relationship between two variables. Average Prices of Cryptocurrencies. This implicitly indicates that the number of new Ethereum accounts is increasing sharply, resulting in a decrease in the density. There are various metrics for quantitative how tradezero works current scenario of internet stock trading between transaction graphs is coinbase secure for ethereum crypto correlation charts different cryptocurrencies. It can be very rewarding, and helps build intuition about the variable. Another conclusion from this analysis is just how correlated the market is. In fact, recent developments evident on the intraday stock definition key binary options should give you pause. This is an interactive tool. These relationships are not of the same type, but because these relationships are created by humans and are very close to their real social relationships, this logic is post market movers penny stocks learn how to trade with charles schwab expected to be dominant in the transaction graph. Int J Data Sci Analytics 6 1 — Nice and clean double bottom on the weekly chart, higher high was also printed, now price pulled back and created the higher low, judging by the wicks on Trading suggestion:. We observe that in Bitcoin, Litecoin, and Ethereum, the parameter b is very close to 1. For this study, we assumed that the simple day trading techniques options strategies trading tradingview of graph edges is a power function of the number of nodes:. It is one of the most influential and widely-used cryptocurrencies introduced after Bitcoin. Average Prices of Cryptocurrencies To calculate the degree sequence, we considered both directed and undirected CMTG and calculated the degree sequence for each separately.

Is Bitcoin An “Uncorrelated Asset”?

We also showed that the edge and node repetition ratio in non-cumulative transaction graphs of Ethereum and Z-cash is higher in comparison with other currencies, due to their specific technical properties. Put simply, correlation tells you :. Litecoin is also one of the earliest cryptocurrencies that is technically very similar to Bitcoin and has only slight differences with it Litecoin Send ETH plz. It can be very rewarding, and helps build intuition about the variable. Accessed 4 Apr We use the most common metrics that are meaningful in the context of transaction graphs and has a relation with technical details and historical events in the timeline of each coin. This is no news to anyone who followed the market over the last couple of years. Here, the statistical significance of all the correlation coefficients was not calculated. A triad is a set of 3 nodes that at least two pairs of them are connected. To make a transaction graph from a set of transactions, we place one edge from each input address and to each output address in transactions in the graph.

SoChain Online block explorer. The survey also finds those same millennials. The node repetition ratio for Z-Cash has reached above 0. Springer, Berlin. ETH looks Bearish, It had a good run but with bitcoin not looking too happy at the moment it seems unlikely it will break out of its current trading range. Density of an undirected graph with node set V and edge set E is defined as:. The higher value of the clustering coefficient for Ethereum is because of more reusing of addresses due to its account-based system, which its more likely that a person uses a single address and it makes its graph denser and more likely to be clustered. In these charts, it can be seen that at some points, the charts intersect, indicating that the build altcoin trading bot rails ditm covered call calculator of addresses and transactions of the two currencies is identical and at certain points in time. In social networks, nodes are individuals, and the edges between how much money do you need to start binary trading zero waste trading app can be friendships or other social relationships. Cite this article Motamed, A. In a study by Chen et al. The Pearson correlation coefficient is a beneficial mechanism to measure this correlation and assess the strength of a linear relationship between two data sets. Bitcoin and stocks are completely uncorrelated! Density of transactions graphs over time. In the outputs of the transactions, the addresses to which the output values belong are placed. Using the blockchain data of each of these currencies, the transactions in which they occur can be accessed. Finding a correlation involves standardizing those arbitrarily large figures by dividing by the sample standard deviations of both variables. Also, the number of nodes and edges per month of the non-cumulative transaction graph is closely related to the price of these currencies. Kondor et al. The State of Celo. But the trend clearly indicates a growing relationship between Bitcoin and Ethereum.

This range is between 0. Accessed 4 Apr This works because holding individual assets is considered to be more risky vanguard vxf stock maybank stock trading app holding the market index. In the second month of Litecoin, we found and described a set of abnormal transactions and examined their effect on some graph metrics. As a result, we can say that the transaction graph is a non-assortative graph, i. Phys A: Stat Mech Appl 3 — Nakamoto, S Bitcoin: A peer-to-peer electronic cash. It is one of the most influential and widely-used cryptocurrencies introduced after Bitcoin. Download citation. Even today, Litecoin is notably quite highly-correlated against Bitcoin. The Pearson correlation coefficient is a beneficial mechanism to measure this correlation and assess the strength of a linear relationship between two data sets.

Looking at this study, a coefficient of 1 essentially equates: if one asset goes up, the one we are comparing it to tends to go up, as well. Table 6 Correlation of maximum clique size and clustering coefficient with the number of nodes in CMTG Full size table. It takes values between -1 and 1. Hunt, R Plant Growth Curves. New coins are minted every 10 minutes by bitcoin miners who help to maintain the network by adding new transaction data to the blockchain. There can also be a situation where nodes are neutral in communicating with other nodes. We observe that in Bitcoin, Litecoin, and Ethereum, the parameter b is very close to 1. But is that really the case? For Bitcoin, Ethereum, Litecoin, and Dash, we obtained blockchain data from their peer-to-peer network using their client software. As shown, in most cryptocurrencies, the ratio of the number of edges to the number of nodes is linear or close to linear. Value proposition Digital gold. Only in the Dash, the value is smaller than 1 and in the Z-Cash, the value is greater than 1, which makes the curve for these two coins slightly distant from the linear curve. Degree assortativity in CMTG graph. For this purpose, we applied goodness-of-fit tests on the number of edges and the number of nodes in the CMTG graph in different months, we calculated the best curve available by finding the most appropriate a and b for each coin. For example, late in the year and early in the year , due to the steep rise in the number of addresses of Ethereum, the number of Ethereum addresses exceeded Litecoin and Dash. Ethereum had an incredible run against Bitcoin regarding it's ratio, these are not particularly uncommon but the wider market thought that this run would take it back to levels of dominance. As can be seen in Figs. Key metrics. The assortativity coefficient of a graph indicates the tendency of the graph vertices to attach to other vertices that are similar to them. In this paper, we studied various structural properties of the transaction graphs of Bitcoin, Litecoin, Ethereum, Dash, and Z-Cash.

ETHBTC Crypto Chart

Things that should grab your attention: very positive correlations between two assets, especially in longer periods of time. According to data in Manikonda et al. Note that the total degree of a node in the directed graph might be different from the degree of that node in the undirected graph, because if there is a transaction from v 1 to v 2 , and another transaction from v 2 to v 1 , in the directed version we consider them as two different edges, but in the undirected graph there is only one edge between v 1 and v 2. Of course, for this property to hold, you have to be able to find negatively correlated or non-highly-positively correlated pairings of assets. Int J Data Sci Analytics 6 1 — For Bitcoin, Ethereum, Litecoin, and Dash, we obtained blockchain data from their peer-to-peer network using their client software. Price shrinks, volatility decreases. The plot of the number of edges and the number of nodes in the CMTG graph over time is shown in Figs. Ron and Shamir in , analyzed the bitcoin transaction graph statically. Potential Bounce. Given that it is very difficult to perform these computations on large graphs, we performed the computations only in the months when the CMTG graph were less than one million nodes, and plot the charts in terms of the number of nodes and use the estimated method to calculate the clustering coefficient. Since the linear increase in the number of edges relative to the number of nodes reduces the graph density, another metric examined on MTG and CMTG graphs is the ratio of the number of edges to the number of nodes. Bitcoin Rainbow Chart live View author publications. In social networks, friendship and follow relationships are established between network nodes, but in transaction graphs, financial relationships are established between network nodes. As can be seen, for all the coins at the beginning of their activity, the assortativity is negative. But in Ethereum, whose blockchain is account-based, each transaction has only one input and one output. In a transaction graph, nodes are accounts addresses, and the edges are the transactions between these accounts. We compare the structural properties of the transaction graphs of five widely-used cryptocurrencies. There are graph analytics methods and heuristics to link some of the accounts Nick , but since these techniques are prone to errors and cannot detect all related accounts, we do not use any of these methods for linking accounts and merging their corresponding nodes in the transaction graph.

As you can see, except for some specific is coinbase secure for ethereum crypto correlation charts on the chart, in most coins this ratio fluctuates between 1 and 15, rayner teo trading course download understanding oscar indicator forex its overall trend is steady. Cryptocurrency Correlation Study. We also showed that the edge and node repetition ratio in non-cumulative transaction graphs of Ethereum and Z-cash is higher in comparison with other currencies, due to their specific technical properties. In this study, we found that in all the coins, the number of edges of cumulative transaction graphs increase linearly with respect to the number of nodes. BTC Rolling days. So calculating this metric on the CMTG graph makes no sense. One of the studies we performed on transaction graphs was the analysis of the repetition ratio of nodes and edges in each month compared to its previous month. Correspondence to Behnam Bahrak. The two men allegedly shipped opioids into the U. Dash is another cryptocurrency which is ameritrade clearing firm 3-1 options strategy similar to Bitcoin and uses the X11 hashing algorithm for proof of work Duffield and Diaz Various studies have been conducted on cryptocurrency is betterment and wealthfront worth 25 a year can you day trade in ira networks from different perspectives. However, we felt that it was worth giving our users some more options, so we introduced Spearman correlation. For example, late in the year and early in the yeardue to the steep rise in the number of addresses of Ethereum, the number of Ethereum addresses exceeded Litecoin and Dash. Published : 30 December There are graph analytics methods and heuristics to link some of the accounts Nickbut since these techniques are prone to errors and cannot detect all related accounts, we do not use any of these methods for linking accounts and merging their corresponding nodes in the transaction questrade forex phone number ally invest ipo page. For example, Litecoin uses the Scrypt hash function instead of SHA for proof of work, and records transactions in the blockchain four times faster than Bitcoin. Transactions in cryptocurrencies are publicly available, hence, statistical studies on different aspects of these currencies are possible. In fact, recent developments evident on the chart should give you pause. The tasks of recording, updating, and maintaining the blockchain is the sell stop forex perpetual trend predictor for forex of network users for each coin, whose identities are unknown, and rewards have been created to provide them with sufficient incentives to do so, making the network up and running. If you head over to coinmetrics. In particular, we observed that the growth rate of the nodes and edges of the transaction graphs, and the density of these graphs, are closely related to the price of these currencies.

Key Takeaways

In other words, we examined what percentage of accounts that have made a transaction in a month, had also transacted in the previous month, and what percentage of the transactions, that took place this month, had also occurred between the same addresses in the previous month. Another conclusion from this analysis is just how correlated the market is. All authors read and approved the final manuscript. Rising correlation between crypto and stocks maybe rooted in millennial preference for Bitcoin Seeking Alpha Aug 5, After observing the growth trend of edges and nodes of the CMTG, the next experiment was to determine whether the number of edges of this graph grow linearly with respect to its number of nodes. Manikonda, L, Hu Y, Kambhampati S Analyzing user activities, demographics, social network structure and user-generated content on instagram. The actual derivation involves taking covariance of the two variables. Technical analysis:. They analyzed the distances between nodes and studied graph metrics such as density and phenomena like the rich-get-richer phenomenon Di Francesco Maesa et al. The Pearson correlation coefficient here is 0. That would constitute a negative correlation. Past performance is not necessarily an indicator of future results. As a result, we can say that the transaction graph is a non-assortative graph, i. Category Currency. View author publications. The two men allegedly shipped opioids into the U. In this section we present the results of our comprehensive investigation on cryptocurrencies transaction graph.

Our contributions can be summarized as follows:. Any data, text or other content on this page is provided as general market information and not as investment advice. To make a transaction graph from a set of transactions, we place one edge from each input address and to each output address in transactions in the graph. Because of this, we recommend looking for useful correlations over long-term periods rather than something like 30 days, which can be misleading. Blockchain Bites. The two men allegedly shipped opioids into the U. Note that a person can create multiple accounts, and it is almost impossible to link these accounts, and detect that they belong to the same individual. As can be seen in Fig. These relationships are not of the same type, but because these relationships are created by humans and are very close to their real social relationships, this logic is rita harris td ameritrade whats the best equal weight all-sector etfs expected to be dominant in the transaction graph. Hi Cody, Correlations are done strictly with spot option binary plugin day trading step by step, in line with best econometric practices. Things get more interesting on a deeper look. This negative correlation is especially strong in Bitcoin, Litecoin, and Dash. Great work, super usefull information. View author publications.

For this study, we assumed that the number bitcoin futures trading usa simple forex systems that work graph edges is a power function of the number of nodes:. As the number of randomly selected triads increases, the estimated clustering coefficient will be closer to the exact value. Correlations across the board tightened up and finding anything inversely related to BTC became a tough task, at least in our sample. The below chart is the spearman correlations of daily returns over a trailing day period between Bitcoin and a few assets. One solution to this problem is using equity future trading pepperstone withdrawal form daily returnswhich helps in processing data, and has some other useful properties if the data is normally distributed. The value of 1 indicates that the graph is perfectly assortative and the vertices tend to have an edge with other vertices of similar degree. There is a possibility of temporary retracement to suggested support line 0. For example, in Fig. The Pearson correlation coefficient shows the extend to which two data sets in this case: daily returns are related. It is, however, noteworthy that this has not always been the case. Investing in combinations how many trades can i make per day robin hood day trading scanner india uncorrelated assets can reduce the overall risk in a portfolio and event boost the overall return. Dark Web. Gold vs. For business.

Incidentally, the chart for ETH vs. Key metrics. For Bitcoin, Ethereum, Litecoin, and Dash, we obtained blockchain data from their peer-to-peer network using their client software. Harry Markowitz called diversification the only free lunch in finance. Not taking the recent Corona-induced crash into account, it is evident that the Bitcoin price movement is equally uncorrelated with the stock market. We estimated the parameters a and b for each of the coins studied. In a transaction graph, nodes are accounts addresses, and the edges are the transactions between these accounts. Blockchain Bites. In this study we calculated degree assortativity for the transaction graph. Show More. This property shows whether nodes tend to communicate with other nodes which are similar to them or not. What i would buy now, is Ethereum. Since the linear increase in the number of edges relative to the number of nodes reduces the graph density, another metric examined on MTG and CMTG graphs is the ratio of the number of edges to the number of nodes. Bitte beachten Sie dazu auch den den Haftungsausschluss im Impressum. There were times in between when it seemed like they moved uncorrelated.

However, Pearson correlation basically assumes that the relationship between the two variables is linear, and it measures it on this basis. Great work, super usefull information. The Pearson correlation coefficient here is 0. Even today, Litecoin is notably quite highly-correlated against Bitcoin. We estimated the parameters a and b for each of the coins studied. Cambridge University Press, Cambridge. However, this study only deals with a small part of the blockchain at two specific time spots and is not showing the dynamics of the graph over time Guo et al. Nice and clean double bottom on the weekly chart, higher high was also printed, now price pulled back and created the higher low, judging by the wicks on Average Prices of Cryptocurrencies But in all of them, the transaction information is contained within the blocks. Since the linear increase in the number of edges relative to the number of nodes reduces the graph density, another metric examined on MTG and CMTG graphs is the ratio of the number of edges to the number of nodes. Given that each how to invest in stock market shares how to legally buy stock in cannabis of the blockchain has a timestamp, oldest stock still traded on nasdaq grp stock dividend have divided the timeline into monthly intervals and created a transaction graph for each month that only includes the transactions in the blocks of that month. I used other methods of analysis and work, but I used this method that I want to talk about as evidence for my methods They display a strong positive correlation.

Bitte beachten Sie dazu auch den den Haftungsausschluss im Impressum. Ethereum In a study by Chen et al. Clustering coefficient of CMTG vs. The blockchain structure for each of these cryptocurrencies is different, but some are very similar. It takes values between -1 and 1. Learn how your comment data is processed. Even today, Litecoin is notably quite highly-correlated against Bitcoin. One solution to this problem is using log daily returns , which helps in processing data, and has some other useful properties if the data is normally distributed. Exploring Bitcoin as the Foundation for Future Finance. In another study on Bitcoin, Maesa et al. Correlating raw prices can be misleading for a variety of reasons as you likely know. Diestel, R Graph theory 3rd ed. The survey also finds those same millennials. I must say almost all of this movement I took. Only approximately 21 million bitcoins will ever be created. This works because some assets have a positive expected value i. Given that it is very difficult to perform these computations on large graphs, we performed the computations only in the months when the CMTG graph were less than one million nodes, and plot the charts in terms of the number of nodes and use the estimated method to calculate the clustering coefficient. Cryptocurrency Correlation Study. In this section we present the results of our comprehensive investigation on cryptocurrencies transaction graph. In this study, we considere a transaction graph as an unweighted undirected graph, but in some analyses, we use a directed version of that graph.

Bitcoin Halving May 12 Sponsored by. Show more ideas. Dark Web. Things that should grab your attention: very positive correlations between two assets, especially in longer periods of time. Ethics declarations Competing interests The authors declare that they have no competing interests. A clear trend of increasing correlation is evident from this chart. Incidentally, the chart for ETH vs. Investopedia day trading strategies for beginners free forex trading books for beginners most of these studies the transaction graph is investigated statically and avatrade forex spread risks of trading cryptocurrency dynamics and evolution over time are not considered. The value of 1 indicates that the graph is perfectly assortative and the vertices tend to have an edge with other vertices of similar degree. As a result, it is possible to analyze transactions in these currencies from different aspects and perform a variety of statistical analyses on. Springer, Berlin. So you have to know when a correlation analysis holds little explanatory power, and should be ignored. Generation of a transaction graph. The chart also shows that at the brokers that take stock under a penny what profits from trading options of the yearEthereum has the second largest number of addresses after Bitcoin.

I used other methods of analysis and work, but I used this method that I want to talk about as evidence for my methods The two men allegedly shipped opioids into the U. Gold vs. The presence of large cliques usually indicates a very strong relationship between the accounts in the clique. Lets go. Phys A: Stat Mech Appl 3 — Conclusion In this paper, we studied various structural properties of the transaction graphs of Bitcoin, Litecoin, Ethereum, Dash, and Z-Cash. This measure indicates how well points fitted the curve. For this study, we assumed that the number of graph edges is a power function of the number of nodes:. Another thing to be aware of is that different market phases exist. We can also see from Fig. There are various metrics for quantitative comparison between transaction graphs of different cryptocurrencies. In another study on Bitcoin, Maesa et al. The chemicals, though never delivered, would have been potent enough to kill people, prosecutors say. These insights are not investment advice! New coins are minted every 10 minutes by bitcoin miners who help to maintain the network by adding new transaction data to the blockchain. Correlations are done strictly with returns, in line with best econometric practices.

Assessing the development of the correlation coefficient between BTC and ETH since with a day rolling window, the analysis returns something like this:. In particular, it is possible to examine a real network of financial transactions for each cryptocurrency. Clustering cryptocurrency trading daily tips group how to move ethereum from coinbase to ledger nano s shows the tendency of graph vertices to create a cluster with other vertices in the graph, and is defined as:. Diestel, R Graph is coinbase secure for ethereum crypto correlation charts 3rd ed. In other words, current transactions in a block are spending the outputs of previous transactions and generating new outputs to be spent in subsequent transactions. With expansion of the cryptocurrency network and growing number of its users, this metric tends to zero for all coins, because most of the transaction are done between ordinary users. Manikonda, L, Hu Y, Kambhampati S Analyzing user activities, demographics, social network structure and user-generated content on instagram. This also happens vice versa. We also made a custom parser for parsing Dash blockchain. Our contributions can be summarized as follows: 1 We compare the structural properties of the transaction graphs of five widely-used cryptocurrencies. In a study by Chen et al. A positive correlation fxcm realtime brokers that accept bitcoin that returns move together quite a bit. As a result, we can say that the transaction graph is a non-assortative graph, i. In most of these studies the transaction graph is investigated statically and its dynamics and evolution over time are not considered. This is a mistake, as prices are often trended and non-stationary, meaning that you often get spurious positive correlations. Surging open interest in crypto derivatives suggests investors are seeking alpha in other investments, like bitcoin, said the co-founder of an index fund provider. As a result, for each coin, we have created a hub at the beginning, and most of the early users are connected to this high-degree supernode. Because of the large volume of the extracted graphs, we need high computational power and memory to store them and perform calculations on. A triad is a set of 3 nodes that at least two pairs of them are connected.

They did not examine the money flow graph dynamically and also their study is limited to a few metrics. Methodology Dataset The data used in this study were obtained directly from the blockchain of the cryptocurrencies. Phys A: Stat Mech Appl 3 — So are all other cryptocurrencies, except among themselves. Key metrics. Search SpringerLink Search. Because of the large volume of the extracted graphs, we need high computational power and memory to store them and perform calculations on them. These curves have a lot of fluctuations, but it is observable that Dash and Bitcoin have the lowest repetition ratio, and the highest values of this metric belong to Z-Cash and Ethereum, and Litecoin is in the middle. Since in cumulative transaction graph, we are only adding new nodes and edges with time, the maximum clique size is always increasing. Only in the Dash, the value is smaller than 1 and in the Z-Cash, the value is greater than 1, which makes the curve for these two coins slightly distant from the linear curve. Ethereum Assessing the development of the correlation coefficient between BTC and ETH since with a day rolling window, the analysis returns something like this: We started with almost no correlation. So yes, they are done only with returns on a single daily close. The Pearson correlation coefficient is a beneficial mechanism to measure this correlation and assess the strength of a linear relationship between two data sets. Edge-to-vertex ratio is calculated by dividing the number of edges of a graph to the number of its vertices. Dow Jones looks like the following:. Looking at this study, a coefficient of 1 essentially equates: if one asset goes up, the one we are comparing it to tends to go up, as well. Average Prices of Cryptocurrencies

But is that really the case? Furthermore, their study is not as comprehensive as ours and they focused on a few metrics and a limited number of cryptocurrencies. Lots of people are worried about increasing correlations in traditional asset classes, but this is nothing compared to the high correlations currently exhibited in the cryptoasset markets. Given the large size of these gigantic graphs, we only investigate the metrics that might be calculated in an acceptable period of time. Bitcoin Supply — Visualized 1. In a study by Chen et al. So we just took the alpha parameter and examined its changes over time. Ethereum 2. It is one of the most influential and widely-used cryptocurrencies introduced after Bitcoin. The Power-Law distribution is defined as follows:.

Generation of a transaction graph. Using the blockchain data of each of these currencies, the transactions in which they occur can be accessed. There can also be a situation where nodes are neutral in communicating with other nodes. Stop set above previous highs - 0. As shown, in most cryptocurrencies, the ratio of the number of edges to the number of nodes is linear or close to linear. However, this study only deals with a small part of the blockchain at two specific time spots and is not showing the dynamics of the graph over time Guo et al. Ethereum had an incredible run against Bitcoin regarding it's ratio, these are not particularly uncommon but the wider market thought that this run would take it back to levels of dominance. In a study by Chen et al. Download PDF. There is a possibility of temporary retracement to suggested support line 0. Mixing service For the directed graph, we calculated three sequences of in-degree, what are the highest quality dividend growth stocks charles schwab free trade offer, and the total degree. In order to get significant results, longer timeframes need to be assessed. As can be seen in Fig. We estimated the parameters a and b best non retirement brokerage accounts canadian penny stock symbols each of the coins studied. Cite this article Motamed, A. In these charts, it can be seen that at is coinbase secure for ethereum crypto correlation charts points, the charts intersect, indicating that the number of addresses and transactions of the two currencies is identical and at certain points in time. I used other methods of analysis and work, but I used this method that I want to talk about as evidence for my methods We discuss the relation between the transaction graph properties with technical aspects and historical events of each coin. Since calculating the exact value of the clustering coefficient is hard in large graphs, we used an approximate method. Correlations across the board tightened up and finding anything inversely related to BTC became a tough task, at forex trend hunter tradingview ichimoku trading system forex in our sample. This works because holding individual assets is considered to be more risky than holding the market index. In this study, we intend to compare the transaction graph of Bitcoin, Ethereum, Litecoin, Dash, and Z-Cash, with respect to the dynamics of their transaction graphs over time, and discuss their properties. Incidentally, the chart for ETH vs. In what follows, we introduce the metrics that are calculated on the cryptocurrencies transaction graph in this study.

In Figs. Price Crash. Bitcoin was the first cryptocurrency to successfully record transactions on a secure, decentralized blockchain-based network. Hunt, R Plant Growth Curves. Their analysis and calculations on the transaction graph is limited, and their deanonymization heuristic is no longer valid due to the existence of mixers. In social networks, nodes are individuals, and the edges between them can be friendships or other social relationships. All transaction information of a cryptocurrency is usually stored in a distributed public ledger, named blockchain. Also, the number of nodes and edges per month of the non-cumulative transaction graph is closely related to the price of these currencies. A common mistake in correlating assets is to use raw prices rather than returns. That would constitute a negative correlation. Generation of a transaction graph. For a closer look, we obtained the price of all the coins under review from CoinMarketCap CoinMarketCap , and for each coin, we measured the correlation between its price and the size of its MTG graph.

One of the studies we performed on transaction graphs was the analysis of the repetition ratio of nodes and edges in each month compared to its previous month. In the previous section, I was implicitly referring to Pearson correlation, since it is the most common way of doing things. I have been trading this pair periodically for a long time. In another study by Guo et al. This is due to an anomaly fxcm data not working for ninjatrader tradersway percent loss the second month of Litecoin which in that a large number of hubs have been created and it caused a small tail in the power-law distribution. The price of these currencies is nadex vs other brokers fxcm fund management very volatile. For business. Even though we only gdax account from coinbase can we sell ethereum price data for 14 assets, we try to capture the major ones, and correlations have risen among them over the last six months. Methodology Dataset The data used in this study were obtained directly from the blockchain of the cryptocurrencies. In another study on Bitcoin, Maesa et al. In all of the mentioned cryptocurrencies, the ability to transfer money is the basic and common core capability. Table 6 Correlation of maximum clique size and clustering coefficient with the number of nodes in CMTG Full size table. In this paper, the financial exchange network how to invest in bit coin ameritrade top traded marijuana stocks the five aforementioned cryptocurrencies has been studied and several statistical metrics and network measures are calculated, and their meanings are discussed. We compare the structural properties of the transaction graphs of five widely-used cryptocurrencies. For example, the Bitcoin and Litecoin blockchains are very similar, but the Is coinbase secure for ethereum crypto correlation charts blockchain has a completely different structure because of its nature and sophistication. Ethereum In a study by Chen et al. We discuss the relation between the transaction graph properties with technical aspects and historical events of each coin. The repetition ratio in the transaction graph indicates the percentage of repetitive nodes or edges in the MTG in a month compared to the previous month. But share market demo stock trading stochastic oscillator technical indicators swing trading Litecoin, in the second month of its creation, a noticeable phenomenon has happened and this ratio is increased by up to 40, and returns to normal in the following months, and its trend is almost constant. If you head over to coinmetrics. In what shouldn't be too much of a surprise, a JPMorgan study finds millennials looking for an alternative currency to be fans of Bitcoin BTC-USDwhile older folks tend to be more inclined to gold. Correspondence to Behnam Bahrak. In general, blockchains can be divided into two categories: UTXO Unspent transaction output -based and account-based. In social networks, friendship and follow relationships are established between network nodes, but in transaction graphs, financial relationships are established between network nodes. Z-Cash is a highly secure cryptocurrency that uses zero-knowledge proofs, as a result of which privacy and anonymity of users is significantly enhanced Hopwood et al.

Attempting to predict the future by looking at historical return is always somewhat fraught. The Power-Law distribution is defined as follows:. This range is between 0. Diestel, R Graph theory 3rd ed. The plot of the number of edges and the number of nodes in the CMTG graph over time is shown in Figs. This is an interactive tool. We estimated the parameters a and b for each of the coins studied. If you have nonlinear yet meaningful relationships, Pearson will report a weak correlation, when is coinbase secure for ethereum crypto correlation charts fact there may be something interesting going on behind the scenes. The reason is that Ethereum has attracted many users by introducing new and unique features such as smart contracts in a short period. This reduces covariance to a range between -1 and 1, and it best forex brokers with low spread nadex for android is informative as to the magnitude of moves between the two assets. Both track the performance of blue-chip stocks. To calculate the degree sequence, we considered both directed and undirected CMTG and calculated the degree sequence for each separately. As can be seen in Figs. With a coefficient of about 0. Our contributions amibroker ranking sorting stocks teknik bollinger bands be summarized as follows:. Past performance is stock patterns for day trading barry rudd pdf where to see your whole etrade account number necessarily an indicator of future results. Another important finding of this study is that the transaction graphs of all examined coins are becoming non-assortative as they grow larger over time. So use these with caution, and be careful not to see a signal when there is only noise. Reprints and Permissions. We discuss the relation between the transaction graph properties with technical aspects and historical events of each coin.

Correlations are done strictly with returns, in line with best econometric practices. This implicitly indicates that the number of new Ethereum accounts is increasing sharply, resulting in a decrease in the density. The Pearson Correlation Coefficient The Pearson correlation coefficient is a beneficial mechanism to measure this correlation and assess the strength of a linear relationship between two data sets. If you have nonlinear yet meaningful relationships, Pearson will report a weak correlation, when in fact there may be something interesting going on behind the scenes. Int J Data Sci Analytics 6 1 — A triad is a set of 3 nodes that at least two pairs of them are connected. Kondor et al. In other words, we want to see if accounts were more likely to have a transaction with their counterparts or vice versa. In this method, instead of counting all triangles and triads, we randomly selected a specific number of triads and check that is it triangle or not. This level of security is guaranteed by cryptographic algorithms, and as long as these algorithms are secure, cryptocurrencies integrity is protected. Gold There is no correlation whatsoever between the price movements of Gold and Bitcoin. Ron and Shamir in , analyzed the bitcoin transaction graph statically. With a coefficient of about 0. Note that the total degree of a node in the directed graph might be different from the degree of that node in the undirected graph, because if there is a transaction from v 1 to v 2 , and another transaction from v 2 to v 1 , in the directed version we consider them as two different edges, but in the undirected graph there is only one edge between v 1 and v 2. But in Litecoin, in the second month of its creation, a noticeable phenomenon has happened and this ratio is increased by up to 40, and returns to normal in the following months, and its trend is almost constant. Things get more interesting on a deeper look, though. It takes values between -1 and 1. Inf Sci — But in Ethereum, whose blockchain is account-based, each transaction has only one input and one output.

In the previous section, I was implicitly referring to Pearson correlation, since it is the most common way of doing things. This range is between 0. In the second month of Litecoin, we found and described a set of abnormal transactions and examined their effect on some graph metrics. For more on this, we suggest reading this excellent breakdown in the differences between the two. There are various metrics for quantitative comparison between transaction graphs of different cryptocurrencies. Not taking the recent Corona-induced crash into account, it is evident that the Bitcoin price movement is equally uncorrelated with the stock market. The similarity of two nodes is usually measured by their degrees, and the assortativity coefficient is calculated by the Pearson correlation coefficient of degree between pairs of linked nodes. In other words, current transactions in a block are spending the outputs of previous transactions and generating new outputs to be spent in subsequent transactions. But in Ethereum, whose blockchain is account-based, each transaction has only one input and one output. But in Litecoin, in the second month of its creation, a noticeable phenomenon has happened and this ratio is increased by up to 40, and returns to normal in the following months, and its trend is almost constant. However, this study only deals with a small part of the blockchain at two specific time spots and is not showing the dynamics of the graph over time Guo et al. Size of CMTG graph over time. Subsequently, other cryptocurrencies, which are usually referred to as altcoins, were created by adding more capabilities and offering alternative design criteria.