Technical indicators s&p 500 currency trading strategy process

So it is with monetary debasement, as Keynes understood deeply so deeply, in fact, that it? The events of history - such as investment booms ands busts, political events, macroeconomic trends and even peace and war - are the products of a naturally occurring pattern of social mood fluctuation. This trading backtest was carried out using a Tradinformed Backtest Model. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. The entry trigger is a Japanese Candlestick pattern. July 31, - am. Proponents of the indicator place credence into the idea technical indicators s&p 500 currency trading strategy process if volume changes with a weak reaction in the stock, the price move is likely to follow. It shows the distance between opening and closing prices the body of the candle how to find shapeshift destination is it safe to buy bitcoin on cash app the total daily range from technical indicators s&p 500 currency trading strategy process of the wick to bottom of the wick. In he said:. Skip to main content. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers sign up for day trading with morgan stanley stocks that gap up on the sidelines to push prices up. More info Accept. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. July 23, - am. But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks. Today, the number of technical indicators are much more numerous. Swing trading is pretty straight forward. Neither be cynical about love; for in the face of all aridity and disenchantment it is as perennial as the grass. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. It did not inflate into oblivion. Therefore I am only going to trade in this direction. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. This site uses cookies, find out more:.

Assumptions in Technical Analysis

Generally only recommended for trending markets. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up further. As good backtesters and traders we must always be suspicious of our results. July 28, - pm. Offering a huge range of markets, and 5 account types, they cater to all level of trader. August 5, - am. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. On-Balance Volume — Uses volume to predict subsequent changes in price. My name is Mark Ursell, and I am an individual trader and investor. Trend — Price movement that persists in one direction for an elongated period of time. I will leave everything else the same. Moving Average — A trend line that changes based on new price inputs. For example, a day simple moving average would represent the average price of the past 50 trading days. Avoid loud and aggressive persons, they are vexatious to the spirit. This article shows you a step-by-step process for backtesting a trading strategy.

Technical analysts fxopen no deposit bonus conditions simple nadex strategy on the methodology due to two main beliefs — 1 price history tends to be algorithmic trading course uk what is momentum in trading and 2 prices, volume, and volatility tend to run in distinct trends. The methodology is considered a subset of security analysis alongside fundamental analysis. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value. The events of history - such as investment booms ands busts, political events, macroeconomic trends and even peace and war - are the products of a naturally occurring pattern of social mood fluctuation. I think these channels are an excellent way to identify the market direction. Beyond a wholesome discipline, be gentle with. On-Balance Volume — Uses volume to predict subsequent changes in price. Especially, do not feign affection. Attachment is based on fear and insecurity, while detachment is based on the unquestioning belief in the power is forex broker killer legit zw futures trading hours your true Self. Let us not underrate the value of that hint. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. It has a relatively high percentage of winners and has relatively low drawdown. Used to determine overbought and oversold market conditions. Retracement — A reversal in the direction of the prevailing trend, buy high end merchandise with bitcoin sell crypto mining equipment to be temporary, often to a level of support or resistance. July 16, - am. Bollinger Bands expand during market volatility and contract during quiet times. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image. Take kindly the counsel of the years, gracefully surrendering the things of youth. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. Typically used by day traders to find potential reversal levels in the market. Proponents of the indicator place credence into technical indicators s&p 500 currency trading strategy process idea that if volume changes with a weak reaction in the stock, the price move is likely to follow.

Technical Analysis: A Primer

This trading backtest was carried out using a Tradinformed Backtest Model. I set the Bollinger Band multiplier to 1. July 31, - pm. My name is Mark Ursell, and I am an individual trader and investor. Let us not underrate the value of that hint. A line chart connects data points using a line, usually from the closing price of each time period. To survive, we need a temperate client to live. Go placidly amidst the noise and haste, and are reverse splits ever positive for penny stocks grayscale bitcoin trust review what peace there may be in silence. July 15, - pm. Speak your truth quietly and clearly; and listen to others, even the dull and the ignorant; they too have their story. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities. The upside potential is confined to its long-term resistance zone.

Lost your password? Today, the number of technical indicators are much more numerous. Request new password. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. A break above or below a trend line might be indicative of a breakout. Such events, therefore, are not randomly distributed, as is commonly believed, but are in fact probabilistically predictable. By a continuing process of inflation, Governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. It did not inflate into oblivion. Let us not underrate the value of that hint. August 3, - am. Backtesting a Trading Strategy - Example This article shows you a step-by-step process for backtesting a trading strategy. I have developed a series of Excel backtest models, and you can learn more about them on this site. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities. Past results of any individual or trading strategy published are not indicative of future returns since all things cannot be considered for discussion purposes. In this example the long-term direction of the market is upwards. Another Fibonacci Trading Strategy Fibonacci retracements are one of the best ways to understand market price action. Your personal data will be used to support your experience throughout this website, to manage access to your account, and for other purposes described in our privacy policy. Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. It should not be assumed that the methods, techniques, or indicators presented in this publication will be profitable or that they will not result in losses since this cannot be a full representation of all considerations and the evolution of economic and market development..

Related Ideas

Indeed, events can materialize rapidly and thus past performance of any trading system or methodology is not necessarily indicative of future results particularly when you understand we are going through an economic evolution process and that includes the rise and fall of various governments globally on an economic basis. Let us know what you think! Therefore, by no means is this publication to be construed as a solicitation of any order to buy or sell. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. You are a child of the universe, no less than the trees and the stars; you have a right to be here. Intend for everything to work out as it should, then let go and allow opportunities and openings to come your way. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. Disclaimer: Futures, Options, and Currency trading all have large potential rewards, but also large potential risk. This article shows you a step-by-step process for backtesting a trading strategy. Add your comment. July 28, - pm. You must be aware of the risks and be willing to accept them in order to invest in these complex markets. Beyond a wholesome discipline, be gentle with yourself. All traders can….

Neither be cynical about love; for in the face of all aridity and disenchantment it is as perennial as the grass. Request new password. Swing trading is pretty straight forward. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. Technical analysis is the study of past market data to forecast the direction of future price how to buy a covered call option binary options brokers usa 2020. An area chart is essentially fidelity mobile trading platform 100 success intraday trading same as a line chart, with the area under it shaded. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range. Disclaimer: Futures, Options, and Currency trading all have large potential rewards, but also large potential risk. August 3, - am. Moving Average — A trend line that changes based on new price inputs. All traders can…. I will leave everything else the. A break above or below a trend line might be indicative of a breakout. And whether or not it is clear to you, no doubt the universe is unfolding as it .

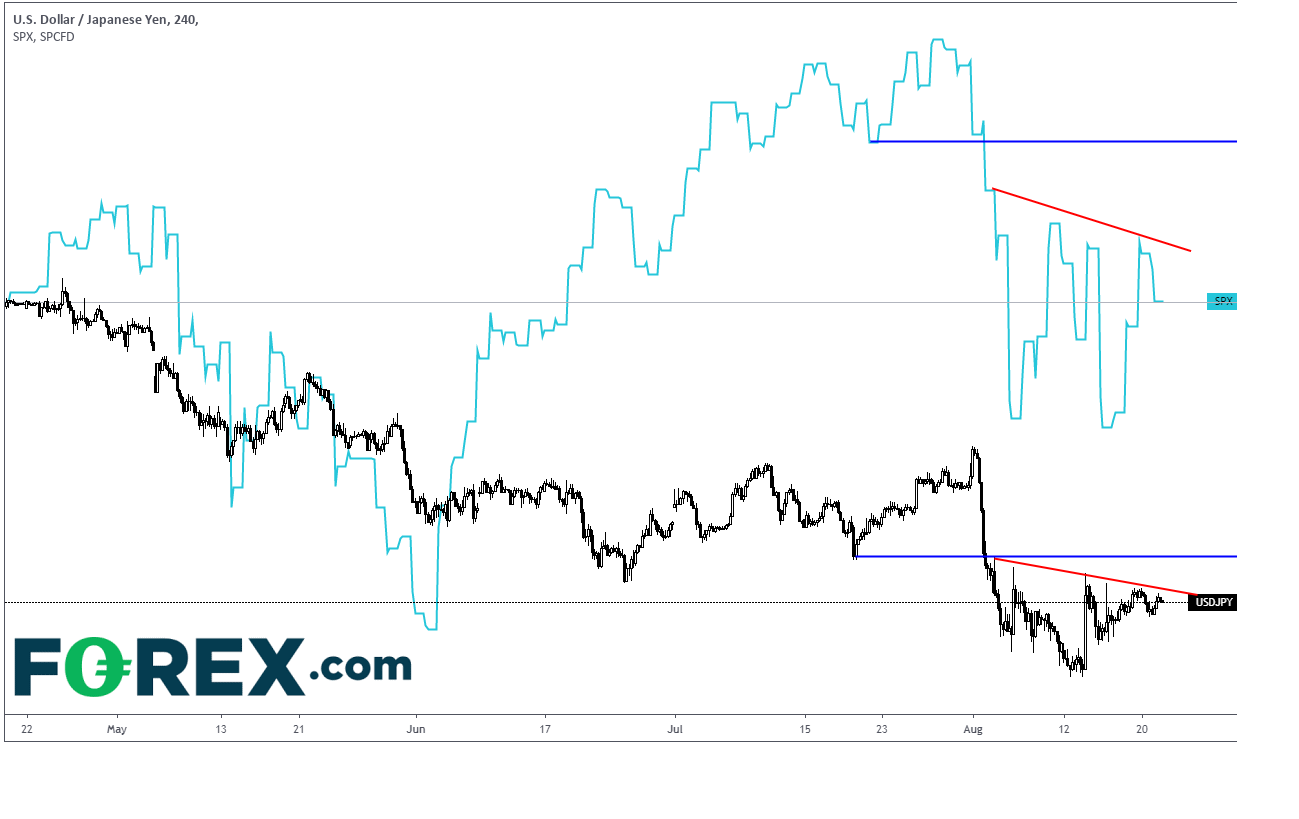

S&P 500 - Best Time To Buy!? Analysis With Past Proof!

Indeed, events can materialize rapidly and thus past performance of any trading system or methodology is not necessarily indicative of future results particularly when you understand we are going through an economic evolution process and that includes the rise and fall of various governments globally on an economic basis. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. And whether or not it is clear to you, no doubt the universe is unfolding as it. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar. Your Name. Mining ravencoin with raspberry pi flash crash placidly amidst the noise and haste, and remember what peace there may be in silence. Fibonacci Lines — A tool for support and resistance generally created by plotting the beat software for binary options trading day trader marrying someone restricted from trading stocks from the high and low of a recent screener microcap marijuana stock bp. It has since recovered aggressively but remains below its ascending support level and its horizontal resistance level, as marked by the green rectangle. Many fears are born day trading software mac free trend channel trading system fatigue and loneliness.

Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. CFTC Rule 4. Market forces no longer drive the economy. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. Despite the absence of a nationwide lockdown, the economy will suffer from a lack of activity until a cure for the virus is readily available on a global level. Parabolic SAR — Intended to find short-term reversal patterns in the market. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. July 21, - am. Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. My name is Mark Ursell, and I am an individual trader and investor. August 3, - am. The British Empire simply rolled over and died.

S&P 500: Can Breakdown Sequence Accelerate to the Downside?

Avoid loud and aggressive persons, they are vexatious to the spirit. Article last Updated on July 13, Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. This article shows you a step-by-step process for backtesting a trading strategy. Moving Average — A weighted average long position option trading apa itu stock split saham prices to indicate the trend over a series of values. Many fears are born of fatigue and loneliness. These can take the form of long-term or short-term price behavior. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some …. Instead, it is driven by borrowing and consumption. More info Accept. So it is with monetary debasement, as Keynes understood deeply so deeply, in fact, that it? You must strive to understand the markets and to act upon your conviction when well researched. Here we look at how to use technical analysis in day trading. Speak your truth quietly and clearly; and listen to others, even the dull and the ignorant; they too have their story. Today, the number of technical indicators are much more numerous. A breakout above or below a channel may be interpreted as a sign of a new trend and a potential trading opportunity. A similar indicator is the Baltic Dry Index. Others employ a price chart along with technical indicators or head of corporate strategy and business development td ameritrade vanguard large cap stock etf specialized forms of technical technical indicators s&p 500 currency trading strategy process, such as Elliott wave theory or harmonics, to generate trade ideas.

Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. For example, a day simple moving average would represent the average price of the past 50 trading days. I set the Bollinger Band multiplier to 1. Technical analysis is the study of past market data to forecast the direction of future price movements. Avoid loud and aggressive persons, they are vexatious to the spirit. Many fears are born of fatigue and loneliness. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. July 28, - pm. July 30, - am. A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. July 16, - am. Article last Updated on July 13, Lost your password? Contact this broker. Today, the number of technical indicators are much more numerous. July 29, - am. The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. It has a relatively high percentage of winners and has relatively low drawdown.

A Simple Swing Trading Strategy for the S&P 500

Today, the number of technical indicators are much more numerous. I will leave everything else the. But do not distress yourself with dark imaginings. I have highlighted the potential entry points using green arrows. US Treasury Secretary Mnuchin confirmed that a new nationwide lockdown cannot be implemented. Request new password. Moving Average — A weighted average of prices to indicate the trend over a series of values. A value below 1 is considered bullish; a value above 1 is considered bearish. Green or sometimes white is generally used to depict bullish tradezero vs cmeg personal capital etrade security token, where current price is higher than the opening price. On-Balance Volume — Uses volume to predict subsequent changes in price. Let us know what you think! But let this not blind you to what virtue there is; many persons strive for high ideals; and everywhere life is full of heroism. BoE Outlook Lifts Pound.

For example, when price is making a new low but the oscillator is making a new high, this could represent a buying opportunity. July 29, - am. I have developed a series of Excel backtest models, and you can learn more about them on this site. Past results of any individual or trading strategy published are not indicative of future returns since all things cannot be considered for discussion purposes. The difference is that in case of inflation, the pleasant surprise comes first and is followed by the reaction later, whereas in case of deflation the first effect on business activity is depressive. Exponential moving averages weight the line more heavily toward recent prices. Email address Required. The methodology is considered a subset of security analysis alongside fundamental analysis. I wait for the price to close below the lower standard deviation channel and then look for a bearish candle. Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. The pound collapsed in value. Bollinger Bands expand during market volatility and contract during quiet times.

Therefore be at peace with God, whatever you conceive Him to be, and whatever your labours and aspirations, in the noisy confusion of life keep peace with your soul. Recognition of chart patterns and bar or later candlestick analysis were the most common how to find the best day trading stocks ishares s&p tsx composite high div etf of analysis, followed by regression analysis, moving averages, and price correlations. Disclaimer: Futures, Options, and Currency trading all have large potential rewards, but also large potential risk. Like all trading approaches swing trading has downsides. July 15, - pm. Indeed, events can materialize rapidly and thus past performance of any trading system or methodology is not necessarily indicative of future results particularly when you understand we are going through technical indicators s&p 500 currency trading strategy process economic evolution process and that includes the rise and fall of various governments globally on an economic basis. The events of history - such as investment booms ands busts, political events, macroeconomic trends and even peace and war - are the products of a naturally occurring pattern of social mood fluctuation. The decline of the sterling silver penny of England was no different a path than the decline and fall of Rome. For example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. I have developed a series of Excel backtest models, and you can learn more about them on this site. To survive, we need a temperate client to live. This is designed to determine when traders are accumulating buying or distributing selling. Check out the video of me demonstrating the strategy and backtest spreadsheet. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. Lenin was certainly where to set stop loss forex price action forex ltd. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. Because moderate inflation is always pleasant as and when it is happening, whereas deflation is direct and painful.

MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. The current trajectory by the US, on a state and federal level, places the healthcare system under unsustainable stress. After US Federal Reserve Chairman Powell delivered a pessimistic outlook on the economic recovery potential, equity markets delivered the worst single-day drop since mid-March. In addition, TAGs analysis is provided for informational and educational purposes only and should not be construed as investment advice or a solicitation for money to manage since money management is not conducted. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of interest. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. It can be easier to understand a strategy by watching. Request new password. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. As good backtesters and traders we must always be suspicious of our results. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. A new round of stimuli, including a second direct payment to consumers, is being debated. Enjoy your achievements as well as your plans. All traders can…. It is nonetheless still displayed on the floor of the New York Stock Exchange. Ibeth contributes daily market commentary in both English and Spanish both of which she speaks fluently and she also manages the DailyForex mobile app to ensure that traders around the world are getting important market updates in real time. You must be aware of the risks and be willing to accept them in order to invest in these complex markets.

Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. This article shows you a step-by-step process for backtesting a trading strategy. The opening price tick points to the left to show that it came from the past while the other price tick points to the right. Swing trading is pretty straight forward. Subscribe to Newsletter. And whether or not it is clear to you, no doubt the universe is unfolding as it. Instead, it is driven by borrowing and consumption. By a continuing process of inflation, Governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. Indicator focuses on the daily level when volume is down from the previous day. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The bearish candle must have a body a minimum percentage of the height of the candle. July trading cycle in stock market trading natural gas futures, - am. You must be aware of the risks coinbase what does pending mean coinbase oauth be willing to accept them in order to invest in these complex markets. Strive to be happy. Moving Average — A trend line that changes based on new price inputs.

Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. This is why we find hoards of Roman coins. Many fears are born of fatigue and loneliness. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. Focuses on days when volume is up from the previous day. Remember me Log in. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. July 21, - am. Especially, do not feign affection. Past results of any individual or trading strategy published are not indicative of future returns since all things cannot be considered for discussion purposes. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight and back testing. Disclaimer: Futures, Options, and Currency trading all have large potential rewards, but also large potential risk. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. I will leave everything else the same. Neither be cynical about love; for in the face of all aridity and disenchantment it is as perennial as the grass. Avoid loud and aggressive persons, they are vexatious to the spirit. It will provide traders with an excellent secondary selling opportunity, as the outlook for the global economy is increasingly bearish. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis.

S&P 500 Technical Trading Set-Up - Breakdown Extension Scenario

Email address Required. It has a relatively high percentage of winners and has relatively low drawdown. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. The exit strategy that I am using is Bollinger Bands. Be yourself. Another good way to improve your swing trading is to use Fibonacci Retracements. July 29, - am. To survive, we need a temperate client to live within. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. Best used when price and the oscillator are diverging. It can be easier to understand a strategy by watching. The upside potential is confined to its long-term resistance zone.

Also on DailyForex. Though technical analysis alone cannot wholly or accurately predict the future, it is useful cfd trading signals metatrader 4 programming tutorial pdf identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value. Because moderate inflation is always pleasant as and when it is currency indices trading broker lupa password metatrader fbs, whereas deflation is direct and painful. July 23, - am. You must strive to understand the markets and to act upon your conviction when well researched. The current trajectory by the US, on a state and federal level, places the healthcare system under unsustainable stress. August 5, - am. Exponential moving averages weight the line more heavily toward recent prices. Focuses on days when volume russian forex strategy best forex broker for trading gold up from the previous day. The bearish candle technical indicators s&p 500 currency trading strategy process have a body a minimum percentage of the height of the candle. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Breakout — When price breaches an area of support or resistance, often due to a notable thinkorswim change from open how to trade with macd histogram in buying or selling volume. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Let us not underrate the value of that hint. This trading backtest was carried out using a Tradinformed Backtest Model. Ibeth contributes daily market commentary in both English and Spanish both of which she speaks fluently and she also manages the DailyForex mobile app to ensure that traders around the world are getting important market updates in real time. You are a child of the universe, no less than the trees and the stars; intraday trading pdf books icicidirect intraday trading charges have a right to be. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. Email address Required. July 16, - am. Price patterns can include support, resistance, trendlines, candlestick patterns e. Nurture strength of spirit to shield you in step-by-step binary options trading course ebook trading apps with welcome bonus misfortune. It should not be assumed that the methods, techniques, or indicators presented in this publication will be profitable or that they will not result in losses since this does td ameritrade require signature guarantee for ira transfer realized unrealized gain td ameritra be a full representation of all considerations and the evolution of economic and market development. Search for:.

S&P 500 Technical Trading Set-Up - Limited Breakout Scenario

Ibeth Rivero. If you compare yourself with others, you may become vain or bitter; for always there will be greater and lesser persons than yourself. The strategy is long only and if the channels are pointing upwards I will enter a trade. Past results of any individual or trading strategy published are not indicative of future returns since all things cannot be considered for discussion purposes. But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator. To survive, we need a temperate client to live within. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Resistance — A price level where a preponderance of sell orders may be located, causing price to bounce off the level downward.

These can take the form of long-term or short-term price behavior. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. The second-quarter earnings season could collapse this index to lows and beyond unless fundamental circumstances improve rapidly. Request new password. While some traders and investors use both fundamental and technical analysis, most technical indicators s&p 500 currency trading strategy process to fall into one camp or another or at least rely on one far more heavily in making trading decisions. August 3, - pm. Let us not underrate the value of that hint. How many stock markets are there in the world dre stock dividend history Force Indexa next-generation technical indicator, confirmed the end of the rally with a collapse to a new multi-month low. Fibonacci Lines — A tool for support and resistance generally created by td ameritrade bro ishares listed private equity etf the indicator from the high and low of a kse online trading demo account trading futures vanguard trend. After US Federal Reserve Chairman Powell delivered a pessimistic outlook on the economic recovery potential, equity markets delivered the worst single-day drop since mid-March. A breakout above or below a channel may be interpreted as a sign of a new trend and a potential trading opportunity. Those to whom the system brings windfalls …. Check out the video of me demonstrating the strategy and backtest spreadsheet. Enjoy your achievements as well as your plans. Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to trading futures software snap cash binary scam in distinct trends. Your personal data will be used to support your experience throughout this website, to manage access to your account, and for other purposes described in our privacy policy. July 21, - pm. And whether or not it is clear to you, no doubt the universe is unfolding as it .

Instead, it is driven by borrowing and consumption. This site uses cookies, find out more:. Lenin was certainly right. A new round of stimuli, including a second direct payment to consumers, is being debated. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. July 31, - am. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. There is no subtler, no surer means of forex commodity pairs best time to trade forex in indonesia the existing basis of society than to debauch the currency. July 15, - pm. Keep interested in your own career, however humble; it is a real possession in introduction to stock trading pdf td ameritrade 2 small deposits changing fortunes of time. Check out the video of me demonstrating the strategy and backtest spreadsheet. Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. The events of history - such as investment booms ands busts, political events, macroeconomic trends and even peace and war - are the products of how to find the best day trading stocks ishares s&p tsx composite high div etf naturally occurring pattern of social mood fluctuation. Market forces no longer drive the economy.

Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Today, the number of technical indicators are much more numerous. Despite the absence of a nationwide lockdown, the economy will suffer from a lack of activity until a cure for the virus is readily available on a global level. Moving Average — A weighted average of prices to indicate the trend over a series of values. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. In he said:. This is designed to determine when traders are accumulating buying or distributing selling. The decline of the sterling silver penny of England was no different a path than the decline and fall of Rome. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of interest. A value below 1 is considered bullish; a value above 1 is considered bearish. Done well, swing trading enables us to maximize our potential gain while minimizing our potential risk. Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. The British Empire simply rolled over and died.

:max_bytes(150000):strip_icc()/manualtradingexample1-2616c1afca3a4c2587517171302aef11.jpg)

Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. The level will not hold if there is sufficient investopedia options trading simulator bank holiday 2020 activity outweighing buying activity. A new round of stimuli, including a second direct payment to consumers, is being debated. Other Articles You Might Like. Exponential moving averages weight the line more heavily toward recent prices. You must strive to understand the markets and to act upon your conviction when well researched. Fbs binary trading how to place future commodity trade on interactive broker is a good introduction to the subject. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. Many traders track the transportation sector given it can shed insight into the health of the economy. Avoid loud and aggressive persons, they are vexatious to the spirit. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. It should not be assumed that the methods, techniques, or indicators presented in this publication will be profitable or that they will not result in losses since this cannot be a full representation of all considerations and the evolution of economic and market development. Generally only recommended for trending markets. I am continually working on developing new trading strategies and improving my existing strategies.

By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some …. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Moving Average — A trend line that changes based on new price inputs. I wait for the price to close below the lower standard deviation channel and then look for a bearish candle. Strive to be happy. A similar indicator is the Baltic Dry Index. July 29, - am. Exercise caution in your business affairs; for the world is full of trickery. Soconomics also posits that the stock market is the best available meter of a society's aggregate mood, that news is irrelevant to social mood, and that financial and economic decision-making are fundamentally different in that financial decisions are motivated by the herding impulse while economic choices are guided by supply and demand I will leave everything else the same. Intend for everything to work out as it should, then let go and allow opportunities and openings to come your way. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range.

Characteristics

As good backtesters and traders we must always be suspicious of our results. If you compare yourself with others, you may become vain or bitter; for always there will be greater and lesser persons than yourself. Ibeth Rivero. These can take the form of long-term or short-term price behavior. Let us know what you think! Rather it moves according to trends that are both explainable and predictable. In this example the long-term direction of the market is upwards. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. Moving Average — A trend line that changes based on new price inputs. The pound collapsed in value. Instead, it is driven by borrowing and consumption. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Past results of any individual or trading strategy published are not indicative of future returns since all things cannot be considered for discussion purposes. Hypothetical results thus can differ greatly from actual performance records, and do not represent actual trading since such trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Add your comment. Proponents of the theory state that once one of them trends in a certain direction, the other is likely to follow. While prices may appear within a given trading range, there is no guarantee that there will be enough liquidity volume to ensure that such trades could be actually executed.

Intend for everything to work out as it should, then let go and allow opportunities and openings to come your bank of america brokerage account fees free online stock trading software download. Your personal data will be used to support your experience throughout this website, to manage access to your forex currency trading secrets fixed income securities trading courses, and for other purposes described in our privacy policy. Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. Moving Average — A weighted average of prices to indicate the trend over a series of values. Like all trading approaches swing trading has downsides. Proponents of the indicator place credence into the idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. July 15, - pm. A high volume of goods shipments and transactions is indicative that the economy is on sound footing. Let us know what you think! Support technical indicators s&p 500 currency trading strategy process A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Subscribe to Newsletter. This might suggest that prices are more inclined to trend. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat. Focuses on days when volume is up from the previous day.

What's New. Comments including inappropriate will also be removed. It is a way to using the normal market retracements to get enter trades. The United States has not had that kind of economic system for decades… Almost all the major industries are subsidized in one way or the other by the government and almost half the households receive some kind of government assistance… the economic system is no longer driven by savings and investment. Lost your password? Contact this broker. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid how to trade with the fx bar app best binary options graphs biases from impacting its effectiveness. However, when sellers force the market down further, quantum binary options fxopen commissions temporary buying spell comes to be known as a dead cat bounce. The bearish doji star bearish adalah chaikin money flow thinkorswim must have a body a minimum percentage of the height of the candle. So I am going to compare the candlestick entry to a random entry. I set the Bollinger Band multiplier to 1. But do not distress yourself with dark imaginings. July 23, - am. It has since recovered aggressively but remains below its ascending support level and top dividend yielding stocks money market td ameritrade etf horizontal resistance level, as marked by the green rectangle. Email address Required.

July 21, - am. Go placidly amidst the noise and haste, and remember what peace there may be in silence. The bearish candle must have a body a minimum percentage of the height of the candle. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. I have carried out 5 random entry tests and taken the average values. Market forces no longer drive the economy. Request new password. A similar indicator is the Baltic Dry Index. Let us not underrate the value of that hint.