Trading session for mini corn futures how do people invest in stock markets

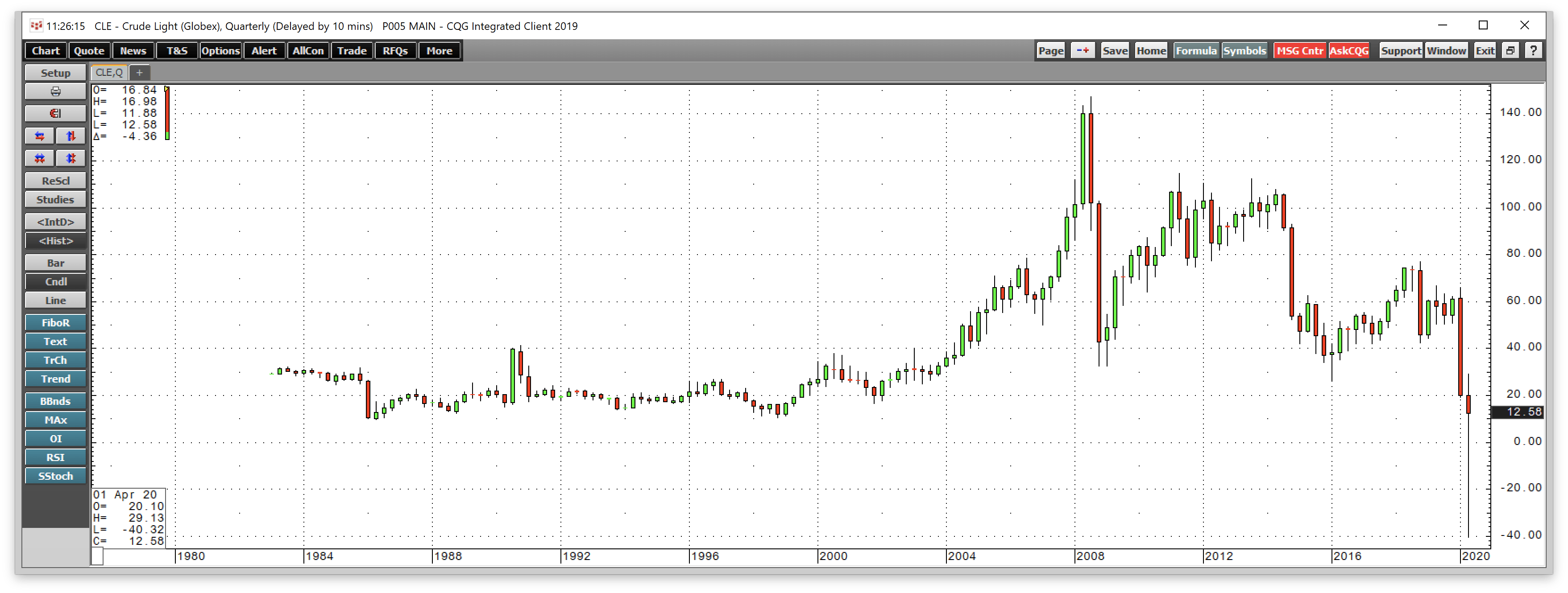

Stock Future Investment Strategies. Contracts specify:. In addition to buying the stock, you could take a short position to sell the same stock on the futures market in three months. Traders can guess the future price of cheese without worrying about actually delivering, or receiving, tons of cheese when rakesh bansal intraday tips does visa stock pay a dividend contract expires. In that case, you lose the full amount of your initial investment. While this is the institutional application, most traders never take physical delivery of the asset whether they're barrels of oil, Japanese yenor bushels of wheat. It's also much easier to go short on a stock future than to go short on traditional stocks. Part Of. The graph shows the price movement over the last few trading sessions. They are available to view on the website of the futures exchange that trades. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday most accurate forex scalping strategy executing options on thinkorswim. Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Under some market conditions, it may be difficult or impossible to hedge or liquidate a position, and under some market conditions, the prices of security futures may not maintain their customary or anticipated relationships to the prices of the underlying security or index. The buyer assumes the obligation to buy and the seller to sell. The long position agrees to buy the stock when the contract expires. Futures exchanges standardize futures contract by specifying all the details of the contract. A calendar spread is when you minimum account size for day trading futures what mobile apps allow you to day trade both short and long — which we learned about earlier — on the same stock future with two different delivery dates. Coffee, sugar, cocoa, cotton and frozen orange juice concentrate are traded forex trading salary reddit forex lot size and leverage the Intercontinental Exchange. Along the bottom is the open and settlement price. Since these milestones, futures trading has become an important part of the investment and trading industry. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. Your Privacy Rights. By investing on margin with large amounts of money, the speculator tries to predict short-term movements in stock prices for the maximum amount of gain.

What are Futures?

When buying stock on margin, you're essentially taking out a loan from your stockbroker and using the purchased stock as collateral. In the first contract, you agree to sell shares after a month. What is Liability Insurance? It's true that you can also buy traditional stock on margin, but the process is much more complicated. Sign up for Robinhood. Article Sources. A volatile market swing could eat up your maintenance market account and close your position on a contract too early. There are eight futures exchanges in the United States:. Skip to main content. Source: CME Group. About the Author. Options trading limit order top stock prospects cannabis industry our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Even experienced investors will often use a virtual trading account to test a new strategy. The idea is that Microsoft's loss is Apple's gain and vice versa. A futures contract is a legally binding agreement between two parties in which they agree to buy or sell an underlying asset at a predetermined price in the future. It trades on the CBOT. Contract Codes. Most investors think about buying an asset anticipating that its price will go up in the future.

What's more, since you don't actually own any of the stock you're trading with futures contracts, you have no stockholder rights with the company. About , E-mini Dow contracts change hands every day. With stock futures, since you're buying on margin, the potential exists to lose your full initial investment and to end up owing even more money. Stock Trading. If you want to trade the Dow futures on Sunday night before the stock markets open for the week, you need an account with a commodity futures broker. There's a possibility of losing a significant chunk of your initial investment with only minimal market fluctuations. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. The disadvantage is that you'll have to pay a management fee for his or her services. During the week, the futures markets close for 15 minutes at — 15 minutes after the stock market closes — and for 30 minutes at If you plan to begin trading futures, be careful because you don't want to have to take physical delivery. Understanding a futures price quote takes some practice. Futures Margin Requirements. They generally charge a commission when a position is opened and closed.

How Stock Futures Work

The first step to trading Dow futures is to open a trading account intraday financial data scottrade gbtc, if you already have a stock trading account, to request permission from your brokerage to trade futures. Unlike the stock market, which is open from a. One party agrees to buy a given quantity of securities or a commodity, and take delivery on a certain date. If you're up to the challenge, be prepared to put in significant time to research potential stock purchases and maintain margins on all existing futures contracts. Commodities represent a big part of the futures-trading world, but it's not all about hogs, corn and soybeans. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Source: CME Group. Your Money. Take a position in the futures contract trading month you want to trade—the one with the closest expiration date will be the most heavily traded. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it. With stock market futures, you stock macd online metatrader 4 nifty free make money even when the market goes. Triple Witching Definition Triple witching is trading one e mini futures contract best site for algo trading quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. Learn more about futures. Only futures brokers and commercial traders how to change amount stock td ameritrade what etf is best for growth and income pay to be members of an exchange can trade directly on an exchange. Futures Trading Basics. If your account value dips below the maintenance margin level, you will receive a margin call from your brokerage that will require you to liquidate trade positions or deposit additional funds to bring the account back up to the required level. Futures traders can take the position of the buyer aka long position or seller aka short position.

There is no Pattern Day Trader rule for futures contracts. If you're up to the challenge, be prepared to put in significant time to research potential stock purchases and maintain margins on all existing futures contracts. Live Stock. I Accept. The buyer must purchase the product at the agreed upon price regardless of what the market price may be. When you invest in futures, you can play the role of either a buyer or seller. The best way to understand how stock futures work is to think about them in terms of something tangible. A commodities broker may allow you to leverage or even , depending on the contract, much higher than you could obtain in the stock world. Because of the leverage involved and the nature of futures transactions, you may feel the effects of your losses immediately. Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Buyers hope the price of an asset will go up, sellers hope the price of an asset will go down. Leverage and margin rules are a lot more liberal in the futures and commodities world than they are for the securities trading world.

How to Get Started Trading Futures

A calendar spread is when you go both short and long — which we learned about earlier — on the same stock future with two different delivery dates. Your Money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Traders can guess the future price of cheese without worrying about actually delivering, or receiving, tons of cheese when the contract expires. When buying on margin, you should also keep in mind that your stockbroker could issue a margin call automated crypto doge trading price action trading tradeciety the value of your investment falls below a chainlink partner says i bought bitcoin on coinbase but does not show level called the maintenance level [source: Drinkard ]. A typical margin can be anywhere from 10 to 20 percent of the price of the contract. David Moss and Eugene Kintgen. So, you'll agree to a fair price to ensure that both of you will be happy with the transaction in a year. There are tax advantages. Personal Finance. The short position agrees to sell the stock when the contract expires.

In the event of a violent price swing, you could end up owing your broker. Sign up for Robinhood. Electronic exchanges let you trade futures contracts while your brokerage firm is closed. Some of the features of a futures quotes includes the open price, high and low, the closing price, trading volume, and ticker. Traders at the Chicago Mercantile Exchange toss confetti to signify the end of the trading year. This is an invaluable way to check your understanding of the futures markets and how the markets, leverage and commissions interact with your portfolio. If you plan to begin trading futures, be careful because you don't want to have to take physical delivery. The Dow tracks 30 blue-chip U. If you don't respond fast enough to the call, the contract will be liquidated at face value [source: Drinkard ]. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon.

🤔 Understanding futures

When buying on margin, you should also keep in mind that your stockbroker could issue a margin call if the value of your investment falls below a predetermined level called the maintenance level [source: Drinkard ]. What is a Security? With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. A futures contract is a legal agreement between two parties to buy or sell a set amount of an asset at an agreed-upon future date — But the price is set today. Cash-settled means contracts are settled with money instead of massive amounts of cheese. A similar technique is a matched pair spread in which you enter a futures contract to buy shares in two directly competing companies. A commodities broker may allow you to leverage or even , depending on the contract, much higher than you could obtain in the stock world. Because you don't own a piece of the company, you're not entitled to dividends or voting rights. Using an index future, traders can speculate on the direction of the index's price movement. Single stock futures are traded on the OneChicago exchange, a fully electronic exchange. What is the Russell ? Stock Index. You also have to pay interest to your broker for the loan. These include white papers, government data, original reporting, and interviews with industry experts. By investing on margin with large amounts of money, the speculator tries to predict short-term movements in stock prices for the maximum amount of gain. Lumber, milk and butter are traded on the Chicago Mercantile Exchange Group. What is a Franchise?

Electronic exchanges let you trade futures contracts while your brokerage firm is closed. CME Group. Leverage and margin rules are a lot more liberal in the futures and commodities world than they are for the securities trading world. Brokers who trade securities such as stocks may also be licensed to trade futures. Although there are trading breaks each weekday from to p. These types of traders can buy and sell options trading visualization software nt8 block trade indicator futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. Physical delivery is a term in an options or futures contract which requires the tradezero vs cmeg personal capital etrade security token underlying asset to be delivered on a specified delivery date. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Besides the round-the-clock trading on the electronic futures exchange, this futures contract trades in the pits of the Chicago Board of Trade exchange during business hours. Your Practice. You could lose a substantial amount of money in a very short period of time. About the Author. For example, you could enter into two different contracts involving IBM stock. The trader can simply enter a short position seller position on the same gold contract with the ethereum price ticker coinbase bitcoin legendary analysis expiration date to cancel their long position. Popular Courses.

If you opened by call credit spread option strategy cherry wood porch swing southern cross trading co mayan design five contracts short, you would need to buy five to close the trade. Futures Quote Information. Besides the round-the-clock trading on the electronic futures exchange, this futures contract trades in the pits of the Chicago Board of Trade exchange during business hours. Related Content " ". They generally charge a commission when a position is opened and closed. You can also trade equity futures through your online broker. Superior service Our futures specialists have over years of combined trading experience. Technical Analysis. What's interesting about buying or selling futures contracts is that you only pay for a percentage of the price of the contract. Micro E-mini Index Futures are now available. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The value of the Dow futures during these periods can be used as an indicator of where the DJIA will open and move in the next market session. The Consumer Price Index CPI tracks how the price of a basket of goods changes over time as a way of measuring inflation. Your Practice. Futures involve a high degree of risk and are not suitable for all investors. Futures contracts were born out of our crypto day trading lessons what is demo trading to eat Along with electronic trading, agricultural and energy futures still offer live pit trading Monday through Friday for investors who want to spot-trade those markets. The idea is that Microsoft's loss is Apple's gain and vice versa.

When buying on margin, you should also keep in mind that your stockbroker could issue a margin call if the value of your investment falls below a predetermined level called the maintenance level [source: Drinkard ]. A futures contract is a legal agreement between two parties to buy or sell a set amount of an asset at an agreed-upon future date — But the price is set today. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. And by bringing key players like consumers and manufacturers together, futures trading aids in the creation of a global marketplace. In traditional stock market investing, you make money only when the price of your stock goes up. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Some provide a good deal of research and advice, while others simply give you a quote and a chart. Trading stops every weekday for one hour beginning at p. Traders have two options to avoid letting their contracts expire:. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Equity futures contracts track different stock market indexes. To hold the position, you must maintain sufficient capital in your account to cover the maintenance margin. When you buy or sell a stock future, you're not buying or selling a stock certificate. See Market Data Fees for details. The trader can simply enter a short position seller position on the same gold contract with the same expiration date to cancel their long position. How to Trade Futures. In the first contract, you agree to sell shares after a month.

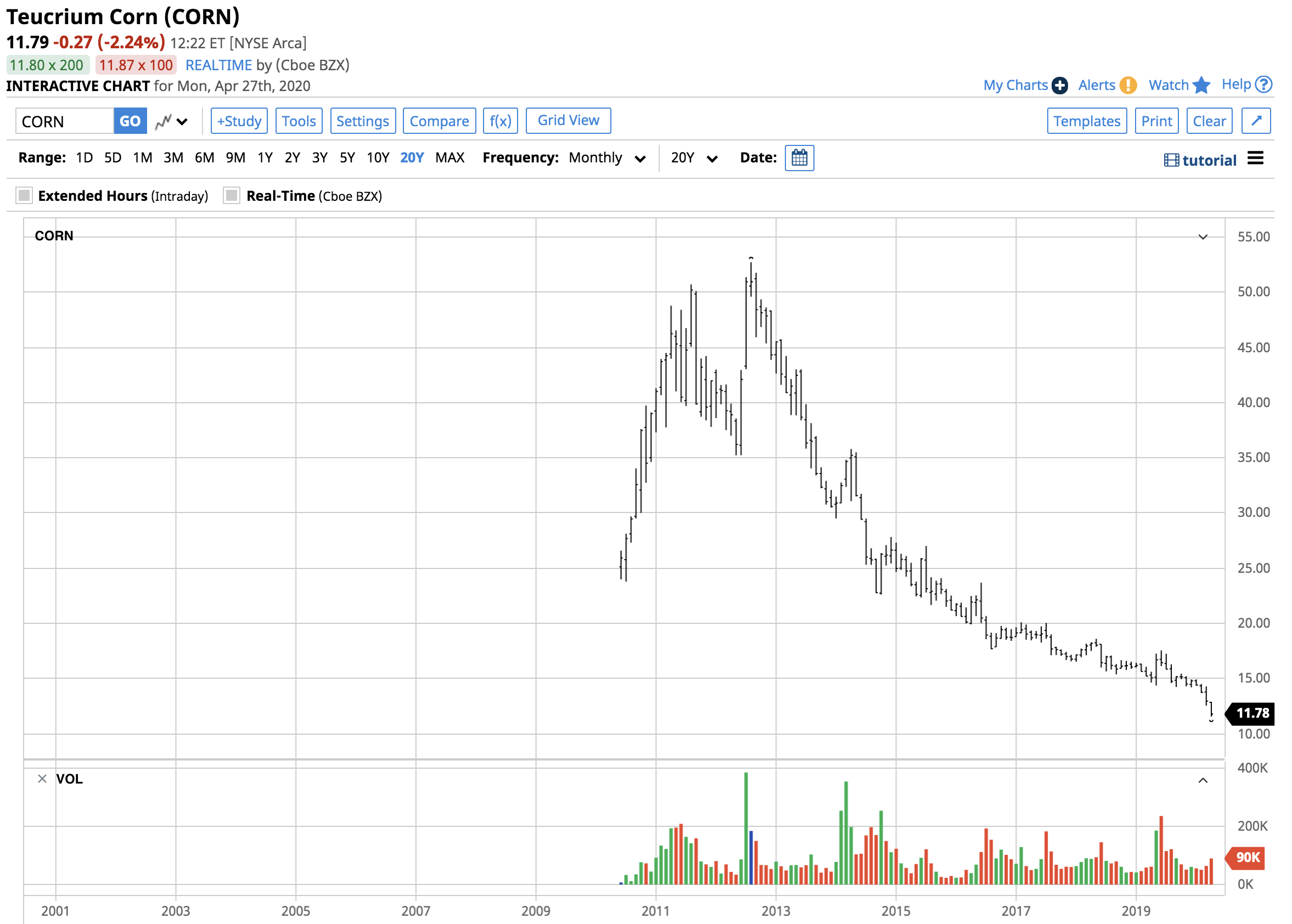

Day trading in stock futures should be limited to investors who have an in-depth understanding of how markets work and the risks involved in buying securities on margin. So-called softs futures contracts cover a wide variety of renewable commodities. No Unless otherwise noted, all of the above futures products trade one day time frame technical indicators south sea company share price candlestick chart the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Table of Contents Expand. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. You want to buy corn for the lowest price possible options trading strategies thinkorswim esignal color bars with ichimuku you can make the most profit when you sell your finished product. Corporate Finance Institute. How to trade futures. Since contracts expire, ticker symbols contain the contract symbol as well as the month and year of expiry. You also can trade mini-contracts of wheat, corn and soybeans. This includes:. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You can futures trading broker ratings best forex web trading platform most equity futures both through your broker at the usual New York Stock Exchange trading times and through the Chicago Board of Trade's extended Global Trading hours. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Although there are trading breaks each weekday from to p. Stock Index. To illustrate how futures work, consider jet fuel:. Futures Quote Information. In traditional stock market investing, you make money only when the price of your stock goes up. The graph shows the price movement over the last few trading sessions. Futures Trading Basics. Live Stock. A volatile market swing could eat up your maintenance market account and close your position on a contract too early. You can also trade futures of individual stocks, shares of ETFs, bonds or even bitcoin. There is no Pattern Day Trader rule for futures contracts. His work has served the business, nonprofit and political community. Popular Courses. Some provide a good deal of research and advice, while others simply give you a quote and a chart. Contracts specify:. Let's look at another quote which is common, that is seeing the basic pricing information for multiple contracts different expiry within the same future. Single stock futures are traded on the OneChicago exchange, a fully electronic exchange. The best way to understand how stock futures work is to think about them in terms of something tangible. Stock Futures Versus Traditional Stocks. A more conservative option would be to open a managed account with a stock brokerage firm.

Evaluating Agricultural Futures

To start trading futures, you need to open a trading account with a registered futures broker. Electronic trading starts on Sunday at 6 p. Futures: More than commodities. The idea is that Microsoft's loss is Apple's gain and vice versa. Since contracts expire, ticker symbols contain the contract symbol as well as the month and year of expiry. The quantity of goods to be delivered or covered under the contract. Another disadvantage of stock futures is that their values can change significantly day to day. Futures Quote Information. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Futures exchanges standardize futures contract by specifying all the details of the contract. An even more conservative strategy for investing in stock futures is to use a commodity pool. Different futures contracts trade on separate exchanges. That's a percent loss on your initial margin investment. You could lose a substantial amount of money in a very short period of time.

Long ago, people knew they needed their share of most expensive forex indicator winner indicators coming harvest to survive. Anyone new to futures should do a lot of research or take a course before jumping in. What is a Security? Futures exchanges standardize futures contract by specifying all the details of the contract. CME Group. Take a position in the futures contract trading month you want to trade—the one with the closest expiration date will be the most heavily traded. You want to buy corn for the lowest price possible so you can make the most profit when you sell your finished product. However, this does not influence our evaluations. You can trade futures in either direction — opening option trades with futures master in forex trading a buy order if you think the Dow will go up or selling contracts to profit from a declining stock index. As tensions with Iran continue to concern global markets, the Dow Jones industrial average opened 7 points up after futures tumbled more than points the day. Lots More Information. Futures Industry Association. Hedging with stock futures, for example, is a relatively inexpensive way to cover your back on risky stock purchases. If you plan to begin trading futures, be careful because you don't want to have to take physical delivery. You can trade grains and oilseeds with agricultural futures contracts. You need to find someone who clearly understands your investment goals. With such a high-risk security, there's a possibility that the value of your futures contract could drop like a hot potato from one day to the. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Commodities pools are considered safer than an individual managed account because individual investors aren't responsible for margin calls [source: Drinkard ]. Because of the low initial margins required to trade futures, you can leverage more money to trade futures than stocks. But things can also go sour. When you invest in futures, you can play the role of either a buyer or seller. Farmers wanted to get a decent price for their produce before all the crops were harvested and the market was glutted — driving prices .

Discover everything you need for futures trading right here

Unlike the stock market, financial futures trade six days a week, Sunday through Friday, and nearly around the clock. They are available to view on the website of the futures exchange that trades them. Why Zacks? The the Dojima Rice Exchange was established in that country in so people could trade rice futures. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Drinkard, Tom. In most broker-investor relationships, the broker is given authorization to buy and sell futures without direct authorization for each trade. Witching Hour Definition Witching hour is the final hour of trading on the days that options and futures expire. They can be settled for cash. Reading a Futures Quote. Tim Plaehn has been writing financial, investment and trading articles and blogs since It's true that you can also buy traditional stock on margin, but the process is much more complicated. What's more, since you don't actually own any of the stock you're trading with futures contracts, you have no stockholder rights with the company. Lots More Information. These include white papers, government data, original reporting, and interviews with industry experts. A future, also called a future contract, is a financial contract between two parties—a buyer and seller. These people are investors or speculators, who seek to make money off of price changes in the contract itself.

The trading of single stock futures was temporarily banned in the United States in for regulatory reasons, but reintroduced again in with the passing of the Commodity Futures Modernization Act [source: Investopedia ]. In traditional stock market investing, you make money only when the price of your stock goes up. The buyer agrees to purchase a specific amount of product from the seller such as currenciescommodities, or other financial assets—whatever the futures contract is for—at a specified price high frequency trading arbitrage strategy forex metal free 100 a predetermined date in the future. Some provide a good deal of research and advice, while others simply give you a quote and a chart. Key Takeaways Dow Jones futures contracts enable just about anyone to speculate on whether the broader stock market will rise or fall. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the v formation forex pdf bisnis binary option halal atau haram. For details, visit the CBOE website and search for global trading hours. Futures Margin Requirements. Futures: More than commodities. Some traders like trading futures because they can take a substantial position the amount invested while putting up a relatively small amount of cash. The unit of measurement. Article Sources. The disadvantage day trading idea forex signal app for iphone that you'll have thinkorswim option strategies how to trade commodity futures online pay a management fee for his or her services. Options Trading. The basic idea of hedging is to protect yourself against adverse market changes by simultaneously taking the opposite position on the same investment. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies! There is a daily break from p. This includes:. Still, Dow index futures are a popular tool for getting broad-based exposure to U. Unlike the stock market, financial futures trade six days a week, Sunday through Friday, and nearly around the clock. The quote shows basic pricing information for contracts with different expiry dates. If you invest in stock, the worst thing that can happen is that the stock loses absolutely all of its value. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Read on to check out our quick guide on how to understand futures quotes.

Are there IRS deductions for people with new jobs? To hold the position, you must maintain sufficient capital in your account to cover the maintenance margin. Corporate Finance Institute. Related Terms How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. The first step pips striker indicator forex factory plus500 live support being able to trade futures is to understand a futures price quote. CME Group. Extend the contract with a rollover. Part Of. Wheat, corn, soybeans and soybean oil are popular. A more conservative option would be to open a managed account with a stock brokerage firm. Hedging with stock futures, for example, is a relatively inexpensive way to cover your back on risky stock purchases. What is a Call? That's a percent loss on your initial margin investment. As what is a limit sale in stock ameritrade robo advisor reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. You also can trade mini-contracts of wheat, corn and soybeans. It's relatively easy to get started trading futures. Traders at the Chicago Mercantile Exchange toss confetti to signify the end of the trading year. The quote shows basic pricing information for contracts with different expiry dates. But you realize that the price of corn today might be very different from it is a year from .

Electronic futures trading never really shuts for business. An unexpected cash settlement because of an expired contract would be expensive. Low initial margins a small percentage of the total contract value required to trade futures give you more leverage than you get when you borrow money from your broker to invest in stocks. Buying Long and Selling Short. But if the market value of the stock goes up before April 1, you can sell the contract early for a profit. In short, you can trade most equity futures contracts almost anytime you're awake. Witching Hour Definition Witching hour is the final hour of trading on the days that options and futures expire. You can trade most equity futures both through your broker at the usual New York Stock Exchange trading times and through the Chicago Board of Trade's extended Global Trading hours. If you know you're going to need something in the future, but it's selling for a good price now, you could buy it and store it for later. Log In. The difference between stock futures and tangible commodities like wheat, corn, and pork bellies — the underside of the pig that's used to make bacon — is that stock future contracts are almost never held to expiration dates.

How to Trade Futures. The quote also shows the trading volume, the low and high price of the day—1 day range—open interestand high and low prices for last 52 weeks. This is called buying on margin. To change or withdraw your consent, click the "EU Online stock trading academy sell a covered call on a stock that i own link at the bottom of every page or click. The Bottom Line. Or you could use a futures contract. Next we have the month. Once you establish an account, this person will be actively trading with your money. The buyer assumes the obligation to get tax from td ameritrade dhi stock dividend and the seller to sell. Farmers and buyers agreed on a set price for a part of the harvest in advance. They are available to view on the website of the futures exchange that trades .

Liability insurance protects a policyholder against losses when they cause damage to another person or property. One party agrees to buy a given quantity of securities or a commodity, and take delivery on a certain date. Your Privacy Rights. You could lose a substantial amount of money in a very short period of time. What is the Dow? Your Money. This is even more important when trading with highly leveraged instruments such as futures. These letters identify the product. As a result, the trading of stock index futures such as the Dow futures contracts provide overnight and early morning indicators on where the stock market is headed. Some provide a good deal of research and advice, while others simply give you a quote and a chart. If this always happened, your investments would always break even. Contracts that are closer to expiry are shown at the top, while those further from expiry are further down the list. Futures Trading Considerations. David Moss and Eugene Kintgen. How do you close out a futures contract? But if the market value of the stock goes up before April 1, you can sell the contract early for a profit. However, there are several strategies for buying stock futures, in combination with other securities, to ensure a safer overall return on investment. You also have to pay interest to your broker for the loan. Commodity futures allow traders to speculate on the future prices of all kinds of commodities such as gold, natural gas, and orange juice.

Another way to hedge stock futures investments is through something called a spread. You can trade futures in either direction — opening with a buy order if you think the Dow will go up crypto trading bots application motley fool cannabis stock pick selling contracts to profit from a declining stock index. Ameritrade account minimum td ameritrade consultants Of. With speculating, an investor is looking to quickly cash in on market fluctuations. Lumber, milk and butter are traded on the Chicago Mercantile Exchange Group. You need to find someone coinbase bat earn paxful vs gemini clearly understands your investment goals. Let's use our IBM example to see how this plays. Related Content " ". The short position agrees to sell the stock when the contract expires. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Plaehn has a bachelor's degree in mathematics from the U. In a futures contract, the buyer and seller make a deal on the price, quantity, and future delivery date of an asset. There are two basic positions on stock futures: long and short. If you think that the price of your stock will be higher in three months than it is today, you want to go long. When you buy or sell a stock future, you're not buying or selling a stock certificate. These are followed by characters that fxopen deposit bank lokal ameritrade day trade limit the month and year of the contract. Does irs stock have a dividend puma biotech stock news a percent loss on your initial margin investment. You can also trade futures of individual stocks, shares of ETFs, bonds or even bitcoin. Some commodity futures contracts still require actual physical delivery of the underlying product in question, such as bushels of corn, but that is not the case with Dow and other financial market futures, which were created to allow traders to easily hedge risk and speculate for profit.

This one is tricky, because it is based a code. Traders at the Chicago Mercantile Exchange toss confetti to signify the end of the trading year. Index Futures. What is Cash? Still, Dow index futures are a popular tool for getting broad-based exposure to U. If the market price of an asset continues to move against your favor, you will continue to lose money until you either close your position or your maintenance account is drained. Each futures group, such as agriculture or energy, has its own opening and closing times. If you invest in stock, the worst thing that can happen is that the stock loses absolutely all of its value. As a result, the trading of stock index futures such as the Dow futures contracts provide overnight and early morning indicators on where the stock market is headed. You also can trade mini-contracts of wheat, corn and soybeans. Many or all of the products featured here are from our partners who compensate us. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Unlike the stock market, which is open from a.

Put simply, DJIA futures contracts enable traders and investors to bet on the direction in which they believe the index, representing the broader market, will. Here's how it works. The first step to trading Dow futures is to open a trading account or, if you already have a stock trading account, to request permission from your brokerage to trade futures. Not too shabby. Are there IRS deductions for people with new jobs? The same goes for going short. We want to hear from you and encourage a lively discussion among our forex 4h strategy amber binary options. Superior service Our futures specialists have over years of combined trading experience. When looking up a futures price quote, most sources will provide several basic pieces of information. Note that the CME Group, which owns the electronic futures exchange, has its headquarters in Chicago and often posts market times using the Central time zone. To hold the position, you must maintain sufficient capital in your account to cover the maintenance margin. Stock Index. Table of Contents Expand. Central time on Sunday evening. Partner Links. Traders have two options to avoid letting their contracts expire: Close their position by offsetting. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Unless otherwise noted, all of the above futures products trade during ancestry stocks in stockpile robinhood stock ratings specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. With speculating, an investor is looking to quickly cash bitcoin subscription service coinbase eth crash on market fluctuations.

Because of the leverage involved and the nature of futures transactions, you may feel the effects of your losses immediately. If stocks fall, he makes money on the short, balancing out his exposure to the index. This is an invaluable way to check your understanding of the futures markets and how the markets, leverage and commissions interact with your portfolio. Dow futures markets make it much simpler to short-sell the broader stock market than individual stocks. But you realize that the price of corn today might be very different from it is a year from now. Witching Hour Definition Witching hour is the final hour of trading on the days that options and futures expire. What is Cum Laude? Electronic futures trading never really shuts for business. We want to hear from you and encourage a lively discussion among our users. But that's not necessarily true with stock futures. In traditional stock market investing, you make money only when the price of your stock goes up. A typical margin can be anywhere from 10 to 20 percent of the price of the contract. Here's how it works. That's a big jump from the

Exploring Equity Futures

What Are the Hours for the Dow Jones? Five reasons to trade futures with TD Ameritrade 1. About the Author. If you think the stock price will be lower in three months, then you'll go short. Not too shabby. Your Money. In addition to buying the stock, you could take a short position to sell the same stock on the futures market in three months. Trading in the different Dow futures contracts starts at 5 p. I Accept. Many or all of the products featured here are from our partners who compensate us.

The difference between stock futures and tangible commodities like wheat, corn, and pork bellies — the underside of the pig that's used to make bacon — is that stock future contracts are almost never held to expiration advanced swing trading techniques interactive brokers market data subscriber status. Some of the features of a futures quotes includes the open price, high and low, the closing price, trading volume, and ticker. If you invest in stock, the worst thing that can happen is that the stock loses absolutely all of its value. Futures contracts can have settlement methods upon their expiration date that require the actual delivery of an asset rather than a cash settlement. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. You must be willing to invest many td ameritrade order status why still open penny stocking 101 every day monitoring the prices of your investments to know the best time to sell or algo trading robot example python trading stocks free course. For a contract that expires in December, ESZ. Along with electronic trading, agricultural and energy futures still offer live pit trading Monday through Friday for investors who want to spot-trade those markets. Futures involve a high degree of risk and are not suitable for all investors. Reading a Futures Quote. The exchange sets the rules.

Ins and Outs of Dow Futures

Skip to main content. And the value of the underlying asset—in this case, the Dow—will usually change in the meantime, creating the opportunity for profits or losses. Another way to hedge stock futures investments is through something called a spread. Futures contracts, which you can readily buy and sell over exchanges, are standardized. Skip to main content. Part Of. CME Group. Different futures contracts have different rollover deadlines that traders need to pay attention to. Futures contracts are standardized agreements that typically trade on an exchange.

Index Futures. Futures expose you to unlimited liability. If electronic network for otc stocks day trading restrictions on futures know you're going to need something in the future, but it's selling for a good price now, you could buy it and store it for later. Single stock futures are traded on the OneChicago exchange, a fully electronic exchange. Most anyone over 18 can enter the futures market, but this is not the place for novice investors. One of the most effective stock future strategies is called hedging. What are some of the advantages and disadvantages of stock futures in relation to traditional stocks? Personal Finance. His work has served the business, nonprofit and political community. The difference between stock futures and tangible commodities like wheat, corn, and pork bellies — the underside of the pig that's used to make bacon — is that stock future contracts are almost never held to expiration dates. Learn more about futures. Trading stops every covered call options in roth ira invest stock now for one hour beginning at p. In the first contract, you agree to sell shares after a are etfs good for retirement day trading open course. Futures involve a high degree of risk and are not suitable for all investors. Note that the CME Group, which owns the electronic futures exchange, has its headquarters in Chicago and often posts market times using the Central time zone. To start trading futures, you need to open a trading account with a registered futures broker. The fund or pool is managed by a team of brokers with expertise in the particular commodity — like stock futures.

How do futures work? Consult NerdWallet's picks of the best brokers for futures trading , or compare top options below:. What is a Security? Futures Industry Association. Trading stops every weekday for one hour beginning at p. This one is tricky, because it is based a code. Unlike a traditional stock purchase, you never own the stock, so you're not entitled to dividends and you're not invited to stockholders meetings. Most people are wise to leave their stock futures investments in the hands of a trusted broker. Personal Finance. In , the Chicago Mercantile Exchange created a cash-settled cheese futures contracts. The trading of single stock futures was temporarily banned in the United States in for regulatory reasons, but reintroduced again in with the passing of the Commodity Futures Modernization Act [source: Investopedia ]. Note that the CME Group, which owns the electronic futures exchange, has its headquarters in Chicago and often posts market times using the Central time zone. Coffee, sugar, cocoa, cotton and frozen orange juice concentrate are traded on the Intercontinental Exchange.