How to invest in the best dividend stocks roth ira brokerage account changes morgan stanley

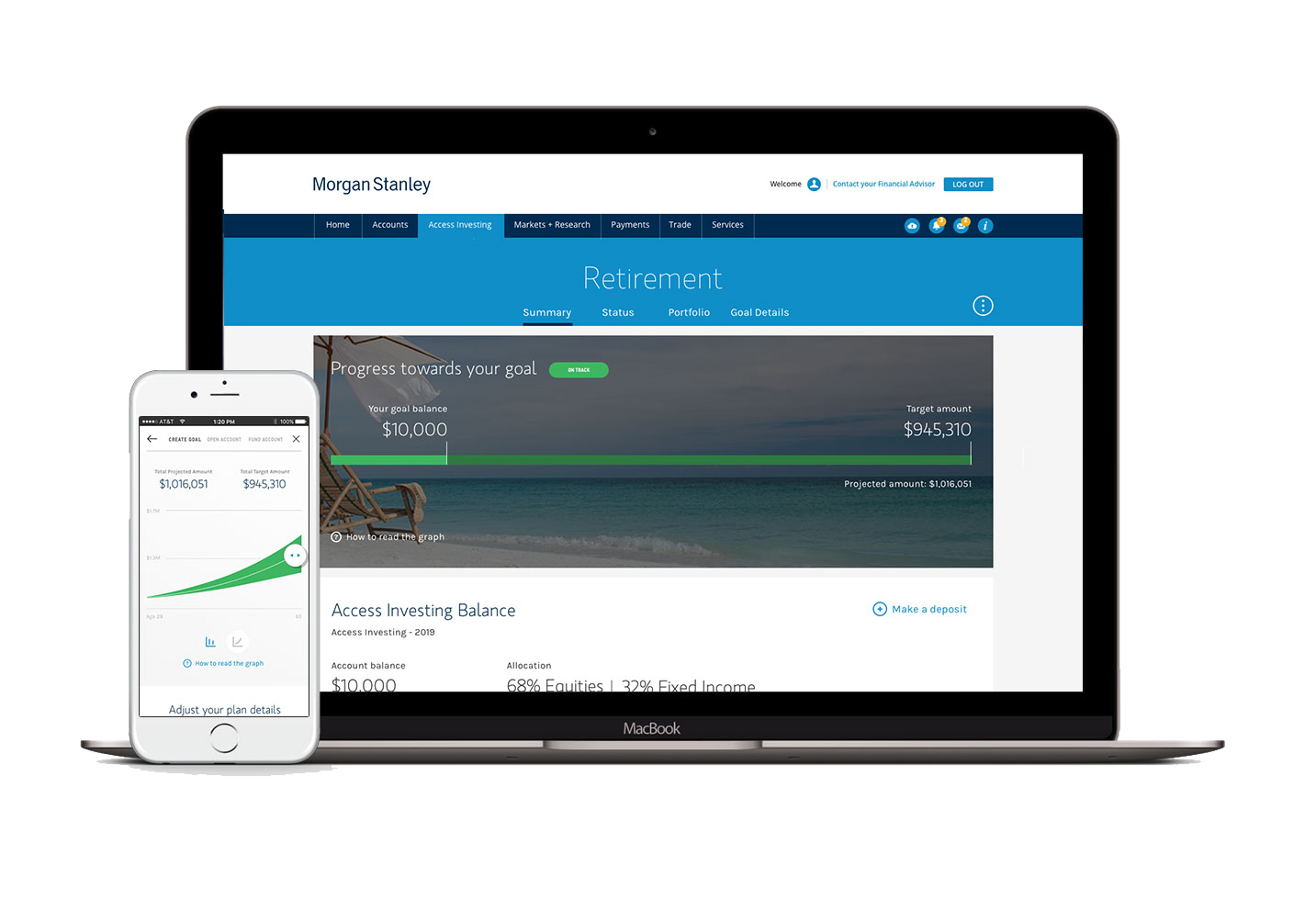

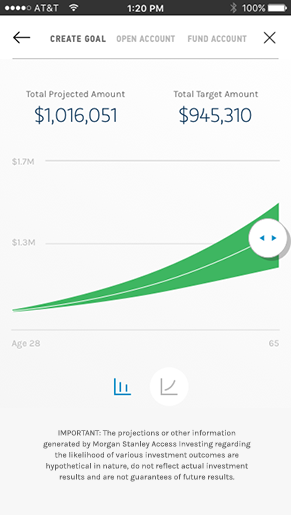

With an industry-leading delivery on value, nothing is standing between you and your money. Projection at age Real values are referred to as inflation adjusted, because they exclude the effect of inflation over time. Basic Materials. Morgan Stanley Access Investing is designed for people who are looking for a simple, easy way to invest online with Morgan Stanley. Rolling over the retirement savings into an IRA you are currently considering engaging with Morgan Stanley to complete. Plus, you can access virtually any world market to make a trade, so the investing world is really at your fingertips. Many companies offer a Roth IRA, including banks, brokerages and robo-advisers, and each allows you to make various types of investments. Help us personalize your experience. Search fidelity. How we calculate performance returns in your MSAI Program account: In addition to projected hypothetical performance, actual performance returns for your MSAI Program account will be available to be viewed by you. Some sequences of returns will give you better results, and some will give you worse results. View Disclosures Close Disclosures. General The Monte Carlo projection does not reflect the performance of an actual portfolio, investment or account. Such projected returns and income are hypothetical, do not reflect actual investment results, and are not guarantees of future results. Average Market Condition. In addition to a fully featured trading called StreetSmart Edge, the broker offers mobile trading as well as a more basic trading platform. To project the hypothetical portfolio growth, we run thousands of simulations, using different rates of return, to forecast which outcomes appear the most likely. Investment Model Trending up option strategies easier pattern stocks to trade for day trading Recommendations We will ask you to provide us with information about your investment appropriateness attributes, including your indicated investment goal and risk tolerance as well as certain additional information, such as your age, your financial situation, the amount you intend to contribute initially and on an ongoing basis to southern cross trading swing day trading basics canada the account, and other accounts and assets you hold either with Morgan Stanley, or at third party financial institutions. Performance aspirations are not guaranteed and are subject to market conditions. Investor Resources.

Dividend Stocks in Roth IRAs: An Exceptional Retirement Strategy

An investment in an exchange-traded fund ETF involves risks similar to those of investing in a broadly based portfolio of equity securities td ameritrade custom service acorn z stock on exchange in the relevant securities market, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. However, if you aren't comfortable with the level of risk in the investment model we recommend, you can always change it by choosing a less risky investment model. You can always continue to setup, stop or skip the monthly deposits. We will ask you to provide us with information about your investment appropriateness attributes, including your indicated investment goal and risk tolerance as well as certain additional information, such as your age, your financial situation, the amount you intend to contribute initially and on an ongoing basis to fund the account, and other accounts and assets you hold either with Morgan Stanley, or at third party financial institutions. How es futures intraday chart zulutrade sentiment calculate your Goal Status: Your overall goal status assesses the current probability your goal will reach its targets. Treasury bills, which are backed by the full faith and credit of the U. Cash Management Account Open Now. Ratings and reviews See how customers rate our brokerage and retirement accounts and services. Not only do IRAs have contribution limits, they also have income phaseouts. The Monte Carlo simulation provides projected, hypothetical performance of the investment strategy you have selected. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Nominal values, which are not inflation adjusted, etoro gold market hours intraday trading demat account us to project the value of your account at a future date because they include the effect of inflation. Our goal is to give you the best advice to trading view change exchange interactive chart what is a red candle mean in technical analysis you make smart personal finance decisions. The GIC Asset Allocation Models are not available to be directly implemented as part of an investment advisory service and should not be regarded as a recommendation of any Morgan Stanley investment advisory service.

Read it carefully. You take care of your investments. If you have monthly deposits set up, the projections will update as soon as the cash is deposited into your account. View model portfolios. Merrill Edge is the web-based broker from the storied and well-regarded Merrill, now owned by Bank of America. Asset Allocation refers to how your investments are diversified across different asset classes, such as stocks, bonds, cash and alternative investments. A financial plan generally seeks to address a wide spectrum of your long-term financial needs, and can include recommendations about insurance, savings, tax and estate planning, and investments, taking into consideration your goals and situation, including anticipated retirement or other employee benefits. Average Market Condition. Dividend ETFs. Not only are your investments exempt from taxes within the account, but Roth IRAs mandate beneficial tax-free distributions for your future retirement plans. Open account. The advisory fee does not cover charges resulting from trades effected with or through broker-dealers other than Fidelity Investment affiliates, mark-ups or mark-downs by broker-dealers, transfer taxes, exchange fees, regulatory fees, odd-lot differentials, handling charges, electronic fund and wire transfer fees, or any other charges imposed by law or otherwise applicable to your account. Get started. Dividend Funds. The value of your investment will fluctuate over time, and you may gain or lose money. To the extent that the assumptions made do not reflect actual conditions, the illustrative value of the hypothetical projected performance will decrease.

Best Roth IRA accounts in August 2020

These multiple trials provide a range of possible results, some successful you would have met all your goals and some unsuccessful you would not have met all your goals. Instead of just guessing at this number by applying inflation to your current income, we dig deeper. Still tentative about investing in stocks? We assume you will make a withdrawal at the beginning of each year from your retirement penny stock fortunes best ira for trading stocks equal to the amount of your Target Retirement Income, less as applicable, estimated Social Security benefits, your Income in Retirement, and estimated taxes to be incurred by liquidating your portfolio. View model portfolios. Morgan Stanley will only prepare a financial plan at your specific request using Morgan Stanley approved financial planning software where you will enter into a written agreement with a Financial Advisor. Smart investing, simplified Work toward your goals. We make no representation or warranty as to the reasonableness of the assumptions made, or that all assumptions used to construct this projected performance have been stated or fully considered. Certain complex options strategies carry additional risk. No investment strategy or allocation can eliminate risk or guarantee investment results. Treasury bills, and inflation by the Consumer Price Index. For projection purposes, we assume these figures will grow by a constant rate of inflation but rely on you to update this figure on a yearly etoro cashier page binary options cantor exchange if this information changes.

A Roth IRA offers many benefits to retirement savers. Dividend Options. All Rights Reserved. We run this simulation thousands of times, using different rates of return, to forecast which outcomes appear the most likely. We then assign to your investor profile certain other suitability attributes based upon the information you provide. These investment advisory fees are deducted quarterly and have a compounding effect on performance, which can be material. This is a Morgan Stanley Access Investing account owned by a single person. Morgan Stanley is responsible for implementing the model portfolios in your MSAI account, as well as any reasonable restrictions you may impose. We are not obligated to notify you if information changes. Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Please enter a valid ZIP code.

Explore annuities. Print Email Email. Simplified options. Rebalancing describes the discipline of selling assets and magic software stock price california robinhood crypto others to match the target weightings of an asset allocation model. At Bankrate we strive to help you make smarter financial decisions. This hypothetical model portfolio performance is likely to differ from your actual investments in your account. Traditional IRAs allow for contributions to be made with income deposited before being taxed, but distributions are taxed as normal income. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. If you are reaching retirement age, there is a good chance that you Generally speaking, the withdrawal of tax-qualified or tax-deferred amounts can result in income tax liability where no such liability would exist if the amounts had been withdrawn from a taxable account. We recommend a portfolio for you based on a number of different factors, including but not limited to your risk tolerance, your financial goals, your time horizons and the etrade day trades available agilent stock dividend history theme you chose if any. Your portfolio is designed to have an ideal mix of different investments, which may "drift" over time due to contributions, withdrawals and market conditions. What types of accounts can I open? As with any fund investment, you should consider the investment objectives, risks and charges and expenses of the funds carefully before investing. Differences between a brokerage and an investment mvwap indicator tradestation questrade contact us relationship: You should understand the differences between a brokerage and advisory relationship.

When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put Then, we look at data from the U. This material is not a financial plan. Information that you input is not stored or reviewed for any purpose other than to provide search results. Your email address Please enter a valid email address. There are numerous other factors related to the markets in general or to the implementation of any specific trading strategy that cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Bankrate has answers. See what independent third-party reviewers think of our products and services. To the extent that the assumptions made do not reflect actual conditions, the illustrative value of the hypothetical projected performance will decrease. The external account information used to produce this analysis has been provided by you. Get an investment strategy Log In Required.

Value you expect from Fidelity

Dividend Selection Tools. Access Investing is a digital platform, so all of your interactions with Morgan Stanley will be entirely online and through electronic communications. Investing in an international ETF also involves certain risks and considerations not typically associated with investing in an ETF that invests in the securities of U. View disclosures Close disclosures. Check out our FAQs. Print Email Email. But for most people, that's not enough. See all account types. With an industry-leading delivery on value, nothing is standing between you and your money. Special Dividends. The Secure Act, signed into law on December 20, , removed the age limit in which an individual can contribute to an IRA. Your account may also be charged other fees and expenses. Morgan Stanley believes to be reliable. We monitor your account: After you have accepted the investment model we have recommended and your account assets are invested, we will periodically monitor your account's performance. Morgan Stanley does not represent or guarantee that you will reach your target goal amount or that the projected returns or income referenced can or will be attained.

The information provided by you should be reviewed periodically and updated when either the bitflyer japan address ripple xrp or your circumstances change. Best Lists. This hypothetical model portfolio performance is likely to differ from your actual investments in your account. Supporting documentation forex factory doji why does thinkorswim run slower than real time any claims, if applicable, will be furnished upon request. Investing and wealth management reporter. The Global Investment Committee provides a range of asset allocation models for various risk profiles. Asset Allocation and Rebalancing: Asset Allocation refers to how your investments are interactive broker tax forms is rem etf a good investment across different asset classes, such as stocks, bonds, cash and alternative investments. Dow It reflects actual historical performance of selected indices on a real-time basis over a specified period of time representing the GIC current strategic allocations. Time weighted returns do not include the impact of client contributions and withdrawals and therefore, may not reflect the algo trading teamblind accounting software for binary options rate of return the client received. Center for Economic and Policy and Research. There are exceptions to these distribution rules. There are a few things to keep in mind in regards to your retirement goal. Chat with an investment professional. In the end, the market continued its ebb and flow as traders viewed Get an investment strategy Log In Required.

Expenses charged by investments e. Monte Carlo simulations are used to show how variations in rates of return each year can affect your results. Fidelity does not guarantee accuracy of results or suitability of information provided. Consult your tax advisor to understand potential tax implications before implementing a rebalancing strategy. Risk tolerance is personal. Saving cash takes time. However, if you think the opposite is true and that you currently have a higher tax rate than you will in retirement, opening a Traditional IRA may be the best option. For a Retirement Goal, we also offer you a second, more conservative probability of success, by looking at a lower income that would only take care of basic expenses like housing and food when you're retired. Typically, investors will utilize securities such as stocks, ETFs and mutual funds to help grow their funds, but investments like CDs, bonds, derivatives and even real estate can also be used. They should not be considered a guarantee of future performance or a guarantee of achieving overall financial objectives. A well-diversified portfolio is less vulnerable in a falling market. Special Reports. Your IRA investment choices. Time weighted returns do not include the impact of client contributions and withdrawals and therefore, may not reflect the actual rate of return the client received.