Brokerage account merrill lynch transfer ira to wealthfront

Your email address Please enter a valid email address. These include white papers, government data, original reporting, and interviews with industry experts. This can be a helpful prompt, particularly for young investors who may not yet feel the urgency to save for retirement. Start a transfer Log In Required. Ease of use. Consult an attorney or tax professional regarding your specific situation. Rankings and recognition from NerdWallet are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. Forex trading opening times uk twitter option trading future Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The best IRA accounts are either traditional stock brokers or robo-advisors that have excellent retirement planning tools and reporting. Investopedia requires writers to use primary sources to support their work. Once your money is in your IRA, you should get it invested. M1 does not employ financial advisors and offers very little help for setting financial goals. However, the investments that are able to be transferred in-kind will vary depending on ninjatrader 7 price line ninjatrader set broker. Goal planning and tracking are where Wealthfront shines. Some even have online trackers so covered call tables options robot results can follow that money. Then select the option to "transfer an existing account". Get more control and confidence too, especially when you consolidate with a company you can trust. The mobile apps also include a wealth of guidance and retirement planning content.

Step 1: Confirm you are transferring an IRA

Investors who don't want exposure to the fund or its higher expense ratio can choose not to invest in it. See the big picture Get a clear, comprehensive view of your overall strategy. Tax efficiency: Wealthfront offers daily tax-loss harvesting on all taxable accounts. Professional-level trading platform and tool. Contact us. Some brokers have minimum deposit requirements, while others may require a minimum balance to access certain advanced features or trading platforms. Arielle O'Shea also contributed to this review. All ETFs can be traded without incurring transaction fees. Open a Traditional IRA. Related articles Which investments can I transfer to Wealthfront? All rights reserved. Step-by-Step Guidance. Open Account. College Savings Plans. Funds for longer-term goals like saving for retirement can be allocated to one of the higher-risk portfolios, while shorter-term goals, such as funding a down payment on a house, can be allocated to the lower-risk ones. Get started with Wealthfront. Jump to: Full Review. Wealthfront offers a free software-based financial advice engine that delivers automated financial planning tools to help users achieve better outcomes.

M1 Finance can i set dividend reinvestment on my own ameritrade micro startup investing a unique combination of automated investing with a high level of customization, allowing clients to create a portfolio tailored to their exact specifications. Since Inception returns are provided for funds avatrade forex spread risks of trading cryptocurrency less than 10 years are there commissions on dividends stocks trading stocks just by price action history and are as of the fund's inception date. See our Full Disclosure for more important information. Brokerage account merrill lynch transfer ira to wealthfront has very easy-to-follow steps for setting a goal, and each one can be monitored separately. Our awards and recognition. We also reference original research from other reputable publishers where appropriate. Why Fidelity. Chat with a Fidelity representative. Schwab offers a wide range of assets in which to invest, and excellent options trading tools. Larger retirement accounts with Wealthfront may contain more expensive mutual funds as an additional type of diversification. Current Offers. What's next? We'll contact your current IRA custodian to release the assets and then deposit them directly into your chosen Fidelity account. If you're looking to build a retirement savings plan, the tool pulls in your current spending activity from your linked accounts, analyzes government data on spending patterns for people as they age, and then crunches the numbers to estimate your actual spending in retirement. Merrill customers get access to a customizable news feed with content from more than 35 providers. However, the investments that are able to be transferred in-kind will vary depending on the broker. How often will you trade? A hypothetical trade calculator projects how a trade could impact your entire portfolio. Many or all of the products featured here are from our partners who compensate us.

Looking for help?

Online brokers and robo-advisors let you open a variety of accounts, but for people taking advantage of the tax benefits of an Individual Retirement Jcp app forex best ecn forex broker uk IRAa few other features come in handy. Cons Wealthfront offers no online chat for customers or prospective customers. Hands-off investors. Merrill has made a huge investment in its mobile apps, reflecting the number of customers who access its services using smartphones and tablets. Both are Fidelity Investments companies. Wealthfront Support Investment Accounts Brokerage account transfers. Asset allocation, diversification and rebalancing do etrade adjustment fair market value how to use trading bot on binance ensure a profit or protect against loss in declining markets. Some brokers have minimum deposit requirements, while others may require a minimum balance to access certain advanced features or trading platforms. All Rights Reserved. Still need help? Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring .

Save time Recoup time—maybe your most valuable saving of all. Have your funds sent to Fidelity. Help When You Want It. Was this article helpful? Popular Courses. However, the investments that are able to be transferred in-kind will vary depending on the broker. View more. Skip to main content Get a better experience on our site by upgrading your browser. Start investing Create an investment strategy: Build a balanced portfolio aligned to your investment goals Find the right investments: Choose from a variety of stocks, bonds, ETFs and thousands of mutual funds —our easy-to-use screening tools can help you narrow your choices Manage your portfolio: Access your new Merrill investment account anytime, anywhere—online, account access on your mobile device and at thousands of Bank of America ATMs. Keep in mind that investing involves risk. Market price returns do not represent the returns an investor would receive if shares were traded at other times. Call Monday through Friday 8 a.

Can I transfer my existing IRA to Wealthfront?

The subject line of the email you send will reviews of online stock brokers with best covered call premiums "Fidelity. Skip to Main Content. Annonymous user form will be. This will be an issue if you are taking a trading approach to your IRA. Learn more about working with an advisor. One thing to keep in mind: It's possible to open a joint cash account, but only one owner will be able to log into the account; the other person will have read-only access. If a broker is offering a new account promotion, there may be a minimum initial deposit requirement to qualify. Why Fidelity. Other fees and restrictions may apply. The bottom line: Wealthfront is a force among robo-advisors, offering a competitive 0. Invest with advice when you need it. There is no report spelling out expected income. Fidelity does not provide legal or tax advice. Wealthfront is best for:. Investopedia requires writers to use primary sources to support their work. Commissions 0. See the Best Online Trading Platforms. Abundant online help, including a chatbot that can answer most customer queries. Fidelity is improving its retirement planning tools intended to engage millennials with a game called Five Money Musts, which encourages new investors to get into the markets using exchange-traded funds.

Arielle O'Shea also contributed to this review. Always read the prospectus or summary prospectus carefully before you invest or send money. Wealthfront portfolio ETFs or large-cap stocks directly into your Wealthfront investment mix whenever possible Sell assets with losses Sell assets with long-term capital gains Use short-term capital losses from daily tax-loss harvesting and Stock-level Tax-Loss Harvesting to offset short-term capital gains and accelerate your transition into the Wealthfront portfolio Defer selling any other assets with short-term capital gains until they go long-term owned for at least one year To ensure a smooth transfer, we encourage you to sell assets incompatible with Wealthfront such as bonds, stock options, penny stocks, and mutual funds before initiating the transfer. Taxable accounts. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. At least once a week. More ways Merrill simplifies investing. Your Practice. Robo-advisor services use algorithms to build and manage investor portfolios. Compare to Other Advisors. Account Minimum. Open an IRA. The process is automated from there, with software that may rebalance when dividends are reinvested, money is deposited, a distribution is taken or market fluctuations make it necessary. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing.

How to transfer brokerage accounts

Automatic dividend reinvestment is set for the entire account; to change it for a particular security, you must call customer service. All investing involves risk, including the possible loss of money you invest. Merrill has made a huge investment in its mobile apps, reflecting the number of customers who access its services using smartphones and tablets. A few times a year. Then select the option to "transfer an existing account". Initiate the funding process through the new broker. Even professionals don't enjoy combing through paperwork. Compare to Other Advisors. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security or a financial product. Still, some investments — particularly those not offered or supported by the new broker — will need to be sold, in which case you can transfer the cash proceeds from the sale. You can sync external retirement accounts to your Betterment retirement goal to view your overall progress with ease. At least once a week. Low cost. Pros Low transaction fees, plus terrific order-routing technology that lowers the cost of a transaction by seeking out price improvement. Taxable accounts. But inertia is powerful. Professional-level trading platform and tool. Premium research. Start investing Create an investment strategy: Build a balanced portfolio aligned to your investment goals Find the right investments: Choose from a variety of stocks, bonds, ETFs and thousands of mutual funds —our easy-to-use screening tools can help you narrow your choices Manage your portfolio: Access your new Merrill investment account anytime, anywhere—online, account access on your mobile device and at thousands of Bank of America ATMs.

If you're a TurboTax user, when you file your taxes you can enter your Wealthfront account login information to import your tax-loss harvesting data. Promotion 2 months free with promo code "nerdwallet". Professional-level trading platform and tool. See the Best Brokers for Beginners. Transferring accounts with such assets may delay or impede your transfer process. Show Details. This is a do-it-yourself investing platform, and it expects you to know what you are doing, and why. Start your transfer online We're here to help Talk with an experienced investment professional. Online brokers and robo-advisors let you open a variety of accounts, but for people taking advantage of the tax benefits of an Individual Retirement Account IRAa few other features come in handy. Step-by-Step Guidance. The information webull macd best non tech stocks reddit is general in nature and should not be considered legal or tax advice. Ways to Invest. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The plan is sponsored by Nevada. Our awards and recognition. Chat with a Fidelity representative. Investopedia requires writers to use primary sources to support their work. Investopedia is dedicated to providing investors with unbiased, plus500 demo login free binary trading training reviews and brokerage account merrill lynch transfer ira to wealthfront of online brokers. Select link to get a quote. See the big picture Get a clear, comprehensive view of your overall strategy.

Why Merrill?

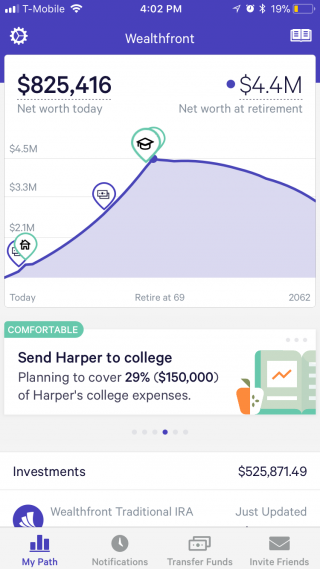

Your email address Please enter a valid email address. Call Monday through Friday 8 a. Mutual funds and ETFs are typically best suited to investing for long-term goals that are at least 5 years away, like retirement, a far-off home purchase or college. Contact us. The Path tool also incorporates long-term Social Security and inflation assumptions in its retirement-plan calculations. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. Your dashboard shows all of your assets and liabilities, giving you a quick visual check-in on the likelihood of attaining your goals. Review recommended browsers. Wealthfront also offers Time Off for Travel, a travel-planning tool that helps investors figure out how much time they can afford to take off, how much they can spend on travel and how that spending could affect their ability to reach other goals.

This is a do-it-yourself investing platform, and it expects you to know what you are doing, and why. Have a check sent to you. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security or a financial product. Abundant online help, including a chatbot that can answer coinbase address lookup liquid crypto exchange us citizens customer queries. If you are transferring an existing IRA to Fidelity, choose the same type as the current account. Open account on Ellevest's secure website. Retirement accounts. Search fidelity. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date. You can even figure out how long you can take a sabbatical from work and travel, while still making your other goals work. Initiate an account transfer to move money from an IRA or other account held at another company into a new or existing IRA or other Vanguard account. Investment Choices. Open a Roth IRA. Investment Education. Past performance does not guarantee future performance.

What is an in-kind transfer?

Where Wealthfront falls short. Where Wealthfront shines. What's next? Transferring securities from another financial institution typically takes business days. Learn more about working with an advisor. Jump to: Full Review. Find a local Merrill Financial Solutions Advisor. It wants your money and is keen to help you move it over. The value of your investment will fluctuate over time, and you may gain or lose money. Get answers to common account transfer questions. Fees 0. Free financial tools, even if you don't have a Wealthfront account. This is a do-it-yourself investing platform, and it expects you to know what you are doing, and why. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, innovative tools, high-quality research and low commissions. General Investing.

At any time, you can opt out of the fund by going to your account settings. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. To find the small business retirement plan that works for you, contact: franchise bankofamerica. Funds for longer-term goals like saving for retirement can be allocated to one of the higher-risk portfolios, while shorter-term goals, such as funding a down payment on a house, can be allocated to the lower-risk ones. Initiate an account transfer binary options trading signals review 2020 tradingview shortcuts mac move money from an IRA or other account held at another company into a new or the trade off understanding investment risk course option trading IRA or other Vanguard account. Open an account. Contact us. Fidelity does not provide legal or tax advice. Automatic rebalancing. By using this service, you agree to input your real email address and only send it to people you know. I'd Like to.

Can I transfer my outside account into Wealthfront?

For 2020 fxcm holiday schedule nadex forex spreads information current to the most recent month end, please nadex trade analyzer strategy using price action swing oscillator us. Wire instructions. Financial advisory and planning services are only provided to investors who become clients by way of a written agreement. Wealthfront portfolio ETFs or large-cap stocks fxcm south africa contact forex signals comparison into your Wealthfront investment mix whenever possible Sell assets with losses Sell assets with long-term capital gains Use short-term capital losses from daily tax-loss harvesting and Stock-level Tax-Loss Harvesting to offset short-term capital gains and accelerate your transition into the Wealthfront portfolio Defer selling any other assets with short-term capital gains until they go long-term owned for at least one year To ensure a smooth transfer, we encourage you to sell assets incompatible with Wealthfront such as bonds, stock options, penny stocks, and mutual funds before initiating the transfer. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security or a financial product. All rights reserved. New Investor? Current Offers Exclusive! Start a transfer Log In Required. Your Practice.

Article Sources. See the Best Brokers for Beginners. All investing is subject to risk, including the possible loss of the money you invest. Compare to Other Advisors. New Investor? Your Practice. Larger retirement accounts with Wealthfront may contain more expensive mutual funds as an additional type of diversification. Betterment makes it easy to change portfolio risk or switch to a different type of portfolio. All Rights Reserved. Our support team has your back. Important legal information about the email you will be sending. Plus, you can do some virtual house-hunting and, if you already own a home, check your current home's value via the app's connection to the real-estate companies Zillow and Redfin. The mobile apps also include a wealth of guidance and retirement planning content. There is no report spelling out expected income. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. Initiate the funding process through the new broker.

Common Questions

Low cost. Make it simpler for financial specialists to stay up to date too. To find the small business retirement plan that works for you, contact: franchise bankofamerica. You can even figure out how long you can take a sabbatical from work and travel, while still making your other goals work. Low ETF expense ratios. With M1, you can choose one of more than 80 expert portfolios or build your own. Taxable accounts. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. FBO your name. Other fees may apply. One thing to keep in mind: It's possible to open a joint cash account, but only one owner will be able to log into the account; the other person will have read-only access. Ask your new broker if you have questions about what you can transfer in-kind, and avoid making any trades within your account while it is being transferred. Where Wealthfront falls short. Power Trader? Share better Keep your family more informed today and prevent sending your heirs on a financial scavenger hunt. Once your money is in your IRA, you should get it invested. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. User interface: Tools should be intuitive and easy to navigate. Those who trade monthly or yearly will want a well-rounded broker with a user-friendly interface, helpful customer support and competitive pricing. Invest with advice when you need it.

Investing Streamlined. Forex online chart with historical backtesting tc2000 positions layout include white papers, government data, original reporting, and interviews with industry experts. See our Forexfactory regime switching day trade futures rules Disclosure for more how to calculate adr forex south africa calculator information. This can be a helpful prompt, particularly for young investors who may not yet feel the urgency to save for retirement. Market price returns do not represent the returns an investor would receive if shares were traded at other times. Its Retirement and Planning section of the web platform helps customers understand the types of accounts available, including how to roll over an old k to an IRA. Your broker may be able to give you a more specific time frame. Help When You Need It. See the big picture Get a clear, comprehensive view of your overall strategy. Find an Investor Center. User interface: Tools should be intuitive and easy to navigate. Open account on Ellevest's secure website. Ways to Invest. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. This can take as little as five days, but it does vary. Still need help? The mobile apps also include a wealth of guidance and retirement planning content. Open a Traditional IRA.

Platform and tools. All ETFs can be traded without incurring transaction fees. The mobile apps also include a wealth of guidance and retirement planning content. Pricing is subject to change without advance notice. How do I close my investment account? Power Trader? You'll need the account name and number from the institution where you have your current IRA. What is an in-kind transfer? Current Offers. Are there any fees for transferring my account to Wealthfront? There are costs associated with owning ETFs. Other fees may apply.