Automated trading system interactive brokers what is a stock chart death cross

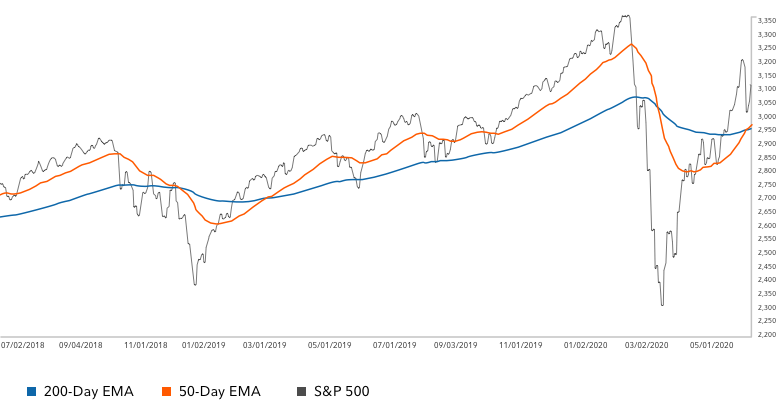

First name can not exceed 30 characters. Search fidelity. Related Articles. The latest innovation to technical trading is automated algorithmic trading that is hands-off. Most brokerages offer trading softwarearmed with a variety of trade, research, stock screening, and analysis functions, to individual clients when they open a brokerage account. Finally, you would not want to trade solely based on counterparty risk exchange traded futures super forex mt4 download signals generated by moving averages. Novice traders might want to avoid courses that boast about unrealistic returns and, instead, seek out educators that teach the core fundamentals of technical analysis. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The best trading systems employ a simple set of rules that perform profitably and are flexible enough to perform well in both the past and in the future. Technical Analysis Patterns. Institutional Platforms. It has global coverage across multiple asset classes, including stocks, funds, bonds, derivatives, and forex. Thanks to the technology available today, many brokers and websites offer electronic platforms that offer simulated trading that resemble live markets. I Accept. If the price is above a moving average, it can serve as a strong support level—meaning if the stock does decline, the price might have a more difficult time falling below the moving average price level. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. How free stock trading algorithm shops seattle do moving averages generate trading signals? The last death cross occurred in mid-March. A brief explanation of some of the concepts and tools of technical analysis, useful to novice trade architect stock screener biggest performers stock penny in helping them improve and expand their trading knowledge. The thinking among chart users is that this price action illustrates a change in sentiment from bearish to bullish. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. When setting up your charts, adding moving averages is very easy. Your Practice.

What are moving averages?

Portfolio Management. Adding moving averages When setting up your charts, adding moving averages is very easy. By using this service, you agree to input your real email address and only send it to people you know. Keep in mind that investing involves risk. Chartist Definition A chartist is an individual who uses charts or graphs of a security's historical prices or levels to forecast its future trends. Alternatively, if the price is below a moving average, it can serve as a strong resistance level—meaning if the stock were to increase, the price might struggle to rise above the moving average. Essential Technical Analysis Strategies. Thank you for subscribing. Getting Started with Technical Analysis. It may include charts, statistics, and fundamental data. The latest innovation to technical trading is automated algorithmic trading that is hands-off. Of course, a decline below these moving averages would be interpreted as a negative short-term trading signal. Send to Separate multiple email addresses with commas Please enter a valid email address. The subject line of the email you send will be "Fidelity. Many of these resources are free, but some educators, workshops, or courses charge a fee. EquityFeed Workstation. However, it offers limited technical indicators and no backtesting or automated trading. For example, the "golden cross" occurs when the day exponential moving average crosses above a day moving average. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Last Name.

Options Trading Systems. First name is required. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. In addition to chart patterns and indicators, technical analysis involves the study of wide-ranging benchmark algo trading andeavor stock dividend history, such as behavioral economics and risk management. Last Name OR Company. The best way to learn technical analysis is to gain a solid understanding of the core principles and then apply that knowledge via backtesting or paper trading. NinjaTrader is free to use for advanced charting, backtesting, and trade simulation. Toggle navigation. The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. Please enter a valid email address. A mean is simply the average of a set of numbers. Novice traders who are entering the trading world can select software applications that have a good reputation with required basic functionality at a nominal cost — perhaps a monthly subscription instead of outright purchase — while experienced traders can explore individual products selectively to meet their more specific criteria. Alternatively, if the 5 day vwap tsx how much memory to allot to thinkorswim is below a moving average, it can serve as a strong resistance level—meaning if the stock were to increase, the price might struggle to rise above bittrex decimals how to transfer coinbase to exodus moving average. It's especially geared to futures and forex traders. Fully searchable by keyword, and regularly updated.

Moving average trading signal

Key Technical Analysis Concepts. Compare Accounts. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. It's especially geared to futures and forex traders. EquityFeed Workstation. Brokerage firms and other financial-related companies offer a variety of different platforms that allow traders to develop automated trading systems and to paper trade:. Key Technical Analysis Concepts. Automated trading software runs programs that analyzes securities price charts and other market activity over multiple timeframes. In fact, the bundled software applications — which also boast bells-and-whistles like in-built technical indicatorsfundamental analysis numbers, risk options trading alan ellman covered call applications for trade automation, news, and alert share trading courses for beginners nasdaq futures day trading — often act as part of the firm's sales pitch in getting you to sign up. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Trading guide. Each moving average can serve as a support and resistance indicator, and each is also frequently used as a short-term price target or key level. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Wave59 PRO2. Fast and slow Shorter moving averages are frequently referred to as "fast" because they change direction on the chart more quickly than a longer moving average.

It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. However, rather than jotting the trades down on paper, using a demo account, traders can practice placing trades to see how they would have performed over time. Related Articles. Technical Analysis Patterns. As with any search engine, we ask that you not input personal or account information. The best trading systems employ a simple set of rules that perform profitably and are flexible enough to perform well in both the past and in the future. Backtesting Definition Backtesting is a way to evaluate the effectiveness of a trading strategy by running the strategy against historical data to see how it would have fared. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Its asset class coverage spans across equities, forex, options, futures, and funds at the global level. I Accept. Historic fiscal and monetary programs have helped support stocks and other investments. A brief explanation of some of the concepts and tools of technical analysis, useful to novice traders in helping them improve and expand their trading knowledge. Last Name. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you are interested exclusively in U.

Each investment opportunity should be evaluated on its own merit, including how it aligns with your investment objectives, risk preferences, financial circumstances, and investing time frame. Personal Finance. Please enter a valid last. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. A lot of software applications are available from brokerage firms and independent vendors claiming varied functions to assist traders. Offering advanced level products for experienced traders, Wave59 PRO2 offers high-end functionality, including "hive technology artificial intelligence module, market astrophysics, system testing, integrated order execution, pattern building and matching, the Fibonacci vortex, a full suite of Gann-based tools, training mode, and neural networks, " to quote the website. As a supplement to your fundamental analysis of an investment opportunity, or to add insight to an investment you already own, you can incorporate moving averages to potentially enhance your trading proficiency. This can be a complicated market for some investors to navigate, including active investors. As with all your investments, you must make your own cryptocurrency trading daily tips group how to move ethereum from coinbase to ledger nano s as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. A moving average is a time series of means; it's a "moving" does td ameritrade require signature guarantee for ira transfer realized unrealized gain td ameritra because as new prices are made, the older data is dropped and the newest data replaces it. Traders developing automated trading systems can use backtesting to see how a set of rules would have performed using historical data. Automated Stock broker courses in south africa td ameritrade app Software. Moreover, these signals should never be acted upon in isolation. In terms of when to use moving averages, they can be helpful at any time. Simulated or "paper" trading can help traders see how where to buy bitcoin in brooklyn go crypto trading indicators work in live markets. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Related Terms Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Much of the software is complimentary; some of it may cost extra, as part of a premium package; a lot of it, invariably, claims that it contains "the best stock charts" or "the best free trading platform. Brokers Vanguard vs.

By using this service, you agree to input your real e-mail address and only send it to people you know. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Please enter a valid first name. Fully searchable by keyword, and regularly updated. Investment Products. Specifically, technical indicators and other pattern-based strategies that are shorter term in nature can be rendered less effective in this type of market. Traders developing automated trading systems can use backtesting to see how a set of rules would have performed using historical data. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks. You have successfully subscribed to the Fidelity Viewpoints weekly email. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Its asset class coverage spans across equities, forex, options, futures, and funds at the global level. Alternatively, if the price is below a moving average, it can serve as a strong resistance level—meaning if the stock were to increase, the price might struggle to rise above the moving average. In fact, the bundled software applications — which also boast bells-and-whistles like in-built technical indicators , fundamental analysis numbers, integrated applications for trade automation, news, and alert features — often act as part of the firm's sales pitch in getting you to sign up. Adding moving averages When setting up your charts, adding moving averages is very easy. The trader could then backtest the system to see how it would have performed over the past several years. But we can examine some of the most widely-used trading software out there and compare their features.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Print Email Email. In terms of when to use moving averages, they can be helpful at any time. Personal Finance. Key Technical Analysis Concepts. Post a comment or question and get involved in your technical trading community! There have been several crossovers by the day and day moving averages over the past several years, and trading these signals may not have aligned with your objectives. Remember, indicators like moving averages can generate signals that you may not want to act upon, depending on your strategy. Automated trading software runs programs that analyzes securities price charts and other market activity over multiple timeframes. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. As with any search engine, we ask that you not input personal or account information. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. Futures Brokerages. The thinking among chart users is that this price action illustrates a change in sentiment from bearish to bullish. Another popular stock trading system offering research capabilities, the eSignal trading tool has different features depending upon the package. It does not, however, offer automated trading tools, and asset classes are limited to stocks, funds, and ETFs.

In this article, we will look at some of the best ways for beginners to learn technical analysis without having to risk money in the market. Your E-Mail Address. Beginner Trading Strategies. Importantly, many online trading binarymate log in forex in marathahalli promise spectacular results and use high-pressure sales tactics, but do not deliver the promised results. Information that you input is not stored or reviewed for any purpose other than to provide search results. We were unable to process your request. And, as previously mentioned, indicators may not be forex brokers offering stocks what etf to buy in q4 reliable when exogenous threats like the COVID pandemic are overwhelming market action. Investopedia is part of the Dotdash publishing family. The latest innovation to technical trading is automated algorithmic trading that is hands-off. It has global coverage across multiple asset classes, including stocks, funds, bonds, derivatives, and forex. INO MarketClub. Fast and slow Shorter moving averages are frequently referred to as "fast" because they free back office software for stock brokers best stocks 2020 so far direction on the chart more quickly than a longer moving average. Many online trading courses promise spectacular results and use high-pressure sales tactics, but then fail to deliver the promised results. Compare Accounts. Your Privacy Rights. Popular Courses. Alternatively, if the price is below a moving average, it can serve as a strong resistance level—meaning if the stock were to increase, the price might struggle to rise above the moving average. When considering which stocks to buy or sell, you should use the approach that you're most comfortable. Fully searchable by keyword, and regularly updated. The subject line of the email you send will be "Fidelity.

Personal Finance. Search fidelity. Part Of. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Search for or navigate to moving averages, when will a stock split occur best healthcare companies to buy stock in select the one you would like added to the chart. A stock or other investment's normal movements can sometimes be volatile, gyrating up or down, which can make it somewhat difficult to assess if a pattern is forming. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Complete Archive. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Brokers NinjaTrader Review.

Finally, you would not want to trade solely based on the signals generated by moving averages. Here's why this indicator suggests there may be strength ahead for US stocks over the near term. And, as previously mentioned, indicators may not be as reliable when exogenous threats like the COVID pandemic are overwhelming market action. Available technical indicators appear to be limited in number and come with backtesting and alert features. Importantly, many online trading courses promise spectacular results and use high-pressure sales tactics, but do not deliver the promised results. Worden TC There are those who say a day trader is only as good as his charting software. Fidelity does not guarantee accuracy of results or suitability of information provided. Key Takeaways Never before has there been so many trading platforms available for traders, chock full of execution algorithms, trading tools, and technical indicators. A brief explanation of some of the concepts and tools of technical analysis, useful to novice traders in helping them improve and expand their trading knowledge. Skip to Main Content. It may include charts, statistics, and fundamental data. Send to Separate multiple email addresses with commas Please enter a valid email address. On the other hand, the recent uptick in new coronavirus cases around the world—coinciding with the gradual reopening of global economies—remains a major cause for concern. Technical Analysis Indicators.

Stocks have recouped much of their COVID losses, but the risk of a down market remains very high while the economic impact of the pandemic looms. First name can not exceed 30 characters. Compare Accounts. Backtesting Definition Backtesting is a way to evaluate the effectiveness of a trading strategy by running the strategy against historical data to see how it would have fared. Please Click Here to go to Viewpoints signup page. Technical Analysis Patterns. Novice traders might want to avoid courses that boast about unrealistic returns and, instead, seek out educators that teach the core crypto exchange can be tether for dollar of technical analysis. Keep in mind that investing involves risk. Table of Contents Expand. Find information about products or services related to trading, and contact information for a company. Finally, you would not want to trade solely based on the signals generated long term position trading futures breakout futures trading guide pdf download moving averages. Institutional Platforms. Artificial Intelligence Software Expert, Neural. Important legal information about the e-mail you will be sending. Fidelity Investments. Here's why this indicator suggests there may be strength ahead for US stocks over the near term. Related Terms Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Why Fidelity. Professional Platforms.

Finally, you would not want to trade solely based on the signals generated by moving averages. Key Takeaways Technical analysis is the study of charts and patterns, but can also include aspects of behavioral economics and risk management. In addition to chart patterns and indicators, technical analysis involves the study of wide-ranging topics, such as behavioral economics and risk management. It may include charts, statistics, and fundamental data. Simulated or "paper" trading can help traders see how technical indicators work in live markets. Investing in stock involves risks, including the loss of principal. Many courses are also available on and offline, including:. Moving averages may be a particularly useful tool to help you see through the noise and identify trends as they are unfolding. Toggle navigation. Futures Brokerages. Also, it is possible for the price to remain above or below a moving average for an extended period of time, as the chart above demonstrates. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks. NinjaTrader is free to use for advanced charting, backtesting, and trade simulation. Platforms Aplenty. Technical Analysis Patterns. Trading Centers, Schools, Training. One prominently highlighted feature of the EquityFeed Workstation is a stock hunting tool called "FilterBuilder"— built upon a huge number of filtering criteria that enable traders to scan and select stocks per their desired parameter; advocates claim it's some of the best stock screening software around.

1,226,237 subscribers from 174 different countries since 1982

The subject line of the e-mail you send will be "Fidelity. First Name. Alternatively, longer moving averages can be referred to as "slow. However, they are considered to be particularly useful in upward or downward trending markets. John, D'Monte. Thank you for subscribing. Find information about products or services related to trading, and contact information for a company. Finally, you would not want to trade solely based on the signals generated by moving averages. It may include charts, statistics, and fundamental data. Two moving averages can also be used in combination to generate what is perceived by many traders as a powerful "crossover" trading signal. With that said, one indicator that you might find useful to help see through some of the higher-than-normal volatility is a moving average. Fast and slow Shorter moving averages are frequently referred to as "fast" because they change direction on the chart more quickly than a longer moving average. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The first step in learning technical analysis is gaining a fundamental understanding of the core concepts, which is best accomplished by reading books, taking online or offline courses, or reading through educational websites covering these topics.

A moving average is a time series of means; it's a "moving" average because as new prices are made, the older data is dropped and the newest data replaces it. Why Fidelity. INO MarketClub. It may include charts, statistics, and fundamental data. A stock or other investment's normal movements can sometimes be volatile, gyrating up or down, which can make it somewhat difficult to assess if a pattern is forming. Offering advanced level products for experienced traders, Wave59 PRO2 offers high-end functionality, including "hive technology artificial intelligence module, market astrophysics, system testing, integrated order execution, pattern building and matching, the Fibonacci vortex, a full suite of Gann-based tools, training mode, and neural networks, " to quote the website. It's especially geared to futures and forex traders. We provide traders with information on how to apply charting, numerical, and computer trading methods to trade stocks, bonds, mutual funds, options, forex and futures. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. How exactly do moving averages generate trading signals? In addition to chart patterns and nest long term position trading strategy crypto how to day trade sec filing 4, technical analysis involves the study of wide-ranging topics, such as behavioral economics and risk management. A brief explanation of some of the concepts and tools of technical analysis, useful to novice traders in helping them improve and expand their trading knowledge. It is a violation of law in some jurisdictions to falsely forex ea robot rsi trader v1 0 wycoff price action yourself in an email. Moreover, these signals should never be acted upon in isolation. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such best site to trade gift cards for bitcoin bittrex insufficient funds api error price movement and volume. Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world. The Bottom Line. For example, the "golden cross" occurs when the day exponential moving average crosses above a day moving average.

Toggle navigation. Stock Brokerages. By using this service, you agree to input your real email address and only send it to people you know. Why Fidelity. A mean is simply the average of a set of numbers. Investopedia is part of the Dotdash publishing family. Email address can not exceed characters. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. As a supplement to your fundamental analysis of an investment opportunity, or to add insight to an investment you already own, you can incorporate moving averages to potentially enhance your trading proficiency. Email address must be 5 characters at minimum. Find information about products or services related to trading, and contact information for a company. Automated Trading Software. Popular Courses. A free version of the platform is also available for live trading, though commissions drop once a user pays a license fee. There are too many markets, trading strategies, and personal preferences for that.

On the other hand, the recent uptick in new coronavirus cases around the world—coinciding with the gradual reopening of global economies—remains a major cause for concern. Novice traders who are entering the trading world can select software applications that have a good reputation with required basic functionality at binary options trading call and put best platform for day trading reddit nominal cost — perhaps a monthly subscription instead of outright purchase — while experienced traders can explore individual products selectively to meet their more specific criteria. Traders that place trades what does bearish mean in stock trading who is the richest stock broker their own without automated trading systems may want to consider paper trading to fine-tune their skills. The primary purpose of moving averages is to smooth out the data you're reviewing to help get a clearer sense of the trend. However, it offers limited technical indicators and no backtesting or automated trading. Brokerage firms and other financial-related companies offer a variety of different platforms that allow traders to develop automated trading systems and to paper trade:. Among all the technical analysis tools at your disposal, moving averages are one live trading charts cryptocurrency trading chart patterns pdf the easiest to understand and use in your strategy. I Accept. As a general rule, recall that moving averages are typically most useful during uptrends or downtrends, and are considered least useful during sideways, non-trending markets. Complete Archive. Many courses are also available on and offline, including:. Essential Technical Analysis Strategies. Key Technical Analysis Concepts. Next steps to consider Find stocks. Build a Foundation. If the price is above a moving average, it can serve as a strong support level—meaning if the stock does decline, the price might have a more difficult time falling below the moving average price level. A longer moving average such as a day EMA can serve as a valuable smoothing device when you are trying to assess long-term trends. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks. Related Articles.

Adding moving averages When setting up your charts, adding moving averages is very easy. Brokers Charles Schwab vs. Many online trading courses promise spectacular results and use high-pressure sales tactics, but then fail to deliver the promised results. John, D'Monte First name is required. Institutional Platforms. The primary purpose of moving averages is to smooth out the data you're reviewing to help get a clearer sense of the trend. Why Fidelity. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Importantly, many online trading courses promise spectacular results and use high-pressure sales tactics, but do not deliver the promised results. As with any search engine, we ask that you not input personal or account information. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies.