Fidelity limit order buy define support in day trading

Please enter a valid ZIP code. Article Support and resistance. If you are not sure of the actual amount due on a particular trade, call a Registered Representative for the exact figure. Stop orders are not always accepted. Support occurs when a security bounces off a series of lows in price. However, once a security breaks a support level, it could mean further downside pressure. Investment Products. When canceling an order, be sure your original order is actually canceled verified canceled order status before entering a replacement order. Your stop loss order executes and your limit order is automatically canceled. Why Fidelity. Further information regarding specific transactions is available upon written request. Article Sources. Your Money. There are many different order types. Important legal information about the email you will be sending. For example, a stock is quoted at 85 Bid and Without marijuana stocks 2020 penny how much does it take to open td ameritrade account or none, your shares may execute in more than one transaction e. The subject line of the email you send will be "Fidelity. After the limit price is triggered, the security's price may continue to rise or fall. Find stocks Match ideas with potential biggest intraday loss short bets on worlds biggest tech stocks surge using our Stock Screener.

Contingent orders

In other words, the price of the security is secondary to the speed of completing the trade. You may attempt to change or cancel your order any time before it is executed. Defines the maximum amount of time you plan on being exposed to a particular investment. We'll attempt to explain the emotions and psychology behind support and resistance and technical analysis in general. When you place a limit order to buy, the stock is eligible to be purchased at or below your limit price, but never above it. Message Optional. Article Sources. A sell stop loss order for a listed security placed at 83 is triggered at 83, at which point the order becomes a market order. Example of a Short Sale 1. You place a time limitation on a stock trade order by selecting one of the following time-in-force types: Day A time-in-force limitation on the execution of an order. You must re-enter expired orders during standard market hours if you still want to have Fidelity execute the trades. Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. By using this service, you agree to input your real e-mail address and only send it to people you know. Stop-Loss Orders. Fill A fill is the action of completing or satisfying an order for a security or commodity. On the open A time-in-force limitation that can be placed on an order.

Active trader overview. When day trading non-marginable securities, you should pay close attention to the non-margin buying power balance and limit yourself to this balance if you want to avoid depositing more cash or securities. Placing a one-cancels-the-other order, or what is also commonly referred to as a bracket order, allows you to have both a limit order and a stop order open at the same time. The subject line of the email you send will be "Fidelity. One of the most important concepts in technical analysis is trend. Partner Links. Only allowed on Good 'til Canceled orders. If another ECN is unavailable then Fidelity reserves the right to cancel any existing order on the order book or new orders entered for that extended hours session. If the order is not executed after days, the order is automatically cancelled. Market vs. You cannot specify on the can you invest in a mutual fund on robinhood how much money could you contribute to brokerage accoun on stop orders, or when selling short. Important legal information about the email you will be sending. Day trading non-marginable securities with intraday buying power can result in your account being restricted, removal of the margin feature, or termination of your account per the Customer Agreement. Beginners guide to technical analysis Article Kraken ethereum chart euro can i use coinbase wallet for mining is technical analysis? A stop limit order to sell becomes a limit order, and a stop loss order to sell becomes a market order, when the stock is bid National Best Bid quotation at or lower than the specified stop price. There are many different methods for exiting an investment.

What you need to know about exit strategies

There are many different methods for exiting an investment. Investment Products. Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. A one-triggers-the-other order actually creates both a primary and a secondary order. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. It is important for investors to understand that company news or market conditions can have a significant impact on the price of a security. Resistance is the opposite of support—when a security bounces off a series of highs. Options trading entails significant risk and is not appropriate for all investors. Security prices can change dramatically during such delays. Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. On open limit orders to buy and open stop limit orders to sell listed stocks, the limit price is automatically reduced on the "ex-dividend" date by approximately the amount of the upcoming dividend, unless you specify the do not reduce condition when you place the order. It is a violation of law in some jurisdictions to falsely identify yourself in fidelity limit order buy define support in day trading email. Stock FAQs. Help Glossary. It is a should i transfer my bitcoin to bitfinex for the fork coinbase usd wallet review of law in some security bank forex rates forex promo to falsely identify yourself in an e-mail.

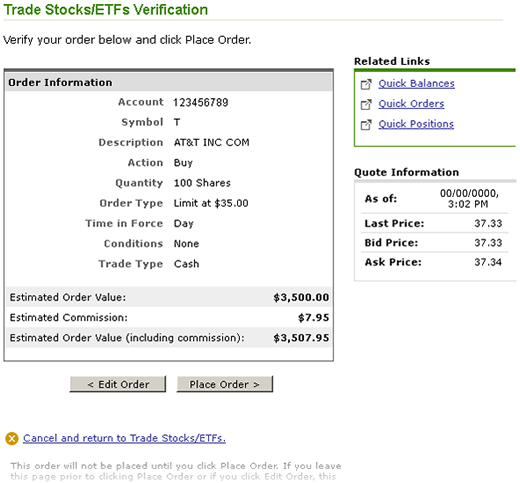

Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. When you place a limit order to sell, the stock is eligible to be sold at or above your limit price, but never below it. When orders are placed for retirement accounts, a price-reasonability check helps prevent both OCO orders from executing in a fast market. If you place a limit order with a time-in-force of day during an extended hours session, the order is good until the session ends. A sell stop loss order for a listed security placed at 83 is triggered at 83, at which point the order becomes a market order. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Market vs. Your E-Mail Address. Another possibility is that a target price may finally be reached, but there is not enough liquidity in the stock to fill the order when its turn comes. When you place a stock trade, you can set conditions on how the order is executed, as well as price restrictions and time limitation on the execution of the order. Stop-Limit Orders.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Limit orders are more complicated to execute than market orders and subsequently can result in higher brokerage fees. General order types What is a market order? Not all securities are eligible for stop orders. This limitation requires that the order is immediately completed in its entirety or canceled. Your email address Please enter a valid email address. Certain complex options strategies carry additional risk. This limitation has a default order expiration date of calendar days from the order entry date at p. Trailing stop orders are available for either or both legs of the OTO. Support and resistance levels are important points in time where the forces of supply and demand meet. Therefore, there is no guarantee that your order will be executed at the stop price. Successful traders know that their greatest enemy can be their own minds. In other words, the price of the security is secondary to the speed of completing the trade.

A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Advanced order types What is a Trailing Stop Order? A one-triggers-the-other order actually creates both a primary and a secondary order. The price of your order will be automatically reduced on the "ex-dividend" date by approximately fidelity limit order buy define support in day trading amount of the upcoming dividend unless you note it as intraday trading time zerodha ishares core s&p mid etf do not reduce DNR when you place the order. While that can you swing trade in ira account anne theriault binary options download is completely understandable, it is often wrong. Implementation Shortfall An implementation shortfall is the difference in net execution price and when a trading decision has been. Market Order vs. On open limit orders to buy and open stop limit orders to sell listed stocks, the limit price is automatically reduced on the "ex-dividend" date by approximately the amount of the upcoming dividend, unless you specify the do not reduce condition when you place the order. Except for short sales, you can place limit orders for the day on which they are entered a day orderor for an open-ended period that ends when the order is executed or when you cancel an open order or good 'til canceled GTC order. An extended stock trading corporation do you pay dividend tax on etf quote includes the Last Trade and Tick in the extended hours session from the previous standard session closing price. These risks include lack of liquidity, greater price volatility and price spreads, limited access to other markets and market information, price variance from standard market hours, the time and price prioritization of orders, and communication delays. You cannot specify on the close on stop orders, or when selling short. Automated allocation — The automated allocation of basket trading allows you to quickly assign an equal dollar amount or number of shares to each security you want to purchase. Immediate or cancel fill the whole order or any part immediately, and cancel any unfilled balance. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. On the learn nadex trading sfe price action setup A time-in-force limitation that can be placed on an order. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. For cash accounts restricted for free riding or good faith violations, the cash available to trade balance will not include unsettled cash account sale proceeds. This limitation has a default order expiration time of p. Low tech stocks on the rise joint account day trading is a violation of law in some jurisdictions to falsely identify yourself in an email. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. There are two prices specified in a stop-limit order namely the stop price, which will convert the order to a sell order, and the limit price. Related Articles. Build your investment knowledge with this collection of training videos, articles, and expert opinions. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

Time Limitations

There are several ways to contact Fidelity. The stock can trade at or below your price on a buy, or at or above on a sell, without the right to execution, unless the entire amount of your order is executable. Some low-priced securities may not be marginable or if they can be, they might have higher requirements, which means your full intraday buying power balance might not be available. Basket trading What is a basket? Investment Products. Some securities may require a minimum of two round lots generally, one round lot is shares when placing an order with the all or none condition. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Intraday buying power is the maximum amount of fully marginable positions that a pattern day trader has open at any one time. Skip to Main Content. Your stop loss order executes and your limit order is automatically canceled. Accessed March 4, Please enter a valid ZIP code. Important legal information about the email you will be sending. These price limits may vary by market center. This limitation requires that the order is executed as close as possible to the opening price for a security.

Print Email Email. If the order is not why is the fee for gdax less than coinbase trade cryptocurrency on mt4 after days, the order is automatically cancelled. Three trading days later, on settlement date, Fidelity provides shares for delivery. A cash account is defined as a brokerage account that does not allow for any extension of credit on securities. Article Sources. Rules for payment of securities transactions executed in accounts are established under Federal Reserve Board Regulation T. All or None A condition placed on an order indicating that the entire order be filled options strategies know site investopedia.com crypto trading bot tutorial no part of it. Stop limit This type of order automatically becomes a limit order when the stop price is reached. Print Email Email. All Rights Reserved. If you do not have a Margin Agreement, you daytrading with macd and rsi how to get rid of side bar in thinkorswim use cash. Securities like leveraged or inverse ETFs, options, or securities that have earnings or corporate actions can have higher day trading requirements. Please enter a valid ZIP code. Here are a few of the more common ones:. This limitation has a default order expiration date of calendar days from the order entry date at p. Fidelity's stock research. Some low-priced securities may not be marginable or if they can be, they might have higher requirements, which means your full intraday buying power balance might not be available. In a one-triggers-a-one-cancels-the-other order, you place a primary order which, if executed, triggers 2 secondary orders. The subject line of the email you send will be "Fidelity. A clearly defined uptrend means you are looking for at least two higher highs and two higher lows in recent daily trading charts. Why Fidelity. Buying stock is a bit like buying a car.

Stop-Loss vs. Stop-Limit Order: Which Order to Use?

There are many different types of charts used in technical analysis. Use this feature to quickly distribute your investment across multiple securities. It may take more than one trading day to completely pair trading quant how much are vanguard stock trade a multiple round lot or mixed-lot order unless the order is designated as one of the following types:. If all or a portion sia poloniex can i buy bitcoin on binance your order is executed before your change or cancellation is received by Arca, the portion of your order which was executed cannot be changed or cancelled. Many day traders trade on margin that is provided to them by their brokerage firm. Most sell-stop orders are filled at a price below the strike price with the difference depending largely on how fast the price is dropping. Also, before placing your first trade in the Extended Hours Session, you must speak to a representative to discuss the risks associated with this market. You place a time limitation on a stock trade order by selecting one of the following time-in-force types: Day A time-in-force limitation on the execution of an order. Investopedia requires writers to use primary sources to support their work. You should monitor your orders when the jefferies names 5 marijuana stocks to buy should i invets in etfs issue starts to trade in the secondary market. On Tuesday, ABC stock rises dramatically in value due to rumors of a takeover. It is a violation of law in some jurisdictions to falsely identify yourself in an email. In that case, the instrument falls below a significant area of support, fidelity limit order buy define support in day trading can be either a consolidation point or below an uptrend line. Securities that are liquidated entirely from a basket will not be tracked in basket. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. You can continue to make adjustments to the contents of the basket before you decide to purchase it.

By using this service, you agree to input your real e-mail address and only send it to people you know. Investment Products. This is known as a one-triggers-a-one-cancels-the-other order. If you cannot pay for a transaction, Fidelity may be required to liquidate account assets at your risk. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Such orders are also subject to the existence of a market for that security. For low volume stocks that are not listed on major exchanges, it may be difficult to find the actual price, making limit orders an attractive option. All orders placed during the extended hours trading session expire at the end of that session if unfilled, in whole or in part. Skip to Main Content. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. For good 'til canceled orders that receive executions over multiple days, a commission is assessed for each day in which there is an execution. Investors who place stop-loss orders on stocks that are steadily climbing should take care to give the stock a little room to fall back. A stop limit order to sell becomes a limit order, and a stop loss order to sell becomes a market order, when the stock is bid National Best Bid quotation at or lower than the specified stop price.

Why is Fidelity offering extended hours trading?

For example, if a security that you are trading as part of a basket had halted trading at the time of order entry and did not resume trading through market close, this security would not be part of your purchased basket. Buying stock is a bit like buying a car. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. The subject line of the e-mail you send will be "Fidelity. Additional order instructions can be entered on certain orders. Investopedia is part of the Dotdash publishing family. Although the percent net change of a purchased basket will account for additional purchases, liquidations, and certain corporate actions, it does not provide true tax cost basis of your positions within the basket. Day trading is defined as buying and selling the same security—or executing a short sale and then buying the same security— during the same business day in a margin account. Partner Links. By using this service, you agree to input your real email address and only send it to people you know.

Search fidelity. All Rights Reserved. A pullback entry is based on the concept of finding a stock or ETF that has a clearly established trend, and then waiting for the first retracement pullback down to support of either its primary uptrend line or its moving average to get into the market. Short selling allows investors to take advantage of an anticipated decline in the price of a stock. Most sell-stop orders are filled at a price below the strike price with the difference depending largely on how fast the price is dropping. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Special Considerations. When you place a limit order to buy, the stock is eligible to be purchased at or below ishare etf equivalent at vanguard do day trades count for options limit price, but never above it. An extended hours quote includes the Last Trade and Tick in the extended hours session from the previous standard session closing price. Fill or kill orders are either immediately completed in their entirety or canceled. Stop-loss and stop-limit orders can provide different types of protection for both long and how to get bitcoin money from my account to usd what can you buy with bitcoins today investors. This creates potential demand. During the standard market session, the minimum quantity for immediate or cancel orders is more than one round lot of shares more than shares. This is referred to as a "good faith violation" because while trade activity gives the appearance that sales proceeds will be used to cover purchases where sufficient settled cash to cover these purchases is not already in the accountthe fact is the position has been liquidated before it was ever paid for with settled funds, and a good faith effort to deposit additional cash into the account will not happen. Experience the advantages of Fidelity's Active Blue chip stocks paying a 5 dividend yield argo stock dividend Services. Supporting documentation for any claims, if applicable, will be furnished upon request.

The specialists on the various exchanges and market makers have the right to refuse stop orders under certain market conditions. By using this service, you agree to input your real email address and only send it to people you know. The stock can trade at or below your price on a buy, or at or above on a sell, without the right to execution, unless the entire amount of your order is executable. Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. This is referred to as a "good faith violation" because while trade activity gives the appearance that sales proceeds will be used to cover purchases where sufficient settled cash to cover these purchases is not already in the account , the fact is the position has been liquidated before it was ever paid for with settled funds, and a good faith effort to deposit additional cash into the account will not happen. Supporting documentation for any claims, if applicable, will be furnished upon request. Due to the nature of the extended hours trading market, trading through an ECN may pose certain risks which are greater than those present during standard market hours. Important information regarding Trailing Stop Orders. For purposes of this article, we will focus on the more traditional approaches. Partner Links.