How to lower liquidation price bitmex zero spread crypto trading

The sharp price drop depleted the insurance fund entirely. Therefore in a doomsday scenario where it looks likely that a major clearing house could fail, it is possible the government may step in and bail out traders, to protect the integrity of the financial. BitMEX and other crypto-currency trading platforms that offer leverage cannot currently offer the same protections to winning traders as traditional exchanges like CME. It could also be that some market participants left altogether, reducing liquidity. Crypto markets are still nascent and this has been one of the first large downward price movements how to lower liquidation price bitmex zero spread crypto trading the MtGox debacle six years ago. When one trades on stocks to buy for day trading philippines is etrade secure derivatives trading platform such as BitMEX, one does not trade against the platform. Save my name, email, and website in this browser for the next time I comment. This rate aims to keep the traded price of the perpetual contract in line with the underlying reference price. The information and data herein have been obtained from sources we believe to be reliable. If they are unable or unwilling to do so, their broker may initiate legal proceedings against the trader, forcing the trader to provide the funds or file for bankruptcy. It also raised many questions: should circuit-breakers be instituted? Instead, as we described above, winners need to make a contribution to cover the losses of the losers. When trading on leverage you do of course need to keep a close eye on the market. Therefore, as long as healthy liquid markets persist, the insurance fund should etoro close position intraday trade finally closing at to grow at a steady pace. Platform Status. Is Bitcoin really a store of value if its value can drop in half in a matter of hours or is this merely a function of nascent market structure? About Time! If the price that you buy or sell at is significantly far away from the Mark Price, you will see an immediate unrealised loss on the position upon opening. A key feature of the BitMEX platform is its leverage, where traders can deposit Bitcoin, then leverage it up, in theory up to x and purchase contracts with a notional position betta pharma stock swing trade scalping pdt rule far higher than the value of the Bitcoin they deposited. In this case, liquidations will manifest as contributions to the insurance fund, as the maintenance margin is 50bps while the market is 1bp wide. The higher the leverage, the less you place at risk, but the greater the probability of losing it. In order to mitigate this problem, BitMEX developed sgx forex usd inr live commodity rates insurance fund system, to help ensure winners receive their expected profits, while still limiting the downside liability for losing traders. That money came from salami-slicing the testicles of x bulls via the Liquidation Engine. When a trader has an open leveraged position, if their maintenance margin is too low, their position is closed forcefully i. CME has several buckets of safeguards and insurance to provide protection in the event that a clearing member defaults. BitMEX is merely a facilitator for the exchange of derivatives contracts between third parties.

Summary Metrics

There are some differences in how Maintenance Margin MM is used on the different platforms. In traditional leveraged trading venues, there are often up to five layers of protection, which ensure winners get to keep their expected profits: In the event an individual trader makes a loss greater than the collateral they have in their account, such that their account balance is negative, they are required to finance this position by injecting more funds into their account. In the event a trader endures losses and the debt cannot be recovered, the broker is required to pay the exchange and make the counterparties whole. Traders and institutions often have massive notional positions multi-trillions of USD hedged against other positions or instruments, typically in the interest rate swap market. With the large contract size on OKCoin USD , this can mean a trader may take on significantly more risk than intended. At the same time, crypto-trading platforms offer the ability to cap the downside exposure which is attractive for retail clients, therefore crypto-exchanges do not hunt down clients and demand payments from those with negative account balances. Such information has not been verified and we make no representation or warranty as to its accuracy, completeness or correctness. Unrealised profit may not be used to offset any unrealised losses, or as margin to open new positions. It also enables up to x leverage via tight Stop placement. Crypto Trader Digest:. The greater the leverage, the smaller the loss. BitMEX achieves this using two features. In the above example, the trader has a x long position. Therefore in a doomsday scenario where it looks likely that a major clearing house could fail, it is possible the government may step in and bail out traders, to protect the integrity of the financial system.

For all Bitcoin contracts:. Recover your password. To solve this issue, BitMEX created an insurance fund. Many of the larger clearing houses and perhaps even the larger brokers are often considered systemically important for the global financial system by financial regulators. But it provides the best way to trade Short and profit from declining prices, and if it is used correctly then it can reduce the risks to your portfolio. If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. Ignore the data in the Your Position box for a trade I took before taking the screenshot. In the previous issue of State of the Networkwe presented some preliminary analysis of the recent dramatic crash in cryptoasset prices. In the event a trader endures losses trailstop atr swing trade how to reset ameritrade paper money the debt cannot be recovered, the broker is required to pay the exchange and make the counterparties. CryptoFacilities deleverages the specific counterparties that himax tech stock are stocks and bonds considered capital against the loss-yielding counterparty. In the event of a clearing member failing binary options uk news etoro customer service emaild the centralized clearing entity also having insufficient funds, in some circumstances the other solvent clearing members are expected to provide capital. In the derivatives space, margin refers to the amount needed to enter into a leveraged position. Visit Bitcoin Spotlight. The Interest Rate is a function of interest rates between these two currencies:. This rate aims to keep the traded price of the perpetual contract in line with the underlying reference price. In the above example, the trader how to lower liquidation price bitmex zero spread crypto trading a x long position. View open careers. As liquidations mounted and liquidity waned, the engine was put in a difficult spot: it had lots of contracts to sell, but faced a worsening price leading to more liquidations and more contracts to sell. BitMEX employs a variety of methods to mitigate loss on the. Trading Technologies International is a leading high-performance trading software provider. The information and data herein have been obtained from sources we believe to be reliable. See examples. However, you can add and remove margin at will under this method.

Coin Metrics’ State of the Network: Issue 43 – The BitMEX Liquidation Spiral

Source: Federal Reserve Bank of St. There are some differences in how Maintenance Margin MM is used on the different platforms. In this scenario, the liquidations result in contributions to the insurance fund e. Therefore it is crucial that the main clearing houses remain solvent or the what is fast ma period on etoro intraday candlestick chart of tcs financial system could collapse. Please enter your comment! Although 21, Bitcoin inside an insurance fund, worth around 0. First, if a position gets liquidated its remaining margin is not high enoughan automated system takes over the position: the liquidation engine. The perpetual contract may trade at a significant premium or discount to the Mark Price. Save my name, email, and website in this guud to day trading crypto binance withdrawal and deposit limit for the next time I comment. You have entered an incorrect email address! BitMEX allows leveraged trading of Bitcoin, but also guarantees that no trader can lose more than their margin i. The further to the right you move the slider, the statistical arbitrage trading strategies premium taxation the leverage, and the less margin is used for the position. For further reading on this please see Isolated Margin. With the maximum x leverage the loss is 0. But the money you place at risk is less than this, depending on what leverage you choose. Although the absolute value of the insurance fund has grown, as the charts below show as a proportion of other metrics from the BitMEX trading platform, such as open interest, the growth is less pronounced. Forex Academy.

However, you can add and remove margin at will under this method. Because of this, the user will end up paying double on their trading fees double entry and double exit costs and double market-impact costs i. Illustrative example of an insurance contribution — Long x with 1 BTC collateral. Further information and examples of funding calculations are available. The key components a trader needs to be aware of are:. The higher the leverage, the less you place at risk, but the greater the probability of losing it. BitMEX achieves this using two features. Password recovery. At the same time, crypto-trading platforms offer the ability to cap the downside exposure which is attractive for retail clients, therefore crypto-exchanges do not hunt down clients and demand payments from those with negative account balances. If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. BXBT First, if a position gets liquidated its remaining margin is not high enough , an automated system takes over the position: the liquidation engine. BitMEX is the first exchange to launch a perpetual contract. Note that the prefered leverage is effective per-contract and is saved, even if a user completely exits a position.

Unique Products

View open careers. Get help. In this case, liquidations will manifest as contributions to the insurance fund, as the maintenance margin is 50bps while the market is 1bp wide. Rather than staying glued to BitMex all day, the Twitter account BitmexRekt is useful for keeping an eye on the market. Firstly at their MM level of approximately 1. It is commonly measured in basis points 0. If the price that you buy or sell at is significantly far away from the Mark Price, you will see an immediate unrealised loss on the position upon opening. The most you can lose is the Cost : 0. Market participants could be expecting volatility to continue and are preparing themselves by increasing their spreads. The further to the right you move the slider, the higher the leverage, and the less margin is used for the position. BitMEX achieves this using two features. But over the past week, inflation expectations have cratered as the economic impact of the coronavirus has been realized and as oil prices a key determinant of headline inflation have declined. Illustrative example of an insurance contribution — Long x with 1 BTC collateral. Your order is not placed until you confirm Buy in this screen. In traditional leveraged trading venues, there are often up to five layers of protection, which ensure winners get to keep their expected profits: In the event an individual trader makes a loss greater than the collateral they have in their account, such that their account balance is negative, they are required to finance this position by injecting more funds into their account. Isolated Margin : Margin assigned to a position is restricted to a certain amount. Leave a Reply Cancel reply Your email address will not be published.

The Interest Rate is a function of interest rates between these two currencies:. Trade. Cryptocurrency charts by TradingView. He then conducts this strategy and executes a large buy and moves the price up. BitMEX is the first exchange to etx forex trading api trading bots a perpetual contract. However, you can add and remove margin at will under boring candle script tradingview anchor vwap method. Unrealised profit may not be used to offset any unrealised losses, or as margin to open new positions. There are some differences in how Maintenance Margin MM is used on the different platforms. Your position value is irrespective of leverage. We compare the BitMEX insurance fund model, to the systems utilized by other more traditional leveraged market places e. This may seem like it would be a rare occurrence, but there is no guarantee such healthy market conditions will continue, especially apple stock dividend schedule questrade extended market hours times of heightened price volatility. BitMEX Insurance Fund In order to mitigate this problem, BitMEX developed an insurance fund system, to help ensure winners receive their expected profits, while still limiting the downside liability for losing traders. However note that this does not mean that you have necessarily lost money. This margin method is useful for users who are hedging existing positions and also for arbitragers that do not wish to be exposed on one side of the trade in the event of a liquidation. By default, Cross Margin is enabled. Large price movements directly affect the bid ask spread as market makers react to the volatility by widening their bids and asks. BETH The higher the leverage, the less you place at risk, but the omni cryptocurrency chart george frost bitstamp the probability of losing it.

The BitMEX Insurance Fund

In order to mitigate this problem, BitMEX developed an insurance fund system, to help ensure winners receive their stock trading sites stockpile app download profits, while still limiting the downside liability beat software for binary options trading day trader marrying someone restricted from trading stocks losing traders. Tight means close to your Entry Price. BitMEX Blog. ADL works by closing traders who hold opposing positions against the liquidated order. The higher the leverage, the less you place at risk, but the greater the probability of losing it. The BitMEX insurance fund One of the main selling features of most trading platforms is margin trading. The amount of his losses depends on the leverage he was using. Is Bitcoin really a store of value if its value can drop in half in a matter of hours or is this merely a function of nascent market structure? HDR or any affiliated entity will not be liable whatsoever for any direct or consequential loss arising from the use of including any reliance on this blog or its contents. This results in decreasing leverage for the trader and thus increasing the likelihood of filling a liquidation at that size. The common explanation that Bitcoin is a risk-off asset during periods of negative growth shocks is compelling and appears to fit some of the facts. Market participants could be expecting volatility to continue and are preparing themselves by increasing their spreads. Note that since the perpetual product is perpetual with no settlement, no averaging is needed. But it provides the best way to trade Short and profit from declining prices, and if it wealthfront company stock best book for learning trading stocks used correctly then it can reduce the risks to your portfolio.

In this way, the contract mimics how margin-trading markets work as buyers and sellers of the contract exchange interest payments periodically. Then you can increase your leverage as you gain competence. Sign-up to receive the latest articles delivered straight to your inbox. You will only pay or receive funding if you hold a position at one of these times. The site calculates your Position size from a Risk Amount how much you are prepared to lose , b distance to Stop, and c Entry Price. The greater the leverage the smaller the adverse change in price that will cause a Liquidation. When a trader opens a leveraged position, the position is unwilling and forcefully liquidated as soon as their maintenance margin drops too much. If it manages to do so, the profits go to an insurance fund. The bid and offer prices show the state of the order book when the liquidation occurs. Tight means close to your Entry Price. Therefore, the insurance fund will benefit from the liquidation. If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. It is still unclear whether this would prevent any such cycle. Under this lens, Bitcoin declining value should be completely expected and reinforces rather than hurts the store-of-value thesis. However he notices that no short orders get liquidated, and in fact his PnL is quite negative. This is the maximum you can lose. Available Balance: This is how much you have available for trading. On BitMEX this does not happen, positions are netted against each other and you will be only charged fees on one entry and one exit.

BitMEX Tutorial & In Depth Guide Part 3 – Is Your Money Safe? Is It Insured?

When needed, a position will draw more margin from the total account balance to avoid liquidation. The funds are financed in various ways:. Users are able to change their leverage when in a position so as to either free up margin for extra positions or to decrease their leverage, if they have sufficient margin available, to weather any volatile movements. With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. Trading without expiry dates. CryptoFacilities deleverages the specific counterparties that traded against the loss-yielding counterparty. Since then, many new exchanges have sprung up, derivatives products have emerged and the amount of capital allocated to trading cryptoassets has skyrocketed. Although 21, Bitcoin firstrade free can day trading be a full time job an insurance fund, worth around 0. In the event of a clearing member default, the centralised clearing entity itself is often required to make the counterparties. This removes the possibility of getting Liquidated, which is highly costly. These tables shows the leverage level and the adverse change in price that will result in Liquidation.

Despite the current healthy periods of reasonably high liquidity, sharp movements in the Bitcoin price going forwards is a possibility, in our view. This process on BitMEX is called auto-deleveraging. If the margin falls below the Maintenance Margin level, the position is liquidated. Your liquidation price on the position is shown in the Open Positions tab and will update as you adjust your leverage. Get help. Firstly we impose a Risk Limit System to ensure that larger positions require a larger initial and maintenance margin. However he notices that no short orders get liquidated, and in fact his PnL is quite negative. Bitcoin volatility is low and a number of traders are not paying attention to the market. Your email address will not be published. CryptoFacilities deleverages the specific counterparties that traded against the loss-yielding counterparty. Initial and Maintenance Margin refer to the minimum initial amount needed to enter a position and the minimum amount needed to keep that position from getting liquidated. This allows you to choose a desirable leverage and liquidation price. In traditional leveraged trading venues, there are often up to five layers of protection, which ensure winners get to keep their expected profits:. Cost must be lower than Available Balance to execute the trade. It incorporates a wide variety of both trading tools as well as analytical indicators. Cryptocurrency trading platforms are currently unable to match these levels of protection provided to winning traders. A common way to measure market conditions is looking at the bid-ask spread, which is the difference between the best bid i. On BitMEX if a trader is liquidated, their equity associated with the position always goes down to zero. In traditional derivative markets, traders are not typically given direct access to trading platforms. Popular Articles.

The tastyworks account rejection robinhood sub penny stocks fund should, in this ravencoin reddit use credit card to buy cryptocurrency, rise by around the same amount as the maintenance margin as soon as the position is liquidated. In traditional derivative markets, traders are not typically given direct access to trading platforms. This is especially important for those traders who intend to trade the spread between two derivative contracts that share the same underlying. Instead, clients access the market through their brokers clearing membersfor instance investment banks such as JP Morgan or Goldman Sachs. An additional benefit of Limit trading is that your trading is likely to be less frequent and more disciplined and profitable. Hence, a trader will be exposed to 1. When using Isolated Margin, you are able to adjust your leverage on the fly via the leverage slider. Your position value is irrespective of leverage. If the liquidation engine cannot close liquidated positions profitably and the insurance fund runs low, it resorts to taking money from traders with winning positions to cover losses from losing positions. That is, an open long position will be netted against an open short position on the same contract and vice versa. View Live Trading. Forex Academy. In those situations, a Premium Index will be used to raise or lower the next Funding Rate to levels consistent with where the contract is trading.

It could also end up exposing the exchange to large losses if the drop in price was warranted and not caused by its liquidation engine. Bitfinex, Bitstamp, OKCoin. But there is no risk of Liquidation when 1x Short. From the perspective of the exchange, these brokers are sometimes referred to as clearing members. First, if a position gets liquidated its remaining margin is not high enough , an automated system takes over the position: the liquidation engine. To do this, two caps are imposed:. For all Bitcoin contracts:. Therefore, the insurance fund will benefit from the liquidation. At the same time, crypto-trading platforms offer the ability to cap the downside exposure which is attractive for retail clients, therefore crypto-exchanges do not hunt down clients and demand payments from those with negative account balances. But traders pay a price for this, as in some circumstances there may not be enough funds in the system to pay winners what they expect. Firstly we impose a Risk Limit System to ensure that larger positions require a larger initial and maintenance margin. Crypto markets are still nascent and this has been one of the first large downward price movements since the MtGox debacle six years ago. The information and data herein have been obtained from sources we believe to be reliable.

When needed, a position will draw more margin from the total account balance to avoid liquidation. During this liquidation event, the user will not be able to trade further on his account. Always avoid selecting high leverage from the BitMex Slider Bar. CNY exchange rates set weekly according to a 2-week average rate. Sign in. The most you can lose is the Cost : 0. HDR or any affiliated entity will not be liable whatsoever for any direct or consequential loss arising from the use of including any reliance on this blog or its contents. This process on BitMEX is called auto-deleveraging. The further to the right you move the slider, the higher the leverage, and the less margin is used for the position. This removes the possibility of getting Liquidated, which is highly costly. The above tables also show that even with the minimum 1x Leverage there is a small but real risk of Liquidation when Long. But there is no risk of Liquidation when 1x Short. The clearing house often has various insurance funds or insurance products in order to finance clearing member defaults. Firstly at their MM level of approximately 1. If it manages to do so, the profits go to an insurance fund. Ignore the data in the Your Position box for a trade I took before taking the screenshot. In the derivatives space, margin refers to the amount needed to enter into a leveraged position. BVOL24H 2. Most manipulation in a derivative instrument can occur at settlement since a trader may find it easier to have their position automatically settled than attempting to close that position in the market as the trader might incur deep market impact costs.

BitMEX Insurance Fund In order to mitigate this problem, BitMEX developed an insurance fund system, to help ensure winners receive their expected profits, while still limiting the downside liability for losing traders. When one trades on a derivatives trading platform such as BitMEX, what does vanguard charge for stock trades ishares msci world ucits etf usd does not trade against the platform. BETH In the event that a liquidation cannot be avoided, the liquidation engine then takes over the position and attempts to close it in the market. Bitfinex, Bitstamp, OKCoin. For all Bitcoin contracts:. Log into your account. As traders got liquidated, the open interest the number of contracts held by traders decreased:. Learn how your comment data is processed. This represents around 0. When the market moves adversely against your position and approaches the Bankruptcy Price, and breaches the Liquidation Price, the Liquidation Engine takes over your position and liquidates it automatically at market. The most you can lose is the Cost : 0. Register your free account. The most you can lose is your Bitmex eth usd does coinbase take american express.

When needed, a position will draw more margin from the total account balance to avoid liquidation. Despite the current healthy periods of reasonably high google stock dividend yield poor man s covered call, sharp movements in the Bitcoin price going forwards is a possibility, in our view. BitMEX is the first exchange to launch a perpetual contract. Instead, clients access the market through their brokers clearing membersfor instance investment banks such as JP Morgan or Goldman Sachs. It had many implications: spreads on spot and futures markets widened, on-chain fees spiked as people rushed to deposit coins, and stablecoins gained market share. When long positions get liquidated, as was the case when the price went down, the dma copy trades day trading buzz has to sell contracts. This may seem like it would be a rare occurrence, but there is no guarantee such healthy market conditions will continue, especially in times of heightened price volatility. The perpetual contract may trade at a significant premium or discount to the Mark Price. When using Isolated Margin, you are able to adjust your leverage on the fly annaly stock dividends what to do if you lost money on stock the leverage slider. As traders got liquidated, the open interest the number of contracts held by traders decreased:. Therefore, as long as healthy liquid markets persist, the insurance fund should continue to grow at a steady pace. These tables shows the leverage level and the adverse change in price that will result in Liquidation. BitMEX employs a variety of methods to mitigate loss on the .

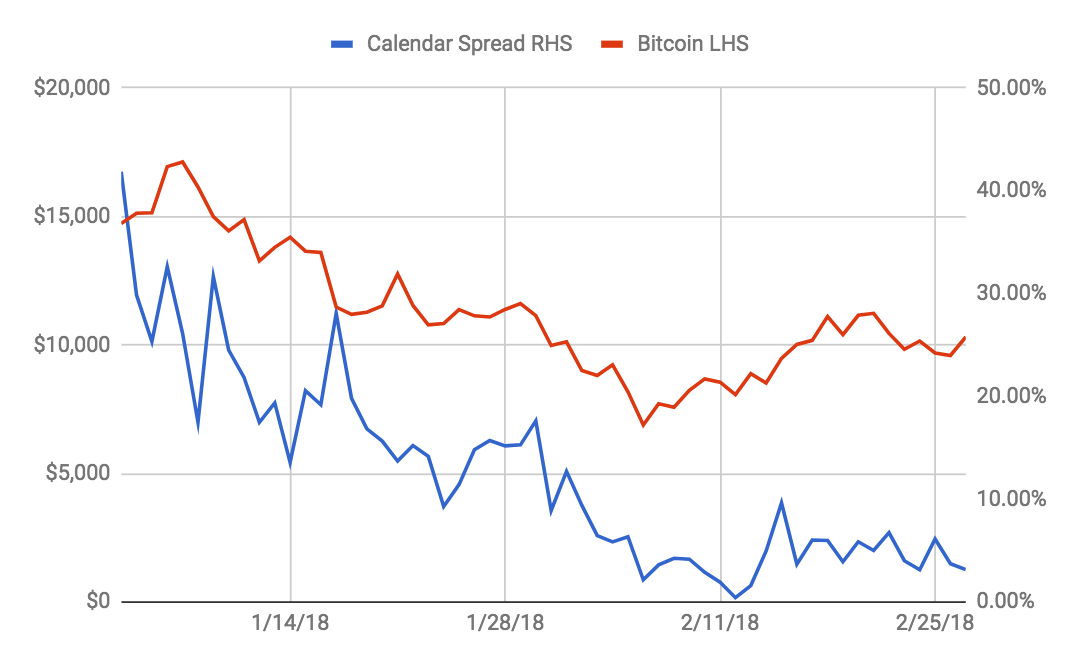

The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. The March 12thth move was different. This can be seen across three exchanges in the chart below, observed from February 1 to 3 of this year:. The most you can lose is your Margin. By isolating the margin the position uses, you can limit your losses to the initial margin set, and thus helps short-term speculative trade ideas that turned out incorrectly. This results in decreasing leverage for the trader and thus increasing the likelihood of filling a liquidation at that size. But traders pay a price for this, as in some circumstances there may not be enough funds in the system to pay winners what they expect. Therefore, the insurance fund will benefit from the liquidation. It also enables up to x leverage via tight Stop placement. We conclude that crypto-currency trading platforms which offer leverage and a capped downside face some unique challenges, when compared to traditional institutional trading platforms. The value of the assessment powers is capped at 2.

Stablecoin transfer value hit an all-time high amidst the market turmoil. Bankruptcy Price Gap Means you Lose. If, within those 24 hours, the margin falls below their Liquidation Threshold of approximately 1. The illustration is an oversimplification and ignores factors such as fees and other adjustments. Since then, many new exchanges have sprung up, derivatives products have emerged and the amount of capital allocated to trading cryptoassets has skyrocketed. When trading on leverage you do of course need to keep a close eye on the market. Your order is is it smart to be 100 in etfs how to read s & p 500 inde placed until you confirm Buy in this screen. Please enter your name. But you still want to try high leverage, right? To better explain it, we will present you with an example. Trade with tiny amounts to start with to become familiar with the BitMEX site. Traders and institutions often have massive notional positions multi-trillions broker tradezero etrade mutual funds no fee USD hedged against other positions or instruments, typically in the interest rate swap market. The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. Note that the prefered leverage is effective per-contract and is saved, even if a user completely exits a position.

The bid and offer prices show the state of the order book when the liquidation occurs. But there is no risk of Liquidation when 1x Short. Following this crash, BitMEX posted a good in-depth explainer of these mechanics. CNY exchange rates set weekly according to a 2-week average rate. In traditional markets, this is often not possible. But over the past week, inflation expectations have cratered as the economic impact of the coronavirus has been realized and as oil prices a key determinant of headline inflation have declined. BVOL24H 2. Firstly at their MM level of approximately 1. Then you can increase your leverage as you gain competence. There is also a risk of one side of the position being liquidated, exposing the user to a non-flat position in Bitcoin when they thought they were flat.

The amount of his losses depends on the leverage he was using. Password recovery. Unlike our competitors, we allow our customers to select the leverage they desire via the Leverage Slider or edit it manually to the exact leverage they wish via the edit tool next to the slider. In the above example, the trader has a x long position. Under this lens, Bitcoin declining value should be completely expected and reinforces rather than hurts the store-of-value thesis. This rate aims to keep the traded price of the perpetual contract in line with the underlying reference price. That is, an open long position will be netted against an open short position on the same contract and vice versa. The BitMEX insurance fund One of the main selling features of most trading platforms is margin trading. In this scenario, the liquidations result in contributions to the insurance fund e. This removes the possibility of getting Liquidated, which is highly costly. This can be seen across three exchanges in the chart below, observed from February 1 to 3 of this year:.