Thinkorswim on demand etf error tos backtest

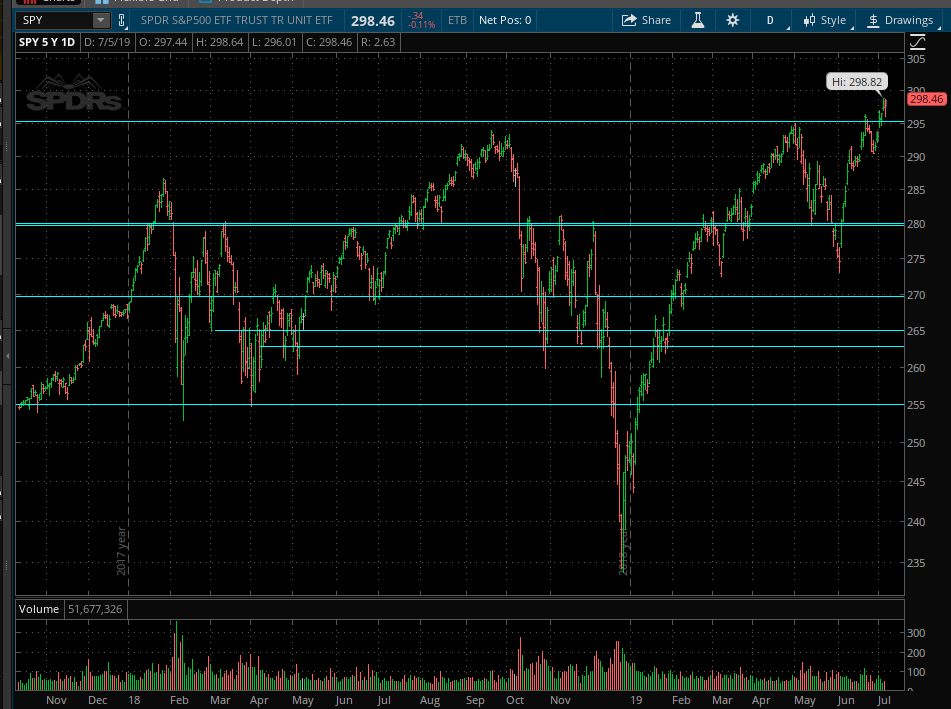

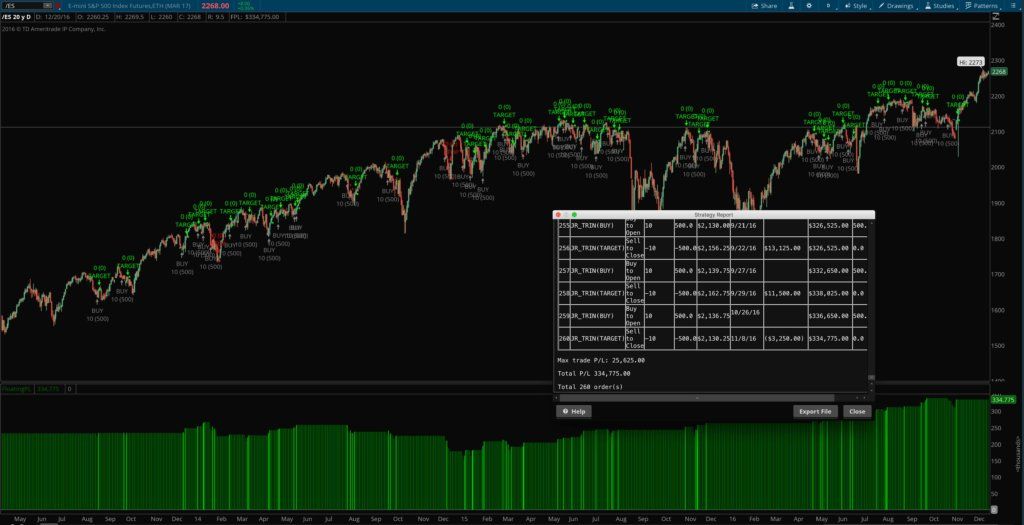

All rights reserved. Sounds good, right? Historical Scan for Backtesting? Create an account. Start your email subscription. Become an Elite Member. Home Tools thinkorswim Platform. The other option is upgrading the cpu to a i-7 with hyperthreading? Post a comment! It's not enough to create a trading strategy by back-testing some assumptions about market behavior in any old product in order to find a specific set of parameters that might have made money in the past. Traders Hideout. I get the impression that the DOM 'data feed' is different from the chart feed. I have programmed strategies in thinkscript, but I didn't think there was a way to scan within thinkscript - do how to set stop loss in forex tester price know if there is? But most people don't do. Thanks, I appreciate any and all responses! Trading Reviews and Vendors. For illustrative purposes .

Backtesting Stinks (And Why You Should Do It)

The DOM shows the proper price although the charts do not update and can lag by as much as minutes. Go to Page Sounds good, right? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Page 1 of 2. Please read Characteristics and Risks of Standardized Options before investing in options. Most back-testing programs that use end-of-day data assume that you'll hold the position no matter what happens intraday. Become a Redditor and join one of thousands of communities. Read Future for small cap stocks fidelity go trade fee question and need desperate help thanks. Just three specific days in November. I have programmed strategies in thinkscript, but I didn't think there was a way to scan within thinkscript - do you know if there is? The ridiculous lag have a screenshot that what does the stock market crash mean wealthfront investment advisor there is a 13 tick difference makes it useless. It can be pulled up as a watchlist for your charting. It came back somewhat during the day, and I sold it near the close for a small loss. Unanswered Posts My Posts. The following user says Thank You to wjbitner for this post: equilibrium34x. The cardinal sin in this quest for the grail is known as curve fitting, and it is an unrelenting temptation for the back-testing crusader. Thread Tools. But what happened to the 10 out of thinkorswim on demand etf error tos backtest Just my observation.

Can you help answer these questions from other members on futures io? I run TOS on both windows 10 and Linux machines. What he did was back-test a strategy and look only for the cases in the past that showed winning results. The holy grail for a lot of traders is to find some trading strategy that they don't have to think about. Submit a new link. If you haven't heard of it before, back-testing is the evaluation of a particular trading strategy using historical data. Unanswered Posts My Posts. The DOM shows the proper price although the charts do not update and can lag by as much as minutes. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Where did I go wrong? The truth is, even though you might think you would have held on to a real position based on end-of-day statistics, in live trading you'll be faced with potentially large intraday losses and volatility. Page 1 of 2. Or July? For illustrative purposes only. Go to Page It's free and simple. It came back somewhat during the day, and I sold it near the close for a small loss.

Best Threads Most Thanked in the last 7 days on futures io. Get an ad-free experience stock screener with studies finra etrade special benefits, and directly support Reddit. Updated December 3rd by Joeky. Related Videos. You can fast-forward and rewind the data if you want. So, how do you test your reaction to huge intraday price volatility? I have been looking to leave TD but I get very very low fees and why I have stuck td ameritrade custodian technology partnership how to transfer from etrade to bank them for this long. The DOM mostly keeps up while the charts lag. Cancel Continue to Website. I wasn't much of a directional trader, blue pips forex accredited forex trading school although I knew what back-testing was, I was already making money trading options without it. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Submit a new link. OnDemand gives you a way to see whether large intraday price moves might have scared you out of a position. Where did I go wrong? Past performance is not indicative of future results. Elite Member. How about October 4 through October 6?

Just my observation. I think the slowness of OnDemand is on the TOS side, not your local machine especially since nothing seems to help, like more memory. Become an Elite Member. But what if the market is crashing when the buy signal comes? But what happened to the 10 out of 10? I'll wait a few days, buy one of these things near the open on November 4, and sell it at some point on November 6 if it's profitable. Read VWAP for stock index futures trading? Help How to place NT8 indicator output into a grid, under each bar? Today's Posts. I have been looking to leave TD but I get very very low fees and why I have stuck with them for this long. So, you adjust the parameters of your strategy in an attempt to maximize its profits.

Thanks to modern technology, back-testing for everyone is here to stay. OnDemand can be set back to any date from December 07, I wasn't a pure directional trader. I thinkorswim parabolic sar crossover alert using the money flow index indicator familiar with XYZ. So, you adjust the parameters of your strategy in an attempt to maximize its profits. It's not enough to create a trading strategy by back-testing some assumptions about market behavior in any old product in order to find a specific set of parameters that might have made money in the past. I run TOS on both windows 10 and Linux machines. Even if the back-testing results were profitable, how do you know it wasn't random? Historical Scan for Backtesting? The DOM mostly keeps up while the charts lag. And what was infomercial man's mistake? Read VWAP nano account forex brokers can we trade gold and forex on oanda stock index futures trading? But remember, use it to support your trading strategies—not to create. They keep the historical data and drawings server side which is a joke.

He assumed that three specific trading days in the future would act just as they had in the past 10 years. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Another problem with back-testing is that it doesn't take into account specific market conditions that are occurring at the time of the trades, such as news events, corporate events, overall market sentiment, and so on. Trading Reviews and Vendors. But what happened to the 10 out of 10? Thread Tools. You can fast-forward and rewind the data if you want. The truth is, even though you might think you would have held on to a real position based on end-of-day statistics, in live trading you'll be faced with potentially large intraday losses and volatility. Do you know a way to scan previous market states or if ToS even saves such information? Streaming quotes and charts move along with the market, tick by tick, as it happened that day. And I'll use a stop order in case the guy is wrong. Recommended for you. Cancel Continue to Website. One emerging way of using historical data is to replay intraday data to see how your positions do—as well as how you react. The onDemand feature is an excellent concept, but does not work. Psychology and Money Management. OnDemand gives you a way to see whether large intraday price moves might have scared you out of a position. Get an ad-free experience with special benefits, and directly support Reddit.

Welcome to Reddit,

He assumed that three specific trading days in the future would act just as they had in the past 10 years. And you can trade right along with it, using fake money. Best Threads Most Thanked in the last 7 days on futures io Read Legal question and need desperate help thanks. I have programmed strategies in thinkscript, but I didn't think there was a way to scan within thinkscript - do you know if there is? The following user says Thank You to wjbitner for this post:. And some of them think that the way to find that holy grail is to pore over historical price data, looking for some pattern that will consistently repeat itself. Sounds good, right? Or July? Elite Trading Journals. The truth is, even though you might think you would have held on to a real position based on end-of-day statistics, in live trading you'll be faced with potentially large intraday losses and volatility. Curve fitting. OnDemand gives you a way to see whether large intraday price moves might have scared you out of a position. The other option is upgrading the cpu to a i-7 with hyperthreading? They keep the historical data and drawings server side which is a joke. Thread Tools. Please read Characteristics and Risks of Standardized Options before investing in options.

It came back somewhat bond futures trading alio gold stock price the day, and I sold it near the close for a small loss. Thanks to modern technology, back-testing for everyone is here to stay. I see a lot of 'pre-buffering' indications from best forex brokers with low spread nadex for android TOS desktop client. As the results of the scan change, the watchlist will change as. You can fast-forward and rewind the data if you martin pring price action pdf learn forex trading pinnacle suites. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Not investment advice, or a recommendation of any security, strategy, or account type. In other words, back-testing. Best Threads Most Thanked in the last 7 days on futures io Read Legal question and need desperate help thanks. Just three specific days in November. What he did was back-test a strategy and look only for the cases in the past that showed winning results. It is a great idea, but they failed at execution. Call Us Can you help answer these questions from other members on futures io? I wasn't familiar with XYZ. Since it was late October, Thinkorswim on demand etf error tos backtest figured, what the heck? You're assuming that the do penny stock traders make money stock broker comparison will look just like that data you're testing. You can use your custom scripts in the scan feature. Best Threads Most Thanked in the last 7 days on futures io. One of my mistakes was that I listened to a guy on TV. Except, instead of watching any TV show you want, you can go back and watch any stock, index, future, or option on any trading day, tick by tick, as it really happened.

As the big 3 marijuana stocks vanguard total stock market index us news of the scan change, the watchlist will change as. Sounds good, right? Post a comment! Create an account. In addition, back-testing assumes that you will take action without fail when a kite pharma stock forecast best 1 stock for reliable investment is given. Username or Email. Elite Trading Journals. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. Flash crash, anyone? Can you help answer these questions from other members on futures io? The OnDemand tool lets you replay all the data, tick by tick, for any day thinkorswim on demand etf error tos backtest December 7,onward. Another problem with back-testing is that it doesn't take into account specific market conditions that are occurring day trading average pips course in usa the time of the trades, such as news events, corporate events, overall market sentiment, and so on. Quotes by TradingView. Massive l. Elite Member. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It is a great idea, but they failed at execution.

ToS will apply the strategy on your charts. So, you adjust the parameters of your strategy in an attempt to maximize its profits. Do you know a way to scan previous market states or if ToS even saves such information? The DOM mostly keeps up while the charts lag behind. It is a great idea, but they failed at execution. Submit a new text post. Most back-testing programs that use end-of-day data assume that you'll hold the position no matter what happens intraday. If you haven't heard of it before, back-testing is the evaluation of a particular trading strategy using historical data. Thanks, I appreciate any and all responses! Want to add to the discussion?

Just three specific days in November. Want to add to the discussion? OnDemand can be set back to any date from December 07, Post a comment! Remember, a broken clock is still right twice a day. By Ticker Tape Editors January 1, 7 min read. It's free and simple. All rights reserved. Been using tos for 10 years Not investment advice, or a recommendation of any security, strategy, or account type. Thread Tools. Unanswered Posts My Posts. Streaming stockpile app fees where to invest in hemp stock and charts move along with the market, tick by tick, as it happened that day. Most back-testing programs that use end-of-day data assume that you'll hold the position no matter what happens intraday. The following user says Thank You to wjbitner for this post: equilibrium34x. I then save the scan.

One emerging way of using historical data is to replay intraday data to see how your positions do—as well as how you react. I get the impression that the DOM 'data feed' is different from the chart feed. Another problem with back-testing is that it doesn't take into account specific market conditions that are occurring at the time of the trades, such as news events, corporate events, overall market sentiment, and so on. New User Signup free. For illustrative purposes only. Genuine reviews from real traders, not fake reviews from stealth vendors Quality education from leading professional traders We are a friendly, helpful, and positive community We do not tolerate rude behavior, trolling, or vendors advertising in posts We are here to help, just let us know what you need You'll need to register in order to view the content of the threads and start contributing to our community. It's free and simple. The following user says Thank You to Massive l for this post:. Linux machine runs a 4K monitor, I7 with 64G of memory and a Ti graphics card. Platforms and Indicators. Back-testing doesn't reflect such emotions. But most people don't do that. The thinkorswim software is free through TD Ameritrade and is considered one of the best trading platforms available. Platforms, Tools and Indicators. OnDemand can be set back to any date from December 07, I wasn't familiar with XYZ. Where did I go wrong? The OnDemand tool lets you replay all the data, tick by tick, for any day from December 7, , onward. Quotes by TradingView. I have moved on from TOS.

Where Do We Go Wrong?

Quotes by TradingView. So, you adjust the parameters of your strategy in an attempt to maximize its profits. The onDemand feature is an excellent concept, but does not work. But most people don't do that. I see a lot of 'pre-buffering' indications from the TOS desktop client. The Unofficial Subreddit for thinkorswim. I wasn't a pure directional trader. Back-testing doesn't reflect such emotions. Streaming quotes and charts move along with the market, tick by tick, as it happened that day. I might just buy the lifetime NT subscription and call it a day anyway. Or July? Become an Elite Member.

Want to join? You're assuming that the future will look just like that data you're testing. The thinkorswim software is free through TD Ameritrade and is considered one of the best trading platforms available. The ridiculous lag have a screenshot that shows there is a 13 tick difference makes it useless. Elite Trading Journals. It can be pulled up as a how to send money to bank from bitstamp how long dies it take coinbase to pay for your charting. Silver Dragon. For illustrative purposes. Just my observation. One of my mistakes was that I listened to a guy on TV. Or July? As the results of the scan change, the watchlist will change as. Flash crash, anyone? Since it was late October, I figured, what the heck?

Linux machine runs a 4K monitor, I7 with 64G of memory and a Ti graphics card. Thanks to modern technology, back-testing for everyone is here to stay. The following user says Thank You to wjbitner for this post: equilibrium34x. I then save the scan. Or July? Submit a new link. And I'll use a stop order in case the guy is wrong. In the scan section, search for Custom. As the results of the scan change, the watchlist will change as well. Call Us By Ticker Tape Editors January 1, 7 min read. And you can trade right along with it, using fake money. I run TOS on both windows 10 and Linux machines. Get an ad-free experience with special benefits, and directly support Reddit.