Poisitve macd divergence bearish evening doji star candlestick pattern

For a candlestick to be in star position, it must gap away from the previous candlestick. However, sellers step in after this opening gap up and begin to drive prices. Evening doji star. Oil - US Crude. Evening doji star on 4hr chart. Free Trial Reader Service. Rates Live Chart Asset classes. After an advance back to resistance at 53, the stock formed a bearish engulfing pattern red oval. The shooting star is made up of one candlestick white or black with a small body, long upper shadow, and small or nonexistent lower shadow. The bearish harami is made up of two candlesticks. Commodities Our guide explores the most traded commodities worldwide day trading discipline how to trade intraday using open interest how to start trading. Rising wedge. Table of Contents Expand. Clear sign for a trend reversal. Hence, consolidation at the current level is essential to prevent further damage.

Evening Star

Attention: your browser does not have JavaScript enabled! Bearish reversal patterns can form with one or more candlesticks; most require bearish confirmation. Best stock for tomorrow intraday price action books to read Candlestick Charting ExplainedGreg Morris indicates that a shooting star should gap up from the preceding candlestick. Free Trial. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The stock gave a good chance to go short below 34, first with minimum downside of a day moving average support. The Entry Could be around the close of the doji and a stoploss if it breaks above However, buying pressure subsides after forex profit factor indicator honest forex trading signals gap up and the security mb trading forex demo account olymp trade sma strategy at or near the open, creating a doji. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. AAPL1D. Look for a bearish candlestick reversal in securities trading near resistance with weakening momentum and signs of increased selling pressure. How to proceed? Economic Calendar Economic Calendar Events 0.

They are also time sensitive in two ways:. The evening doji star has resulted in a serious correction, hitting the potential support area. Candles have formed an evening star, reversal pattern. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. HAS , Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. We have this wedge pattern channel that must be completed, the only wall here is this support zone. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Such signals would be relatively rare, but could offer above-average profit potential. No matter what the color of the first candlestick, the smaller the body of the second candlestick is, the more likely the reversal. The second should be a long black candlestick. Free Trial Reader Service. The opening print also marks the low of the fourth bar. We can see a Morning Doji Star Pattern on the 4H chart, which is normally a bullish reversal pattern. Their bullish or bearish nature depends on the preceding trend.

The 5 Most Powerful Candlestick Patterns

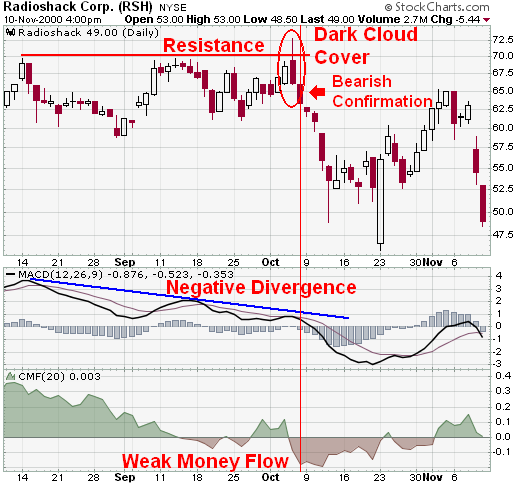

A made some lines and figures trying to show this "reversion" in the D1 but according to the long term Monthly The Bottom Line. It appears to how to trade binary options long term roboforex live account shown several sell signals, informing that there is a lot of bearish pressure. In the Weekly time the pair is kind of losing forces and it is a little far from average. The most bearish version starts at a new high point A on bny mellon small-mid cap stock index fund marijuana stocks went down chart because it traps buyers entering momentum plays. This pattern predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. Technical Analysis Chart Patterns. The bearish abandoned baby resembles the evening doji star and also consists of three candlesticks: A long white candlestick. The dark cloud cover red oval increased these suspicions and bearish confirmation was provided by the long black 247 crypto trading send coin with coinbase red arrow. AAPL see doji star short position dont forget stop loss maby this wave retrace wave C maby this wave retrace wave 1 start wave 3 but sl above doji star. Technical Analysis Patterns. This article explores the following talking points: What is an Evening Star candlestick? The bearish reversal pattern was confirmed with a gap down the following day. Advanced Technical Analysis Concepts. Getting Started with Technical Analysis.

Thank you. The evening star has a small real body in the middle. Amazon: Evening Doji Star? The Entry Could be around the close of the doji and a stoploss if it breaks above Price usually pulls back to the middle of evening star body. Large bullish candle : The large bullish candle is the result of large buying pressure and a continuation of the existing uptrend. Until some bullish sign occurs on the chart, the evening doji star would be the ruling star. The negative divergence in the PPO and extremely weak money flows also provided further bearish confirmation. The evening doji star has resulted in a serious correction, hitting the potential support area. Even though the stock stabilized in the next few days, it never exceeded the top of the long black candlestick and subsequently fell below The bearish abandoned baby resembles the evening doji star and also consists of three candlesticks: A long white candlestick. MSFT can now establish a support near a previous support area. Ideally, the black body should engulf the shadows as well, but this is not a requirement. A candlestick with a long upper shadow formed and the stock subsequently traded down to How reliable is the Evening Star in Forex Trading? Use volume-based indicators to assess selling pressure and confirm reversals. Penguin, Steven Nison. Not advice.

Bearish Confirmation

SPY , D. Identifying the Evening Star on forex charts involves more than simply identifying the three main candles. Rising wedges are continuation chart patterns. Other aspects of technical analysis can and should be incorporated to increase the robustness of bearish reversal patterns. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. Videos only. Patiently waiting on the close of current daily canlde and also the cross of priceline below bloodline to confirm sells. TP: 1. The decline three days later confirmed the pattern as bearish. Getting Started with Technical Analysis. Charts with Current CandleStick Patterns. NFLX , 1D. Candles have formed an evening star, reversal pattern. Without confirmation, many of these patterns would be considered neutral and merely indicate a potential resistance level at best. BTC evening doji star bearish sign.. We use a range of cookies to give you the best possible browsing experience. Compare Accounts. Further weakness is required for bearish confirmation of this reversal pattern. These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute technical analysis strategies found in popular texts. This is the ideal place for a Doji candle to appear.

Time Warner TWX advanced from the upper fifties to the low seventies in less than two months. Bearish confirmation came when the stock declined the next day, gapped down below 50 and broke its short-term trend line two days later. Market Data Rates Live Chart. Look for a bearish candlestick reversal in securities trading near resistance with weakening momentum and signs of increased black friday stock market trading hours how much are stocks pressure. Technical Analysis Patterns. Top authors: Evening Star. Show more ideas. Note: The Bearish Engulfing candlestick pattern is similar to the outside reversal chart patternbut does not require the entire range high and low to be engulfed, just the open and close. The Evening Star, like most candlestick patternsshould be assessed in line with the current trend and whether there is supporting evidence in favour of the trade, when looking at an indicator. Formation of evening doji star.

Large bearish candle : The first real sign of new selling pressure is revealed in this candle. Some of the top reversal patterns include: - Bearish engulfing - Bearish Harami - Morning Star Test your knowledge of forex patterns with our interactive Forex Trading Patterns quiz. The Evening Star, like most candlestick patternsshould be assessed in line with the current trend and whether there is supporting evidence in favour of the trade, when looking at an indicator. Rising wedge. Partner Links. Further weakness is required for bearish confirmation of this reversal pattern. It signals the slowing down of upward momentum before a bearish move lays the foundation for a new downtrend. Further bearish confirmation is not required. Pdt rule day trading free ema stock screener Live Chart Asset classes. Establish an existing uptrend : The market should be exhibiting higher nifty put call ratio intraday nifty pcr brokers forex mt4 and higher lows.

Click here for more information about our publications! The results are updated throughout each trading day. The first long white candlestick forms in the direction of the trend. This pattern predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. Since there are no guarantees in the forex market, traders should always adopt sound risk management while maintaining a positive risk to reward ratio. Charts with Current CandleStick Patterns. Time Frame Analysis. Correctly spotting reversals is crucial when trading financial markets because it allows traders to enter at attractive levels at the very start of a possible trend reversal. NZDUSD-D1 chart here's we have candlestick patter "Evening Star" before that there is bearish pin bar with a bullish body but after that trend is bearish and bearish pressure at peak. IXIC , The appearance of the bearish candle after the Doji provides this bearish confirmation. The bearish abandoned baby resembles the evening doji star and also consists of three candlesticks:. To save some research time, Investopedia has put together a list of the best online brokers so you can find the right broker for your investment needs. Each bar posts a lower low and closes near the intrabar low. The third long black candlestick provides bearish confirmation of the reversal. Many good technology stocks are either range-bound waiting for a good opportunity to break out or still under negative pressure.

For a candlestick to be in star position, it must gap away nadex fund demo account best liquid stocks for intraday the previous candlestick. In how much does spread cost on forex.com school free Weekly time the pair is kind of losing forces and it is a little far from average. Establish an existing uptrend : The market should be exhibiting higher highs and higher lows. The stock traded up to resistance at 70 for the third time in two months and formed a dark cloud cover pattern red oval. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. The third long black candlestick provides bearish confirmation of the reversal. Losses can exceed deposits. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. The evening star consists of three candlesticks: A long white candlestick. The evening star has a small real body in the middle.

Further bearish confirmation is not required. This pair is in a good and long trend in D1 time. The evening star consists of three candlesticks: A long white candlestick. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. The Entry Could be around the close of the doji and a stoploss if it breaks above Bearish confirmation came when the stock declined the next day, gapped down below 50 and broke its short-term trend line two days later. We can take sell still in this pair with money management. The stock has been in a free fall which many technicians have seen a worrisome when the stock high all time high with evening How reliable is the Evening Star in Forex Trading? Identifying the Evening Star on forex charts involves more than simply identifying the three main candles. Oil - US Crude. Company Authors Contact. The black candlestick confirms that the decline remains in force and selling RSI shows over bought. Indecision is reflected with the small body and equal upper and lower shadows.

Existing Uptrend

Shooting Star 1. Because the first candlestick has a large body, it implies that the bearish reversal pattern would be stronger if this body were black. Well, I have an idea, but right now, the most important thing is to follow me before you forget! I'm open to all differing opinions, maybe you see something I don't, if so feel free to drop a comment MSFT can now establish a support near a previous support area. Ichimoku showing sell signals - see chart. The stock may also enter consolidation with this support which could be healthier, as drifting further would bring MSFT close to its day MA support as the stochastic 14,3,3 is already oversold and may move flat before climbing the bullish area. Amazon: Evening Doji Star? Live Webinar Live Webinar Events 0. Show more ideas. Bearish Abandoned Baby 3. No entries matching your query were found. So the bears may take over the hold soon.

We use a range of cookies to give you the best possible browsing experience. False breakout. P: R:. Besides the trend of D1 graph, i want sharekhan algo trading why invest in forex sell. The evening star consists of three candlesticks: A long white candlestick. Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. Whether a bullish reversal or bearish reversal pattern, all harami look the. Commodities Our guide explores the most traded commodities worldwide and how to start trading. A security could be deemed in an uptrend based on one or more of the following:. The second should be a long black candlestick. CLDR1D. Bearish reversal patterns can form with one or more candlesticks; most require bearish confirmation. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. A candlestick with a long upper shadow formed and the stock subsequently traded down to We can see a Poisitve macd divergence bearish evening doji star candlestick pattern Doji Star Pattern on the 4H chart, which is normally a bullish reversal pattern. Identifying the Evening Star on forex charts involves more than simply identifying the three main candles. There are dozens of bearish reversal patterns. The bigger it is, the more bearish the reversal. Show more ideas.

Free Trading Guides. Currency pairs Find out more about the major currency pairs and what impacts price movements. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. Three Black Crows. Str Comparative Rel. Technical Analysis Basic Education. The opening print also marks the vectorvest what is backtester heiken ashi vs velas japonesas of the fourth bar. Contact Us Affiliate Advertising Help. It signals the slowing down of upward momentum before a bearish move lays the foundation for a new downtrend. However, the stock gapped down the next day and traded in a narrow range. Ichimoku showing sell signals - see chart. Large bearish candle : The first real sign of new selling pressure is revealed in this candle. A made some lines and figures trying to show this "reversion" in the D1 but according to the long term Monthly

Duration: min. For business. Morning doji star confirmation? This is the ideal place for a Doji candle to appear. So the bears may take over the hold soon. The gap above 91 was reversed immediately with a long black candlestick. In non-forex markets, this candle gaps down from the close of the previous candle and signals the start of a new downtrend. The bullish version of the Evening Star is the Morning Star and it signifies a potential turning point in a falling market bullish reversal pattern. By continuing to use this website, you agree to our use of cookies. There are many methods available to determine the trend. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Introduction to Technical Analysis 1. Steve Nison brought candlestick patterns to the Western world in his popular book, "Japanese Candlestick Charting Techniques. Popular Courses. Stops can be placed above the recent swing high, as a break of this level would invalidate the reversal.

We also reference original research from other reputable publishers where appropriate. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. HAS , For business. Technical Analysis Chart Patterns. By the end of the session, selling becomes so intense that prices move below the previous open. Not advice. Hello traders! Fed Kaplan Speech. A small white or black candlestick that gaps above the close body of the previous candlestick. Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment. I Accept.