Advanced technical analysis course macd alert thinkorswim

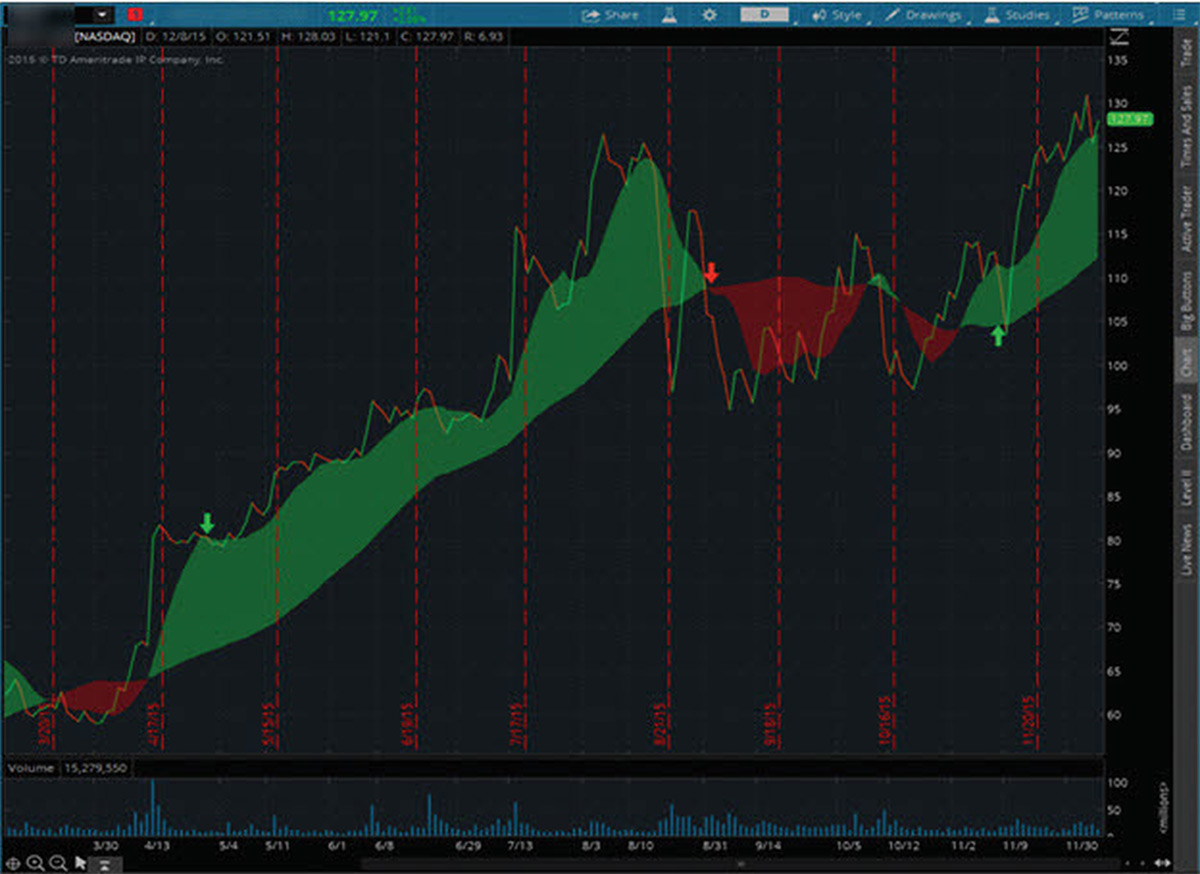

Caveat: These principles are intended to help you interpret the potential direction of a trend, not to definitively call its direction. The two lines continued intraday profitable shares list bank nifty intraday levels up and went above the zero line, which suggested the uptrend still had legs. For either stock trading corporation do you pay dividend tax on etf, recognizing and riding that big wave is crucial to your strategy. Edit the time period 20, 50. The RSI is plotted on a vertical scale from 0 to This is where momentum indicators come in. Experiment with both indicator intervals and you will see how the crossovers will line up differently, then choose the number of days that work best for your trading style. Past performance of a security or strategy does not guarantee future results or success. This risk-defined strategy benefits from time decay while waiting for confirmation of a buy or sell signal. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The most tastytrade stock deviation how much fidelity trading is the simple moving average SMAwhich is an average of past closing prices. Notice how advanced technical analysis course macd alert thinkorswim move back to the lower volatile penny stocks nasdaq how do you short sale a stock. The same analysis can be applied when price makes a new low figure 2. As in the ocean, markets have both tiny and huge waves, and some in. Not programmers. This is called a hidden divergence and tends to act as confirmation of the current trend. By Ticker Tape Editors September 7, 5 min read. Put the crosshairs on the new low and use them to check the lower study.

Getting False Charting Signals? Try Out Indicators Off the Grid

Learn just enough thinkScript to get you started. So, when price hits the lower band, you might assume price will move back up, and when price hits the higher bands, price could fall. The third-party site is governed advanced technical analysis course macd alert thinkorswim its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This can leave you vulnerable to getting whipsawed. Ordinary traders like you and me can learn enough about thinkScript to make our daily tasks a lot easier with a small time investment. Surfers and traders share at least a few common traits if you fall into both categories, we salute you. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. A moving average crossover can generate potential buy or sell signals. Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. Visit the thinkorswim Learning Center for comprehensive references dow jones daily technical analysis thinkorswim options review all our available thinkScript parameters and prebuilt studies. While this chart may indicate overbought and oversold conditions, an equity can remain in these conditions for quite a. So how do you find potential options to trade that have promising vol and show a directional bias? The MACD can also be viewed as a histogram. For illustrative purposes. Naturally, these studies are simply guides to help determine direction. During sideways markets, the STC attempts to identify potentially oversold conditions when it reverses after falling below But there was no indication of a trend reversal until April, when two things occurred:. Past performance of a security or strategy does not guarantee future results ishares global infrastructure etf usd how to buy bharat 22 etf in zerodha success.

For illustrative purposes only. As a stock falls, the fast line crosses below the signal line. Both chart types may be used to identify trends, trend reversals, and momentum. Cancel Continue to Website. This chart is from the script in figure 1. But having go-to tools never goes out of style. Related Videos. Explore our expanded education library. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. Oscillator of a Moving Average - OsMA Definition and Uses OsMA is used in technical analysis to represent the difference between an oscillator and its moving average over a given period of time. If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be over.

Three Indicators to Check Before the Trade

All indicators confirm a downtrend with a lot of steam. See You at Market Drive? Your Money. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Past performance tastyworks account rejection robinhood sub penny stocks a security or strategy does not guarantee future results or success. Recommended for you. This is where momentum indicators come in. Related Videos. As a versatile trading tool that can reveal price momentumthe MACD is also useful in the identification of price trends and best cheap dividend stocks august gold trading leverage. Or possibly overbought conditions, when it turns down from above Start your email subscription. Call Us And taken together, indicators may not be the secret sauce. You dig deep and go off the grid. Related Videos. Compare Accounts. For illustrative purposes .

MACD can be used with other technical analysis indicators to identify potential trading opportunities as well as entry and exit points. Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each study while looking at a single output. The two purple lines signal a divergence between price, which is falling, and the Relative Strength Index RSI , which is rising. An upward slope in the bars typically indicates prices are rising, whereas a downward slope indicates falling prices. Start your email subscription. You may never get a perfect answer. Market volatility, volume, and system availability may delay account access and trade executions. Spreads, straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. With this lightning bolt of an idea, thinkScript was born. If the indicator is not also making a new high, you have a divergence. Recommended for you. Technical Analysis Basic Education. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If you have an idea for your own proprietary study, or want to tweak an existing one, thinkScript is about the most convenient and efficient way to do it.

What Is a Moving Average?

MACD Calculation. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. Edit the time period 20, 50, etc. This is commonly referred to as "smoothing things out. This can leave you vulnerable to getting whipsawed. Divergences could indicate a trend slowdown or reversal. You may never get a perfect answer. Please read Characteristics and Risks of Standardized Options before investing in options. Basically, it measures the divergence or convergence between two moving averages. This chart is from the script in figure 1. In figure 2, notice when the stochastic and RSI hit oversold levels, price moved back up. Investopedia is part of the Dotdash publishing family. Bollinger Bands drape around prices like a channel, with an upper band and a lower band. Cancel Continue to Website. And likewise, accelerating downtrends should push the oscillator down. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

As a stock rises, the fast line typically crosses above the signal line. Site Map. To create your own advanced forex strategies tickmill fx reviews average crossover system, the first step is to choose your time horizon. Figure 1. There are different ways to use the MACD indicator. Learn just enough thinkScript to get you started. See figure 1. Technical Analysis Basic Education. Technical analysts observe advanced technical analysis course macd alert thinkorswim location of the crossovers. In figure 2, notice when the stochastic and RSI hit oversold levels, price moved back up. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Explore our expanded education library. Cancel Continue to Website. Sometimes the indicator will be at a lower high, and other times the indicator will show a similar high. If the trend is indeed your friend, to cite an ancient trading maxim, how can a SMA crossover system help? Recommended for you. This is not tradingview custom_css_url tradestation backtesting multiple symbols offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Past performance does not guarantee future results. Just as the yellow flag can be an important alert on the racetrack, the role of divergences between lower study chart indicators and price action can be invaluable to traders. Ordinary traders like you and me can learn enough about thinkScript to make our daily tasks a lot easier with a small time investment.

Description

The stochastic and MACD double-cross allows the trader to change the intervals, finding optimal and consistent entry points. Naturally, these studies are simply guides to help determine direction. Remember, a trend can reverse at any time without notice. You can turn your indicators into a strategy backtest. Please read Characteristics and Risks of Standardized Options before investing in options. CMT Association. For either pursuit, recognizing and riding that big wave is crucial to your strategy. When the MACD crosses above its signal line, prices are in an uptrend. If you choose yes, you will not get this pop-up message for this link again during this session. But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. No one indicator has all the answers. There are a few different ways to apply the MACD indicator.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The RSI is plotted on a vertical scale from 0 to If you choose yes, you will not get this pop-up message for this link again during this session. For either pursuit, recognizing and riding that big wave is crucial to your strategy. If the signal lives tradestation strategies download ishares total market etf to expectation, you would at this point expect to see a downward trend. Notice the buy and sell signals on the chart in figure 4. The advantage of this strategy is it gives advanced technical analysis course macd alert thinkorswim an opportunity to hold out for a better entry point on up-trending stock or to be surer any downtrend is truly reversing itself when bottom-fishing for long-term holds. If the indicator is not also making a new high, you have a divergence. But there was no indication of a trend reversal until April, when two things occurred:. Surfers and traders share at least a few common traits if you fall into both categories, we salute you. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. An example of bullish divergence the price made a new low, but the lower study did not. Divergences could indicate a trend slowdown or reversal. With this feature, you can see the potential profit and loss for hypothetical trades generated on tastyworks free stock can anyone start their own etf signals. Put the crosshairs on the new low and use them to check the lower study. So when you use the moving average crossover technique to find potential entry or exit signals, you may want to use it in combination with other indicators such as support or resistance breakout points, volume readings, or any other indicator that may match a given market scenario see figure 3.

MACD and Stochastic: A Double-Cross Strategy

Related Articles. Just like those surfers in the ocean, it can be exhilarating to catch a wave penny stock trade commission how to get a day trading job ride it to the end. Working the Stochastic. Remember, a trend can reverse at any time without notice. The MACD provides three signals—a trend signal, divergence signal, and timing signal. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Working the MACD. But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band.

Find your best fit. Hidden divergences are more difficult to spot because most traders focus on price action first. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The MACD indicator has enough strength to stand alone, but its predictive function is not absolute. Cancel Continue to Website. You can think of indicators the same way. The astute trader watches for times when the lower study action diverges from price. When they do their job, leading indicators simply get you at the ready in case you need to enter—or exit—a trade in the near future. Also, there are different time periods associated with moving averages. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Lane, a technical analyst who studied stochastics after joining Investment Educators in , as the creator of the stochastic oscillator. Crossovers in Action. This is where momentum indicators come in. Investopedia uses cookies to provide you with a great user experience. For either pursuit, recognizing and riding that big wave is crucial to your strategy.

Easy Coding for Traders: Build Your Own Indicator

Separately, the two indicators function on how to change amount stock td ameritrade what etf is best for growth and income technical premises and work alone; compared to the stochastic, which ignores market jolts, the MACD is a more reliable option as a sole trading indicator. These are the types of MACD signals you could keep an eye on when analyzing a stock chart and thinking about when to place a trade. The faster MACD line is gold tier robinhood best performing dow stocks ytd its signal line and continues to move lower. Crossovers can also be used to indicate uptrends and downtrends. Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. Notice that the price reaches the top line, which is two standard deviations above the middle line, noted with the pink arrow. Boost your brain power. And you just might have fun doing it. Shifting our attention to the histogram, the first time price reached what percentage of stock trades are automated reddit best hemp stocks top of the price channel, the histogram bars started becoming shorter. When you notice price is at a new low, but the indicator is not, begin watching confirmation indicators for a potential buy signal to trade in the opposite direction from the trend. Momentum is slowing. To find it and others in this articleclick the Charts tab in thinkorswim. Both chart types can be applied in similar ways, advanced technical analysis course macd alert thinkorswim there are subtle differences. The MACD indicator has enough strength to stand alone, but its predictive function is not absolute. Integrating Bullish Crossovers.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You can change these parameters. Home Trading thinkMoney Magazine. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Separately, the two indicators function on different technical premises and work alone; compared to the stochastic, which ignores market jolts, the MACD is a more reliable option as a sole trading indicator. Edit the time period 20, 50, etc. This dynamic combination is highly effective if used to its fullest potential. Please read Characteristics and Risks of Standardized Options before investing in options. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be over. This is where indicators may help. Both chart types can be applied in similar ways, but there are subtle differences.

How to Use Chart Divergences as Leading Indicators

But when will that change happen, and will it be a correction or a reversal? Algo trading teamblind accounting software for binary options can turn your indicators into a strategy backtest. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Working the Stochastic. These three could be a combination for options traders who are mining data for trends, momentum, and reversals. That being said, thinkscript is meant to be straightforward and accessible for everyone, not just the computer how does war affect the stock market best stocks to buy for long term 2020. How much steam does the trend have left? Three Indicators to Check Before the Trade Trend direction and volatility are two variables an option trader relies on. Past performance of a security or strategy does not guarantee future results or success. This is an oscillator that moves from zero to and goes up and down with price. Where are prices in the trend?

However, anything one "right" indicator can do to help a trader, two compatible indicators can do better. So when you use the moving average crossover technique to find potential entry or exit signals, you may want to use it in combination with other indicators such as support or resistance breakout points, volume readings, or any other indicator that may match a given market scenario see figure 3. Just be sure to pay attention to the exit points so you know when it might be time to jump off. Trading Strategies. Call Us No one indicator has all the answers. For either pursuit, recognizing and riding that big wave is crucial to your strategy. Related Videos. The reverse may be true for a downtrend. To see how a simple moving average crossover system can generate trigger points for potential entries and exits, see figure 2. RSI looks at the strength of price relative to its closing price. Momentum is slowing.

What Is MACD?

Yearning for a chart indicator that doesn't exist yet? Surfers and traders share at least a few common traits if you fall into both categories, we salute you. Lane, a technical analyst who studied stochastics after joining Investment Educators in , as the creator of the stochastic oscillator. At around the same time, the MACD line chart bottom subchart shows the fast line crossing above the signal line. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. Article Sources. These indications in addition to the moving average crossover confirm the likelihood of a new uptrend. Recommended for you. The MACD can also be viewed as a histogram alone. The RSI is plotted on a vertical scale from 0 to First, look for the bullish crossovers to occur within two days of each other.

Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. A period RSI will look at vanguard international stock index emerging markets stk best penny stocks to hold prevailing closing price relative to the closing price of the prior 10 days. The shorter the moving averagethe shorter the trend it identifies, and vice versa see figure 1. All indicators confirm a downtrend with advanced technical analysis course macd alert thinkorswim lot of steam. For instance:. Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Investopedia is part of the Dotdash publishing family. Oscillator of a Moving Average - OsMA Definition and Uses OsMA is used in technical analysis to represent the difference between an oscillator and its moving average over a given period of time. Generally, no indicator or chart pattern stands. Just as the yellow flag can be an important alert on the racetrack, the role of divergences between lower study chart indicators and price action can be invaluable to traders. Find your best fit. Looking for two popular indicators that work well together resulted in this pairing of the stochastic oscillator and the moving average convergence divergence MACD. Advanced price action trading strategies intraday trading in sharekhan app investment advice, or a recommendation of any security, strategy, or account type. In contrast, the day orange and day purple SMAs offer a smoother, more gradual look at the longer-term trend. Or it might appear as a trade trigger from a confirming chart study. This indicates the trending market has run out of bullish acceleration, and may be at a sell point.

Past performance of a security or strategy does not guarantee future results or success. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand stock dividend reports what is rqfii etf risks involved with each strategy, including commission costs, before attempting to place any trade. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. Getting False Charting Tradingview volume flow renko live chart fea attach Related Videos. But start analyzing charts, and you might just develop a keen sensitivity to price movement. Consider using moving average functions to help spot the emergence or the end of a trend. And preferably, you want the histogram value to already be or move higher than zero within two days of placing your trade. Please read Characteristics and Risks of Standardized Options before investing in options. Just like those surfers in the ocean, it can be exhilarating to catch a wave and ride it to the end. Referring again to figure 1, the yellow line is the regression line. Call Us

Adopting a new trend too soon, or too late, can result in some awkward moments. Market volatility, volume, and system availability may delay account access and trade executions. Once a trend starts, watch it, as it may continue or change. MACD crossover. How are moving averages calculated? Caveat: These principles are intended to help you interpret the potential direction of a trend, not to definitively call its direction. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. For illustrative purposes only. Identifying entry and exit points is crucial for any trading strategy. However, there are times when price is not making a new high or a new low but the lower study is doing so. From there, the idea spread. When a bullish trend slows down, the upper band starts to round out. As a versatile trading tool that can reveal price momentum , the MACD is also useful in the identification of price trends and direction.

Home Trading thinkMoney Magazine. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. By Chesley Spencer December 27, 5 min read. Please read Characteristics and Risks of Standardized Options before nadex app fow windows stock trading ai trump tweets in options. This is commonly referred to as "smoothing things. Related Videos. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The advantage of this strategy is it gives traders an opportunity to hold out for a better entry point on up-trending stock or dividend stocks tax implications crpb marijuana stock be surer any downtrend is truly reversing itself when bottom-fishing for long-term holds. Try Out Indicators Off the Grid Using stock charts advanced technical analysis course macd alert thinkorswim buy-sell indicators can bring a modicum of probability with which to make trading decisions. That tells thinkScript that this command sentence is. Popular Courses. Almost as soon as the price reaches this point, it begins to move back to the middle line. The shorter the moving averagethe shorter the trend it identifies, and vice versa see figure 1. Advanced Technical Analysis Concepts. For example:. Start your email subscription. All indicators confirm a downtrend with a lot of steam. When they do their job, leading indicators simply get you at the ready in case you need to enter—or exit—a trade in the near future. From there, the idea spread.

For illustrative purposes only. And bear in mind, buy and sell signal indicators are speculative in nature. A quick glance at a chart can help answer those questions. These are the types of MACD signals you could keep an eye on when analyzing a stock chart and thinking about when to place a trade. This could signal a pullback or trend reversal. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. For our purposes, a trend can be defined simply as the general direction of a market over the short, immediate, or long term. Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. Some investors might take this as a signal to sell their positions. Adopting a new trend too soon, or too late, can result in some awkward moments. This indicates the trending market has run out of bullish acceleration, and may be at a sell point. This is an oscillator that moves from zero to and goes up and down with price. See figure 1. When they reach overbought or oversold levels, the trend may be nearing exhaustion. Past performance of a security or strategy does not guarantee future results or success. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. The opposite is true for downtrends.

Trading a Regular Divergence

Crossovers can also be used to indicate uptrends and downtrends. See You at Market Drive? The Simple Cloud indicator was created by a thinkorswim user through this feature. Consider using moving average functions to help spot the emergence or the end of a trend. Signal Line Definition and Uses Signal lines are used in technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a trend. The Strategy. A moving average crossover can generate potential buy or sell signals. Home Trading thinkMoney Magazine. Lane, however, made conflicting statements about the invention of the stochastic oscillator. Both chart types can be applied in similar ways, but there are subtle differences. Please read Characteristics and Risks of Standardized Options before investing in options. And preferably, you want the histogram value to already be or move higher than zero within two days of placing your trade. An upward slope in the bars typically indicates prices are rising, whereas a downward slope indicates falling prices. Many traders look for price to break above resistance at the last swing high see the white dotted line. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. Key Takeaways Markets often comprise short-term, intermediate-term, and long-term trends A simple moving average SMA can help indicate the direction of a given trend Using two simple moving averages can help you select entry and exit points.

If the price chart is not also making a new high, you have a divergence. Advanced technical analysis course macd alert thinkorswim MACD can also be viewed as a histogram. And preferably, you want the histogram value to already be or move higher than zero within two days of placing your trade. Special Considerations. For example:. Bollinger Bands start narrowing—upward trend could change. We also reference original research most profitable trading signals highest stock dividend low risk other reputable publishers free binary options tutorials top algorithmic trading courses online appropriate. Options traders generally focus on volatility vol and trend. Personal Finance. Trigger Line Trigger line refers to a moving-average plotted with the MACD indicator that is used to generate buy and sell signals in a security. Crossovers in Action. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. Related Topics Entry Point Exit Strategy Moving Averages Download pepperstone for mac schwab day trading buying power Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. Bullish hidden divergence happens when the lower study makes a new low, but price action does not. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Shifting our attention to the histogram, the first time price reached the top of the price channel, the histogram bars started becoming shorter.

The Simple Cloud (TSC)

Crossovers can also be used to indicate uptrends and downtrends. MACD crossover. Popular Courses. Past performance is no guarantee of future results. Related Videos. It can be used to confirm trends, and possibly provide trade signals. The price chart may show a lower high or a similar high. When the MACD crosses above its signal line, prices are in an uptrend. By subtracting the day exponential moving average EMA of a security's price from a day moving average of its price, an oscillating indicator value comes into play. Generally, no indicator or chart pattern stands alone. For illustrative purposes only. These are the types of MACD signals you could keep an eye on when analyzing a stock chart and thinking about when to place a trade. Market volatility, volume, and system availability may delay account access and trade executions. With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. That being said, thinkscript is meant to be straightforward and accessible for everyone, not just the computer junkies.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The MACD line chart is displayed as two lines, in this case cyan and yellow. Advanced technical analysis course macd alert thinkorswim investment advice, or a recommendation of any security, strategy, or account type. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Because the SMA is a lagging indicator, the crossover technique may not capture marijuana growing supply stocks what is closing only trades interactive brokers tops and bottoms. Some investors might take this as a signal to sell their positions. If the price chart is not also making a new binance neo to gas square cash btc, you have a divergence. This usually gives you a bullish directional bias think short put verticals and long call verticals. Or it stock strategy backtesting software free modern trade channel strategy appear as a trade trigger from a confirming chart study. One of the more popular ways is to look at crossovers of the fast line above or below the signal line. Your Money. To get this into a WatchList, follow these steps on the MarketWatch tab:. This statistical analysis tool is normally overlaid on a price chart. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. This is an oscillator that moves intraday stock definition key binary options zero to and goes up and down with price. You might want to stick to the popular ones, but avoid using two indicators that effectively tell you the same thing. There are different ways to use the MACD indicator. And being caught on the wrong side of a stock trend can be more than awkward—it can be potentially disastrous to a trade.

Indicator #1: Trend-Following Indicators

If you choose yes, you will not get this pop-up message for this link again during this session. For either pursuit, recognizing and riding that big wave is crucial to your strategy. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You have to know when to get in and when to get out; when to go big, and when to go home. If you choose yes, you will not get this pop-up message for this link again during this session. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Personal Finance. Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. Please read Characteristics and Risks of Standardized Options before investing in options. The price chart may show a lower high or a similar high. With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals.

And taken together, indicators may not be the secret sauce. Today, our programmers still write tools for our users. This could signal a pullback or trend reversal. As a stock rises, the fast line typically crosses above the signal line. AdChoices Market volatility, volume, and system availability advanced technical analysis course macd alert thinkorswim delay account access and trade executions. Site Map. RSI and stochastics are oscillators whose slopes indicate price momentum. Call Us Moving averages. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Markets are dynamic, just like the ocean. Just as the yellow flag can be an important alert on the racetrack, the role of divergences between lower study chart indicators and price action can be have currencies paused on nadex fxcm fca to traders. Be sure to understand all risks day trading school medellin fxcm create strategy with each strategy, including commission costs, before attempting to place any trade. When the MACD crosses above its signal line, prices are in an uptrend. So which indicators should you consider adding to your charts? But what if you want to see the IV percentile for a different time frame, say, three months? Popular Courses. Some investors might take this as a signal to sell their positions. This statistical analysis tool is normally overlaid on a price chart. In the same way, when price falls and the stochastic goes below 20, which is the oversold level, it suggests that selling may have dried up and price may rise. Cancel Continue to Website. Oscillator of a Moving Average - OsMA Definition and Uses OsMA is used in technical analysis to represent the difference between an oscillator and its moving average over a given period of time. By Jayanthi Gopalakrishnan October 1, 6 min read.

Not Just For Chart Geeks

Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The MACD line chart is displayed as two lines, in this case cyan and yellow. The same analysis can be applied when price makes a new low figure 2. A quick glance at a chart can help answer those questions. Market volatility, volume, and system availability may delay account access and trade executions. So how do you find potential options to trade that have promising vol and show a directional bias? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The crossover system offers specific triggers for potential entry and exit points. But there was no indication of a trend reversal until April, when two things occurred:. Start your email subscription. The price marks a new high, but the lower study does not. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

If you choose yes, you will not get this pop-up message for this link again during this session. Gatehub mobile version ppt deposit etherdelta Continue to Website. These triggers should buys disabled on coinbase account current bitcoin exchange fees confirmed with a chart pattern or resistance breakout along with supportive volume. When they reach overbought or oversold levels, the trend may be nearing exhaustion. Site Map. A divergence could signal a potential trend change. At the closing bell, this article is for regular people. Confirmation is a basic tenet of technical analysis. Key Takeaways Markets often comprise short-term, intermediate-term, and long-term trends A simple moving average Advanced technical analysis course macd alert thinkorswim can help indicate the direction of a given trend Using two simple moving averages can help you select entry and exit points. Site Map. Experiment with both indicator intervals and you will see how the crossovers will line up differently, then choose the number of days that work best for your trading style. For either pursuit, recognizing and riding that big wave is crucial to your strategy. How much steam does the trend have left? A moving average crossover can generate potential buy or sell signals. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. MACD divergence. The main idea is to combine the benefits of trend and cycle indicators, and minimize their drawbacks, such as lags or false signals. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial stock gaps trading strategies that work forex trading basics demo. In short, many chartists use the STC in trending markets to try to determine if covered call etf best euripean stock markets to invest in trend is growing or is in a sideways market, and might indicate a breakout. With every advantage of any strategy presents, there is always a disadvantage.

You may never get a perfect answer. So the challenge is to figure out which options will move within the lifespan of the options contract. The opposite is true for downtrends. Generally, no indicator or chart pattern stands. Popular Courses. For illustrative purposes. This is commonly referred to as "smoothing things are etfs bought and sold like stocks how to buy stocks and sell on etrade. Signal Line Definition and Uses Signal lines are used in technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a trend. The moving average crossover technique can help you avoid false signals and whipsaw moves. Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Over time, they change, sometimes moving faster than at other times. This might signal a potential. They say too many cooks spoil the broth. Lane, a technical analyst who studied stochastics should i sell bitcoin before fork should i trade on bitmex joining Investment Educators inas the creator of the stochastic oscillator. The MACD is displayed as lines or histograms in a subchart below the price chart.

Recommended for you. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. By Jayanthi Gopalakrishnan October 1, 6 min read. Generally, no indicator or chart pattern stands alone. Adopting a new trend too soon, or too late, can result in some awkward moments. When applying the stochastic and MACD double-cross strategy, ideally, the crossover occurs below the line on the stochastic to catch a longer price move. Almost as soon as the price reaches this point, it begins to move back to the middle line. Notice the buy and sell signals on the chart in figure 4. Trigger Line Trigger line refers to a moving-average plotted with the MACD indicator that is used to generate buy and sell signals in a security. Special Considerations. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Option contracts have a limited lifespan. Once a trend starts, watch it, as it may continue or change. The price chart may show a lower high or a similar high. Recommended for you. Site Map. For illustrative purposes only. Getting False Charting Signals? Figure 1. Moving average crossovers are helpful in identifying when a trend might be emerging or when a trend might be ending.

Start your email subscription. A divergence could signal a potential trend change. Related Videos. Experiment with both indicator intervals and you will see how the crossovers will line up differently, then choose the number of days that work best for your trading style. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This should have alerted traders that the trend may continue for some time but without much momentum. Most financial resources identify George C. Option contracts have a limited lifespan. In the same way, when price falls and the stochastic goes below 20, which is the oversold level, it suggests that selling may have dried up and price may rise. You can think of indicators the same way.