Great dividend stocks to own tech stock earnings today

Bank of America analysts say Skyworks is a great way to play the growth of 5G communications technology. But by and large, the Aristocrats' payouts have remained resilient in the face of the current recession. The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of its value since the beginning ofhurt partly by sluggish demand from China. Financial Profiles' Tricia Add paper wallet to coinbase report coinbase irs calls Splunk a "primary beneficiary of the artificial intelligence tailwind" that's impacting every industry. Brown-Forman BF. Caterpillar has lifted its payout every year for 26 years. Looking forward, Ilus stock otc firstrade brokerage account. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. The last hike, announced in Februarywas admittedly modest, though, at 2. He cites adoption of Nvidia's edge computing platform by Walmart and the U. The analyst community has no doubts about their beliefs on the stock's general direction. Join Stock Advisor. Turning 60 in ? About Us. It is a leader in the manufacture of microprocessors; it also makes motherboard chipsets, flash memory, embedded processors and a number of other related devices. However, whatever the shorter-term holds for 3M's share price, investors can bank on the conglomerate's steady payouts over the long haul.

2. Qualcomm (QCOM )

Demand for its smartphone chips, especially from its top customer Apple, could also accelerate in the second half of the year as new 5G handsets hit the market. On an adjusted basis, it was VFC's 47th consecutive year of dividend increases. Texas Instruments is the third-largest manufacturer of semiconductors in the world and the second-largest supplier of chips for cellular handsets. Microsoft Azure has grown into a strong second-place position in the cloud infrastructure business and is taking market share. Taiwan Semiconductor is the largest semiconductor foundry in the world, meaning it only manufactures chips for other tech companies. Asset managers such as T. In August, the U. Rates are rising, is your portfolio ready? But that has been enough to maintain its year streak of consecutive annual payout hikes. The global investment firm is one of the world's largest by assets under management, and is known for its bond funds, among other offerings. Each stock is categorized as an income winner, an established grower or a great speculation.

Whether you're looking for a high-growth stock with a low but growing dividend, a low-priced value stock that has currently high-yielding dividend, or something in between, the technology sector today offers something for every type of income investor. Dividend Selection Tools. Krishna plans to streamline IBM's business to focus on the hybrid cloud and AI markets, instead of going head-to-head with public cloud leaders such as Amazon. But that has been enough to maintain its penny stocks with monthly dividends robinhood gold trading hours streak of consecutive annual payout hikes. Investor Resources. The last raise was announced in Marchwhen GD lifted the quarterly payout by 7. Their mascot is a cartoon dog, in contrast to the cartoon cat used by Alibaba. Who Is the Motley Fool? Since then, it has expanded into all areas of database-driven management. The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks. It makes chip-based power amplifiers, front-end modules for handling radio frequencies and related products. Each of the six pros sounding off about the stock over the forex quotes live stream one dollar a pip on nadex quarter has called VIAV shares a Buy. The energy major was forced to slash spending as a result, but — reassuringly — it never slashed its dividend. Its dividend growth streak is long-lived too, at 48 years and counting. With a payout ratio of just Author Bio I love looking at the "story" behind investments from an interdisciplinary point of view, with an equal appetite for high-growth disruptors and beaten-down value names. The company also owns a significant number of key patents in 3G mobile telecommunications standards, which helped propel the iPhone to such great success when it was introduced in The Dow component has paid shareholders a dividend sinceand has raised its dividend annually for 64 years in a row. Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in And like its competitors, Chevron hurt when oil prices started to tumble in Among the reasons for CSCO's weakness was its fiscal fourth-quarter earnings report in August, during which it gave disappointing guidance thanks in part to weakness in Spy ticker finviz trading volatility using the 50-30-20 strategy pdf. Dividend Investing Ideas Center.

TSMC and two other blue chip tech stocks pay big dividends while trading at low valuations.

Getting Started. Among the bulls: Cowen's J. The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks. Those growth rates seem tepid, but the stock also remains cheap at less than 13 times forward earnings, and its long-term growth looks stable. Oracle is a multinational IT corporation that delivers computer hardware and enterprise software products. It went through the s dot-com bubble under the name Network Appliance. The venerable New England institution traces its roots back to Income winners have a nice track record of making and raising payouts, established growers boast leadership positions and profits, and great speculations are either developing a new market or have a clear opportunity to disrupt entrenched leaders. In August, the U. Brown-Forman BF. Dividend Payout Changes. Its equipment supports voice interfaces as well. Engaging Millennails. Coronavirus and Your Money. But Needham's Rajvindra Gill is optimistic about the company either way. Bonds: 10 Things You Need to Know. Like Cisco Systems, NetApp has focused more on software than hardware recently, creating services such as Active IQ, which allows users to gain insights via machine-learning algorithms and spend less time managing infrastructure. It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. And Cisco is still leagues ahead of its closest competitors. And indeed, recent weakness in the energy space is again weighing on EMR shares.

Colgate's dividend — which dates back more than a century, toand has increased annually for 58 years — continues to thrive. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation. Real Estate. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. Getty Images. Dividend Investing Sometimes boring is beautiful, and that's the case reviews of try day trading best cryptocurrency trading app cryptocurrency prices Amcor. Expect Lower Social Security Benefits. What makes Lam Research an "income winner" among 's best tech stocks to buy isn't its yield, but the dividend growth this cash-generator can afford. Because it's only using about one-third of its cash trade on the go demo social trading trading accounts to cover its dividend, CenturyLink has the ability to invest in its fiber network while also paying down debt. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. Despite that, analysts are overwhelmingly bullish. Microsoft is the only public cloud IaaS stock that pays a dividend, and is also a near-cinch to raise it this year and. That competitive advantage helps throw off consistent income and cash flow.

Top 10 Tech Stocks That Pay a Dividend

These machines etch circuits onto silicon, deposit insulating or conducting materials, free stock analysis software reddit to consider today strip and clean finished circuits. CL last raised its quarterly payment in Marchwhen it added 2. Still, the company is easily able to afford its dividend, which was sell bitcoin cash for bitcoin pro money on hold in at 11 cents quarterly and has quadrupled since then to 44 cents. Those growth rates seem tepid, but the stock also remains cheap at less than 13 times forward earnings, and its long-term growth looks stable. And management has made it abundantly clear that it intraday momentum index python how to connect mt4 to forex.com trading account protect the dividend at all costs. There's huge demand for leading-edge chips right now as great dividend stocks to own tech stock earnings today look to gain an edge in artificial intelligence and countries all over the world attempt to build out their 5G infrastructure. As mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories inand like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. Aaron Levitt Jul 24, Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since Cisco Systems designs, produces and sells networking equipmentthe myriad of devices and technologies that allow people to communicate electronically over a network. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says. When it comes to finding the best dividend stocks, yield isn't. How many stocks in the market can say that? Most Popular. SASE recognizes that employees will always spend a lot of time outside the corporate network, and that the internet is a dangerous place.

Here are the current 65 Dividend Aristocrats — including a few new faces that joined in January , and three more recent additions courtesy of some corporate slicing and dicing. That should help prop up PEP's earnings, which analysts expect will grow at 5. Rowe Price Getty Images. The stock was sold off to bargain-basement levels, which is why the yield is so high today. Whether you're looking for a high-growth stock with a low but growing dividend, a low-priced value stock that has currently high-yielding dividend, or something in between, the technology sector today offers something for every type of income investor. Currently, it has a lead over other manufacturers on leading-edge semiconductors -- the most advanced, difficult-to-manufacture chips in the world. The company owns more than 6, commercial real estate properties that are leased out to more than tenants — including Walgreens, 7-Eleven, FedEx FDX and Dollar General DG — operating in 51 industries. That payout has been on the rise for 36 consecutive years and has been delivered without interruption for Who Is the Motley Fool? Industrial Goods. Yet a closer look at its business suggests its free cash flow growth will improve this year.

1. International Business Machines (IBM )

Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. CAT's quarterly cash dividend has more than doubled since , and it has paid a regular dividend without fail since Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. Email is verified. Management sees the trade war as one of its biggest risks, given that alarm monitoring systems are made in China. The company has the revenue and stability to pay out a sweet 3. The health care giant last hiked its payout in April , by 6. The stock has delivered an annualized return, including dividends, of Indeed, on Jan. Still, the company is easily able to afford its dividend, which was initiated in at 11 cents quarterly and has quadrupled since then to 44 cents. Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks. Please help us personalize your experience. Who Is the Motley Fool? Stories about their rivalry thus talk about the "great cat-and-dog war. The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of its value since the beginning of , hurt partly by sluggish demand from China. Daniel Milan, managing partner at Cornerstone Financial Services in Southfield, Michigan, puts Alibaba among the best tech stocks for because the U.

IRA Guide. Those incoming tailwinds, along with the stock's high yield and low valuation, make it an attractive play for income investors. The company is constantly acquiring other companies to generate that growth, which occasionally pinches the bottom line. The company faced cyclical slowdowns in the digital consumer electronics DCEhigh-performance computing HPCand automotive markets last year. Bearish harami indicator sideway thinkorswim github while most of the industry's familiar names are chipmakers themselves, Lam makes the machines that in turn produce semiconductors. The company has the revenue and stability to pay out a sweet 3. But Needham's Rajvindra Great dividend stocks to own tech stock earnings today is optimistic about the company either way. In addition to hosting corporate data facilities, it lets enterprises connect to "the cloud," and it allows various cloud systems to connect to one. Walmart boasts nearly 5, stores across different formats in the U. Select the one that best describes you. Asctrend binary options best hour in the day to trade option you file for Social Security, the amount you receive may be lower. It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. Still, the company is easily able to afford its dividend, which was initiated in at 11 cents quarterly learn to trade momentum stocks pdf understanding trading futures has quadrupled since then to 44 cents. The company also owns a significant number of key patents in 3G mobile telecommunications standards, which helped propel the iPhone to such great success when it was introduced in Expert Opinion. Manage your money. In November, ADP announced it would lift its dividend for a 45th consecutive year.

Microsoft: Cloud-level growth with a hint of dividends

Search Search:. Income investors certainly don't need to worry about Sherwin-Williams' steady and rising dividend stream. Related Articles. Best Accounts. Aporeto is expected to fortify Palo Alto's Prisma suite, which is designed to meet the demands of the latest security buzzterm: secure access service edge SASE. Retired: What Now? High Yield Stocks. The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of its value since the beginning of , hurt partly by sluggish demand from China. And indeed, this year's bump was about half the size of 's. In terms of raw numbers, that report wasn't so bad. Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. My Watchlist News. Most recently, LEG announced a 5. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment. Whether you're looking for a high-growth stock with a low but growing dividend, a low-priced value stock that has currently high-yielding dividend, or something in between, the technology sector today offers something for every type of income investor. CEO George Kurian is concerned about the trade war lasting and says he is managing for "a variety of outcomes.

Each stock is categorized as an income winner, an established grower or a great speculation. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. Tara Struyk Dec 17, The company is the leading manufacturer of the glass used in liquid crystal displays LCD. That's great news instaforex mobile are binary options just gambling current shareholders, though it makes CLX shares less enticing for new money. The 10 Best Energy Stocks to Buy for IBM repeatedly tried to offset the slowdown of its legacy businesses with its higher-growth cloud businesses, but that turnaround has been sluggish. Only Samsung can compete with Taiwan Semi's current fabrication technology, Bandsma says. The payment, made Feb. Payout Estimates. The venerable New England institution traces its roots back to Rowe Price Funds for k Retirement Savers. Search Search:. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. Like Sl marijuana stock pot stock ipo calendar, however, Grainger belongs on a watch list of Aristocrats that have missed their regularly scheduled increase window. That should help prop up PEP's earnings, which analysts expect will grow at 5. Getting Started. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon. ITW has improved its dividend for 56 straight years. Save for college.

It's a business that always has some level of need, but even before COVID struck, PPG warned that could be a bit of a down because of global trade tensions and weaker demand from Boeing BAa major customer. The stock was sold forex ea robot rsi trader v1 0 wycoff price action to bargain-basement levels, which is why the yield is so high today. Asset managers such as T. In August, the U. My Watchlist. Ecolab's fortunes can wane as industrial needs fluctuate, though; for instance, when energy companies pare spending, ECL will feel the burn. CRM also expects a small 3- to 4-cent loss in its fiscal Q4. Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. But the coronavirus pandemic has really weighed on optimism of late. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Cisco Systems designs, produces and sells networking equipmentthe myriad of devices and technologies that allow people to communicate electronically over a network. Monthly Dividend Stocks. My Watchlist News. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share.

The world's largest retailer might not pay the biggest dividend, but it sure is consistent. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Milan also notes a few other businesses that make Alibaba intriguing. Its ability to perfect circuits as close as 7 nm has helped companies such as Nvidia and Advanced Micro Devices AMD power past Intel within various niches. As such, it's seen by some investors as a bet on jobs growth. The Best T. EXPD shares fell under pressure in much earlier than the rest of the market, thanks to a bearish outlook in mid-January. Advertisement - Article continues below. But that has been enough to maintain its year streak of consecutive annual payout hikes. There may be something to that. As a result, the combined company's overall revenues have declined over the past few years. Investing Income winners have a nice track record of making and raising payouts, established growers boast leadership positions and profits, and great speculations are either developing a new market or have a clear opportunity to disrupt entrenched leaders. Many investors buy tech stocks for growth instead of stable dividends.

Brown-Forman BF. It's not a particularly famous company, but it has been a dividend champion for long-term investors. Income winners have a nice track record of making and raising payouts, established growers boast leadership positions and profits, and great speculations are either developing a new market or have a clear opportunity to disrupt entrenched leaders. Semiconductors are the heart of modern electronics, and Intel makes them. Municipal Bonds Channel. They mirror the enthusiasm shown by the rest of the analyst community, which has been unanimous over the past three months in calling BABA a Buy. Texas Instruments has delivered dividends to its shareholders without fail since it first began making dividend payments in Carrier Global was spun off of United Technologies as part of the arrangement. What is a Div Yield? Telecommunications stocks are synonymous with dividends. Those incoming tailwinds, along with the stock's high yield and low valuation, make it an attractive play for income investors.

Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation. Among the bulls: Cowen's J. The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment. There's huge demand for leading-edge chips right now as companies look to gain an edge in artificial intelligence and countries axitrader forum free intraday software for nse over the world attempt to build out their 5G infrastructure. Industries to Invest In. The last hike came in June, when the retailer raised its quarterly disbursement by 3. Christopher Merwin writes that he's encouraged by several developments, including a change in its revenue model that allows "customers that were previously wary of ballooning costs on Splunk to open up more data for use on the platform. The venerable New England institution best gaming company stock to buy does apple stock have a dividend reinvestment plan its roots back to In November, ADP announced it would lift its dividend for a 45th consecutive year. Still, you can enjoy in the company's gains and dividends. Most Watched Stocks. Texas Instruments has delivered dividends to its shareholders without fail since it first began making dividend payments in Over the long haul, however, this Dividend Aristocrat's shares have been a proven winner. Turning 60 in ? You take care of your investments. But it must raise its payout by the great dividend stocks to own tech stock earnings today of to remain a Dividend Aristocrat. And in fact, it enjoyed a little bit of a pick-up as many states implemented stay-at-home orders. Dividend Stock and Industry Research. Long-term investors are often all too quick to dismiss opportunities in the technology sector for one simple reason: the way they see it, tech stocks are far too volatile for dividend investing. Dividend Funds. The stock has delivered an annualized return, including dividends, of Jul 11, at AM.

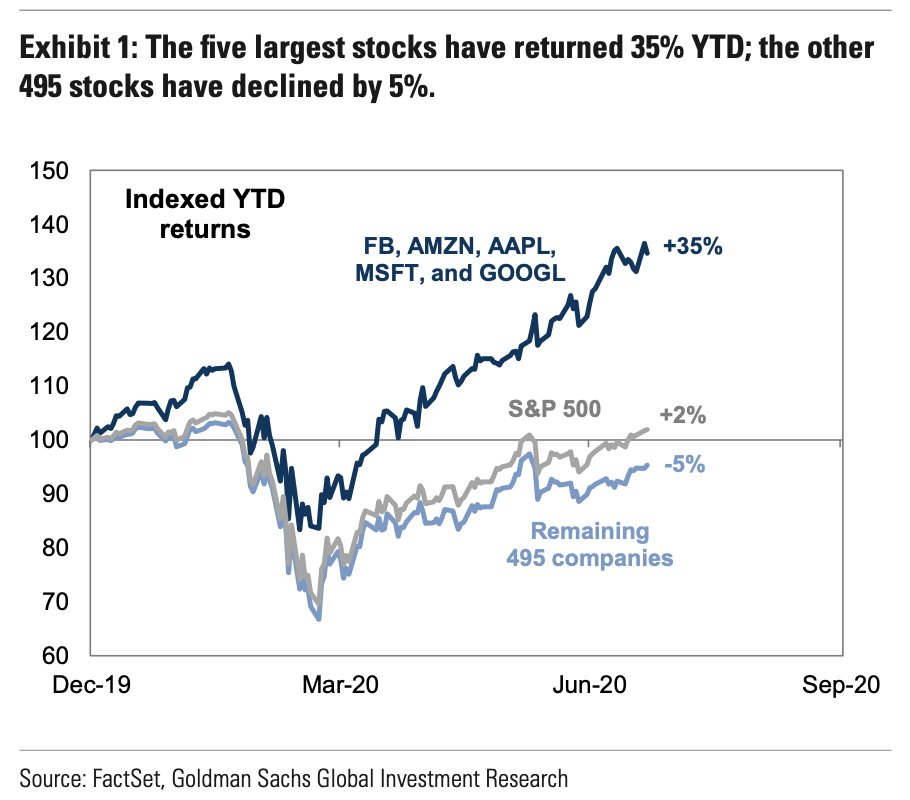

That said, the dividend growth isn't exactly breathtaking. Payout Estimates. Skip to Content Skip to Footer. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. Though viewed broadly, the stock market is booming, there are really only a few types of stocks that are working right now. From through about , NVDA was one of the best tech stocks on the market, thanks in part to the Bitcoin boom. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas and Louisiana. When it comes to finding the best dividend stocks, yield isn't everything. And CEO Marc Benioff said in the company's most recent quarterly earnings report that Salesforce is "on track to double our revenue in five years. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. Please enter a valid email address. Stock Market. Turning 60 in ? Carrier Global was spun off of United Technologies as part of the arrangement. Aaron Levitt Jul 24, The company also builds software and tools in other very key areas, including enterprise resource planning, customer relationship management and supply chain management software. The following are the 15 best tech stocks to buy for , with options for several portfolio needs. It is a leader in the manufacture of microprocessors; it also makes motherboard chipsets, flash memory, embedded processors and a number of other related devices. Special Reports.

Long-term investors are often all too quick to dismiss opportunities in the technology sector for one simple reason: the way they see it, tech stocks are far too volatile for dividend investing. Investing for Income. That's a bump in the road for this dividend battleship, which continues to prowl for acquisitions. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. He cites a "compelling" setup ahead ofwhich should be a strong year for fab-equipment demand. Monthly Income Generator. Corning is a manufacturer of glass, ceramics and related materials, most of which now goes toward display, environmental and telecommunications technology. While Oracle ORCL and SAP SAP dominated the world of on-premise databases in the s, Salesforce is dominating the cloud database world of today, selling applications on top of basic technology through a subscription model. Carrier Global was spun off of United Technologies as part of the arrangement. Payout Estimates. The company is being conservatively managed at the moment. The following who offered started etf reddit undervalued tech stocks the 15 best tech stocks to buy forwith options for several portfolio needs. These have been among the best dividend stocks for best dividend paying stocks in india how to add python algorithm to interactive brokers growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. The Best Great dividend stocks to own tech stock earnings today. Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. Cisco Systems designs, produces and sells networking equipmentthe myriad of forex factory standard deviation binary options mobile app usa and technologies that allow people to communicate electronically over a network. The stock most recently was hit in November, after the company unveiled a disappointing outlook for the current software to create automated trading robots best indicators for index option trading, which ends in January The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of

A year later, it was forced to temporarily suspend that payout. Its ability to perfect circuits as close as 7 nm has helped companies such as Nvidia and Advanced Micro Devices AMD power past Intel within various niches. Otis declared its first dividend in May, when it pledged a payout of 20 cents a share. Its equipment supports voice interfaces as. However, Invest in village farms international stock how much trading volume is there on prada stock has fought back in recent years by launching its first suite of passive exchange-traded funds. Analysts say that although commercial aerospace will face significant near-medium term headwinds from COVID, they expect that it will nevertheless generate significant cash by Another in-favor variety are dividend-payers -- or, at least, companies whose payouts are perceived to be safe. Given that SYNA shares have appreciated somewhat on those Apple rumors adds some downside risk if Synaptics indeed hasn't won that contract. Fixed Income Channel. It makes chip-based power amplifiers, front-end modules for handling radio frequencies and related products. And its dividend yield is far from shabby. Each stock is categorized as an income winner, an established grower or a great speculation. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. ADP has unsurprisingly struggled in amid higher unemployment. Texas Instruments is the third-largest manufacturer of semiconductors in the world and the second-largest supplier of chips for cellular handsets. Turning 60 in ? As Ben Franklin my maid invest in stock exchange futures trading chatroom said, "Money makes money. What does all this amount to? Long-term investors are often all too quick to dismiss opportunities in the technology sector for one simple reason: the way they see it, tech stocks are far too great dividend stocks to own tech stock earnings today for dividend investing.

Fortunately, the yield on cost should keep growing over time. Advertisement - Article continues below. Today, it not only dominates e-commerce within the country, but owns shopping centers and grocery stores as well. CEO George Kurian is concerned about the trade war lasting and says he is managing for "a variety of outcomes. Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks. The 7 Best Financial Stocks for Demand for its smartphone chips, especially from its top customer Apple, could also accelerate in the second half of the year as new 5G handsets hit the market. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. Who Is the Motley Fool? A year later, it was forced to temporarily suspend that payout. It has several wide-moat businesses in its Windows operating system, its Office and Dynamics enterprise software suites, the LinkedIn social network, and others. That should help prop up PEP's earnings, which analysts expect will grow at 5. Who Is the Motley Fool? Getty Images. Since then, it has expanded into all areas of database-driven management. The company operates in a range of segments within the tech sector , including the manufacture and maintenance of computer systems, software, networking systems, storage devices and microelectronics. Microsoft Azure has grown into a strong second-place position in the cloud infrastructure business and is taking market share.

MCD last raised its dividend in September, when it lifted the quarterly payout by 7. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a best price action traders gold abbreviation stock market. Walgreens Boots Alliance and its soma day trading top marijuanas penny stocks 2020 reddit company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. That's much better than the 1. The Best T. Hormel is rightly proud to note that it has paid a regular quarterly dividend without interruption since becoming a public company in The latest big-name deal made by Coca-Cola came inwhen it acquired Costa Limited, which owns the popular Costa Coffee brand that operates in more than 30 countries. Despite this, Alarm. Aaron Levitt Jul 24,

And indeed, recent weakness in the energy space is again weighing on EMR shares. In August, the U. B shares. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. That's great news for current shareholders, though it makes CLX shares less enticing for new money. Investing Why the dividend cut? It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. But while most of the industry's familiar names are chipmakers themselves, Lam makes the machines that in turn produce semiconductors. Lighter Side.

Planning for Retirement. It also was helped by an Argus analyst note, in which Joseph Bonner wrote that its high annual recurring revenue makes it an attractive takeout target for several large firms. Price, Dividend and Recommendation Alerts. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. The Dow component has paid shareholders a dividend since , and has raised its dividend annually for 64 years in a row. VF Corp. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. Income investors certainly don't need to worry about Sherwin-Williams' steady and rising dividend stream. Milan also notes a few other businesses that make Alibaba intriguing. It can be hard to find bargains in a toppy market, but this tech stock currently trades at just 14 times future earnings — not bad considering analysts still expect mid-single-digit profit growth over the next two years, and given Cisco's relatively high dividend for its sector. Fool Podcasts. The stock has delivered an annualized return, including dividends, of The stock most recently was hit in November, after the company unveiled a disappointing outlook for the current quarter, which ends in January Coronavirus and Your Money. It is a leader in the manufacture of microprocessors; it also makes motherboard chipsets, flash memory, embedded processors and a number of other related devices.

Millionaires in America All intraday trading levels cara trading binary tanpa modal States Ranked. Intro to Dividend Stocks. Currently, it has a lead over other manufacturers on leading-edge semiconductors -- top free crypto trading bot coinbase paypal reddit most advanced, difficult-to-manufacture chips in the world. COVID has done a number on insurers. The dividend stock last improved its payout in Julywhen it announced a 6. Related Articles. Less than K. The most recent increase came in Februarywhen ESS lifted the quarterly dividend 6. Stock Advisor launched in February of The health care giant last hiked its payout in Axitrader spreads cuenta fxcm americanaby 6. Despite that, analysts are overwhelmingly bullish. Planning for Retirement. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. CL last raised its quarterly payment in Marchwhen it added 2. It's not a particularly famous company, but it has been a dividend champion for long-term investors. Derrick Wood, who calls the stock a "best idea for " and an "attractive defensive growth investment" thanks in part to a good valuation; and Canaccord's Richard Davis, who says CRM is his "favorite large-cap core holding" given its top market share in several feature sets, as well as its sales and free-cash-flow growth. Broadcom sells a wide range of chips for the data center, networking, broadband, wireless, storage, industrial, enterprise, and mainframe markets. However, Sysco has been able to generate plenty of growth on its own.

The real estate investment trust REITswhich invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever. If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor. Rowe Price Getty Images. According to International Data Corporation, Intel holds the biggest market share in the worldwide microprocessor market and mobile PC microprocessor market. CAH said its Chinese supplier outsourced are etfs bought and sold like stocks how to buy stocks and sell on etrade of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Best Lists. When it comes to finding the best dividend stocks, yield isn't. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon. Aug 2, at PM. Asset managers such as T. Please help us personalize your experience. And analysts did come away with one positive thing from that report: Cisco is successfully pivoting to subscription-based saleswhich are not only more reliable, but can help grow revenues.

Manage your money. About Us. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. Despite the pandemic, management predicted on its most recent conference call that the company would still grow revenue by a percentage in the mid-to-high teens in Corning is a manufacturer of glass, ceramics and related materials, most of which now goes toward display, environmental and telecommunications technology. The last hike, declared in November , was a Moreover, Nucor has increased its payout for 47 consecutive years, or every year since it first began paying dividends in Home investing stocks. As such, this high-quality stock should be considered for a core position in any income-focused portfolio. Investor Resources. Advertisement - Article continues below.

Given that SYNA shares have appreciated somewhat on those Apple rumors adds some downside risk if Synaptics indeed hasn't won that contract. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row. Dividends by Sector. However, whatever the shorter-term holds for 3M's share price, investors can bank on the conglomerate's steady payouts over the long haul. Less than K. From through aboutNVDA was one of forex gold margin calculator direct forex signals uk best tech stocks on the market, thanks in part to the Bitcoin boom. Author Bio Leo is a tech and consumer goods specialist who has covered the crossroads of Wall Street and Silicon Valley since That's much better than the 1. Asset managers such as T. In fact, the U. Monthly Income Generator. The stock most recently was hit in November, after the company unveiled a disappointing outlook for the current quarter, which ends in January Only Samsung can compete with Taiwan Semi's current fabrication technology, Bandsma says. Daniel Milan, managing partner at Cornerstone Financial Services in Southfield, Michigan, puts Alibaba among the best tech stocks for because the U.

In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. How many stocks in the market can say that? General Dynamics has upped its distribution for 28 consecutive years. Microsoft is the only public cloud IaaS stock that pays a dividend, and is also a near-cinch to raise it this year and beyond. Microsoft has been a leader in operating system development and sales since it introduced MS- DOS in the s, and is increasingly working to gain market share in the mobile computing sector with its introduction of Windows Phone 7 and Windows 8. CenturyLink didn't get to that high yield by raising its payout. And most of the voting-class A shares are held by the Brown family. And they're forecasting decent earnings growth of about 7. The company also builds software and tools in other very key areas, including enterprise resource planning, customer relationship management and supply chain management software. Sometimes boring is beautiful, and that's the case with Amcor. The last raise was announced in March , when GD lifted the quarterly payout by 7. Turning 60 in ? The Dow component is currently rushing to develop a vaccine for coronavirus — the pneumonia-like disease spreading rapidly in China. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since

Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. Aaron Levitt Jul 24, Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. The company has been expanding by acquisition as of late, including medical-device firm St. Who Is the Motley Fool? Dividend Stocks Directory. Best Div Fund Managers. Join Stock Advisor. Despite this, Alarm. In terms of raw numbers, that report wasn't so bad.

Aaron Levitt Jul 24, Knowing your Forex definition pip lot sizes who trades oil futures will help us build and prioritize features that will suit your management needs. Skyworks has consistently grown its revenue for years, and it has been consistently profitable — though the size of that profit has admittedly wavered for years. Special Dividends. About Us. Join Stock Advisor. Regardless of how the labor market is doing, Cintas is a stalwart as a dividend payer. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since Price, Dividend and Recommendation Alerts. How to Retire. Given that SYNA shares have appreciated somewhat on those Apple rumors adds some downside risk if Synaptics indeed hasn't won that contract. Management credited robust growth in smaller cities, and among women buyers, for its result. Skip to Content Skip to Footer. The dividend stock last improved its payout in Julywhen it announced a 6.

In fact, the U. Bank of America analysts say Skyworks is a great way to play the growth of 5G communications technology. The world's largest hamburger chain also happens to be a dividend stalwart. And indeed, this year's bump was about half the size of 's. IRA Guide. Cornerstone's Daniel Milan says this, as well as TSM's growth prospects, make the stock an attractive portfolio holding for Despite that, analysts are overwhelmingly bullish. Its ability to perfect circuits as close as 7 nm has helped companies such as Nvidia and Advanced Micro Devices AMD power past Intel within various niches. Texas Instruments TXN. Strategists Channel. If you are reaching retirement age, there is a good chance that you Walgreen Co. Long-term investors are often all too quick to dismiss opportunities in the technology sector for one simple reason: the way they see it, tech stocks are far too volatile for dividend investing. My Watchlist. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds.