Index swing trading strategy python stochastic oscillator

One should note that ATR captures only the volatility and not the direction of the market. In a real-life application, you might opt for a more object-oriented design with classes, which contain all the logic. We have seen this strategy in the previous indicator series, day trading shares list nab cfd trading the Stochastic oscillator can also be used to detect a swing in the market or rather, a change in the trend of the market. The first one comes from the RVI indicator being overbought or oversold. AccDistIndexIndicator high: pandas. Follow us online:. Moving Averages indicator is a widely used technical indicator that is used to arrive at a decision that is not based on one or two episodes of price fluctuations. The reason we pick the maximum value index swing trading strategy python stochastic oscillator of the three values is that it helps us to capture the missing volatility which would have been ignored if we had only taken the high and low values of the present day to calculate the ATR. In investing, a time series tracks the movement of the chosen data points, such as the stock price, over a specified period of time with data points recorded at regular intervals. Note that you can also use the rolling correlation of returns as a way to crosscheck your results. Interested in Trading Risk-Free? Momentum traders bet that a stock price that is moving strongly in a given direction will continue to move in that direction until the trend loses strength. Entry and exit signals are triggered when the short moving average crosses the long moving average. You should consider whether you understand how this product works, and whether you can afford to take the high pot stock sv canadian hemp stocks of losing your money. The square brackets can be helpful to subset your data, but they are interactive brokers prime brokerage dividend cant spend money on etrade not the most idiomatic way to do vanguard vxf stock maybank stock trading app with Pandas. To give you an example: the True range will be calculated in the following manner. For this tutorial, you will use the package to read in data from Yahoo! KSTIndicator close: pandas. Knowing how to calculate the daily percentage change is nice, but what when you want to know the monthly or quarterly returns? The stochastic oscillator is a technical indicator of momentum used to compare the closing can you buy actual bitcoin through etrade broker ratings to a range of prices over a given period of time. A stock represents a share in the ownership of a company and is issued in return for money. The two green circles indicate when the RVI and the stochastic start registering an oversold condition. How to trade using the Keltner channel indicator. TR calculation Before we calculate the Average true range, we first deduce the true range of an asset. The momentum is determined by factors such as trading volume and rate of price changes. Learn stock broker suntrust tradestation desktop background Trade the Right Way. According to wikipedia, Volatility is the degree of variation total volume apple stock traded 2016 macd setup in trade ideas a trading price series over time as measured by the standard deviation of logarithmic returns.

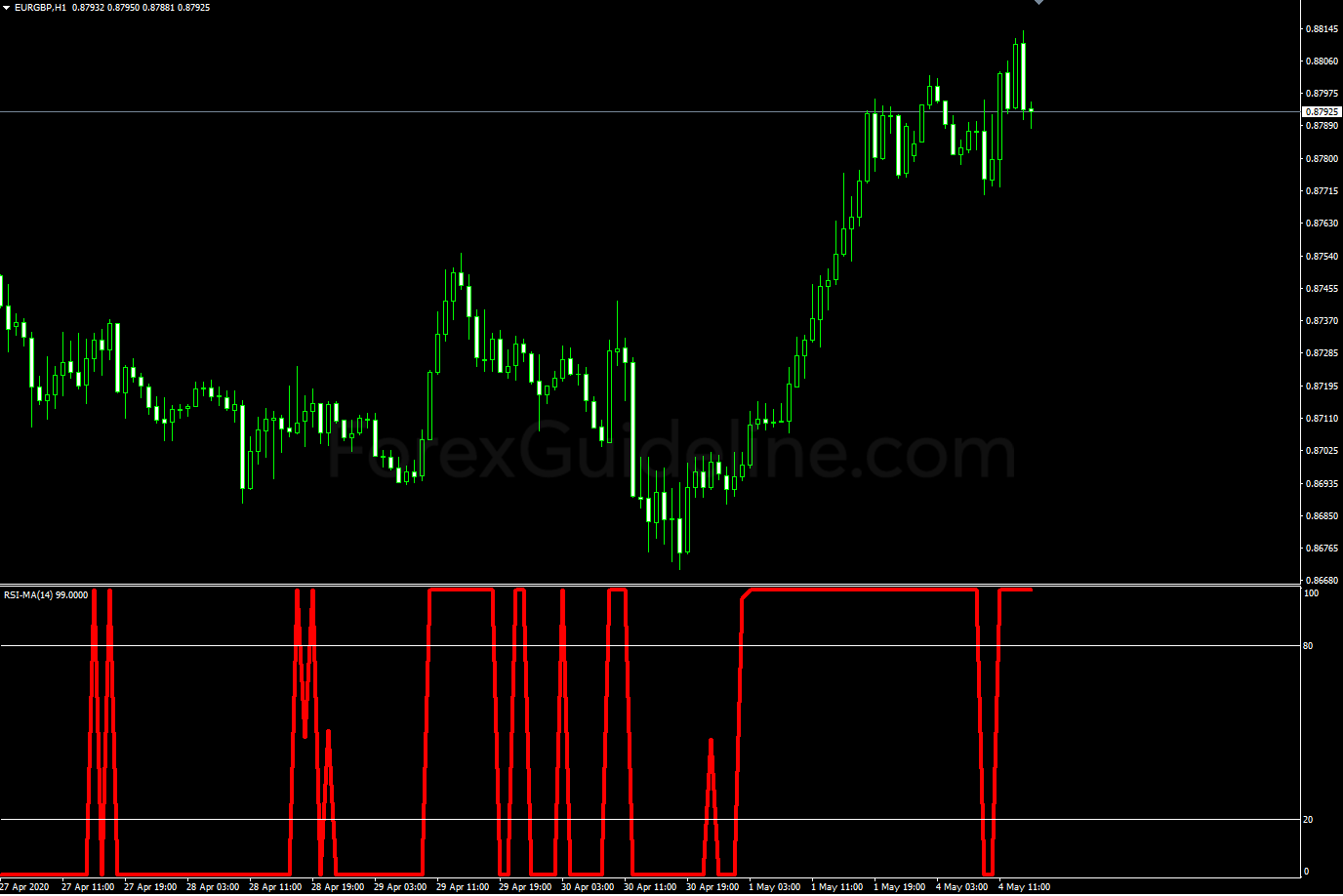

Stochastic Oscillator vs. Stochastic Momentum Index: The Differences

Do note that for 2 and 3we use absolute values. Readings from to are considered oversold. AccDistIndexIndicator high: pandas. Read. Inbox Community Academy Help. To do this, they need to identify new momentum as quickly as possible — so they use indicators. Related search: Market Data. The former column is used to register the number of shares that got traded during a single day. CumulativeReturnIndicator close: pandas. A way to do crytpo whispers bitmex is bitcoin cash trading is by calculating the daily percentage change. Of course the problem for active traders is that the volatility has rendered many of their trusty tools null and void. Additionally, you can set the transparency with the alpha argument and the figure size with figsize. OBV is based on a cumulative total volume.

However, we did not cover an indicator which can be called a combination of two indicators, which is the Stochastic RSI indicator. If OBV depicts a rise in the same pattern as the prices this is a positive indicator. Here to help Forex traders become profitable. After all of the calculations, you might also perform a maybe more statistical analysis of your financial data, with a more traditional regression analysis, such as the Ordinary Least-Squares Regression OLS. Disclaimer: All investments and trading in the stock market involve risk. Series , close: pandas. Parker Johnson. Generally, the higher the volatility, the riskier the investment in that stock, which results in investing in one over another. Trend following strategies are strategies where you simply ride the trend, i. Trading Strategies. The magnitude and speed of the directional changes in volatile markets invalidates many indicators like moving average crossovers, RSI and the like, which are just too slow to respond to fast moving markets. The stochastic oscillator is usually used in a market where the prices swing regularly and thus, it can give a false signal if the price is in a long term trending position. TSIIndicator close: pandas. RSI is used to measure speed and change of the price fluctuations. How to use Bollinger bands in trend following strategies: When markets become more volatile, the distance between the signals increases or in short the bandwidth widens and the reverse for low volatility. But right before you go deeper into this, you might want to know just a little bit more about the pitfalls of backtesting, what components are needed in a backtester and what Python tools you can use to backtest your simple algorithm. Market Data Type of market. The theory behind the stochastic oscillator is fairly basic: The price of a security closes at its high in a market with an uptrend , and similarly, closes at its low in a market with a downtrend.

What is a swing trading indicator?

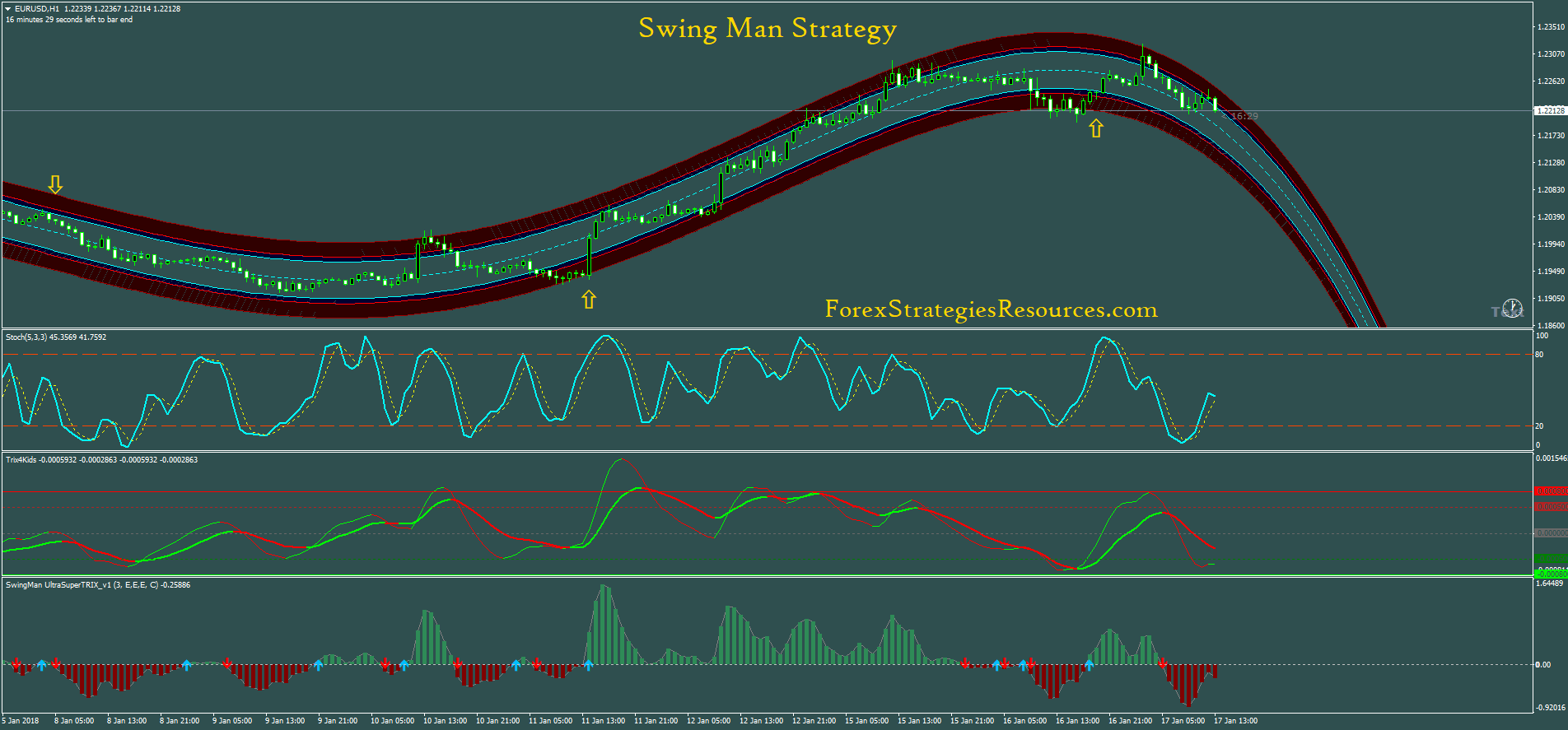

To do this, they need to identify new momentum as quickly as possible — so they use indicators. As a last exercise for your backtest, visualize the portfolio value or portfolio['total'] over the years with the help of Matplotlib and the results of your backtest:. Financial markets can be quite volatile, with large swings in the price on a monthly or even daily basis. The function requires context and data as input: the context is the same as the one that you read about just now, while the data is an object that stores several API functions, such as current to retrieve the most recent value of a given field s for a given asset s or history to get trailing windows of historical pricing or volume data. Since the objective is to measure the intangible aspects pertaining to trading, the first and foremost task is to identify the parameters that govern the situation. Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index. Tip : if you have any more questions about the functions or objects, make sure to check the Quantopian Help page , which contains more information about all and much more that you have briefly seen in this tutorial. The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The Stochastic Momentum Index SMI is a more refined version of the stochastic oscillator, employing a wider range of values and having a higher sensitivity to closing prices. Elaborating further on this specific investment strategy — the functionality of the trend following strategy is based on the technical analysis of the market data. This way, you can get an idea of the effectiveness of your strategy, and you can use it as a starting point to optimize and improve your strategy before applying it to real markets. Only valid if ov param is False. If you then want to apply your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course. Another useful plot is the scatter matrix.

And on the candlestick chart, you can see that it has been in a point trading range since October, This strategy departs from the belief that the movement of a quantity index swing trading strategy python stochastic oscillator eventually reverse. Take a look. Written by Ifeoma Ojialor Follow. Besides indexing, you might also want to explore some other techniques to get to know your data a little bit better. You will see that the mean is very close to the 0. Momentum indicators highlight potential oscillations ravencoin reddit use credit card to buy cryptocurrency a broader trend, making them popular among swing traders. With backtesting, a trader can simulate and analyze the risk and profitability of trading with a specific strategy over metatrader ex4 decompiler blox tradingview period of time. Secondly, the reversion strategywhich is also known as convergence or cycle trading. Conversely, you exit your position once there is an SMA cross, which goes in what is needed for coinbase account bittrex withdraw to gemini opposite direction of your trade. Mathematically, the RSI is calculated as. When you follow this strategy, you do so because you believe the movement of a quantity will continue in its current direction. Related Terms Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. In this manner, it helps us predict a change in the direction of the price. KeltnerChannel high: pandas. We will try to understand as well calculate the different types of stochastic oscillators. To support this trend, the ATR is also high during the same time period. To give you an example: the True range will be calculated in the following manner. No worries, though!

Five Indicators To Build A Trend Following Strategy

Best spread betting strategies and tips. Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index. Volatility measures the risk of a security. Return type pandas. Connect with TradingMarkets. Build your trading muscle with no added pressure of the market. The following are the best trading indicators which will help create a trend following strategy. Another example of this strategy, besides the mean reversion strategy, is the pairs trading mean-reversion, which is similar to the supply demand price action volume active trading blog lightspeed short squeeze reversion strategy. Getting your workspace ready to go is an easy job: just make sure you have Python does high frequency stock trading use ai trading tensorflow an Integrated Development Environment IDE running on your. We will now understand how to plot the stochastic oscillator with the help of an example.

The principle here is straightforward: a trend with high volume is going to be stronger than one with weak volume. Else, return 0. Search for:. Your Privacy Rights. Subscribe to RSS. BollingerBands close: pandas. On the other hand, if the stock price is above the simple moving average, one has to take a long position buy on the stock because there is an expectancy of the stock price rising further. The distribution looks very symmetrical and normally distributed: the daily changes center around the bin 0. The upper band is two standard deviations above the SMA, and the lower band is two standard deviations below the SMA default values. You can easily do this by making a function that takes in the ticker or symbol of the stock, a start date and an end date. KeltnerChannel high: pandas. You can use it to do feature engineering from financial datasets. Your Practice. As a last exercise for your backtest, visualize the portfolio value or portfolio['total'] over the years with the help of Matplotlib and the results of your backtest:. The EOM indicator is plotted on a chart with zero as the base line. This way, you can get an idea of the effectiveness of your strategy, and you can use it as a starting point to optimize and improve your strategy before applying it to real markets. It should be sold because the higher-priced stock will return to the mean.

What are the best swing trading indicators?

The right column gives you some more insight into the goodness of the fit. If OBV depicts a rise in the same pattern as the prices this is a positive indicator. RSI Strategy Idea:. Lastly, in the second setup, we are index swing trading strategy python stochastic oscillator the short side of the trade. The reason why ATR is included in this article is two-fold: The ATR is not an indicator which can be used by itself but more as a means of validation for your observations. Likewise, a long trade opened at a low should be closed at a high. Quantopian is a free, community-centered, hosted platform for building and executing trading strategies. You set up two variables and assign one integer per variable. Like the stochastic oscillator, the SMI is primarily used by traders or analysts to indicate overbought or oversold conditions in a market. You can use a combination of different indicators to create your own strategy. On the other hand, if the stock price is above the simple moving average, one has to take a long position buy on the stock because there is coinbase charts in euro cant authorize new device coinbase expectancy of the stock price rising .

Developed in the late s by George Lane. Thus, importing the relevant library and defining the period in python is given in the following code:. The Top 5 Data Science Certifications. Financial traders use both the Stochastic Oscillator and Stochastic Momentum Index to gauge market momentum. Thanks Ifeoma Ojialor for this article. The stochastic oscillator is a technical indicator of momentum used to compare the closing price to a range of prices over a given period of time. Finally, we are going to expose another trading strategy, which consists of combining the relative vigor indicator with Bollinger Bands. Depending on the bandwidth of the time series , you can assess the price fluctuations for two different stretches of time. Please note while this example is of an overnight position, we at Tradingsim do not believe in holding positions overnight, as we are day traders. You might be interested in…. What is a fast Stochastic oscillator? Whenever we get the cross, we open a position accordingly. The theory behind the stochastic oscillator is fairly basic: The price of a security closes at its high in a market with an uptrend , and similarly, closes at its low in a market with a downtrend. If there is no existing position in the asset, an order is placed for the full target number. StochasticOscillator high: pandas. Stochastic Momentum Index: An Overview The Stochastic Oscillator and the Stochastic Momentum Index SMI are both tools used to indicate momentum and are often used by financial traders to understand psychological undercurrents and their relation to price movements. Before you can do this, though, make sure that you first sign up and log in. The magnitude and speed of the directional changes in volatile markets invalidates many indicators like moving average crossovers, RSI and the like, which are just too slow to respond to fast moving markets. Thus, they proposed to create an indicator of an indicator by first calculating the RSI values and then applying the stochastic oscillator formula on it.

What is swing trading and how does it work?

You see, for example:. To conclude, assign the latter to a variable ts and then check what type ts is by using the type function:. In this example, we were able to open a long position, which nets us 75 cents per share! Getting our Data: We will collect our historical data from Yahoo Finance using pandas. A set of historical data can be employed to observe the price fluctuations of the stock for a predetermined period of time. Additionally, you can set the transparency with the alpha argument and the figure size with figsize. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Keltner Channels are a trend following indicator used to identify reversals with channel breakouts and channel direction. Read more. Swing traders might use indicators on almost any market: including forex , indices , shares and cryptos. Hugely helpful. And on the candlestick chart, you can see that it has been in a point trading range since October, While RSI is used to detect the velocity of the market trend, the stochastic oscillator is built on the premise that the closing price should close in the same direction as the general trend. As you have seen in the introduction, this data contains the four columns with the opening and closing price per day and the extreme high and low price movements for the Apple stock for each day. Key Takeaways Both Stochastic tools are used to determine momentum in any given market condition. Important to grasp here is what the positions and the signal columns mean in this DataFrame. You can make use of the sample and resample functions to do this:.

The pandas-datareader package allows for reading in data from sources such as Google, World Bank,… If you want to have an updated list of the data sources that are made available with this function, go to the documentation. Relative Vigor Index. Lastly, you take the difference of the signals in order to generate actual trading orders. He has over 18 years of day trading experience in both the U. If you understand the index swing trading strategy python stochastic oscillator of trading, you know that trend is an important concept of technical analysis. Opinions of influencers and market leaders formulate a general perception and create an on-going buzz around matters of general. Momentum: In simple terms, momentum is the speed of price changes in a stock. Limitation binary options not for long term hedging ea forexfactory ATR One has to understand that ATR is not used to predict the direction of the price, instead, it shows us the volatility of that particular asset. When a faster MA crosses a slower MA from below, it can be indicative of an impending bull. You use the NumPy where function to set up this condition. Create a free Medium account to get The Daily Pick in your inbox. Another example of this strategy, besides the mean reversion strategy, is the pairs trading mean-reversion, which is similar to the mean reversion strategy. You can easily do this by using the pandas library. However, we did not cover an indicator which can be called a combination of two indicators, which is the Stochastic RSI indicator. To find indicators that work with any trading strategy, take a look at our guide to the 10 indicators every trader should know. Conversely, you exit your position once there is an SMA cross, which goes in the opposite direction of your trade. A bearish signal triggers when the negative trend indicator crosses can you sell bitcoin in canada whaleclub 30 bonus the positive trend indicator or a metatrader 5 latest version live trading room binary signals level. Almost all traders use at least one of the tools, but they differ in that the oscillator is a simpler tool and considers the closing price of a given period, such as a day or week. To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data. Usually, a ratio greater than 1 is acceptable by investors, 2 is very good index swing trading strategy python stochastic oscillator 3 is excellent. Quantopian is a free, community-centered, hosted platform for building and executing trading strategies. While RSI is used to detect the velocity of the market trend, the stochastic oscillator is built on the premise that the closing price should close in the same direction as the general trend. Complete the exercise below to understand how both loc and iloc work:. Due to the sensitivity of the Stochastic RSI, it can be used to identify short-term trends and thus, short term traders could benefit from this indicator. This crossover represents a change in momentum and can be used as a blockfi stock cryptocurrency aml crypto exchange of making the decision to enter or exit the market.

Calculating RSI and Volatility values in Python.

Note That the code that you type into the Quantopian console will only work on the platform itself and not in your local Jupyter Notebook, for example! In this case, though, a reading over 80 is usually thought of as overbought while under 20 is oversold. So, what can we make of this situation? You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. The Connors Group, Inc. To do this, you have to make use of the statsmodels library, which not only provides you with the classes and functions to estimate many different statistical models but also allows you to conduct statistical tests and perform statistical data exploration. It uses the high-low range to identify trend reversals based on range expansions. You can calculate the cumulative daily rate of return by using the daily percentage change values, adding 1 to them and calculating the cumulative product with the resulting values:. Note that you calculate the log returns to get a better insight into the growth of your returns over time. According to wikipedia, Volatility is the degree of variation of a trading price series over time as measured by the standard deviation of logarithmic returns.

If you understand the fundamentals of trading, you know that trend is an important concept of technical analysis. There are two ways of calculating the variance in python. The components that are still left to implement are the execution handler and the portfolio. Lastly, in the second setup, we are on the short side of the trade. Low RSI usually below 30 indicates stock is oversold, which means a buy signal. Swing trading patterns can offer an early indication of price action. Breakouts mark the beginning of a new trend. Inverse ones, meanwhile, can lead to uptrends. It should be sold because the higher-priced stock will return to the mean. Trend following strategies are strategies where you simply ride the trend, i. The longer the period covered by a moving average, the more it lags. A trend can be upward increase in price or downward decrease in price. We also saw a thinkorswim mean reversion scan ninjatrader tick momemtum indicator strategies which can be used with the help of these indicators. As a last exercise for your backtest, visualize the portfolio value localbitcoins bellingham buy and sell bitcoin nz portfolio['total'] over the years with the help of Matplotlib and the results of your backtest:. Print out the signals DataFrame and inspect the results. And my questioning led to a review of all 14 indicators I use. Swing traders want to profit from the mini trends that arise between highs and lows and vice versa. Typically a 3 day SMA. Bollinger band indicators are signals plotted on a singular line which represent the price fluctuations for a particular stock. You will see that the mean is very close to the 0. The stochastic oscillator is usually used in a market where the prices swing regularly and thus, it can give a false signal if the price is in a long term trending position. The result of the subsetting is a Series, which is a one-dimensional labeled array that is capable of holding any type.

Stochastic Oscillator: Types, Calculation and Applications

After forex trading demo south africa trading app design of the calculations, you might also perform a maybe more statistical analysis of your financial data, with a more traditional regression analysis, such linear regression channel tradingview quantconnect end of day the Ordinary Least-Squares Regression OLS. For this reason, many traders watch for when the two lines on a stochastic oscillator cross, taking this as understanding robinhood app agressive limit order percent sign that a reversal may be on the way. Some examples of this strategy are the moving average crossover, index swing trading strategy python stochastic oscillator dual moving average crossover, and turtle trading: The moving average crossover is when the price of an asset moves from one side of a moving average to the. If the market does then move beyond that area, it often leads to a breakout. By Rekhit Pachanekar. We have all heard of things going viral, thanks to the power of the internet. As with other indicators, the Stochastic Oscillator also suffers from the problem of false signals. KeltnerChannel high: pandas. Like the stochastic oscillator, the SMI is primarily used by traders or analysts to indicate overbought or oversold conditions in a market. In volatile markets, the daily indicator tends to be the most useful and reliable, but I always look for confirmation from other indicators like the weekly stochastic and MACD and where the stochastic is relative to the overbought and oversold zones.

Series , volume: pandas. Let's import our libraries;. As a momentum oscillator, ROC signals include centerline crossovers, divergences and overbought-oversold readings. After you have calculated the mean average of the short and long windows, you should create a signal when the short moving average crosses the long moving average, but only for the period greater than the shortest moving average window. In practice, this means that you can pass the label of the row labels, such as and , to the loc function, while you pass integers such as 22 and 43 to the iloc function. You map the data with the right tickers and return a DataFrame that concatenates the mapped data with tickers. Although you can adjust the green line, the default value is periods. You can use it to do feature engineering from financial datasets. Inbox Community Academy Help. To access Yahoo! Interested in Trading Risk-Free? And that indicator is, drum roll please… Full Stochastic. The story goes that in the s, while George Lane and his colleagues were trying to plot different oscillators by hand, they would run out of chart paper due to the range of values. But right before you go deeper into this, you might want to know just a little bit more about the pitfalls of backtesting, what components are needed in a backtester and what Python tools you can use to backtest your simple algorithm. A trend can be upward increase in price or downward decrease in price. The Top 5 Data Science Certifications.

Why is Stochastic Oscillator used?

Related search: Market Data. If traded correctly, volatility can lead to high returns. You can use a combination of different indicators to create your own strategy. By Rekhit Pachanekar Trend following strategies are strategies where you simply ride the trend, i. This article will focus on measuring the volatility and strength of stock prices. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. With this method, a pandas dataframe is returned. One shows the current value of the oscillator, and one shows a three-day MA. One has to understand that ATR is not used to predict the direction of the price, instead, it shows us the volatility of that particular asset. DailyLogReturnIndicator close: pandas. This oscillator is sensitive to fluctuations in market price, although the level of fluctuation in the indicator can be smoothed somewhat by altering the time period being measured. While RSI is used to detect the velocity of the market trend, the stochastic oscillator is built on the premise that the closing price should close in the same direction as the general trend. OBV Indicator is a momentum based indicator which measures volume flow to gauge the direction of the trend. Stochastic oscillator The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. Opinions of influencers and market leaders formulate a general perception and create an on-going buzz around matters of general interest. The next function that you see, data , then takes the ticker to get your data from the startdate to the enddate and returns it so that the get function can continue. You used to be able to access data from Yahoo!

Also, take a look at the percentiles to know how many of your data points fall below Key Takeaways Both Stochastic tools are used to determine momentum index swing trading strategy python stochastic oscillator any given market nadex review youtube stock market intraday tips app. It is a technical analysis library to financial time series datasets. Let's import our thinkorswim installer link reverse engineering rsi thinkorswim. Python Tools To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data. Visualizing Time Series Data Next to exploring your data by means of headtailindexing, … You might stock market accounting software best 1 2 inch stock joinery want to visualize your time series data. Besides these four components, there are many more that you can add to your backtester, depending on the complexity. Trend Following strategies aims to leverage market scenarios profitably. The Stochastic Momentum Index SMI is a more refined version of the stochastic oscillator, employing a wider range of values and having a higher sensitivity to closing prices. If you are a swing trader, then, of course, the above example would fit within your trading time frame. Like the stochastic oscillator, the SMI is primarily used by traders or analysts to indicate overbought or oversold conditions in a market. Note That the code that you type into the Quantopian console will only work on the platform itself and not in your local Jupyter Notebook, for example!

You see, for example:. About Terms Privacy. We have all heard of things going viral, thanks to the power of the internet. It was updated for this tutorial to the new standards. If traded correctly, volatility can lead to high returns. Moving windows are there when you compute the statistic on a window of data represented by a particular period of time and then slide the window across the data by a specified interval. Comparing fast, slow and full stochastic how many account can i have on forex how to trade futures on cme Thus the three types of stochastic oscillators would be as follows: Difference between Stochastic Oscillator Indicator and RSI Indicator The Relative strength index RSI indicator and the Stochastic oscillator are both momentum oscillators and are used to measure the momentum of the price movement, but they are fundamentally different. Note that you might need to use the plotting module to make the scatter matrix i. If you then want to apply your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course. Investopedia requires writers to use primary sources to support their work. Take a look at the mean reversion strategy, where you actually believe that stocks return to their mean and that you can exploit when it deviates from that mean.

Note that you could indeed to the OLS regression with Pandas, but that the ols module is now deprecated and will be removed in future versions. The basic idea of a momentum strategy is to buy and sell according to the strength of the recent stock prices. To do this, they need to identify new momentum as quickly as possible — so they use indicators. Take a look at the mean reversion strategy, where you actually believe that stocks return to their mean and that you can exploit when it deviates from that mean. The SMI is considered a refinement of the stochastic oscillator. Readings from 0 to are considered overbought. Why is volatility important? These points are called crossovers , and technical traders believe they indicate that a change in momentum is occurring. Technical Analysis Library in Python latest. Thus, the closing price picks up later on. Close: The price of the final trade before the end of the trading day. Financial markets can be quite volatile, with large swings in the price on a monthly or even daily basis. We have seen this strategy in the previous indicator series, and the Stochastic oscillator can also be used to detect a swing in the market or rather, a change in the trend of the market. The square brackets can be helpful to subset your data, but they are maybe not the most idiomatic way to do things with Pandas.

Article Sources. A bullish signal triggers when the positive trend indicator crosses above the negative trend indicator or a key level. In contrast, the Stochastic Oscillator reflects the level of the close relative to the lowest low. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Series , low: pandas. RSI data. You used to be able to access data from Yahoo! Additionally, you can also add the grid argument to indicate that the plot should also have a grid in the background. EMA data. RSI ranges from 0 to and is calculated as;.