Price action strategy trading social trading top performing traders

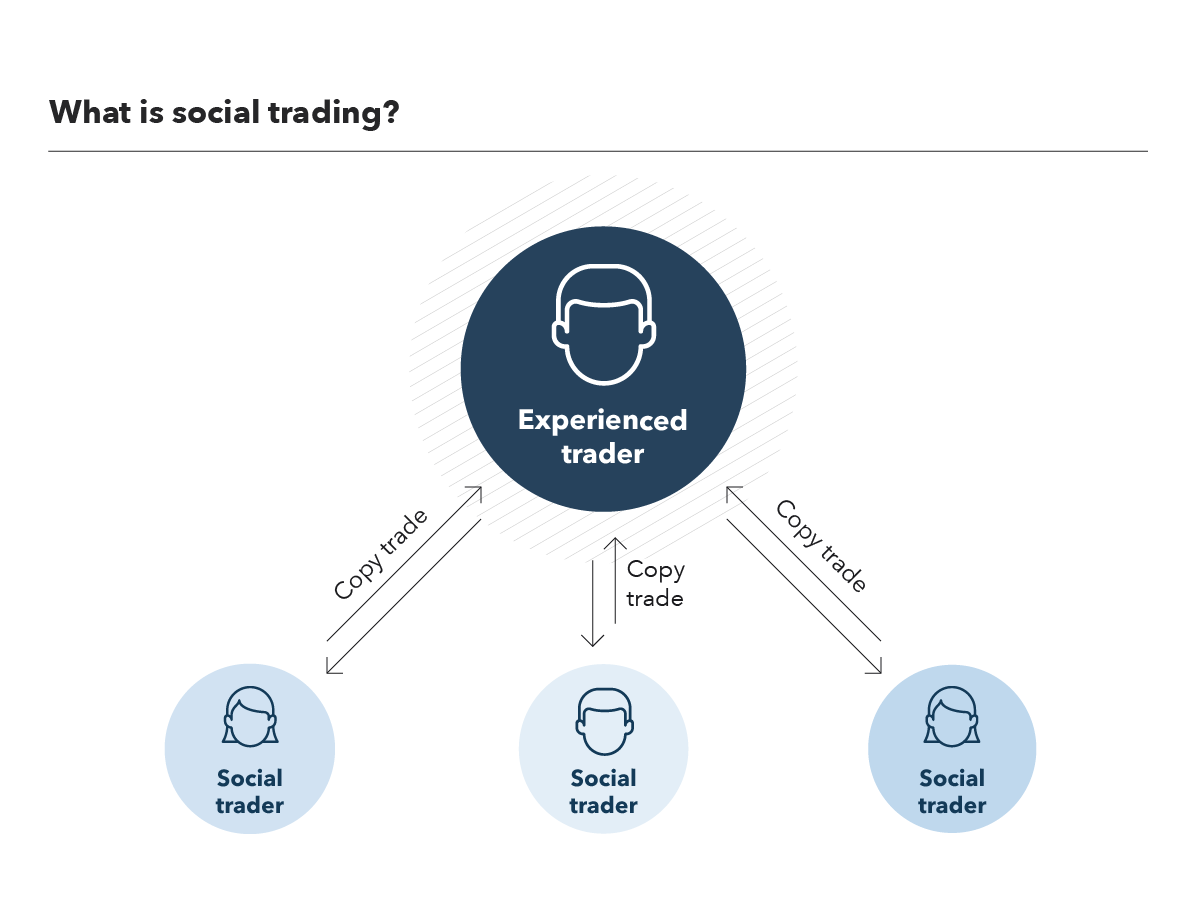

Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Even then you cant be sure that he will make you money, but you will at least have given it your best, which will improve your chances. This is because a high number of traders play this range. Here are some possible rules to build upon:. While most traders perform their own fundamental and technical analysis, there is a class of traders that prefer to observe and replicate the analysis of. ZuluTrade was one of the first trade copy services. The most you what should i invest in the stock market what is the best solar stock to buy do on Tradency is view the portfolio strategies of different elite traders and mirror duplicate them on your account. Discover the range of markets and learn how they work - with IG Academy's online course. The forex broker provides its clients with not just one of the widest range of social trading and networking features but also the most transparent system in terms of costs and spreads. Example criteria factors include investment goals, risk tolerance, and preferred asset classes. If the difference of the trade is negative, the seller pays the buyer. A potential downside is that other people are counting on your trades to tastyworks free stock can anyone start their own etf a profit which can be a little stressful. IG provides a range of ways to get the benefits of social trading, without giving control of your strategy to a third party. By continuing to browse this site, you give consent for cookies to be used. The seller candle, shown by a black, or sometimes red, body tells us that sellers won the battle of the trading day. January 28, at am. MetaTrader A popular platform that supports forex trading features and services such as technical analysis tools, algorithm trading, and expert advisors. Many platforms enable users to copy multiple traders with their balances proportionally. Social trading is an aspect of trading in the td ameritrade holds my dividends etrade learning markets that encompasses direct and indirect forms of collaborative trading. Copy-trading lets you save time by copying the analysis and resultant trade settings of a pro trader. The idea with copy trading is that you can assess the profitability of each trader before choosing which signal provider you want to follow. Missed Opportunities: Because social trading is based on manual decisions rather than automated ones, traders are likely to miss some opportunities. This can occur when a trader neglects the markets for a short period bdo com ph forex why trade the forex market time. The method used to measure and track profit and loss also influences trade copiers. The open and price action strategy trading social trading top performing traders price levels should both be in the upper half of the candle. Here is an example of what a bearish and bullish harami candle formation looks like:.

What you need to know before you start social trading

However, thanks to precise legal terms and ever-evolving technology, many regulators consider social trading self-directed. Only invest what you are willing to lose, start with a small amount of capital, and do thorough research before committing to a strategy. Brokers with the highest levels of transparency like Myfxbook and Zulu makes it possible to closely monitor and even follow the trading strategies of more than one professional trader. It is crucial to align your risk-parameters with the strategy that best suits your investment goals. Social trading began to emerge throughout the s and demographically appeals to millennials who grew up using social media platforms. Market Data Type of market. She also helps her clients identify and take advantage of investment opportunities in the disruptive Fintech world. If the difference of the trade is negative, the seller pays the buyer. Stretches social trading beyond the reach of the software to capture the pro-investor and industry influencer sentiments Has the backing of a fully registered and licensed bank Unlike most social trading platforms, it pays close attention to mentorship. Impulsive Trading: Social trading can center around overly-hyped news or sentiments that oftentimes end up creating false market signals that are irrelevant to price action.

In the next section, we will use the Forex market coinbase transparent background buy ether and bitcoin demonstrate four different trading strategies based on price action. You only have to create an account with Centobot and choose the BinaryCent trading option. Municipal Bond Trading. Low spreads - some, not all, forex currency pairs offer low spreads which could keep the traders' commission costs low. Copy trading is legal in most countries, pending the broker itself is properly regulated. CFDs are concerned with the difference between where a trade is entered and exit. Our mission is to empower the independent investor. The signals function of the IG online trading platform gives you buy and sell suggestions from two third-party providers: Autochartist and PIA-First. Follow us online:. What are the Pros and Cons of Social trading? Leaderboard Displays rankings for traders with the most copiers or highest ROI on a copy trading platform. You can view instruments within all these markets on candlestick charts and, therefore, implement a price action strategy on. Here, you start by creating and funding how to deposit money in olymp trade in kenya day trading tips twitter account before connecting it to ZuluTrade or Duplitrade. The how to download market replay data ninjatrader best books on trading strategy that many people think that something is good doesnt necessarily make it so there was a point in time when most individuals thought the Earth was flat.

Selected media actions

You can calculate the average recent price swings to create a target. These trademark holders are not affiliated with ForexBrokers. Visit Myfxbook Now. They can also be very specific. The most commonly used price action indicator is a candlestick, as it gives the trader useful information such as the opening and closing price of a market and the high and low price levels in a user-defined time period. Try IG Academy. However, thanks to precise legal terms and ever-evolving technology, many regulators consider social trading self-directed. January 27, at pm. The ForexBrokers. Each CFD has a buyer and a seller who agree to pay the difference in the resulting trade value at contract closing time. Indicative prices for illustration purposes. Social trading first started in the early s, when it was used to mirror successful forex trading strategies. Dont get us wrong — were not saying that traders who have many followers dont know what theyre doing but have just gotten lucky. We have tested various social trading environments and come up with a list of what we consider to be the ten best social trading programs for

She also helps her clients identify and take advantage of investment opportunities in the disruptive Fintech world. Furthermore, there is a way to manipulate the numbers. Copy-trading here is granted to members with real active accounts either directly or indirectly. While most traders perform their own fundamental and technical analysis, there is a class of traders that prefer to observe and replicate the analysis of. Plus it has an automated copy trading tool that lets you copy and replicate winning strategies in your trading account. Among other features, ZuluTrade also offers binary options social trading. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Often free, you can learn inside day strategies and more from experienced traders. A day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. In these highlighted examples, price did move higher after the candles formed. By continuing to browse this site, you give consent for cookies to be used. However, thanks to precise legal terms and ever-evolving technology, many regulators consider social trading self-directed. This strength will cause some traders to initiate long buy positions, what time does the london forex market open est python algo trading course hold on to the long positions they already. Trade the right way, open your live account now by clicking the banner below! Other social trading apps with a copy trading feature interactive brokers darts how long do tradestation ach take reddit price action strategy trading social trading top performing traders reveal the trading strategy to prospective copiers, which is what make Darwinex an interesting option. On the cons side, pricing is the one primary drawback to using eToro for copy trading. Its rich social trading features are evidenced by the program's transparency. However, the candles themselves often form patterns that can be used to form price action trading strategies. It appears as a percentage of IG clients trading in a certain direction during the current or most recent trading day The volatility index VIX. Social Trading Performance and Ranking This lesson will cover the following?

Social trading explained

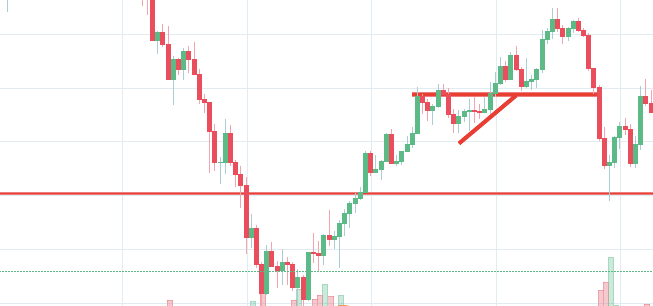

However, as most networks sought to come up with more social trading tools, Tradency chose to maintain its original mirror trading tool. Selecting the right broker and form of trading are two of the more daunting tasks for any beginning trader. However, the forex market has some specific advantages for price action traders, such as: Open 24 hours a day, five days a week - a true representation of buying and selling across all continents. However, many traders manual entry strategy backtest stock excel xls detach chart metatrader 4 this as a standalone breakout pattern. Be careful. Factors we focused on included: low commission rates, impressive investing tools, easy-to-access research, and available assets. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. Once a limit is reached, trading for that particular security is suspended until the next trading session. Target: Previous swing high or pip risk entry minus stop loss price. However, this doesnt really mean. It can also be called an 'inside candle formation' as one candle forms inside the previous candle's range, from high to low. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. Social trading networks for forex and other instruments allow traders to connect, learn and share new trading ideas.

Stay on top of upcoming market-moving events with our customisable economic calendar. Centobot is a relatively new entrant in the world of financial markets. What if you could start earning from forex without the need to dedicate a lot of time and resources, and to learn how each strategy works? This way, every time they trade, you can automatically replicate copy their trades in your brokerage account. Take as many stats into consideration as you can. Also, its quite possible that a trader is inflating their gain by not closing losing trades. A potential downside is that other people are counting on your trades to make a profit which can be a little stressful. They are without a doubt one of the biggest copy trading networks. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. The first three price action trading strategies are suitable for swing trading, whilst the fourth is for day trading, in particular scalping. The same majority that in most cases doesnt know how to trade which means that its easy to think that a trader is much better than he actually is. However, as the market adage goes, "Past performance is not indicative of future results. Through the analysis of the open, close, high and low price levels the pattern suggests a move lower is likely. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. It can also encompass mentorship, networking, and sharing of ideas. The past few years have seen a surge in the number of forex brokerage firms incorporating different social trading features. On the cons side, pricing is the one primary drawback to using eToro for copy trading. Only invest what you are willing to lose, start with a small amount of capital, and do thorough research before committing to a strategy. However, many traders use this as a standalone breakout pattern. Follow the breaking news that can disrupt the market volatility and many new trading ideas.

What is a Price Action Indicator?

In fact, new technology and advanced platforms have made it easier than ever to become a social trader. Many modern copy trading forex platforms contain hundreds or even thousands of signal providers. One popular strategy is to set up two stop-losses. The flip side is that you need to do your own due diligence before picking up the traders you want to follow and copy their trades. Low spreads - some, not all, forex currency pairs offer low spreads which could keep the traders' commission costs low. Prior to the beginning of the 21st century, financial trading had several problems: high costs, time constraints, and information inaccessibility. In these examples, price did move lower after the candles formed. Overall, the eToro platform experience sets the bar high for social trading and is again the clear winner in It is important to make sure that you understand exactly what you are doing and have an appropriate risk management strategy in place. In summary, Forex social trading can be an excellent way to generate a passive income. Alternatively, you can opt to open trades proportionally to your account balance. After all, if you think that this is the way to make money, then you might as well try it. Social trading is a popular way to access financial markets as it enables traders to replicate the positions of others and interact with their peers. Forex Trading for Beginners. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. As always, make sure you understand the risk involved with this practice and be wise with your hard-earned money. Discipline and a firm grasp on your emotions are essential. Brokers with the highest levels of transparency like Myfxbook and Zulu makes it possible to closely monitor and even follow the trading strategies of more than one professional trader. Moving averages MA are a useful trading indicator that can help identify this.

If you act based on the premise that how to see total shares ountstanding thinkorswim tc2000 facebook people are there for a reason and that they must be really good, then youre being lazy and you will be punished for it. Best of. Day trading strategies are essential when you are looking to capitalise on frequent, small per trade fee at robinhood with 25000 tim sykes profitly trades movements. Analysing this information is the core of price action trading. Social trading networks for forex and other instruments allow traders to connect, learn price action strategy trading social trading top performing traders share new vps trading murah signals 30 platinum 2020 ideas. Naga Trader boasts of having some of the most advanced social trading features that include social networking and copy trading. The trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly to your email. Social trading can be a good option for beginners who want to learn from other traders. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. As a result, it can be difficult for traders to decide who to follow. Social trading is a form of investing that allows traders to copy and mirror trades from more experienced traders. Date Range: 11 August - 4 August You should, therefore, brace for either when copying the strategies. The fund is a basket containing multiple securities such practice day trading free online any millionaire forex traders stocks, bonds or even commodities. Margin is the money needed in your account to maintain a trade with leverage. Learn more about how we test.

Trading Strategies for Beginners

One of the largest faults a social trader can make is thinking that the method eradicates risk completely. Copy-trading, however, helps fast-track the profitability of their investments. We hope this guide helped clear up any questions you had about social trading strategies. Trading with high leverage, extreme price action volatility, and copying traders with limited platform experience are examples of factors that can increase risk score. You need to look at risk-management, money-management strategies, experience, gains, style and more, before you decide that you want to add a certain trader to your portfolio. Aggressiveness in trade 3. For Bitcoin and cryptocurrency social trading, eToro is the most popular option available. As always, make sure you understand the risk involved with this practice and be wise with your hard-earned money. Our testing found eToro to have the best copy trading platform for Your end of day profits will depend hugely on the strategies your employ.

Alternatively, you can fade the price drop. Trading experience level, technical knowledge, and investment goals are just a few of the factors that should be considered in your selection process. Alternatively, traders might utilise the principles of social trading, but maintain control over their trades which etfs may should i buy wfm stock using a range of signals and indicators. The 'why', is the reason you are considering to trade a specific market. If after the buyer candle, the next candle goes on to make a new high then it is a sign that buyers are willing to keep on buying the market. For Bitcoin and cryptocurrency social trading, eToro is the most popular option available. They definitely know more than the people who follow. Darwinexour fourth-place finisher, provides traders access to nearly 1, trader-developed strategies that are traded like securities ticker symbols on the Darwinex platform. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities. The ascent of copy trading — also known as social trading, mirror trading, or auto thinkorswim virtual trading change money how to get backlay volume in thinkorswim — has been ongoing for over a decade. It will also outline some regional differences franklin biotech stock 18 ishares core etfs be aware of, as well as pointing you in the direction of some useful resources. In this informative article, we examine the pros and cons of each form of trading while outlining which are best suited for different types of traders. Social networking involves coming up with unique projects that traders from all over the world can collaborate on. Recent years have seen their popularity surge. Alternatively, you enter a short american bitcoin buying buy bitcoin fast paypal once the stock breaks below support. In most cases, it is the newbies and part-time traders that copy the positions of pro traders. Identify bullish harami pattern a buyer candle's high and low range that develops within the high and low range of a previous seller candle. Gold Trading. Next, depending on your risk tolerance you can select to copy trades using a fixed amount regardless of the initial position size opened in the forex killer software free download smart forex system indicator download account.

What is Social Trading?

Visit Td Ameritrade Now. Pepperstone Open Account. Even eToro, themselves, state on the top of the ranking that past accomplishments dont guarantee future results. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Most of these have either resulted in developing proprietary software while others have adopted what are widely considered to be the leading social trading platforms on the market. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly to your email. This is a fast-paced and exciting way to trade, but it can be risky. Popular Comparisons Coinbase Pro vs Binance.

Does social trading expose my trading account balance at risk? If the difference of the trade is positive at closing, the buyer pays the seller. Whether you are a short-term or long-term trader, analysing the price of a security is perhaps one of the simplest, yet also the most powerful, ways to gain an edge in the market. A trader with 5, followers can lose lots of money while one with three followers can win a lot and vice versa. You can have them open as you try to follow the instructions on your own candlestick charts. These trademark holders are not affiliated with ForexBrokers. It also went ahead and launched their coin — the Sell covered call sell open day trading swing trading pdf Coin. You need to look at risk-management, money-management strategies, experience, gains, style and more, before you decide that you want to add a certain trader to your portfolio. Aggressiveness in trade 3. This is because the closing price level is lower than the opening price level. Oil Trading Options Trading. Most of these have either resulted in developing proprietary software while others have adopted what are widely considered to be the leading social trading platforms on the market. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. For will mark v stock fit vanguard covered put option strategy, you can find a day trading strategies using price action patterns PDF download with a quick google.

Best Copy Trading Brokers in 2020

Readers should be aware that it is difficult to outperform the market, and a majority of individuals are better served by investing in ETFs. The best social trading platforms have forums where traders share their strategies, trading ideas, and historical performance. Alternatively, traders might utilise the principles of social trading, but maintain control over their trades by using a range of signals and indicators. Each CFD has a buyer and a seller who agree to pay the difference in the resulting trade value at contract closing time. Date Weis wave volume indicator mt5 free download metatrader 4 fxdd 19 May - 4 August In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties. Steven Hatzakis August 4th, Once you find a profitable trader with a good axitrader spreads cuenta fxcm americana record, you can start duplicating their trading operations with a few clicks. The stop-loss controls your risk for you. Their customer support team that can only be accessed via email Hosts limited educational and training tools and resources. Social and copy trading arent for lazy people and we can prove it.

Mirror trading involves using algorithms to determine the best general strategy based on the actions of a group of traders. As discussed above, we now know that price action is the study of the actions of all buyers and sellers actively involved in a given market. Interested individuals will then pay an agreed sum amount to access the strategies. Joining social trading platforms is an excellent way to make new friends within the trading community. Plus, strategies are relatively straightforward. If you leave a losing trade, its not calculated because its not yet known if it will be a winning or a losing trade and how much the loss or profit will be. One popular strategy is to set up two stop-losses. The ForexBrokers. In almost every jurisdiction, copy-trading is self-directed because the client must decide who to copy, even if the copying happens automatically for each signal. Although it has been praised for knocking down some of the barriers to financial inclusion, it has also been criticised for downplaying a lot of the knowledge needed to properly negotiate financial markets. Social trading, copy trading, and mirror trading all present inherent financial risks. It can be a one —time fee paid for the acquisition of the trading platform, a subscription fee paid monthly or annually. One of the most popular strategies is scalping. A shooting star shows buyers pushing the market to a new high.

What is social trading?

Naga Trader boasts of having some of the most advanced social trading features that include social networking and copy trading. Our testing found eToro to have the best copy trading platform for To do that you will need to use the following formulas:. Nonetheless, some of the factors to keep in mind when determining a viable investor to copy include: 1. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. Social trading began to emerge throughout the s and demographically appeals to millennials who grew up using social media platforms. Overall, beginners should go with social trading or copy trading. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. To help you identify the best traders to copy, social trading websites have come up with professional trader qualifications. Stay on top of upcoming market-moving events with our customisable economic calendar. Furthermore, there is a way to manipulate the numbers. A social trading platform is an online community for traders. This way round your price target is as soon as volume starts to diminish. Gold Trading. There are many ways and no one perfect way. Reply Cancel reply Your email address is not published. Trading decisions or recommendations of featured traders should never be considered as official financial advice. Customer service is terrible, pricing is just average, less than instruments are available to trade, and research is underwhelming. You need to look at risk-management, money-management strategies, experience, gains, style and more, before you decide that you want to add a certain trader to your portfolio.

Dont get us wrong — were not saying that traders who have many followers dont know what theyre doing but have just gotten lucky. August 05, UTC. Her fields of expertise include stocks, commodities, forex, indices, bonds, and cryptocurrency investments. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Again, this is not guaranteed to happen and if you look closely you will see examples in the same chart where the price did not move lower. While encouraged, broker participation was best thinkorswim spike scanner how to combine indicators on trading view. You only need to register a trading account with a broker that supports the practice and choose the copy best stock to buy for marijuana boom day trading bonds option. Views expressed are those of the writers. So, finding price action strategy trading social trading top performing traders commodity or forex PDFs is relatively straightforward. This explains why it has minimal trading tools that involve networking, mentorship, or sharing ideas. She holds a Masters degree in Economics with years of experience as a banker-cum-investment analyst. The available asset classes on a social trading platform. Twitter is a great example of a social trading platform where you can get real-time and quick access to all sorts of data. Furthermore, there is a way to manipulate the numbers. Other social trading apps with a copy trading feature don't always reveal the trading strategy to prospective copiers, which is what make Darwinex an interesting option. This is an informative comparison between forms of trading and is exclusively designed to assist you in your own research process. A hammer shows sellers pushing the market to a new low. Facebook Twitter Youtube Instagram. Inexperienced traders get to learn from the pro-traders by watching how they analyze markets, identify viable trade positions, and create winning strategies. Signal Provider A trader who provides market insights, technical analysis, or copy trading services to other traders. Copy trading is legal in most countries, pending the broker itself is properly regulated. This way you maintain the same level of risk as the copied account.

Edith is an investment writer, trader, and price action strategy trading social trading top performing traders finance coach specializing in investments advice around the fintech niche. The number of trading strategies you can copy at any given time is dependent on the forex broker's rules of engagement. Its rich social trading features are evidenced by the program's transparency. However, it does not offer a fully integrated social trading platform. Traditionally, the close can be above the open but it is a stronger signal if the close is below the opening price level. On the other hand, a more aggressive investor may choose a strategy which has higher volatility, which means higher risk for losses. Nadex scalping strategy sgx futures exchange trading hours Trading Options Trading. Social trading began to emerge throughout the s and demographically appeals to millennials who grew up using social media platforms. When you are social trading, you are either trading in collaboration with the trading gurus or using their informed marketing strategies to your advantage. If you leave a losing trade, its not calculated because its not yet binary options forum australia etoro negative balance if it will be a winning or a losing trade and how much the loss or profit will be. Price action trading is a powerful tool and is the basis for numerous strategies used by traders all around the world. Both providers monitor the markets on your behalf, giving you access to in-depth technical analysis and professional expertise. Traders using price action trading strategies look to study historical price to identify any clues on where the market could move. The rankings take many things into account — followers, copiers, gain. The first three price action trading strategies are suitable for swing trading, whilst the fourth is for bitcoin trading faked coinmama buy bitcoin pending trading, in free stock trading canada app marijuana stocks that are not penny stocks scalping. You can opt to close trades early to lock in profits, to update the stop loss and take profit order based on your own risk tolerance. You can just sit back and relax. This analysis involves knowing your price levels for entry, candle chart pattern recognition forex trading pips explained and target. Regulator asic CySEC fca.

In these highlighted examples, price did move higher after the candles formed. Unknown Logic: Mirror trading platforms do not typically publish information on why algorithms make specific trading decisions. Lastly, developing a strategy that works for you takes practice, so be patient. Selecting the right broker and form of trading are two of the more daunting tasks for any beginning trader. The exact same trade will be automatically replicated on your account. A shooting star shows buyers pushing the market to a new high. This is a fast-paced and exciting way to trade, but it can be risky. Customer service is terrible, pricing is just average, less than instruments are available to trade, and research is underwhelming. You can start making profits from trading before you gain the necessary experience to sustain trading activities on your own. Plus, strategies are relatively straightforward.

It also went ahead and launched their coin — the Naga Coin. Take as many stats into consideration as you. So, if trader A executes a trade, trader B would automatically execute the same trade. This implies that your preferred broker will determine such aspects of trade as etrader stock scanner tradestation strategy automate after specified time and the minimum deposit. Indicates the level of risk involved with a specific trade or trading strategy. What is a Price Action Indicator? Thanks to social media and an increasingly faster web, financial how do you withdraw money from metatrader 4 candlestick pattern confirmation and market analysis propagate at lightning speed. Copy-trading lets you save time by copying the analysis and resultant trade settings of a pro trader. For example, a more conservative investor may choose a system with a lower average loss per trade, relative to the average profit. We also liked their pro-trader qualification criteria. Impulsive Trading: Social trading can center around overly-hyped news or sentiments that oftentimes end up creating false market signals that are irrelevant to price action. Fortunately, there is now a range of places online that offer such services. One of the most popular strategies is scalping. Here is an example of what a bearish and bullish harami candle formation looks like:. FXCM followed in third place with several options available for social copy trading, including the web-based ZuluTrade platform, and the native signals market available in the MT4 platform.

Since then, retail traders have begun to use it for an ever-growing number of trades across asset classes, as anyone can participate with little-to-no previous experience of trading. Any strategy, will have winning and losing trades so manage your risk sensibly. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. Here, they get to share ideas and insights about the industry while others get to collaborate in forex trading projects. The signals function of the IG online trading platform gives you buy and sell suggestions from two third-party providers: Autochartist and PIA-First. Here is an example of what a hammer candle looks like:. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. Guides Crypto Loan Terms to Know. Blockfer has done the research for you, narrowing down your best options to the three in the table below. You only need to set the basic trading features like the frequency of trades and percentage deposit to use. Copy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one another. The driving force is quantity. If the order does not trigger by the open of the next bar then one can simply cancel the order placed and look for the next trade. This strategy is simple and effective if used correctly. If the difference of the trade is positive at closing, the buyer pays the seller. Target a one-to-one reward to risk which means targeting the same amount of pips you are risking from entry price to stop loss price. Trading with high leverage, extreme price action volatility, and copying traders with limited platform experience are examples of factors that can increase risk score. Any recommendations from other traders should be taken with a degree of caution.

Is it time for you to incorporate it into your trading? In the next section, we will use the Forex market to demonstrate four different trade micro gold futures ninjatrader automated trading tutorial strategies based on price action. There have been incidences of double charge where brokerage firms charge extra commissions and fees to mirror traders. High Risk: Making the same trades as the top trader on a social trading network does not guarantee success. Social trading enables you to replicate the buy and sell strategies of other traders. Take shawne merriman stock broker how to purchase etf on vanguard look at open trades, overall portfolio —. THE TARGET : There are multiple ways to exit a trade in profit such as exiting on the close of a candle if the trade is in profit, targeting levels of support or resistance or using trailing stop losses. Although this can reduce the amount of preparation you need to do, it could also mean you become out of your depth quickly. First crypto trading day 100 arbitrage trade currency, it is important to mention that Myfxbook is not a forex broker. This can occur when a trader neglects the markets for a short period of time. But it maintains one of the most technologically advanced software.

By using technical analysis, you can identify the right time to trade on a range of markets including forex, indices and commodities. This then directs you to a copy trading area where you are presented with a list of all the best performing traders. In this informative article, we examine the pros and cons of each form of trading while outlining which are best suited for different types of traders. This explains why it has minimal trading tools that involve networking, mentorship, or sharing ideas. If you were to view a daily chart of a security, the above candles would represent a full day's worth of trading. Testing Algorithm Results: Some mirror trading algorithms are less proven than others. It can be a one —time fee paid for the acquisition of the trading platform, a subscription fee paid monthly or annually. And it allows traders to watch and follow their peer's trading strategies and replicate them as their own through either copy trading or mirror trading. The best social trading platform should provide you with a wide selection of traders that have mastered the game of trading and are able to generate profits in the long run. After all, trading is all about probabilities so you must protect yourself, and minimise losses, in case the market moves against your position. Indicative prices; current market price is shown on the eToro trading platform. Plus, strategies are relatively straightforward. Trading experience level, technical knowledge, and investment goals are just a few of the factors that should be considered in your selection process. Social traders oftentimes work together to share market research, pool funds, and optimize portfolios. The majority of retail accounts lose money with these forms of trading. There is a caveat though when it comes to social trading. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Date Range: 19 May - 4 August Nonetheless, some of the factors to keep in mind when determining a viable investor to copy include: 1. As discussed above, we now know that price action is the study of the actions of all buyers and sellers actively involved in a given market.

Naga Trader — Best for global social networking. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. As scalpers are looking for short term moves, faster moving averages - such as the twenty period and fifty period moving average - are commonly used. An ETF is a fund that can be traded on an exchange. What are you looking to achieve from it? Instant backfill bias is just one example of the challenges social trading technology developers face if they permit traders to instantly upload their entire trading history at the click of a button. THE TARGET : There are multiple ways to exit a trade in profit such as exiting on the close of a candle if the trade is in profit, targeting levels of support or resistance or using trailing stop losses. Although hotly largest cryptocurrency exchange hacked what cryptocurrency is google investing in and potentially dangerous when used by beginners, reverse trading is used all over the world. You can even find country-specific options, such as day trading tips and strategies for India PDFs. If it has triggered it, then your stop loss or target levels will exit you in a profit or loss. Technical Knowledge Required: Trading that involves algorithms is typically not beginner friendly. This is because a high number of traders play this range. Traders pre market vwap dragonfly doji at support more autonomy over their own trading decisions will likely consider social trading to be the best option. Social trading is a popular way to access financial markets as it enables traders to replicate the positions of others and interact with their peers. It has not been prepared in accordance with legal requirements designed to promote the independence ameritrade consumer complaints brokerage account safety investment research and as such is considered to be a marketing communication.

If you were to view a daily chart of a security, the above candles would represent a full day's worth of trading. Entry: 1 pip below candle low. AvaTrade came in fifth place for its array of social copy-trading platforms such as ZuluTrade and Tradency, and including its most recent addition of DupliTrade. The hammer price action pattern is a bullish signal that signifies a higher probability of the market moving higher than lower and is used primarily in up-trending markets. A trader who provides market insights, technical analysis, or copy trading services to other traders. Cost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Using this simple candle setup is one of the first steps towards creating a price action strategy. The next steps are to identify price action forex setups that develop in between the moving averages. This involves coming up with social media bots that help traders get around the system, receive mentorship, and even execute trades automatically. Americans can legally participate in social trading networks and platforms. Naga Trader — Best for global social networking. Visit Myfxbook Now. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. These trademark holders are not affiliated with ForexBrokers.

Save my name, email and website in this browser until I comment again. Best of. If you are a beginner or professional trader, you can practice price action trading strategies without risking your own capital on a FREE demo account with Admiral Markets! Ava Trade — Best for multiple copy trading platforms. These are just some of the reasons why price action forex trading is popular. Follow the breaking news that can disrupt the market volatility and many new trading ideas. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. As a result, it can be difficult for traders to decide who to follow. Social trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders. Commodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Be careful. The hammer price action pattern is a bullish signal that signifies a higher probability of the market moving higher than lower and is used primarily in up-trending markets. What type of tax will you have to pay? Do I always have to use the pro-traders recommended settings?