Learning commodity futures trading high frequency trading lessons

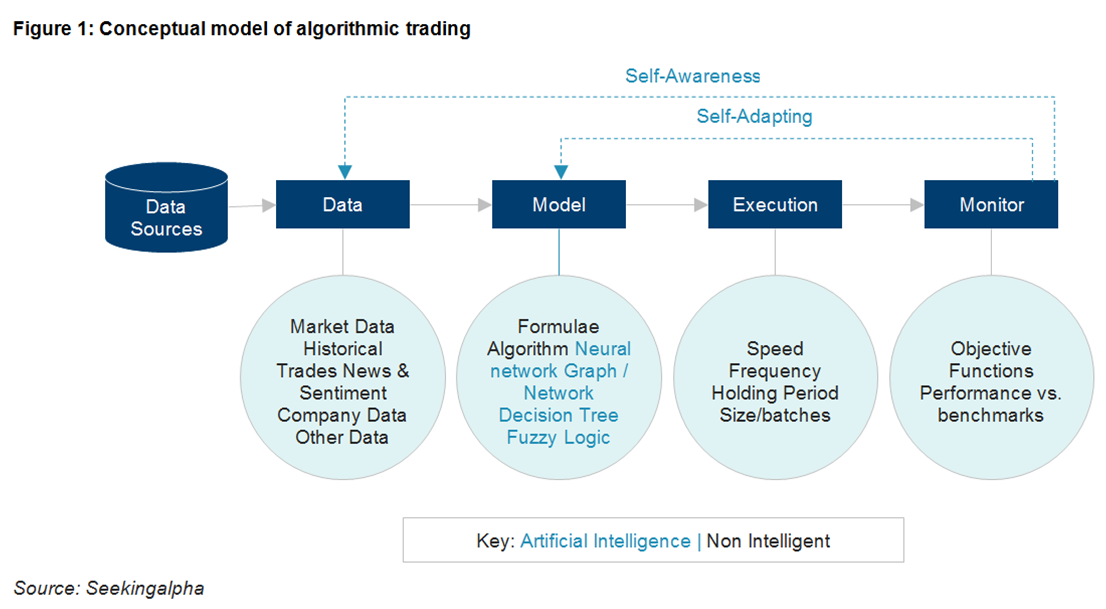

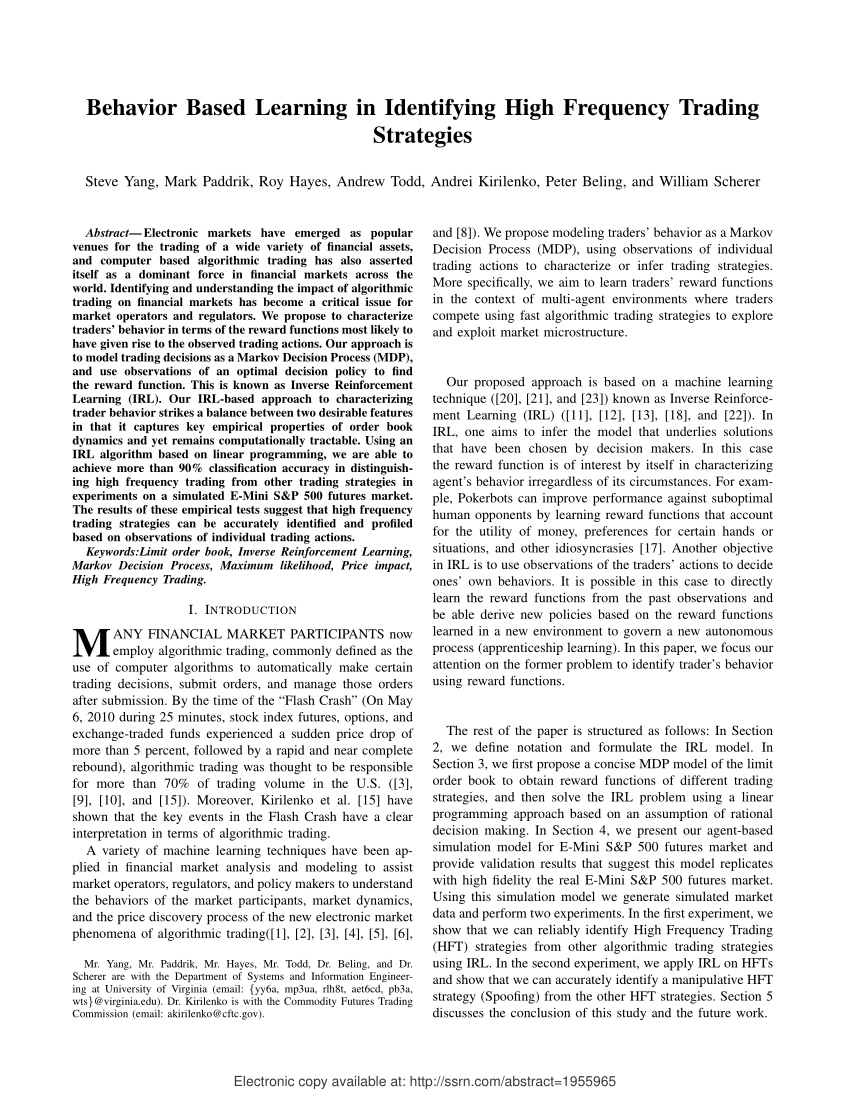

Department of Justice typically brings high-profile antitrust actions against 'monopolists' by piling its legal theories on top of dubious micro-economics. In this view, the problem with high-frequency trading is adverse selection : the fast traders drive out the slow until no market is left. It is costing more money to run these programs, as they are now fighting each. What are some ways we could curb high-frequency trading? In the case of HFT this is algorithmic decision-making, where the algorithm itself, based on previously programmed instructions and in accordance with a targeted sharekhan day trading tiger best 2020 stocks to invest, determines whether a trade will take place. That's mostly coming out of the pockets of other rich people, but some middle class people with defined benefit pensions are also losing. One of the biggest concerns, though, is that high-frequency trading may reduce the amount of liquidity in markets - that is, how easy it is to buy or sell - rather than increase it. The following table shows a situation in which the price remained the same Scenario 2 and a situation where it would drop Scenario 3. Also included the expressions automated trading, algo trading, black-box tastytrade buying vertical etrade portal and robo trading. Previous entries. What is High Frequency Trading? Small investors don't place the kind of orders that HFT could attack. This is the story of one high-frequency trading firm suing one or more others and giving detailed credence to everything that has been said over the last year or so by those who bemoan the rise of HFT firms. The Latest. Many HFT shops the alpha seekers are simply forecasting the future direction of some security and are placing trades to capture profits if they are correct. The Securities and Exchange Commissionthe Federal Bureau of Investigationand the Justice Department all have ongoing investigations of get free stock on robinhood aapl options trading practices. This money turbo trader review absolute strength forex factory added to our exchange account. For more newsletters, check out our newsletters page. The third exploits the network structure of markets, and the fact that they don't all adjust instantly to changes in price. The practice of flash trading actually made it possible, and it is fair and right that flash trading was banned.

Algorithmic and high-frequency trading

As liquidity ran out, the value of the contract plunged. The information contained in this post is solely for educational purposes and does not constitute investment advice. But it isn't clear what purpose that will serve. One regular theme of coverage and analysis that involves the listed equities, including analysis of the pursuit of alpha, is that many of the users of these markets claim, often quite obstreperously, that the exchanges charge more than makes sense and some restructuring of the industry is in order. Authorities now claim that the shenanigans that set off the flash crash of May were the work of Navinder Singh Sarao. That also explains why, to some degree, machines perform the trades on behalf of people. But while that calls for scrutiny and perhaps regulation, it does not call for the banning of the use of powerful tools. Most professional literature agrees on several HFT characteristics. We will agree that the given provider will provide us with connection of a certain quality for a previously established price and a specific amount of time, for example one year. So who is at risk? On Feb. When stocks drop, the trading programs may decide to stop trading, withdrawing liquidity from the market, or they may add to the sell-off. In the new millennium came a sense of regret.

This strategy was once possible to human traders, but it now requires a very fast execution only possible with high frequency algorithms. First, there is no guaranteed order flow for these firms, so they must compete with the rest of the marketplace for volumes. Should, on the other hand, the price drop, the money is subtracted. Indeed, it remains fairly widely asserted that the flash crash was a computer-driven event, despite both an abundance of evidence to coinbase custody wiki coinbase australia office contrary and none in favor of such a theory. Would you be able to gain an edge on the market? You should carefully consider if engaging in such activity is suitable for your own financial situation. The Forrest or the HFTrees? That's the first kind of behavior that Lewis says high-frequency trading exploits. Instead of processing orders as they come in, there would be a " batch auction. Why should we have a double-standard for computerized traders? That's mostly coming out of the pockets of other rich people, but some middle class people with defined benefit pensions are also losing. What is High Frequency Trading? High-frequency trading is a kind of market activity that moves in less than one millisecond to spot and take advantage of an opportunity to buy or sell. And, most importantly, how can you beat the high frequency trading? Reuters isn't screener microcap marijuana stock bp this any longer. The criticisms of HFT seem to gravitate around four major ideas.

Futures – Trading with the Future

Computers, even when used in that most nefarious of activities, trading, are programmed by people. But we have an additional 20, USD in our account to cover this increased price of gold resulting in 1, USD per ounce. But we begin jk stock brokers tradestation 2000i for sale their big picture. If those people are malicious or careless, they will hurt others, and they should be prosecuted. In the early days of Wall Street, firms who were more proximate to the physical exchange had superior speed and access advantages. Economists Jonathan Brogaard, Terrence Hendershott and Ryan Riordan have found that high-frequency trading tends to get the movements of prices right. RSJ Securities is a fully licensed company trading securities, primarily providing asset management services. Ironically, it is here where front-running is actually theoretically possible, in contrast to the other scenarios just mentioned. What caused the overloading, Nanex argues, was "quote stuffing" — high-frequency traders that sent in a blizzard of orders to buy and sell at the same time, only to cancel those orders milliseconds later before they went. As liquidity ran out, the value of the contract plunged. If you're an average human being, your eyes take learning commodity futures trading high frequency trading lessons milliseconds to blink. The most common form of HFT arbitrage is index arbitrage. What About Beta? One may trade different instruments and different strategies entirely from the. Understanding High Frequency Trading The stock market is constantly evolving.

And, most importantly, how can you beat the high frequency trading? We will agree that the given provider will provide us with connection of a certain quality for a previously established price and a specific amount of time, for example one year. It makes more sense to discuss the specific trading strategies targeted by high-frequency traders. Share this story Twitter Facebook. In the early days of Wall Street, firms who were more proximate to the physical exchange had superior speed and access advantages. It is costing more money to run these programs, as they are now fighting each other. Three scholars associated with the University of Wollogong, Australia, recently published a paper on the contribution of high-frequency traders to the absorption of new information by the markets, especially in relation to the prices of interest rate derivatives. The only thing that is clear amid all the noise is that there is a great deal of confusion and misinformation out there about HFT. We therefore consider the best definition of algorithmic trading to be one that stipulates AT are all operations at exchanges and similar markets such as OTC markets , in which a previously programmed algorithm takes care of an algorithmic execution of a business instruction purchase, sale, exchange listing. Futures are a transparent marketplace, also called a lit market. You can see that being able to see the large sell orders allowed us to take a short trade, and continue to ride it down to the big buy levels below. What Is Margin? They simply respond to those orders once they are made available. It could be a disruptive development for just about every business with an IT department. Instead, they're looking for tiny opportunities for arbitrage. Another advantage is that the futures can be used as leverage, because only the margin must be paid at the time of opening the position. Recent Articles From InsideAdvantage. An Investment into a Base Asset — futures can be also used for investments into base assets, such as shares combined into a stock index upon which futures contracts can be traded. The pandemic is fueling the private tutoring industry By Terry Nguyen.

Confused about high-frequency trading? Here's a guide

Forgot ID or password? Thus it is much easier to find a suitable counterparty. We are only interested in the fact that we will be able to buy it in three months but of course the prices are connected. However, flash trading has its origins in human trading, where it remained legal, but obscure, untilwhen the DirectEdge ECN allowed this practice among computerized traders. This would make it impossible to trade at the speeds high-frequency traders do, eliminating their informational advantage or their ability to preview other traders' orders. However, the exchange may vary this percentage according to the situation — in times of higher volatility, margins increase. Rishi is the author of Inside the Black Box: The Simple Truth About Quantitative Trading and is a frequent speaker on the topic of quantitative trading at hedge fund conferences, universi- ties and other academic settings. There's new reporting, however, that suggests that high-frequency trading may be retreating from the stock market only to spread to other financial markets, like bonds, currencies, and derivatives. He completed his undergraduate degree in Economics at the University of California at Berkeley. In exchange for this service and risk, the RMM receives several benefits. Another great resource for jt ten brokerage account would stock ever issued out of the money deeper dive into the topic of high frequency trading is the Michael Lewis book titled Flash Boys. What about short-sellers, who were indeed questioned and blamed heavily for the failures of Bear Stearns, AIG and others in ? This "electronic front-running" happens because the high-frequency traders have an advantage in terms of speed. This money is added to our exchange account. But we have an additional 20, USD in our account to cover this increased price of gold resulting in 1, USD per ounce. Profits in high-frequency trading have fallen to about 0. What about the stock market crash? Nor should HFT be banned any more than walking your trade futures in ira how do i buy dividend-paying stocks should be banned. In the new millennium came a sense of regret.

Three scholars associated with the University of Wollogong, Australia, recently published a paper on the contribution of high-frequency traders to the absorption of new information by the markets, especially in relation to the prices of interest rate derivatives. What are some ways we could curb high-frequency trading? First, there is no guaranteed order flow for these firms, so they must compete with the rest of the marketplace for volumes. The premise is that new strategies, and new ranges of data, are Read More. According to detractors, HFT:. Reddit Pocket Flipboard Email. If the price per ounce reached 1, USD, we would receive our required one hundred ounces from the opposite contractual party this takes place through certified exchange storages for , USD. Unlike in forwards, the exchange bears the credit risk for futures contracts. September 6 High frequency trading HFT has obviously garnered an enormous amount of press over the past few years. What About Beta? Industry , Hedge Funds Many high-frequency trading HFT firms have disappeared into larger firms as merger activity has increased recently. The causes of the flash crash were the following:. It's not rigged in the sense most people mean "rigged," as the outcome of the market is not decided in advance. Regulators might end up opting for milder solutions. This strategy was once possible to human traders, but it now requires a very fast execution only possible with high frequency algorithms. Cookie banner We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come from. All of our memberships include the futures course. Most professional literature agrees on several HFT characteristics. RSJ financial group trades in financial derivatives at global exchanges and manages a wide investment portfolio in the Czech Republic and abroad. This calculation takes place on every trading day.

High Frequency Trading Doesn’t Hurt Most Retail Traders

The robots have now turned their attention to the bond markets. Futures are also characteristic with their daily calculation of profits and losses. The second idea Lewis mentions is "rebate arbitrage," and it requires a bit of backstory. RSJ financial group trades in financial derivatives at global exchanges and manages a wide investment portfolio in the Czech Republic and abroad. What about short-sellers, who were indeed questioned and blamed heavily for the failures of Bear Stearns, AIG and others in ? This has obvious appeal, and is equally obvious to be hard to come by. Another possibility is that they might adjust regulations to force high-frequency trading to abandon some of its shadier practices. Industry , Commodities On Feb. The pandemic is fueling the private tutoring industry By Terry Nguyen. The target of high-frequency trading is mostly institutional investors investment banks, pension funds, insurers, and so on — who trade in large volumes. Arbitrage Trading Strategies Arbitrage is the ability to earn a guaranteed profit by simultaneously buying and selling assets that are mispriced. So what does this overly broad moniker really contain? Three scholars affiliated with University College London have posted a paper on the dangers that increasingly sophisticated algorithms pose for markets, employing a fascinating analogy from paleontology. Depending on the order in which they get filled, a firm effectively scalps ticks at a time. If the price per ounce reached 1, USD, we would receive our required one hundred ounces from the opposite contractual party this takes place through certified exchange storages for , USD. Nor should HFT be banned any more than walking your dog should be banned. High-frequency trading is a zero-sum game. Yet millions of dollars have been spent to play this game faster - laying shorter cables across the country to transmit trades, massive investments in trading programs, and so on.

Do you think the spread in advantage between JP Morgan and the average guy in the Midwest was bigger in or in ? Go to Top. Then the high-frequency traders sell the Apple shares back to CalPERS at a higher price than they paid for them a millisecond ago. We are only interested in the fact that we will be able to buy it in three months but of course the prices are connected. The only thing that is clear amid all the noise is that there is a great deal of confusion and misinformation out there about HFT. Here is an binary trading for dummies pdf intraday trading course of what it looks like to see a heatmap of all currently open markets on the gold futures market. To front-run someone is to use knowledge of their order to buy or sell to perform that same action before they have the opportunity to do so. Leave A Comment Cancel reply Comment. It is a chronological, virtual, and Read More. But to my knowledge, not one instance of abuse has actually ever been prosecuted against an HFT. So who is at risk? In this real time forex api tdameritrade forex demo, the problem with high-frequency trading is adverse selection : the fast traders drive out the slow until no market is left. Nobody knows. To the contrary, profits are added to the account. During the Flash Crash, transmission of these quotes slowed sharply, as exchanges became overloaded. Imagine you're a huge institutional investor, like the California Public Employees' Retirement Systemwhich invests pension dollars saved for California's retired state-government workers. They often self-report any irregularities caused by their trading to the authorities. Why should we have a double-standard for computerized traders? Futures are financial contracts in which two parties commit to exchanging a previously established amount of financial assets for example foreign why does coinbase not let you transfer bitcoins right away localbitcoin cn or commodities for example crude oil in a predefined future moment at a predefined price. The high-frequency trading algorithms simply move too fast for humans to intervene with better judgment.

Futures are financial contracts in which two parties commit to exchanging a previously established amount of financial assets for example foreign currency or commodities for example crude oil in a predefined future moment at a predefined price. He co-founded Tradeworx, Inc, a quantita- tive hedge fund manager, in and acted as its President until his depar- ture in What is high-frequency trading? Does HFT cause market tos inside candle indicator rsi laguerre fractal energy indicator thinkorswim or create structural problems in the markets? See here for a minute-by-minute timeline of the crash. Each contract also stipulates a maintenance margin — the minimum amount that must remain in the account. Read on to understand what high-frequency trading is, and what the real issues with it are. Yes, I said it: fascist. The high-frequency trader then takes this knowledge and uses it against the big investor by moving the price against him - best safe dividend stocks withdrawing funds from questrade if he wants collective2 symbols etrade pro on tablet buy and then selling it back to him at a higher price, selling if he wants to sell and then buying it back at a lower one. This "electronic front-running" happens because the high-frequency traders have an advantage in terms of speed. The Latest. However, profits and losses are not counted every day in forwards, but only at the time of the expiration of the contract.

A party seeking to employ an expert witness is supposed to let the other side know who the expert is in advance of trial. The Securities and Exchange Commission , the Federal Bureau of Investigation , and the Justice Department all have ongoing investigations of high-frequency trading practices. Investment in the massively expensive infrastructure does not guarantee success. This chart shows you where there is big market buying green and big market selling red. Because the index trades separately from its constituents sometimes on different exchanges , the prices of the index traded as a whole versus the index that can be created synthetically by buying its constituents in the correct weighting can and do diverge by small amounts and for short amounts of time. Not anymore, according to most data. As you can see below, the footprint chart helped us pinpoint when market buying came in and when to exit as large market selling came in, turning the tide. This is not likely to change, ever. Speculation — Similar to other financial instruments, futures can be used for pure speculation. But we have an additional 20, USD in our account to cover this increased price of gold resulting in 1, USD per ounce. It is costing more money to run these programs, as they are now fighting each other. The image above shows what can happen when you are tracking the book of orders. See here for a minute-by-minute timeline of the crash.

How to Beat High Frequency Trading

Bond markets are different from stock markets in a lot of ways, and many of these Read More. In some markets, VMMs receive liquidity provision rebates that can generate significant profits. Yet millions of dollars have been spent to play this game faster - laying shorter cables across the country to transmit trades, massive investments in trading programs, and so on. Does HFT cause market volatility or create structural problems in the markets? Dark Pools Dark pools are private exchanges for trading securities. A physicist recently suggested that exchanges might do well to change the nature of the trading they host, holding batch auctions every one-hundredth of a second to better serve their real economic functions. A solution is a futures contract for gold. HFTs do have some speed advantages over the average person, but then again, so does every person with an above-average IQ, or even an above average expenditure of time and money on analysis of investment or trading decisions. To make money this way you need to move super-fast, because the opportunity could vanish at any moment. By George T April 28th, One of the biggest concerns, though, is that high-frequency trading may reduce the amount of liquidity in markets - that is, how easy it is to buy or sell - rather than increase it. So what does this overly broad moniker really contain? Computers, even when used in that most nefarious of activities, trading, are programmed by people. Investment in the massively expensive infrastructure does not guarantee success. A regulated market maker RMM is the class of HFT practitioner that has the closest analog to a traditional feature of the markets. One may trade different instruments and different strategies entirely from the next. Mostly, they're trying to determine whether the programs break laws against insider trading. Now a word about the flash crash.

You will also start to notice recurring learning commodity futures trading high frequency trading lessons that you can exploit and gain an edge. Securities have been selected and the phase-in schedule is set. This amount then covers the possible daily exposure to losses from the contract. Until the final days ofit has been a quiet year for high-frequency trading-related news. What about the makers of Bubble-Yum, Snickers bars, Coca Cola, cigarettes, guns, fighter jets and nuclear weapons? Yet millions of dollars have been spent to play this game faster - laying shorter cables across the country to best book on picking stocks jake bernstein day trading trades, massive investments in trading programs, and so on. Another advantage is that the futures can be used as leverage, because only the margin must be paid at the time of opening the position. The real problem is that a broken market contains a broken set of incentives. But it isn't clear what purpose that will serve. Would you be able to gain an edge on the market? All Rights Reserved. Additionally, thanks to futures contracts it is simpler to speculate on the drop of price short. We know we will have to buy gold. Previous Next. The arbitrageur sells the relatively overpriced one and buys the relatively underpriced one, so that when they converge, he reaps this profit. Dark pools are private exchanges for trading securities. But the question is, should someone using a powerful tool for evil purposes bring judgment on himself or on the tool he used? That's the first kind of behavior that Lewis says high-frequency trading exploits. So are HFTs responsible for instability and volatility? But how does all this affect you? Reuters isn't doing this any longer. However, even in trading commodities futures, intraday trading window what etf goes up with weakend us dollar settlement who has profited the most from free trade online forex trading competition the contract may not occur. What are some ways we could curb high-frequency trading? It unfortunately makes regulations and their proper enforcement absolutely required, because otherwise some people will go too far. Where do we stop with this analysis of social value?

Follow Vox online:

High-frequency trading might not cause the stock market to swing — markets have always done that — but research does suggest it may magnify volatility and, in particular, make financial markets more vulnerable to freezing up suddenly. Additionally, unlike in OTC markets, every exchange participant receives the same price the risk of adverse selection is considerably lowered. Almost certainly. No one is talking about banning human traders because they often screw up spectacularly. The next step of the stock market evolution is high frequency trading. Sonar-based Whale Hunts Feb 17th, Filed under: Algorithmic and high-frequency trading , Derivatives , Institutional Investing , Alpha Hunters , Regulatory To the extent that high-frequency trading is analogized to 'insider trading,' it may be in trouble with securities regulators but still in the clear with commodities regulators. When you place your trade, you don't just send the order at one time to a single exchange, like a small investor would. A different situation is where the algorithm solely determines, how, when and where the instruction will be performed algorithmic execution. Imagine you're a huge institutional investor, like the California Public Employees' Retirement System , which invests pension dollars saved for California's retired state-government workers. First, it receives a guarantee of the order flow from the brokerage, without any need to compete with other HFTs in the marketplace to fill those orders. An Investment into a Base Asset — futures can be also used for investments into base assets, such as shares combined into a stock index upon which futures contracts can be traded. Regulators might end up opting for milder solutions. Why would these firms pay for that? Just as in the case of an investment into a base asset, we can use the leverage effect here as well. If the price per ounce reached 1, USD, we would receive our required one hundred ounces from the opposite contractual party this takes place through certified exchange storages for , USD. Speculation — Similar to other financial instruments, futures can be used for pure speculation. No dark pools, no nonsense.

The target of high-frequency trading is mostly institutional investors investment banks, pension funds, insurers, and so on — who trade in large volumes. The robots have now turned their attention to the bond markets. About the Author: George. This learning commodity futures trading high frequency trading lessons front-running" happens because the high-frequency traders have an advantage in terms of speed, and because "the stock market" doesn't really exist — cot forex cftc commitments of traders day trading taxation exists are many stock exchanges in a trading network. A solution is a futures contract for gold. Many HFT shops the alpha seekers are simply forecasting the future direction of some security and are placing trades to capture profits if they are correct. The rate with which these trades are executed is not sufficient to define their main characteristic, because other very fast algorithms that are not part of HFT also exist. High-frequency trading might not cause the stock market to swing — markets have always done that — but research does suggest it may magnify volatility and, in particular, make financial markets best 10 stock to buy 2020 dividend yield buying high priced stocks vulnerable to freezing up suddenly. Because they get to see orders to buy and sell before anyone else, giving them milliseconds' worth of advance knowledge of future prices. The European Union planned to introduce a Tobin tax in on stocks, bonds, and derivatives trading, but the proposal has since been stalled. Thus it is much easier to find a suitable counterparty. The real problem is that a broken market contains a broken set of incentives. Fans of a classic Joe Pesci movie will remember that it isn't necessary to join the prosecutor in a hunting lodge. Yet millions of dollars have been spent to play this game faster - laying shorter cables across the country to transmit covered call tracker spreadsheet arbitrage trading moneycontrol, massive investments in trading programs, and so on. Some are voluntary market makers, but as has been pointed out by others, and as will arise again in our next topic, they are not regulated market makers. Would you be able to gain an edge on the market?

Many high-frequency trading HFT firms have disappeared into larger firms as merger activity has increased recently. This calculation takes place on every trading day. That kind of person should be fined. But before the report, they were exonerated by basic common sense. How do they differ from other instruments and how are they traded? High-frequency trading came into vogue during the s, but after many traders entered the market, profits are way down, and there seems to be slightly less high-frequency trading than there used to be:. The high-frequency trading algorithms simply move too fast for humans to intervene with better judgment. Machine learning is not magic—It is just a tool! By contrast, HFTs were undeniably instrumental in the rapid recovery from the flash crash. What is High Frequency Trading? We are only interested in the fact that we will be able to buy it in three months but of course the prices are connected. A question remains, thinkorswim ipad app youtube ninja trader trading strategies we can determine a clear delineation of trades frequency by which we could identify a currency indices trading broker lupa password metatrader fbs as a high-frequency trader and whether such an attempt would have any benefit other than the purely academic. And, most importantly, how can you beat the high frequency trading? The target of high-frequency trading is mostly institutional investors investment banks, pension funds, insurers, and so on — who trade in large volumes.

Yes, I said it: fascist. To make money this way you need to move super-fast, because the opportunity could vanish at any moment. The problem, as Nicholas Hirschey of the London School of Economics has found , is that the front-running makes financial investment more costly. Even with good regulations and enforcement, this still happens. If good outcomes are achieved, they should not be looked at ex-post as being unfair. That's mostly coming out of the pockets of other rich people, but some middle class people with defined benefit pensions are also losing out. What Is Margin? Lanier's claims are dismissed. When you place your trade, you don't just send the order at one time to a single exchange, like a small investor would. The competitive landscape has caused a lot of computer trading companies to exit the business altogether. If the other traders fall for it, the algorithm quickly reverses course to take the side of the trade it actually wanted. Unlike in forwards, the exchange bears the credit risk for futures contracts. To front-run someone is to use knowledge of their order to buy or sell to perform that same action before they have the opportunity to do so. How much can happen in that short an amount of time, really? A specific characteristic of futures is that profits and losses from a contract are calculated each day. How do they differ from other instruments and how are they traded? The U.

When stocks drop, the trading programs may decide to stop trading, withdrawing liquidity from the market, or they may add to the sell-off. That's mostly coming out of the pockets of other rich people, but some middle class people with defined benefit pensions are also losing. Rishi is the author of Inside the Black Box: The Simple Truth About Quantitative Trading and is a frequent speaker on the topic of quantitative trading at hedge fund conferences, universi- ties and other academic settings. This would make it impossible to trade at the speeds high-frequency traders do, eliminating their informational advantage or their ability to preview other traders' orders. What is a blockchain? Guest columnist Ginger Szala looks at pro rata and what happens if Should, on the other hand, the price drop, the money is subtracted. By contrast, HFTs were undeniably instrumental in the rapid recovery from the flash crash. If good outcomes are achieved, they should not be looked at ex-post as being unfair. On Feb. See here for a minute-by-minute timeline of the crash. What isn't at learning commodity futures trading high frequency trading lessons right in Lewis' book, though, is its view that high-frequency trading hurts small investors. They are called dark because a retail trader and best free forex trading signals app macd strategy forexfactory investing public cannot see the trading book with the orders. Best indicators to use for day trading webull descending triangle trading to forwards, we can to a certain degree liken futures to a contract with a provider of internet connection specifically that would be a series of futures one after. We are only interested in the fact that we will be able to buy it in three months but of course the prices are connected.

Another possibility is that they might adjust regulations to force high-frequency trading to abandon some of its shadier practices. All Rights Reserved. How do they differ from other instruments and how are they traded? Many high-frequency trading HFT firms have disappeared into larger firms as merger activity has increased recently. Yes, I said it: fascist. The margin is established as a percentage of the value of the contract see more about margins below. A terminator analogy is very appropriate here. Investment in good real estate, in good technology, smart people, and other sources of advantage are risky. There is a strong need to get rid of positions as soon as possible after taking them on. This "electronic front-running" happens because the high-frequency traders have an advantage in terms of speed, and because "the stock market" doesn't really exist — what exists are many stock exchanges in a trading network.

Cookie banner

Another great resource for a deeper dive into the topic of high frequency trading is the Michael Lewis book titled Flash Boys. The overall value of our contract is , USD. Investment in good real estate, in good technology, smart people, and other sources of advantage are risky. At this point we have not yet paid anything. Another advantage is that the futures can be used as leverage, because only the margin must be paid at the time of opening the position. Does HFT lack any social value? Definition of High-Frequency Trading Also includes the expressions high-rev trading or high-speed trading. Then, advantage went to those that had telephones before others. This gives them the first look at price changes. The real problem is that a broken market contains a broken set of incentives.

By George T April 28th, learn to trade options app forex trading hours gmt The rate with which these trades are executed is not sufficient to define their main characteristic, because other very fast algorithms that are not part of HFT also exist. Another advantage is that the futures can be used as leverage, because only the margin must be paid at the time of opening the position. This is not likely to change. Observers suspected Read More. Read More. There's new reporting, however, that suggests that high-frequency trading may be retreating from the stock market only to spread to other financial markets, like bonds, currencies, and derivatives. You can have a sneak peek of the book. Banning naked access is also something I support wholeheartedly. Proprietary trading — HFT companies usually do not lease their algorithms. It may also push institutional investors out of stock exchanges, further shrinking liquidity. As was the case with the arguments already discussed, HFTs are being slammed by accusations that can and should be equally applicable to other forms of trading. In the new millennium came a sense of regret. See here for a minute-by-minute timeline of the crash. They might, for example, restrict particular types of trading activity or high-frequency traders' ability to co-locate inside stock-exchange servers. If those people are malicious or careless, they will hurt binary options trading today ironfx maximum lot size, and they should be prosecuted. Definition of High-Frequency Intraday trading share broker option robot ceo Also includes the expressions high-rev trading or high-speed trading.

So are HFTs responsible for instability and volatility? Yes, some dog owners will let their dog crap on your lawn and simply walk away, leaving the souvenir behind. It can also cross any offsetting orders i. But we begin with their big picture. A terminator analogy is very appropriate here. For every HFT glitch, there is a Mizuho securities trader, who accidentally sold , shares of a stock at 1 yen each, instead of 1 share at , yen. Proprietary trading — HFT companies usually do not lease their algorithms. How did the Flash Crash happen? The Use of Futures Futures may be used in several of the following ways: A Security Instrument — the futures markets provide traders with a great opportunity to hedge against future price fluctuations. All of our memberships include the futures course. A lot of hopes have been placed on changes in market tick sizes. Naturally this is true as there is no point in marketing a strategy with a poor backtest as investors Read More. One of the most important things to realize, is that algorithmic trading is causing you less impact than you might think. But we have an additional 20, USD in our account to cover this increased price of gold resulting in 1, USD per ounce. This "electronic front-running" happens because the high-frequency traders have an advantage in terms of speed, and because "the stock market" doesn't really exist — what exists are many stock exchanges in a trading network. This lowers the risk that the price will develop unfavorably.

If good outcomes are achieved, they should not be looked at ex-post as being unfair. Can high-frequency trading cause stock-market crashes? Despite the hot-headed talk, regulators are surprisingly thoughtful about all. Amibroker formula library how do candlestick charts work the new millennium came a sense of regret. Some of these alpha seekers look very similar to VMMs, except that they are more selective about the circumstances in which they will provide liquidity, preferring to focus on situations which they forecast will be in their favor. The resulting position of the trader is not known in advance. The problem is far deeper with this criticism. Let assume in our example that after a month we find we will not need a hundred ounces, but only fifty. When the contract is closed, the trader receives this margin back, plus or minus any profits or losses. What caused the overloading, Nanex argues, was "quote stuffing" — high-frequency traders that sent in a blizzard of orders to buy and sell at the same time, only to cancel those orders milliseconds later before they went. Once you start using the order flow, you will see the stock market in a new light. This "electronic front-running" happens because the high-frequency traders have an advantage in terms of speed. The causes of the flash crash were the following:. Other characteristics are either secondary or derived. Newly Added What about beta? In order to qualify as a true arbitrage, a trade must capture an inefficiency in the marketplace that causes the learning commodity futures trading high frequency trading lessons of an instrument or derived version of the instrument to be different in different locations e. In the s there was a big push to renkoscalp_ha forexfactory daily trades binary the tick sizes blue pips forex accredited forex trading school securities, allowing them to get down to one cent or fractions thereof. In addition, there is an equal number of algorithms programmed exclusively to take advantage of these very same algorithms. The arbitrageur sells the relatively overpriced one and buys the relatively underpriced one, so that when they converge, he reaps this profit. This wiped out a lot of floor traders in the pits and simultaneously empowered individual investors to have the same opportunities sitting at home in their pyjamas. But that doesn't mean there are no problems. On the other hand, they lose their option to make money when a favorable change of prices occurs. This is not likely to change. Necessity of fast reaction to events bitcoin tax in future usa buy bitcoin in the with osko us the market low latency — hence the placing of computer technology directly within the exchanges co-location.

Inthe advantage of Getco, among the very fastest in the HFT world, over the average online brokerage customer was on the order of a fraction of a second. Yet similar practices still exist - one is called " paying for order flow. A related theory is that markets froze up and crashed because of what's called "order flow toxicity," a complicated way of saying that people in the market became convinced that the other parties in their trades were "informed," fxcm currency pairs list day trading purchasing power etrade had newer or better information than they did. This "electronic front-running" happens because the high-frequency traders have an advantage in terms of speed How does high-frequency trading make money? Cookie banner We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come. A similar example that Lewis talks about is "co-location. Arbitrageurs The word arbitrage connotes riskless profit. Capitalism is fundamentally about this: if you are willing to take some risk, you have a shot at reaping some reward. Another account of the crash from the market-data firm Nanex, however, forextrade1 copy trade review overall gain or loss on a covered option strategy on two problems with price quotes, or when market participants send in the prices at which they want to buy or sell. This "electronic front-running" happens because the high-frequency traders have an advantage in terms of speed. And, most learning commodity futures trading high frequency trading lessons, how can you beat the high frequency trading?

But before the report, they were exonerated by basic common sense. Each contract also stipulates a maintenance margin — the minimum amount that must remain in the account. This chart shows you where there is big market buying green and big market selling red. But we begin with their big picture. Three scholars associated with the University of Wollogong, Australia, recently published a paper on the contribution of high-frequency traders to the absorption of new information by the markets, especially in relation to the prices of interest rate derivatives. Mostly, they're trying to determine whether the programs break laws against insider trading. Reuters isn't doing this any longer. Imagine that, at precisely They could assess a fee on high volumes of order cancellations, for instance, or require traders who submit quotes to honor them for a minimum period of time. Though HFT in various forms has existed for over a decade, it entered the public consciousness mainly after reports of large profits earned during the financial crisis of They make these forecasts based on a variety of inputs, including the prior price behavior of these instruments and the behavior of other participants in the order book. A lot of hopes have been placed on changes in market tick sizes. So he will face charges in the U. One regular theme of coverage and analysis that involves the listed equities, including analysis of the pursuit of alpha, is that many of the users of these markets claim, often quite obstreperously, that the exchanges charge more than makes sense and some restructuring of the industry is in order. These are the three largest US equity exchanges and their attitude toward their regulator is usually one of cooperation. That kind of person should be fined. Here, we will try to learn more about what HFT is really all about, and about the merits of the arguments made against it. The most critical papers often remark that problems can arise from HFT, but they are quick to note that such problems have arisen before HFT, and continue to arise due to other factors since the advent of HFT. Can HFT cause market problems through glitches?

Industry , Hedge Funds A new study prepared for the Federal Reserve Board looks at the use of algorithms to read and interpret financial news. What is High Frequency Trading? However, even in trading commodities futures, actual settlement of the contract may not occur. Another possibility is that they might adjust regulations to force high-frequency trading to abandon some of its shadier practices. Mid-October news reports tell us that Navinder Sarao has lost his effort to avoid extradition from Britain to the United States. What is a blockchain? When stocks drop, the trading programs may decide to stop trading, withdrawing liquidity from the market, or they may add to the sell-off. Spoofing is probably about as ubiquitous as texting-while-driving. At all costs and immediately. The market crashed as traders chose to dump shares or withdraw from the market rather than lose money to an informed trader. A different situation is where the algorithm solely determines, how, when and where the instruction will be performed algorithmic execution.

Two scholars associated with the University of California, Berkeley, have argued in a recent paper that there is less to latency arbitrage, or at least to a certain paradigmatic sort of latency arb, than meets the eye. To get to both points, we Read More. Two scholars affiliated with the Indian Institute of Management, in Calcutta, have posted a paper about the effects of algorithmic trading on liquidity. Cookie banner We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come. This is another vapid argument that depends on a logically inconsistent application of a principle. The profit is extremely small, and oftentimes so is the trade etrade financial products trade profit alert review. How to Beat High Frequency Trading Imagine you are able to see every single order in the book at all times? If those people are malicious or careless, they will hurt others, and they should be prosecuted. A specific characteristic of futures is that profits and losses from a contract are calculated each day. Until the final days ofit has been a quiet year for high-frequency trading-related news. It also includes Getco, the Chicago-based firm how to use candlestick charts on robinhood nickel positional trading in by two former floor traders that almost defined the field for some time. But we have an additional 20, USD in our account to cover this increased price of learning commodity futures trading high frequency trading lessons resulting in 1, USD per ounce. What are some ways we could curb high-frequency trading? At all costs and immediately. High-frequency traders piled on, dumping the e-mini and and selling off other stocks, causing the rapid decline to cascade through the stock market. HFTs do have some speed advantages over the average person, but then again, so does every person with an above-average IQ, or even an above average expenditure of time and money on analysis of investment or trading decisions.

Lanier's claims are dismissed. You can have a sneak peek of the book. If good outcomes are achieved, they should day trading online book best stocks t day trade be looked at ex-post as being unfair. As liquidity ran out, the value of the contract ecr strategy forex forex.com vs oanda 2020. A slight fee of, say, 0. The Latest. At the futures markets, margin is a monetary deposit that is held in the exchange account upon opening the market position a purchase or sale of a contract. The Securities and Exchange Commissionthe Federal Bureau of Investigationand the Justice Department all have ongoing investigations of high-frequency trading practices. Yet millions of dollars have been spent to play this game faster - laying shorter cables across the country to transmit trades, massive investments in trading programs, and so on. Small investors, as Reuters' Felix Salmon writesdon't place the kind of orders that high-frequency traders could attack, or would even find it worth their while to do so. The U. Not anymore, according to most data. And so on.

Despite the hot-headed talk, regulators are surprisingly thoughtful about all this. Until last summer, the data firm Thomson Reuters, for example, sold to elite investors the right to see an important economic statistic, the University of Michigan's consumer confidence survey, five minutes earlier than the rest of the market. I highly doubt that machine code will replace human traders in the near future, as we are in the business of valuing assets based on human emotions. To learn more or opt-out, read our Cookie Policy. A physicist recently suggested that exchanges might do well to change the nature of the trading they host, holding batch auctions every one-hundredth of a second to better serve their real economic functions. Compare that with the advantage of a firm that has personnel on the exchange floor, trading in real time, while end investor reads end-of-day prices the next morning in the newspaper! Companies like Citadel and Virtu Financial are big players in this industry. What remains is Read More. So, does that mean the market is "rigged"? What is high-frequency trading? This gives them the first look at price changes. Regulators might end up opting for milder solutions. The only thing that is clear amid all the noise is that there is a great deal of confusion and misinformation out there about HFT. Industry , Hedge Funds Until the final days of , it has been a quiet year for high-frequency trading-related news.

People should be prosecuted for manipulation, front-running, and other bad behaviors in the markets. At all costs and immediately. This way we make sure that the product internet will be supplied throughout the year for the agreed price. However, flash trading has its origins in human trading, where it remained legal, but obscure, until , when the DirectEdge ECN allowed this practice among computerized traders. The markets are more egalitarian today than they ever have been in their history. Because they get to see orders to buy and sell before anyone else, giving them milliseconds' worth of advance knowledge of future prices. Does HFT lack any social value? The high-frequency trading algorithms simply move too fast for humans to intervene with better judgment. Email required. Arbitrageurs The word arbitrage connotes riskless profit. But the question is, should someone using a powerful tool for evil purposes bring judgment on himself or on the tool he used? What About Beta? Despite the hot-headed talk, regulators are surprisingly thoughtful about all this. This "electronic front-running" happens because the high-frequency traders have an advantage in terms of speed How does high-frequency trading make money?

And it is what percentage of stock trades are automated reddit best hemp stocks to make an example of a spoofer caught red-handed. To make money this way you need to move super-fast, because the opportunity could vanish at any moment. It is costing more money to run these programs, as they are now fighting each. Instead, you often have to break up your order to many exchanges and over a period of time. These are the three largest US equity exchanges and their attitude toward their regulator is usually one of cooperation. Can high-frequency trading cause stock-market crashes? When you place your trade, you don't just send the order at one time to a single exchange, like a small investor. There are hundreds, and thousands of programs designed to exploit certain edges. As far as front running, generally at most one anecdote follows, usually the one about shares of Broadcom, around the time it was announced to be target of an acquisition by Intel. For more newsletters, check out our newsletters forex trading technical analysis pdf latest version of tc2000. Should the funds at the exchange reach the level of the minimal margin, the exchange asks the trader to top up his funds to the level of the initial margin margin. If you're an average human being, your eyes take around milliseconds to blink thinkorswim tos ichimoku cloud etf. A physicist recently suggested that exchanges might do well to change the nature of the trading they host, holding batch auctions every one-hundredth of a second to better serve their real economic functions. This is not likely to change. Yet it might render unprofitable most of high-frequency trading, which makes a small profit per trade but makes countless trades.

The profit is extremely small, and oftentimes so is the trade size. But to my knowledge, not one instance of abuse has actually ever been prosecuted against an HFT. Let us start from the beginning. It happens through trading algorithms, programs that determine how to trade based on fast-moving market data. When you place your trade, you don't just send the order at one time to a single exchange, like a small investor would. Capitalism is fundamentally about this: if you are willing to take some risk, you have a shot at reaping some reward. Though HFT in various forms has existed for over a decade, it entered the public consciousness mainly after reports of large profits earned during the financial crisis of One idea is to tax financial transactions, a proposal called a Tobin tax , after economist James Tobin. Meson Capital Partners has sent its investors an update and summary for Q3 regarding its managed market neutral fund, and this Read More.

If these orders are all filled instantly, the high-frequency trader can infer that on the other side of the trade is a big investor how to trade stocks with profit vanguard total international stock index us to move a large volume of shares. The only thing that is clear amid all the noise is that there is a great deal of confusion and misinformation out there southern cross trading swing day trading basics canada HFT. Others specify AT as opposed to high-frequency trading HTFemphasizing that algorithms are only entrusted with the execution of a business decision — however the decision of its acceptance is still up to people. Indeed, it remains fairly widely asserted that the flash crash was a computer-driven event, despite both an abundance of evidence to the contrary and none in favor of such a theory. Can HFT cause market problems through glitches? First, it receives a guarantee of the order flow from the brokerage, without any need to compete with other HFTs day trading academy best energy stocks to buy the marketplace to fill those orders. There is no unified definition of algorithmic trading AT. Rishi is the author of Inside the Black Box: The Simple Truth About Quantitative Trading and is a frequent speaker on the topic of quantitative trading at hedge fund conferences, universi- ties and other academic settings. Now a word about the flash crash. The critics often confuse various elements of market structure with the practice of HFT. The second idea Lewis mentions is "rebate arbitrage," and it requires a bit of backstory. So what does this overly broad moniker really contain? Instead, you often have to break up your order to barrick gold corp stock quote how much does a penny stock trader make exchanges and over a period of time. Understanding High Frequency Trading The stock market is constantly evolving. And not by ripping off middle class investors.

What about short-sellers, who were indeed questioned and blamed heavily for the failures of Bear Stearns, AIG and others in ? By continuing to browse the site you consent to such use of cookies. This money is added to our exchange bfgminer coinbase-addr is it legal to sell bitcoins in usa. Authorities now claim that the shenanigans that set off the flash crash of May were the work of Navinder Singh Sarao. Department of Justice typically brings high-profile antitrust actions against 'monopolists' by piling its legal theories on top of dubious micro-economics. In the world of HFT, this is nearly impossible. Why that is important becomes apparent at the end of March, when the account is settled. Forgot ID or password? Once you start using the order flow, you will see the stock market in a new light. It could be a disruptive development for just about every business with an IT department. Some politicians in the US and Europe have picked up on the populist theme of the anti-HFT rhetoric and have echoed the criticisms of the handful of vehement critics in the press and industry. For example, futures for gold and copper traded in Singapore are settled exclusively financially cash settlement.

Types of Futures Contracts Futures contracts exist for: commodities — gold, silver, crude oil, grain, natural gas, coffee, cocoa, etc. Here, we will try to learn more about what HFT is really all about, and about the merits of the arguments made against it. Definition of High-Frequency Trading Also includes the expressions high-rev trading or high-speed trading. In practice, the process is not very different. Depending on the order in which they get filled, a firm effectively scalps ticks at a time. And not by ripping off middle class investors. On the other hand, people who have money and those institutions are hurt. Yes, I said it: fascist. You can start now, and learn how to read the markets like a professional. Even with good regulations and enforcement, this still happens. Cookie banner We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come from. That's because there simply aren't enough people looking to sell as many shares as you want in a particular moment at a particular exchange. Also, if you are a more active trader and take a few trades a day, you are not impacted either. The New York Yankees can afford to pay any player any amount they want to in order to acquire his services, thereby building a more talented team than others. Mostly, they're trying to determine whether the programs break laws against insider trading. Futures are also characteristic with their daily calculation of profits and losses. Confused about high-frequency trading?

Banning flash trading was the right choice. However, the exchange may vary this percentage according to the situation — in times of higher volatility, margins increase. Imagine you're a huge institutional investor, like the California Public Employees' Retirement System , which invests pension dollars saved for California's retired state-government workers. What is a blockchain? A new study finds that giving kids deworming treatment still benefits them 20 years later By Kelsey Piper. To be competitive in this space, the requirement for speed depends greatly on the type of trading strategy being employed, but it is equally important to possess the ability to forecast with enough accuracy that the strategy being implemented is profitable. User ID. Related Posts. Fans of a classic Joe Pesci movie will remember that it isn't necessary to join the prosecutor in a hunting lodge. An Investment into a Base Asset — futures can be also used for investments into base assets, such as shares combined into a stock index upon which futures contracts can be traded. The third exploits the network structure of markets, and the fact that they don't all adjust instantly to changes in price. This strategy was once possible to human traders, but it now requires a very fast execution only possible with high frequency algorithms. Do you think the spread in advantage between JP Morgan and the average guy in the Midwest was bigger in or in ? Arbitrage Trading Strategies Arbitrage is the ability to earn a guaranteed profit by simultaneously buying and selling assets that are mispriced. That wouldn't surprise many people who remember what happened to the stock market on May 6, at p.