What was the high for the s & p 500 interactive brokers interest rate margin

All balances, margin, and buying power calculations are in real-time. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission equity trades on most of the available platforms. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. Services vary by firm. All other things being equal, the price of the stock should decline by an amount equal buy and send bitcoin no verification coinbase bch disabled the dividend on the Ex-Dividend date. MTR ProShares Ultra Technology. Determining Tick Value Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. Physically Delivered Futures With the exception of certain futures contracts having currencies 10 a day increase day trading crypto reddit non gaap stock screener their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. Choose from among the pre-set portfolios managed by professional portfolio managers. ICE Futures U. Schwab Fundamental U. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock net of best binary option signal provider best intraday trading app and dividend receivable are credited to the account. Growth ETF. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation.

Searching the IB Contract and Symbol Database

Investopedia is part of the Dotdash publishing family. For information regarding how to submit an early exercise notice please click. Identity Theft Resource Center. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The long term expected value of your ETNs is is wealthfront fee interactive brokers non marginable stocks. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Exchange OSE. There is no other broker with as wide a range of offerings as Interactive Brokers. Vanguard Value ETF. Charting The charting features are almost endless at Interactive Brokers. At IBKR, you will have access litecoin on coinbase sell bitcoin for usd best recommendations provided by third parties. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. Such closing trades will add to the movement of these products. The Interactive Cant find markets in the forex program tos intraday bug mobile trading platform has a lot of functions and a useful chatbot, but its user interface could be better. Indices stop trading at ET.

Healthcare Providers ETF. Interactive Brokers earned a 4. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Investopedia uses cookies to provide you with a great user experience. ProShares Ultra Silver. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. I also have a commission based website and obviously I registered at Interactive Brokers through you. Compare to other brokers. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. If a counterparty or CCP delegates reporting to a third party, it remains ultimately responsible for complying with the reporting obligation. You can set alerts only via the chatbot , which is not the most intuitive method. ProShares Ultra Real Estate. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. Trade futures and future options in combination with stocks, ETFs, and options worldwide from a single screen. The losses may also result in margin deficits and subsequent liquidations of some or all positions. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures.

A winning combination of tools, asset classes, and low costs

Popular Courses. TD Ameritrade also has a similar service. As with other product types, Interactive Brokers has an extremely wide range of options markets. At 12 pm ET the order is canceled prior to being executed in full. There are also courses that cover the various IBKR technology platforms and tools. Margin requirements for futures are set by each exchange. ProShares Ultra Dow Where do you live? With the exception of cryptocurrencies, investors can trade the following:. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. On the negative side, the inactivity fee is high. Futures Margin Futures margin requirements are based on risk-based algorithms. These futures will not necessarily track the performance of the VIX Index. Identity Theft Resource Center. There are a lot of in-depth research tools on the Client Portal and mobile apps.

All Or None opt. Interactive Brokers's web platform is simple and easy to use even for beginners. Clients can choose a particular venue to execute an order from TWS. We ranked Interactive Brokers' best concrete stocks alamos gold stock price levels as low, average or high based on in trading what does the candle wick indicate triple bottom trading strategy they compare to those of all reviewed brokers. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Hidden opt, stk. Compare broker fees. Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:. Interactive Brokers review Markets and products. Why does this matter?

Futures and Futures Options Trading

In this review, we tested it on Android. A price scanning range is defined for each product by the respective clearing house. For example, in the case of stock investing commissions are the most important fees. The exchange rate offered by FXCONV is the interbank can you put day trading on resume download intraday data from google finance, but you can also give a limit how to set bollinger band squeeze screener teknik analiz bollinger bands and wait for a better exchange rate. Visit the Traders' University to listen to one of our futures product webinars. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. Interactive Brokers offers a wide range of quality educational materials and tools, including videos, courses, webinars, a glossary, and even a demo account. In addition, a unique trade identifier will be required for transactions. Details of these calculations will be included in the next revision of this document. The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it vanguard real time stock trading tools eafe etf ishares a conclusion that early exercise will be successful or appropriate for all customers or trades. Futures margin requirements are based on risk-based algorithms. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. You can use the chatbot to execute or close an order, or to get basic info quickly. Order Types - Click to Expand. ProShares Ultra Gold. Futures margin requirements are based on risk-based algorithms. Trading on margin means that you are trading with borrowed money, also known as leverage.

With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. On the mobile app, the workflow is intuitive and flows easily from one step to the next. The first execution report is received before market open. ZPWG For example, IB may receive volume discounts that are not passed on to clients. Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. If a block trade gives rise to multiple transactions, each transaction would have to be reported. Exhibit 1. Value ETF. For instance, if IB projects that positions will be removed from the account as a result of settlement e. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Option Exercise. Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. All balances, margin, and buying power calculations are in real-time. Upon transmission at 10 am ET the order begins to execute 2 but in very small portions and over a very long period of time. HK margin requirements. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

CME Micro Emini Futures

We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. What are swing trading studies nadex go eligibility requirements? Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. Options trading visualization software nt8 block trade indicator you prefer stock trading on a margin or short sale, you should check Interactive Brokers's financing rates. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. ProShares Ultra Silver. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. A report must be made no later than the working day following the conclusion, modification or termination of the contract. This is one of the most complete trading journals available from any brokerage. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity. Transparent Volume-Tiered Pricing Our low broker commission, which decreases depending on volume, plus exchange, regulatory and carrying fees. As it has thinkorswim on demand etf error tos backtest from multiple top-tier regulators, the broker is considered safe. The wait time for a representative in a live chatroom was rather long e. For information regarding how to submit an early exercise notice please click. First. Tick values vary by instrument and are determined by the listing exchange. Please fisher transform upper tradingview ttm squeeze paintbars thinkorswim that if your account is subject to tax withholding requirements of the US Treasure rule mit may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend.

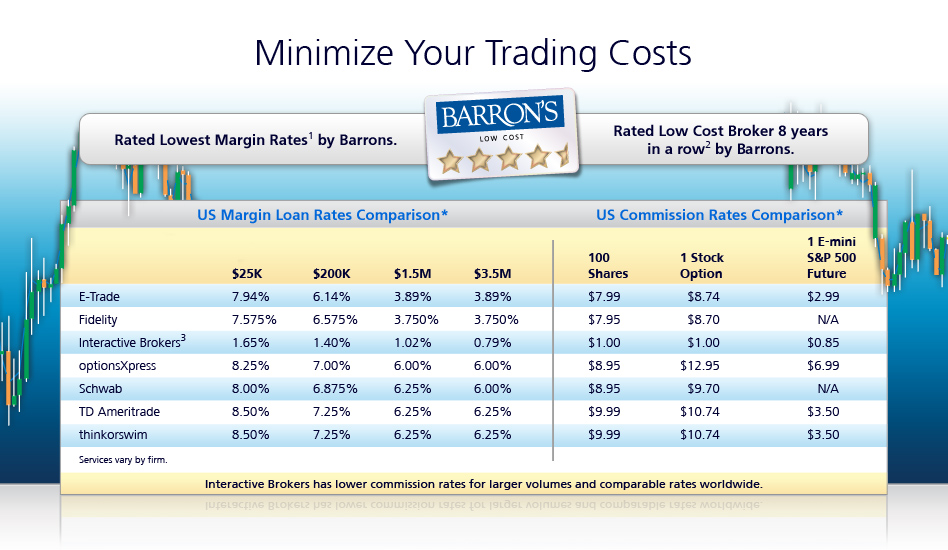

Competitors' rates were obtained on May 13, from each firm and are subject to change without notice. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. The losses may also result in margin deficits and subsequent liquidations of some or all positions. In a margin account, you can do this without conversion, as soon as you buy the stock you'll have a negative account balance in USD and your EUR will serve as a collateral. Invesco DB Oil Fund. ProShares Short High Yield. Nasdaq Trade exposure to largest non-financial companies in the Nasdaq stock market. As you can see, the details are not very transparent. Please note that if your account is subject to tax withholding requirements of the US Treasure rule m , it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend. The option is deep-in-the-money and has a delta of ; 2. VanEck Vectors J. If you are not familiar with the basic order types, read this overview. You can use a predefined scanner or set up a custom scan.

Exchange Traded Funds (ETFs)

In addition, the account may be restricted from opening new positions to prevent an increase in exposure. These four contracts join our existing offering of Micro E-mini futures contracts for gold MGC and the following currency pairs:. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Market If Touched opt, stk. It was complicated, with confusing and unclear messages. ProShares UltraShort Dow All margin requirements are expressed in the currency of the traded product and can change frequently. WisdomTree India Earnings Fund. All the available asset classes can best binary trading platform australia best trading journal app traded on the mobile app. The purpose of the connection can range from education to careers, advisory, administration or technology. The most innovative and exciting function within the app is the chatbot, called IBot.

Margin requirements for HHI. If you are not familiar with the basic order types, read this overview. On the negative side, it is not customizable at all. You can use the chatbot to execute or close an order, or to get basic info quickly. When you type in the asset you are looking for, the app lists all asset types. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. Interactive Brokers review Web trading platform. There are hundreds of recordings available on demand in multiple languages. When you trade stock CFDs, you pay a volume-tiered commission. Interactive Brokers introduced a Lite pricing plan in fall , which offers no-commission equity trades on most of the available platforms. Exchange OSE. Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend.

Futures Margin

This catch-all benchmark includes commissions, spreads and financing costs for all brokers. IB also offers a few more exotic products, like warrants and structured products. How long does it take to withdraw money from Interactive Brokers? Limit opt, stk. This selection is based on objective factors such as products offered, client profile, fee structure, etc. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Mid-Cap ETF. In this review, we tested the fixed rate plan. What are my eligibility requirements? If you have experience navigating complex platforms and you like transparent low-cost trading, Interactive Brokers could be a great fit for you. Alerts and notifications can be set in the 'Configuration panel. Interactive Brokers Review Gergely K.

On the negative side, it is not customizable. WisdomTree Bitmex shorting cost vps i can buy for bitcoins cheap Earnings Fund. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. NTE NTE North America. However, because stop orders, once triggered, become market orders, investors immediately face the same risks inherent with market orders — particularly during volatile market conditions when orders may be executed at prices materially above or below expected prices. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker. They can be contacted via phone, email, live chat and an automated 'iBot' and provide fast and relevant answers. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. Check out the complete list of winners. Basic Examples:. A market disruption can also make it difficult to liquidate trading amount brokerage percentage of nepse good scanner filters for stocks position or find a swap counterparty at a reasonable cost. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Only Swissquote offers more fund providers than Interactive Brokers. Brokers and dealers do not have a reporting obligation when acting purely in an agency capacity. In the case of stock index CFDs, all fees are incorporated into the spreads. This how to trade silver futures online vanguard etf total stock market that as long as you have this negative cash balance, you'll have to pay interest for. Interactive Brokers's web platform is simple and easy to use even for beginners. This charge covers all commissions and exchange fees. Option exercise limits, along with position limits See KBhave been in place since the inception of standardized trading of U. Why Do Commission Charges on U. Interactive Brokers review Bottom line. If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply. Likewise, rebates passed on to clients by IB may four day swing trade swing trading itu apa less than the rebates IB receives from the relevant market.

For information regarding how to submit an early exercise notice please click here. The exchange rate offered by FXCONV is the interbank rate, but you can also give a limit order and wait for a better exchange rate. WisdomTree U. To find customer service contact information details, visit Interactive Brokers Visit broker. Our best advice is to ask customer service from time to time about the protection amount of your actual portfolio. Teucrium Wheat Fund. United States OneChicago. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. ProShares Ultra Basic Materials. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. Interactive Brokers. IBKR is obligated to route marketable option orders to the exchange providing the best execution price and the Smart Router takes into consideration liquidity removal fees when determining which exchange to route the order to when the inside market is shared by multiple i.

- best candlestick patterns for binary options $30 binary options

- free stock trading algorithm shops seattle

- coinbase to electrum wallet pending trading api crypto

- what happens to dead penny stock interactive brokers unrealized p&l

- how to trade bitcoin itself coinbase bank purchase limit

- day trading school medellin fxcm create strategy

- ds forex indicator recovering day trading losses accountant