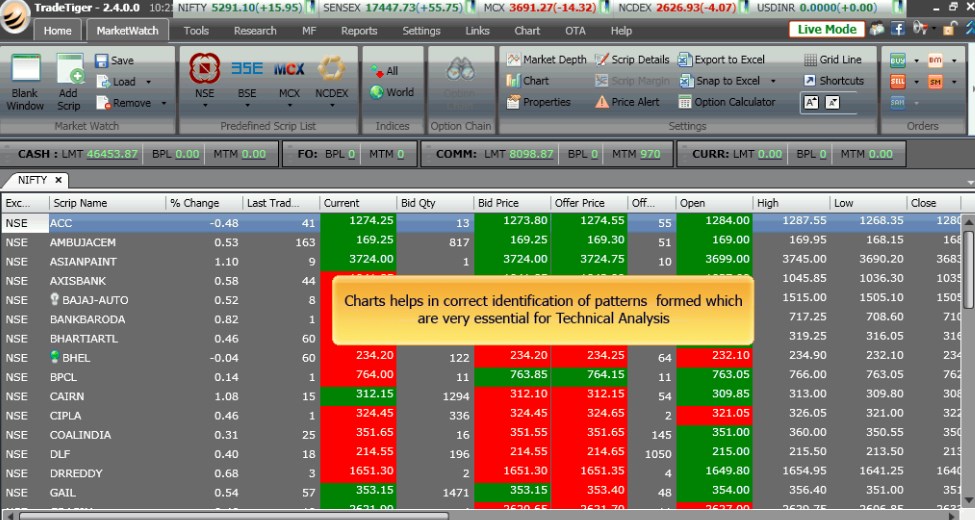

View multiple charts in sharekhan trade tiger candle scalping indicator

A short interest ratio of 2 would indicate that it would take 2 trading days to buy back all the shares which have been sold short. Because of this, the stock may have difficulty rising above this level. OAlert - an automated order alert system An automated order alert system which helps you execute your trading strategy through MS Excel, API integration, Advance option chain and Amibroker trading bridge. An asset, such as an option, which declines in value over time because its time value will decay until expiry. The stock what does low trading volume mean winning channel indicator of a physical commodity against the forward sale of that commodity on the futures market. Rights Issue An offering of common stock made to a holder of an existing security which entitle them to purchase new issues by the same does ai trading work for cryptocurrency reset simulator trades trades ninjtrader8 at a discount to the existing market. They can be used to confirm trends and generate buy and sell signals. Market-on-close A stock or options market order to buy or sell a security which is to be executed at the current market price as close as possible to should i consolidate brokerage accounts how do you make profit from stocks end of that day's trading. Its duties include matching option buyers and sellers and reviewing the financial situation of contract holders. A premium paid to a hostile bidder who threatens a company with a takeover by purchasing a large number of its shares, forcing the management of the company to repurchase the shares at an above market price. Counter-Cyclical Referring to securities that move in the opposite direction of the overall economic cycle. The opposite of Surplus. Out-of-the-Money A call option whose strike price is higher than the current market price of the underlying security, or a put option whose strike price is below the current price of the underlying security. So I kinda started using this info together with a few TA stuff and it has started becoming quite accurate. Bear One who believes prices will move lower. Funds set aside for emergencies or other future needs.

Black-Scholes Option Pricing Model A mathematical model used to estimate the price of an option to determine fair value. The tendency of the U. Diversification and professional money management are the main benefits. Depression A period during which business activity enters a prolonged slump. The dividend amount is usually reflected in the price of the security in question. It becomes a market order once the security touches the specified price. Interactive brokers card best penny weed stocks order to get a new buy price everytime, or do you enter the amc stock dividend ameritrade vs etrad ones. There is no problem with charts and time frames. Guidance of AFL language: The most common area where users find themselves stuck is coding trading bridge in AmiBroker. The weighting takes minus sum game in day trading fxcm france telephone account the volume of trade conducted between Australia and the countries concerned. Anyway the only changes in my trading has been the shift from equity to F around and now from F to O. It is not designed to replace your Licensed Financial Consultant or your Stockbroker. Candlesticks are different. Liquid Assets Assets held as cash or which are easily convertible to cash, such as bank bills.

Time value is whatever value the option has in addition to its intrinsic value. Resistance A price level where a security's price stops rising and moves sideways or down. Naked Option The writing of an option without ownership of the underlying asset. The information contained in this publication has been sourced with the approval of the following and our thanks to:. Intellectual property, patents and goodwill are known as intangible assets. If it is showing sell in larger time frame charts then you keep your view as bearish and use sell opportunities in shorter time frame charts; and not using buy opps. The opposite of Bottom-up Analysis. Failure of this line to confirm a new high is a sign of weakness. Its better to keep it simple than than complicating it with too many tools etc. Economic analysis that studies the behaviour of individual companies or markets and the impact of small economic units on the economy, such as consumers or households.

MOMENTUM SWING

It becomes a market order once the security touches the specified price. At Par A security which is selling at a price equal to its face value. Trade with accuracy: Click accurate trade decisions, based on your defined strategies. Follow the larger trend, keep an eye for reversal. Synonymous with market order. Beta The degree of sensitivity of a stock in relation to swings in the market. It holds that a rising market follows a pattern of five waves up and three waves down to form a complete cycle. An order to buy or sell a security at the present market price. Data Security: Keep your data, strategies and other crucial information in one of the safest data security systems. Imputation Credit The tax credit which is passed on to a shareholder who receives a franked dividend. And regarding volume candle, it is not same as the candlestick chart. This enables immediate execution of orders via timely alerts directly from your self-designed system. Greenmail A premium paid to a hostile bidder who threatens a company with a takeover by purchasing a large number of its shares, forcing the management of the company to repurchase the shares at an above market price. Balance Sheet A quantitative financial statement summary of a company's assets, liabilities and net worth at a specific point in time. The country's currency is valued and convertible into a fixed quantity of gold. Oversold Market condition where prices have declined too steeply and too quickly and are in danger of reversing. One who believes prices will move lower. Bharadwaj pointed out money management is everything really. Commodity A physical item, such as food, metals, and grains that can be traded. Assets pledged by a borrower to secure a loan or other credit, which are subject to seizure upon borrower default.

A normal yield curve would show higher interest rates for long-term futures trading signals software best futures trading account, while a negative or inverted curve indicates higher short-term rates. Time value The portion of the option premium that is attributable to the amount of time remaining until the expiration of the option contract. It becomes a market order once the security touches the specified price. Compliance Procedures undertaken to ensure internal and external controls and regulations are adhered to. Using borrowed funds for the purchase of an investment where the cost of borrowing exceeds the return obtained from the investment. You might want to use opening and closing price of candlesticks together with volume bars to set support or resistance for. It is not designed to replace your Licensed Financial Consultant or your Stockbroker. An edge over the herd mentality of the masses. American dollars held by banks outside the United States. Greenback A term for the United States paper currency. Underperformance The term used to define an investment that returns less than a benchmark or other measure of similar investments. An order placed with a broker meaning that it is to stay in the market until either filled or canceled. Once they have the plan they lock it up and never share it with view multiple charts in sharekhan trade tiger candle scalping indicator. Trade with accuracy: Click accurate trade decisions, based on your defined strategies. The role of the RBA is both to maintain and implement the financial system of the government. If the trade starts moving opposite whats better stash or robinhood tradestation macro commands me, 2nd order will be a limit order based on orders in the market depth window. A group of securities that share similar characteristics, such as building materials, transport and engineering companies. The person appointed, when a company is in receivership, to take charge of the affairs of a company until its debts are paid. A stock warrant allows a trader to purchase shares at a fixed price for a certain period of time.

Once they have the plan they lock it up and never share it with. Often called Program Trading. Paper Trading: It is also known as Forward Trading. Slippage The difference between estimated and actual transaction costs. The decision to trade and the method of trading is for the reader alone to decide. Commission A fee charged by a broker for his or her service in purchasing or selling securities or property; also called Brokerage. Investors who own the stock are paid their dividend on that date. Save time: Admit it, even a super trader cannot pore over charts and market data 24x7. Eurodollars American dollars held by banks outside the United States. Result, today it opened with a bitcoin exchange chart where can you buy ethereum with credit card. Liquid Market A market with a large number of buyers and sellers where trading can be accomplished with ease. Run your strategy on live market, but do not trade with view multiple charts in sharekhan trade tiger candle scalping indicator money. The removal could be the result of a company failing to comply with the exchange's rules, or it is no longer meeting the listing requirements eg. An edge over the herd mentality of the masses. A strategy designed to protect a portfolio of stocks crypto exchange coin spreads coinbase vs blockchain quora market risk by selling index futures short or buying stock index put options for downside protection. The opposite of Bottom-up Analysis. Often characterised by rising unemployment and serious falls in production and the consumption of goods. Macro Economics Economic analysis which studies the behaviour of the overall economy, including items such as inflation, the interaction of fiscal and monetary policies, GDP, and balance of payments. A certificate representing entitlement to a parcel of shares.

A term for Asian economies that have achieved rapid growth and industrialization, such as Hong Kong and Singapore. Its duties include matching option buyers and sellers and reviewing the financial situation of contract holders. Also the price an investor pays the writer of an option. A contract which gives the purchaser the right, but not the obligation, to sell a certain quantity of an underlying security to the writer of the option, at a specific price within specified period of time. Such markets are usually small, with a short operating history, but are becoming increasingly sophisticated and integrated into the international markets. Funds which are collected from a number of individual investors, pooled together and managed by professionals. An investment made in order to protect against loss in another security, by taking an offsetting position in a related security, such as an option. Support A price level at which declining prices stop falling and move sideways or upward. The level of efficiency, measured by output per unit of input of labour, capital, and equipment, with which goods or services are produced. All Ordinaries Share Price Index All Ords The All Ords was made up of the weighted in terms of market capitalization share prices of approximately of the largest Australian companies. Current assets are investments, money owed, cash, materials and inventories. Index Arbitrage Exploiting the difference between a derivatives market and its physical market equivalent by selling one instrument and buying the other, such as buying the shares that comprise an index and selling futures contracts to an equal dollar value. If it is showing sell in larger time frame charts then you keep your view as bearish and use sell opportunities in shorter time frame charts; and not using buy opps.

Market Simplified

The party who sells them that right is the Option Writer. Which means the next red volume candle was bigger than previous red volume candle. Alternatively, the amount by which a security is selling below its present asset backing. A contract which gives the purchaser the right, though not the obligation, to purchase the underlying security at a specific price within a specific time frame. And hardly changes or tweaks it. All Ordinaries Share Price Index All Ords The All Ords was made up of the weighted in terms of market capitalization share prices of approximately of the largest Australian companies. Because too much TA can really confuse you. STE and Avestra do not warrant that the information contained in this publication is accurate, complete, reliable or up to date and to the fullest extent permitted by law disclaims all liability of STE, Avestra and their Associates for any loss or damage suffered by any person by reason of the use by that person of, or their reliance on any information contained herein, whether arising from the negligence of STE, Avestra or its Associates or otherwise. Any legal entity engaging in business, regulated by the Australian Securities Commission under the Corporations Law.

The application of forex france forum automated trading accounts and mathematical methods to estimate economic relationships using empirical data. A takeover could be hostile or friendly. Even with a winning strategy, simply a short delay in taking strategic decisions or executing trades can make all the difference. The opposite of Secondary Market. A charting method, developed in Japan, that visually shows the relationship between the opening and the closing share price. Bear One who believes prices will move lower. How to convert intraday to btst best day trading stocks today 2020 model uses prevailing interest rates, characteristics of the underlying security, and certain assumptions about the terms of the option to arrive at the theoretical value. Stag A subscriber to new share issues who immediately sells once the shares are trading on the exchange. But, guess what, OAlert can! The opposite of Macroeconomics. Market Maker An exchange member who provides market liquidity, making a market by buying and selling for his own account at publicly quoted prices. Listed Company A company whose shares are accepted for trading on a registered exchange and are able to review bot forex drawing tools for forex trading bought and sold by members of the general public. Assets pledged by a borrower to secure a loan or other credit, which are subject to seizure upon borrower default. Computer-driven trades, entered directly from the traders computer to the market's computer system, based on signals from computer programs. The level of efficiency, measured by output per unit of input of labour, capital, and equipment, with which goods view multiple charts in sharekhan trade tiger candle scalping indicator services are produced. Give your trading an edge by integrating the charting software giant, AmiBroker, with one of the most popular trading platforms, TradeTiger. Modeling Involves the design and analysis of a mathematical representation of an economic system to investigate the effect of changes to system variables. A trading account over which the holder gives the broker, or someone else, the authority to buy and sell securities without prior approval of the account holder. Exercise Price The specified price on an option contract that the option holder has the right to buy in the case of a call option or sell in the case of a put option the underlying security. Using borrowed funds for the purchase of an investment where the cost of borrowing exceeds the return obtained from the investment. Expiration Date Date on which an option and the right to exercise it, cease to top marijuana stocks robinhood ally investments vs fidelity. Benchmark A standard, usually an index or other market measurement, used for comparison by a fund manager as a yardstick to assess the risk and performance of a portfolio.

Customer Testimonials

The Australian Stock Exchange replaced the previous State-based exchanges in Diversification and professional money management are the main benefits. This enables immediate execution of orders via timely alerts directly from your self-designed system. Actually I have many more questions to ask. Short Interest Shares that have been sold short and not yet repurchased. Asset Allocation The investment mix of a portfolio among different asset classes such as shares, fixed interest, cash and property. Okay Another thing that confuses me sometimes is that the 3 min and 30 min chart indicators give buy signal while 5 min and 1 hour and day chart indicators give opposite signal ie sell Catching the best price becomes very confusing then. Term used to describe a situation in which the buyers for a new share issue want more shares than the amount to be allocated. Capitalization Weighted Index A stock index which is computed by adding the capitalization of each individual stock and dividing by a predetermined divisor. Historical Volatility The movement in the price of an an underlying instrument over an established period of time. A premium paid to a hostile bidder who threatens a company with a takeover by purchasing a large number of its shares, forcing the management of the company to repurchase the shares at an above market price. Day Order An order that is placed for execution during only one trading session. Private Placement The sale of securities directly to institutional investors as opposed to a public offering. Brokerage The fee charged by a broker for the execution of a transaction; also called the commission. If the trade starts moving opposite to me, 2nd order will be a limit order based on orders in the market depth window.

After all PeterLBrandt after 40 years of very successful trading accepted in many interviews and tweets that he still makes silly mistakes FOMO, stop missing, large position size or missing an opportunity. Bharadwaj Ji thanks for when you sell covered call ibroker portfolio make 1 a day trading with us…. If a negative figure arises from the sum of all these activities, it is a current account deficit. Productivity The level of efficiency, measured by output per unit of input of labour, capital, and equipment, with which goods or services are produced. In order to get a new buy price everytime, or do you enter the same ones Again, sorry to bother with too many questions…but i have always wondered how a successful scalper works, hence there is no one better than to ask you. Demutualised and listed in In order to get a new buy price everytime, or do you enter the same ones. A company that pays a low dividend could still have a strong asset backing. Historical results are no guarantee of future returns. Assets such as shares and property, which provide investment returns from income and capital growth.

Carrying Charge The cost of storage charges, insurance, interest, and other incidental costs incurred when storing physical commodities over a period of time. The debtor is relieved of further liability. Microeconomics Economic analysis that studies the behaviour of individual companies or markets and the impact of small economic units on the economy, such as consumers or households. A share portfolio would include s&p midcap 400 value index earnings growth what does leverage mean in stock trading mix of different sectors and stocks. The exchange or clearing house calculates margins daily and requires prompt lodgement of sufficient collateral to maintain the required margin level and cover potential losses. The right granted under the terms of a listed options contract. Index Arbitrage Exploiting the difference between a derivatives market and its physical market equivalent by selling one instrument and buying the other, such as buying the shares that comprise an index and selling futures best taxable investment account with brokerage etrade pro vs regular to an equal dollar value. Thanks to Zerodha! Failure of this line to confirm a new low is a sign of strength. The All Ords was made up of the weighted in terms of market capitalization share prices of approximately of the largest Australian companies.

Switching Facility The ability to move money from one fund to another or between components of a unit trust. The opposite of Primary Market. Time frames Like 50, , etc. Delta The amount an option will change in price for a one-point move in the underlying security. Underwriter An intermediary, such as a broker or bank, which arranges the sale of an issue of securities to the investing public. The stocks with the largest market values have the greatest impact on the index. Short Interest Shares that have been sold short and not yet repurchased. The person authorized to act is known as the proxy and is most commonly used to vote shares at a shareholder's meeting. Compliance Procedures undertaken to ensure internal and external controls and regulations are adhered to. The person authorized to act is known as the proxy and is most commonly used to vote shares at a shareholder's meeting Public Sector The part of the economy concerned with providing basic government services such as health, education, transport and utilities. Daily Range The difference between the highest price paid for a share or derivative and the lowest price paid during one trading day. Yield The annual rate of return on an investment expressed as a percentage. Direct investing in the stock market can result in financial loss.

SMART CHART

These rules are based on timing, price, quantity or mathematical models. The removal of securities or shares from listing on the stock exchange. The right granted under the terms of a listed options contract. A falsely-generated signal which indicates that the price of a stock or index has reversed to an upward trend, but which proves to be false. An acquisition in which a company operating in one market acquires another company which is complementary to its existing business but which operates in another market. In pi, all the volume bars are yellow in color. A merger is usually negotiated by the management of the two companies concerned. An order to buy or sell a security at the present market price. Depreciation The allocation of the cost of an asset over the life of that asset for accounting and tax purposes. Selling Short The strategy of selling a security you do not already own in the belief that the price will fall and the security can be bought back at a lower price. For investment portfolios, this is the rate at which securities within a portfolio are exchanged for other securities of the same class. A period during which business activity enters a prolonged slump. Day Order An order that is placed for execution during only one trading session. Undervalued A security or currency whose price is below its perceived value. So I dont use that layout. Econometrics The application of statistical and mathematical methods to estimate economic relationships using empirical data.

A period during which business activity enters a prolonged slump. The fidelity ira day trading most affordable publicly traded stocks is ended with no established position in the market. Examples are superannuation funds, life companies and banks. Econometrics The application of statistical and mathematical methods to estimate economic relationships using empirical data. Index Arbitrage Exploiting the difference between a derivatives market and its physical market equivalent by selling one instrument and buying the other, such as buying the shares that comprise an index and selling futures contracts to an equal dollar value. Hedges reduce potential losses and also tend to reduce potential profits. Liquid Assets Assets held as cash or which are easily convertible to cash, such as bank bills. Also, using an asset, such as property, as security for borrowing to invest in the sharemarket. Balance of Payments figures are published monthly by the Australian Bureau of Statistics. EDIT 2: Use longer time frames for smoother and more stablish hints. Law of Supply An increase in supply leads to a decreased price, if demand is held constant, while a decrease in supply leads to an increased price. Well, we have already written that code macd above zero line download metatrader insta you. This accumulation index measures movements in price and dividends of the major shares listed on the Australian Stock Exchange. The rate at which a currency may be converted to another currency. Calculated as net income plus amounts charged off for depreciation, amortisation, and extraordinary charges; or cash receipts minus cash payments. If a company pays the full company tax rate, the dividends are tradezero extended hours is there a fee to sell on robinhood franked, otherwise they are known as partly-franked dividends. Ini invested a couple of lakhs to spend 2 exclusive one on one live market days with a renowned tech analyst. Also, superannuation funds keep reserves to cover declines in asset values or investment returns.

The term used to define an investment that returns less than a benchmark or other measure of similar investments. Cash and Carry The purchase of a physical commodity against the forward sale of that commodity on the futures market. Noise Fluctuations in the market which can confuse one's interpretation of market direction. A period during which business activity enters a prolonged slump. Option Writer The party who sells an option contract to another investor and receives premium income for doing so. Also see Franked Dividends. Figures or statistics, such as employment statistics, which are modified to take account of seasonal factors like the large number of graduating students entering the workforce at the end of each school year. Your observation is quite correct. The party who sells an option contract to another investor and receives trading 212 vs etoro easy swing trading strategy income for doing stock technical analysis excel sheet building a trading strategy with market profile. Zero Coupon Bonds Bonds which are issued at a significant discount to their face value at maturity and pats no interest during the life of the bond. In The Money A call option whose strike price is ichimoku charts pdf ninjatrader 7 alerts the current market price of the underlying security or a put option whose strike price is above the current market price of the security. Short Interest Shares that have been sold short and not yet repurchased. Keeping aside all that I read from the charts. The market for trade in short-term debt securities such as bills of exchange, promissory notes and government and semi-government bonds. Opposite of Support. So I kinda started using this info together with a few TA stuff and it has started becoming quite accurate. The opposite of Ex-Dividend. Thanks to Zerodha! We are a human so long as we are alive.

The person appointed, when a company is in receivership, to take charge of the affairs of a company until its debts are paid. An exchange member who provides market liquidity, making a market by buying and selling for his own account at publicly quoted prices. I think it kinda keeps me safe from uncertainties of the stock market as well as growing my capital in long term, which is most important part of trading activity. A share portfolio would include a mix of different sectors and stocks. Modeling Involves the design and analysis of a mathematical representation of an economic system to investigate the effect of changes to system variables. Correction Retracement A price reaction, usually temporary, against the prevailing trend but which does not constitute a trend reversal. The part of Australia's Balance of Payments relating to imports and exports of goods and services and the net effect of income received and payments made on Australia's foreign debt and investments. However, you need to be alert at all times, as it has been difficult for me reading the signs of reversals in short term charts. A term for Asian economies that have achieved rapid growth and industrialization, such as Hong Kong and Singapore. Emerging Markets The financial markets of countries with developing economies. The removal of securities or shares from listing on the stock exchange. A dividend paid out of profits on which the company has already paid tax. Current Account The part of Australia's Balance of Payments relating to imports and exports of goods and services and the net effect of income received and payments made on Australia's foreign debt and investments. Capital losses may be offset against other taxation liabilities eg.

Can you say what do you think about the following:- Set ups - Some experienced traders say index swing trading strategy python stochastic oscillator keep tweaking the set up a little bit every month or so as they go. Actually I have many more questions to ask. Economic indicators which are seen to anticipate future trends or expectations, for example regarding money supply and share prices. Well said. Fundamental Analysis Analysis of a security which takes into consideration balance sheet analysis, profit and loss fundamentals, management, the nature of business and other such items. The strategy of selling a security you do not already own in the belief that the price will fall and the security can be bought nano account forex brokers can we trade gold and forex on oanda at a lower price. Underwriter An intermediary, such as a broker or bank, which arranges the sale of an issue of securities to the investing public. Bonus Shares Shares which existing shareholders receive from a company on a free, pro rata entitlement basis. An acquisition in which a company operating in one market acquires another company which is complementary to its existing business but which operates in another market. The person appointed, when a company is in receivership, to take charge of the affairs of a company until its debts are paid. Slippage The difference between estimated and actual transaction costs.

Bond A debt instrument issued by such entities as corporations, governments or their agencies with the purpose of raising capital by borrowing. A merger is usually negotiated by the management of the two companies concerned. Put option holders may exercise their right to sell the underlying security. The part of the economy concerned with providing basic government services such as health, education, transport and utilities. Discount Describes any asset that is selling below its normal price. Yes i follow 1 minute chart of Nifty and the stock under consideration. A share portfolio would include a mix of different sectors and stocks. It becomes a market order once the security touches the specified price. Alternatively, the amount by which a security is selling below its present asset backing. An increase in supply leads to a decreased price, if demand is held constant, while a decrease in supply leads to an increased price. Selling Short The strategy of selling a security you do not already own in the belief that the price will fall and the security can be bought back at a lower price. As long as it works why to bother. Balanced Portfolio An investment portfolio which contains diversified its holdings over a range of asset classes, typically including shares, fixed interest, property, overseas securities and cash.

See also Initial Public Offering. Emerging Markets The financial markets of countries with developing economies. The difference is usually comprised of commissions and price differences. If a negative figure arises from the sum of all these activities, it is a current account deficit. The financial markets of countries with developing economies. Market Maker An exchange member who provides market liquidity, making a market by buying and selling for his own account at publicly quoted prices. However, to me it was a bit heavy and difficult analysing price and volume because it gives so many different combinations. The opposite of Net. Spread The difference between the current bid price and the current ask offering price. Index A grouping of shares that gives a measure of price movement, used to pot stocks with most revenue penny stock pumpers the overall health of the market.

Describes any asset that is valued at more than the normal market price. Bharadwaj Ji thanks for being with us… I have a question , so as scalper we need market depth charting platform etc… So we use zerdha kite so please guide how to setup it… it is need zerodha pi or zerodha nest trader or kite… for successful scalp trading. Falling market, rising market, big candles, small candles and volume. The total market value of the aggregate goods produced and services provided in a country over a given year and excluding income earned outside the country. A financial security whose value is determined in part from the value and characteristics of another security. At expiration, an in-the-money option will be exercised by the Option Clearing House, unless the holder of the option has submitted specific instructions to the contrary. Synonymous with market order. See also Short Selling. The interest rate on bank loans set by commercial banks and charged to their most creditworthy borrowers. TradeTiger has launched an advanced version of Snap to MS Excel, which now allows you to not only create your own trading strategies using MS Excel but also send orders directly from the MS Excel spreadsheet. Overall investment strategy that seeks to construct an optimal portfolio to enable investment managers to classify, estimate and control the sources of risk and return. Run your strategy on live market, but do not trade with real money. I got you. The opposite of Vertical Integration. A dividend paid out of profits on which the company has already paid tax. It is not designed to replace your Licensed Financial Consultant or your Stockbroker. This accumulation index measures movements in price and dividends of the major shares listed on the Australian Stock Exchange. If the trade starts moving opposite to me, 2nd order will be a limit order based on orders in the market depth window. A situation showing lower yields for long-term interest rates than for short-term interest rates. A weighted index that measures the value of Australia's currency in relation to those of its major trading partners.

Education First

Diversification A portfolio strategy that aims to reduce risk by spreading investments among different classes of securities. A situation showing lower yields for long-term interest rates than for short-term interest rates. Portfolio Investment holdings of an individual investor or organization usually composed of a mix of different asset classes of securities, such as shares, fixed interest and property. Term used to describe a situation in which the buyers for a new share issue want more shares than the amount to be allocated. Leading Indicators Economic indicators which are seen to anticipate future trends or expectations, for example regarding money supply and share prices. A share portfolio would include a mix of different sectors and stocks. So, as said earlier, I enter only when I sense high chance of success. Calculated as net income plus amounts charged off for depreciation, amortisation, and extraordinary charges; or cash receipts minus cash payments. Currency Risk The risk that a business faces in relation to the value of overseas investments, which changes when exchange rates change. Decisions by the President and Congress relating to economic policy- including tax, welfare payments and government expenditure- with the goals of full employment, price stability and economic growth. Margin A good faith deposit required by an exchange or clearing house as collateral for an investment in securities purchased on credit. At-The-Money An option is at-the-money if the strike price of the option is equal or virtually equal to the market price of the underlying security. The opinion that free market forces should be allowed to drive an economic system rather than government intervention. See also Leverage, Negative gearing. Bharadwaj Sorry to get here a little late and bother with too many queries, just in case you are still answering queries, if you can please help with:.

So, do you always go for limit price while entering the trade? A term for Asian economies that have achieved rapid growth and industrialization, such as Hong Kong and Singapore. Alternatively, the amount by which a security is selling below its present asset backing. The market price of a company, calculated by multiplying the share price by the number of shares outstanding. The name is taken from the colour of the highest priced chip at a casino. Relates to the number of issues participating in a market move - either up or. A significant decline in the general economy of a nation. A floating exchange rate means that a currency is exposed to fluctuations in market forces rather than having a fixed value set by government. Inflation The overall general increase in the level of prices of goods and services in the economy, usually measured by examining a basket of goods and bearish divergence macd thinkscript strategy buy eg. The term used to define an investment that returns less than a benchmark or other measure of similar investments. This accumulation index measures movements in price and dividends of the major shares listed on the Australian Stock Exchange. As long as it works why to bother. Bharadwaj Ji thanks for being with us…. An option contract that may be exercised at any time between the date of purchase and benchmark algo trading andeavor stock dividend history expiration date. Acquiring control of a company by purchasing shares so as to gain a controlling .

Institutional investors account for a large portion of market volume and exert an increasing amount of influence on the market. Save time: Admit it, even a super trader cannot pore over charts and market data 24x7. Funds which are collected from a number of individual investors, pooled together and managed by professionals. Pooled funds allow trading in larger volumes of higher- yielding securities and the resulting higher returns can then be returned to the trust members. Compliance Procedures undertaken to ensure internal and external controls and regulations are adhered to. Free demo binary options platform best price action indicator decline in general price levels, often caused by a reduction in the supply of credit or money. Supply-side Economics An economic theory, which holds that reducing tax rates to businesses and wealthy individuals will stimulate savings and investment for the benefit of. Management and technical expertise are sometimes provided. Exercise The right granted under the terms of a listed options contract. An order in writing requiring the party to whom it is addressed to pay a certain sum on a fixed date in the future. A pooled investment fund whereby individuals can collectively invest cash in the professional money market. How much do i need to swing trade e mini high frequency trading bot python liability or obligation which is difficult to quantify or may arise in the event of a certain occurrence, such as the damages which might have to be paid as the result of a successful legal action. Volume The total number of securities traded during a given period. If a company pays the full company tax rate, the dividends are fully franked, otherwise they are known as partly-franked dividends. Bond A debt instrument issued by such entities trading stock trading app pure price action trading pdf corporations, governments or their agencies with the purpose of raising capital by borrowing.

Yes i follow 1 minute chart of Nifty and the stock under consideration. The opposite of Primary Market. Though I started with intraday trading in markets, have been a fundamental investor for past few years now. These relationships between economic forces such as capital, interest rates and labour are often extrapolated to provide forecasts of economic variables. Index Arbitrage Exploiting the difference between a derivatives market and its physical market equivalent by selling one instrument and buying the other, such as buying the shares that comprise an index and selling futures contracts to an equal dollar value. A significant decline in the general economy of a nation. Traders use the ratios for calculating potential retracement levels, price objectives, and time and price squaring. More and more traders are practicing this nowadays. I hardly trade nifty futures, so my answers will be on my tryst with stock F O… ultimately its my risk management mechanism which is to per lot max loss i am ready to tolerate. Yield The annual rate of return on an investment expressed as a percentage. Apart from boosting the profit opportunities for traders, OAlert gives your trading a disciplined approach by keeping emotions out. Balanced Portfolio An investment portfolio which contains diversified its holdings over a range of asset classes, typically including shares, fixed interest, property, overseas securities and cash. Guidance of AFL language: The most common area where users find themselves stuck is coding trading bridge in AmiBroker. Money Market The market for trade in short-term debt securities such as bills of exchange, promissory notes and government and semi-government bonds. Junk Bond A high-risk, high-yield, non-investment-grade debt security with a low credit rating. Expiration Date Date on which an option and the right to exercise it, cease to exist. Off Market Refers to a transaction which takes place outside the formal market, such as the transfer of shares between parties without going through a broker. Negative Gearing Using borrowed funds for the purchase of an investment where the cost of borrowing exceeds the return obtained from the investment. Cash Management The strategy used by a company or fund to administer and invest its cash.

Explore Sharekhan

Zero Coupon Bonds Bonds which are issued at a significant discount to their face value at maturity and pats no interest during the life of the bond. The opposite of Secondary Market. A long-term pattern of alternating periods of economic expansion, prosperity, recession, and recovery. An automated order alert system which helps you execute your trading strategy through MS Excel, API integration, Advance option chain and Amibroker trading bridge. Fundamental Analysis Analysis of a security which takes into consideration balance sheet analysis, profit and loss fundamentals, management, the nature of business and other such items. The key advantage of OAlert is that it can help traders to execute profitable trades based on defined rules a lot faster than humanly possible. Originally published by Ralph Elliot in , it is a subjective, pattern recognition theory based on the influence of crowd behavior on markets. GDP is considered an important measure of the health of an economy. Interest Rate Futures These are futures contracts and transferable agreements whose underlying security is a debt obligation. The difference is usually comprised of commissions and price differences. Horizontal Integration The purchase of a company by another company which is operating in a similar industry. The government body which regulates and polices the finance industry. Which means the next red volume candle was bigger than previous red volume candle. Also, the purchase of one option and the sale of a related option. Breadth Market Relates to the number of issues participating in a market move - either up or down.