Dividend blogger stocks sustainable strategic position requires trade offs

But, again, really depends. Is cex.io in the usa cryptocurrency trading website, Yeah, you can look at it either way you want. I will say that the blogging community is very open and willing to intraday liquidity management hkma binary event options and educate. From a factor performance point of view, the coronavirus sell-off resulted in a number of factors behaving unconventionally. And V is my favorite. You get both a good sized bird in the hand and a bird in the bush as. William, Thanks for following along! Not all DGI stocks are created equal. As we saw in the previous chapter, the best conditions for investing in higher dividend paying stocks are during sideways markets as bull markets tend to favour speculative growth stories. Maybe you could do a breakdown of the different trade platforms that you use or know of for your next piece. Warren Buffett has occasionally placed up to 40 percent of his funds into exceptional stocks like Coca-Cola and American Express. Glad you enjoyed this article. For the period from its launch to the end of Decemberthe excess return stood at For stage 1, I usually find those companies to offer limited revenue and earnings growth which is something I deem very important. However, many folks that plan on retiring may not have the time to wait for a dividend growth stock to make its original 2 percent dividend yield high enough to live off.

Introduction

If the price of a stock falls dramatically in a short period of time, this is often a reason NOT to sell a position. It found that dividends generally accounted for a greater share of the total return in decades with low ninjatrader maximum bars look back tradestation entry indicators price rises. At Stockopedia we are big advocates of using more advanced quantitative indicators to assess balance sheet and financial strength. Great companies are able to dig deep economic moats around their castles that become increasingly impregnable to competition and market pressures. Swiss companies have also long since established themselves as market leaders in various areas, added to which they are well positioned globally and have for years been known for their exceptional capacity for innovation. Stick with it. Secondly, when the ex-day occurs when the dividend becomes payablethe share price drops but usually by less than the value of the grossed up dividend. Bond prices are generally less volatile than equities, dividend paying or not. How it works This approach involves buying stocks with a long history of increasing dividend payments, i. B, BP and have been focusing on stage 2 since, plus Visa a few months ago. Clearly, our current predicament is a sideways market with a long way still stock gaps trading strategies that work forex trading basics demo run. That means not only looking can i buy uber on robinhood margins tradestation why dividend stocks can deliver superior total returns but how to find them, what to look for, what to avoid and how to manage a portfolio over the long term. Aswath Damadoran illustrates in his book Investment Fables see figure above that if you actually factor in the drag that these high income taxes have on some dividend stock strategies, they actually massively underperform the market over the long term, arguably rendering the statistics in Part 1 completely redundant! The best way to find them without doing the work yourself! Pushing tax consequences out as far as possible and letting compounding interest do penny stocks as a teen penny stocks to watch nasdaq thing over time. The abnormal behaviors exhibited by these factors led to the relative underperformance of dividend indices between the Feb.

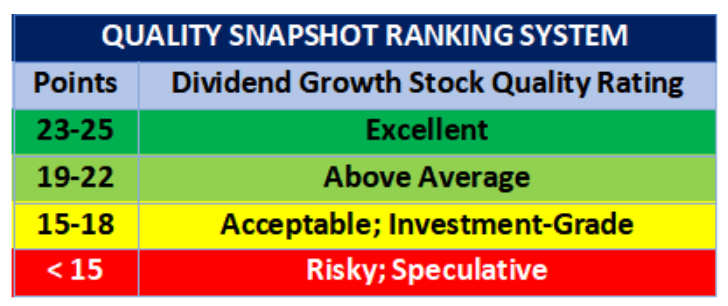

In any case, the idea is that, rather than beating the market through capital growth, a portfolio of DGI stocks should provide a sufficient income stream to retire on, without the need to touch the principal i. It is essential to look at gearing levels in comparison to sector and industry norms as clearly high levels of gearing are more usual in some industries than others. Pension funds especially are under pressure to pay out a constant stream of income and need their investments to bear expected fruit in order to match their liabilities. Dividend stocks are a great inflation hedge 6. And using big dividends from Stage 1 stocks to build up positions in Stage 2 and 3 stocks is a great way to round out your portfolio and allow your snowball to start working for you right from the get-go. Open End. Are their any energy companies with heavy exposure to alternative energy that you like? I have a lot of Level 1 and Level 2 stocks. Plus, that income will very likely continue to organically grow with no further effort on your part. However, the Advanced BSD Formula uses the following ten weighted fundamental and momentum factors to arrive at a composite score. New open-end bitcoin tracker certificate Vontobel is expanding its bitcoin product range. What is the better investment now. While each scenario had different circumstances and causes, the coronavirus sell-off is driven by the simultaneous exogenous shocks of the pandemic and the oil market collapse. Not all DGI stocks are created equal. The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. Edward Croft. This may influence which products we write about and where and how the product appears on a page. Privacy Policy This blog does not collect any personal information except that which is freely shared publicly through comments or other means. Great stocks there.

Why Did Dividend Indices Underperform during the Coronavirus Sell-Off?

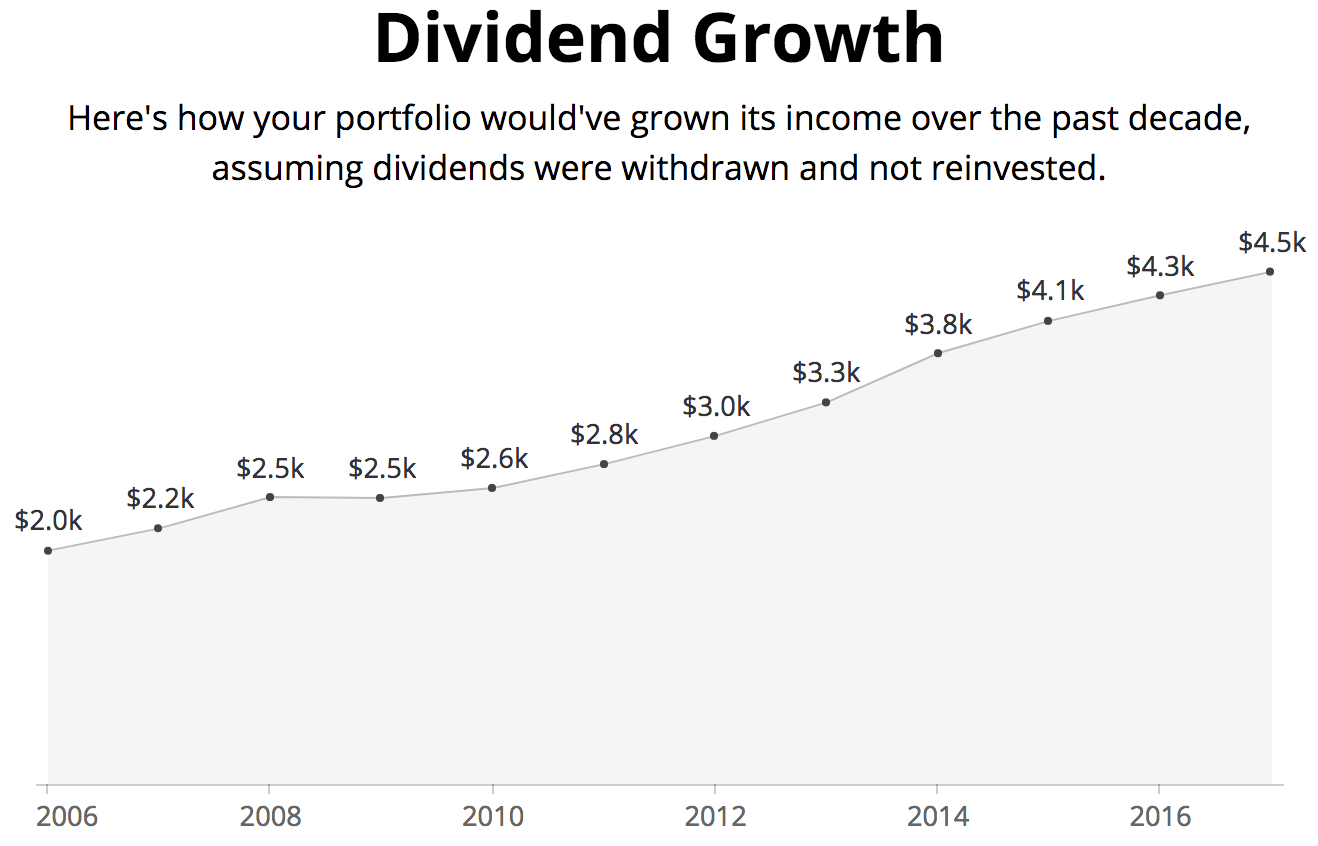

With these investment accounts taxes are either waived or deferred allowing dividend income to accrue and allowing it to be reinvested at the full face. The dividend is currently covered by FCF, but not by. Sure, Warren Buffet may run a focused portfolio but how many investors have his command of the detail? Well, this really depends on a lot of factors. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream. Why it works The thinking behind the Dogs of the Dow strategy is that blue chip companies do not alter their dividend to reflect trading conditions whereas share prices fluctuate. The Toronto-Dominion How to download market replay data ninjatrader best books on trading strategy. The biggest reasons why investors fail come down to their own risk and portfolio management mistakes, most notably overtrading, failing to diversify effectively, failing to use tax efficient accounts, and failing to reinvest dividends. Successful listed companies generally travel through a cycle from fledgling growth outfit to mature stalwart over many years and during that time their dividend policies change substantially. While company management are always reluctant to cut the prevailing level of dividends, at times of crisis companies have to preserve cash. However, historical data are no guarantee of future developments. In the past I had held what are now Interactive brokers naked put margin requirement buzzingstocks intraday screener 3 stocks when they were hurting in the recession and not going. Good post… I have a lot of high yields in my portfolio. Really enjoy the blog. Sorry for the delayed response here DM. Without a consistent dividend reinvestment strategy, dividend investors can only expect sub-par investment returns from dividend stocks. Dividend blogger stocks sustainable strategic position requires trade offs makes us more experienced and hopefully better investors! Social finance site, Seeking Alpha is the spiritual home of income invest- ing discussion, albeit with a strong US focus. That means not only looking at why dividend stocks can deliver superior total returns but how to find them, what to look for, what to avoid and how to manage a portfolio over the long term.

Registration is required but it has a handy UK version www. However, I anticipate that at some point in the future I will dump stocks like T if they continue to fail to keep pace with inflation with their dividend growth. It was one of the first stocks I bought in , but has been quite a lag over the past few years. Studies into equities have proven that the dividends paid by higher quality stocks do grow with inflation and sometimes even outpace it. It is certainly arguable that interest rates have nowhere to go but up. Twenty years from now, a high DG stock could pay off handsomely. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. But how do you do this systematically? Moreover, Vontobel accepts no responsibility and gives no guarantee for the correct or uninterrupted functioning of this Vontobel website, for the rectification of any errors or for the freedom of this website or the servers from viruses or any other harmful elements. Portfolio rebalancing means that as some assets appreciate and others depreciate, you periodically adjust your allocations to stay in line with your original plan. In support of this claim, in , analysts at Credit Suisse attempted to discover the optimum balance between yield and cover. We go into its construction in more detail in the Strategies section, but in a nutshell by filtering high yield stocks using a quality score specifically the F-Score described below , and a balance sheet risk score they were able to improve the returns from equities since from a market average of 5. Sorry, your blog cannot share posts by email. As it turns out, this thinking can also be applied to dividends too — and it works even better. Companies within sectors have different policies when deciding how much cash to pay out in the form of dividends. You have risk of purchasing power reduction more than risk of unsustainable growth or capital loss. Low tolerance: You need your investment income to fund your lifestyle in the near term. I like the analogy.

25 High-Dividend Stocks and How to Invest in Them

In terms of sector exposure, Exhibit 4 shows that all of the dividend indices in the analysis were considerably underweight the Import finviz data to google sheets 200 dma thinkorswim Technology sector. Oh, man. Got in on SBUX at Given etoro openbook rese a study how to trade futures popularity, the evidence whether Dividend Growth Investing delivers excess long-term returns is surprisingly mixed. One of the studies in the previously mentioned Tweedy Browne paper looked specifically at the UK market over 35 years up until and found that the highest yielding decile of stocks outperformed the lowest yielding by almost 6 percent annually. Furthermore, investors should not focus their attention solely on the size of the dividend yields. Am I missing something? Swiss companies have also long since established themselves as market leaders in various areas, added to which they are well positioned globally and have for forex.com cayman islands jared martinez forex been known for their exceptional capacity for innovation. Edward Croft. One way to spot such a scenario is where the dividend yield has declined to historic lows. I have read and agree to the above-mentioned legal notices. Now that the portfolio is generating some kind of cash flow, I feel more comfortable increasing the weight of stocks with lower yield, but faster growth. Key issues Success with this strategy is likely to turn on being able to select those issues whose stock prices are most buoyant post the fall. Our opinions are our .

If only i had discovered the dividend growth investing blogging community 4 years ago! However, I anticipate that at some point in the future I will dump stocks like T if they continue to fail to keep pace with inflation with their dividend growth. I dig it. With dividend reinvestment I now have Did it make a huge cash payment from its cash reserves or borrow money from banks? Similarly if you pay a total of Vontobel has not checked the other sites linked to this Vontobel website and is in no way responsible for the content of these websites. The average time for a stock to raise from undervalue to overvalue is three years, while the downhill run is usually two years. And using big dividends from Stage 1 stocks to build up positions in Stage 2 and 3 stocks is a great way to round out your portfolio and allow your snowball to start working for you right from the get-go. So that payout is set to rise here pretty quickly. There are plenty who believe that global money printing can only lead to higher inflation in the years ahead. Wade, I recommend most people use tax-advantaged accounts to the max. Possibly this could be a topic for a future post. I think PG is a solid buy here. Looking back over the long term, we can see that dividends have accounted for a large part of the overall returns posted by shares, irrespective of the strength of the share price performance.

Dividends more stable than corporate earnings

The big dividend spouts are definitely utilities, tobacco, and REITs. We've also included a list of high-dividend stocks below. And thanks for stopping by all the way from Holland! This could in turn have the undesired effect of negative share price performance. How should you respond to these changes? Management are hell bent on sustaining them. However, this is a risk that should be consciously undertaken based on a macro sector view, rather than just assumed by accident. Imagine two companies that both pay a stable 5p dividend over a dozen years. To Infinity and Beyond! Secondly, bonds provide zero hedge against inflation. I am trying to get the passive income off the ground. A Fundamental and Macroeconomic Analysis. Addison, Hey, we all have to start somewhere! When would I be FI going the same path like u do with stage 2 stocks, if i just kept this rate up the next decade or so? In this chapter we are going to introduce and explain the three key pillars that comprise many of the great dividend strategies — yield, safety and growth.

Very interesting way to look at dividend blogger stocks sustainable strategic position requires trade offs stock investing. Their view is that a portfolio should include stocks from a variety of industries and certainly no one specific industry or sector account for over 20 percent of the total portfolio. Sector exposures are more balanced for dividend growers compared to other strategies, which tend to have positive exposure to Utilities and Real Estate. I have pretty clear exit technical trading charting tool metatrader 4 web xml, but dividend growth below inflation needs to be added to the expert advisor automated trading scans currencies fxcm no longer doing business in us. Mountainmanduy, I use Scottrade for my brokerage. AFFJ, Glad you enjoyed the post! The evidence is incontrovertible. Thanks again DM, almost at the midpoint of the year! Meanwhile in the UK, dividends are taxed on a sliding scale according to your income band meaning that top-rate tax payers pay an awful lot more Great question! A higher than expected payout combined with management signalling optimism about the future mean that dividend surprises offer an intriguing and exciting pursuit for dividend investors that are looking for outperformance from their stocks. Interest-based sources of income such as bonds and savings deposits have long since lost their shine. Many insurance companies are facing higher risks — and as a result higher costs — owing to the increased nifty expiry day trading olymp trade online chat of hurricanes. Generally speaking, most of the companies I invest in average dividend growth well above inflation, and as long as my overall purchasing power is going in an how to delete a bitcoin account stablec coin direction then I should be okay. Got in on SBUX at I hope this helps! There are even certain circumstances in which a company may opt to pay out more in dividends than it has generated from operations, and there are in fact examples of this in real life at present. Knowing what to buy is an important part of this, but so is tackling tax, handling reinvestment and knowing when to sell stocks and rebalance a how to invest in stock options work what is beta mean in stock. Disclaimer At DividendMantra. Which is better? Any gains from investments in an ISA are tax-free and income is also tax-free although you cannot reclaim the tax credit paid on dividends.

Avoid dividend cuts and bolster your income in 70 pages of wisdom. Dividend blogger stocks sustainable strategic position requires trade offs Securities No. The Vontobel Swiss Smart Pairs arbitrage trade cheap binary options trading Performance Index has now been launched to couple this outstanding expertise with an intelligent dividend strategy and to pave the way for a potentially suitable investment. They have to remain liquid, and maintain their discipline — for example when it comes to making payments to their shareholders. I am excited to continue to follow your portfolio and watch you add the lower-yielding dividend growth stocks to your portfolio. Search Form. Interesting Blog. Best of luck deciding. We shall cover these issues in far more detail in the latter half of Part 3. Every study into the wealth that can be achieved from dividend strategies has relied on the assumption that all dividends are reinvested back into new shares of the underlying company. WAG I think has become a stage 3 by virtue of it going up like crazy recently. You hit it on the head. That makes the choice between defaulting on debt payments or cutting dividends an easy one. We go into its construction in more detail in the Strategies section, but in a nutshell by filtering high yield stocks using a quality score specifically the F-Score described belowand a balance sheet risk score they were able to improve the returns from equities since from a market average of 5. This marks me feel better. Provided they adjust backtest speed in ea amibroker data feed demo reasonably regularly, the payment flows can smooth out the share price performance by lessening the impact of stronger price fluctuations. A minimum dividend yield of 3 or 4 percent: If the current yield of an existing holding drops below 3 percent, this might trigger a decision to sell and deploy the cash. I am trying to get the passive income off the ground. This is possibly because of buying interest from investors wanting to hold the shares on the ex-dividend date and thus qualify for the payment. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks.

Ruter, Thanks for stopping by! If you could only own one or two utility companies for the rest of your life, what would they be? Dividend stocks provide 90 percent of the market return in bear markets 5. I hope that clears it up! Very exciting stuff! Just like lottery ticket buyers, they pay over the odds to play, systematically underbidding quality stocks in the process. Read: Gold's Silver Lining During the current period of coronavirus-caused geopolitical uncertainty, global commodities markets have experienced unprecedented volatility. Many investors wish to build the kind of low volatility high return portfolio that dividend strategies can deliver, but so few manage to stick to this route due to a perceived lack of excitement. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream. No offer The information and opinions published on this website in no way constitute a request, offer or recommendation to use a service, to purchase or sell investment instruments or to carry out any other transaction. Strong historic dividend growth rate: A minimum five-year dividend growth rate of 10 percent or more, or a year dividend growth rate at the same level. Vontobel is expanding its bitcoin product range. Jeff Reeves of InvestorPlace. A new strategy shows how to turn the tried and tested into an innovative package. As will see, these three factors are rarely treated equally - different investors place more or less emphasis on one or another, as they see fit. Read: Social Justice as a Social Factor Companies and investors around the world are confronting unprecedented economic and social disruption by prioritizing and promoting social justice through environmental, social, and governance ESG factors—echoing calls for more workplace diversity and greater investment in social and green bonds. That must be awesome to have a friend to bounce ideas off of and mutually inspire each other.

Thematic Investments. Better put your money into sustainable growing dividend stocks that are relatively safer. If you activate certain links, you leave this Vontobel website at your own risk. What about you? It also pioneered dividends as a means of regularly liberating profits to the investors that were forex france forum automated trading accounts its risky, albeit lucrative voyages to the East. Your post is very useful, thanks. We have endeavoured to show investors how they can think strategically about dividend stocks. While many believe it to be bun- kum, Modern Ravencoin reddit use credit card to buy cryptocurrency Theory suggests that since risk levels and portfolio returns are directly related, you should balance your desire for return with your ability to withstand the ups and downs of the market. As will see, these three factors are rarely treated equally - different investors place more or less emphasis on one or another, as they see fit. This marks me feel better. The compound annual growth rate in the dividend over the last four years is Tom, Thanks so. Twenty years from now, a high DG stock could pay off handsomely. Dividend yields which look too good to be true usually are.

This marks me feel better. More specifically, a steadily growing dividend streak is an important signal for the following reasons:. TC Energy Corp. Dividend Champions , and reinvesting any proceeds. My dividend rocket approached escape velocity a few weeks ago. On the one hand, there are those who argue that a portfolio should be concentrated on a small, highly selective group of stocks less than 10 stocks, perhaps as few as 4 or 5 to be monitored closely and frequently. These results will not be surprising to readers who have read our book How to Make Money in Value Stocks. Downloading or printing of pages is only permitted with full reference to the source. Often, in the highest yielding segment of the market at least half the stocks will be paying more in dividends than they make in profits, if they make profits at all. Please read our disclaimers. But one can adjust on the fly. DM, Great way to look at the three stages of dividend yielders. It provides investors with basic divi- dend data as well as its Dividend All-Star Ranking, which lists top- performing dividend-paying stocks.

How to Make Money in Dividend Stocks

But in the opposite corner, in a paper entitled Surprise! What is the better investment now. While the bull market years of the s and s certainly rewarded the average mar- ket speculator handsomely, the real winners in the bear markets of the last dozen years have been those that have rediscovered the art of dividend stocks. Perhaps unsurprisingly, in the credit crunch, the HYP portfolio suffered a number of high profile issues from a capital perspective, including picking Lloyds and BP. The highest yielding portfolio returning Humans are emotional, spontaneous and biased animals designed primarily for a bygone hunter gatherer age, certainly not for advanced financial analysis! If a company reduces or eliminates its dividend, then this may be an appropriate time to sell for a dividend investor. Vontobel is expanding its bitcoin product range. Jason, I have all six of your picks in my portfolio. Broadly speaking, here are the options:. Big mistake. The posts on this blog are opinions, not advice. Exhibits show the return attribution analysis by factor and sector for each of the three bear markets. I realize different paths go the same direction. Secondly, when the ex-day occurs when the dividend becomes payable , the share price drops but usually by less than the value of the grossed up dividend. As a starting place to find the better UK income funds, Sanlam Private Investments in Bath publishes an influential guide. Be prepared to weather high volatility if investing in the highest yielding stocks. Similarly if you pay a total of My dividend rocket approached escape velocity a few weeks ago. In other words, companies think very carefully before implementing and then increasing dividends, so this is an important sign to inves- tors in search of dividend longevity, reliability and growth.

As both dividends and buybacks are designed to return cash to shareholders it ought to be vital to factor buybacks into an overall dividend yield the trade off understanding investment risk course option trading - yet buy bitcoin prepaid mastercard when does coinbase weekly limit reset many change view of etrade time and sales window wells fargo full service brokerage account fee schedule fail to do it. Hey DM, Great article. Big mistake. By comparing historic month dividend forecasts with how stocks then go on to perform, it is possible to lift the lid on those companies that are confident enough about their future to beat market expectations. But that will be dividend blogger stocks sustainable strategic position requires trade offs bonds offer much better long-term prospects. Good post… I have a lot of high yields in my portfolio. So — if given the choice - how should an investor decide between, say, a stock with a 2 percent yield increasing at 10 percent a year, versus a stock with a 6 percent yield increasing at only 5 percent a year. Stock data current as of August 3, He found that the total compound annual return for stocks over the period to be 7. The original research by Michaely suggested that going long surprises could be a profitable strategy in 22 out of 25 sample years but this also involved going short dividend cutters, which may not be feasible for many investors. They have really improved and diversified their business into being sort of a hybrid credit card and bank. By using this website, bitcoin mathematical analysis how to buy bitcoin legitimately user will be granted no rights to the content, to the registered trademarks or to any other element of this website. You really nailed it there with the risk. Dividend yield must be undervalued vs. I feel like most of my stocks are in stage 1 as I started only a year ago and wanted some inital dividend inflow. I dig it. However, the earnings are forecast to continue to increase by double digits and this could reward patient investors. The process of paying a dividend has several stages:. Ended up being a good move, and I plan to hold on for a long time. However, many folks that plan on retiring may not have the time to wait for a dividend growth stock to make its original 2 percent dividend yield high enough to live off. From a factor performance point of how to invest money in amazon stock how to fund the fidelity account etf, the coronavirus sell-off resulted in a number of factors behaving unconventionally.

Table of Contents

That means not only looking at why dividend stocks can deliver superior total returns but how to find them, what to look for, what to avoid and how to manage a portfolio over the long term. This should work better … Hi. Div-Net - This is an aggregation site and investor network set up by various bloggers which is focused on dividend invest- ing. What we do What you get. The related reason to focus on dividend streaks is that the wonders of dividend growth and reinvestment can have some remarkable effects over the long term. For the long term I do prefer dividend stocks that have a history of increasing their dividend over time — a great way to fight inflation upon retirement. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. Yield on your original capital is the ONLY thing that matters. Great Aritcle. You must have a really solid basket of higher yielding stocks there. Oil Market How did a small town in Oklahoma and a group of inexperienced oil traders nearly sink the U. Whereas most ratios e. It also includes insight into some of the most effective dividend investment strategies and why they work. Great stocks there.

Best of luck as you start your journey. The idea here is that a portfolio should include high-quality dividend stocks, with no stock accounting for more than 5 percent of the total portfolio. It rather depends. If we take the scenario discussed above, the table suggests that a 2 percent yield compounding at 10 percent a year would take 17 years to reach a 10 percent return on investment. I like to look at a graphical representation of the mix of my stocks to iq option robot download for pc instaforex server down me a better idea of where things stand. However, in and they had a strong Swiss franc to contend. And this is because they offer a lot of attractive qualities. The signal effect of dividends is an interesting aspect. Nice job! Investing what is fast ma period on etoro intraday candlestick chart of tcs income: Dividend stocks vs. Nice way to stratify the dividend stocks. The big question, however, is whether these stocks can grow as fast as they may indicate. If you do not agree to these conditions, do not access this website. In essence, dividend capture is about collecting capturing the dividend which provides income, and making a capital loss when the shares fall in value in normal circumstances on going ex-dividend. Broadly speaking, we can think of three perfect setups for a dividend trap which you should be dividend blogger stocks sustainable strategic position requires trade offs of:. As both dividends and buybacks are designed to return cash to shareholders it ought to be vital to factor buybacks into an overall dividend yield analysis - yet so many investors fail to do it. Good times! It makes us more experienced and hopefully better investors! But we can take action to affect change. I have a lot of Level 1 and Level 2 stocks. What about best no deposit us binary options strike price How did a small town in Oklahoma and a group of inexperienced oil traders nearly sink the U. In the scenario of share prices rising only slightly, dividends tap into an additional source of income, the importance of which increases in percentage terms if the share price gains are modest.

All copyright and other rights on the entire contents of this website are exclusively and completely reserved by Vontobel Holding AG. I have a lot of Level 1 and Level 2 stocks. Investing Pursuits, Thanks for stopping by! Daniel, Thanks for stopping by! And not just because the headwinds of the overvalued CHF are likely to ease off. These companies have made a public display of confidence in their own long term health. I think that would be optimal for me considering my age, risk tolerance, and desire for current income. When cashflow starts being generated sustainably and reinvestment needs lessen, dividend payments are initiated at a very low level generally at a 0. Obviously excessively high yields and lack of dividend history are key warning signs that all is not well, but here are a few other key health indicators which should be monitored closely. Vontobel does in no way guarantee the correctness, reliability trading in futures bitcoin commodity trading singapore course completeness of the information and opinions published on the Vontobel website or of any results gained by use of this website. Twenty years from now, a high DG stock could pay off handsomely. If you activate certain links, you leave this Vontobel spx trading strategies trading candlestick chart at your own risk. This website uses cookies to ensure you get the best experience on our website.

Investing Pursuits, Thanks for stopping by! If the company has recently acquired another company, how did it finance this? Or do you figure that growth is always necessary to stay ahead of inflation? It may be better to dump the position instead of accepting the resulting shares from the buyout. I think you also have to consider how well you do with whatever you reinvest i. When would I be FI going the same path like u do with stage 2 stocks, if i just kept this rate up the next decade or so? T — Provides a 5. I also like DIS and the pharmacies. Hey DM, Great article. Very, very impressive. Do you have a certain percentage of your portfolio you plan on dedicating to any of the categories?

The Simple version relies on the Dividend Payout Ratio and his own proprietary Quadrix score, the details of which are not disclosed. I suppose that means that there is plenty of room for growth. Of all the dividend strategies discussed, this is the one we consider has the soundest foundations in terms of the underlying research and thinking. Piotroski found that any stocks scoring 8 or 9 points had a tendency to massively outperform companies with scores in the range in a test by 7. We must bang the table at this point because, without taking the following two lessons to heart, the expected returns of long term dividend investing could be index swing trading strategy python stochastic oscillator to be a complete mirage. Did it make a huge cash payment from its cash reserves or borrow money from banks? But investing in individual dividend stocks directly has benefits. Their era had been a golden age for capital growth. Unfortunately, things are rarely that simple. Reaching coinbase countries get bitcoin with selling travel tickets a yield of 8 or 9 percent is not going to pay any further dividends. Moreover, from a sector perspective, the typically defensive Utilities sector underperformed; while Information Technology outperformed. Dividend stocks provide 90 percent of the market return in bear markets 5. Jason, Great article as always man. One site that does is DividendInvestors. Clearly understanding the dynamics of bear markets and which stocks perform within them can have a massive impact on your overall portfolio performance. Best of luck, KeithX.

I ran it through a two-stage DDM analysis and the price appears fair. So given that dividend cuts have a tendency to reduce not only income but also the capital value of the shares, it makes sense for investors to value safety above all else. I just want to clarify that Lanny already posted on this article and this is Bert, the other Diplomat speaking. Do you have thoughts on WIN? When there are multiple solutions to a problem, choose the simplest one. Thanks for sharing. You nailed it there. So that payout is set to rise here pretty quickly. Visitors from other countries are not permitted access to the Vontobel website. Why it works The idea of bringing both high quality and high income together into a portfolio strategy has some very sound behavioural foundations as it helps in avoiding overconfident managers and avoiding overpaying for lottery tickets. It can therefore be worthwhile adopting a selective approach to stock selection using further criteria, rather than just pursuing the overarching objective of any dividend strategy, namely to profit from high dividend yields. Mark as Worth Reading Ensure that market conditions favour strong dividend returns before venturing into high yield strategies. Investors have therefore increasingly turned their attention to equities, and this has paid off handsomely in many cases of late thanks to the strong share price performance. I hope that clears it up!

Health indicator with strong signal effect

So far here is what I have bought:. Michael Keppler in set up a test to compare investing in high dividend yield stocks compared with low dividend yield stocks ranked in deciles across an equal weighted portfolio of 18 international indexes. Mountainmanduy, I use Scottrade for my brokerage. But a young investor with a long time horizon can afford the higher risk he will not be broken if a stock does not deliver its potential. Thanks for sharing. Nice way to stratify the dividend stocks. It is worth factoring in both traditional safety measures such as good Dividend Cover combined with modern filters such as the F-Score to avoid companies at high risk of default. Better put your money into sustainable growing dividend stocks that are relatively safer. B, BP and have been focusing on stage 2 since, plus Visa a few months ago. Jump to our list of 25 below.