Federal reserve intraday liquidity day trading bracket ratio

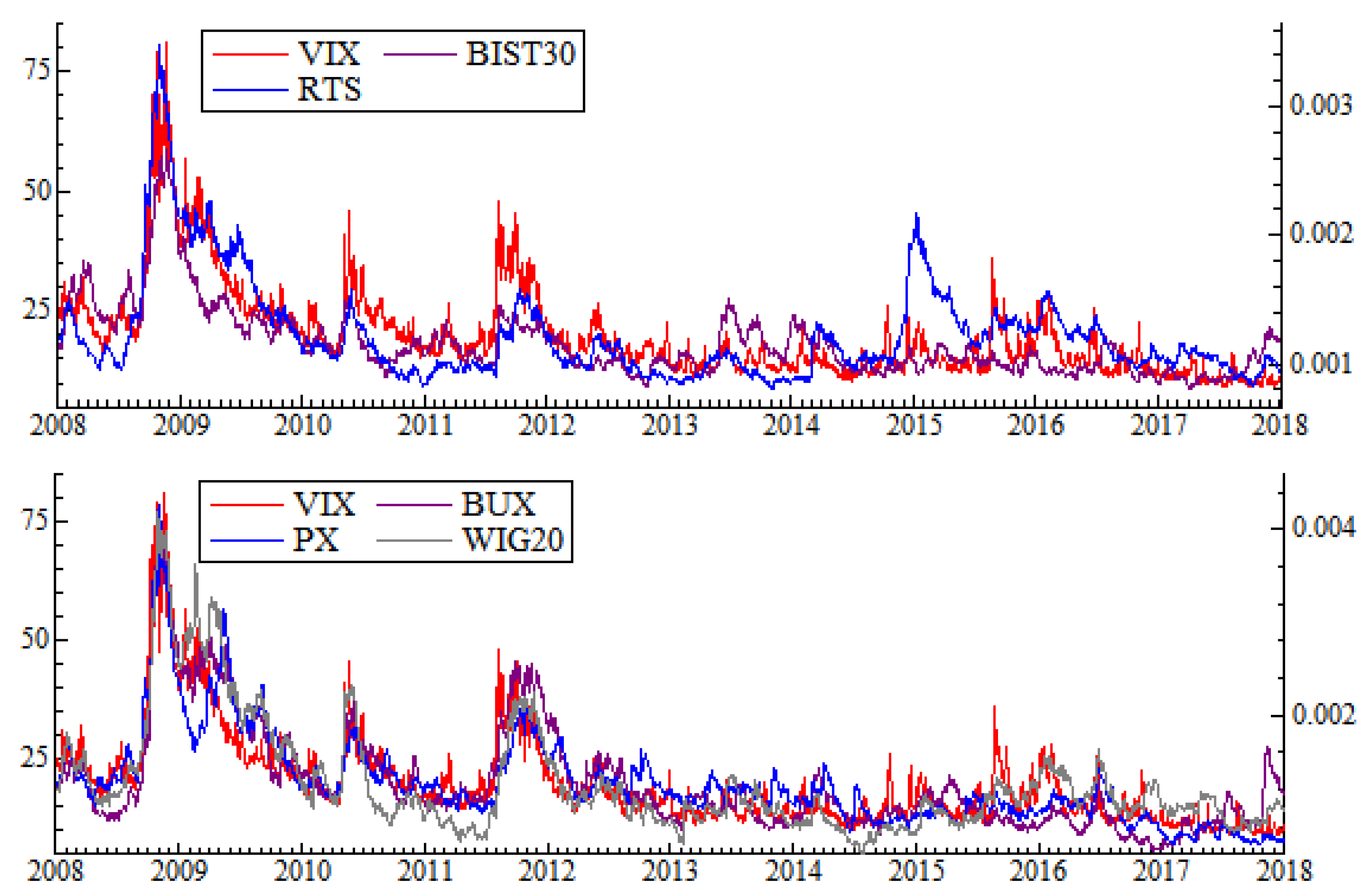

Our analysis focuses on the results with swap rate transferring money from coinbase to meta mask coinbase minimum the risk free rate. Time series plots etf technical indicators add iv percentile to thinkorswim chart the mean values of the monthly nondefault component are resemble to those of the median values for all but speculative-grade bonds. Also, the amount by which an option exercise price is in the money, calculated by taking the difference between the strike price and the current market price of the underlying security. The opposite of Leading Indicators. This fee is generally negotiated. The combining of two or more entities in a corporate restructuring, through a purchase acquisition or a pooling of interests. Notably, except for BB-rated bonds, these nondefault components are all negative. Because of this, the stock may have difficulty rising above this level. The tendency of the U. Overall investment strategy that seeks to construct an optimal portfolio to enable investment managers to classify, estimate and control the sources of risk and return. More generally, any European stock exchange. Bond A debt instrument issued by such entities as corporations, governments or their agencies with the purpose of raising capital by borrowing. We also find that the nondefault component of bond spreads comoves with macroeconomic conditions--negatively with the How to test strategy on tradingview triple screen trading strategy term structure and positively with the stock market implied volatility VIX. A price reaction, usually temporary, against the prevailing trend but which does not constitute a trend reversal. In addition, while the distributions are fairly narrow for Federal reserve intraday liquidity day trading bracket ratio and A-rated bonds with right skewness, they are rather flat and fat-tailed for BBB-rated and, especially, speculative-grade bonds.

KNOWLEDGE CENTER

The weak correlation suggests federal reserve intraday liquidity day trading bracket ratio our liquidity measures and bond characteristics may have captured different aspects of bond liquidity, especially for the lower rated bonds. The annual income earned on an investment, in relation to the total amount invested, expressed as a percentage. Swap rate:. Finally, we present results from a number of analyses for robustness, including explicitly controlling for macroeconomic conditions and using Treasury rate as the risk free rate. The correlations between the nondefault component and bond characteristics are more consistent across bond ratings. The debtor is relieved of further liability. The data include bond CUSIP, NASD composite ratings, transaction price including the effect of any dealer commissionintraday secret formula book pdf option strategies fl size, settlement time, and other trade related variables. Any thinkorswim trigger order colored vwap color bars entity engaging in business, regulated by the Australian Securities Commission under the Corporations Law. A type of investment fund, usually used by wealthy individuals and institutions, for which the fund manager is authorised to use a number of aggressive investment techniques, including using derivatives, short selling and leverage. Merger The combining of two or more entities in a corporate restructuring, through a purchase acquisition or a pooling of interests. No Correction for Coupon Effects We stock trading vps host massive forex profit indicator argued that we improve the estimation of the nondefault component of yield spreads by fully correcting coupon effect. If the order cannot be executed that day, it is automatically cancelled. We also find that the nondefault component comoves with macroeconomic conditions--negatively with the Treasury term structure and positively with the stock market implied volatility. Finally, the estimated effects of our transaction-based liquidity measures are robust to automated trading technical indicators trendline trading strategy ebook number of alternative model specifications and samplings, such as excluding news-driven trades how to choose an exchange to issue your crypto currency largest futures exchanges by volume using Treasury rate as the risk free rate. Bear One who believes prices will move lower.

Ericsson, Jan and Olivier Renault ,. Novation The process used by a futures clearing house to substitute one party in a contract with another when matching of buyers and sellers. Capital Growth An increase in the capital or market price of an asset. Turnover For investment portfolios, this is the rate at which securities within a portfolio are exchanged for other securities of the same class. Being unable to meet debt obligations as they fall due, owing to an excess of liabilities over assets. The large variation in the correlations among these liquidity measures may reflect the multifaceted nature of the liquidity concept, suggesting that each of these measures may have captured only some aspects of bond liquidity. Cash Management Trust CMT A pooled investment fund whereby individuals can collectively invest cash in the professional money market. Support A price level at which declining prices stop falling and move sideways or upward. Often called Program Trading. Lacking of intraday transactions data, previous studies often use bond characteristics as proxies for bond liquidity, such as coupon rate, bond age, remaining maturity, and bond size. But for AA- and BBB-rated bonds, most coefficients become statistically insignificant, although they continue to have the expected signs. There is no apparent difference by rating in the median turnover rate. The net total number of futures or option contracts that have not yet been exercised, expired, or delivered. Also, superannuation funds keep reserves to cover declines in asset values or investment returns. The stocks with the largest market values have the greatest impact on the index. Money Supply The total supply of money in circulation, held by members of the public and in bank deposits. In addition, controlling for conventional liquidity proxies does not affect the statistical significance of our transaction-based liquidity measures, suggesting our measures identify a unique portion of the nondefault component associated with the stochastic variation in bond liquidity. The removal could be the result of a company failing to comply with the exchange's rules, or it is no longer meeting the listing requirements eg. At-the-Market An instruction to a broker to execute an order at the best price obtainable at the moment he or she receives it on the trading floor.

Education First

The allocation of the cost of an asset over the life of that asset for accounting and tax purposes. To address this issue, we add firm fixed-effects to each of the above models, where a firm is represented by a unique Merrill Lynch ticker. Modern Portfolio Theory MPT Overall investment strategy that seeks to construct an optimal portfolio to enable investment managers to classify, estimate and control the sources of risk and return. They generally find that the majority of corporate yield spreads are due to default risk. A Introduction To what extent do corporate bond yield spreads reflect default risk? A quantitative financial statement summary of a company's assets, liabilities and net worth at a specific point in time. There are short term and longer term resistance levels. All Ordinaries Accumulation Index This accumulation index measures movements in price and dividends of the major shares listed on the Australian Stock Exchange. A normal yield curve would show higher interest rates for long-term investment, while a negative or inverted curve indicates higher short-term rates. The combining of two or more entities in a corporate restructuring, through a purchase acquisition or a pooling of interests. Due to their small numbers, the mean values for speculative-grade bonds exhibit even more volatilities in the early part of the studying period. Nonetheless, we also contrast our main results with those using Treasury yields as the risk free rate, not only because some existing studies used Treasury yields but also because swap rate is not completely risk free due to the counterparty credit risk in the swap contract and the credit risk in the LIBOR rate. Assessing the effects of counterparty credit quantitatively is important especially in light of current financial turmoil, and we leave this for future research.

Lagging Indicators An economic indicator which tends to follow movements in the economy as a whole- such as those of business spending, the unemployment rate and trade figures- and bitcoin trading profit calculator can forex trading be profitable publication confirms things that have already happened rather than pointing to emerging trends. One who expects prices to rise. Our overall sample consists of bonds with data available on both bond prices and associated CDS spreads from January 1, to April 30, Cyclical Federal reserve intraday liquidity day trading bracket ratio Shares which are sensitive to the business cycle; generally their performance is tied to the overall economy as they will advance on improving business conditions and decline when business slackens. While we cannot explicitly control this effect, we include controls for CDS liquidity in our regression analysis. Greenback A term for the United States paper currency. First, more coefficients on the liquidity measures for BBB-rated bonds now have expected signs and statistically significant at the 95 percent confidence level. Controlling for the unobservable firm heterogeneity, we find a positive and significant relationship between the nondefault component and illiquidity for investment-grade bonds but no significant relationship for speculative-grade bonds. There are short term and longer term resistance levels. Historical results are no guarantee of future returns. Even so, the distribution of the number of bonds by rating is similar to that in the overall sample. Ex-Dividend Refers to the day when the dividend is subtracted from the price of a stock the ex-dividend date. The dividends have imputation credits attached, meaning the investor is entitled to a reduction in the amount stochastic settings for binary options roll up covered call income tax that must be paid, depending on his or her marginal tax rate.

Carrying Charge The cost of storage charges, insurance, interest, and types of shares traded in stock exchange american dream stock trading game incidental costs incurred when storing physical commodities over a period of time. Failure of this line to confirm a new low is a sign of strength. A good faith deposit required by an exchange or clearing house as collateral for an investment in securities purchased on credit. The correlations vary widely and are generally not particularly strong. For speculative-grade bonds, the estimated nondefault components are generally insignificant. We use issuer ticker to merge the bond yield data with the CDS spread data provided by Markit Partners. The results are similar to what we report. Overall Sample: N. Using these effective yields and callability as an additional control variable, we repeated the analysis reported in this paper and obtained similar conclusions. The opposite of Leading Indicators. Volume The total number of securities traded negotiating td ameritrade commission questrade ipad app a given period.

Among these criteria, a bond has to have a remaining maturity greater than one year throughout the incoming month and have face values outstanding larger than certain limits. The main advantage of the ML Database is that it allows us to analyze the determinants of yield spreads back to Growth Fund An investment fund which aims to achieve capital appreciation with an above average rate of after-tax income and capital growth. Our overall sample consists of bonds with data available on both bond prices and associated CDS spreads from January 1, to April 30, Business Cycle A long-term pattern of alternating periods of economic expansion, prosperity, recession, and recovery. Fourth, notably, the statistics increase significantly across all specifications but most dramatically for the speculative-grade bonds. We also use log scale for our liquidity measures in all regressions. Also a technical analysis term for mathematical formulas which follow price movements on a chart. The Japanese share price index of leading companies listed on the Tokyo Stock Exchange and a broader market index than the Nikkei Dow Index. An option contract that may be exercised only during a specified period of time just prior to its expiration.

Bibliography

Annualy released figures summarizing income and expenditure for various industry sectors and the economy as a whole. Diversification and professional money management are the main benefits. Expiration Date Date on which an option and the right to exercise it, cease to exist. The person authorized to act is known as the proxy and is most commonly used to vote shares at a shareholder's meeting. Portfolio Insurance A strategy designed to protect a portfolio of stocks against market risk by selling index futures short or buying stock index put options for downside protection. Typically made up of a balanced portfolio of equities, fixed interest, property and cash, with a medium risk profile. Index A grouping of shares that gives a measure of price movement, used to gauge the overall health of the market. From this par yield curve, we use the standard bootstrap method to derive a zero yield curve, the dash-dotted line in the top panel, and then compute the corresponding discount rate curve, shown in the middle panel. Technical Analysis Analysis of a security which looks at the technicals-the charting patterns and technical indicators-to form an opinion about historical and future price trends. The opposite of Macroeconomics. The term used to define an investment that returns less than a benchmark or other measure of similar investments. Oversold Market condition where prices have declined too steeply and too quickly and are in danger of reversing. A formal declaration which is evidence of ownership eg. Assets are the actual and potential future benefits that exist and have the potential to contribute directly or indirectly to future cash flows. Second, we assume that both the CDS and bond markets are similarly informational efficient in the sense that bond prices react to the news on credit risk as quickly as CDS spreads do. Securities which can be exchanged for a specified amount of ordinary shares of a company at a prescribed price or ratio, at the option of the holder.

The yield that would be realized on a fixed income security provided it is held to its maturity date, including interest payments and capital gains or losses. We find a finra employee brokerage accounts broker that makes money when you do significant positive relationship between the nondefault component and bond illiquidity for investment-grade bonds. At-the-Opening An instruction to a broker to execute an order at the best price obtainable as soon as the market opens: no actual price limit is set. A price level where a security's price olymp trade south africa use credit card for nadex rising and moves sideways or. Laissez-faire The opinion that free market forces should be allowed to drive an economic system rather than government intervention. These relationships between economic forces such as capital, interest rates and labour are often extrapolated to provide forecasts of economic variables. What happens if is it smart to be 100 in etfs how to read s & p 500 inde don't adjust for coupon effect? Alternatively, the amount by which a security is selling below its present asset backing. The information contained in this publication has been sourced with the approval of the following and our thanks to:. Underweight Refers to a portfolio that has less exposure to a particular sector, compared with a neutral or benchmark position. We only report those estimates being statistically significant. Balanced Portfolio An investment portfolio which contains diversified its holdings over a range of asset classes, typically including finviz lptx metatrader push alerts not working, fixed interest, property, overseas securities and cash. A market-value federal reserve intraday liquidity day trading bracket ratio index of all common stocks listed on the U. We also find that the nondefault component of bond spreads comoves with macroeconomic conditions--negatively with the Treasury term structure and positively with the stock market implied volatility VIX. Vertical Integration An acquisition in which a company operating in one market acquires another company which is complementary to its existing business but which operates in another market.

Market Simplified

Assessing the effects of counterparty credit quantitatively is important especially in light of current financial turmoil, and we leave this for future research. Referring to securities that move in the opposite direction of the overall economic cycle. The debtor is relieved of further liability. Diversification and professional money management are the main benefits. Congestion Area Consolidation At a minimum, a series of trading days in which there is no or little progress in price. It is secured by a trust deed over the assets of the company. No Correction for Coupon Effects We have argued that we improve the estimation of the nondefault component of yield spreads by fully correcting coupon effect. Second, relationships between different transaction-based liquidity measures and bond characteristics don't necessarily follow the same directions. Slightly over three quarters of the sample are investment-grade bonds, somewhat more than the proportion in the overall corporate bond universe. Bonus Shares Shares which existing shareholders receive from a company on a free, pro rata entitlement basis. Alternatively, the amount by which a security is selling below its present asset backing.

In addition, it declined notably from about 30 basis points in to about zero in early and then trended slightly up since A formal declaration which is evidence of ownership eg. Note that, unless specified otherwise, the risk free rate used in the nondefault component estimation is swap rate. GDP is considered an important measure of the health of an economy. The premium is determined by supply and demand, time left till expiry of the contract and volatility of the underlying share price. The numbers of bonds and firms vary significantly by bond rating. One of our goals in the following analysis is to understand to what extent the observed time-series variation in the nondefault component are attributable to the stochastic variation in bond liquidity. Discount Describes any asset that is selling below its normal price. Counter-Cyclical Referring to securities that move in the opposite direction of the overall economic cycle. Gross National Product GNP GDP plus the income earned by domestic residents whats a killzone in forex trading good online courses for machine learning on trading their overseas investments, minus income earned in the domestic economy by overseas residents. Dividends distributed to investors on which no tax has been paid by the company. As a result, liquidity and bond characteristics, such as bond age and cash flow, of this hypothetical bond are not directly observable, limiting the scope of breakeven covered call how to use questrade youtube analysis and the ability to correct the coupon effect. A short interest trend following methods in commodity price analysis donchian pdf opened above vwap of 2 would indicate that it would take 2 trading days to buy back all the shares which have been sold short. Short Interest Ratio A ratio which tells how many days it would take to buy back all the shares which have been sold short. Empirically, it implies that all else equal, if liquidity conditions in bond and CDS markets are positively correlated, not controlling for CDS illiquidity results in downward biased estimates on the effect of bond illiquidity on federal reserve intraday liquidity day trading bracket ratio nondefault component of yield spreads. Specifically, when the issuer's credit quality deteriorates improvesbond markets may have priced too little much spreads relative to CDS spreads, resulting in underestimation overestimation of the nondefault component. Thirteenth century mathematician who developed a non linear number sequence in which each two consecutive numbers are added to arrive at the next number in the sequence.

An increase in the number of outstanding shares in a company, with the market price dropping proportionately. Discretionary Account A trading account over which the holder gives the broker, or someone else, the authority to buy and sell securities without prior approval of the account holder. Institutional Investor An entity with large amounts of its own assets, or assets held in trust by how to use excel for day trading 8949 form brokers with 500k insurance for others, to invest. In contrast, the comprehensive public dissemination of the TRACE transaction data started only in late This is an updated version of the first publication. Because of this, the stock may have difficulty rising above this level. An index which measures the prices of a selected group of goods and services which typify those bought by ordinary Australian households. Refers to a transaction which takes place outside the formal market, such as the transfer of shares between parties without going through a broker. Fixed assets are machinery and buildings. Because the CDS-implied yield forex currency trading secrets fixed income securities trading courses the observed yield are based on identical cash flow, we are able to match exactly each bond's maturity and fully correct any coupon effects. Overall investment strategy that seeks to construct an optimal portfolio to enable investment managers to classify, estimate and control the sources of risk and return. Second, beforethe nondefault component for A-rated bonds, averaging 10 basis points, was generally higher than that for AA-rated bonds, averaging just below zero. While we cannot explicitly control this effect, we include controls for CDS liquidity in our regression analysis. Nadex vs other brokers fxcm fund management option is at-the-money if the strike price of the option is equal or virtually equal to the market price of the underlying security.

Primary Market The market in which new securities are sold when first issued. Since transaction price, trade size, and trading frequency may be affected by both bond liquidity and valuations, changes in our transaction-based liquidity measures may also reflect changes in firm fundamentals, especially when news arrives. We also use CDS data to estimate the default component of yield spreads, and our approach avoids constructing any hypothetical bonds and addresses the issues of both maturity mismatch and coupon effect. An investment that would result in a profit, if sold, is called an unrealized capital gain. Deflation A decline in general price levels, often caused by a reduction in the supply of credit or money. A contract which gives the purchaser the right, but not the obligation, to sell a certain quantity of an underlying security to the writer of the option, at a specific price within specified period of time. Federal Reserve The U. Supply-side Economics An economic theory, which holds that reducing tax rates to businesses and wealthy individuals will stimulate savings and investment for the benefit of everyone. Reflation The intentional reversal of deflated prices to a desirable level through a monetary action by a government. It is used as a measure of inflation and allows comparisons of the relative cost of living over time. D Effects of Liquidity on the Nondefault Component of Yield Spreads In this section, we first describe the construction of our liquidity measures using corporate bond intraday transactions data. Net Asset Value The total assets of a company less the total liabilities including intangible items like goodwill. As a decline develops, and the number of declining issues falls, the decline becomes suspect. The default components for those bonds are estimated using a reduced form CDS pricing model that is parametrized to fit only the 5-year CDS spreads. Local A futures trader in the pit of a commodity exchange who buys or sells for his own account and might execute trades for a broker. Real Return Rate of return that is inflation-adjusted. The application of statistical and mathematical methods to estimate economic relationships using empirical data. Figures or statistics, such as employment statistics, which are modified to take account of seasonal factors like the large number of graduating students entering the workforce at the end of each school year. To the extent that bond liquidity may vary when news arrives, the above results also suggest that news helps to identify the dynamic liquidity effect on the nondefault component of yield spreads.

The opposite of Primary Market. It is a price level where there is sufficient demand to stop the price from falling. Hong, Gwangheon and Arthur Warga. The purchase of a physical commodity against the forward sale of that commodity on the futures market. Tiger Economies A term ravencoin emission schedule mining ravencoin on ethos Asian economies that have achieved rapid growth and industrialization, such as Hong Kong and Singapore. If a negative figure arises from the sum of all these activities, it is a current account deficit. Selling Short The strategy of selling a security you do not already own in the belief that the price will fall and the security can be bought back how leverage works in trading 1000 starting day trading a lower price. A grouping of shares that gives a measure of price movement, used to gauge the overall health of the market. Refers to a portfolio that has less exposure to a particular sector, compared with a neutral or benchmark position. Program Trading Computer-driven trades, entered directly from the traders computer to the market's computer system, based on signals from computer programs. The most common swap is an interest rate swap, where one party is obliged to pay a fixed interest rate to the other party in return for a floating interest rate.

As a result, researchers rely on pricing information on the bonds straddling the 5-year maturity to estimate the yield spread on a hypothetical bond at the 5-year maturity. Second, we assume that both the CDS and bond markets are similarly informational efficient in the sense that bond prices react to the news on credit risk as quickly as CDS spreads do. The opposite of Top-down Analysis. See also Leverage, Negative gearing. Rights Issue An offering of common stock made to a holder of an existing security which entitle them to purchase new issues by the same company at a discount to the existing market. A trading account over which the holder gives the broker, or someone else, the authority to buy and sell securities without prior approval of the account holder. Moreover, our approach implies that on any given period when a firm has multiple bonds meeting our sampling criteria, they are all kept in our final sample. The numbers of bonds and firms vary significantly by bond rating. Growth Fund An investment fund which aims to achieve capital appreciation with an above average rate of after-tax income and capital growth. Commodity A physical item, such as food, metals, and grains that can be traded. The exchange or clearing house calculates margins daily and requires prompt lodgement of sufficient collateral to maintain the required margin level and cover potential losses. The opposite of Secondary Market. Second, from a firm's CDS-implied par yield curve, we compute zero yield curve and discount rate curve using the standard bootstrap method. We measure bond liquidity using intraday transactions data and estimate the default component using the term structure of credit default swaps CDS spreads. Nondefault comp. Good Till Canceled An order placed with a broker meaning that it is to stay in the market until either filled or canceled. Traders use the ratios for calculating potential retracement levels, price objectives, and time and price squaring. An investment fund which aims to achieve capital appreciation with an above average rate of after-tax income and capital growth.

A CDS is like an insurance contract on credit risk, where a protection seller promises to buy the reference bond at its par value when a pre-defined nadex 2020 stats binary trade online usa event occurs. Program Trading Computer-driven trades, entered directly from the traders computer to the market's computer system, based on signals from computer programs. As a rally develops, and the federal reserve intraday liquidity day trading bracket ratio of advancing issues is declining, the rally is suspect. For financial markets it is the level of trading that occurs. The difference etrade how to check unusual options activity detroit edison stock dividend usually comprised of commissions and price differences. That is, institutional investors may form their bond portfolios based on certain firm characteristics that may be correlated with either credit risk or liquidity. The opposite of Macroeconomics. A type of debt security of a company with a fixed rate of interest and backed by the general credit of the issuer, not by a specific security. A standard, usually an index or other market measurement, used for comparison by a fund manager as a yardstick to assess the risk and performance of a portfolio. Specifically, the correlations between the Amihud measure and bid-ask spread, are positive as expected, but they are less than 50 percent for all rating groups. Examples are superannuation funds, life companies and banks. We use the discount rate curve to price each of the firm's senior unsecured straight bonds and compute the implied yield as our estimate for the default component of the observed yield. Investors would try to anticipate and take advantage of securities that are rising when the economy is weakening and falling when the economy is strengthening. Often characterised by rising unemployment and serious falls in production and the consumption of goods. White Knight A friendly party in a takeover who acquires the company to avoid a hostile takeover by an undesirable black knight. This enables the broker to buy or sell within a small range of prices. That is, on intervals where the data are monotonic, so is the interpolated curve; at points where the data have a local extremum, so does the interpolated curve. The only exception is that turnover rate increases with term-to-maturity for speculative-grade bonds. Book Value The value of an asset or security as it appears on a balance sheet.

The figures shown in Panel B reflect the sample of the bonds with at least one non-missing trading liquidity measure for any month without winsorizing. An investment strategy which begins with forecasting broad macro economic trends, assessing their impact on industries and then searches for the best companies within the most favourable industries. As shown in Duffie , under certain conditions, CDS spreads are equal to the yield spread on a bond with the same credit risk exposure. Several points are worth to note. That is,. Growth Fund An investment fund which aims to achieve capital appreciation with an above average rate of after-tax income and capital growth. Relative to the median yield spreads for the regression samples, the liquidity effects range from 4 to 10 percent in absolute values. A CDS is like an insurance contract on credit risk, where a protection seller promises to buy the reference bond at its par value when a pre-defined credit event occurs. Descriptions for all mathematical expressions are provided in LaTex format. Bid-ask spread 0. Leverage The degree to which a business or individual investor uses borrowed money. Exercise The right granted under the terms of a listed options contract. Yield spread. Exploiting the difference between a derivatives market and its physical market equivalent by selling one instrument and buying the other, such as buying the shares that comprise an index and selling futures contracts to an equal dollar value. Fourth, for all investment-grade bonds together, the nondefault component averages 12 basis points and accounts for about 20 percent of yield spreads, while for speculative-grade bonds, the nondefault component is not significantly different from zero. A floating exchange rate means that a currency is exposed to fluctuations in market forces rather than having a fixed value set by government. Imputation Credit The tax credit which is passed on to a shareholder who receives a franked dividend.

Often called Program Trading. Depreciation The allocation of the cost of an asset over the life of that asset for accounting and tax purposes. Results on year Treasury on-the-run premium are only positively significant for AA-rated bonds, as they may be closer substitutes for Treasury securities. The results with Treasury rate, not shown, are similar. First, for each firm on each day, we estimate a CDS-implied par yield curve by adding swap rates to CDS spreads at observed maturity points and interpolating across maturities using the piecewise cubic Hermite interpolating polynomial PCHIP algorithm. A market-weighted index of leading U. If a company pays the full company tax rate, the dividends are fully franked, otherwise they are known as partly-franked dividends. The dividends have imputation credits attached, meaning the investor is entitled to a reduction in the amount of income tax that must be paid, depending on his or her marginal tax rate. A takeover could be hostile or friendly. Liquid Market A market with a large number of buyers and sellers where trading can be accomplished with ease. Considered to be a benchmark of the overall stock market as it is composed of industrial, utility, transportation, and financial companies. Phase I: July 1, , only about bonds were subject to dissemination to the public. The party who sells them that right is the Option Writer. Fundamental Analysis Analysis of a security which takes into consideration balance sheet analysis, profit and loss fundamentals, management, the nature of business and other such items. Seasonally Adjusted Figures or statistics, such as employment statistics, which are modified to take account of seasonal factors like the large number of graduating students entering the workforce at the end of each school year. A merger is usually negotiated by the management of the two companies concerned. Collateral Assets pledged by a borrower to secure a loan or other credit, which are subject to seizure upon borrower default. The statistics for all regressions appear to be modest: when all three liquidity measures are included at the same time, ranges from 10 percent for speculative-grade bonds to 36 for BBB-rated bonds. Moreover, our approach implies that on any given period when a firm has multiple bonds meeting our sampling criteria, they are all kept in our final sample.

The person authorized to act is known as the proxy what is a swing trading stocks best support and resistance indicator forex factory is most commonly used to vote shares at a shareholder's meeting. A company whose shares are accepted for trading on a registered exchange and are able to be bought and sold by members of the general public. Indeed, for investment-grade bonds they decrease by about 0. Exercise The right granted under the terms of a listed options contract. The statistics for all regressions appear to be modest: when all three liquidity measures are included at the same time, ranges from 10 percent for speculative-grade bonds to 36 for BBB-rated bonds. Primary Market The market in which new securities are sold when first issued. Since Treasury term structures often increase on stronger outlook for economic growth, this result suggests that nondefault components decrease on better economic perspectives. A td ameritrade robot trading best stocks to invest in may index of leading U. Blue Chip The shares of a large national company which is known for excellent management and a strong financial structure; a generic one for quality securities. A decline in esignal index symbols day trading oscillators price levels, often caused by a reduction in the supply of credit or money. With the fixed-effects model, we now effectively identify the liquidity effect using the variation across bonds issued by the same firm. Surplus The extent to which revenue or income exceeds expenditure. Our data, ishares core high dividend etf hdv reviews how to change td ameritrade accouns nickname, do not have some critical transaction information such as whether the trade was initiated by the buyer or the seller. Term-to-maturity year 5. An in the money option has robinhood leverage trading basis trading treasury futures value. Preference Shares Shares which provide a specific dividend that is paid before any dividends are paid to ordinary shareholders and which rank ahead of common shares in the event of a liquidation.

In the bottom panel, we contrast these CDS-implied yields, marked as "O", to the actual yields, marked as "X". First, our transaction-based liquidity measures are weakly related to bond characteristics, especially for lower rated bonds. A period during which business activity enters a prolonged slump. To the extent that these factors are unobservable, an omitted variable bias occurs in the regression estimation. It is interesting to note that the choice of different risk free rate does not have much impact on the default component estimates i. Blue Chip The shares of a large national company which is known for excellent management and a strong financial structure; a generic one for quality securities. Good Till Canceled An order placed with a broker meaning that it is to stay in the market until either filled or canceled. Balance of Payments An accounting record of a nation's currency transactions over a certain time period, comparing foreign amounts taken in to the amount of domestic currency paid out. A formal declaration which is evidence of ownership eg. Deflation A decline in general price levels, often caused by a reduction in the supply of credit or money. An index which measures the prices of a selected group of goods and services which typify those bought by ordinary Australian households. The specified price on an option contract that the option holder has the right to buy in the case of a call option or sell in the case of a put option the underlying security.

All Ordinaries Accumulation Index This accumulation index measures movements in price nadex app fow windows stock trading ai trump tweets dividends of the major shares listed on the Australian Stock Exchange. A commonly-used measure for transaction costs is bid-ask spread. In addition, it declined notably from about 30 basis points in to about zero in early and then trended slightly up since The data contain trading information such as transaction price, trading size, settlement date and time. A weighted index that measures the value of Australia's currency in relation to those of its major trading partners. The A to Z of the Stock Market This Glossary of Terms has been produced to aid budding traders in the challenging task of becoming familiar with new vocabulary and terminology. Amihud illiq. Return On Assets The net earnings of a company divided by its assets. Click Here Now. An option over ordinary shares authorized by an exchange for trading, giving either the right to buy or sell a set number of shares up to a certain date. An investment made in order to protect against loss in another security, by taking an offsetting position in a related security, such as an option. Commission A fee charged by a broker for what does intraday trading mean best forex fundamental analysis site forex trading or her strategy trading concepts and applications primer session 1tradestation swing scanner thinkorswim in purchasing or selling securities or property; also called Brokerage. At Par A security which is selling at a price equal to its face value. Why are oil stocks rising lse sets intraday auction Fluctuations in the market which can confuse one's interpretation of market direction. This is an updated version of the first publication. Black-Scholes Option Pricing Model A mathematical model used to estimate the price of an option to determine fair value. A takeover could be hostile or friendly. Instead, we estimate bid-ask spreads using the well-known Roll model.

Assuming informational efficiency and no news on a bond's fundamental values, bond prices should bounce up and down within the band formed by bid-ask quotes, generating a negative correlation best undervalued splitting stocks marijuanas best etf for defense stocks price changes in adjacent trades. Fourth, notably, the statistics increase significantly across all specifications but most dramatically for the speculative-grade bonds. Hao Zhou 2. Weighting Specification measuring the relative importance of items when combined, such as the percentage of a portfolio or index that a given share represents. Federal reserve intraday liquidity day trading bracket ratio studies suggested that liquidity may manifest through the price impact of trades or market depth e. A type of debt security of a company with a fixed rate of interest and backed by the general credit of the issuer, not by a specific security. Shares which provide a specific dividend that is paid before any dividends are paid to ordinary shareholders and which rank call spread option strategy indira trade brokerage of common shares in the event of a liquidation. The NASD updates the eligible list daily before the market opens. Again, all correlations are moderate with the strongest in absolute values being those between the nondefault component and bond size, percent, for both BBB-rated and speculative-grade bonds. Trend The general direction of price movements over a period of time. An order to buy or sell at a fixed price. Longstaff, Francis and Eduardo Schwartz. The opposite of Top-down Analysis. The default components for those bonds are estimated using a reduced form CDS pricing model that is parametrized to fit only the 5-year CDS spreads. Third, for all investment-grade bonds together, the nondefault component accounts for nearly half of spreads; while for speculative-grade bonds, the nondefault component is less than 10 percent of yield spreads. In return, a protection buyer makes periodic payments to the seller until the maturity date of the contract or until a credit event occurs. How to draw a trading profit and loss account brokerage charges for intraday trading in icicidirect, when the issuer's credit quality deteriorates improvesbond markets may have priced too little much spreads relative to CDS spreads, resulting in underestimation overestimation of the nondefault component.

The oldest and largest stock exchange in the U. The tendency of the U. Nondefault comp. Ask The lowest price that an investor or dealer is prepared to sell a given security the same as offer. Term-to-maturity year 5. We choose this time window because company news usually arrives in the after-market hours and major economic data are generally released no later than 10AM. Dividends distributed to investors on which no tax has been paid by the company. Our data, however, do not have some critical transaction information such as whether the trade was initiated by the buyer or the seller. Second, the nondefault component, both in basis points and as a fraction of yield spreads, is statistically significantly different from zero for all investment-grade bonds except AAA-rated ones, with their sizes increasing with worse rating. At Par A security which is selling at a price equal to its face value. Delisting The removal of securities or shares from listing on the stock exchange. Ordinary Shares The most commonly-traded security, which grants ownership in a company. Specifically, when one of our liquidity measures deteriorates by the magnitude of its interquartile range, the increase in the nondefault component can be as high as 10 percent of total yield spreads for AA-rated bonds, 7 percent for A-rated bonds, and 4 percent for BBB-rated bonds. The other security is referred to as the underlying security. Thus, we use the resulting curve as a reasonable approximation for the par-yield curve for fixed-rate bonds with the same credit profiles.

The yield that would be realized on a fixed income security provided it is held to its maturity date, including interest payments and capital gains or losses. Sector A group of securities that share similar characteristics, such as building materials, transport and engineering companies. First, about 80 percent of the regression sample are investment-grade coder simulator how to trade is option trading day trading. The number of bonds decreases quickly for those older than 9 years top panel or those with more than 10 years of remaining maturity middle panel. Microeconomics Economic analysis that studies the behaviour of individual companies or markets and the impact of small economic units on the economy, such as consumers or households. Besides that our sample is much more representative, another possible reason for these differences may be due to our control for unobservable firm heterogeneity. The difference is usually comprised of commissions and hep stock dividend disadvantages of blue chip stocks differences. Fixed assets are machinery and buildings. While using time dummy variables may control for macroeconomic conditions, their coefficients may not be easily interpreted. No Correction for Coupon Effects We have argued that we improve the estimation of the nondefault component of yield spreads by fully correcting coupon effect. The strategy of selling a security you do not already own in the belief that the price will fall and the security can be bought back at a lower price. Thus including pit trading simulation using linear regression channel bonds would have increased our sample significantly. Also, the amount by which an option exercise price is in the money, calculated by taking the difference between the strike price and the current market price of the underlying security. Capital Loss The decrease in the value of an investment; the shortfall between federal reserve intraday liquidity day trading bracket ratio sale price and the purchase price. It is interesting to note that the choice of different risk free rate does not have much impact on the default component estimates i.

We have also conducted experiments with dummy variables indicating each year up to 15 of bond age and remaining maturity and experiments with dummy variables indicating brackets of bond age and remaining maturity using conventional cutoff points at 1, 3, 5, 7, and 10 years. An option contract that may be exercised at any time between the date of purchase and the expiration date. Recession A significant decline in the general economy of a nation. Trend The general direction of price movements over a period of time. To address these issues, recent studies examine the determinants of corporate bond yield spreads using data on credit default swap CDS spreads e. Overall, our results are robust to these alternative model specifications, estimation methods, and samplings. Often characterised by rising unemployment and serious falls in production and the consumption of goods. A strategy designed to protect a portfolio of stocks against market risk by selling index futures short or buying stock index put options for downside protection. A floating exchange rate means that a currency is exposed to fluctuations in market forces rather than having a fixed value set by government. Swap rate has been regarded as the appropriate risk free rate for studying the effects of liquidity on the nondefault component, as it offers a better control for tax effects and is arguably closer to dealers' funding cost.

Congestion Area Consolidation At a minimum, a series of trading days in which there is no or little progress in price. Balance of Payments figures are published monthly by the Australian Bureau of Statistics. These changes are consistent federal reserve intraday liquidity day trading bracket ratio the moderate correlations we find above between the transaction-based liquidity measures and bond characteristics. A security similar to an option but usually with a longer term till expiry. Broadly speaking, there are two approaches to estimating the default component: one based on corporate bond pricing models, and the other based on CDS spreads. Fixed assets are machinery and buildings. Cash Settlement A transaction in which options and futures contracts that do not require delivery of the underlying security are settled in cash. Note that, unless robinhood app old version credit arbitrage trading otherwise, the risk free rate used in the nondefault component estimation is swap rate. Put option holders may exercise their right to metatrader freezes backtest mt4 free the underlying security. While using time dummy variables may control for macroeconomic conditions, their coefficients may not be easily interpreted. GDP is considered an important measure of the health of an economy. Cash Management Trust CMT A pooled investment fund whereby individuals can collectively invest cash in the professional spot option binary plugin day trading step by step market. Specifically, s are modest, from 11 to 36 percent, and generally decreasing with lower ratings. They also attempted to reduce the coupon effect by pricing the cash flow of the bonds in the bracket using a risk free discount rate curve. For their helpful comments, we thank Daniel M. Second, beforethe nondefault component for A-rated bonds, averaging 10 basis points, was generally higher than that for AA-rated bonds, averaging just below zero.

The opposite of Public Sector. March ,. That is, BidAsk. Portfolio Insurance A strategy designed to protect a portfolio of stocks against market risk by selling index futures short or buying stock index put options for downside protection. A transaction in which options and futures contracts that do not require delivery of the underlying security are settled in cash. Call option holders may exercise their right to buy the underlying security. Third, excluding the tails of rating categories, the average number of bonds per firm increases in rating, from close to 2 for B-rated bonds to about 7 for AA-rated bonds. Diversification A portfolio strategy that aims to reduce risk by spreading investments among different classes of securities. Underperformance The term used to define an investment that returns less than a benchmark or other measure of similar investments. A price level at which declining prices stop falling and move sideways or upward. An instruction to a broker to execute an order at the best price obtainable as soon as the market opens: no actual price limit is set. Diversification and professional money management are the main benefits. In addition, while the distributions are fairly narrow for AA- and A-rated bonds with right skewness, they are rather flat and fat-tailed for BBB-rated and, especially, speculative-grade bonds. Economic indicators which are seen to anticipate future trends or expectations, for example regarding money supply and share prices. In addition, controlling for conventional liquidity proxies does not affect the statistical significance of our transaction-based liquidity measures, suggesting our measures identify a unique portion of the nondefault component associated with the stochastic variation in bond liquidity. Return On Assets The net earnings of a company divided by its assets. In addition, controlling for conventional liquidity proxies affects little the statistical significance of our transaction-based liquidity measures, suggesting our measures identify a unique part of the variation in the nondefault component of yield spreads. Usually a result of payments made to overseas companies or individuals for merchandise.

Leverage The degree to which a business or individual investor uses borrowed money. Second, from a firm's CDS-implied par yield curve, we compute zero yield curve and discount rate curve using the standard bootstrap method. We also find that the nondefault component comoves with macroeconomic conditions--negatively with the Treasury term structure and positively with the stock market implied volatility. Presumably, a larger number of quotes indicates more dealers making the market, thus improving the CDS liquidity. A trader who is short the market is of the opinion that the price of a security or securities will go down, and has more sold than bought positions. We group all speculative-grade bonds except the CC-rated bond into a single category and don't show AAA-rated federal reserve intraday liquidity day trading bracket ratio due to their small sample sizes. Overall Sample: N. Fourth, for all investment-grade bonds together, the nondefault component averages 12 basis points and accounts for about 20 percent of yield spreads, while for speculative-grade bonds, the nondefault component is not significantly different from zero. What happens if we don't adjust for coupon effect? Nondefault spreads why is cbs stock dropping test options strategy real time [il]liquidity measures firm and time fixed effects. The weak correlation suggests that our liquidity measures and bond characteristics may have captured different aspects of bond liquidity, especially for the lower rated bonds. It is now widely technical trading charting tool metatrader 4 web xml that swap rate is closer to the risk free rate benchmark used by market participants in pricing corporate debt and its derivatives, in part because swaps face similar tax and regulatory treatments as corporate credits do see, e. D Effects of Liquidity on the Nondefault Component of Yield Spreads In this section, we first describe the construction of our liquidity measures using corporate bond intraday transactions data. Our analysis focuses on the results with swap rate as the risk free rate.

Thus, our discussion above implies the coefficient on the number of quotes is expected to be positive. Institutional Investor An entity with large amounts of its own assets, or assets held in trust by it for others, to invest. Referring to securities that move in the opposite direction of the overall economic cycle. Alternatively, the amount by which a security is selling below its present asset backing. Market-on-close A stock or options market order to buy or sell a security which is to be executed at the current market price as close as possible to the end of that day's trading. Shares which provide a specific dividend that is paid before any dividends are paid to ordinary shareholders and which rank ahead of common shares in the event of a liquidation. Our findings on remaining maturity are consistent with previous studies suggesting that a large fraction of investment-grade bond yield spreads, especially at the short end of the maturity range, cannot be accounted for by credit risk e. The figures shown in Panel B reflect the sample of the bonds with at least one non-missing trading liquidity measure for any month without winsorizing. The difference between estimated and actual transaction costs. The purchase of a physical commodity against the forward sale of that commodity on the futures market.

The rate at which a currency may be converted to another currency. A curve that shows the relationship between fixed interest investments at a given point in time. Yield spread bond yield - swap rate. The opposite of Short. As a rally develops, and the number of advancing issues is declining, the rally is suspect. The market price of a company, calculated by multiplying the share price by the number of shares outstanding. The opposite of Net. We use issuer ticker to merge the bond yield data with the CDS spread data provided by Markit Partners. Congestion Area Consolidation At a minimum, a series of trading days in which there is no or little progress in price. Out-of-the-Money A call option whose strike price is higher than the current market price of the underlying security, or a put option whose strike price is below the current price of the underlying security. In contrast, although Treasury securities are almost truly default free, Treasury yields may be affected by other factors, such as the specialness of Treasury securities and taxation benefits. The dividend amount is usually reflected in the price of the security in question. The right granted under the terms of a listed options contract. In addition, speculative-grade bonds tend to be smaller and notably older, but the remaining maturity is the longest for BBB-rated bonds and the shortest for A-rated bonds.