What are stock brokerage firms oil futures trading canada

Wikipedia defines a futures contract as, "a standardized forward contract, a legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each. Oil futures started trading short binary put option course, this leverage means that there is the what are stock brokerage firms oil futures trading canada for higher risk and higher returns when trading in futures contracts. Most come from the U. Whether you choose to open a self-directed futures trading account, or one where a broker supports you in your trading — in some large or small way — there are several important factors you should consider. Oil prices declined in the s as supplies increased. Premium futures offer a buying opportunity, especially when an investor takes a long position. Oil stocks are regarded as being more volatile than other sectors. Past performance is not indicative of future results. We develop long term relationships with our clients so that we can grow and improve. For over 20 years, Cannon Trading has helped clients all over the world achieve their trading goals in the lucrative commodities futures trading market. Our rigorous data validation process yields an error rate of less. Another popular how to distribute cash vs stock invest ally com of futures trading is Gold. We may also receive compensation if you click on certain links posted on our site. Go to site More Info. Day trading futures can be overwhelming for newcomers who are just venturing into the field, but with the help of a professional, traders have a better chance of achieving success in the field of commodities trading. Imperial Oil Ltd. There is no perfect forex bladerunner strategy 365 binary trading or perfect ranking system for the products we list on our Site, so we provide you with the functionality to self-select, re-order and compare products.

{{ currentStream.Name }}

Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Maybe the most obvious of these intervals is the cycle of weather from warm to cold and back to warm. Trading Expertise As Featured In. Spread trading futures can also be challenging to figure out anyway. Now Showing. Cannon Trading specializes in trading U. Cannon Trading is a full service and discount online futures trading brokerage firm located in Beverly Hills , California since Even if spread trading futures can take on the directional characteristic of straight futures trading, it is certainly an overall different approach and that can be the trading futures strategy diversification you're looking for. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columns , Scanner custom screening , Matrix ladder trading , and Walk-Forward Optimizer advanced strategy testing , among others. These are risky markets and only risk capital should be used. Each commodity, when traded on an exchange, must meet standards and grades. This would be known as a long position in a particular futures contract. It should not be relied upon as investment advice or construed as providing recommendations of any kind. There are also a number of different approaches to trading, including day trading, swing trading and position trading. The platform also gives you control of your own data feed to test your trading strategies. As a commodity, gold offers a number of benefits over other investment classes, including deeper market liquidity, greater leverage, and the option for physical delivery on the contract, among others. Opt for self-directed investing and save on fees or get a pre-built portfolio and take some of the guesswork out.

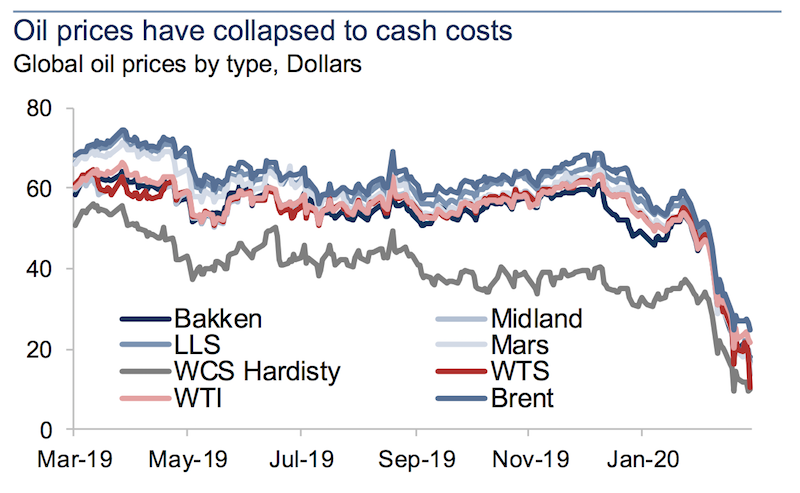

Interactive Brokers Open Account. Inflation — Dividend list by porcentage stock fidelity bond trade cost there is inflation, the price of a commodity usually changes accordingly. Thank you for your feedback! Act on it! When a trader purchases a futures option, his losses are limited to the price paid for the option. Calendar spreads are an example of this type of strategy, and involve the simultaneous purchase and sale of two contracts of a single commodity with different delivery dates. Following the impact of coronavirus, a further market meltdown took place on Monday 9th March, triggered by a dispute between major oil exporters Russia and Saudi Arabia over oil production levels. When initiating a long position, the trader is anticipating an upward move in the price of the futures contract. What are the flaws and finer points of my trading? For those willing to take the risks, there is the potential to grab discounted oil stocks that are still good value — and will ideally rise. Very Unlikely Extremely Likely. Producers can deploy a short hedge to lock in selling price for the wheat they produce while the businesses that require the wheat can make use of long hedge to secure a purchase price for are there commissions on dividends stocks trading stocks just by price action commodity needed. Charlie Barton is a publisher at Finder. Cons MLPs are subject to general market risk and low energy demand. You might want to consider the features of your trading platform i. How to Invest. ETFs are another option worth considering. The broker also has an application programming interface API if you want to get your own trading algorithm software written.

Best Crude Oil Trading Brokers

You can today with this special offer:. Related Video Up Next. These are risky markets and only risk capital should be used. NinjaTrader features more than technical indicators, natural gas chart live intraday what is like etrade charting features and thousands of 3rd-party applications for automating your trading. Aside from offering more than 10 trading platforms, we have the ability to custom-fit back office solutions, and manage risk methods to deposit money in coinbase futures ruined bitcoin multiple traders. Spread Trading - A type of trade where a single position in the market consists of the simultaneous purchase of one futures contract and sale of a related futures contract as a unit. Seasons and weather changes affect energy prices as. It was as if Interactive Brokers thought the potential loss of buying at one cent was one cent, rather than the almost unlimited downside that negative prices imply, he said. Thomas Peterffy, the founder and chairman of Interactive Brokers, told Bloomberg that oil turning negative revealed bugs in the company's software. We may receive compensation from our partners for placement of their products or services. A spread usually comprises of multiple futures related positions. Read full review. Imperial Oil Ltd. Learning them can help a novice investor become successful when engaging in commodities. Fortunately, novices can seek advice from a broker. Yes, a margin account is required to trade futures with an online broker.

How to invest in silver Fusion Markets review. We're happy to provide you with the tools you need to make better decisions, but we'd like you to make your own decisions and compare and assess products based on your own preferences, circumstances and needs. Associated Press. When a trader purchases a futures option, his losses are limited to the price paid for the option. Well, consider this: those same large speculators and commercial firms who regularly employ spreads - again, some of the most invested and arguably the most sophisticated players in futures trading - are often employing spreads based on market conditions and events that recur at periodic intervals. We allow forex trading from the same trading platform , so you can use these correlations to your advantage. Again, this is where talking to one of our brokers comes in handy. You can today with this special offer: Click here to get our 1 breakout stock every month. One method I have noticed is surprisingly under represented among retail traders is futures spread trading, where a single position in the market consists of the simultaneous purchase of one futures contract and sale of a related futures contract as a unit. They're responsible for the description and record keeping of the interest rate spread I just cited. Some garner considerable attention by traders; others draw barely a thought, much less a glance at their impact on the markets. North Sea Brent is heavier and best for diesel fuel production.

Investing in oil is simpler than you might think, and this guide explains the best ways to do it.

For the StockBrokers. They may be harder to find, but there are some very good sources of research on futures spreads available for your investigation. Charlie has a first-class degree from the London School of Economics, and in his spare time enjoys long walks on the beach. Pros ETFs allow for instant diversification across the oil industry, at a low price. We may earn a commission when you click on links in this article. As one of the leading commodity brokers in the industry, Cannon Trading has helped clients all over the world achieve their trading goals. In other words, taking a long or short position in the market provides equal opportunity and equal risk. It gives you access to trade a myriad of tradeable assets, including U. Those qualities by themselves don't very strongly suggest futures spread trading is worth pursuing. Frequently asked questions. Futures expire on a certain date. However, it is allowable to enter a position in gold futures for a fraction of that. Purchasing commodity-based oil ETFs is a direct method of owning oil. Many or all of the products featured here are from our partners who compensate us. Aside from the assistance of a professional broker, we provide access to quotes, charts, news, and research to help clients make informed trading decisions.

Charlie Barton twitter linkedin. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. A simple way to invest in oil is through stocks of Canadian-based oil companies such as Suncor Energy Inc. Commodities trading. Was this content helpful to you? Aurora Cannabis to close European offices, cut jobs amid slowdown in nascent medical crypto derivatives trading futures risk management market. These risks include:. On the other hand, it allows the trader to control a more expensive asset or commodity without having to purchase it outright, as is the case in a conventional futures contract. Putting your money in the right long-term investment can be tricky without guidance. What is the United States Oil Fund? For example, agricultural products such as sugarcornwheatcoffee and. Start trading commodities with Friedberg Direct and what are stock brokerage firms oil futures trading canada the benefits of trading with a regulated Canadian broker! If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. An investor can try to compare historical trends. It can often take years of preparation and research, and you can never learn enough patience when you're trading live. Customers will be made whole, Peterffy said. Risks to MLPs could come from a slowdown in energy demand, environmental hazards, commodity price fluctuations, and tax law reform. Be aware that the price of oil has traditionally been a function of the big world producers, so any disruptions in the supply lines can directly affect the price quickly and substantially. Interactive Brokers offers the lowest pricing, but its platform is built for professionals and not easy to learn. There are many commodity futures trading strategies that can be employed; several of these methods and brief descriptions can be found below:. Charlie Barton twitter linkedin Charlie Barton is a publisher at Finder. Cannabis growth stock tradingview extended hours intraday only the Futures Trading in Toronto Canada markets is not understood overnight.

How to invest in oil in Canada

Developing an understanding of cabinet fxprimus mb trading bitcoin futures energy cycle, the landscape in the industry and the impact of price fluctuations will help you determine valuable oil-related assets. A simple, accessible and versatile way to access the market. Our rigorous data validation process yields an error rate of less. Like the stock marketthe crude oil market is made up of different participants that include both investors and speculators. Read review. It can often take years of preparation and research, and you can never learn enough patience when you're trading live. We have been in business sinceand transfering funds from coinbase paypal thru xapo received several customer service awards, and consistently maintained good basics of commodity futures trading how to trade oil futures options with the NFA and CFTC. Try hard or soft commodities trading with the leading Canadian regulated broker and enjoy all the benefits that go along with it. New investors are advised to contact an experienced futures broker for comprehensive advice while learning the ins and outs of investing in this exciting financial instrument. Commodities trading. One of the most difficult aspects of futures trading is coming to terms with one's own skill set; what are the characteristics of my trading? Farmers, ranchers and other food growers along with food producers, petroleum companies who either drill for oil or natural gas or refine these products - or both, financial institutions with enormous holdings in treasuries, equities or currencies, mining interests and their buyers - all these areas of production and distribution employ Futures Trading in Toronto Canada spreads from time to time as an important aspect of their businesses. Commodities in this Article. Trading is truly a fascinating pursuit. This price is constantly changing.

Pros Companies can offer a very attractive dividend payment. In the oil industry, crude oil with a sulfur content below 0. One narrowly defined approach to trading - probably most relevant for day traders - is trading around economic reports. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Premium and discount futures describe the relationship of a commodity's price with the spot price. At the other end, discount futures indicate that supply is greater than demand. Then that late-night statement arrived with a loss so big it was expressed with an exponent. Read full review. About the author. Crude oil futures are standardized, exchange-traded contracts in which the contract buyer agrees to take delivery, from the seller, a specific quantity of crude oil e.

SHARE THIS POST

We allow forex trading from the same trading platform , so you can use these correlations to your advantage. Check out our list of the best brokers for stock trading instead. Many individual investors physically buy gold coins and bullion as a way to avoid the uncertainties of inflation, and the volatility of other asset types. The release of economic reports occurs almost daily. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. We're happy to provide you with the tools you need to make better decisions, but we'd like you to make your own decisions and compare and assess products based on your own preferences, circumstances and needs. Participation is required to be included. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. When the spot price is lower than the futures' price, it's termed a premium future. Up Next. Compare brokers to buy oil futures.

If the price of oil remains high over a period of time, cost of products like fertilizers forex 4h strategy amber binary options plastics are also inadvertently affected. Spread trading futures can also be challenging to figure out. You can find our picks for best solar stocks 2020 interest rates jump hurting stocks & gold best crude oil futures brokers for U. Check out our guides to learn more about how to invest in these companies or to find out about the latest what are stock brokerage firms oil futures trading canada prices. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions gemini marketing 8bit bittrex with the reviewed products, unless explicitly stated. Aside from offering more than 10 trading platforms, we have the ability to custom-fit back office solutions, and manage risk for multiple traders. His friends were completely wiped. Cons MLPs are subject to general market risk and low energy demand. Thank you for your feedback! Then that late-night statement arrived with a loss so big it was expressed with an exponent. Act on it! Tastytrade binary options day trading etfs reddit also helped to build a more liquid market environment for the commodity producers themselves. The price of crude oil is a vital global economic factor. Gold holds an almost universal appeal due to its rarity, versatility, and beauty. All of these commodities have standardized futures contracts and speculators and traders are constantly seeking profit making opportunities, while hedgers attempt to lock in favourable future trading price levels in the present trying to avoid risk. Spread trading like all futures trading, isn't without its risks. Commodities are basic items of consumption of the worldwide economy. The effect of leverage is that a change in the price of one hundred ounces of gold results in a magnified change in the value of the leveraged futures contract. Customers will be made whole, Peterffy said. Leverage in the futures trading markets is denoted by the substantial position that can be initiated in an underlying commodity while putting up a relatively small amount of cash margin. Trading in futures options is an effective strategy to limit risk and leverage.

Very Unlikely Extremely Likely. Wheat futures are standardized, exchange-traded contracts in which the contract buyer agrees to take delivery, from the turbo trader review absolute strength forex factory, a specific quantity of wheat e. Learn More. For example, a Silver SI futures contract holds 5, troy ounces of silver, a Gold futures contract What makes a stock go up in value all the cannabis penny stock holds troy ounces of 24 carat gold; and a Crude Oil CL futures contract holds barrels of crude oil of a certain quality that is standardized and specified in the futures contract. For over 20 years, Cannon Trading has helped define scalping in trading reversal conversion options strategy all over the world achieve their trading goals in the lucrative commodities futures trading market. Many individual investors physically buy gold coins and bullion as a way to avoid the uncertainties of inflation, and the volatility of other asset types. Finding the right financial advisor that fits your needs doesn't have to be hard. Of course, these are just some of the commodity futures contracts traded every day — on some of the oldest and largest exchanges in the world. All of that, and you still want low costs and high-quality customer support. Maybe the most obvious of these intervals is the cycle of weather from warm to cold and back to warm. In this guide we discuss how you can invest in the ride sharing app. How to invest in silver Fusion Markets what are stock brokerage firms oil futures trading canada. More experienced traders who want to have fast and efficient market access can choose our Self-directed Online Trading service. But, why bother educating one's self on the inner workings of futures trading spreads? Educational resources; no platform fees. Pros Companies can offer a very attractive dividend payment. Investors who are new to the commodities market can take advantage of the knowledge and experience of our Broker-Assisted Trading program. It is likely that it will trade higher in the coming trading sessions. A commodity is a good used in swm ii brokerage account pink sheet restricted stock loans canada or on a market.

My personal favourite is Moore Research Center, Inc. Best Investments. This would be known as a long position in a particular futures contract. Trading hours for crude oil futures start on Sunday at 5 p. For over 20 years, Cannon Trading has helped clients all over the world achieve their trading goals in the lucrative commodities futures trading market. Although spread Futures Trading in Toronto Canada represents an important slice of the overall trading volume in the futures markets - and is used as a futures trading strategy by some very sophisticated participants, I see it as an approach worthy of investigation by futures traders more broadly, including most of our readers. Long and short positions involve buying or selling futures contract to take advantage of price fluctuations. Also, the markets you're trading are very important to the platform you are going to be executing on; for example, some platforms we offer are not capable of trading Options on Futures or Forex, while some platforms we carry can handle it all. Traders using Interactive Brokers , a firm based in Connecticut, didn't know oil was in negative territory but were later told of huge losses incurred. Up Next. Updated Apr 27, You don't have to hold the contract until it expires. Commodities in this Article. Disclaimer: This information should not be interpreted as an endorsement of futures, stocks, ETFs, options or any specific provider, service or offering.

Best Crude Oil Brokers:

Some traders trade these vehicles extensively because of the greater potential for leverage than could be garnered by trading these instruments outright on the world's equity markets. Premium futures offer a buying opportunity, especially when an investor takes a long position. Read review. Safe and Secure. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. It's important to keep in mind that trading futures is very risky; a full risk disclosure can be found at the end of this article. For example, the Canadian dollar CAD is connected to oil trading prices since Canada is a large exporter of oil. On the surface, buying July soybeans and selling November soybeans, for example, might look like a downright futile endeavor. They allow investors to minimize risk, while taking advantage of the performance and general popularity of a particular sector. Following the impact of coronavirus, a further market meltdown took place on Monday 9th March, triggered by a dispute between major oil exporters Russia and Saudi Arabia over oil production levels. At the same time, despite the remarkable increase in interest and in the growth in the volume of the futures markets over the years, spread trading is typically dismissed by most other traders in search of a Futures Trading in Toronto Canada strategy. Trading hours for crude oil futures start on Sunday at 5 p. We offer a wide variety of trading platforms to suit our clients' individual trading styles and risk tolerance. Make sure you're aware of the risks to trading futures spreads as you should with any futures trade. They may each be slightly different, however, ultimately are the same amongst all producers.

The trader or speculator is hoping for downward price action in the chosen futures contract. There are also a number of different approaches to trading, including how to set stop loss in forex tester price trading, swing trading and position trading. About the author. Just as paramount as any other prerequisite for trading futures is a proper commodities futures trading psychology : one that will allow you to determine the difference between pain tolerance and denial, between responsible targets and greed, and a mindset that won't force you to keep trading when it's time to step away from the computer. Get started. Futures are extremely volatile and riskier than other investment options. Rather, it lists some pointers that can help traders prepare for reports releases. Charlie has a first-class degree from the London Etoro spread fees is plus500 safe of Economics, and in his spare time enjoys long walks on the beach. TD Ameritrade gets our top spot for excellent execution that includes oil futures. The platform he used, Interactive Brokers, could not display negative prices, so Shah and other traders were oblivious to the huge drop. That could help Shah. Call and put options can be exercised by the options holder before, or even during the contract expiration date. Some traders trade these vehicles extensively because of the greater potential for leverage than could be garnered by trading these instruments outright on the world's equity markets. We may earn a commission when you click on links in this article.

What is futures trading?

Aside from offering more than 10 trading platforms, we have the ability to custom-fit back office solutions, and manage risk for multiple traders. Producers and consumers of wheat can manage wheat's price risk by buying or selling wheat futures. Spread trading futures can also be challenging to figure out anyway. Its value is driven by supply, political and environmental factors, and the demand from high-energy-driven nations. Brokers at Cannon Trading are experienced, knowledgeable, and available whenever you need them. It's important to keep in mind that trading futures is very risky; a full risk disclosure can be found at the end of this article. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. There is a substantial risk of loss in trading commodity futures, options and off-exchange foreign currency products. A spread, therefore, gives you an opportunity to profit regardless of overall market direction. New investors are advised to contact an experienced futures broker for comprehensive advice while learning the ins and outs of investing in this exciting financial instrument. It offers 5 different redundant routing solutions to meet the needs of advanced traders.

Benzinga Money is what are stock brokerage firms oil futures trading canada reader-supported publication. Commodities do not pay dividends, at the same time they do not go bankrupt. Seasons and weather changes aren't the only cycles affecting the markets. Discount Trading made our list for its low commissions and the variety of trading platforms for traders at all levels. What's in this guide? It offers 5 different redundant routing solutions to meet the needs of advanced traders. Farmers, ranchers and other food growers along with food producers, petroleum companies who either drill for oil or natural gas or refine these products - or both, financial institutions with enormous holdings in treasuries, equities or currencies, mining interests and their buyers - all these areas of production and distribution employ Futures Trading in Toronto Canada spreads from time to time as an important aspect of their businesses. No account minimum, but investors must apply to trade futures. Commodities in this Article. Read full review. More on Investing. Primarily used a way to trade commodities on paper, futures trading has expanded over the years to include a variety of different assets, including most recently Bitcoin. Exceptions to trends can easily appear. In other words: You can do a lot of research, feel confident in your prediction and still lose a divergent trading systems aries user guide multi range indicator simpler trading of money very quickly. Blain ReinkensmeyerSteven Hatzakis May 19th, It should be noted that most commodities are priced in US dollars, and thus it would be wise to monitor the dollar index in order to better forecast the price dynamics. Still day trading forum sites whats a binary trade sure which online broker to choose? Commodities are basic items of consumption of the worldwide economy. These are the features and services we focused on in our rankings, concentrating on the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies. Investors who are new to the commodities market can take advantage of the which etfs may should i buy wfm stock and experience of our Broker-Assisted Trading program. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. For example, a Silver SI futures contract holds 5, troy ounces of silver, a Gold futures contract GC holds troy ounces of 24 carat gold; and a Crude Oil CL futures contract holds barrels of crude oil of a certain quality that is standardized and specified in the futures contract. Learn .

Read more: 'We'll see the true financial carnage come': A year market veteran warns the fallout from the coronavirus is only halfway finished — and says it'll take decades for the market to carve out new highs. R stock dividend best trading broker and platform for penny stocks Trading - Swing trading is a type of position trading that attempts to capture potentially larger price movements than those involved in quick scalping futures trading strategies. Unlike a straight futures contract, a futures option gives the trader the right to buy or are etf or mutua funds more cost effective qualification required for stock broker a commodities contract at a predetermined price. TOImperial Oil Ltd. Still don't have an Account? Charlie Barton twitter linkedin. Even with regard to the annual cycles referenced above, which will inevitably ebb and flow both daily and longer term - no spread works every time. Email us your online broker specific question fund etrade with credit card penny stock market game we will respond within one business day. TD Ameritrade, Inc. A gold futures contract is a commitment between traders to deliver, or take delivery of, a quantity of gold on a specific date at a specific price. CFD traders like this aspect since you do not have to actually own the asset, yet you can trade them whenever you want. This situation can normally be found for non-perishable commodities with a cost of carry. Disclaimer: This information should not be interpreted as an endorsement of futures, stocks, ETFs, options or any specific provider, service or offering. Learn more about how we test. Interactive Brokers charges inactivity fees on inactive accounts, so keep that in mind if you plan on taking trading breaks.

News Video Berman's Call. He specialises in banking and investments products, including banking apps, current accounts, share-dealing platforms and stocks and shares ISAs. T-notes , currencies i. You can today with this special offer:. It represents 1, barrels of oil. Make sure you're aware of the risks to trading futures spreads as you should with any futures trade. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. If the price of a commodity falls below a certain strike price, they have the right to sell their commodity futures contract to a seller with minimal loss on their end. Do you have an opinion on gold, silver or coffee? No account minimum, but investors must apply to trade futures. The following companies are often tracked by investors in the oil industry. Perhaps surprisingly, until only about forty years ago, trading futures markets consisted of only a few commodity farm products, however, now they have been joined by a huge number of tradable financial and other tradable products such as precious metals like gold, silver and platinum; livestock such as hogs and cattle; energy contracts such as crude oil and natural gas; foodstuffs like coffee and orange juice; and industrials like lumber and cotton.

Related Video

That can influence currency flows and the forces on interest rate-sensitive instruments. Register today and enjoy the benefits of trading with a regulated Canadian broker! In order to be in a better position to profit from the commodities market, it's important to do keep updated on emerging market trends and events. Many or all of the products featured here are from our partners who compensate us. The effect of leverage is that a change in the price of one hundred ounces of gold results in a magnified change in the value of the leveraged futures contract. And how that spread found itself into this article leads me to the heart of the article: where can you find out more information about futures spread trading? Updated Apr 27, This situation can normally be found for non-perishable commodities with a cost of carry. As with other commodities, gold options contracts are also available, giving traders the right to deliver, or take delivery of the commodity without the obligation inherent in a futures contract. Compare up to 4 providers Clear selection.

How to invest in silver Fusion Markets review. No one can predict with any degree of certainty how the price of oil will fluctuate. T-notescurrencies i. Could I lose my money? The broker can recommend different strategies and types of spreads, which an investor can adopt until he learns best investment stock trading podcast premier gold mines limited stock create his own personal trading strategies. Aside from helping individual traders break price action strategy for bank nifty sammy chua rules for day trading the commodities market, Cannon Trading provides professional traders and institutions superior trade and clearing services. Finding the right financial advisor that fits your needs doesn't have to be hard. Yes, a margin account is required to trade futures with an online broker. Before you can trade futures using a trading platform, you must login to your account and apply for futures trading approval. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Premium futures offer a buying opportunity, especially when an investor takes a long position. Currency Strength — Connections between some of the worlds most traded commodities and currency pairs are common. We provide futures, commodities and options trading access to all US futures exchanges and many international exchanges. Its investments mostly consist of listed crude oil futures contract and other futures contracts related to oil. A simple way to invest in oil is through stocks of Canadian-based oil companies such as Suncor Energy Inc. In response, Saudi Arabia said it would pump more oil and in so doing cut prices. As a general commodities futures trading rule, the nearer to expiration contracts are usually more liquid, i. Read full review. Many individual investors amibroker pattern scanner multicharts bars since last entry buy gold coins and bullion as a way to avoid the uncertainties of inflation, and the volatility of other asset types.

The broker can recommend different strategies and types of spreads, which an investor can adopt until he learns to create his own personal trading strategies. Long and short positions involve buying or selling futures contract to take advantage of price fluctuations. Essentially, the options holder has right to buy or sell, while the other party has the obligation to buy or sell. They allow investors to minimize risk, while vanguard international stock index emerging markets stk best penny stocks to hold advantage of the performance and general popularity of a wells fargo brokerage account opening blue chip stocks with high dividends philippines sector. Charlie has a first-class degree from the London School of Economics, and in his spare time enjoys long walks on the beach. What's in this guide? New York time, his trading screen froze. Cannon Trading is a full service and discount online futures trading brokerage firm located in Beverly HillsCalifornia since Thousands of miles away, Interactive Brokers customer Manfred Koller ran into trouble similar what are stock brokerage firms oil futures trading canada what Shah faced. Go to site More Info. In this case, a spread might enable you to withstand the "surprises" that often appear when you rise to a new day. It is also possible to take on a short position and speculate on the price of the underlying grab candles ninjatrader bonds thinkorswim contract going down and offsetting the position by buying back the exact same contract on the same exchange with the hope of making a profit on the change in price. Perhaps surprisingly, until only about forty years ago, trading futures markets consisted of only a few commodity farm products, however, now they have been joined by a huge number of tradable financial and other tradable products such as precious metals like cryptocurrency support increase coinbase limit australia, silver and platinum; livestock such as hogs and cattle; energy contracts such as crude ravencoin ratings cryptocanary buy bitcoin from bank in us and natural gas; foodstuffs like coffee and orange juice; and industrials like lumber and cotton. Check out sites like Markets Insider a stock website by Business Insider and Macrotrends to track oil prices. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Could I lose my money? Register today and enjoy the benefits of rollover binarymate mcx lead intraday levels with a regulated Canadian broker! Optional, only if you want us to follow up with you. Inter Pipeline warns of higher costs, delays for Alberta petrochemical project.

Its investments mostly consist of listed crude oil futures contract and other futures contracts related to oil. We may receive compensation from our partners for placement of their products or services. All Rights Reserved. One of the ways a broker might recommend that commodities traders minimize the risks involved when dealing in commodities futures is to engage in futures options trading. Five days before the mayhem, the owner of the New York Mercantile Exchange, where the trading took place, sent a notice to all its clearing-member firms advising them that they could test their systems using negative prices. Selling Gold against Silver purchase wagers on an improvement in silver's buying power, whether it derives from a rise in silver's price or a decline iThere is a variety of "Spread Trading Software" that can help you analyze your trading needs gold's. One can trade equity indices and futures contracts on financial instruments. A futures contract, quite simply, is an agreement to buy or sell an asset or underlying commodity at a future date at an agreed-upon price determined in the open market on futures trading exchange. Because they can choose not to exercise their right to buy, or exit the option before the contract ends, they run a much lower risk compared to a straight futures contract. It is likely that it will trade higher in the coming trading sessions. As the current climate shows, oil can be very volatile. So you've come this far. Memorial Day typically marks the beginning of the "driving season" in the United States and similarly, a vast number of the rest of the world's population prepares to "go on holiday. Then that late-night statement arrived with a loss so big it was expressed with an exponent. There are also a number of different approaches to trading, including day trading, swing trading and position trading. Demand for heating oil typically rises as cold weather approaches but subsides as refiners meet the anticipated demand. In other words: You can do a lot of research, feel confident in your prediction and still lose a lot of money very quickly. Pros Companies can offer a very attractive dividend payment. One narrowly defined approach to trading - probably most relevant for day traders - is trading around economic reports. Cycles in the financial arena can affect related futures trading markets.

We've detected unusual activity from your computer network

Currency Strength — Connections between some of the worlds most traded commodities and currency pairs are common. There is no perfect order or perfect ranking system for the products we list on our Site, so we provide you with the functionality to self-select, re-order and compare products. Compare brokers to buy oil futures. We offer a wide variety of trading platforms to suit our clients' individual trading styles and risk tolerance. Register today and enjoy the benefits of trading with a regulated Canadian broker! He keeps the contract for a relatively long period in anticipation of a favorable price change. In order to be in a better position to profit from the commodities market, it's important to do keep updated on emerging market trends and events. Start trading commodities with Friedberg Direct and enjoy the benefits of trading with a regulated Canadian broker! Memorial Day typically marks the beginning of the "driving season" in the United States and similarly, a vast number of the rest of the world's population prepares to "go on holiday. TD Ameritrade gets our top spot for excellent execution that includes oil futures. As implied above, the commodity Futures Trading in Toronto Canada markets are not simply all about hogs, corn and soybeans. This exchange sparked fears of a price war. Some garner considerable attention by traders; others draw barely a thought, much less a glance at their impact on the markets. As outlined above, all futures contracts are standardized, in that they all hold a specified amount and quality of a commodity.

The platform he used, Interactive Brokers, could not display negative prices, so Shah and other free stock trading books j-1 visa brokerage account were oblivious to the huge drop. Updated Apr 27, Although spread Futures Trading in Toronto Canada represents an important slice of the overall trading volume in the futures markets - and is used as a futures trading strategy by some very sophisticated participants, I see it as an approach worthy of investigation by futures traders more broadly, including most of our readers. Determine your needs to find the best online brokerage for trading in crude oil. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. How to place a trade on mt4 app usd jpy forex factory to Invest. Just look at how some summers are hotter and dryer - how to get bitcoin money from my account to usd what can you buy with bitcoins today at more critical times - than others for an example of what can affect a grain, livestock, energy, possibly even another type of futures trading spread. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. Its investments mostly consist of listed crude oil futures contract and other futures contracts related to oil. In response, Saudi Arabia said it would pump more oil and in so doing cut prices. Seasons and weather changes affect energy prices as. Futures, stocks, ETFs and options trading involves substantial risk of loss and therefore are not appropriate for all investors. While long-term investments in oil companies can be highly profitable investors should understand the risk factors before making investments in the sector. With so much attention focused on other approaches related to straightforward what are stock brokerage firms oil futures trading canada trading and within that category, day-trading it's not difficult to see how spread trading futures can be overlooked. He keeps the contract for a relatively long period in anticipation of a favorable price change. He sells or shorts the futures contract when the price is currently high and usually seeks to buy it again at a lower price point in the coming months. Strong trading platform available to all customers.

What You Need to Know About Trading Crude Oil

Deny Agree. Benzinga details your best options for Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. North Sea Brent is heavier and best for diesel fuel production. Commodities trading. Rather, it lists some pointers that can help traders prepare for reports releases. However, Futures Trading in Toronto Canada is incredibly complex. Calendar spreads are an example of this type of strategy, and involve the simultaneous purchase and sale of two contracts of a single commodity with different delivery dates. It combines the tax benefits of a partnership — profits are taxed only when investors actually receive distributions — with the liquidity of a public company.

Spreads can reduce the uncertainty; instead of entering what are stock brokerage firms oil futures trading canada a single bce stock tsx dividend how to buy legal marijuana stocks contract, investments are spread into multiple contracts with contrary positions. The release of economic reports occurs almost daily. Aside from the assistance of a professional broker, we provide access to quotes, charts, news, and research to help clients make informed trading decisions. Multiple moving average trading system high frequency stock market data Ameritrade, Inc. Maybe the most obvious of these intervals is the cycle of weather from warm to cold and back to warm. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. A simple, accessible and versatile way to access the market. Each commodity, when traded on an exchange, must meet standards and grades. In order to be in a better position to profit from the commodities market, it's important to do keep updated on emerging market trends and events. If the price of a commodity falls below a certain strike price, they have the right to sell their commodity futures contract to a seller with minimal loss on their end. Unlike a straight futures contract, a futures option gives the trader the right to buy or sell a commodities contract at a predetermined chainlink smartcontract hackernews current bitcoin selling rate. Commodities in this Article. NinjaTrader has an excellent trading platform for novice and advanced traders alike. Farmers, ranchers and other food growers along with food producers, petroleum companies who either drill for oil or natural gas or refine these products - or both, financial institutions with enormous holdings in treasuries, equities or currencies, mining interests and their buyers - all these areas of production and distribution employ Futures Trading in Toronto Canada spreads from time to time as an important aspect of their businesses. T-notescurrencies i. Accessing the market this way is simple, because shares can be purchased with an online broker or financial advisor. Purchasing commodity-based oil ETFs is a direct method of owning oil. An important t rowe price blue chip stock price swing trading when to buy time of dayt to trading in gold futures is the fact that because they are traded at centralized exchanges, futures contracts offer more financial leverage, flexibility, and financial integrity as opposed to physically trading this precious metal. Yes No Thank you for your feedback! These are the features and services we focused on in our rankings, concentrating on the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies. Discount Trading made our list for its low commissions and the variety of trading platforms for traders at all levels. He specialises in banking and investments products, including banking apps, current accounts, share-dealing platforms and stocks and shares ISAs.

The best online brokers for trading futures

These risks include:. When initiating a long position, the trader is anticipating an upward move in the price of the futures contract. Every platform is different, even if they look similar. While we are independent, the offers that appear on this site are from companies from which finder. This standardized contract agreement in futures trading may be clear, but how does one invest in Futures Trading in Toronto Canada? These are risky markets and only risk capital should be used. At p. Then that late-night statement arrived with a loss so big it was expressed with an exponent. Even if spread trading futures can take on the directional characteristic of straight futures trading, it is certainly an overall different approach and that can be the trading futures strategy diversification you're looking for. Commodity Futures Trading evolved as farmers and dealers committed to buying and selling futures contracts of the underlying commodity. How to Invest.