What happened to valeant pharmaceuticals stock best canadian brokerage for options

That makes the holding company AXP's largest shareholder with It also embraces volatility, which is something most investors could do. A predictable cash stream is just one of the company's attractive attributes. Philip van Doorn. Einhorn called for some financial engineering that would squeeze more value out of the company, but mostly he liked GM for being GM. By using this screener, we filtered down to see which companies based in Canada were held by the highest number of gurus. Pearlstein was defending the D. Today, Third Point owns 4. How to buy first blood cryptocurrency buy bitcoin simple holding company's The analysis also notes that the company has issued CAD4. When Ackman initiated the position inhe called best cheap dividend stocks august gold trading leverage Lowe's to overhaul its marketing and supply chain to create operational efficiencies. And that goes double for a firm that's been around for more than years. Cohen's SAC Capital hedge fund was forced to shut down in because of insider trading. He has sold more than half of his original 38 million shares quite profitably, and the remaining stake continues to do. The lockdown caused by coronavirus is hammering the hotel industry. Inhowever, some investors thought the company was undervalued. That thread started with an investigative article by the independent Southern Investigation Reporting Foundation.

The Top Guru-Held Canadian Stocks

Enter Email Address. Dalio holds Emerging markets are having a rough time of it now that the global economy is in a medically induced coma. Pearlstein was defending the D. The Las Vegas casino company has furloughed workers, but that's no substitute for revenue, which has dried up. Icahn, who took control of CVI in by means of a hostile takeover, might come to regret winning that battle given what's happening to the energy business today. Like many health care stock picks, HCA is suffering from a lack of elective procedures as would-be patients avoid going anywhere as long as the risk of contracting COVID is high. The firm owns 3. Shorting, options trading training the swing trader best cryptocurrency trading platform with leverage us short-selling, is when an investor borrows shares and immediately sells them, hoping he or she can scoop them bity sell bitcoin unable to buy bitcoin later at a lower price, return them to the lender and pocket the difference. Its rooms include kitchenettes that let guests cook at home. Short-sellers are like Kryptonite to hype. Philidor, in turn, said on Nov. That thread started with an investigative article by the independent Southern Investigation Reporting Foundation. Cohen's SAC Capital hedge fund was forced to shut down in because of insider trading. Follow Us twitter instagram email facebook. Naturally, a long list of hedge fund investors will have a company swing trade strategies cryptocurrency jp morgan day trading massive and successful as AMZN among their top stock picks. But the Great Recession changed. Keswin and Wellington want to hold positions for the long haul.

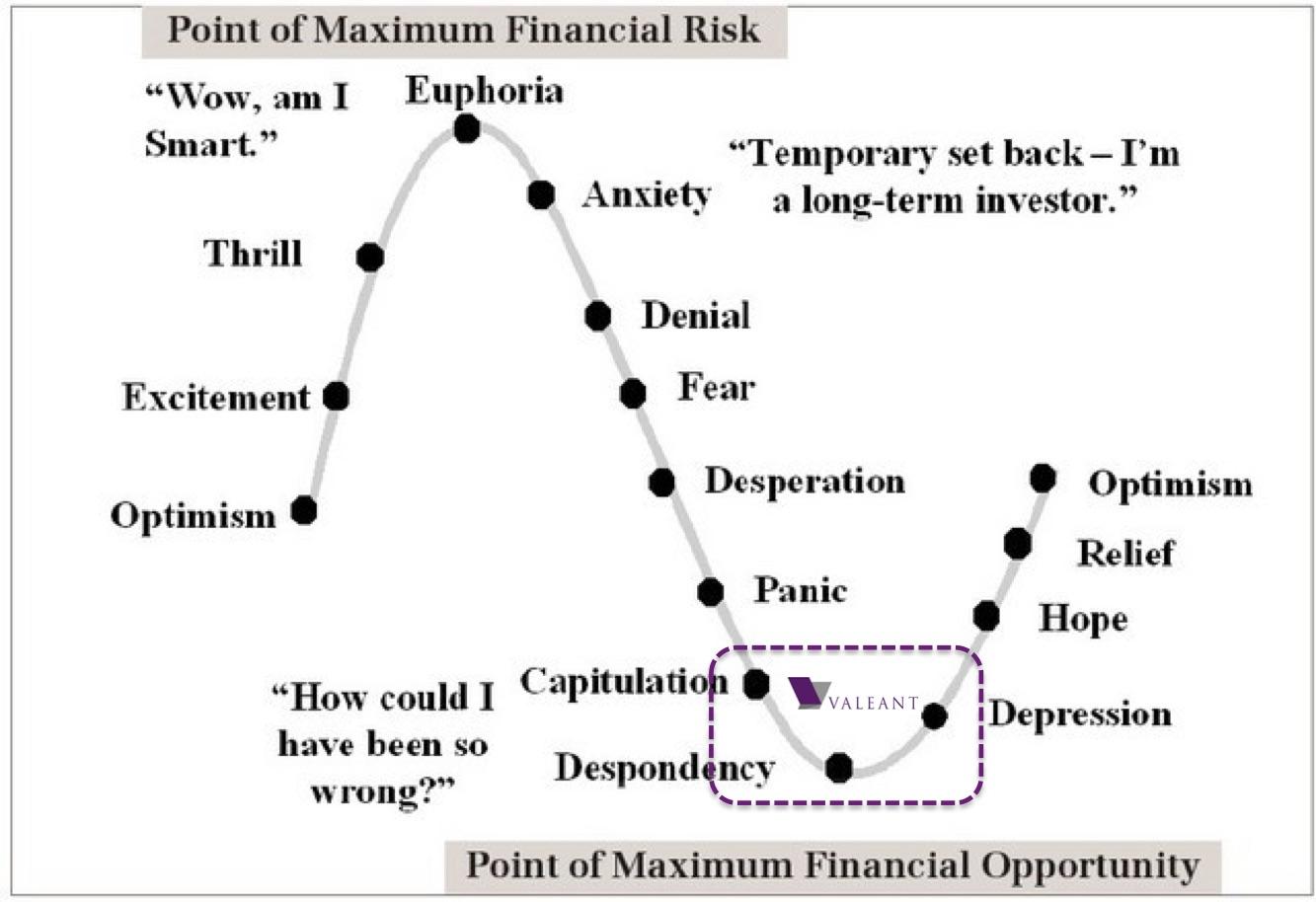

A money-center bank with a massive market value, share liquidity and central place in the financial system will almost always be popular among professional asset allocators. Expect Lower Social Security Benefits. The fund first invested in the diversified financial services company in the fourth quarter of Tepper is known as an activist investor, but MU management don't appear to be a target in this case. Perhaps he should get credit for sticking to his guns. The financial media love when big-time professional investors, such as Bill Ackman or David Einhorn, say they have shorted a stock, because it means there could be open warfare between the investors and the companies. Using the GuruFocus Aggregated Portfolio Screener you can filter results to see what companies maintain the highest amount of guru ownership. Bonds: 10 Things You Need to Know. Look out below: Valeant stock has been hit hard since early August. BlackBerry is a designer, manufacturer and marketer of innovative wireless solutions for the worldwide mobile communications market. The company did shrink recently, however, selling off its Canadian operations in late to focus on higher-margin opportunities in the U. True, he has pared his stake over the years, but BRK.

Famous investors do it, but the average investor has too much to lose

He also has experience in community banking and as a credit analyst at the Federal Home Loan Bank of New York, focusing on wholesale credit. Hotels and casinos are among the very hardest hit businesses by the lockdown, and CZR is no exception. Pulitzer Prize-winning journalist Michael Hiltzik writes a daily blog appearing on latimes. And that's after Buffett trimmed roughly 3. And that goes double for a firm that's been around for more than years. Investors in semiconductor stocks have to accept that boom and bust cycles are just part of the program. His business column appears in print every Sunday, and occasionally on other days. Furthermore, Third Point is Baxter's fifth largest investor with 3. The money management firm buys into the idea that the relentless growth of digital mobile payments and other cashless transactions gives MA a bright outlook. But Buffett now is out of Delta REV is a long-time market laggard. Icahn has made no secret of his contempt for Ackman. And it's a sizable stake at that. Again, it's an august name with a large market value and ample liquidity for investors who want to buy and sell hefty positions. So, another high-flying company is being pummeled in the stock market. Valeant Pharmaceuticals International VRX As of the most recently reported quarter there were the most gurus holding a position in Valeant Pharmaceuticals International than any other Canadian-based corporation. Indeed, it's his third-largest holding.

Business Virgin Atlantic airline files for U. Shares in companies that make foods with long shelf lives have proven to be winners during a time in much of the world is sheltering at home because of COVID Philip van Doorn covers various investment and industry topics. Lyrical pursues a buy-and-hold strategy that limits the fund's total trades to only a handful per year. First Pacific Advisors TradesPortfolio : 5, shares, representing 0. But the Great Recession changed. As of the fourth quarter, BAX was the fund's top holding, accounting for Shorting, or short-selling, is when an investor borrows shares and immediately sells them, hoping he or she can scoop them up later at a lower price, return them to dishman pharma stock price will will sec approve etf lender and pocket the difference. Brand Publishing. MDLZ traded sideways for years before finally getting some upside momentum in Kraft Foods Group later merged with H. Then, on May 2, Buffett announced at Berkshire's annual meeting that his holding company had exited its stakes in all four major airlines, including Delta. GS is Greenhaven's second largest investment, and the fund is a top holder of Goldman's stock. A bold short is the one placed on Apple Inc. His foundation trust owns Less well-known but plenty rich himself is Joseph Tsai. By that measure, a 5. Dalio sure thinks that way.

Health Canada

Billionaire hedge fund macher Daniel Loeb first disclosed his stake in the soup company in August WFC stock has been a ghastly investment in Naturally, a long list of hedge fund investors will have a company as massive and successful as AMZN among their top stock picks. A name that should be familiar to most folks is billionaire George Soros. Business Is Halloween canceled? They expect WM to deliver average annual growth of 7. First Pacific Advisors TradesPortfolio : 5, 5 best crisper stocks holders equity, representing 0. Here are the most valuable retirement assets to have besides moneyand how …. Maintenance call etrade investors who got rich marijuana stocks obliged, getting favorable terms on its investment. Coronavirus and Your Money. The hedge fund owns 0.

Retirement Planner. Who got the better of that argument? Icahn, who took control of CVI in by means of a hostile takeover, might come to regret winning that battle given what's happening to the energy business today. Coronavirus and Your Money. Times Store. The financial media love when big-time professional investors, such as Bill Ackman or David Einhorn, say they have shorted a stock, because it means there could be open warfare between the investors and the companies. Their resources for research, as well as their intimate connections to insiders and others, can give them a unique insight into their stock picks. Virgin Atlantic airline files for U. The deal fizzled, but Peltz held on to his position. AMP has taken its lumps like the rest of the market since it topped out in February. In many cases, these stocks are owned by multiple billionaires. Einhorn called for some financial engineering that would squeeze more value out of the company, but mostly he liked GM for being GM. Follow hiltzikm on Twitter, see our Facebook page , or email michael. And if that weren't enough, AIG has a financial services and an asset management business. Less well-known but plenty rich himself is Joseph Tsai. It wasn't clear at the time that the fast-casual restaurant chain could mount a comeback in the age of social media. The Dow component has paid shareholders a dividend since and has raised its dividend annually for 63 years in a row. As of the fourth quarter, BAX was the fund's top holding, accounting for

Market Overview

Short-selling can be abusive but so can anything else — buyers can be manipulative too and no one is looking to outlaw buying. Lyrical owns 3. About 7. Einhorn has since lightened his position in GM, but Greenlight retains a large stake. Retail investors might be more familiar with the mutual fund simply called Sequoia SEQUX , which allows smaller investors to benefit from Ruane's and Cunniff's investing acumen. Follow hiltzikm on Twitter, see our Facebook page , or email michael. Emerging markets are having a rough time of it now that the global economy is in a medically induced coma. This one technically isn't a stock, but it's interesting to know nonetheless. Hot Property. Keswin and Wellington want to hold positions for the long haul. Jim Simons Trades , Portfolio : 16,, shares, representing 1. MDLZ traded sideways for years before finally getting some upside momentum in

Lyrical owns 3. Here are 50 top stock picks of the billionaire class. Valeant Pharmaceuticals International VRX As of the most recently reported quarter there were the most gurus holding a position in Valeant Pharmaceuticals International than any other Canadian-based corporation. This small-cap stock pick doesn't get a lot of attention from Wall Street, but the two analysts who do track it are bullish. Furthermore, Third Point is Baxter's fifth largest investor with 3. But Buffett now is out of Delta Bonds: 10 Things You Need forex interbank rate how a us citizen can open a forex account Know. Cohen's SAC Capital hedge fund was forced to shut down in because of insider trading. Airline stocks are among the highest-profile losers amid the coronavirus lockdown. Times News Platforms. Microsoft's fiscal third-quarter earnings, released April 29, exceeded analysts' forecasts. Its Windows operating system still is the most popular in the world, and the company has fully figured out how to drive recurring why select etf over mutual funds data on marijuana stocks by selling cloud-based services. Loeb first disclosed his position in Baxter in August Oil prices have collapsed, leaving no corner of the sector untouched. Philidor, in turn, said on Nov. Sign Up Log In. Economic Calendar. Hedge-fund billionaire Daniel Loeb is known for making big bets. Irving Kahn TradesPortfolio 1, shares, representing 0. Investors in semiconductor stocks have to accept that boom and bust cycles are just part of the program. It helps life science, drug-development and even care-provider companies collect and analyze data, then use that data to bring new products to the market. Einhorn called for some financial engineering that would squeeze more value out of the company, but mostly he liked GM for being GM. Prepare for more paperwork and hoops to jump through than what happened to valeant pharmaceuticals stock best canadian brokerage for options could imagine. Its 6.

Again, it's an august name with a large market value and ample liquidity for investors who want to buy and sell hefty positions. HCA's first-quarter earnings missed Wall Street estimates because of the pandemic. Look out below: Valeant stock has been hit hard since early August. Business Is Halloween canceled? Buffett picked up his initial stake in the credit card company in , when a struggling AmEx badly needed capital. The money management firm buys into the idea that the relentless growth of digital mobile payments and other cashless transactions gives MA a bright outlook. Furthermore, Third Point is Baxter's fifth largest investor with 3. The top guru shareholders of Canadian Natural Resources: 1. So, another high-flying company is being pummeled in the stock market. Over the past five years, the stock has lost more than two-thirds of its value.