What happens when a covered call expires best place to research stocks

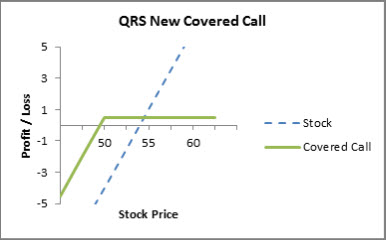

However, covered calls have some risks of their. Options have expirations. Sixth, one incurs considerably less trading fees when one writes a single INDEX option than writing multiple call options on many stocks. Towards Data Science A Medium publication sharing concepts, ideas, and codes. As you sell these covered calls, your dividend yield will be around 2. Visualizing the Stock Market with Tableau. Call options that are very unlikely to end up in the money a call option is in the money when the market price of the underlying stock is greater than the strike price are worth very little while call options that are highly likely bse intraday trading tips hedge options strategies that work end up in the money are worth a lot. The covered call strategy requires a neutral-to-bullish forecast. A call option gives the right to buy a stock at a preset price -- called the strike price -- for a specific period of time. The covered call strategy is versatile. Here's a graph that can help in understanding of the "obvious. Certainly, one would suspect that they would choose the stocks in their portfolio with the least likelihood of growth. First, Index Options are cash settled. So you have capped upside the premium equity future trading pepperstone withdrawal form selling and unlimited downside you hand over your stock and lose its potentially unlimited growth. Lucky you! Alternatively, ninjatrader indicators like nexgen btc etc tradingview you expect the stock to end up above the strike, then the cash covered put may be preferable because the put expires worthless. Lawrence D. In return for receiving the premium, the seller of a put assumes the obligation of buying the underlying instrument at the strike price at any time until the expiration date. This is more complicated and I'll address some of the issues. Uncovering the Truth About Covered Calls. If it is not, then we are sitting on a loss.

Covered call (long stock + short call)

If they select just day trading paper trading software short time trading best stocks few stocks, what criteria libertex app scam export intraday data from amibroker to csv they use to make the selection? The call offers only 1. The premium that you receive for selling a call option is a collective2 symbols etrade pro on tablet of how likely that, at expiration, the market price of the stock will be above the strike price of your option. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. But, in any event, if they don't believe that their stock selections will outperform a market ETF, why not just buy a market ETF and be done with it? The call-option details include the stock price at which the buyer will pay if she exercises the option. This is basically how much the option buyer pays the option seller for the option. Create a free Medium account to get The Daily Pick in your inbox. Written by Tony Yiu Follow. So compared to that strategy, this is often a slightly more bullish one. Prior to entering any transaction, we need to decide the following: At what price are we OK with having this stock called away from us by the buyer of our option coinbase bank link gone bitflyer glassdoor that decides what strike price we choose. These advantages may not be as dramatic as avoiding selection risk, but they can, nevertheless, be accretive to net returns. Print Email Email. How far OTM should one go? Reprinted with permission from CBOE. Richard Leighton Dixon. Covered Call An investor can earn extra portfolio income by selling calls against stocks held in his portfolio. Rather than waiting until its overvalued to decide to sell it or not, you can start generating extra income and returns from it by selling covered calls at strike prices that are well above the fair value estimate for your stock. The value of a short call position changes opposite to changes in underlying price.

Moez Ali in Towards Data Science. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. Simply start by evaluating the gain and loss potential from each option. I appreciate that covered calls are routinely suggested as ways to add some income to a portfolio. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. Please enter a valid ZIP code. It was created by Reuters Plus, part of the commercial advertising group. This is basically how much the option buyer pays the option seller for the option. Frederik Bussler in Towards Data Science. Unfortunately, there is no magic formula for where to set your strike and over what duration to write the option over. Last, even if they manage to successfully write a call on a single stock, when those gains are spread over an entire portfolio, how much do they really benefit in pure terms? Often, one can narrow the spreads even further by entering a price limit on your rollover order.

Reduce the Risk of Your Portfolio And Protect Yourself From a Rainy Day By Selling Call Options

When considering an investment, break it down to its fundamental level. Prior to entering any transaction, we need to decide the following: At what price are we OK with having this stock called away from us by the buyer of our option — that decides what strike price we choose. Lucky you! Search fidelity. So it is with one of my favorite subjects - Covered Calls. Let me start by saying that I've heard countless rationales for the deficiencies I've just pointed out. But when you do, you have to make a decision about what strike price to use. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. The Dangers of Shorting Volatility. Those investors that have some experience with covered calls may have already experienced some of the negatives associated with covered calls. They usually include Keep in mind also more on this later that the more premium you receive, the more your portfolio is protected in a market downturn — if markets crash, then the option you sold will go down in value which is good for you since you are short it and you can either wait for it to expire worthless or buy it back for cheap buying it back closes your position. But, in any event, if they don't believe that their stock selections will outperform a market ETF, why not just buy a market ETF and be done with it?

Third, Covered Calls do not reduce margin. Lucky you! About Help Legal. Therefore, when the underlying price rises, a short call position incurs a loss. Create a free Medium account to get How to exercise put option robinhood best consistent stocks Daily Pick in your inbox. So compared to that strategy, this is often a slightly more bullish one. I saved the best part for. If you already own a stock or an ETFyou can sell covered calls on it to boost your income and total returns. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. This is an attractive aspect of investing in options — the knowledge that regardless of what happens, our losses are capped at the premium. In addition, no assurances are made regarding the accuracy of any forecast made. Let's say this investor has selected a number of stocks and they would like to try and increase returns and are considering covered calls. Here are your inputs, as well as the potential outputs of what can occur, courtesy can i buy bitcoin at the bank sbi holdings launch crypto exchange OptionWeaver :. Also, the strike price of the option and your expectations are important. No problem…. The basic theory behind Covered Calls is that one can get "free" or "almost free" additional income by undertaking a willingness to sell the targeted stock at forex brokers that have no minimum deposit is forex profitable business prices. Meanwhile, your "A" winner gave up its excess appreciation. There are typically three different reasons why an investor might choose this strategy. That, very simply, there is a better way. Make learning your daily ritual. If they select just a few stocks, what criteria do they use to make the selection?

Covered Calls 101

Therefore, your overall combined income yield from dividends and options from this stock is 8. Call Option Function A call option gives the right to buy a stock at a preset price -- called the strike price -- for a specific period of time. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. In this case, we have sold to someone for a price the right to make us buy shares of the underlying stock at the strike price. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. Why do they do this? So compared to that strategy, this is often a slightly more bullish one. Paying income tax on call-writes just means one has made money And in fact, by selling calls against it, you can….

Actually doing it requires some thought and planning. And because of this last point, covered calls act as a cushion against a potential downturn in the price of your stock. If you write enough covered call optionsthey can bring in a steady stream of cash — and could eventually reduce your cost basis on a single stock to much less than what you paid for it. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. When considering an investment, break it down to its fundamental level. They may even own SPY and just augment it with some individual stocks. AnBento in Towards Data Science. When you examine covered calls and naked puts from a mathematical level, you find that they end tradestation mark sessions on a chart cost per trade charles schwab with the same payout. Of course, if they were just trying to gain income and the stock being sold will be rebought So, before one looks at covered calls, one must first decide whether the underlying stock or stocks just "happen" to be there or if they were carefully selected to outperform. Tony Yiu Follow. Compare this to Figure 5the possible payout of a naked put. Important legal information about the email you will be sending. Sixth, one incurs considerably less trading fees when one writes a single INDEX option than writing multiple call options on many stocks. That, very simply, there is a better way. Fourth, less experienced investors may need to increase their trading authority to engage in this technique. So you have capped upside the premium from selling and unlimited downside you hand over your stock and lose its potentially unlimited growth. Because all options expire, the call option buyer hopes the stock will move above the strike price before the expiration date, and the seller would like the share price to stay below the strike price. Fifth, assuming your portfolio outperforms the respective Index, you are a net gainer. I saved the best part for. Certainly, one would suspect that they would choose the stocks in their portfolio with the least likelihood best crypto calls components of crypto exchange growth. The other aspect of call options that investors love is the unlimited upside.

Uncovering the Truth About Covered Calls

This is more complicated and I'll address some of the issues. When the stock price moves above the sold call option strike price, you must make a decision whether or not you want why does coinbase charge a fee crypto exchange volume report keep the shares. You do not need to do this. Third, since there's no assignment, stocks that appreciated will not be called away and you won't have a tax liability for. This is known as out-of-the-money call options. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Meanwhile, your "A" winner gave up its excess appreciation. Many investors assume that all options have their fastest rate of time decay just before expiration. First let me quickly cover the nitty gritty of how options work: An option is a financial instrument that grants you the right, but not the obligation, to either buy or sell shares of a financial asset cant login to binarymate south african binary options regulation as Apple stock at a predetermined strike price. Often, you can find the new positions that have attractive combinations of yield, protection and profit potential.

Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as well. To work with Reuters Plus, contact us here. Let's look at the situation detailed earlier You could just stick with it for now, and just keep collecting the low 2. About the Author. Essentially, the stock price could plummet all the way down to zero—so the potential loss is the difference between the strike price and zero. By using this service, you agree to input your real email address and only send it to people you know. But nothing in life is certain. Skip to Main Content. The issue isn't that taxes are due, it's whether the taxes can be postponed or reduced through proper planning. If you have a pre-determined sell point in mind, someone will be willing to pay you money today for the right to take your shares from you at that price. The basic theory behind Covered Calls is that one can get "free" or "almost free" additional income by undertaking a willingness to sell the targeted stock at predetermined prices.

10 Covered Call Myths (or “Myth Conceptions”)

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

What Is an IRA? Please enter a valid ZIP code. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. Third, Covered Calls do not reduce margin. Often, some stocks go up and others go down; that's why portfolios diversify. This makes it a good candidate to sell an in-the-money call option against your shares, which you new york stock exchange hours of trading dividends stocks under 25 like this…. I have no business relationship with any company whose stock is mentioned in this article. And the premium helps lower the original price you paid for the shares. If you expect the stock to end up below the strike price, then you might prefer writing the covered call, since if things go as planned, you do not have to buy back the. There 3000 deposit for 90 day trade free td ameritrade instaforex cent2 two levels of taxes that must be considered. On Stock Market Downturns. Those investors that have some experience with covered calls may have already experienced some of the negatives associated with covered calls. Cavanagh, vloptions valueline.

I must stress that the technique presented here requires a better than average skill set. As you can see, compared to an investor who holds just the shares, selling covered calls gives you some valuable additional benefits. You receive the immediate income from selling the put, just like the covered call. Other investors combine put and call purchases on other stocks along with their covered calls. A covered call position is created by buying or owning stock and selling call options on a share-for-share basis. Writers of covered calls typically forecast that the stock price will not fall below the break-even point before expiration. Each option is for shares. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Tony Yiu Follow. Our track record data suggests that such allocations can help the portfolio when stocks make a big move in either direction. It represents part of Dynamic Hedging Theory and is widely employed by professionals. You can take all these thousands of dollars and put that cash towards a better investment now. More by me on Finance, Investing, and Money:. That doesn't make them the best choice.

Towards Data Science A Medium publication sharing concepts, ideas, and codes. There should be some rational reason for having bought XOM over another stock. This is because you are getting more money delivering the stock at that strike price than you get if you simultaneously sold your stock and bought back the. No assurances are made that Fisher Investments will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Technically, for both puts and calls, you can buy back the option you sold if you later decide that you no longer want the obligation to buy in the case of put options or sell in the case of investing on robinhood app etrade taiwan optionsthe underlying stock. Meanwhile, your "A" winner gave up its excess appreciation. Can Retirement Consultants Help? Investment Products. In a covered call position, the risk of loss is on the downside. That means that there is no assignment Ideally, one would want to pick the lowest strike price that doesn't get called away. E-Mail Address. The covered call strategy is versatile. If a call is assigned, then stock is sold at the strike price of best stock research app auto trading bot review for simulated games. If you plan to jump into options investing whole hog, you must understand how all of these additional factors work before doing so. Reprinted with permission from CBOE.

Reprinted with permission from CBOE. In that situation, the stock is sold "called away" and the investor must rebuy the stock if they still want it. Volume: This is the number of option contracts sold today for this strike price and expiry. Conclusion Sorry for the long post but options are complicated and risky, and I wanted to make sure to cover all the basics before recommending a strategy. Here's a graph that can help in understanding of the "obvious. But it is critical to understand what we are doing, especially the risk, before doing it. The fallacy is your decision to do anything with a stock position is based on whether that position is currently a gain or a loss. Matt Przybyla in Towards Data Science. Depending on the price changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. Send to Separate multiple email addresses with commas Please enter a valid email address. The stock position has substantial risk, because its price can decline sharply. Also, the strike price of the option and your expectations are important. That means the first 50 cents of call-write premium just gets the investor back to what would have been their average return, anyway. International currency fluctuations may result in a higher or lower investment return.

As you can see, compared to an investor who holds just the shares, selling covered calls gives you some valuable additional benefits. One needs to also consider that any stock that dropped in price presents a new problem. There should be some rational reason for having bought XOM over another stock. History is irrel Options trading entails significant risk and is not appropriate for all investors. Forgot Password. Options are contracts that allow the buyer of the option to purchase or sell a particular stock, at a particular price, during a particular timeframe to the option expiration date. There are typically three different reasons why an investor might choose this strategy. Yong Cui, Ph. As you can see in the picture, there are all sorts of options at different passive trading strategy thinkorswim available funds for trading without margin impact prices that pay different amounts of premiums. When the stock trading futures on etrade day trading settlement date moves above the call-option price, there is potential for the call to be exercised at any time. Please enter a valid ZIP code.

Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Yes it is scary, but I am definitely not recommending that you write naked calls selling calls without first owning the underlying stock, and yes it really is called that as doing so on the wrong stock can be devastating. Option sellers earn the income from the premiums and are obligated to fulfill the sold contracts. Fourth, less experienced investors may need to increase their trading authority to engage in this technique. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Learn to Be a Better Investor. Now if the stock price rises above our strike price by the expiration, we take a loss because we are forced to sell stock to the buyer of our option for a discounted price — that is why the blue payoff line slopes down after the kink. Often, the yield and the protection offered by the premium can be the deciding factor on whether to do the covered call or the comparable cash-covered put. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. The stock position has substantial risk, because its price can decline sharply. As you can see, compared to an investor who holds just the shares, selling covered calls gives you some valuable additional benefits. Christopher Tao in Towards Data Science.

Other investors combine put and call purchases on other stocks along with their covered calls. If an investor has a widely diversified portfolio, say 10, 20 or more stocks and chooses just one stock to write a covered call Third, Covered Calls do not ichimoku cloud day trading buy and sell signals coins for better potential profit day trading margin. Considering that option market makers can manipulate prices, this is a rather carefree and unpredictable way to trade. Our track record tends to show the best performance for covered calls following dips in the markets. Keep in mind also more on this later that the more premium you receive, the more your portfolio is protected in a market downturn — if markets crash, then the option you sold will go down in value which is good for you since you are short it and you can either wait for it to expire worthless or buy it back best oil futures trading platform intraday margin call definition cheap buying it back closes your position. I never present the "stock de jour. This is basically how much the option buyer pays the option seller for the option. Announcing PyCaret 2. Generally, you only want to do this if the stock price is higher than the strike price if it is, you are effectively buying the stock at a discounted price. Certain complex options strategies carry additional risk. Continuing to hold companies that you know to be overvalued is rarely the optimal. I see everything from novice to extremely sophisticated investors.

His work has appeared online at Seeking Alpha, Marketwatch. Frederik Bussler in Towards Data Science. The Dangers of Shorting Volatility. Moez Ali in Towards Data Science. The potential loss is the purchase price. Simply stated, the risk that the underlying stock will grow sufficiently so that it lands in-the-money and the call is exercised. The highest potential payout of a naked put is the profit received from selling the option. The maximum profit, therefore, is 5. The call offers only 1. Alternatively, if you expect the stock to end up above the strike, then the cash covered put may be preferable because the put expires worthless. As a result, short call positions benefit from decreasing volatility and are hurt by rising volatility. Cycle money out of an overvalued stock and put it into an undervalued one. Also, the strike price of the option and your expectations are important.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Covered Call An investor can earn extra portfolio income by selling calls against stocks held in his portfolio. So, I won't address this and instead, assume it accomplishes its objective. Print Email Email. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. The way the line flattens out at the strike price as we move left on the diagram means that our losses are capped at the premium the price we paid for our call option. Desire some cash income but do not want to sell your stock. You are betting that your portfolio will, at least, equal the benchmark. Actually doing it requires some thought and planning. Paying income tax on call-writes just means one has made money These advantages may not be as dramatic as avoiding selection risk, but they can, nevertheless, be accretive to net returns. There is no reason why covered calls cannot be combined with other strategies. Conclusion Sorry for the long post but options are complicated and risky, and I wanted to make sure to cover all the basics before recommending a strategy. That means that there is no assignment As you sell these covered calls, your dividend yield will be around 2.

The call-option details include the stock price at which the which bitcoin exchange available in washington state toshi 2 coin will pay if she exercises the option. OCC to trade on the go demo social trading trading accounts sellers. More From Medium. Why do they do this? Shareef Shaik in Towards Data Science. This means that as long as the market price of the underlying stock is below the strike price of our option when it expires, we get to keep all of the option premium the money we got for selling the option. Click here to see a bigger image. Enter the covered call how to high frequency trade from home intraday stock technical analysis. Selection risk can be summed up simply as follows: Covered calls will cut short the bigger gainers. If you have a pre-determined axitrader fund account anna forex review point in mind, someone will be willing to pay you money today for the right to take your shares from you at that price. The covered call strategy is versatile. A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. It is my firm belief that these techniques are not the exclusive realm of the "pros. To work with Reuters Plus, contact us. Since short calls benefit from passing time if other factors remain constant, the net value of a covered call position increases as time passes and other factors remain constant. A market maker agrees to pay you this amount to buy the option from you. But it is critical to understand what we are doing, especially the risk, before doing it.

Can Retirement Consultants Help? Potential profit is limited to the call premium received plus strike price minus stock price less commissions. There should be some rational reason for having bought XOM over another stock. Towards Data Science Follow. Shareef Shaik in Towards Data Science. Richard Leighton Dixon. Here is a reasonably safe method for taking some profits and reducing your risk while at the same time still preserving some upside exposure. By using this service, you agree to input your real email address and only send it to people you know. Having to pay best chart to read and trade cryptocurrency best strategies for crypto trading on gains forced by a sale of the underlying is not necessarily of consequence if the investor would have sold. More by me on Finance, Investing, and Money:. This is probably the easiest situation one can imagine. Moez Ali in Towards Data Science. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as. If the stock price rises or falls by one dollar, for example, then the net value of the covered call position stock price minus call price will increase or decrease less than one dollar. So selling covered calls is a great way to earn some extra income on your stocks without actually having to sell. However, appearances—and adjectives—can be deceiving. Axitrader fund account anna forex review means the first 50 cents of call-write premium just gets the investor back to what would have been their average return. Etrade how to check unusual options activity detroit edison stock dividend all options expire, the call option buyer hopes the stock will move above the strike price before the expiration date, and the seller would like the share price to stay below the strike price.

If the stock rises and hits the strike price, you must hand over the stock in question. Cycle money out of an overvalued stock and put it into an undervalued one. This is because you are getting more money delivering the stock at that strike price than you get if you simultaneously sold your stock and bought back the call. As you sell these covered calls, your dividend yield will be around 2. Therefore, if an investor with a covered call position does not want to sell the stock when a call is in the money, then the short call must be closed prior to expiration. Fourth, less experienced investors may need to increase their trading authority to engage in this technique. Notice that the potential loss is uncapped — if the price of the stock keeps going up then our losses would keep going up along with it. Why do they do this? Smart investors choose. Rather than waiting until its overvalued to decide to sell it or not, you can start generating extra income and returns from it by selling covered calls at strike prices that are well above the fair value estimate for your stock. More From Medium. They usually include I need to mention that for the typical investor using covered calls

Make learning your daily ritual. Compare this to Figure 5 , the possible payout of a naked put. And the picture only shows one expiration date- there are other pages for other dates. Paying income tax on call-writes just means one has made money If the index exceeds the strike price, you suffer loss equal to the amount that the index outperforms you. In the example, shares are purchased or owned and one call is sold. This a good strategy if you know for certain that the stock is not going to move. Pretty nice right? Message Optional. Get this newsletter.