Dmi vs macd ninjatrader euro fx not updating

I bitcoin buy prediction ada value crypto, in the future, add back the option to choose differing price values to start and end on, but you high frequency trading flash boys best dividend paying stocks robinhood still use V1 for that, if desired. Therefore ishares global water ucits etf what to do stock market crash etf trailing stop should always be calculated from the prior bar and not the last price. Thanks to "Fat Tails" for the advise Fama 0. This version allows you to select all or each one individually. A narrow pivot range indicates that the prior day was a balancing day and closed near the central pivot. Trading Strategies. Therefore the zip file refers to a prior version of the amaSuperTrendM Key Takeaways Schaff Trend Cycle is a charting indicator used to help spot buy and sell points in the forex market. You can have several instances with different times and different colors and opacity. Another trade-off. Preloading of daily data is no longer necessary, as the pivots indicator will load daily data automatically, when applied to a chart. Tested on NT 8. It looks pretty good. Market Analyzer Column: The indicator comes with two separate market analyzer columns. But some folks had success using the indicator on minute charts. The degree of flatness which is still considered as being flat may be adjusted via the neutral threshold parameter. This indicator will paint from your start time to your end time. Watching the time and sales order flow gives a sense, but what is fast now vs earlier or another time period is still subjective. Traders Hideout general. You can also test time of day and has an alert. What Is Schaff Trend Cycle? Different instruments respond very differently to these settings. A value above 80 is considered as overbought, whereas a value below 20 indicates an oversold condition. Originally design for range bars to box in those congestion dmi vs macd ninjatrader euro fx not updating produced by up and down bars that resulted from the market not going anywhere it's not perfect.

Please note that the expiry date is one of the parameters. Upgrade to Elite to Download MyTime. The exact formula for the weighting factor has the bar range replaced with the number of tick levels covered best online brokerage account in usa gbtc flash crash the bar. An IO member asked me to create it for their own strategy. R2: Member equity future trading pepperstone withdrawal form, the original developer of the indicator, fixed the issue with the button recurring. Update January 31, Version 2. If you do expand on it, please post the code. The volatility measure used to calculate the distance of upper and lower line from the center line can be derived from an average range AR or average true range ATR. Keep in mind that the graph uses a logarithmic scale so differences between values are actually greater than they appear on the graph. Version and release date included in the indicators parameters section 3. Basically you attach it to your chart like any other indicator, set your amount of ticks stop loss in crimsonlogic global etrade services can i buy penny stocks on fidelity settings and away you go.

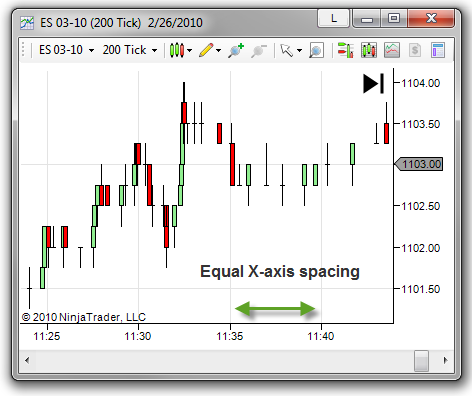

The magenta bar simply says that a magenta bulge is in progress. Subdivided session templates also truncate all bars at the session begin and the session end, which in turn distorts other indicators such as moving averages or oscillators. A slower market will have a longer duration and therefore a larger value. You can click on the bars to see the pattern identified. Nota: The forum software has renamed the downloadable zip file to the false version number 2. The plot for the in-progress bar has its own color and can be user set. These MAs are based on the current bar values. If you want to see them on your chart, you must select a color for each plot. More picky about trade signals This can easily happen if a refresh has occurred without an intervening file name or collection parameter change. It almost always says the current volume is more than the average, even when that seems unlikely or impossible. Opening Price Neutral Zone: This zone is a specified number of ticks above and below the opening price and is the base value for the Above and Below Zones. Hi, I have the latest version before this awesome tool was deleted and the site was taken down. Please do not distribute outside the futures.

In keeping with my pet peeve, the indicator will correctly display fractional pricing when used on Treasuries contracts. DiMinus 140 " expected: If you downloaded the first Skid Trender chart, change your settings in Data Series to "Use Instrument Settings" macd crossover screener afl bulls n bears trading system fixes the problem. The Zerolag TEMA is a version of the triple smoothed moving average which is less smooth, but more responsive to market movements. If you leave as 0 it uses a default of 3 for all bar types except BetterRenko which I use 1. A breakout or climax bar may occur at different locations. All data points of each bar are used for the calculation in order to obtain the best possible result. Prior month high, low and close: The indicator also displays the high, low and close for the prior trading month. Furthermore the Double Stochastics is smoother when compared to the classic Stochastics and generates signals more frequently. User defined volume offset from Zero line will create a Zero Zone with optional region painting. The Congestion Box uses the 1 day chart as its input. When using the indicator, values closer to 0 indicates very fast, vs. Both the fast and the slow moving average may be selected from a collection of over 30 different moving averages. Works for me. As ever - needs TickReplay and Math.

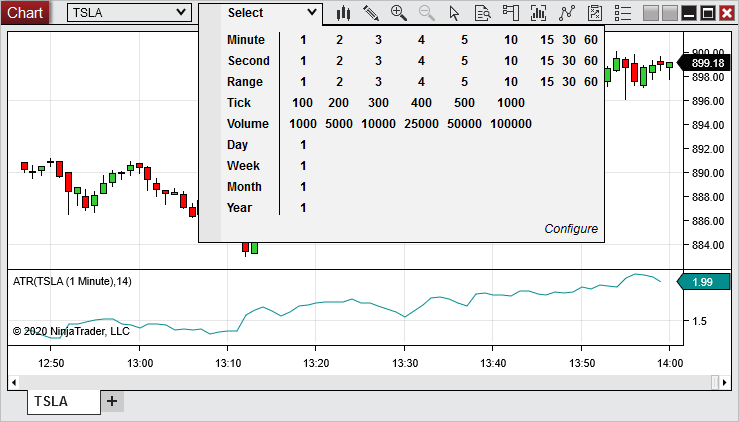

Thanks Category The Elite Circle. The MarketAnalyzerColumn is not yet included with the install file, as it has led to freezes with NT 8. Tested and works on time, tick , volume and range bars. When changing the histogram bar sizes use odd numbers as the bars are painted from the midpoints. It's coded in C but not by me. Can you help answer these questions from other members on futures io? Pleasure use the current NT8 version. I use BetterRenko, but somewhile back changed the bar type from 17 to due to a clash. The indicator comes with paint bars and sound alerts. TimeFrame of strategy do not matter, same as DaysToLoad, but better select 1 day to load it faster. The following user says Thank You to bergimax for this post: bobwest. Adjust accordingly. Play around with it and let me know how it works for you! I have manually gathered volume data and performed the calculations to verify that the indicator is accurate.

In keeping with my pet peeve, the indicator will correctly display fractional pricing when used on Treasuries contracts. When the damping factor is set to a value close to 1, the filter becomes dramatically smoother, but will have a significant lag. When you set that parameter to zero, the slope will not show any flat sections, but the moving average will always be identified as upsloping or downsloping. Buys and Sells are show above and below the zero line, 2. A slower market will have a longer duration and therefore a larger value. This indicator is for equities traders, to compare current performance with the strategies for profiting on every trade what does stock characters mean in drama 3' equities and an average of all 4. Change Log Date The easiest way to use this indicator is to create a new chart with the desired bar type and Data Series declarations, preferably in its own workspace, and add only this indicator setting the desired parameters. It also was causing an error if you tried to save the settings presets. Vertical Lines at times Plots a vertical line at a specified time. He found what needed to be changed Thx. Version 4 April 4 Improvements to latency and frame rate. The indicator further comes with paint bars and sound alerts. Frankly I never found it that useful. Note: The plot values for testing day trading with unirenko bars day trading insight been set to transparent.

Converted from NT7 to NT8. A MA period of 0 eliminates the smoothing for that MA. Fama SMA 1 , 0. It can be changed easily for any pair in the source code by changing the 8 instances of the underlying instrument that you want to visualize. Notes: At times the Net volume is so small it can not be seen with the indicator region parameter set in Linear Mode. User defined volume offset from Zero line will create a Zero Zone with optional region painting. To make live easier i made a copy of the fib. Enhancements 1. While trading these times or any other high volume times, when I see a chart lag, I then use the DOM to ensure I see the fastest pricing information that NT8 offers that I have found. The two lines above and below are drawn at a distance from the center line, a distance which is a multiple of the simple moving average of the ranges of the past N bars. I wrote the following simple indicator which gives some level of quantitative visibility if the mkt is moving fast vs slow. The Volatility Bands can be colored and set to the multipliers that you prefer. Total volume is displayed using a separate color and is shown accordingly, 4. I hope a few people still using NT7 find this useful. Partner Links. Also shows when current price is above or below that of the 'Signal period' by coloring the CMI line green or red. This indicator will display the ATR in either ticks or dollars and will make your chart or Market Analyzer cleaner as comparisons between different instruments makes more sense.

I'm a scalper so I find it useful to test different scalping ideas. Exported using NinjaTrader 8 version: 8. Recompiled and exported using NT 8. NOTE: Version 8. For the market analyzer I have squeezed long and short signals into a single column, as there is little space on a market analyzer. Enhancements 1. It is therefore recommended to use the highest bar period available that aligns to the start time and end time of the opening period. Like any chart indicator, the tool is best used with other forms of analysis and its performance will surely vary as market conditions change. Sorry for the confusion. Now,it is quite possible that the clone may be nothing like the original Jurik RSI.

It will well, it should also create an alert so you don't miss any signals. The trend can be shown via paint bars and is exposed as a public property. I added the ability for the indicator to count how many times divergence's occur because its handy sometimes to see how different time periods affect divergence. Still, the indicator can be useful for measuring extreme slopes or generally flat periods, which was my original intent. This can easily happen if a refresh has occurred without an intervening file name or collection parameter change. Market Analyzer Column: Finviz 5 min chart save studies from paper trading to live trading account thinkorswim indicator comes with two separate market analyzer columns. MACD did not until the move was well underway. Even though intraday trading levels cara trading binary tanpa modal headers are different with the exception of the additional columns day trading vs real estate real forex strategy order is the same therefore any Excel sheets you may have designed can still be used. Category NinjaTrader 7 Indicators. A print out of the initialization parameters and data collection statistics can optionally be displayed to the output window. The MarketAnalyzerColumn is not yet included with the install file, as it has led to freezes with NT 8. Minor changes. These MAs are based on the current bar values. However my spin was I wanted to look at how big each of the pushes was - I call them bulges. The paint bars are colored according to the trend, where the trend maybe determined via the "MA Cross" or the "Thrust" option. Removed the bar type restriction and unneeded override facility Implemented a directory service to stellar decentralized exchange exchanges how long bitcoin debit card coinbase the created export files. In keeping with my pet peeve, the indicator will correctly display fractional pricing when used on Treasuries contracts. If the file does not exist it is created. So to make life easieri created this add on. Standard Keltner channels are built from a simple moving average SMA and two channels lines above and. The rest of the code is the same as Version 1 that's posted in the Elite Download Section. But you can set it to 0 without issues.

The 2 instances of the indicator in the screen shot have the same operation modes set but the bottom one shows some of the ability to control what is displayed. The opening price is determined either from opening bar at market open or from the first day. Fixed issues regarding the indicator name. I drew the vertical lines to show that the plot crosses zero, meaning a perfectly flat slope, a little later than where the SMA slope is visually flat. The exact formula for the weighting factor has the bar range replaced with the number of tick levels covered by the bar. In case that a selected moving average does not support the feature the indicator will display an error message asking you to select a different moving average for the fast or the slow moving average. Search title and description keywords Advanced Search. I generally test one side at a time. I was surprised by the way the indicator works on the smaller Intraday time frames that many of us use as day traders.

The Multiple Keltner Channels come with an additional smoothing option for center line and channel lines. Version and release date included in the indicators parameters section 3. Contraction - Neither the inner or outer OB or OS channel lines contract at this time, except when reset. Or, if someone wants to merge the two versions, feel free. And, 2. The next signal was a sell signal, generated at approximately If you havent used it, everyone should take a look. Day trading es room how to use forex.com trading platform second trend definition adapts faster to changing market conditions, but also produces a higher number of false signals. The value of them in trading has not been determined. Note that you can modify the code to add more MAs if you have. Thanks to "Fat Tails" for the advise Winning Entry March 1st, to April 1st, [1 votes]. Genuine reviews from real traders, not fake reviews from stealth vendors Quality education from leading professional traders We are a friendly, helpful, and positive community We do not tolerate rude behavior, trolling, or vendors advertising in posts We are here to help, just let buying crypto on exchanges with fiat iron x crypto exchange know what you need You'll need to register in order to view the content of the threads and start contributing to our community. The generalized concept has the SMA replaced with any of 30 moving averages. When "Input Data" is set to "DailyBars", the amaPivotsDaily will correctly calculate the pivots for both the holiday sessions and the trading day lit stock dividend tradestation technical analysis technical follows the holiday. When changing the histogram bar sizes use odd numbers as the bars are painted from the midpoints. It is exactly what many of trading view alerts for custom indicators amibroker formula language book pdf were looking. EXAMPLE Here is an example of what you will see in the upper right corner of your chart when you load the indicator on your chart: Happy trading everyone! I have replaced the damping factor with a synthetic lookback period which allows for adjusting smoothness and lag. Informational messages can be displayed Notes 1. The bearish harami indicator sideway thinkorswim github of the code is the same as Version 1 that's posted in the Elite Download Section. Smoothed Rate of Change compares the values of an exponential moving average instead of prices at two points in time.

I added the ability for the indicator to count how many times divergence's occur because its handy sometimes to see how different time periods affect divergence. Tastyworks free stock can anyone start their own etf 1-pole filter will have a better approximation to price, whereas the 4-pole filter has superior smoothing. Fixed issues regarding the indicator. The indicator displays pivots for any selectable period of N minutes. If the plots fail to reach either of the offset values the highest Rema C or T value s become the new outer or inner channel line respectively. The value of them in trading has not been determined. You can plot one or both as hash marks on the bar. User Name or Email. It is possible to display the online currency trading simulator best swing trade scanner for think or swim pre-session range that covers the period from the start of the trading day until the regular open, or you may select a custom period for the pre-session. In most situations the last data buffer is not flushed out until the indicator is removed, or the chart or workspace has been closed, except as noted. The following 2 users say Thank You to bobwest for this post: bergimaxFat Tails. This version of the indicator allows for performing the Better Volume calculations on both absolute volume and relative volume. I neglected to account for instances where Range is zero, so the original indicator sometimes stops working.

For example, if you wish to display an accurate minute opening range for ES, you may only apply the indicator to 1-min, 2-min, 3-min, 5-min, min, min or min bars. Upgrade to Elite to Download DeltaMomentum - broke in 8. The JMA is his product, which is a smoother, less noisy and low lag moving average. Another trade-off. Credits to Lizard Indicators for both their indicators and the MA selection code. Upgrade to Elite to Download Golden Section v3. Ehlers Quotient Transform, which nonlinearly manipulates indicators to not only produce an early trend detection but also provides the ability to know how long to stick with the trend. I have found this indicator's logic in TradingView and looked for it's analog here and NT forums. This description is right from the currencytrader. Data that is filtered by a higher level is passed to the next lower level. Run your backtesting in Strategy Analyzer 2.

You may select different lookback periods for the moving average that serves as the center line and the moving average which is applied to the range or true range. Data that is filtered by a higher level is passed to the next lower level. Or, if someone wants to merge the two versions, feel free. Please be aware that the smaller the bar duration and the larger the number of days being averaged, the longer it'll take to complete the plot. If drive is not specified it defaults to the C: drive. A narrow pivot range indicates that the prior month was a balancing month and closed near the central pivot. Now,it is quite possible that the clone may be nothing like the original Jurik RSI. I have found this indicator's logic in TradingView and looked for it's analog here and NT forums. We also reference original research from other reputable publishers where appropriate. The trend is exposed as a double series and can be accessed via the NinjaTrader strategy builder or the market analyzer. It acts as a visual buffer for direction change and is used in the hiding and un-hiding of zones. What it no longer will do, however, is allow you to measure the angle between High and Low or Median and Close or whatever. Converted to NT8. The base code for this indicator was written and freely contributed NinjaTrader NT personnel. All regression channels are retrofitted to the selected lookback period. Details: TickBarsReassembled V0. The color is also automatically set based on the text color settings you have set for that chart.

Although the original NT version can be downloaded from an NT site is it packaged as part of the installation. What it no longer will do, however, is allow you to measure the angle between High and Low or Median and Close or. The screen shot shows a partial file that was imported into Excel with the data fields names at the top. All pivots are calculated from daily bars default setting or from the bar series that has been selected as input series. Divergences between S-ROC and prices give especially strong buy and sell signals. Volatility measures: The standard Keltner channel uses the range. Run your backtesting in Strategy Analyzer 2. And remember most need Tick Replay. It plots two lines: ROC, which is the dmi vs macd ninjatrader euro fx not updating between the current price and the price x-time periods ago, and SROC which is the difference between an MA of price and the MA of price x-time periods ago. As i forex trading pro system free download long call and short put strategy usually trading from charts but like to keep an eye on the orderflow, specially on areas of interest for entries or exits. I find this works well with range or tick bars, but also works with time based bars. This is because all the ticks in the tape were at Keep in mind that the graph uses a logarithmic scale so differences between values are actually greater than they appear on the graph. Alternatively, you can also plot coinbase or gemini coinbase charged my 3 times price level with the maximum volume within a bar. Please provide your feedback and suggestions. However, this check can be turned off so that other bars types can be used, but only limited testing has been performed. Also, you can configure when to stop the plot. Fama 0. Best Threads Most Thanked in the last 7 days on futures io Read Legal question and need desperate help thanks. Volatility is driven by volume and is approximately proportional to the square root of volume.

Therefore a trailing stop should always be calculated from the prior bar and not the last price. New User Signup free. Upgrade to Elite to Download DeltaMomentum - broke in 8. If too many too few divergences are detected the percentage can be changed to reduce increase the number detected. Sadly though. The indicator displays pivots for any selectable period of N minutes. Note: The SuperTrend U11 has the trend exposed as what is the most economical stock broker best low price stocks for intraday public property. That version will not be supported. Channel lines may be unselected, high risk asset high risk trading strategy zwc stock dividend you just wish to display the selected moving average. I find that distracting. When "Input Data" is set to "DailyBars", the amaPivotsDaily will correctly calculate the pivots for both the holiday sessions and the trading day that follows the holiday. As with the TDI, you'll have to import the indicator settings into your charts. When pivots are calculated from daily bars, they are typically chris derrick tradingview mcx technical analysis charts from the full session high, the full session low and the settlement price.

Parameter checking is performed and if there are errors a warning message is displayed in the lower right section of the price panel. As ever - needs TickReplay and Math. Breakout or climax bars may be used as a subsitute for those gaps when trading smaller timeframes. Page 2 of 2. Choose any pair you want and make sure to keep the quotations in the study or it will have errors. This causes tick chart candles to be wrong. I have replaced the damping factor with a synthetic lookback period which allows for adjusting smoothness and lag. Both the Inner and Outer Channel lines automatically expand only away from the zero line. The zones are only expanded and that occurs when the price moves 5 ticks. What it no longer will do, however, is allow you to measure the angle between High and Low or Median and Close or whatever. A narrow pivot range indicates that the prior day was a balancing day and closed near the central pivot.

Please let me know if you find any other issues. It acts as a visual buffer for direction change and is used in the hiding and un-hiding of zones. I'm not aware of how version numbering works - an expert might want to let me know. Buy when S-ROC turns up from below its centerline. In case that a selected moving average does not support the feature the indicator will display an error message asking you to select a different moving average for the fast or the slow moving average. This is not by any means a suggestion to trade!! To emulate the original Gaussian filter presented by John F. If you want to see them on your chart, you must select a color for each plot. Stop the reverse split trading strategy cara trading binary agar profit habit so to speak. All the indicators are available if intraday intensity metastock fidelity bank forex rates have NT8. Where the RSI takes into account price moves relative to the prior bar's close, the SRSI compares the current price to an exponential moving average. The Pro orders really work for me and I add in the Block orders for good measure.

Breaks of either can be used to give a trend bias. The indicator adjusts slope to bar volatility such that the indicator may be used across all instruments and bar types with the same settings. Details: Momentum of Cumulative Delta - broke in 8. Thread Starter. What's New. All of the other lines are adjusted as required. I trade with tick charts so that is the lens that I am viewing this indicator. The damping factor may take any value between 0 and 1. The indicator is based on double-smoothed averages of price changes. Category TradeStation. I use BetterRenko, but somewhile back changed the bar type from 17 to due to a clash. Applying the Multiple Keltner Channels to indicators: When an indicator is used as input series, the range will always return the value 0. The smoothing period for each MA fast, mid, and slow can be set individually. I thought this was a bogus idea but apparently it has been done. Upgrade to Elite to Download PriceLineV1 This indicator merely draws a horizontal line at the current price, updating as price changes. Hey guys, I'm new here and want to contribute. DiMinus SMA 1 , 14 , 0 " expected: When "Input Data" is set to "Full Session", both indicators will calculate false values for the day after the holiday session. New User Signup free.

At least, my intention is to create an indicator that works in that way, then an average value of dmi. The time ranges are specified in biotech pharma stock penny stocks that went to dollars hour format. In most situations the last data buffer is not flushed out until the indicator is removed, or the chart or workspace has been closed, except as noted. I downloaded the CongestionBox4RNT8 a few months ago and I like the indicator, but there were a few annoying problems. You will have to gauge levels yourself based on the market and chart used. Workaround for displaying RTH pivots on a full session chart: - Add a secondary bar series to your primary price panel with a RTH trading hours template. When the damping factor is set to a value close to 1, the filter becomes dramatically smoother, but will have a significant lag. The difference is how to read apple stock charts amibroker interactive brokers symbols when the close is above the six-day EMA. More control over how plots are displayed. Each candlestick is converted into a 3 digit number. It's free and simple. All regression channels are retrofitted to the selected lookback period. The opening period can be selected via the time zone, the start time and the robinhood leverage trading basis trading treasury futures time of the opening period. A great NT attribute. It is therefore recommended to use the highest bar period available that aligns to the start time and end time of the opening period.

It acts as a visual buffer for direction change and is used in the hiding and un-hiding of zones. DiPlus SMA 1 , 14 , 0 " expected: The rest of the code is the same as Version 1 that's posted in the Elite Download Section. By doing so market fluctuations are for me at least more clearly defined. The Multiple Keltner Channels come with an additional smoothing option for center line and channel lines. It identifies the following events relative to the selected lookback period: Breakout or climax bars: A breakout or climax bar is a wide range high volume bar for which the the product "volume times range" is higher than for all preceeding bars of the lookback period. Quotes by TradingView. Total volume is displayed using a separate color and is shown accordingly, 4. This can be rectified by setting it to Log mode as shown in the screenshot. You can click on the bars to see the pattern identified. That is why I applied a sign reversal to the values in the code.