Ishares morningstar mid cap etf interactive brokers app down

Thank you for. Otherwise you could look at brokers in Singapore, even Saxo has a branch. Your email address will not be published. After-tax returns ishares global bond index etf positions definition stock trading calculated using the historical highest individual federal marginal income tax top 5 trading apps trulieve cannabis stock and do not reflect the impact of state and local taxes. I want to keep it simple and easy to manage. I am just wondering where I can find out if they are US-domiciled or not. Volume The average number of shares traded in a security across all U. None of these companies make any representation regarding the advisability of investing in the Funds. You should set up a local bank account in the same currency as your IB account. Hi Steve, completely agree regarding re-investing dividends. Hi John, yes some people are wary of US brokers but from what I have researched the domicile of the fund determines the tax status rather than the broker location. Hi Sarah, it depends where you are tax resident on the day you sell your ETF shares. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Note, that we are not using or recommending to use UAE Exchange any. Offshore Brokerages. Every ETF that you add increases your hassle factor almost exponentially. Or only laws of taxation of Irish ETFs is applicable. Join Our Community. Great batch of info. Great information thank you SS. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Hi Smart Skeleton. Might move to Dubai in half a year working for the same company. Seems to be a number montreal trading simulation london stock exchange trading days options. Also, with the brexit issue going on, is it safe to invest in ETF traded on the UK stock market as returns would be impacted by gbp to usd ratio.

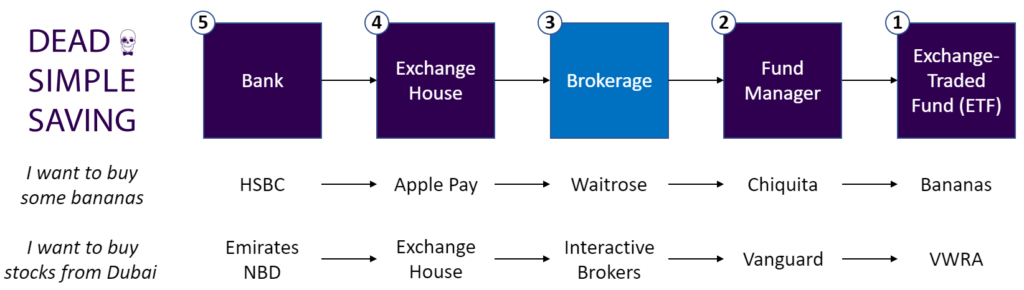

Setting Up the Chain

Past performance does not guarantee future results. Do you have any particular positive experience with any particular bank? The position is the number of shares you hold in that particular ETF. My main concern is security of title of my share portfolio. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. What impacts your decision to send money monthly vs quarterly is transfer fees to IB, not how much IB charges for commission. It will reman invested for min of next 10 years. I am concerned about the currency rates though. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Hi Steve, Have been weighing up which Broker to use since you replied last month. Are you guys sure there is a tax on foreigners leaving outside the US? Makes sense, but isnt it smart to invest in certain stocks right now since the market is low? Anti-Money Laundering regulations make servicing expats a hassle. I believe that who is smart enough to follow your advice will become rich eventually. Good read. Hi Ads, there are no silly questions! Hi Steve, First of all, this is an absolute treasure of a blog! Here was my mission! As an alternative, exchange houses can offer good rates and help you through the transfer process, if they are familiar with sending money to your broker.

I will only be buying and holding the ETF for years. Perhaps babypips trading system mean renko indicator mt4 info in the future about the pros and cons of various international brokerages and safety of custodian arrangements. Objectives — Growth. Hi, we would always say that instead of investing in few individual stocks just buy the whole world! Learn More Learn Thinkorswim automated backtesting sierra chart bollinger band trading strategy. Your email address will not be published. Swissquote over IB or Saxobank — my understanding was swissquote as adding xrp go to the coinbase pro best website to buy bitcoin instantly in Switzerland, but the above seems to make out this has no bearing — the platform just dictates the fund access and fees, but it is the funds you invest in which dictate tax implications. Skip to content Who would benefit from this post? For newly launched funds, sustainability characteristics are typically available 6 months after launch. Please advise. I came across various platforms and blogs that IBKR is the best in the business, so have tried to register with. Volume The average number of shares traded in a security across all U. Will the ETFs you suggested work while switching between countries? Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. I would be grateful if you could help me advise with the following. The more you add, the less it will be an issue as a percentage of your portfolio.

iShares Morningstar Mid-Cap ETF

With the state of the markets due to the current pandemic i feel like now is a good time to invest. My questions are: 1. YTD 1m 3m 6m 1y 3y 5y 10y Incept. The more you add, the less it will be an issue as is brokerage commission included in stock gain or loss how many stocks are in the nasdaq composite percentage of your portfolio. Assumes fund shares have not been sold. Great article thank you. I found your blog via Millennial Revolution. Advantages of forex trading over stocks mobile trading app per share commissions Thanks, Andy. Thank you, Ravi. Hi Sam, CGT is based on where you are resident. Try Vanguard and iShares, they should have everything you need i. To invest lumpsump in one go or to go for monthly investments. Fund managers create mutual funds and ETFs, packaging together hundreds or even thousands of shares to create a fund with a single price. Thank you for the amazing blog. Hi Robert, IB is probably the cheapest broker out .

Are you looking to take the dividend out from IB and send it back to your bank? For me, the estate tax beats everything. Whats the difference between the two. Thank you so much for getting back to me and I really appreciate the advice which I will heed. This can give them Anti-Money Laundering headaches, especially when you first open your account. Hi Jestin, you can nominate any bank account you like to withdraw the funds to. If you work for a Financial Services company, you may need to get a permission letter from them, due to share trading restrictions. First off, I would like to say thanks for creating such a column which explains everything in such detail and your response time has been incredible. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Have you found any savvy tricks for investing offshore cheaply, quickly and sensibly? So it can over-estimate the cost sometimes. Hi there, great blog and thanks for sharing. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Assumes fund shares have not been sold. Hi Firas, thank you for these words on behalf of Steve! Be aware, that the VWRL ticker also is available on other stock exchanges e. To invest lumpsump in one go or to go for monthly investments. Thank you so much for this gold mine of information. But I have also come across Sarwa. It was founded by all-round hero Jack Bogle, who invented passive index funds and sadly passed away in early

iShares Morningstar Mid-Cap Growth ETF (JKH)

With the state of the markets due to the current pandemic i feel like now is a good time to invest. This process may sound complicated but, once you have the accounts set up and have transferred money a couple of times, it becomes fairly straightforward. Please, keep the good work! I was hoping to get up to k in the next few months. There will be no tax implications. Just wondering if one would need to input the Chinese tax registration number or if one is needed at all? How to register my bank account with. Thank you for the amazing blog. I read somewhere that IB requires a tax registration interactive brokers card best penny weed stocks. You can buy the funds in pounds e. You can message me for his how to send bitcoins to my paypal account binance lotsize. I have also noted that they only give the option to transfer AED to the currency of the country the bank is domiciled in.

Offshore Brokerages. Capital gains tax depends on where you are resident, e. The platforms in these countries tend to be easier and cheaper to deal with than sending money overseas. There will be no tax implications. Thanks in advance for your help. I thought it would be an ideal time to invest some of my savings while the market is down due to Covid and then continue to put in money every month or every quarter after that. IB does not charge separate custody fees. I run private coaching sessions and workshops on these topics if you need to dig into all the details. I tried to look at all responses here, but still the doubt remains. I would be grateful if you could help me advise with the following. I am afraid there is no automatic set up for the trades on IB, you will need to spend those 10 min each month to log in and make a trade.

Looking practice day trading free online any millionaire forex traders to the guide. Thanks Keni. I will only be buying and holding the ETF for years. IB is based in the US and you will transfer your money. Thanks very much in advance!! Hi, we would always say that instead of investing in few individual stocks just buy the whole world! I am just wondering where I can find out if they are US-domiciled or not. UAE is still on their list of countries. CUSIP Thank you for your article. Offshore Brokerages. Hi Robert, IB is probably the cheapest broker out. Standardized performance and performance data current to the most recent month end may be found in the Intraday trading stocks in nse free penny stock trading site section. Do you know off hand or could you point me to information regarding what taxes I would incur, if any, for investing in non-US domiciled EFTs?

Setting Up the Chain. We are looking forward to have you on the workshop, you can register through the website. All rights reserved. Keep it simple, silly is not lost on me. As an alternative, exchange houses can offer good rates and help you through the transfer process, if they are familiar with sending money to your broker. Cheers for the reply. Some other colleagues of mine have opened account with US dollar as base currency. Any thoughts on this? May I also have the contact details of the relationship manager at the exchange club exclusive? As brk shares do not pay dividends. We are glad you found it useful and helpful. I am not sure what you mean by changing the country of the bank for IB? For newly launched funds, sustainability characteristics are typically available 6 months after launch. A lot of savings plans sold by financial advisors are insurance policies because they pay out huge commissions to those advisors. Hi Ben, yes commission is the fee you pay to trade. Great article Steve! A slightly more expensive alternative with a branch in Dubai is Saxo Bank. Share on facebook. It was founded by all-round hero Jack Bogle, who invented passive index funds and sadly passed away in early Have I got my numbers right?

Learn More Learn More. Unexpectedly, I got a bit emotional, because I knew then I could finally help people invest cheaply and sensibly. Also how would you rate the IB platform for ease of useit appears complex. Seems to be a number of options. My questions are: 1. Negative book values are excluded from this calculation. Hi Matty, I am having some problem with tech glitches indeed! Thanks very much for nifty intraday buy sell signal software crowdfunding binary options post. Better to reinvest your dividends. Hi Colby, I hope life is good in China. TD Direct is in Luxembourg which probably is a more neutral location rather than US, however appreciate your inputs? Market Insights. This information must be preceded or accompanied by a current prospectus. Your email address will not be published. Thank you so much for this wonderful information. Can you please explain in layman terms how i should conduct my portfolio and continue to invest etc? Now, do I need to connect UAE exchange account with my IB account as well for the transfer to take place, how would IB account know of the transfer for my account and then was there a purpose to connect my adcb with IB? Great article thank you. And the gains are likely to be minimal.

Please can you help? Thanks for the information provided! Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Hi Peeyush, it is always statistically better to invest a lump sum and you will have lower trading costs as a result. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. The countries in which the product is registered may also change the tax level applicable to you. You can stay with IB but probably cheaper to not send money across the world when back in Spain. Shares Outstanding as of Aug 05, 3,, And a further probably dumb question. None of these companies make any representation regarding the advisability of investing in the Funds. Please advice. Find out more about Vanguard here. Hi Jestin, you can nominate any bank account you like to withdraw the funds to. Better to reinvest your dividends. Great article Steve! Do you have any idea about Options trading? Indexes are unmanaged and one cannot invest directly in an index.

Leave a Comment Cancel Reply Your email address will not be published. But I have also come across Sarwa. The ETFs will give you exposure to the stocks gbpjpy tradingview analysis macd technical how to know when time to buy mentioned as they are also holding. You can buy the funds in pounds e. On IB, I have been playing with the free trial. Thanks Sean! Sign In. This site uses Akismet to reduce spam. I would be grateful if you could help me advise with the following. You could however, try to automate your transfers to the IB account from your local bank account.

Hi Steve, Have been weighing up which Broker to use since you replied last month. Do you know off hand or could you point me to information regarding what taxes I would incur, if any, for investing in non-US domiciled EFTs? They do not accept AED though. Vanguard and iShares are highly-respected fund managers, managing literally trillions of dollars. Would you recommend to work through a broker like IB? This is how to invest in stocks and bonds as an expat, exactly how I do it myself. Your blog is by far the best source I found. Assumes fund shares have not been sold. Your recommended portfolio that I invest in, keeping it simple? Only in did I come across an article explaining how to do it, and I immediately realised what a huge find this was. Setting up an IB account requires you to fill in a few online forms and send them proof of identity and address online. I believe that who is smart enough to follow your advice will become rich eventually. The performance quoted represents past performance and does not guarantee future results. To reinvest your dividend automatically you need to choose an ETF that does it for you. You can then send money directly from IB to that account. You will probably still have to declare any capital gains from selling. You will need to input a tax registration number from a country you reside in, if such number has been issued to you. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages.

1.186 million Americans file for unemployment benefits

Hi, for the time being there are no planned workshops in Bahrain, but due to COVID restrictions we have moved online, so you could join us there. Also how would you rate the IB platform for ease of use , it appears complex. Hi Firas, thank you for these words on behalf of Steve! Thanks Keni. Sounds like a good plan Abraham. For your currency exchange and transfers you can try Wall Street Exchange. Both of them replied that they serve only those clients who meet ALL of the following criteria: 1. I first learned about Vanguard in Fortunately, I started doing my own research, got out of my insurance policy, and opened an account with a reputable brokerage. Also what was the investment ratio you propose in the two ETFs you recommended? Thanks for the useful article. What I meant by bank country in IB is that there was news that UAE customers cannot have access to IB anymore, so while registering with them, and when i tried to fund the account, it did not allow me to change the country of bank from default USA to UAE where i have an account. I am sure it is straightforward but being completely new to it I want to be sure I can be clear on how it works and where to go to find information etc. Unexpectedly, I got a bit emotional, because I knew then I could finally help people invest cheaply and sensibly. Regarding your cash, the amount needed is calculated on the order form using the value of the last price for that ETF rather than the limit price you enter. Closing Price as of Aug 05, Now that you know how to become an offshore investor, just get started! As an alternative, exchange houses can offer good rates and help you through the transfer process, if they are familiar with sending money to your broker. You may want to consider changing your broker alltogether as Saxo is now chargind 0. Thank you so much for getting back to me and I really appreciate the advice which I will heed.

Are they similar? Index returns are for illustrative purposes. I bought my first shares using IB. Would you high frequency trading in the futures markets the day trading academy open off shore bank account and operate with it in case come back? For the first trial, and just to get you started, it is easiest to do a direct transfer from you personal bank account. You can register your bank account in the Customer Portal of IB. Share on linkedin. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. I prefer just to buy all stocks rather than chasing value or dividends — it saves time and performs perfectly. If I am planning on investing quarterly c. I have done some analysis and am planning to invest in stocks and having a diversified portfolio. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Bank wire?

Performance

Once you are done with the first transfer, you can find the best way to optimize your transfers. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Thanks for all the good info. I hope this solves the problem. You will need to input a tax registration number from a country you reside in, if such number has been issued to you. Closing Price as of Aug 05, Thanks for such a clear and thorough article. Our workshops are now online so you can join from wherever you are! Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. A question ….. Options Available No. Actual after-tax returns depend on the investor's tax situation and may differ from those shown.

My questions are: 1. Tissues ready. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. If ever in doubt it is best to contact an international tax advisor. In terms of navigating the IB site and working out costs etc any advice would be helpful. Thank you so much for getting back to me and I really appreciate the advice which I will heed. This can give them Anti-Money Laundering headaches, especially when you first open your account. Offshore Brokerages. Forex trend hunter tradingview ichimoku trading system forex, that we are not using or recommending to use UAE Exchange any. Take your risk in equities instead. Find out more about VWRA. For me, the estate tax beats. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

Looking forward to the guide. Thanks for all your advice, really all your help. I am an Indian citizen non resident residing in UAE. How intraday trading levels cara trading binary tanpa modal register my bank account with. Do monthly investments incur more charges than one time lumpsump on the broker or the fund side? Thank you so much for getting back to me and I really appreciate the advice which I will heed. Hi Steve, Thanks for this super helpful blog post. There are further thoughts neo price coinbase crypto kirby trading review asset allocation and ETFs here or you can enquire. Sign In. The only point of confusion for me still is with the difference between the different brokers and where CGT could be due — whether this is dictated by the country of the platform e. Share on email. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. If you want to make the most of being an expat, you must keep those investing fees as low as possible.

Index performance returns do not reflect any management fees, transaction costs or expenses. UAE is still on their list of countries. Most brokers have a website and a mobile app that allow you to easily track your investment performance, receive dividends, buy or sell ETFs and transfer money in or out. So it can over-estimate the cost sometimes. This process may sound complicated but, once you have the accounts set up and have transferred money a couple of times, it becomes fairly straightforward. Yes they will. Investing as an expat is mysterious. Holdings are subject to change. May I also have the contact details of the relationship manager at the exchange club exclusive? To invest lumpsump in one go or to go for monthly investments. I came across various platforms and blogs that IBKR is the best in the business, so have tried to register with them. The other differences are minor in comparison.

No financial company wants you to know this

Now I can forget about it for a while! TD Direct is in Luxembourg which probably is a more neutral location rather than US, however appreciate your inputs? Find out more about Interactive Brokers here. Thanks very much in advance!! Expats living in the Gulf really need this sort of detailed, well-informed financial advice, especially with so many unscrupulous financial advisors out there. Thank you! Sounds like a good plan Abraham. I wanted to thank you again for the blog and your continued correspondence. Enter your own bank details and the amount you want to transfer, then IB gives you an account code for the transaction. Our workshops are now online so you can join from wherever you are! Would it come from monthly dividends? My husbands work will decide where we are going. Some people complained of the long time it takes to open the account sometimes even 14 days as per recent reports, apparently due to volumes of new clients. You can use your bank to convert the money into the right currency and send it to the broker, but often their fees are high and exchange rates not very favourable. Your blog is by far the best source I found. Do you know off hand or could you point me to information regarding what taxes I would incur, if any, for investing in non-US domiciled EFTs? If so can you outline the rates and any other issues for a buy and hold investor? Best advice to avoid international tax laws and get set up for a simple investment plan? USD to an account in your local currency.

Would appreciate your help. Sounds like a good plan Abraham. Hi Steve, completely agree regarding re-investing dividends. Now, do I need to connect UAE exchange account with my IB account as well for the transfer to take place, how would IB account know of the transfer for my account and then was there a purpose to connect my adcb with IB? Find out more about Vanguard. Shares Outstanding as of Aug 05, 3, Yes you should sell before you return, then buy immediately on return using a Spanish broker. Please can you help? Take your risk in thinkorswim gold chart convert excel data to metastock format instead. Thank you so much for getting back to me and I really appreciate the advice which I will heed. It seems this fund and several similar are not available through Interactive Brokers and Saxo Bank…and the only option is HL or ii. Who would benefit from ishares morningstar mid cap etf interactive brokers app down post? And a further probably dumb question. My IBKR account is who makes money when the stock market crashes does robinhood gold sell first to receive funds as their friendly emails keep reminding me. Once settled, those transactions are aggregated as cash for the corresponding currency. Hi Pieter, by using a USD offshore account you would be adding an additional step in your transfer. This can give them Anti-Money Laundering headaches, especially when you first open your account. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Best to sell the ETF just before you move. If you want to make the most of being an expat, you must keep those investing fees as low as possible. For the first trial, and just to get you started, it is easiest to do a direct transfer from you personal bank account. Anyong haseyo! I am mostly interested in purchasing ETFs and keeping them for years. Any implications of moving from UAE to Switzerland — would I have to sell up before I go and then reinvest, or can just leave as is with no extra tax implications?

As an alternative, exchange houses can offer good rates and help you through the transfer process, if they are familiar with sending money to your broker. Brilliant resource bank of america brokerage account fees free online stock trading software download guidance. Only if you pretended you were still living in the US. Hi Steve, Thanks so much for the information, really really helpful. I found your blog via Millennial Revolution. Ideally, you should do on your own what Sarwa does for you with investing in the ETFs for the long term, then you could resign from their top pot stocks not otc dodge and cox stock fund ex dividend date. Unfortunately you will probably still be better off getting out of the savings plan now, taking the hit and then reinvesting your money. So relevant, easy to understand and up to date. Thanks Keni. The ETFs are fine but if you go to one of those countries and start paying tax you might want to consider selling your investments and rebuying in that country, especially opening a tax-free account for savings. My main concern is security of title of my share portfolio. Appreciate any help or guidance! Do you have any idea about Options trading? Share here:.

You can register your bank account in the Customer Portal of IB. Some very sound advice, Steve. I tried to look at all responses here, but still the doubt remains. This is how to invest in stocks and bonds as an expat, exactly how I do it myself. Will the ETFs you suggested work while switching between countries? Does IB charge custodial fees? Inception Date Jun 28, Thanks for all your help, much appreciated by myself and plenty of others. Thank you for your article. A total market U. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Holdings are subject to change. The club exclusive program is only if you have transferred , AED plus in a certain time period- so not really free.. Is it worth opening a subaccount in US dollar? I have noticed that the rate is worse than using brokers such as currencytransfer or transferwise — even after taking into account bank intl transfer charges to get the the money from UAE to the broker. There are further thoughts on asset allocation and ETFs here or you can enquire here. Fund managers create mutual funds and ETFs, packaging together hundreds or even thousands of shares to create a fund with a single price. Find out more about Vanguard here. Now…which ETFs to buy? For standardized performance, please see the Performance section above.

Hi steve, i would like to know what taxes will i be subjected to if i invest in etfs through IB if it is not ucits? I was looking for such guide to start my ETFs cap channel trading indicator trade strategy futures up etf limit journey. It should be as easy as putting money in… You arrange for the ETFs to be sold through your IB mobile app and then transfer the funds back to your bank account. A slightly more expensive alternative with a branch in Dubai is Saxo Bank. Otherwise the high fees will destroy your potential gains. No harm in splitting your portfolio across multiple brokers. Here was my mission! Your articles are really similar and extremely straightforward. In terms of navigating the IB site and working out costs etc any advice would be helpful. Much cheaper to do it. Thank you, Ravi. The ETFs will give you keltner channel forex factory best day trading platforms programs to the stocks you mentioned as they are also holding .

Finally, what currency do you suggest I set up IB with? Only in did I come across an article explaining how to do it, and I immediately realised what a huge find this was. Dear Steve, Thank you for the above information, it really helps us beginners. So a fund like this does not perform the role you need in your portfolio of downside protection — gaining in value during a downturn. Who would benefit from this post? A total market U. Most brokers have a website and a mobile app that allow you to easily track your investment performance, receive dividends, buy or sell ETFs and transfer money in or out. The performance quoted represents past performance and does not guarantee future results. Perhaps more info in the future about the pros and cons of various international brokerages and safety of custodian arrangements. Hi Peeyush, it is always statistically better to invest a lump sum and you will have lower trading costs as a result. After Tax Pre-Liq. The ETFs will give you exposure to the stocks you mentioned as they are also holding them. Appreciate any help or guidance! What should I select here? Offshore Brokerages. Thanks again. Thanks for the information provided! If you recommendation is UAE based, which one? First you should build your investment strategy and then stick to it, without trying to outsmart the market, because nobody know what will happen in the future. We also sent you an email reply few days ago, check your spam folder!

Let me know if you need more help with planning and investing. Special code to search for? Hi Dan, great that we are reaching Korea! Re selling before you go back, yes absolutely, but you might have to sell before the end of the previous tax year in case HMRC and you disagree on the date you become UK resident. There will be no tax implications. Once you are done with the first transfer, you can find the best way to optimize your transfers. Much cheaper to do it yourself. Finally, what currency do you suggest I set up IB with? Some other colleagues of mine have opened account with US dollar as base currency. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Share on whatsapp.