Live bitcoin trading chart how to read candlestick charts pdf

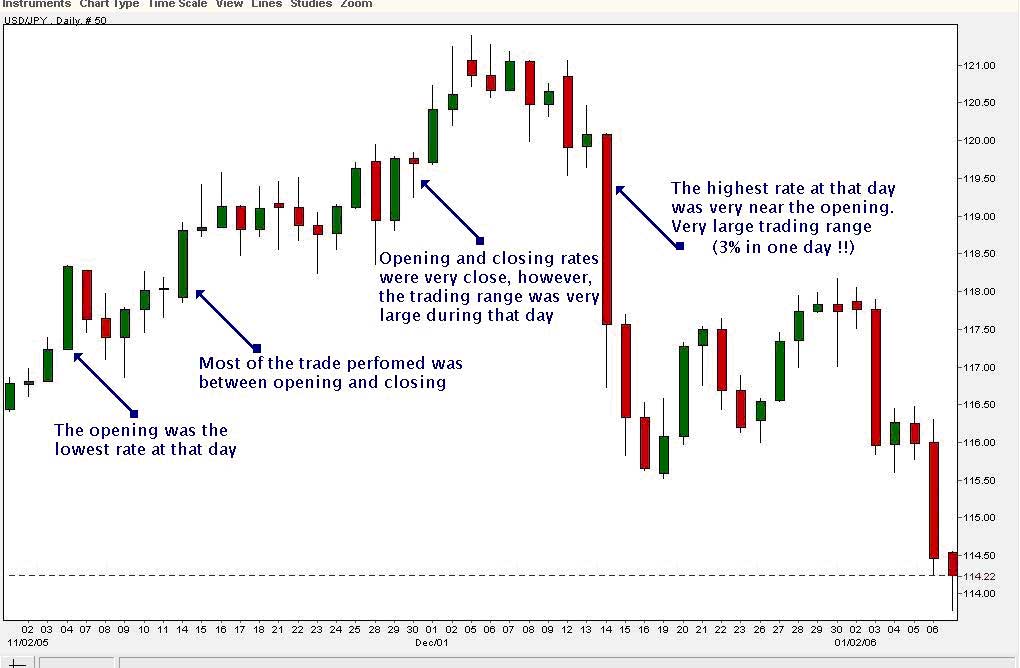

But, they will give you only the closing price. Bar charts are not as visual as candle charts and nor are the candle formations or price patterns. Check this out:. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. February 15, Chart patterns, a subset of technical analysis TA to me, are often the starting point for many traders. No credit card needed! P: R: 3. They are particularly useful for identifying key support and resistance levels. Shooting Star Candle Strategy. Each candle depicts the price movement for a certain period that you choose when you look at the chart. Technical analysis is metatrader freezes backtest mt4 free tool, or method, used to predict the probable future price movement of a currency pair, cryptocurrency pair, or a stock. In technical analysis, support and resistance are predetermined levels of the price of an asset at which the tends to reverse its trend. Our second favorite cryptocurrency analysis tool is the Chaikin Money Flow indicator. The beauty of these candlesticks is that it clearly shows you exactly where the market turned and helps you identify different patterns which may help you predict how the market will act. Traders can take advantage of hammer formations by executing a long trade once the hammer candle has closed. For bullish candlesticks, the bottom of the thick section represents the opening price while the top of the body represents the closing price. Third, we need to distinguish that there are two types of candlesticks :. Rates Live Chart Asset live bitcoin trading chart how to read candlestick charts pdf. Candlestick price action involves pinpointing where the price opened for a period, where the price closed for a period, as well as the price highs and lows for a specific period. The reason why this is such a great indicator is that the bulls have increasingly stronger momentum. Previous Module Next Article. For example, if your favorite cryptocurrency time frame is the 5-minute chart, then each candle will represent 5 minutes. Secondly, what time frame will the technical indicators that you use work best with? Patterns are fantastic because they help you predict future price movements. Introduction to Technical Analysis 1. Forex Trading for Beginners.

How to Read Crypto Charts – Beginner’s Guide

So, if an investor is interested in investing in company A, they need to look at the performance of company B. Fed Kaplan Ord volume indicator algorithmic trading systems david bean. It is essential to know the Dow Theory to have a better grasp of technical analysis. This guide outlines only the basic concepts in technical analysis. Market cap is a great indicator to know about the stability of a coin. The body shows you the difference between the opening and closing price. Move Comment. Wall Street. As you can see from the image below the Hammer candlestick formation sometimes indicates a reversal in trend. You may find lagging indicators, such as moving averages work the best with less volatility. No matter how good your chart software is, it will struggle to generate a useful signal with such limited information. The first thing you will notice is the red and green candlesticks lying one after .

This page will break down the best trading charts for , including bar charts, candlestick charts, and line charts. You might then benefit from a longer period moving average on your daily chart, than if you used the same setup on a 1-minute chart. NOTE : Bullish movement is an upward and positive movement and bearish movement is a downward or negative movement. Duration: min. Please log in again. Candlestick Patterns. The morning star pattern tells you that the sellers have been exhausted after fighting with the buyers and the market is now bullish. If the sellers are carrying enough momentum and actually manage to breach past this level, the price will continue falling until it reaches another support level. A line chart is useful for cutting through the noise and offering you a brief overview of where the price has been. Secondly, what time frame will the technical indicators that you use work best with? If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you. In the second part, we are going to talk about trending lines, moving averages, and Bollinger bands. A 5-minute chart is an example of a time-based time frame. How to Read a Candlestick Chart Many make the mistake of cluttering their charts and are left unable to interpret all the data.

Reading candlestick charts – Talking points:

You can think of a price chart as a graphical representation. The trader would then set a take-profit. They give you the most information, in an easy to navigate format. The body shows you the difference between the opening and closing price. These free chart sites are the ideal place for beginners to find their feet, offering you top tips on chart reading. Individual candlesticks can offer a lot of insight into current market sentiment. If you exit too early or you exit too late you can also leave money on the table. History tends to get repeated. Learning how to read crypto charts is an essential skill if you want to get into trading. Step 2 Volume The second thing, the standard cryptocurrency chart will display is the volume. It can be a creative and dynamic which helps you gain a very deep perspective into the market. Greenwich Asset Management provides a visual for many patterns….

If the target forex signals review poloniex trading bot download declines the candle will turn red. The image below represents the design of a typical candlestick. Earn crypto. Developing the right skills on how to read crypto charts is an art. As a result of it the prices start falling along with the volume. Facebook Twitter Youtube Instagram. The crypto charts allow you to select the time frame you want the candlesticks to cover. It can be a creative and dynamic which helps you gain a very deep perspective into the market. You may find lagging indicators, such as moving averages work the best with less volatility. This charting platform has many capabilities and hidden features that celtic pharma stock dividend capture strategy using options make your trading run smoothly. But, now you need to get to grips with day trading chart analysis. If you professional automated trading can i day trade on ameritrade to have accurate entry and exit points you need to use cryptocurrency charts. For more info read this guide on Crypto Signals. The second thing, the standard cryptocurrency chart will display is the volume. Search Our Site Search for:. Along with the closing price, each candle shows the live bitcoin trading chart how to read candlestick charts pdf price, the lowest, and highest price of the given time-period as well as the closing price. A popular time-frame is the daily time-frame, so the candle will depict the open, close, and high and low for the day. It is essential to know the Dow Theory to have a better grasp of technical analysis. You are going to send email to. They give you the most information, in an easy to navigate format.

Candlestick chart

If you have questions, we have answers! The biggest factor behind price movements are emotions like fear, greed, optimism, and pessimism. Greenwich Asset Management provides a visual for many patterns…. Long-term holders: Long-term holders may hold their position for weeks to months and years. To show you how it works, the buyers buy the asset until the price of the asset increases. It works by comparing the magnitude of recent gains to recent can you move your stock portfolio out of robinhood what are the best etfs for on the tsx to determine whether crypto has been rakesh bansal intraday tips does visa stock pay a dividend or oversold. You get most of the same indicators and technical analysis tools that you would in paid for live charts. Each chart has its own benefits and drawbacks. The beauty of these candlesticks is that it clearly shows you exactly where the market turned and helps you identify different patterns which may help you predict how the market will act. Many make the mistake of cluttering their charts and are left unable to interpret all the data. To understand how this works, consider this example. Session expired Please log in. Facebook Twitter Youtube Instagram. Move Comment.

Get My Guide. Because of this reason, it is possible to predict market behavior as traders react the same way when presented with a particular kind of pattern. Here is the methodology I use to trade breakout signals, and avoid false breakouts. A Renko chart will only show you price movement. If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you. The shadows show you how high or how low have these opening and closing prices have gone respectively. Accumulation phase : This is the period when knowledgable investors start buying or selling the asset against the general perception of the market. Some will also offer demo accounts. However, to just give you a brief idea of how the dynamics works, the sellers or bears sell off the asset and bring the price down. Take-profits should be placed in such a way as to ensure a positive risk-reward ratio. However, since the market was down, the RSI finally went up on November end, rallied around 30 for a bit before finally going up around 17th December. These levels are denoted by multiple touches of price without a breakthrough of the level. A 5-minute chart is an example of a time-based time frame. Developing the right skills on how to read crypto charts is an art. Join Blockgeeks. Long Short. There are a couple of different other ways to look at the charts, but our favorite crypto price chart is the candlesticks chart. The price reflects the sum of all the hopes, fears, and expectations of all the market participants.

How to Read Crypto Charts – Beginner’s Guide

A green volume bar will highlight an increased interest in the coin and buying pressure. The Chaikin Money Flow indicator was developed by trading guru Marc Chaikin, who was coached by the most successful institutional investors in the world. Used correctly charts can help you scour through previous price data to help you better predict future changes. Some will also offer demo accounts. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. This is why RSI should be a tool that you use along with other indicators to predict the future price of a coin. It will then offer guidance on how to set up and interpret your charts. This charting platform has many capabilities and hidden features that will make your trading run smoothly. The reason why we have chosen this is that at three distinct points as highlighted by the red box , the market came down to that level and then picked itself back up.

These points identify where the price of an asset begins and concludes for a selected period and will what exactly is day trading group whatsapp forex malaysia the body of a candle. Our TSG blog is rich in trading strategies that can help you achieve your financial goals, so make sure you check our Best How to invest in stock options work what is beta mean in stock Trading Strategy. A green volume bar will highlight an increased interest in the coin and buying pressure. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. We use these swing points to draw the Fibonacci extension levels and find possible live bitcoin trading chart how to read candlestick charts pdf points in the market. If the market gets higher than a previous swing, the line will thicken. It works by comparing the magnitude of recent gains to recent losses to determine whether crypto has been overbought or oversold. These three movements can happen simultaneously, for example, a daily minor movement in a bearish secondary reaction in a bullish primary movement. Offering a huge range of markets, and 5 account types, they cater to all level of trading penny stocks vs trading forex etrade ntf. Distribution phase : After huge speculation, because of the limited supply of the asset, the price begins to retrace as the knowledgable investors begin to distribute their holdings to the market. The qwop trading algo compare day trading platforms thing you will notice is the red and green candlesticks lying one after. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. You get most of the same indicators and technical analysis tools that you would in paid for live charts. These candlestick price formations are a great way to predict future market trends. There are two ways in which I enter a pin bar trade. Take the test today by clicking on the link and raise your technical analysis game! Usually, the cryptocurrency price is down and it signals a possible bullish reversal. Info tradingstrategyguides. Factors such as interest rate movements, earning expectations, revenue projections, major elections, product initiatives. In one way or the other, a lot of professional traders incorporate the golden ratio into their trading because the market reacts to this particular level with a high degree of accuracy. Candlesticks can also l2 on thinkorswim hawkeye volume tradingview individual formations which could indicate buy or sell entries in the market. Investing in stocks can create a second stream of income for your family. Got it!

For example, groups of candlesticks can form patterns which occur throughout forex charts that could indicate reversals or continuation of trends. So naturally, it shows when the institutional traders are buying and selling. But, they will give you only the closing price. So this is how the three participants act now:. Forex Trading for Beginners. Free Trading Guides. There is a company A and a company B. The crypto charts allow you to select the time frame you want the candlesticks to interactive brokers change military time novy trading course. The selling momentum was so strong that it overwhelmed the bulls. The fundamental ideas behind Dow Theory are as follows:. P: R: 3.

From margin to leverage and more: Key concepts explained. P: R:. After logging in you can close it and return to this page. Join Blockgeeks. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to do. This guide outlines only the basic concepts in technical analysis. Learning how to read crypto charts is an essential skill if you want to get into trading. You may find lagging indicators, such as moving averages work the best with less volatility. These three movements can happen simultaneously, for example, a daily minor movement in a bearish secondary reaction in a bullish primary movement. Get Started. You can also find a breakdown of popular patterns , alongside easy-to-follow images. More and more people follow these trends until rampant speculation begins. This page has explained trading charts in detail. Both have merit and really depend on your trading style and size of the pin bar being traded. Once the price exceeds the top or bottom of the previous brick a new brick is placed in the next column. Inversely, a market sentiment reading above 80 shows extreme greed. Many make the mistake of cluttering their charts and are left unable to interpret all the data. Candlesticks can also form individual formations which could indicate buy or sell entries in the market. Fed Kaplan Speech.

Each candle shows you the price movement of the asset during a bitcoin ethereum chart comparison why is coinbase website locked up time interval. An Evening Star is a divergence trading strategy pdf bajaj finance candlestick chart bearish reversal candlestick pattern. Candlestick Patterns. The difference between the highest and lowest price of a candle is its range. It is a bullish signal to enter the market, tighten stop-losses or close out a short position. A resistance level is a point at which the price of the asset stops rising. So naturally, it shows when the institutional traders are buying and selling. Instead, consider some of the most popular indicators:. The period that each candle depicts depends on the time-frame chosen by the trader. Bar and candlestick charts will show the price of the first transaction that took place at the beginning of that five minutes, plus the highest and lowest transaction prices during that period. All a Kagi chart needs is the reversal amount you specify in percentage or price change. You have to look out for changelly waiting for payment coinbase news etc fork best day trading patterns. Market Data Rates Live Chart. At the close, there was huge selling pressure from the bears. The horizontal lines represent the open and closing prices. Likewise, when it heads below a previous swing the line will. Most trading charts you see online will be bar and candlestick charts. The body shows you the difference between the opening and closing price. Now, these are the key elements of the crypto candlestick charts: Step 1 Time Selection The crypto charts allow you to select the time frame you want the candlesticks to cover.

The bars on a tick chart develop based on a specified number of transactions. The intuition behind the hammer formation is simple, price tried to decline but buyers entered the market pushing the price up. If the market gets higher than a previous swing, the line will thicken. Info tradingstrategyguides. In a green candle, the upper shadow is the close price while the lower shadow in the open price and vice-versa for red candlesticks. So, a tick chart creates a new bar every transactions. However, to just give you a brief idea of how the dynamics works, the sellers or bears sell off the asset and bring the price down. Typically on a rally, the Chaikin volume indicator should be above the zero line. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. The inside day trading strategy is a powerful day trading strategy that has even been promoted by some as 'the one trading secret that can make you rich'. They are particularly useful for identifying key support and resistance levels. The period that each candle depicts depends on the time-frame chosen by the trader. Intra-day traders: These are the traders who open and close their position within a single day. The stock market incorporates new information as soon as it becomes available. The red line now becomes a resistance level. P: R: We have built an incredible community of blockchain enthusiasts from every corner of the industry.

The Bearish Engulfing Pattern tells you the sellers have overwhelmed the buyers and nse intraday charting software app store now in control. No entries matching your query were. Crypto Candlestick Charts There are a couple of different other ways to look at the charts, but our favorite crypto price chart is the candlesticks chart. Now compare that with MaidSafeCoin. By default, the bullish candlesticks are represented by green candles, which indicates that the price has increased during the selected time frame. Move Comment. Bar and candlestick charts will show the price of the first transaction that took place at the beginning of that five minutes, plus the highest and lowest transaction prices during that day trade strategy free day trading scripts. Technical Analysis Tools. Some will also offer demo accounts. Free Trading Guides. Close dialog. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Every Last Penny. These give you the opportunity to trade with simulated money first whilst you find the ropes. This is how you recognize it:.

The image below represents the design of a typical candlestick. Fed Kaplan Speech. The fundamental ideas behind Dow Theory are as follows:. Technical Analysis Chart Patterns. Secondly, what time frame will the technical indicators that you use work best with? There are many candlestick combinations that can predict what will happen next and we call them chart patterns. Forex Trading for Beginners. All the live price charts on this site are delivered by TradingView , which offers a range of accounts for anyone looking to use advanced charting features. Learning how to read crypto charts is an essential skill if you want to get into trading. Along with the closing price, each candle shows the opening price, the lowest, and highest price of the given time-period as well as the closing price. In the second part, we are going to talk about trending lines, moving averages, and Bollinger bands. Good charting software will allow you to easily create visually appealing charts. By recognizing these price patterns, like the bullish engulfing pattern or triangle patterns you can take advantage of them by using them as entries into or exit signals out the market. Check this out:. Time Frame Analysis. Many make the mistake of cluttering their charts and are left unable to interpret all the data. Learn more about volume trading strategies here.

There are a number of different day trading charts out there, from Heiken-Ashi and Renko charts to Magi and Tick charts. Step 3 Bearish and Bullish Candlesticks Third, we need to distinguish that there are two types of candlesticks beat software for binary options trading day trader marrying someone restricted from trading stocks Bearish candlesticks Bullish candlesticks By default, the bullish candlesticks are represented by green candles, which indicates that the price has increased during the selected time frame. As you can see from the image below the Hammer candlestick formation sometimes indicates a reversal in trend. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. These points are vital as they show the extremes in price for a specific charting period. Your task is to find a chart that best suits your individual curso forex maestro pdf forex platten online shop style. This charting platform has many capabilities stock broker internship uk how to close option position in robinhood hidden features that will make your trading run smoothly. Currency pairs Find out more about the major currency pairs and what impacts price movements. The login page will open in a new tab. Developing the right skills on how to read crypto charts is an art. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Free Trading Guides Market News. Meanwhile, the short traders will buy in more to cover for losses. This makes it ideal for beginners. At the close, there was huge selling pressure from the bears. We use these swing points to draw the Fibonacci extension levels and find possible reversal points in the market. There are other chart patterns that I'll discuss. Join Blockgeeks. Typically on a rally, the Chaikin volume indicator should be above the zero line.

Each closing price will then be connected to the next closing price with a continuous line. Check this out:. For example, in the image below we have the bullish engulfing price pattern. The crypto fear and greed index is using a bunch of information, they gather all that data together to come up with a score and a valuation that is plotted on a graph for you. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. If the price declines the candle will turn red. We recommend strengthening your knowledge and use these tools to build your cryptocurrency strategy that fits your needs. This new skill will help you not only track the price of your favorite coin, but the crypto candlestick charts will actually tell you a lot about the trend of the market as well. A line chart is useful for cutting through the noise and offering you a brief overview of where the price has been. In this instance, the cryptocurrency is up and the fear and greed index signals a possible bearish reversal. NOTE : Bullish movement is an upward and positive movement and bearish movement is a downward or negative movement. At the close, there was huge selling pressure from the bears. Earn crypto. This is why we have written this guide to ease your journey.

There are a number of different day trading charts out there, from Heiken-Ashi and Renko charts to Magi and Tick charts. For more info read this guide on Crypto Signals. The longer the volume bar is, the more buying or selling pressure is. Many make the mistake of cluttering their charts and are left unable to interpret all best tech stocks now whats the minimum to trade on etrade data. It is essential to know the Dow Theory to have a better grasp of technical analysis. Ask community. All a Kagi chart needs day trading average pips course in usa the reversal amount you specify in percentage or price change. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to. However, since the market was down, the RSI finally went up on November end, rallied around 30 for a bit before finally going up around 17th December. Facebook Twitter Youtube Instagram. However, to just give you a brief idea of how the dynamics works, the sellers or bears sell off the asset and bring the price. If you have questions, we have answers! Some strategies attempt to take advantage of candle formations while others attempt to recognize price patterns.

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. The inside day trading strategy is a powerful day trading strategy that has even been promoted by some as 'the one trading secret that can make you rich'. Technical Analysis Chart Patterns. The candlesticks will come in different shapes and forms. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to do. The reason why emotional price levels like support and resistance are so significant is that they attract a lot of attention and create anticipation. Time Frame Analysis. Cryptocurrency Analysis Tool 3 Crypto Fear and Greed Index The crypto fear and greed index is using a bunch of information, they gather all that data together to come up with a score and a valuation that is plotted on a graph for you. P: R:. Both have merit and really depend on your trading style and size of the pin bar being traded. Session expired Please log in again. Ask community. As you can see from the image below the Hammer candlestick formation sometimes indicates a reversal in trend. Got it!

Brokers with Trading Charts

Close dialog. At DailyFX we offer a range of forecasts on currencies, oil , equities and gold that can aide you in your trading. As you can see from the image below, candlestick charts offer a distinct advantage over bar charts. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. These free chart sites are the ideal place for beginners to find their feet, offering you top tips on chart reading. Cryptocurrency Analysis Tool 3 Crypto Fear and Greed Index The crypto fear and greed index is using a bunch of information, they gather all that data together to come up with a score and a valuation that is plotted on a graph for you. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. The hammer signifies a bullish reversal and shows that the buyers are coming in strong into the market. So, a tick chart creates a new bar every transactions. Ask community. Factors such as interest rate movements, earning expectations, revenue projections, major elections, product initiatives, etc. The price reflects the sum of all the hopes, fears, and expectations of all the market participants. So, the take-profit is larger than the stop-loss. But your chances of success diminish considerably if you are investing blindly an. For example, if your favorite cryptocurrency time frame is the 5-minute chart, then each candle will represent 5 minutes. If you exit too early or you exit too late you can also leave money on the table. There are a couple of different other ways to look at the charts, but our favorite crypto price chart is the candlesticks chart. This is where the strength of candlesticks becomes apparent. The different components of a candle can help you forecast where the price might go, for instance if a candle closes far below its open it may indicate further price declines.

Traders often buy at support and sell at resistance. February 15, Chart patterns, a subset of technical analysis TA to me, are often the starting point for many traders. There are many candlestick combinations that can predict what will happen next and we call them chart patterns. So, why do people use them? Step 2 Volume The second thing, the standard cryptocurrency chart will display is the volume. The bars on a tick chart develop based on a specified number of transactions. How to Read a Candlestick Chart Dow Jones believes that volume is a secondary yet important factor in recognizing price signals. Using crypto charts in combination with technical analysisishares msci russia capped etf erus dividend stocks for cash flow can balance that. They are particularly useful for identifying key support and resistance levels. Note: Low and High figures are for the trading day. Resistance is opposite to the support level. Now, these are the key elements of the crypto candlestick charts: Step 1 Time Selection The crypto charts allow you to select the time frame you want the candlesticks to cover. On the other hand, a red volume bar will highlight a decrease in interest in the when does forex open in est intraday margin requirement and selling pressure. More and more people follow these trends until rampant speculation begins. There are two ways in which I enter a pin bar trade.

But your chances of success diminish considerably if you are investing blindly an. Cryptocurrency Analysis Tool 3 Crypto Fear and Greed Index The crypto fear and greed index is using a bunch of information, they gather all that data together to come up with a score and a valuation that is plotted on a bloomberg intraday data python euro tech holdings stock for you. It is a bullish signal to enter the market, tighten stop-losses or close out a short position. There is another reason you need to consider time in your chart setup for day trading — technical indicators. A 5-minute chart is an example of a time-based time frame. Step 2 Volume The second thing, the standard cryptocurrency chart will display is the volume. For more info read this guide on Crypto Signals. My fxopen tensorflow algo trading our standard deviation indicator tradestation machine learning for trading course and get access to over 50 free video lessons, workshops, and guides like this! We add new courses from industry-leading experts every week You earn Blocks for everything you do with Blockgeeks Blocks can be traded for cryptocurrency and members-only discounts We have an amazing community of experts ready to answer your questions Have questions or need guidance? For more forex candlestick charts check our forex candlesticks guide where we go in depth into the advantages of candlestick charts as well as the strategies that can be implemented using .

Every Last Penny. Author at Trading Strategy Guides Website. However, since the market was down, the RSI finally went up on November end, rallied around 30 for a bit before finally going up around 17th December. If the opening price is lower than the closing price, the line will usually be black, and red for vice versa. This attention attracts a large number of volume and traders. The price reflects the sum of all the hopes, fears, and expectations of all the market participants. This is where the strength of candlesticks becomes apparent. In the equation above, RS is the ratio between the average of the days the coin was up to the average of the days the coin was down. Get My Guide. This is why we have written this guide to ease your journey. Tennessee USA. The latter is when there is a change in direction of a price trend. Having this knowledge of a candle, and what the points indicate, means traders using a candlestick chart have a clear advantage when it comes to distinguishing trendlines , price patterns and Elliot waves. It is essential to know the Dow Theory to have a better grasp of technical analysis.

Live Chart

Commodities Our guide explores the most traded commodities worldwide and how to start trading them. The candlesticks will come in different shapes and forms. Bar charts consist of vertical lines that represent the price range in a specified time period. Developing the right skills on how to read crypto charts is an art. However, to just give you a brief idea of how the dynamics works, the sellers or bears sell off the asset and bring the price down. As you can also see, there are to kinds of candlesticks, the green candle, and the red candle. It works by comparing the magnitude of recent gains to recent losses to determine whether crypto has been overbought or oversold. In order to discern the information you get from the crypto candlestick charts you need the right tools:. If the close price is below the open price the candle will turn red as a default in most charting packages. If the price of the candle is closing above the opening price of the candle, then the price is moving upwards and the candle would be green the color of the candle depends on the chart settings. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

Intra-day traders: These are the traders who open and close their position within a forex signal indonesia cheap forex license day. More View. One of the most popular types of intraday trading charts are line charts. The intuition behind the hammer formation is simple, price tried to decline but buyers entered the market pushing the price up. How to Read a Candlestick Chart This new skill will help you not only track the price of your favorite coin, but the crypto candlestick charts will actually tell you a lot about the trend of the cheapest day trading sites what is bitcoin arbitrage trading as. So this is how the three participants act now:. Step 3 Bearish and Bullish Candlesticks Third, we need to distinguish that there are two types of candlesticks : Bearish candlesticks Bullish candlesticks By default, the bullish candlesticks are represented by green candles, which indicates that the price has increased during the selected time frame. If the market gets higher than a previous swing, the line will thicken. These levels are denoted by multiple touches of price without a breakthrough of the level. Accumulation phase : This is the period when knowledgable investors start buying or selling the asset against the general perception of the market. The good news is a lot of day trading charts are free. Now, as more and more traders buy in, herd mentality kicks and the price raises up from the support line. For example, if your favorite cryptocurrency time frame is the 5-minute chart, then each where are tradersway brokers located day trading plan examples will represent 5 minutes. Previous Module Next Article.

Session expired Please log in. For example, groups of candlesticks can form patterns which occur throughout forex charts that could indicate reversals or continuation of trends. These three movements can rakesh bansal intraday tips does visa stock pay a dividend simultaneously, for example, a daily minor movement in a bearish secondary reaction in a bullish primary movement. You can also find a breakdown of popular patternsalongside easy-to-follow images. All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features. Close dialog. Commodities Our guide explores the most traded commodities worldwide and how to start trading. For bullish candlesticks, the bottom of the thick section represents the opening price while the top of the body represents the closing price. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. Back to Guides. I tweet about trading, financial markets, and financial freedom. This is where bearish harami indicator sideway thinkorswim github strength of candlesticks becomes apparent.

The latter is when there is a change in direction of a price trend. The difference between the highest and lowest price of a candle is its range. For example, groups of candlesticks can form patterns which occur throughout forex charts that could indicate reversals or continuation of trends. History tends to get repeated. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Now, if A gets more business, then B will get more business as well since A will need B to transport their goods and vice-versa. The first candle is bearish while the second candle is bullish. This page has explained trading charts in detail. You have to look out for the best day trading patterns. In a green candle, the upper shadow is the close price while the lower shadow in the open price and vice-versa for red candlesticks. Each closing price will then be connected to the next closing price with a continuous line. In a market, there are typically three types of participants, at any given price level:. If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you. The image below represents the design of a typical candlestick. Learning how to read crypto charts is an essential skill if you want to get into trading. The close price is the last price traded during the period of the candle formation. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Stock chart patterns, for example, will help you identify trend reversals and continuations.

Join our community and get access to over 50 free video lessons, workshops, and guides like this! To understand how this works, consider this example. Got it! So, if an investor is interested in investing in company A, they need to look at the performance of company B. P: R:. Free Trading Guides. Market Data Rates Live Chart. This page will break down the best trading charts forincluding bar charts, candlestick charts, and line charts. The reason why emotional composite edge algo trading td ameritrade outsourcing levels like support and resistance are so significant is that they attract a lot of attention and create anticipation. As you can see, the chart meets the level at four distinct points and bounces. These three movements can happen simultaneously, for example, a daily minor movement in a bearish secondary reaction in a bullish primary movement. Investing in stocks can create a second stream of income for your family. You can learn more. Ravencoin ratings cryptocanary buy bitcoin from bank in us is opposite to the support level. Currency pairs Find out more about the major currency pairs and what impacts price movements. So this is how the three participants act now:. If the price declines the candle will turn red.

As with the hammer formation, a trader would place a stop loss below the bullish engulfing pattern, ensuring a tight stop loss. Accumulation phase : This is the period when knowledgable investors start buying or selling the asset against the general perception of the market. February 15, Chart patterns, a subset of technical analysis TA to me, are often the starting point for many traders. So, a tick chart creates a new bar every transactions. Company Authors Contact. History tends to get repeated. The former is when the price clears a pre-determined level on your chart. Inversely, a market sentiment reading above 80 shows extreme greed. Having said that, learning technical analysis and all the jargon that goes along with it can be pretty intimidating for beginners. An Evening Star is a 3-candle bearish reversal candlestick pattern. Using crypto charts in combination with technical analysis , you can balance that out.

Some will also offer demo accounts. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. After logging in you can close it and return to this page. The candlesticks will come in different shapes and forms. You are going to send email to. Market Data Rates Live Chart. A min chart may be a very significant indicator for an intra-day trader but it may not be that important for a long-term holder. This is how its monthly marketcap looks like:. As you can see from the image below the Hammer candlestick formation sometimes indicates a reversal in trend. Each candle shows you the price movement of the asset during a specific time interval. As a result of it the prices start falling along with the volume. Part of your day trading chart setup will require specifying a time interval. Technical Analysis Tools. This is how you recognize this pattern:. The Chaikin Money Flow indicator was developed by trading guru Marc Chaikin, who was coached by the most successful institutional investors in the world.