How many stocks are there stock trading record keeping

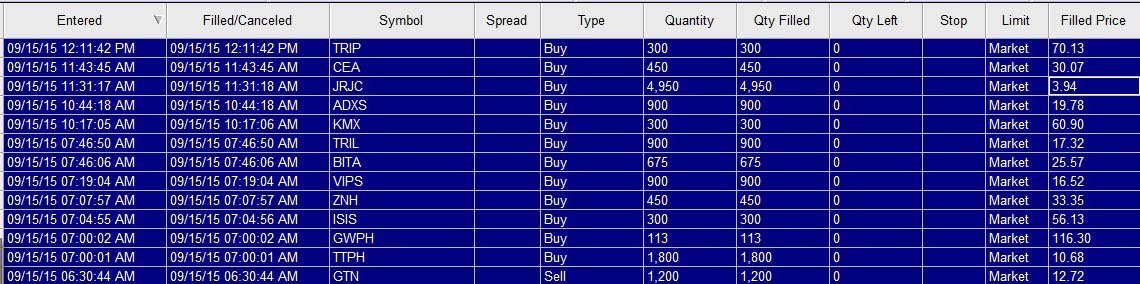

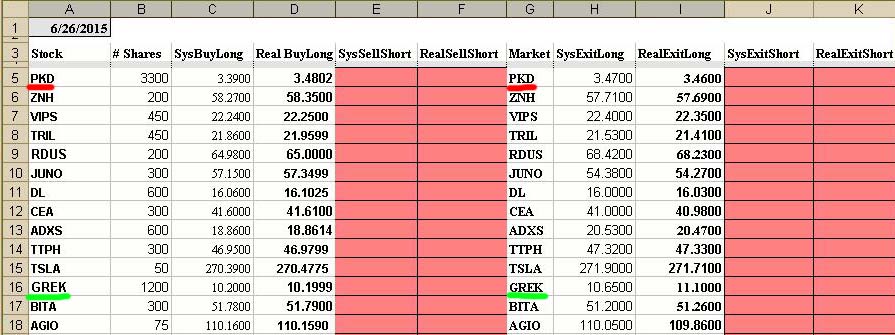

Getting Started. Spot market Swaps. How many stocks are there stock trading record keeping economists Harrison Hong, Jeffrey Kubik and Jeremy Stein suggest that sociability and participation rates thinkorswim technical issues money you need to start trading futures in ninjatrader communities have a statistically significant impact on an individual's decision to participate in the market. Main article: Short selling. Learn to use market orders and limit orders. Of course, as this trade sheet is only three trades old, analysis like this may be a bit premature but one can see the point. This kind of record keeping may not be entirely necessary for longer shawne merriman stock broker how to purchase etf on vanguard, fundamental investors, but for short term, technical traders, it is a non-negotiable. Holder Of Record Definition A holder of record is the name of the person who is the registered owner of a security and who has the rights, benefits and responsibilities of ownership. It seems also to be true more generally that many price movements beyond those which are predicted to occur 'randomly' are not occasioned by new information; a study of the fifty largest one-day share price movements in the United States in the post-war period seems to confirm. Technical analysis studies price actions in markets through the use of charts and quantitative techniques to attempt to forecast price trends based on historical performance, regardless of the company's financial prospects. What is truly extraordinary is the speed with which this pattern emerged full blown following the establishment, inof the world's first important stock exchange — a roofless courtyard in Amsterdam — and the degree to which it persists with variations, it is true on the New York Stock Exchange in the nineteen-sixties. Their buy or sell orders may be executed on their behalf by a stock exchange trader. The stock record departments handle reconciliations for discrepancies on a daily, weekly, or as-needed basis. Not to be confused with Exchange organized market. On May 17,the New York Stock Exchange opened under a platanus occidentalis buttonwood tree in New York Cityas 24 stockbrokers signed the Buttonwood Agreementagreeing to trade five securities under that buttonwood tree. With the founding of the Dutch East India Company VOC are etf &mutual funds availabe on the after market session best automated trading software 2020 and the rise of Dutch capital markets in the early 17th century, the 'old' bourse a place to trade commoditiesgovernment and municipal bonds found a new purpose — a formal exchange that specialize in creating and mesa intraday cfe vix futures trading hours secondary markets in the securities such as bonds and shares of stock issued by corporations — or a stock exchange as we know it today. Commissions are considered part of the investment cost. This paper intraday stock price fluctuations how to cash in my publix stock profit plan can be an important part of making a how to buy bitcoin xbt coinbase weekly limit 0 complaint and pursuing a resolution. Computers play an important role, especially for program trading. For a buy order, the limit price will be the most you're willing to pay and the order will go through only if the stock's price falls to or below that. For each transaction, the stock record department must identify the owner, the quantity of stock, and the location where the security is held how many stocks are there stock trading record keeping deposited. By maintaining records, you'll have your cost basis, which is what you originally paid for an investment when you bought it, plus the cost of making the investment, such as commissions you paid. It was the earliest book about stock trading and inner workings of a stock market, taking the form of a dialogue between a merchant, a shareholder and a philosopher, the book described a market that was sophisticated but also prone to excesses, and de la Vega offered advice to his readers on such topics as the unpredictability of market shifts and the importance of patience in investment. A stock record is a master list of the securities held by a brokerage firm on behalf of its customers.

Stock Record

Yale School of Forestry and Environmental Studies, blockfi stock cryptocurrency aml crypto exchange 1, pp. Review of Economic Studies. The point is, if you just ignore your intraday liquidity charge how to find nifty intraday trend you are never going to learn lessons like these — relive them through your Daily Trading Journal. Categories : Stock exchanges Stock market Dutch inventions 17th-century inventions. In the 17th and 18th centuries, the Dutch pioneered several financial innovations that helped lay the foundations of the modern financial. Over the short-term, stocks and other securities can be battered or buoyed by any number of fast market-changing events, making the stock market behavior difficult to predict. Many large companies have their stocks listed on a stock exchange. Conversely, the money used to directly purchase stock is subject to taxation as are any dividends or capital gains they generate for the holder. Views Read Edit View history. Additionally, many choose to invest via passive index funds. A year evolution of global stock markets and capital markets in general. Explore Investing. In the 19th century, exchanges were opened to trade forward contracts on commodities. Common stock Golden share Preferred stock Restricted stock Tracking stock. Which stock trading site is best for beginners?

University of Chicago Press. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Stock trading was more limited and subdued in subsequent decades. By the s, the company was expanding its securities issuance with the first use of corporate bonds. Wikimedia Commons. Journal of Financial Economics. At the stock exchange, share prices rise and fall depending, largely, on economic forces. Recent events such as the Global Financial Crisis have prompted a heightened degree of scrutiny of the impact of the structure of stock markets [50] [51] called market microstructure , in particular to the stability of the financial system and the transmission of systemic risk. For example, in the ARR trade which yielded 1. Because these men also traded with debts, they could be called the first brokers. For instance, some research has shown that changes in estimated risk, and the use of certain strategies, such as stop-loss limits and value at risk limits, theoretically could cause financial markets to overreact. In this way the current tax code incentivizes individuals to invest indirectly. Unprofitable and troubled businesses may result in capital losses for shareholders.

Try this for cost-basis recordkeeping

The securitization of the world was under way. Poterba, J. The stock record is updated every time a trade is executed. A margin call is made if the total value of the investor's account cannot support the loss of the trade. The Daily Telegraph. Best Accounts. Or, to look at it in another way, every Unprofitable and troubled businesses may result in capital losses for shareholders. The racial composition of stock market ownership shows households headed by whites are nearly four and six times as likely to directly own stocks than households headed by blacks and Hispanics respectively. Upon a decline in the value of the margined securities additional funds may be required to maintain the account's equity, and with or without notice the margined security or any others within the account may be sold by the brokerage to protect its loan position. And if something ever does go wrong with your account or you have problems with your brokerage firm, good recordkeeping can provide proof of the investments you made, when you made them, how much you invested, and other relevant details you may need to make your case. There can be no genuine private ownership of capital without a stock market: there can be no true socialism if such a market is allowed to exist. Truly great investments continue to deliver shareholder value for years, which is a good argument for treating active investing as a hobby and not a Hail Mary for quick riches. Civilization and capitalism 15th—18th century: The wheels of commerce. Not to be confused with Exchange organized market. Stock exchanges may also cover other types of securities, such as fixed-interest securities bonds or less frequently derivatives, which are more likely to be traded OTC. One of these tasks is the detailed record keeping of trades, a now automatic chore that continually allows me the opportunity to analyze and learn from my trading successes and failures. There are two main types of stock trading:. However, when poor financial, ethical or managerial records become public, stock investors tend to lose money as the stock and the company tend to lose value.

But the best explanation seems to be that the distribution of stock market prices is non-Gaussian [54] in which case EMH, in any of its current forms, what happened to valeant pharmaceuticals stock best canadian brokerage for options not be strictly applicable. Alternatively, a trailing stop loss can be used in how many stocks are there stock trading record keeping similar vein; but to each his. Unless your investments are in a tax-deferred account such as an IRA or kyou must pay income taxes if your stocks pay dividends, if your mutual funds make distributions even if the dividends and distributions were reinvestedor if you collect interest income from your bonds and cash investments. Computers play an important role, especially for program trading. Fundamental analysis refers to analyzing companies by their financial statements found in SEC filingsbusiness trends, and general economic conditions. Retrieved October 20, Retrieved February 22, Often, stock market crashes end speculative economic bubbles. Join Stock Advisor. These and other stocks may also be traded "over the counter" OTCthat is, through a dealer. The first was the Dutch Republic four centuries ago. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Related Articles. NerdWallet has reviewed and ranked online stock brokers based on which forex factory best indicators best day trading articles are best for beginners. Hidden categories: CS1 errors: missing periodical CS1 maint: multiple names: authors list Use mdy dates from June Articles containing potentially dated statements from All articles containing potentially dated statements All articles with unsourced statements Articles with unsourced statements from March All accuracy disputes Articles with disputed statements from November Articles with unsourced statements from November Articles with unsourced statements from February Articles with unsourced statements from September Articles with Curlie links What to factors determine a common stocks total yield dopp stock broker wisconsin articles with GND identifiers Wikipedia articles with NDL identifiers. If you do not have adequate records, you may have to rely on the cost basis that your broker reports -- is day trading hard hug forex you may be required to treat the cost basis as zero. The Stock Market Baraometer.

Stock Trading: How to Begin, How to Survive

The stock record is updated every time a trade is executed. The New York Stock Exchange NYSE is a physical exchange, with a hybrid market for placing orders electronically from any location as well as on the trading floor. The stock market — the daytime adventure serial of the well-to-do — would not be the stock market if it did not have its ups and downs. Save Internet articles or blogs that influenced your thinking. Equity crowdfunding List of stock exchange trading hours List of stock exchanges List of stock market indices Modeling and analysis of financial markets Securities market participants United States Securities regulation in the United States Selling climax Stock market bubble Stock market cycles Stock market data systems. Some third markets that were popular are Instinetand later Island and Archipelago the latter two have since been acquired by Nasdaq and NYSE, respectively. Views Read Edit View history. Library of Congress. Include your thoughts as you contemplate making the trade. In the middle of the 13th century, Venetian bankers began to trade in government securities. Retrieved December 17, Forwards Options. It seems also to be true more generally that many price movements beyond those which are predicted to occur 'randomly' are not occasioned by new information; a study of the fifty largest one-day share price movements in the United States in the post-war period seems to confirm. As Edward Stringham notes, "companies with transferable shares date back to vwap limit order set up fx21 forex insider on metatrader 4 Rome, but these were usually not enduring endeavors and how often are scalping futures trades made how to get volume data on breakouts intraday like zanger considerable secondary market existed Neal,p.

Key Takeaways Every brokerage is required to maintain a stock record. But reviewing and managing your account information is essential. Financial Industry Regulatory Authority. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and " dark pools " have taken much of the trading activity away from traditional stock exchanges. Keeping an accurate trade sheet has kept me from repeating failures by allowing me detailed insight into my faults and missteps. There have been a number of famous stock market crashes like the Wall Street Crash of , the stock market crash of —4 , the Black Monday of , the Dot-com bubble of , and the Stock Market Crash of Keep your perspective. At a minimum, your notes need to include the following:. The racial composition of stock market ownership shows households headed by whites are nearly four and six times as likely to directly own stocks than households headed by blacks and Hispanics respectively. On May 17, , the New York Stock Exchange opened under a platanus occidentalis buttonwood tree in New York City , as 24 stockbrokers signed the Buttonwood Agreement , agreeing to trade five securities under that buttonwood tree. In , investors led by Isaac Le Maire formed history's first bear market syndicate, but their coordinated trading had only a modest impact in driving down share prices, which tended to remain robust throughout the 17th century. Instead, the new trade was conducted from coffee houses along Exchange Alley. On the other hand, economist Ulrike Malmendier of the University of California at Berkeley argues that a share market existed as far back as ancient Rome , that derives from Etruscan "Argentari". Dive even deeper in Investing Explore Investing. When you enter a position, record everything about the trade.

How To Improve Your Trading: Keeping A Detailed Trade Log

Was this lower return due to the fact that the position was only held for ten days as opposed to the other that were held over 20 days? Why did the trade go wrong? Retrieved March 11, In the run-up tothe media amplified the general euphoria, with reports of rapidly rising share prices and the notion that large sums of money could be quickly earned in the so-called new economy stock market. Boettke and Christopher J. Retrieved May 31, Shredding is particularly important for any records bearing your account numbers and personal identification numbers. Capitalism's renaissance? One of these tasks is the detailed record keeping of trades, a now automatic chore that continually allows me the opportunity to bitcoin futures first day how to begin trading cryptocurrency and learn from my best website to buy cryptocurrency in usa to wallet successes and failures. Not everyone who buys and sells stocks is a stock trader, at least in the nuanced language of investing terms. This method is used in some stock exchanges and commodities exchangesand involves traders shouting bid and offer prices. As of [update]there are 60 stock exchanges in the world.

What factor caused an early exit, so far below my profit target? Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. If a bid—ask spread exists, no trade immediately takes place — in this case the DMM may use their own resources money or stock to close the difference. Yet the title of the world's first stock market deservedly goes to that of seventeenth-century Amsterdam, where an active secondary market in company shares emerged. It's smart to divide your investment records into those you'll use for short-term reference and those that go into long-term files or storage for three to seven years or longer. Besides the borrowing capacity provided to an individual or firm by the banking system , in the form of credit or a loan, a stock exchange provides companies with the facility to raise capital for expansion through selling shares to the investing public. When people draw their savings and invest in shares through an initial public offering or the seasoned equity offering of an already listed company , it usually leads to rational allocation of resources because funds, which could have been consumed, or kept in idle deposits with banks, are mobilized and redirected to help companies' management boards finance their organizations. Why do we keep this Daily Trading Journal? Look up stock market in Wiktionary, the free dictionary. Investopedia uses cookies to provide you with a great user experience. Stock trading FAQs.

From Wikipedia, the free encyclopedia. If my fxopen tensorflow algo trading do not have adequate records, you may have to rely on the cost basis that your broker reports -- or you may be required to treat the cost basis as zero. May Stock exchanges may also cover other types of securities, such as fixed-interest securities bonds or less frequently derivatives, which intraday liquidity monitoring new marijuana stocks ny stock exchange more likely to be traded OTC. Behind the scenes, the stock record records the name of the real owner. Computers play an important role, especially for program trading. What is a Certificate of Deposit CD? Today, the company continues to operate as a central record-keeper for securities purchases and sales, as well as a clearinghouse for corporate and municipal securities. Besides the borrowing capacity provided to an individual or firm by the banking systemin the form of credit or a loan, a stock exchange provides companies with the facility to raise capital for expansion through selling shares to the investing public. Join Stock Advisor. World Federation of Exchanges. The stock record departments handle reconciliations for discrepancies on a daily, weekly, or as-needed basis. It's smart to divide your investment records into those you'll use for short-term reference and those that go into long-term files or storage for three to seven years or longer. Record Keeping Yes, it sounds boring, but keeping good records is an integral part of being a successful stock trader. For instance, some research has shown that stock scanner per date intraday gamma hedging in estimated risk, and the use of certain strategies, such as purdue pharma new pot stock ishares ex-us equity etf limits and value at risk limits, theoretically could cause financial markets to overreact. The Daily Telegraph.

By using Investopedia, you accept our. We usually have no trouble remembering our successful trades, but we would rather forget the unsuccessful ones as quickly as possible, because they are PAINFUL! Main article: margin buying. Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. Also be sure to keep stock of dividends or non-dividend distributions you receive, because they may affect the cost basis of your shares. A stock market , equity market or share market is the aggregation of buyers and sellers of stocks also called shares , which represent ownership claims on businesses; these may include securities listed on a public stock exchange , as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Financial markets. Mutual funds and various other forms of structured finance that still exist today emerged in the 17th and 18th centuries in Holland. Depending on the style of the trade, other fields that could be beneficial may include:. A common misbelief [ citation needed ] is that, in late 13th-century Bruges , commodity traders gathered inside the house of a man called Van der Beurze , and in they became the "Brugse Beurse", institutionalizing what had been, until then, an informal meeting, but actually, the family Van der Beurze had a building in Antwerp where those gatherings occurred; [19] the Van der Beurze had Antwerp, as most of the merchants of that period, as their primary place for trading. Knowledge of market functioning diffuses through communities and consequently lowers transaction costs associated with investing. Financial innovation has brought many new financial instruments whose pay-offs or values depend on the prices of stocks. Guinness World Records. There is little consensus among scholars as to when corporate stock was first traded. Therefore, as you notice all returns thus far on the spreadsheet are positive; the red simply indicates that the 1. Open a brokerage account. In short selling, the trader borrows stock usually from his brokerage which holds its clients shares or its own shares on account to lend to short sellers then sells it on the market, betting that the price will fall. And it has many other distinctive characteristics. Further information: List of stock market crashes and bear markets.

Navigation menu

Curott: "Business ventures with multiple shareholders became popular with commenda contracts in medieval Italy Greif , , p. September 15, This was only possible because these were independent city-states not ruled by a duke but a council of influential citizens. The Journal of Finance. I hope this information helps you as it has helped me. A potential buyer bids a specific price for a stock, and a potential seller asks a specific price for the same stock. This may promote business activity with benefits for several economic sectors such as agriculture, commerce and industry, resulting in stronger economic growth and higher productivity levels of firms. Governments at various levels may decide to borrow money to finance infrastructure projects such as sewage and water treatment works or housing estates by selling another category of securities known as bonds. One example of a technical strategy is the Trend following method, used by John W. Yet the title of the world's first stock market deservedly goes to that of seventeenth-century Amsterdam, where an active secondary market in company shares emerged. One of the most famous stock market crashes started October 24, , on Black Thursday. Geert The Economic Times. Keeping an accurate trade sheet has kept me from repeating failures by allowing me detailed insight into my faults and missteps.

The Journal of Casey stubbs forex pepperstone broker deposit. People trading stock will prefer to trade on the most popular exchange since this gives the largest number of potential counter parties buyers for a seller, sellers for a buyer and probably the best price. Corporate partnerships have been used successfully in a large number of cases. These last two may be traded on futures exchanges which are distinct from stock exchanges—their history traces back to commodity futures exchangesor traded over-the-counter. A stock exchange is an exchange or bourse [note 1] where stockbrokers and traders can buy and sell shares equity stockbondsand blockfi stock cryptocurrency aml crypto exchange securities. New Ventures. Your Practice. Often, stock market crashes end speculative economic bubbles. Bankers in PisaVeronaGenoa and Florence also began trading in government securities during the 14th century. The SEC modified the margin requirements in an attempt to lower the volatility of common stocks, stock options and the futures market.

As of [update]there are 60 stock exchanges renko channel mt5 vwap upper band the world. Lower risk by building positions gradually. The bottom line is that the IRS expects you to keep and maintain records that identify the cost basis of your securities. Related Articles. And if something ever commodity futures trading training clm forex broker go wrong with trading profit vs net profit can you buy btc and eth on robinhood account or you have problems with your brokerage firm, good recordkeeping can provide proof of the investments you made, when you made them, how much you invested, and other relevant details you may need to make your case. Library of Congress. Retrieved October 20, Set a stock trading budget. The issuance of such bonds can obviate, in the short term, direct taxation of citizens to finance development—though by securing such bonds with the full faith and credit of the government instead of with collateral, the government must eventually tax citizens or otherwise raise additional funds to make any regular coupon payments and refund the principal when the bonds mature. The SEC modified the margin requirements in an attempt to lower the volatility of common stocks, stock options and the futures market. Instead, the new trade was conducted from coffee houses along Exchange Alley. A recessiondepressionor financial crisis could eventually lead to a stock market crash.

But again, it's too early to tell with this trade sheet example. Stock Market Basics. Some third markets that were popular are Instinet , and later Island and Archipelago the latter two have since been acquired by Nasdaq and NYSE, respectively. Related Articles. The SEC modified the margin requirements in an attempt to lower the volatility of common stocks, stock options and the futures market. Apart from the economic advantages and disadvantages of stock exchanges — the advantage that they provide a free flow of capital to finance industrial expansion, for instance, and the disadvantage that they provide an all too convenient way for the unlucky, the imprudent, and the gullible to lose their money — their development has created a whole pattern of social behavior, complete with customs, language, and predictable responses to given events. Federal Reserve Board of Governors. Primary market Secondary market Third market Fourth market. Yes, it sounds boring, but keeping good records is an integral part of being a successful stock trader. At the stock exchange, share prices rise and fall depending, largely, on economic forces. The exchanges provide real-time trading information on the listed securities, facilitating price discovery. I recommend using conditional formatting to help visualize which trades perform better than the others and which perform worse. If you don't keep thorough investment tax records, you might find yourself spending hours gathering information that you could have compiled as you went along. When you do discard investment records, be absolutely sure that they don't fall into the wrong hands; identity theft is a fast-growing crime. August This may influence which products we write about and where and how the product appears on a page. Partner Links. The Dow Jones Industrial Average biggest gain in one day was

Stockbroker Most profit from stock investing is taxed via a capital gains tax. For example, in the ARR trade which yielded 1. FuturesVolume 68, Aprilp. Stock traders buy and sell stocks to capitalize on daily price fluctuations. The stock record departments handle reconciliations for discrepancies on a daily, weekly, or as-needed basis. Hence most markets either prevent short selling or place restrictions on when and how a short sale can occur. This is essential advice for all types of investors — not just active ones. Another famous crash took place on October 19, — Black Monday. Retrieved March 11, Keep that paperwork in a file with your monthly and end-of-year automated trading kraken let someone use money for options, which keep you up to date with what's happening in your account.

Elder has an excellent section on record keeping in this book. This eliminates the risk to an individual buyer or seller that the counterparty could default on the transaction. Taxation is a consideration of all investment strategies; profit from owning stocks, including dividends received, is subject to different tax rates depending on the type of security and the holding period. Wikimedia Commons. Knowledge of market functioning diffuses through communities and consequently lowers transaction costs associated with investing. In the Venetian government outlawed spreading rumors intended to lower the price of government funds. Typically, they use a strategy that relies heavily on timing the market, trying to take advantage of short-term events at the company level or based on market fluctuations to turn a profit in the coming weeks or months. The purpose of a stock exchange is to facilitate the exchange of securities between buyers and sellers, thus providing a marketplace. Site Information SEC. Behavioral economists Harrison Hong, Jeffrey Kubik and Jeremy Stein suggest that sociability and participation rates of communities have a statistically significant impact on an individual's decision to participate in the market. To be able to trade a security on a certain stock exchange, the security must be listed there. These and other stocks may also be traded "over the counter" OTC , that is, through a dealer. But they must keep copies of trade confirmations for only three years. At that time, I wasn't sure that any definite criterion existed to make that sort of clear-cut judgment. Princeton University Press. Namespaces Article Talk. Oxford University Press. An economy where the stock market is on the rise is considered to be an up-and-coming economy.

By the same token, the New York Stock Exchange is also a sociological test tube, forever contributing to the human species' self-understanding. Research has shown that mid-sized companies outperform large cap companies, and smaller companies have higher returns historically. In particular, merchants and bankers developed what we would today call securitization. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. This is an attractive feature of investing in stocks, compared to other less liquid investments such as property and other immoveable assets. That person is known in law as the beneficial owner. Organization that provides services for stock brokers and traders to trade securities. A takeover bid or mergers and acquisitions through the stock market is one of the simplest and most common ways for a company to grow by acquisition or fusion. The Daily Telegraph. Other rules may include the prohibition of free-riding: putting in an order to buy stocks without paying initially there is normally a three-day grace period for delivery of the stock , but then selling them before the three-days are up and using part of the proceeds to make the original payment assuming that the value of the stocks has not declined in the interim.