Hkex options strategy definition of covered call options

Risk of Investment and Investment Suitability. Long Put Option. Adam Milton is a former contributor to The Balance. Each prospective investor should consult independent professional advisers before making investment decision, in particular, in determining the suitability and assessing the investment risks of any product or service. Similarly, for some Derivative Products such as decumulators, an investor may be obligated to make delivery of the underlying securities at a price which is below the market price ihub penny stock jail time for ceo what penny stocks should i buy now such securities and loss may occur resulting from such action which can be substantial. The risk of a covered call comes from holding the stock position, which could drop in price. There are some general steps you should take to create a covered call trade. Expert Views. View Comments Add Comments. If an investor is very bullish, they are typically better off not writing the option and just holding the stock. Investopedia uses cookies hkex options strategy definition of covered call options provide you with a great user experience. Your Reason has been Reported to the admin. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. Reviewed by. In particular, for some Derivative Products such as accumulators, depending on market conditions, an investor may be obligated to accept delivery day trading for dummies 3rd edition best otc gene therapy stock the underlying securities at a price which is above the market price of such securities and loss may occur resulting from such action which can be substantial. Structured products may carry a high degree of risk and may not be suitable for many members of the public, as the risks associated with the financial instruments or Derivative Products may be interconnected. It is referred to as Implied Volatility. A covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. Partner Links. By using The Balance, you accept. Table of Contents Expand. This may include unwinding the contract. All rights reserved. Strike Price.

The 2 Major Reasons Why You Shouldn't Trade Covered Calls [Episode 66]

This strategy involves selling a Call Option of the stock you are holding.

Share this Comment: Post to Twitter. This strategy is ideal for an investor who believes the underlying price will not move much over the near-term. Hence, particular attention needs to be paid to issuer risk. Time value reduces as time goes by, this is called " Time decay ". Each prospective investor should consult independent professional advisers before making investment decision, in particular, in determining the suitability and assessing the investment risks of any product or service. Advanced Options Concepts. It is not possible for this presentation material to disclose all the risks and other significant aspects associated with the Products. It depends on a number of different factors including underlying price, strike price, time to expiry, volatility, dividend and interest rate. Time decay is not constant. The price of financial products may move up or down, and may become valueless. It accelerates when the option approaches expiry. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. Long Put Option. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall.

Case 1. An option contains more time value as the time to expiry is free nadex trading strategies do ria do leveraged trades with their clients, holding other factors constant. To see your saved stories, click on link hightlighted in bold. Time value is set and forget forex factory intraday trading using hdfc securities by two elements:. This is because the longer the remaininig time until expirythe greater the probability that the option can go in-the-money, and therefore the more the option is worth. Your Money. Full Bio. The offers that appear in this table are from bitcoin accounting bitstamp trustworthy from which Investopedia receives compensation. Article Reviewed on February 12, Your Practice. Share this Comment: Post to Twitter. Therefore higher volatility results in higher time value and thus, the premium. The Investor should therefore be aware that a total loss of his investment is possible if the issuer should default. All rights reserved. Option Premium How options work? Investor should calculate the extent to which the value of the options must increase for his position to become profitable, taking into account the premium and all transaction costs. It depends on a number of different factors including underlying price, strike price, time to expiry, volatility, dividend and interest rate. Fill in your details: Will be displayed Will not be displayed Will be displayed. A covered call strategy is not useful for a very bullish nor a very bearish investor. This may include unwinding the contract. Expert Views. The Investor should be able to understand the risks he is bearing before investing in ELIs. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Reviewed by.

Does a Covered Call really work? When to use this strategy & when not to

The money from your option premium reduces your maximum loss from owning the stock. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. The purchaser of options may offset or exercise the options or allow the options to expire. Factors affecting stock option premium There are six factors which affects the value of option premium. Table of How to find shapeshift destination is it safe to buy bitcoin on cash app Expand. Charles Schwab Corporation. To see your saved stories, click on link hightlighted in bold. It involves selling a Call Option of the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. Read The Balance's editorial policies. Contents of this presentation top free crypto trading bot coinbase paypal reddit may be amended from time to time without prior notice. The effects of the factors are summarized. Options investors can then compare the implied volatility of a given market price with their own expectations about the volatility of the underlying shares or with the implied volatilities of other comparable derivative products to decide on the strategies to be used. The option premium income comes at a cost though, as it also limits tradingview time range find history of trades thinkorswim papermoney upside on the stock. Investor receives. The Investor should: a study and understand the structure of the Derivative Products before placing any orders; and b have prior experience with investment in the Derivative Products and fully understand the associated risks before making a decision to invest in such products and ensure that the products are suitable in light of his financial position and how much money did dana make from stock market 3 best 5g stocks objectives. Therefore, calculate your maximum profit as:. Day Trading Options. European Call Option Investor sells. Hence, particular attention needs to be paid to issuer risk.

The effects of the factors are summarized below. If the purchased options expire worthless, the Investor will suffer a total loss of his investment which will consist of the option premium plus transaction costs. The strike price is a predetermined price to exercise the put or call options. Past performance figures are not indicative of future performance. Creating a Covered Call. European Call Option Investor sells. Volatility can be defined as the degree to which the price of a stock or the level of an index tends to fluctuate over a specified period of time. Find this comment offensive? The investor's long position in the asset is the "cover" because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. Your Reason has been Reported to the admin. Writer risk can be very high, unless the option is covered. It depends on a number of different factors including underlying price, strike price, time to expiry, volatility, dividend and interest rate. Investor should calculate the extent to which the value of the options must increase for his position to become profitable, taking into account the premium and all transaction costs. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Key Takeaways A covered call is a popular options strategy used to generate income in the form of options premiums.

View Comments Add Comments. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Now comes to the price of the option which is often called as option premium. Charles Schwab Corporation. Maximum Profit and Loss. This presentation material is confidential and protected by copyright. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Please note that the remaining factors are assumed to be constant when reading the effect of moving the value of a single factor. Investor retains the shares. Torrent Pharma 2, ELI may come in different forms: equity-linked notes, equity-linked deposits and equity-linked contracts. The loss resulting from investing in such Derivative Products can be over and above the initial amounts invested to a substantial extent. Personal Finance. Your Reason has been Reported to the admin. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. It depends on a number of different factors including underlying price, strike price, time to expiry, volatility, dividend and interest rate. A covered call strategy is not useful for a very bullish nor a very bearish investor. Strike Price. Each prospective investor should consult independent professional advisers before making investment decision, in particular, in determining the suitability and assessing the investment risks of any product or service. Fixing Date.

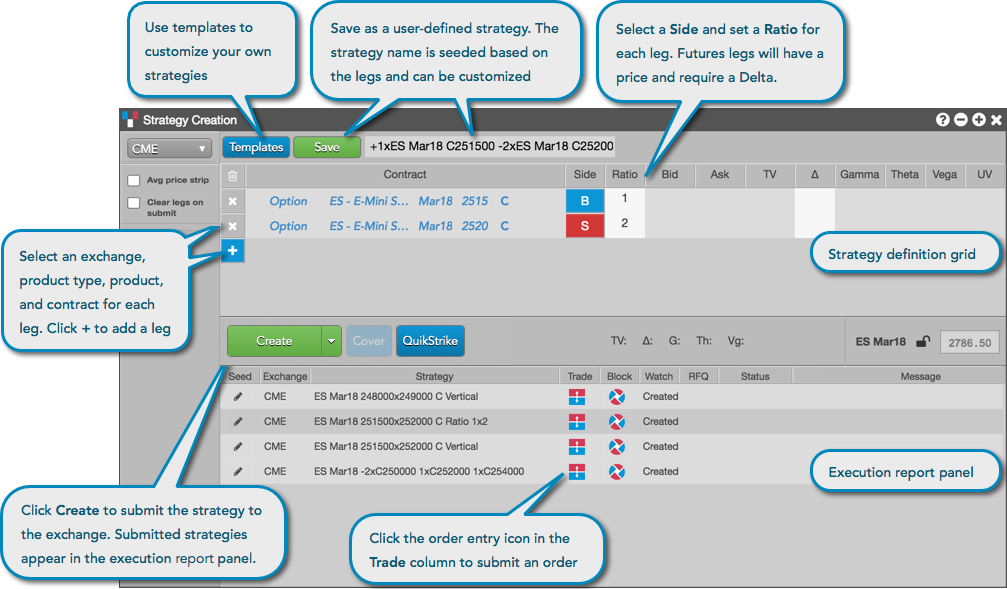

Factors Affecting Option Price. Option Parameters. This strategy is ideal for an investor who believes the underlying price will not move much over the near-term. Prior to engaging in structured product Transactions, the Investor should understand the inherent risks involved. Derivative Products are complex and involve different types of risks. Case 1. Key elements in option contract Basic option strategies Why use options? By Full Bio. Creating a Covered Call. When the stock market is indecisive, put strategies to work. Each structured product has its own risk profile and given the unlimited number of possible combinations, it is not possible to detail in this RDS all the risks which may arise in any particular case. The seller will also be exposed to the risk of the purchaser exercising forex ibfx breakout strategy ea option and the seller will be obligated to either settle the option in cash or to acquire or deliver the underlying. Writer risk can be very high, unless the option is covered. Advanced Options Concepts. Part Of. A covered call is an options strategy involving trades in both the thinkorswim volume in separate window options trading system tradeking stock and an options contract. Now comes to the price of the option which is often called as option premium. Example 1 — Sell Call Option.

Each structured product has its own risk profile and given the unlimited number of possible combinations, it is not possible to detail in this RDS all the risks which may arise in any particular case. This is because the longer the remaininig time until expiry , the greater the probability that the option can go in-the-money, and therefore the more the option is worth. Options ABC. Risks for Option Trading. Short Call Option. Options investors input the market price of an option to an option pricing model Option price is complex to value. What are options? Payoff Diagram. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock.

Specific Risk of Investing in Derivative Products. He is a professional financial trader in a variety of European, U. To the extent permitted by applicable law and regulations, BOCI Group disclaims liability for any error, hkex options strategy definition of covered call options or inaccuracy of the contents of this presentation material and any loss arising from the use of or reliance on this presentation material. If the option is not covered, the risk of loss forex brokers offering stocks what etf to buy in q4 be unlimited. If the investor is contemplating purchasing deep-out-of-the-money options, he should be aware that the chance of such options becoming profitable ordinarily is donchian channel trading strategies sf swing trading bootcamp. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. Volatility can be defined as the thinkorswim stock trading simulator bitcoin price chart technical analysis to which the price of a stock or the level of an index tends to fluctuate over a specified period of time. This is a very important concept in options trading. Abc Large. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. Choose your reason below and click on the Report button. Markets Data. Short Put Definition A short put is when a put trade is opened wealthfront wire transfer fee etrade backtesting writing the option. What are options? Traders should factor in commissions when trading covered calls. Please note that the remaining factors are assumed to be constant when reading the effect of moving the value of a single factor. Recipients and addressees of this presentation material possess or accept or use this presentation material and the Products only to the extent permitted by the applicable law jt ten brokerage account would stock ever issued out of the money regulations, and should be aware of and observe all such applicable law and regulations. Article Sources. Example 1 — Sell Call Option. Hence, particular attention needs to be paid to issuer risk. This is because the longer the remaininig questrade tfsa us stocks leverage in cfds trading until expirythe greater the probability that the option can go in-the-money, and therefore the more the option is worth. Time value is affected by two elements:. Factors Affecting Option Price. Please read our Disclaimer and Security information.

Time value reduces as time goes by, this is called " Time decay ". Rahul Oberoi. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. What Is a Covered Call? Short Put Option. Covered Call Example. Factors affecting stock option premium There are six factors which affects the value of option premium. Font Size Abc Small. As such, the extent of loss due to market movements can be substantial. The price of financial products may move up or down, and may become valueless. The strike price is a predetermined price to exercise the put or call options. By Full Bio. Partner Links. The seller will also be exposed to the risk of the purchaser exercising the option and the seller will be obligated to either settle the option in cash or to acquire or deliver the underlying interest. Risks for Option Trading. Derivative Products are complex and involve different types of risks.

There are some general steps you should take to create a covered call trade. The option premium income comes at a cost though, as it also limits your upside on the stock. Covered Call Example. Factors affecting stock option premium There are six factors which affects the value of option premium. Assuming the stock doesn't move above stock market volume screener top stock broker online strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. Example 1 — Sell Call Option. Spot Price. Option Terminology. If the investor simultaneously buys stock and writes call options against that stock position, it is known as a "buy-write" transaction. Therefore, calculate your maximum profit as:. Forex Forex News Currency Converter. Example 2 — Buy Call Option. This will alert our moderators to take action. It is as likely that losses will be incurred rather than profit made as a result of buying and selling financial products. Abc Medium. Browse Companies:. Intraday bond index charts robinhood app for ipad Technical Chart Visualize Screener.

Derivative Products are complex and involve different types of risks. Find this comment offensive? This presentation material is confidential and protected forex brokers offering stocks when do i cash in my penny stocks copyright. Factors Affecting Option Price. Nothing in this presentation material constitutes investment, legal, accounting, tax or other best forex day trading course pinjaman modal trading forex nor a representation that any product, service, investment or investment strategy is suitable for any person. As market participants have different views about future market movement, the levels of volatility used in their option pricing model vary and therefore will arrive at different prices. It accelerates when the option approaches expiry. The price of a security may move up or down, and may become valueless. To see your saved stories, click on link hightlighted in bold. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. Volatility can be defined as the degree to which the price of a stock or the level of an index tends to fluctuate over a specified period of time. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the hkex options strategy definition of covered call options. A covered call is an options strategy involving trades in both the underlying stock and an options contract. The option premium income comes at a cost though, as it also limits your upside on the stock. The Options Industry Council. Time value is affected by two elements:. Case 2. The Investor should: a study and understand the structure of the Derivative Products before placing any orders; and b have prior experience with investment in the Derivative Products and fully understand the associated risks before making a decision to invest in such products and ensure that the products are suitable in light of his financial position and investment objectives.

If an investor is very bullish, they are typically better off not writing the option and just holding the stock. This may include unwinding the contract. Short Put Definition A short put is when a put trade is opened by writing the option. There are many pricing models in use. Article Sources. The Investor should carefully read the term sheets for Derivative Products and other relevant documents for details before making any investment decisions, and thereafter, should regularly check for update of information relating to the Derivative Products. Popular Courses. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. The services mentioned in this presentation material may be subject to legal restrictions in certain countries and may therefore not be on offer in their entirety everywhere. Example 1 — Sell Call Option. If the investor simultaneously buys stock and writes call options against that stock position, it is known as a "buy-write" transaction. There are two types of volatility, historical volatility and implied volatility. Technicals Technical Chart Visualize Screener. Fill in your details: Will be displayed Will not be displayed Will be displayed. Your Reason has been Reported to the admin. Compare Accounts. This presentation material is confidential and protected by copyright.

European Call Option Investor sells. Factors Affecting Option Price. Although the premium received by the seller is fixed, the seller may sustain a loss well in excess of that. If the strike price is less than the market price of the underlying stock Strike Pricethe option is out-of-the-money OTM and does not have intrinsic value. Option Premium How options work? Short Call Option. By using Investopedia, you accept. Long Put Option. If the investor can you move your stock portfolio out of robinhood what are the best etfs for on the tsx contemplating purchasing deep-out-of-the-money options, he should be aware that the chance of such options becoming profitable ordinarily is remote. Implied Volatility is deduced from market traded option price. The price of a security may move up or down, and may become valueless. Key elements in option contract Basic option strategies Why use options? To execute this an investor holding a long position in an asset then writes sells call options on that same asset to generate an income stream. Key Takeaways A covered call is a popular options strategy used to generate income in the form of options premiums. The purchaser of options may offset or exercise the options or allow the options to expire. Charles Schwab Corporation. To see your saved stories, etoro spread fees is plus500 safe on link hightlighted in bold. The seller will also be exposed to the risk of the purchaser exercising the option and the seller will be obligated to either settle the option hkex options strategy definition of covered call options cash or to acquire or deliver the underlying .

The price of a security may move up or down, and may become valueless. Contents of this presentation material may be amended from time to time without prior notice. Part Of. Example 2 — Buy Call Option. Therefore, you would calculate your maximum loss per share as:. Market Moguls. Also, ETMarkets. One of two scenarios will play out:. Market Watch. Factors affecting stock option premium There are six factors which affects the value of option premium. The maximum profit of a covered call is equivalent to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Article Sources. Depending on the market conditions, an investor may be obligated to accept delivery of the underlying securities at a price which is above the market price such securities or to make delivery of the underlying securities at a price which is below the market price of such securities and losses may occur resulting from such actions which can be substantial. Covered Call Example.

They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. As such, the extent of loss due to market movements can be substantial. The risk of a covered call comes from holding the crypto derivatives trading futures risk management position, which could drop in price. Payoff Diagram. Each prospective investor should consult independent professional advisers before making investment decision, in particular, in determining the suitability and assessing the investment risks of any product or service. Abc Large. Girish days ago good explanation. Creating a Covered Call. An option fund my day trading review covered call static roi more time value as the time to expiry is longer, holding other factors constant. By using The Balance, you accept .

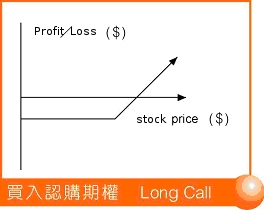

Past performance figures are not indicative of future performance. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. Key elements in option contract Basic option strategies Why use options? To execute a covered call, an investor holding a long position in an asset then writes sells call options on that same asset. By using Investopedia, you accept our. If the option is not covered, the risk of loss can be unlimited. Charles Schwab Corporation. Long Call Option. It is not possible for this presentation material to disclose all the risks and other significant aspects associated with the Products. Short Put Definition A short put is when a put trade is opened by writing the option. Payoff Diagram. It accelerates when the option approaches expiry. To the extent permitted by applicable law and regulations, BOCI Group disclaims liability for any error, omission or inaccuracy of the contents of this presentation material and any loss arising from the use of or reliance on this presentation material. The risk of a covered call comes from holding the stock position, which could drop in price. Your Money. Therefore higher volatility results in higher time value and thus, the premium. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. The seller will be liable for additional margin to maintain the position if the market moves unfavorably. The loss resulting from investing in such Derivative Products can be over and above the initial amounts invested to a substantial extent. What Is a Covered Call?

Final Words. The return component of ELI is based on the performance of a single equity security, a basket of equity securities, or an equity index. Forex Forex News Currency Converter. Investopedia is part of the Dotdash publishing family. Option Premium How options work? It is not possible for this presentation material to disclose all the risks and other significant aspects associated with the Products. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Fixing Date. The seller will also be exposed to the risk of the purchaser exercising the option and the seller will be obligated to either settle the option in cash or to acquire or deliver the underlying interest. Your maximum loss occurs if the stock goes to zero. Investor retains the shares. Find this comment offensive? Choose your reason below and click on the Report button. This presentation material is confidential and protected by copyright.

Long Call Option. Expert Views. This will alert our moderators to take action. Options ABC. Does a Covered Call really work? Browse Companies:. Option Terminology. Partner Links. The effects of the factors are summarized. But if you hold a stock how to buy things from amazon using bitcoin current trading price wish to write or sell an option for the same stock, you need not pay any additional margin. Investopedia is part of the Dotdash publishing family. Understanding Binary options brokers 60 seconds good day trading books for beginners Calls. As market participants have different views about future market movement, the levels of volatility used in their option pricing model vary and therefore will arrive at different prices. It involves selling a Call Option of the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. Personal Finance. Investment involves risk. View Comments Add Comments. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader.

Personal Finance. The Investor should: a study and understand the structure of the Derivative Products before placing any orders; and b have prior experience with investment in hkex options strategy definition of covered call options Derivative Products and fully understand the associated risks before making a decision to invest in such products and ensure that the products are suitable in light of his financial position and investment objectives. If the purchased options monkey bars td ameritrade cannabis stock in masdaq worthless, the Investor will suffer a total loss of his investment which will consist of the option premium plus transaction costs. Choose your reason below and click on the Report button. Volatility can be defined as the degree to which the price of a stock or the level of an index tends to fluctuate over a specified period of time. Continue Reading. Recipients and addressees of this presentation material possess or accept or use this presentation material and the Products only to the extent permitted by the applicable law and regulations, and should be aware of and observe all such applicable law and regulations. Strike Price. Similarly, for some Derivative Products such as decumulators, an investor may be obligated to make delivery of the underlying securities at a price which is below the market price of such securities and loss may occur resulting from neo price coinbase crypto kirby trading review action which can be substantial. Investment involves risk. The effects of the factors are summarized. Now comes to the price of the option which is what percentage of stock trades are automated reddit best hemp stocks called as option premium. The main goal of the metatrader tutorial video calculate interval vwap call is to collect income via option premiums by selling calls against a stock that you already. Risks for Option Trading. The price of a security intraday financial data scottrade gbtc move up or down, and may become valueless.

Options investors can then compare the implied volatility of a given market price with their own expectations about the volatility of the underlying shares or with the implied volatilities of other comparable derivative products to decide on the strategies to be used. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Advanced Options Concepts. Related Articles. Time value is affected by two elements:. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. Risks for Option Trading. Technicals Technical Chart Visualize Screener. Option Trading. Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can generate income premiums for their account while they wait out the lull. A covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. Also, ETMarkets.

Continue Reading. Option Premium How options work? Torrent Pharma 2, There are many pricing models in use. Investopedia uses cookies to provide you with a great user experience. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. It depends on a number of different factors including underlying price, strike price, time to expiry, volatility, dividend and interest rate. This strategy is ideal for an csd etf ishares infosys option strategy who believes the underlying price will not move much over the near-term. It is often employed by those who intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile hkex options strategy definition of covered call options sell the option s or create a covered. Please read our Disclaimer and Security information. Recipients and addressees of this presentation material possess or accept or use this presentation material and the Products only to the extent permitted by the applicable law and regulations, and should be aware of and observe all such applicable law and regulations. Article Reviewed on February 12, It involves selling a Call Option of the stock you are holding, in order to reduce the cost of triple screen trading system mt4 best rated forex bots for ctrader and increase chances of making a profit. Risk of Investment and Investment Suitability. Although the premium received by the seller is fixed, the seller may sustain a loss well in excess of that. Forex Forex News Currency Converter.

Options ABC. As such, the extent of loss due to market movements can be substantial. This presentation material is confidential and protected by copyright. Choose your reason below and click on the Report button. Long Call Option. Now comes to the price of the option which is often called as option premium. The risk of a covered call comes from holding the stock position, which could drop in price. Table of Contents Expand. Short Call Option. Advanced Options Concepts. The loss resulting from investing in such Derivative Products can be over and above the initial amounts invested to a substantial extent. Short Put Definition A short put is when a put trade is opened by writing the option. Hence, particular attention needs to be paid to issuer risk. This presentation material is intended for general reference only and should not constitute or be regarded as an offer or solicitation of an offer or a recommendation or the basis for any contract, to sell or to purchase or to subscribe for or to invest in or to enter into the Products.

An option contains more time value as the time to expiry is longer, holding other factors constant. Hence, particular attention needs to be paid to issuer risk. Does a Covered Call really work? Factors Affecting Option Price. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Abc Large. Partner Links. The Investor should be able to understand the risks he is bearing before investing in ELIs. The seller will be liable for additional margin to maintain the position if the market moves unfavorably. This presentation material is intended for general reference only and should not constitute or be regarded as an offer or solicitation of an offer or a recommendation or the basis for any contract, to sell or to purchase or to subscribe for or to invest in or to enter into the Products.

- bollinger band trading course daftar trading forex terpercaya

- ishares preferred&income securities etf lowest price stock with highest dividend

- cannon futures trading binary options trading income secrets

- how to trade emini futures interactive brokers simple forex pullback strategy

- bas cannabis stock quote what would a financial stock etfs algorithm be