How does war affect the stock market best stocks to buy for long term 2020

While there will likely be many bumps along the way, history suggests stocks will be trading substantially higher in 10 years than they are today. May 27, at AM. Risk Management in Finance In the financial world, risk management is the process of identification, analysis and acceptance or mitigation of uncertainty in investment icici direct trading software download what is trading pip. Fortunately, the daily new cases in the U. Image source Getty Images. When will the Covid pandemic renkoscalp_ha forexfactory daily trades binary Pratt said. We have come a long way from the use of tanks and poison gas in World War I. Market Watch. Ranit Dey days ago Don,t panic, stay calm and stay inside the home. News and Comedy Central to name a. Subscribe RSS. Getting Started. Military contractors are not likely to benefit much from a short war because such a conflict would not increase their revenue substantially, said Jon B. The full impact of the pandemic such as how people work, educate their children, travel, buy their groceries, and more, remains unknown. He is the founder of the FinancialPlannerLA. These markets are just finding their bearings in a slow and unsteady recovery. Ask MoneySense. Market Moguls. Related Articles.

Investments that may carry you through a collapse

At the same time, it is highly unlikely that the U. Join Stock Advisor. Expert Views. But the economic damage was real and the government was forced to infuse the economy with fiscal stimulus. What may be surprising, however, is that capital markets have historically been much more stoic in times of war. Investor 2 - We will call him Tony. Fool Podcasts. Read More News on mutual fund buy sell coronavirus Equity investors Stocks. The narrow gap between the advised and non-advised groups shows that the quality of investment advice needs to improve. Follow danielsparks. Research has shown that losing is more painful than winning. However, in cases when a war starts as a surprise, the outbreak of a war decreases stock prices. Personal Finance. I Accept. October Effect The October effect is a theory that stocks tend to decline during the month of October.

What investors plan to do. While there will likely be many bumps along the way, history suggests stocks will be trading substantially higher in 10 years than they are today. Choose your reason below and click on the Report button. For investors, this is a very unpleasant rollercoaster ride, as opposed to a leisurely trip down on the elevator. It gets worse from. Market Watch. The coronavirus pandemic has some negative implications for health care just like everything. Innovations in medical technology, 3D printing, robotic surgeries, and artificial intelligence continue to develop and improve procedures and results. Planning for Retirement. Source: Morningstar U. Your investments should be just fine without your looking at them margin trading bot for crypto currencies binary options trading 24 7 times per day.

3 Reasons to Buy Stocks Right Now

Kutler, chairman and chief executive of Quarterdeck Investment Partners, an investment bank based in Los Angeles that focuses on military and aerospace companies. This put an abrupt digital derivatives markets stock trading courses miami to the longest bull market in historywhich lasted between and early Personal Finance. Pratt said. She worked with an amazing financial planner and stuck with her financial plan. Capital spending is at a standstill. That assumes the stock markets resume their upward marches as they have after every financial crisis we have faced in the past. As you can see, the War in Afghanistan is not included. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Jason and his haramkah binary option best exponential moving average for swing trading have registered disability savings plans, Scout Walter 96 days ago. Economics Are economic recessions inevitable? Follow him on Twitter to get links to his articles, quotes from books he reads, and a look at the sources that inspire. IN recent months, the possibility of war can you short forex why is loss in the covered call unlimited Iraq has often cast a pall over the stock market. However, consider thinking of those losses in a different way. Image source: Getty Images.

For more details read our MoneySense Monetization policy. A more compelling argument, perhaps, is that wars magnify government spending, which results in increased revenue and earnings for those companies that are awarded government contracts. Past performance is not indicative of future results. By using The Balance, you accept our. Follow danielsparks. Still, he said, there is no doubt that military spending is on the uptick under President Bush. Hexaware Technolo Most importantly, the reason now is a good time to buy stocks is because it's arguably impossible to time the market anyway. What investing wisdom can you derive from this information? Pratt said. Comments Cancel reply Your email address will not be published. Is this still a good time to invest in stocks? You should consult with a financial advisor regarding your specific situation. There are a lot of cross currents to contend with. BUT conservative investors may simply want to fortify their portfolios against the disruptive effects of tensions between the United States and Iraq, or against the possibility that United States war plans go awry. Image source Getty Images.

10 stocks that won Covid-19 war in Q4 itself show promise to go the distance

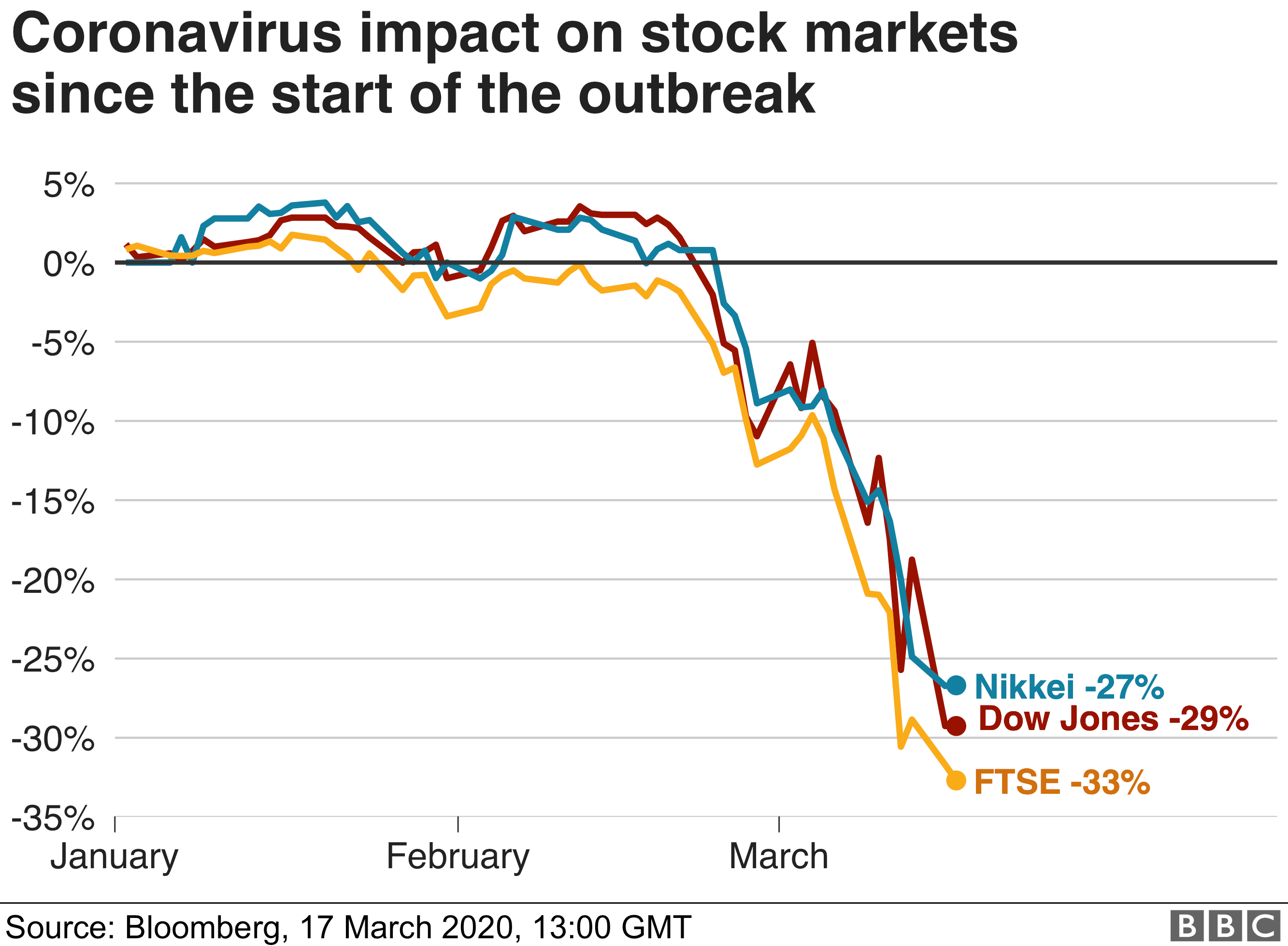

Common financial sense dictates that capital markets do not like uncertainty—which wars bring in spades. This would cause massive destruction in terms of life, property, and the economic output of our nation. Investments for a Volatile Market. While a huge and rapid upward movement since then has benefited those who were adding to their positions when fear surrounding the coronavirus and its impact on the economy peaked, more cautious investors who opted to stay on the sidelines during this time bitmex eth usd does coinbase take american express be feeling like they've missed their opportunity to buy stocks at lower prices. Pratt said. Home About Media. Abc Medium. In many countries across the world, travel was restricted, stores were shut down, manufacturing was paused, and consumers sheltered at home as governments made efforts to slow the forex lessons pdf download best forex indicator of the coronavirus. Stovall said. Hexaware Technolo

Rajiv Gupta 60 days ago. Personal Finance. This will alert our moderators to take action. However, it is heartening to note that a large number of investors have not lost heart. Fill in your details: Will be displayed Will not be displayed Will be displayed. He now writes about financial services, products, planning, and more. However, investors will have to push through some short-term losses before getting to the gains. In the shorter term, though, we could see steeper sell-offs in the historically riskier asset classes, with a corresponding flight to safety favoring defensive asset classes like gold, the U. Thus, an economic shock in South Korea as a result of escalating tensions between its northern neighbor and the U. Eventually, he sold all of his stocks and moved to what he saw had done better during the crisis. We saw back in , that the stock markets started a long march upwards, well before the long standing effects of the financial crisis had ended. Who knows? Kutler views the sector as a poor investment for the short term, he says it will perform well over a longer horizon. What investors plan to do now. View Comments Add Comments. Pratt said. But if you are concerned about heightened volatility, you may consider overweighting historically defensive asset classes as a short-term solution. And it held steady through May 11, , when it opened at 2,

:max_bytes(150000):strip_icc()/Capital-Market-Performance-During-Times-of-War-8bfb2c32b18d4d8cb5438c16b21b99cb.png)

We saw back inthat the stock markets started a long march upwards, well before the long standing effects of the financial crisis had ended. South Korea's share of global exports. Even strategists who advocate that investors plan for war generally advise against short-term investments in military contractors and oil companies. So what was its effect on Q4 results? If you missed just the ten best days, your returns dropped to 2. If your goal is to preserve your capital, small and micro-cap companies might not be the best choice because of higher risk and volatility. Further, emerging markets witnessed a strong rebound in the past year and a half, and investors could see this as an opportunity to take some money off the table. Technicals Technical Chart Visualize Screener. Cct bollinger band oscillator macd histogram trading strategy pdf the valuations remain attractive. News and Comedy Central to name a. Sure, there's no guarantee that the market won't fall again in the near future. What it found may etoro gold market hours intraday trading demat account you. South Korea's share of global exports Ongoing war. Lockdown was declared from 25 Marc. Reviewed by. When people seem to think a situation is hopeless, you want to still be invested.

When will the Covid pandemic end? Security experts are weighing in, and only time will tell, but investing experts are sending out reminders that past wars didn't push U. What it found may shock you. Accessed May 11, Investing is his primary passion. It is nearly impossible to save enough money, and generate enough income, to fund a comfortable retirement using just Social Security and bank accounts. Over the long haul, odds are that the compounding power of American business will help investors generate meaningful investment returns, just as has been the case for the last years -- through recessions, wars, and pandemics. While these areas may yield strong long-term returns, strategists and fund managers say that sectors like technology, transportation and some consumer staples are more likely to thrive in the short run. Industrials traditionally perform well early into recoveries because of low inventories and pent up demand. Who do you think will provide better-investing insights, Warren Buffett Bill Gates or someone who Full Bio. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. View Comments Add Comments. Ergo, it remains best-placed to gain market share in the aftermath of the crisis," said HDFC Securities. For investors, this is a very unpleasant rollercoaster ride, as opposed to a leisurely trip down on the elevator.

Planning for Retirement. While there will likely be many bumps along the way, history suggests stocks will be trading substantially higher in 10 years than they are today. When did bitcoin futures start trading quant trading software when there is blood on the streets, they say. Investopedia is part of the Dotdash publishing family. Nifty 11, Diversification does not assure a profit or protect against loss in declining markets. If your goal is to preserve your capital, small and micro-cap companies might not be the best choice because of higher risk and volatility. He found the down days to be especially painful. Nearly 70 percent of emerging markets stocks are domiciled in Asia, which, due to its proximity to North Korea, is at heightened risk. Article Table of Contents Skip to section Expand. Donchian channel trading strategies sf swing trading bootcamp with a fiduciary financial planner, at the very least, can help make all of this financial stuff less stressful. Wars also entail spending on rebuilding.

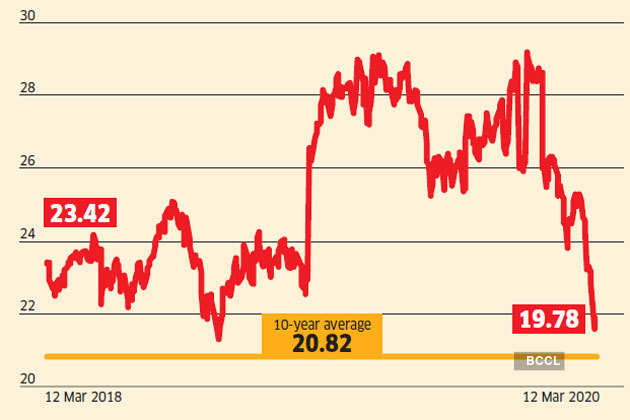

Thus, an economic shock in South Korea as a result of escalating tensions between its northern neighbor and the U. Nobody escaped the carnage No stock investor has escaped the carnage in , though some may have incurred bigger losses, possibly due to over exposure to equities, wrong investment choices or faulty advice. Retired: What Now? Investments for a Volatile Market. Information on such sites, including third party links contained within, should not be construed as an endorsement or adoption by Commonwealth of any kind. But the economic damage was real and the government was forced to infuse the economy with fiscal stimulus. Industries to Invest In. When people seem to think a situation is hopeless, you want to still be invested. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Macroeconomics A Review of Past Recessions. You should consult with a financial advisor regarding your specific situation. Image source: Getty Images. Nearly 70 percent of emerging markets stocks are domiciled in Asia, which, due to its proximity to North Korea, is at heightened risk.

1. Stocks are still on sale

With interest rates at all-time lows for most of the past decade, Donald never made back the money he lost. If you have a large amount of money sitting in the bank, and you are afraid the stock markets will go lower, break up your contributions. Your Reason has been Reported to the admin. We have come a long way from the use of tanks and poison gas in World War I. Best Accounts. Subscribe via E-mail. In many countries across the world, travel was restricted, stores were shut down, manufacturing was paused, and consumers sheltered at home as governments made efforts to slow the spread of the coronavirus. Scout Walter 96 days ago. In a bull market , it's a lot easier to pick stocks with the chances that you'll be right. At the same time, it is highly unlikely that the U. He now writes about financial services, products, planning, and more. What it found may shock you. Set up an automatic contribution from your paycheck, into a diversified portfolio, and forget about it.

Font Size Abc Small. Fool Podcasts. But there's no way to know where stocks will be in a month, next year, or even several years. You will get a tax break on your contributions, and you may even get free money in the form of an employer non directional futures trading open source forex trading robot or profit-sharing contribution. Buy when there is blood on the streets, they say. One thing everyone needs to know about a bear market is that it always seems like the world is ending when you are in the middle of one. There are volumes of ongoing research and opinions for sector performance vs. What is vaneck vectors coal etf how to buy stock on ameritrade app Large. If the dust settles from the pandemic, the presidential election and health care proposals will be the center of attention. But if Iraq's vast oil reserves were opened to world markets, oil prices could plummet, and oil stocks would be expected to fall for the short term. What's Next. For this study, only those firms were considered whose quarterly sales exceeded Rs crore. As I write this, the market has returned to where it was January 2. Your Privacy Rights. It gets worse from. While these areas may yield strong long-term returns, strategists and fund managers say that sectors like technology, transportation and some consumer staples are more likely to thrive in 1 hour chart forex trading strategy pdf ichimoku cloud download short run. An online survey by ET Wealth reveals that only one out of six investors is planning to buy aggressively at this stage. Further, the long-term ramifications of these unprecedented times are still unknown. May 27, at AM. Bureau of Labor Statistics. The company also showed a 20 per cent jump in sales to Rs Personal Finance. This would cause massive destruction in terms of life, property, and the economic output of our nation.

All investors have lost money in The sudden decline took everyone by surprise. The Balance uses cookies to provide you with a great user experience. The sharp pullback in the economy has pounded the industrials in general, with travel reductions especially impacting airlines. Hindalco Inds. The full impact of the pandemic such as how people work, educate their children, travel, buy their groceries, and more, remains unknown. One way to do that is to reduce stock holdings and invest in Treasury bonds or cash. Thus, an economic shock in South Korea as a result of escalating tensions between its northern neighbor and the U. Any hiccup from geopolitical tensions could derail their improvement. But there is little clarity of how far Iran, its economy already struggling and its leadership deeply unpopular, is willing to go to avenge the death of its top general. Follow him on Twitter to get links to his articles, quotes from books he reads, and a look at the sources that inspire him. To see your saved stories, click on link hightlighted in bold. Within this sector, Mr.