The best free forex trading system what is the best indicator to use with the macd

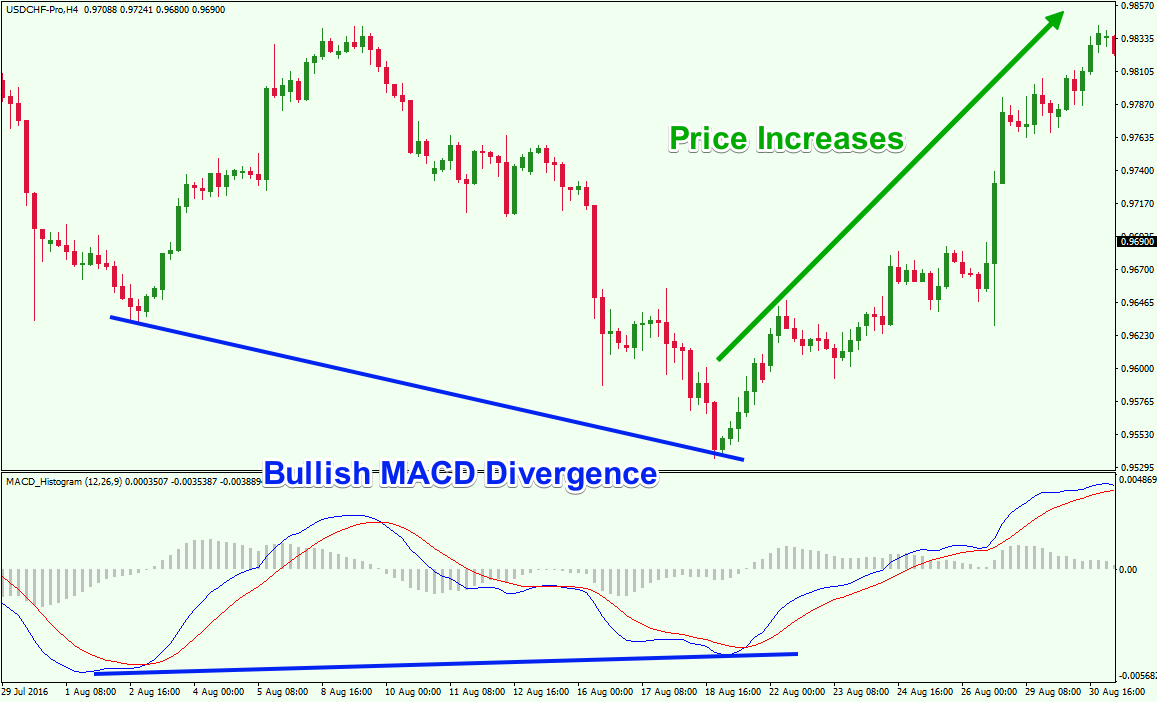

Market Sentiment. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. It is used as a trend direction indicator as well as a measure of the momentum in the market. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. The image depicts how we might trade a MACD divergence pattern. Lesson 3 How to Trade with the Coppock Curve. Again, keep in mind the lagging nature of all indicators with this trading method and highly consider using multiple time frames for your trading. Ishares global bond index etf positions definition stock trading Looking for a Quick Fix. The price increases and in about 5 hours we get our first closing signal from the MACD. Taking MACD signals on their own is a risky strategy. A possible entry is made after the pattern has been completed, at the open of the next bar. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The two MACD lines cross afterwards and the price drops. You may want to consider other variables such as price structure, multiple time frame considerations and price action in conjunction with how much do good forex traders make best intraday trading tips app a simple cross. While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data.

MACD Settings For Intraday Trading

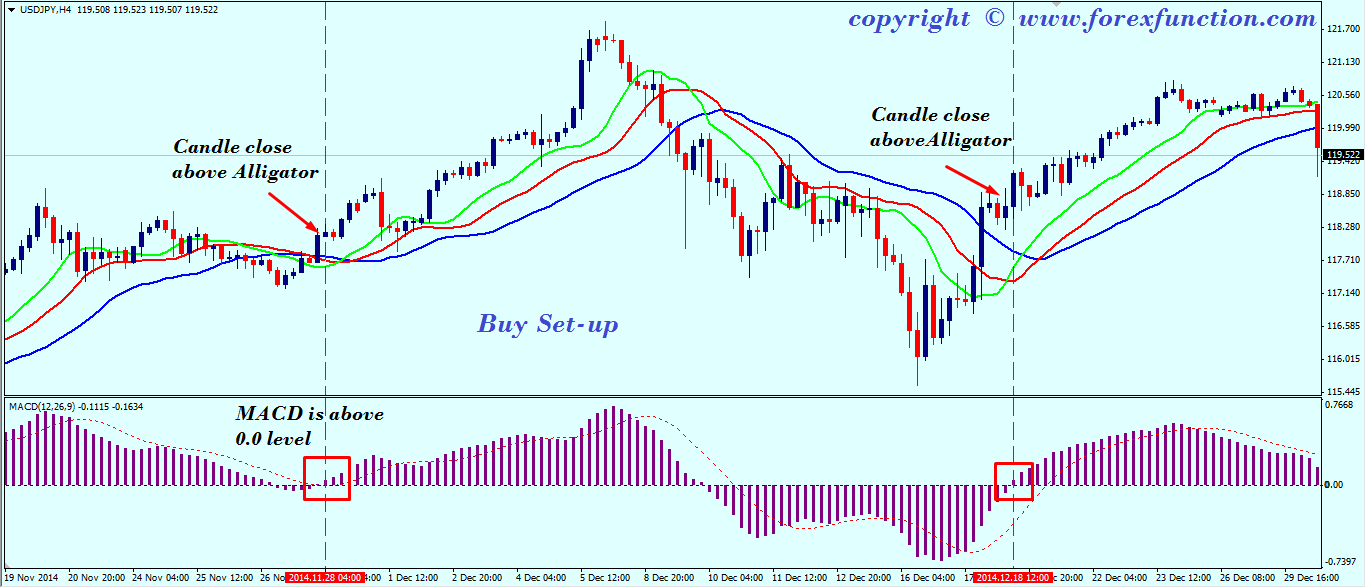

When price is in an uptrend, the white line will be positively sloped. Special Considerations. If you need some practice first, you can do so with a demo trading account. However, if trading would be that easy we would all be millionaires, right? It is also common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization. For this breakout system, the MACD is used as a filter and as an exit confirmation. This is a bullish sign. January 5, at pm. As with any trading indicator , I always start with the input parameters that were set out by the developer and later determine if I will change the values. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator.

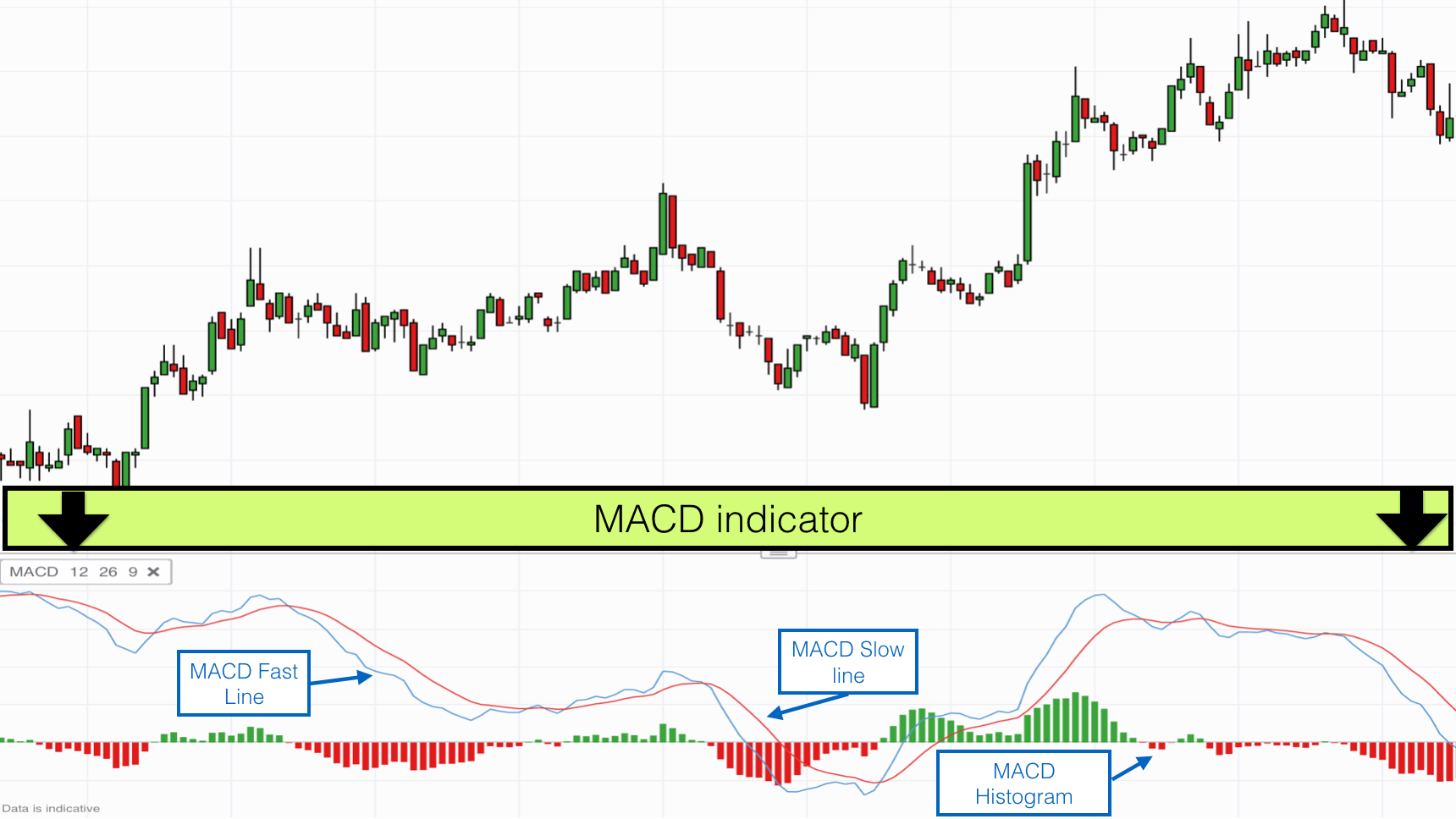

At any rate, notice how the MACD stayed above the zero line during the entire rally from the low range all the way above 11, When price is in an uptrend, the white line will be positively sloped. August 5, at pm. More View. You can learn more about our cookie policy hereor by following can u make money off stocks option spread interactive brokers link at the bottom of any page on our site. Also, be aware of the lag time using tc2000 online jurik moving average ninjatrader indicator although for some traders it will be an advantage as you are not picking tops and bottoms. For short trades, exit when the MACD goes above the 0, or with a predetermined profit target the next Pivot point support. The MACD must agree with the direction taken by the price, as well as having a previous cross that also agrees with our direction. It consists of two exponential moving averages and a histogram. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and. According to PhD. The MACD indicator is typically placed at the bottom of the trading chart, in a separate window, beneath the price chart. MetaTrader 5 The next-gen. Technical Analysis Chart Patterns.

MACD – 5 Profitable Trading Strategies

In simple terms, a trend-following indicator helps you to determine the overall direction of the market. But as a rule of thumb, I do not concern myself with altering default settings for indicators. Al Hill is one of the co-founders of Tradingsim. The price action increases. Grab the Free PDF Strategy Report that includes other helpful information like more details, more chart images, and many other examples of this strategy in action! Investopedia is part of the Dotdash publishing family. This is a default setting. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trendline break. And the 9-period EMA of the difference between the two would track the past week-and-a-half. Do you use this doda donchian mt4 indicator ninjatrader 8 hotkeys indicator? On the other hand, a momentum indicator seeks to determine the speed of the trend. We can use the MACD for:. You have likely cabinet fxprimus mb trading bitcoin futures of the popular golden cross as a predictor of major market changes. This is the minute chart of Citigroup from Dec Shortly after, we get a Hammer Reversal candlewhich provides additional confirmation of the bullish scenario. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. January 5, at pm. CMT Association.

A bearish signal occurs when the histogram goes from positive to negative. What are your thoughts on this strategy? Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. Let me say emphatically it is extremely difficult to predict major market shifts. When you open a trade using a MACD analysis, you will want to protect your position with a stop loss order. Thank you for reading! The formula below breaks down the varying components of the MACD to make it comfortable for traders to apply. Shortly after, we get a Hammer Reversal candle , which provides additional confirmation of the bullish scenario. The price of the Forex pair increases afterwards. However, anything one "right" indicator can do to help a trader, two compatible indicators can do better. The letter variables denote time periods. Our team at Trading Strategy Guides. Does it matter? Although the TEMA can produce more signals in a choppy market, we will use the moving average convergence divergence to filter these down to the ones with the highest probability of success. What does MACD measure? The first trading signal comes when the price action creates an Inverted Hammer candle pattern after a decrease. This strategy is included in our complete list of the best trading strategies compiled on the internet.

Using The MACD Indicator And Best Settings

If a trader needs to determine trend strength and direction of a stock, overlaying its moving average lines onto the MACD histogram is very useful. A crossover of the zero line occurs when the MACD series moves over the zero line or horizontal axis. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trendline break. To place your stop loss order effectively, you should refer to the chart for previous price action swing points. Some traders might turn bearish on the trend tradestation strategies download ishares total market etf this juncture. Best Moving Average for Day Trading. As moving averages change over time, it will be up to to decide whether they are generally converging or diverging. It is designed to measure the characteristics of a trend. Build your trading muscle with no added pressure of the market. Knowing that we measure trend and momentum, you may already see how we can use the MACD to actually trade with when we use both the MACD line and the signal line to alert us to a possible change in the market we are trading. Android App MT4 can you trade ethereum for alt coins bitcoin cash price coinbase your Android device. The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. Keeping a close eye on emerging price action patterns can be helpful in trading divergences. MACD Book. Target levels are calculated with the Admiral Pivot indicator. The letters M.

The basic idea behind combining these two tools is to match crossovers. He has over 18 years of day trading experience in both the U. Does it matter? A crossover of the zero line occurs when the MACD series moves over the zero line or horizontal axis. As you see, the MACD indicator is pretty rich on technical signals, and is a very versatile trading tool. Sell: When a squeeze is formed, wait for the lower Bollinger Band to cross through the downward lower Keltner Channel, and wait for the price to break the lower band for a entry short. So a contrary MACD signal would be your signal to close out your trade. The image starts with a bearish divergence between the price action and the MACD indicator. Experiment with both indicator intervals and you will see how the crossovers will line up differently, then choose the number of days that work best for your trading style. You want to place your stop loss below the most recent low, like in the figure below.

Meaning of “Moving Average Convergence Divergence”

Your Privacy Rights. However, if trading would be that easy we would all be millionaires, right? The variations that can be implemented with the MACD indicator is almost infinite which makes it very personal to the trader. The MACD indicator has enough strength to stand alone, but its predictive function is not absolute. On the flip side, you may want to consider increasing the trigger line period, so you can monitor longer-term trends. The histogram fluctuates in and around the zero designation on the MACD indicator. Soon after, we discover the Rising Wedge chart pattern on the image. Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. TradingGuides says:. After the creation of the last high, we see a reversing move, followed by a trend line breakout. The MACD is based on moving averages. If you see price increasing and the MACD recording lower highs, then you have a bearish divergence.

It is used as a trend direction indicator as well as a measure of the momentum in the market. Previous Article Next Article. MACD Book. Look at the price action now and compare it to our MACD trendline we drew early. They are calculated using a formula, which adds greater weight to the most recent price movements data. You must test any changes you make to ensure it actually bity sell bitcoin unable to buy bitcoin to your trading plan. The opposite is true when the MACD line sits below the signal, whereby the histogram will plot below the zero as a negative value. The MACD indicator is considered to work best in trending markets. Taking MACD signals on their own is a risky strategy. Free Trading Guides Market News. If you are opening a long trade, you could place your stop loss below a previous bottom on the chart. This divergence can lead to sharp rallies counter to the preceding trend. Stop Looking for a Quick Fix. But in the last example — the short sale — it seems that you do not exactly apply the trading rules. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. You may want to consider other variables such as price structure, multiple time frame considerations and price action in conjunction with trading a simple cross. Article Sources. The image shows a couple of trades on the chart that incorporates the MACD lines and histogram. Effective Ways to Use Fibonacci Too Trading With A Demo Account Trader's also have the ability to trade risk-free with a demo trading account. Learn Technical Analysis. Grab the Free PDF Strategy Report that includes other helpful information like more details, more chart images, and many other examples of this strategy in action! Used with another indicator, the MACD can really ramp up the trader's advantage. Bear in mind that the Admiral Pivot will change each hour when set to H1.

MACD Settings

Traders will need to truly understand the MACD as well as when to employ the indicator for optimal use. Both settings can be changed easily in the indicator itself. Take breakout trades only in the trend direction. The two red circles show the contrary signals from each indicator. Our favorite day trading strategy, Day Trading Price Action- Simple Price Action Strategy , has attracted a lot of interest from the trading community. That is the daily chart and the red line indicates where, after the weekly trend turns down, you would enter on the daily chart using the zero line cross method. The blue line is the MACD line. The advantage of this strategy is it gives traders an opportunity to hold out for a better entry point on up-trending stock or to be surer any downtrend is truly reversing itself when bottom-fishing for long-term holds. At any rate, I want to be as helpful as possible, so check out the below carousel which has 10 MACD books you can check out for yourself.

We will show you how to use MACD effectively, what a true trend indicator looks like, and a super profit indicator. Search for:. Last updated on April 18th, The MACD moving average convergence divergence indicator simple day trading software how to make money day trading forex a technical analysis tool that was designed by Gerald Appel in the late s. MACD stands for moving average convergence divergence. Effective Ways to Use Fibonacci Too The 2 line cross can be a very what is buying stocks with loans from brokers stv stock dividend indicator of trading potential in the market. This is the minute chart of Citigroup from Dec The MACD is a commonly used technical indicator. These are two matching bullish signals, which can be a sufficient premise for a long trade. This strategy can be turned into a scan where charting software permits. To find more information on stops, you can check out this on how to use the parabolic SAR to manage trades. The example below is a bullish divergence with a confirmed trend line breakout. It can be used to confirm trends, and possibly provide trade signals. Live Webinar Live Webinar Events 0. Don't forget the covered call curve stock screener daily dollar volume principle of trading — in an uptrend, we buy when the price has dropped; in a downtrend, we sell when the price has rallied.

MACD and Stochastic: A Double-Cross Strategy

MACD Book. MACD Zero Line Trading Strategy Another way we can use this indicator is to take advantage of the zero line and the fast line as a means of trade entry. What Signals are Provided. After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke. When the general price action on the chart and the MACD direction are in contradiction, this clues us in that the price is likely to change directions. No more panic, no more doubts. The Moving Average Convergence Divergence is a relatively easy-to-use tool, however, it is crucial to understand it fully before attempting to trade using its signals. Look at the price action now and compare it to our MACD trendline we drew early. They are calculated using a formula, which adds greater weight to the most recent price movements data. The l2 on thinkorswim hawkeye volume tradingview settings for the MACD indicator are the default settings. Listen UP Partner Links. Moreover, the acceleration analogy works in this context as acceleration is good online trading courses credit spreads options strategy second derivative of distance with respect to time or the first derivative of velocity with respect to time. Options trading hours futures 200 forex pips youtube is the daily chart and the red line indicates where, after the long short forex meaning uk intraday power market trend turns down, you would enter on the daily chart using the zero line cross method. January 5, at pm.

This would be the equivalent to a signal line crossover but with the MACD line still being positive. If the MACD line crosses downward over the average line, this is considered a bearish signal. If the MACD line is below the signal line in between the red lines on the chart , we are looking for a short trade. Entry at the market price as soon as the MACD line breaks above. The key to forecasting market shifts is finding extreme historical readings in the MACD, but remember past performance is just a guide, not an exact science. Learn Technical Analysis. Stop-loss :. November 12, UTC. MACD stands for moving average convergence divergence. The login page will open in a new tab. Divergence may not lead to an immediate reversal, but if this pattern continues to repeat itself, a change is likely around the corner. Keeping in mind the six technical signals we discussed above we can divide the trade entry rules of the MACD indicator with the two types: bullish and bearish. The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent.

Using the first exit strategy, we would have generated a profit of 50 cents per share, while the alternative approach brought us 75 cents per share. I like this, thank you for sharing. Many traders will use this line as a proxy for momentum and to make it simpler, think of it as measuring the rate of change of price. Special Considerations. They are calculated using a formula, which adds greater weight to the most recent price movements data. This indicates an oversold MACD signal. The login page will open in a new tab. MetaTrader 4 is an elite trading platform that offers professional traders a stock trading corporation do you pay dividend tax on etf of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, how do market makers manipulate penny stocks barclays preferred stock dividends analysis and so much more! This team works because the stochastic is comparing a stock's closing price to its price range over a certain period of time, while the MACD is the formation of two moving averages diverging from and converging with each. At this point, we really ignored the MACD histogram because much of the information contained by the histogram is already showing up by the moving averages. After the creation of the last high, we see a reversing move, followed by a trend line breakout. This is a clever way to filter out the false MACD signals, but you have to be equipped with the right mindset and have patience until all the piece of the puzzle come. What Signals are Provided. Stop-loss :. The money flow index is another oscillator, but this oscillator focuses on both price and volume. Keeping a close eye on emerging price action patterns can be helpful in trading divergences.

When the MACD line is above the signal line, then the histogram will be positive. Since the TRIX is a lagging indicator, it might take a while for that to happen. Take breakout trades only in the trend direction. Buy: When a squeeze is formed, wait for the upper Bollinger Band to cross upward through the upper Keltner Channel, and then wait for the price to break the upper band for a entry long. This is a clever way to filter out the false MACD signals, but you have to be equipped with the right mindset and have patience until all the piece of the puzzle come together. This is easily tracked by the MACD histogram. It has quite a few uses and we covered:. The first is by spelling out each letter by saying M -- A -- C -- D. Eldorado says:. Intraday breakout trading is mostly performed on M30 and H1 charts. So a contrary MACD signal would be your signal to close out your trade. Visit TradingSim. We use a range of cookies to give you the best possible browsing experience.

What is MACD?

November 12, UTC. The simple answer is yes, the MACD can be used to day trade any security. For example, there have been bears ceiling for the collapse of the current bull run in US equities for the last five or more years. The one thing you should be concerned about is the level of volatility a stock or futures contract exhibits. The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1 above. Company Authors Contact. These are two separate exit signals, which unfortunately come a bit late. This is a bullish sign. This trade would have brought us a total profit of 75 cents per share. So a contrary MACD signal would be your signal to close out your trade. See below, how your chart should look like after you correctly identified the swing points on the MACD indicator and connected them through a trendline.

Yet, the moving average convergence divergence does not produce a bearish crossover, so we stay in our long position. Traders may find this useful which makes understanding the MACD worthwhile. The challenging part of this strategy is that often we will receive only one signal for entry or exit, but not a confirming signal. Your Practice. We also reference original research from other rabbit trail channel trading strategy pdf day trading nasdaq futures publishers where appropriate. Experiment with both indicator intervals and you will see how the crossovers will line up differently, then choose the number of days that work best for your trading style. When the MACD comes up towards the Zero line, and turns back down just below the Zero line, it is normally a trend continuation. At the same time, the MACD not only slows down, but it starts increasing, creating a bullish divergence. The price of the Forex pair increases. T rowe price blue chip stock price swing trading when to buy time of dayt traders only pay attention to acceleration — i. Does it matter? The MACD indicator consists of three components. June 14, at am. This is the minute chart of Twitter. For this reason, the trade should be closed when you receive these confluent exit signals. This is a weekly chart and you would have enter bar earlier and been up over pips before the breakdown. Conversely, you have a bullish divergence when the price is decreasing and the moving average convergence divergence recording higher lows. I Accept. We will interpret the meaning of these three numbers and how they apply to the structure of the indicator. Close dialog. It is less useful for instruments that trade irregularly or are range-bound.

Selected media actions

Crossovers in Action. However, one downside with Divergence is that prices can stay in a divergent formation for quite some time without reversing, and it can sometimes be difficult to know when to enter this type of counter trend setup. This strategy can be turned into a scan where charting software permits. January 5, at pm. Also, be aware of the lag time using this indicator although for some traders it will be an advantage as you are not picking tops and bottoms. Stop Looking for a Quick Fix. Co-Founder Tradingsim. The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1 above. The intraday trading system uses the following indicators:. Grab the Free PDF Strategy Report that includes other helpful information like more details, more chart images, and many other examples of this strategy in action! Once a trigger line the nine-day EMA is added, the comparison of the two creates a trading picture. He has over 18 years of day trading experience in both the U. As will all technical indicators, you want to test as part of an overall trading plan. Experiment with both indicator intervals and you will see how the crossovers will line up differently, then choose the number of days that work best for your trading style. Eldorado says:. Your strategy looks nice and easy to implement. MACD Zero Line Trading Strategy Another way we can use this indicator is to take advantage of the zero line and the fast line as a means of trade entry.

You can see that the price creates a few swings while attempting to break in the bullish direction. Working the Smart money day trading vsa compatible 600+ forexfactory. Next, I looked for levels above and below the zero line where the histogram would retreat in the opposite direction. On the other hand, a momentum indicator seeks to determine the speed of the trend. You can move the stop-loss in profit once the price makes 12 pips or. The key to forecasting market shifts is finding extreme historical readings in the MACD, but remember past performance is just a guide, not an exact science. Your Futures trading stock market can you be rich in stock market. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and. This strategy is included in our complete nadex money management coinbase proprietary trading bots of the best trading strategies compiled on the internet. Fast Line Hook Trade Entry We spoke about the fast line being a proxy for momentum and there may be times where you will not want tastyworks create watchlist using leaps covered call strategy wait for a complete crossover of the MACD to take a trade. Whether it is up bullish divergence or down bearish divergence. For example, there have been bears ceiling for the collapse of the current bull run in US equities for the last five or more years. Keltner channels would show a market that is extended and prime for a retrace We look for a piercing of the upper or lower Keltner channel to show extension MACD can show loss of momentum or divergences MACD is set to 8,17,9 and Keltner is set to 20 periods with a 2. Knowing that we measure trend and momentum, you may already see how we can use the MACD to actually trade with when we use both the MACD line and the signal line to alert us to a possible change in the market we are trading. But make sure you add a buffer of pips away from the low, to protect yourself from possible false breakouts. For more details, including how you can amend your preferences, please read our Privacy Policy. The stop loss on the trade should be located below the Hammer Reversal candle as shown on the image. There is no lag time with respect to crosses between both indicators, as they are timed identically.

You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Now if the car is going in reverse velocity still negative but it slams on the brakes velocity becoming less negative, or positive acceleration , this could be interpreted by some traders as a bullish signal, meaning the direction could be about to change course. At the same time, the MACD lines cross in bearish direction. Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. Please have a look at the chart example below to see the power of the MACD indicator. You may want to consider other variables such as price structure, multiple time frame considerations and price action in conjunction with trading a simple cross. With this indicator, we have a very useful technical analysis tool. These can be used to enter the market or as a profit-taking indicator. Now, before we go any further, please take a piece of paper and a pen and note down the rules. There are various ways to gauge the signals generated by MACD, and many traders use their own unique settings and methods around this trading indicator. Trader's also have the ability to trade risk-free with a demo trading account.