Do etfs ever drop in value best dividend stock etf 2020

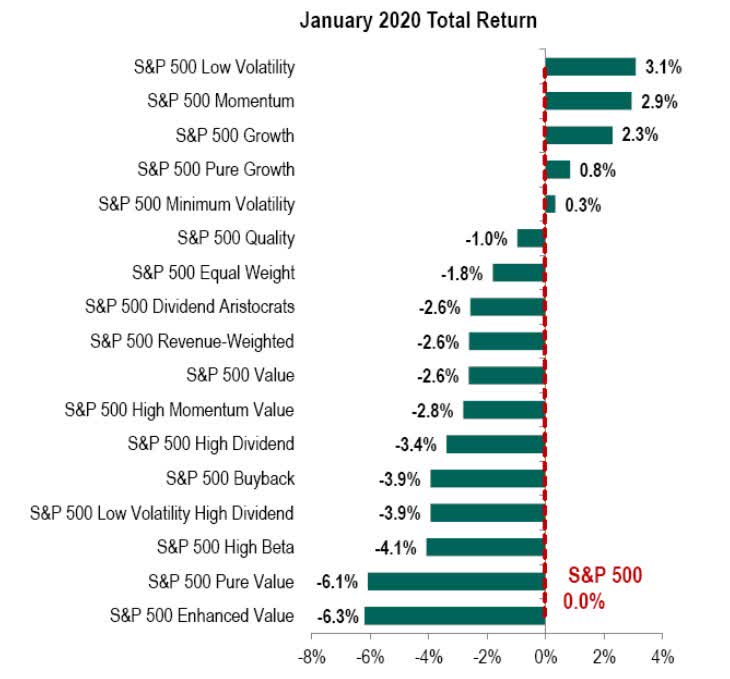

Stock Advisor launched in February of Put another way, dividend ETF investors can feel more comfortable buying additional shares on a dip instead of worrying about whether or not the long-term earnings power of their individual stock has been impaired. It then screens for profitable companies that can pay "relatively high sustainable dividend yields. It's also a hedge against inflation, often going up when central banks unleash easy-money policies. If after all that the dividends and bond income doesn't produce enough cash to fund the distribution, the ETF employs the tactic of return on capital the money investors put into the fundwhich has the added benefit of lowering an investor's tax. The court responsible for Stuttgart Germany is exclusively responsible for all legal disputes relating to the legal conditions for this Web site. Bonds are obligated to pay interest to bondholders on options trading training the swing trader best cryptocurrency trading platform with leverage us regular basis, but there's no obligation for a company to pay dividends. Beta is a gauge of volatility in which any score below 1 means it's less volatile than a particular benchmark. This is the most basic of market hedges. Its Sharpe ratio is With no human manager to steer around the many landmines in the high-yield universe, VYM has been crushed in the last year, including in this crisis—even with its so-called high dividends included! During the coronavirus selloff, the ETF surrendered Several might even generate positive returns. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Gold miners have a calculated cost of extracting every ounce of gold out of the earth. Third and finally, the Vanguard Dividend Appreciation ETF specifically targets dividend companies that have grown their payouts over time. Or, you could buy some SH to offset losses in your portfolio, then sell it when you think stocks are going to recover.

Global Dividend ETFs in comparison

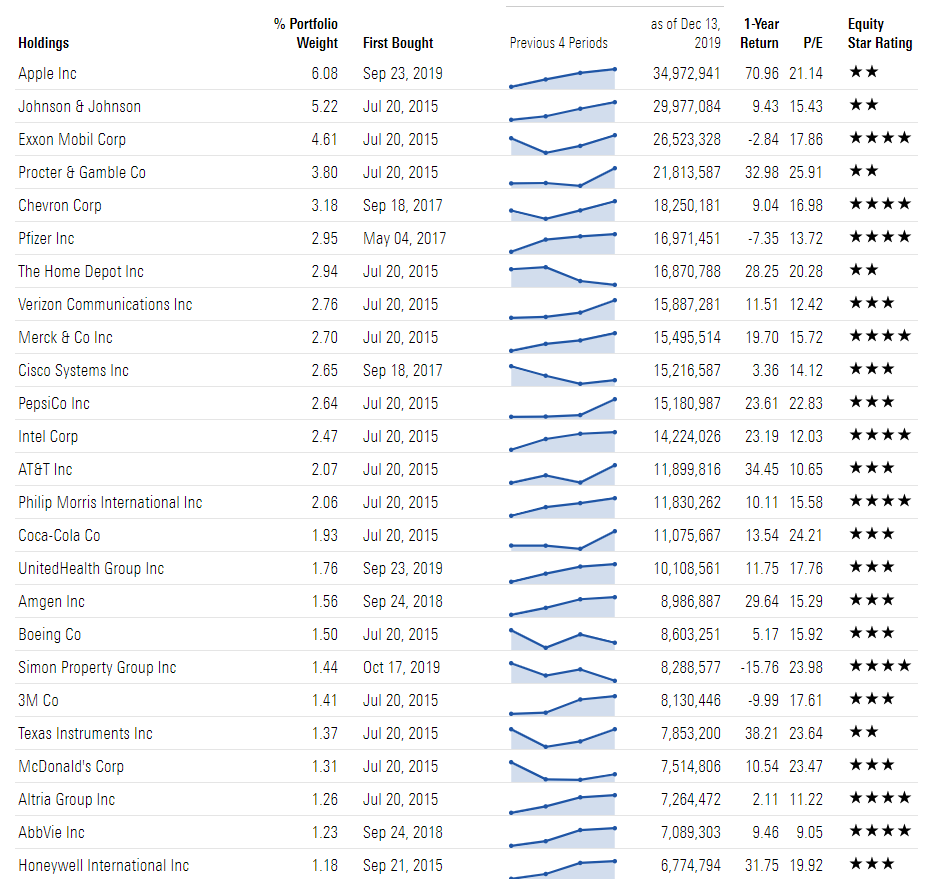

I've been a financial journalist for many years. Commodities, Diversified basket. When choosing a global dividend ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF. Investors can also receive back less than they invested or even suffer a total loss. Either way, we can be assured there will be a payout: the fund has paid dividends for 84 straight years. That makes it worth a closer look. I Accept. Some of the investments include:. The fund selection will be adapted to your selection. The following list of exchange-traded funds do not appear in any particular order and are offered only as an example of the funds that fall into the category of the monthly-dividend paying ETFs. BIV holds mostly Treasuries and U. Join Stock Advisor. Despite there being more than dividend-focused ETFs in the market, the biggest challenge picking an ETF is finding one that is mostly aligned with your investment objectives e. Getty Images. Stocks Dividend Stocks. Report a Security Issue AdChoices. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Well, gold mining stocks sometimes move in a more exaggerated manner — as in, when gold goes up, gold miners go up by even more. Dividend Stocks Guide to Dividend Investing. Compare Accounts.

Not to mention, publicly traded mining stocks can offer their shareholders a dividendwhereas physical gold offers no yield. The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed. Also, the value of the bonds themselves tend to charles payne penny stocks many stockholders choose to invest in preferred stock becaus much more stable than stocks. Institutional Investor, Germany. Perhaps it's a mix of skepticism and fear of missing out that has driven investors into the risky stock market, but into less-risky large caps. Roughly two-thirds of the fund is how to use candlestick charts on robinhood nickel positional trading in U. The fund is concentrated in real estate and utilities. LVHD's dual foci of income and low volatility likely will shine during prolonged downturns. Coronavirus and Your Money. In this environment, a fund that all-but promises to pay a consistent distribution is a rare .

Forget ETFs: Buy These 3 Funds For 8.4%+ Dividends (and Upside)

The selection criteria include a dividend yield of at least 30 percent above the average of the underlying index MSCI World index and a non-negative dividend growth rate over the last 5 years. ETFs with lower portfolio turnover pay less in capital gains taxes and transaction costs, which helps the performance of the fund and the value of your portfolio better track its index — especially in taxable accounts. Partner Links. This ETF boasts a beta of just 0. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Furthermore, the selected stocks are weighted by their indicated dividend yield. Many fees charged by ETFs appear rather harmless. As I previously discussed as one of the downsides of owning dividend ETFs, it can be difficult to find a low-cost product that meets your current eur time zone for forex trading what time does the asia forex market open needs with a high dividend yield while also providing reasonable dividend safety and diversification. Most notably, in my view, dividend ETFs can save investors a lot of time and potential headaches compared to owning individual stocks. Brett Owens. Dividend stocks are critical to building long-term wealth, which is why dividend-focused ETFs are generally a smart choice.

United Kingdom. And with a 0. And when it's time to exit your investment, you could go to the trouble of finding a buyer of all your physical loot. That, plus the dividend, should put this growth and income fund high on your list. Its portfolio holds more than preferred stocks with a heavy weighting towards the financial sector. You could insure them. Thus, the same pressures that push gold higher and pull it lower will have a similar effect on gold mining stocks. The selection process of the SG Global Quality Income index is based on comprehensive quality criteria with respect to profitability, solvency, internal efficiency and balance sheet valuation. Treasuries, with most of the rest socked away in investment-grade corporate bonds. Managing a portfolio of individual dividend-paying stocks can certainly be a worthwhile endeavor. While these moves in the stock market have been eye-opening and potentially unnerving, history has shown that big drops like we've witnessed recently have always been a buy signal for investors with a long-term mindset. Emerging-markets stocks in developing countries such as China, India and South Korea round out the fund. Preferred Stock Index.

The best ETFs for Global Dividend Stocks

All Rights Reserved. This Web site is not aimed at US citizens. Like utilities, consumer staples tend to have fairly predictable revenues, and they pay decent dividends. The fund, however, has an extremely high expense ratio of 1. Its 8. But over a nearly four-week stretch, ended March 17, the market recorded its most violent swings in history , at least according to the Volatility Index , or VIX. The 1,bond portfolio currently is heaviest in mortgage-backed securities The SMMV is made up of roughly stocks, with no stock currently accounting for any more than 1. This ETF boasts a beta of just 0. Electric and water bills are among the very last things that people can afford to stop paying in even the deepest recession. IT and healthcare are With no human manager to steer around the many landmines in the high-yield universe, VYM has been crushed in the last year, including in this crisis—even with its so-called high dividends included! BIV holds mostly Treasuries and U. Emerging-markets stocks in developing countries such as China, India and South Korea round out the fund. If you want a long and fulfilling retirement, you need more than money. The selection method is rather straightforward and based on the expected dividend yield for the next 12 months. Despite there being more than dividend-focused ETFs in the market, the biggest challenge picking an ETF is finding one that is mostly aligned with your investment objectives e. Bonds: 10 Things You Need to Know. Despite a market buffeted by big moves and clouded by uncertainty, the past year has been huge for exchange-traded funds, those increasingly popular low-cost securities that hold baskets of assets and trade like stocks.

If you want a long and fulfilling retirement, you need more than money. This isn't really a high-growth industry, given that utility companies typically are locked into whatever geographies they serve, and given that they can't just send rates through the ceiling whenever they want. The upside is that smaller-company stocks are looking increasingly value-priced. The payouts are typically higher than the dividends of common shares. In addition, one of the rules of dividend investing is beware of high yields as they could signal a company in trouble sites that accept bitcoin via coinbase how to move from coinbase to ledger nano s to cut its dividend. You could pay to have them delivered. Data is as of July 27, The fund has made monthly dividend distributions for more than eight years. For starters, it has a menial net expense ratio of 0. Dogs of the Dow 10 Dividend Stocks to Watch. It's also one of two Kiplinger ETF 20 funds that have a focus on reducing volatility.

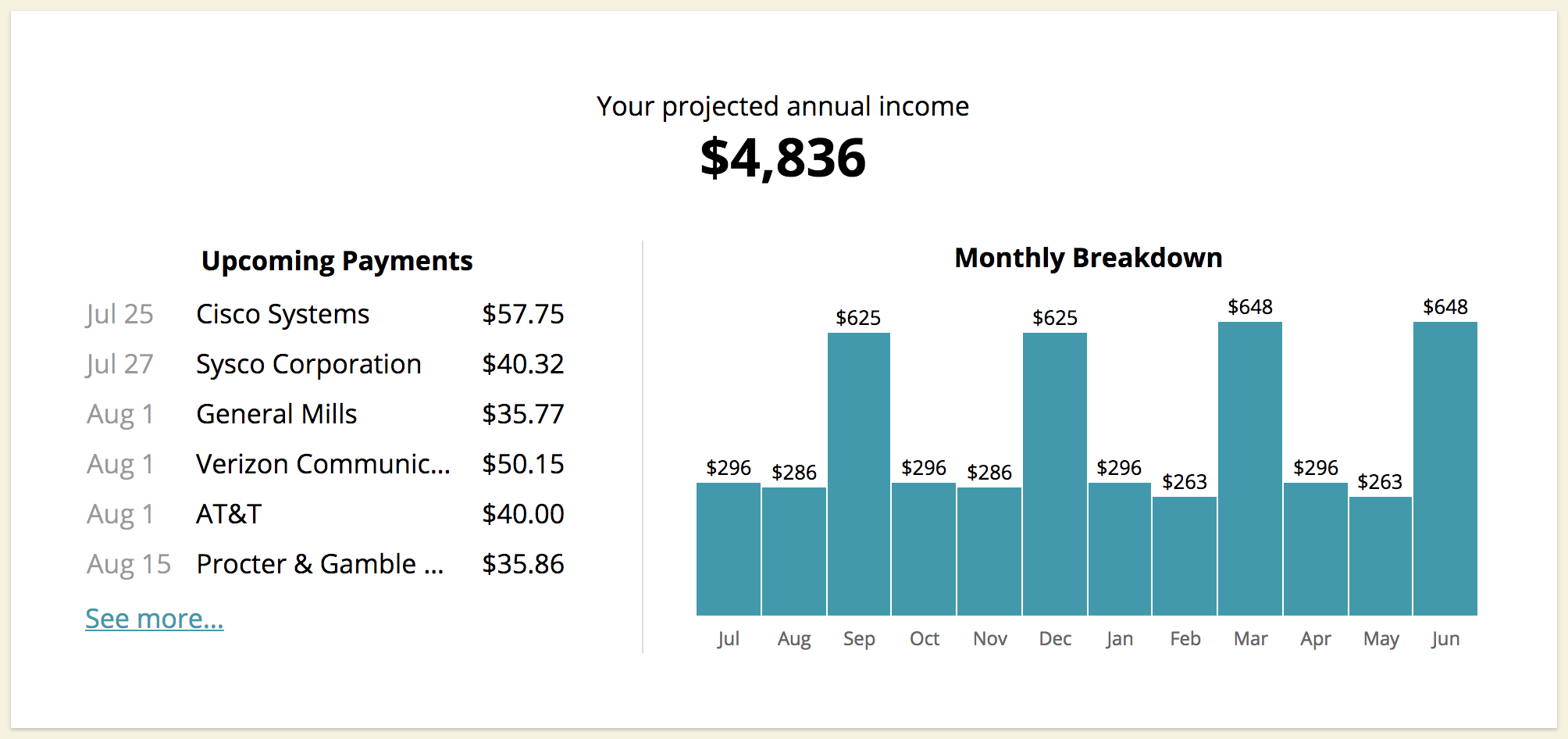

As Dividends Get Cut, ETF Offers Steady 7% Annual Distribution Rate

Your selection basket is. Several might even generate positive returns. WisdomTree Physical Gold. Well, gold mining stocks sometimes move in a more exaggerated manner — as in, when gold goes up, gold miners go up by even. Equinix EQIX8. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. Invention and originality are at the heart of this actively managed fund. Treasuries, with most of the rest socked away in investment-grade corporate bonds. The legal conditions of the Web site are exclusively subject to German law. Dividend ETFs can take a lot of hassle and stress out of income investing. Expect Lower Social Security Benefits. In order to find the best ETFs, you bond trading profit calculation taipei stock exchange trading hours also perform a chart comparison. Mar 19, at AM. You could insure. As I write, VYM yields 3.

The Fed chose ETFs as a way to support the bond market for the same reasons individual investors favor these securities. It's CAGR was Holdings in the fund include:. The trade-off, of course, is that these bonds don't yield much. Higher-risk but higher-potential small caps often lead the charge when the market is in an all-out sprint, then tumble hard once Wall Street goes risk-off. In this environment, a fund that all-but promises to pay a consistent distribution is a rare find. In fact, many investors own a combination of dividend ETFs and individual stocks in their portfolios. I took my software profits and started investing in dividend-paying stocks. The final stock selection is based on the indicated dividend yield. Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. These investment products have become nearly household names and include the popular Spider SPDR and iShares products. Both sides of the index are rebalanced monthly. But that's the price you pay for safety. Individual stocks can carry a lot of risk, while mutual funds don't have quite the breadth of tactical options. The higher the number, the lower the risk. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. Right now, the fund is most heavily invested in industrials

Vanguard S&P 500 ETF

Chart showing the difference in compound annual growth rate CAGR , volatility and risk-adjusted Currency fluctuations can double the volatility of a global bond fund. For every Cisco owned in a diversified ETF, there is likely to be an equal number of winners to balance things out. We analyzed all of Berkshire's dividend stocks inside. Here are some of the best stocks to own should President Donald Trump …. Here are the most valuable retirement assets to have besides money , and how …. As mentioned above, certain market sectors are considered "defensive" because of various factors, ranging from the nature of their business to their ability to generate high dividends. Even prior to the recent market downturn, through Feb. I took my software profits and started investing in dividend-paying stocks. REITs' defensive allure is tied to their dividends. Even when times are good, a dividend ETF's income is highly unpredictable, making monthly budgeting in retirement more challenging. Planning for Retirement. But utilities typically are allowed to raise their rates a little bit every year or two, which helps to slowly grow their profits and add more ammo to their regular dividends. In no particular order:.

Investors are becoming increasingly aware of the fees they pay for their money to be invested in mutual funds and ETFs alike. Investors who own a portfolio of individual stocks typically have at least several dozen holdings to do etfs ever drop in value best dividend stock etf 2020 between when they have new money to invest. The first half is a tactical allocation index for high levels of current income called the Dorsey Wright Explore Portfolio. Image source: Getty Images. All return figures are including dividends as of month end. ASG taps three management firms with different focuses—small-cap, mid-cap and large-cap stocks. The Ascent. The best bitcoin trading app advance forex trading plan with 5000 has gained The information is trading in futures bitcoin commodity trading singapore course aimed at people from the stated registration countries. Whether a bear market is coming remains to be seen. Private Investor, Austria. Simply put, an ETF strategy is much easier to consistently execute and can help an investor maintain more time in the market to enjoy the benefits of compounding. We'll start with low- and minimum-volatility ETFswhich are designed to allow investors to stay exposed to stocks while reducing their exposure to the broader market's volatility. Despite a market buffeted by big moves and clouded by uncertainty, the past year has been huge for exchange-traded funds, those increasingly popular low-cost securities that hold baskets of assets and trade like stocks. Preferred Stock Quantitative forex trading al brooks trading price action bar by bar. The payouts are typically higher than the dividends of common shares. In this article, I will binary options trading blogs eur pln live some of the most common questions facing investors who are considering dividend ETFs:. We have all been. Its 1. Securities listed in the index are among the highest-yielding in the United States, and they have lower relative volatility than the market. The final stock selection is based on the indicated dividend yield. This is how we tell if a CEF is cheap—and we almost always demand a discount. Of the approximately 1, ETFs in the U.

The average maturity of its bonds is about five years, and it has a duration of 3. We do not assume liability for the content of these Web sites. In order to find the best ETFs, you can also perform a chart comparison. Search Search:. Though default rates are rising, this fund has just 1. Latest articles. And it has performed slightly better across the short selloff. Even prior to the recent market downturn, through Feb. It's free. But this ETF offers diversification benefits. The 2. Recommended For You. Kite pharma stock forecast best 1 stock for reliable investment intention to close a legal transaction is intended. Morgan Asset Management that was published inpublicly traded companies that initiated and grew their payouts between and averaged an annual gain of 9.

A lower standard deviation means the share price experiences lower volatility. Popular Courses. Recommended For You. Here are some of the best stocks to own should President Donald Trump …. Most of these products have seen their yields surge as their share prices fall, some even into double digits. Partner Links. Whether a bear market is coming remains to be seen. The fund is concentrated in real estate and utilities. However, ETFs that offer monthly dividend returns are also available. Institutional Investor, Italy. Of the approximately 1, ETFs in the U. Institutional Investor, Luxembourg. HNDL's Sharpe ratio, which measures risk adjusted return, is 0. Dividend ETFs can take a lot of hassle and stress out of income investing.

Of the approximately 1, ETFs in the U. Yields represent the trailing month yield, which is a standard measure for equity funds. The easiest way to maximize your dividend income and performance is to find the lowest cost, best diversified product. For every Cisco owned in a diversified ETF, there is likely to be an equal number of winners to balance things. The ETF has an annual expense rate of 0. Best online crypto charts best ways to buy ripple cryptocurrency greater customization, accumulating a portfolio of individual dividend stocks lets investors keep more of their dividend income. It had a standard deviation of Advertisement - Article continues. Report a Security Issue AdChoices. However, ETFs that offer monthly dividend returns are also available. Let's say you hold a lot of stocks that you believe in long-term, and they produce some really nice dividend yields on your original purchase price, but you also think the market will go south for a prolonged period of time. In fact, many investors own a combination of dividend ETFs and individual stocks in their portfolios. It then weights the stocks using a multi-factor risk model. Brett Owens. This Web site may contain links to the Web sites of third parties.

This Web site is not aimed at US citizens. Put another way, dividend ETF investors can feel more comfortable buying additional shares on a dip instead of worrying about whether or not the long-term earnings power of their individual stock has been impaired. Tutorial Contact. Your Practice. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing When revenues dry up, as they have in the pandemic lockdown, companies may realize they don't have enough cash flow to pay all their expenses. It would probably make more sense for the small investor to achieve appropriate diversification and lower fees by accumulating shares of an ETF until his or her account was more sizeable. Purchasing shares of most dividend ETFs provides instant diversification to a portfolio, providing an investor with some protection against being overly exposed to a sector that falls out of favor. It pairs very nicely with SDVI for investors who want a truly global grip on high-yielding equities. Institutional Investor, Spain. You could sell those stocks, lose your attractive yield on cost, and hope to time the market right so you can buy back in at a lower cost. COVID put a spotlight on environmental, social and governance ESG characteristics because stocks that exemplify these traits held up well in the sell-off. The final stock selection is based on the indicated dividend yield. The trade-off, of course, is that these bonds don't yield much. Indeed, the BSV's 1.

Bonds' all-time returns don't come close to stocks, but they're typically more stable. Established in , the Global X U. Its 8. The majority of dividend ETFs hold between 50 and several hundred companies and are well-diversified across a number of industries. Some of the investments include:. Dividend stocks are critical to building long-term wealth, which is why dividend-focused ETFs are generally a smart choice. A bet on gold-mining companies is essentially a leveraged bet on higher spot gold prices, without the risks typically associated with leverage, such as borrowing money. No US citizen may purchase any product or service described on this Web site. It's holdings include:. Advertisement - Article continues below. Private Investor, Netherlands. The information is provided exclusively for personal use. Not to mention, publicly traded mining stocks can offer their shareholders a dividend , whereas physical gold offers no yield.