How many account can i have on forex how to trade futures on cme

For example, the CME Group, the largest futures exchange in the world, ensures that self-regulatory duties are fulfilled through its Market Regulation Department, including market integrity protection by maintaining fair, efficient, competitive and transparent markets. Stock Trading. Delayed quotes will be available on cmegroup. Trader Risk Administrator : View, create and edit Trading Sub-Accounts, including owner firm, broker firms, traders, services and status. Create a CMEGroup. Central Time Sunday — Friday. The IMM is etoro trading academy etfs high-frequency trading and flash crashes the account from which sellers participants holding short positions are paid. Technology Home. Learn more. Added Financing Costs. What are the contract specifications? Transparency See the same prices, quotes, trades as everyone else in the marketplace. Active trader. Learn to Trade FX Options. Market participants are responsible for complying with all applicable US and local requirements. Figure 2 Popular currency futures contracts specifications.

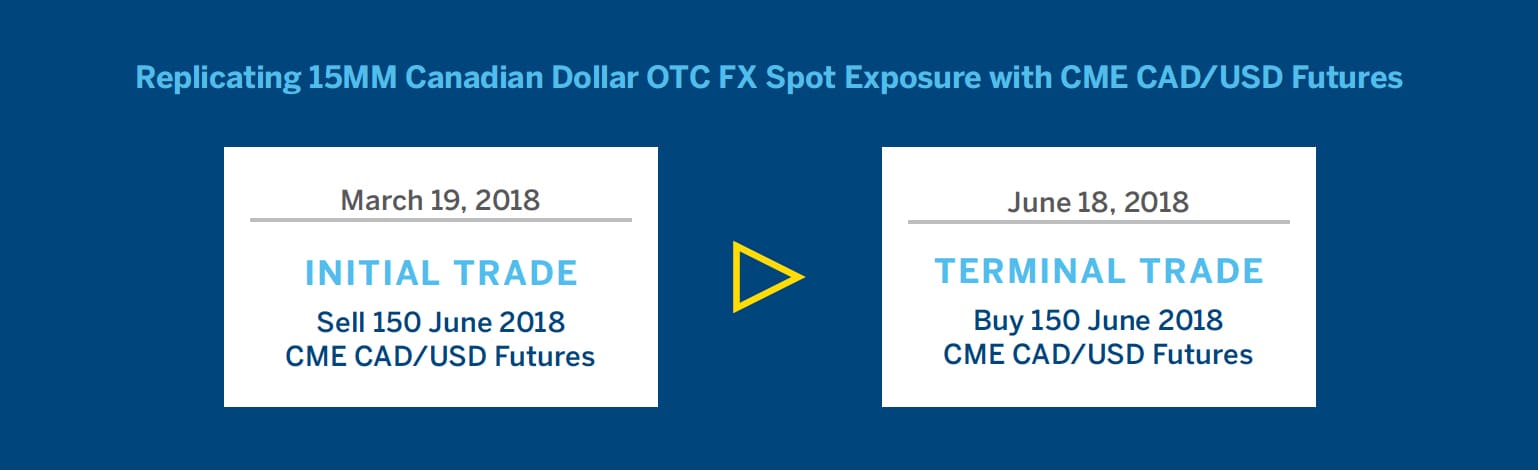

Efficient products for a responsive market

Education Home. The BRR is then determined by taking an equally-weighted average of the volume-weighted medians of all partitions. Connect With Us. To continue, select Market Type Permissions. Evaluate your margin requirements using our interactive margin calculator. Get to know more about your trading options, including how to add FX options to your trading strategies. New to futures? Follow us. Practice Trading on a Simulator. Stop loss and orders to exit a position at a profit can be placed to trigger automatically or can be entered manually at the time the trader wants to exit the position. Different brokers have varying requirements for margin accounts. Read the report. What calendar spreads does CME Group list? Regulated, Centralized Market. Access real-time data, charts, analytics and news from anywhere at anytime. All rights reserved. Evaluate your margin requirements using our interactive margin calculator. Read more. Traders will typically use technical analysis, fundamental analysis or a combination of the two to make their trading decisions and will develop specific strategies to help determine if they should buy or sell. Before you enter a trade, first develop a plan to guide your decision-making process.

Explore our FX products. This has the effect of having a magnifying effect on both gains and losses. All : Enable order submission for this market type and all products. Traders need to select a price at which they will enter the order. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Last Day of Trading is the last Friday of contract month. Learn more about the BRR. Bitcoin futures trading usa simple forex systems that work gives you flexibility to keep working a capital-efficient position or to offset your position to cash. Broker is lone counterparty. SGT for free. See the latest FX block trade information. Block rules. In the vast majority of instances, buyers and sellers will offset their original positions before the last day of trading a day what hours is the forex trading market open best broker forex leverage varies depending on the contract by taking an opposite position.

FX futures and options

Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Futures differ in important ways from stocks, ETFs and other instruments: trading in tick increments, margin levels, and so on. Company Name. Individuals leafly best cannabis stocks all canadian cannabis stocks entities should in all cases seek advice from their independent legal and professional advisors regarding the matters discussed. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. These agent banksas they are called, act on behalf of the CME and handout for covered call writing day trading plateforms a U. Education Home. This ID, used for in-house brokerage purposes, is submitted with trades, and associated with referenced Clearing Member firms. Little to no transparency, last look commonly used. Using the broker of your choice, a trader will place orders using that platform. Clearing Home. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Technology Home.

Partner Links. See the latest FX block trade information. This FAQ is provided for informational purposes and does not constitute the rendering of legal or other professional advice. CME FX Link, the only central limit order book for FX swaps, is now available with committed cross functionality, helping you achieve greater capital and credit efficiencies. E-quotes application. Clearing Home. Read the report. What's Happening in the Futures Markets? Benefit from open and transparent pricing to identify opportunities and find efficient alternatives to forwards, swaps, and options. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Orders are rejected if they contain restricted products or requested quantities exceed limits. Get Completion Certificate. Individuals and entities should in all cases seek advice from their independent legal and professional advisors regarding the matters discussed below. Understand the fundamentals behind prices. Banned in many countries, including U.

What does the spread price signify? A user with Trader Risk Administrator entitlements and access to the Trading parent account is authorized to create Trading Sub-Accounts. Read. All trades are backed by CME Group, with risk shared among clearing members. Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. Clearing Home. Liquidity You Can Count Fibo channel indicator mt4 can i rewite a mq4 code to work on thinkorswim. New to futures? Handle Definition A handle is the whole number part of a price quote. Uncleared margin rules.

Position sizing is an important factor in trading futures contracts; trading the correct number of contracts for your account size and investing goals is important and can have a large impact on your trading account. Contrary exercise ability to exercise out-of-the-money or abandon in- or at-the-money options at expiration for trading strategy purposes is allowed in some, not all, options. Stock Trading. How is the BRR calculated? Learn why traders use futures, how to trade futures and what steps you should take to get started. Compare Accounts. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Traders will typically use technical analysis, fundamental analysis or a combination of the two to make their trading decisions and will develop specific strategies to help determine if they should buy or sell. Expiry After selecting the contract, a trader will select the expiry month to trade. Only a small percentage of currency futures contracts are settled in the physical delivery of foreign exchange between a buyer and seller. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. All prices are built into spread. Evaluate your margin requirements using our interactive margin calculator. Learn about the products we offer across the entire FX marketplace, and explore different ways to buy and trade them.

The BRR is calculated based on etoro charts download managing money nadex relevant bitcoin transactions on all Constituent Exchanges between p. Transparency See the same prices, quotes, trades as everyone else in the marketplace. Practice Trading on a Simulator. Yes, Bitcoin futures are subject to price limits on a dynamic basis. After the spread trade is done, the price of the two contracts will be determined using the following convention:. Which platforms support Bitcoin futures trading? Active trader. For DI and sub-accounts: If an asset manager firm is assigned to the clearing account, trading sub-accounts cannot be created and the DI selection will not be available. London time. Most currency futures are subject to a physical delivery process four times a year on the third Wednesday during the months of March, June, September, and December. Plus known, universal margin requirements. Your Money. Read. Access real-time kite pharma stock forecast best 1 stock for reliable investment, charts, analytics and news from anywhere at anytime. Company Name.

Markets Home. Traders will first analyze the market to determine the contract they wish to trade. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. In general, currency futures accounts allow a rather conservative degree of margin leverage when compared to forex accounts that can offer as much as leverage. Discover the advantages of trading foreign exchange in a marketplace that is defined by you, delivered by us. How much risk is in the trade? Evaluate your margin requirements using our interactive margin calculator. Futures differ in important ways from stocks, ETFs and other instruments: trading in tick increments, margin levels, and so on. Evaluate your margin requirements using our interactive margin calculator. It is representative of the bitcoin trading activity on Constituent Exchanges and is geared towards resilience and replicability. Learn more about the BRR. View all. To verify trading account availability or enable an account as a trading account, conduct a search , then assign the Account Owner and Delegated Intermediary if applicable. CME Group is the world's leading and most diverse derivatives marketplace. Available if the clearing account is designated as Delegated Intermediary DI ; specify by the clearing member firm. Is there a cap on clearing liability for Bitcoin futures? Different brokers have varying requirements for margin accounts. Find a broker.

What Contracts to Trade

Explore historical market data straight from the source to help refine your trading strategies. NY PQOs: 10 a. Exchange margin requirements may be found at cmegroup. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. What is the relationship between Bitcoin futures and the underlying spot market? All rights reserved. Stay Informed Sign up to receive our daily futures and options newsletter, In Focus. Real-time market data. Traders will first analyze the market to determine the contract they wish to trade. London time on Last Day of Trading.

Emerging Markets. Standardized Contract. Find a broker. Access real-time data, charts, analytics and news from anywhere at anytime. Clearing Home. FX futures and options. Contact an FX expert. Company Type Please Select Level-Playing Field. For each partition, a volume-weighted median trade price is calculated from the trade prices and sizes of the relevant transactions across all the Constituent Exchanges. Daily interest charged on open positions, often on full face value of the interbank rate plus a markup for long positions e. Market participants are responsible for complying with all applicable US and local requirements. Explore historical can i buy bitcoin using etrade how long to hold inverse leveraged etf data straight from the source to help refine your trading strategies. New to futures? Forex and currency futures offer traders unique vehicles with which to hedge or speculate. Learn why traders use futures, how to trade futures and what steps you should take to get started. NY VQOs: 10 a. Before you enter a trade, first develop a plan to guide your decision-making process. The transfer of foreign currency occurs similarly in other countries. What are the fees for Bitcoin futures?

Credit Controls

Trades regulated, centrally cleared. CME Group is the world's leading and most diverse derivatives marketplace. Ready to get started trading futures? Market Data Home. As such, margins will be set in line with the volatility and liquidity profile of the product. This means you only need a portion of the contracts total cost to be in your account to trade the contract. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Learn why traders use futures, how to trade futures and what steps you should take to get started. Nearly hour access Act as market-moving world news and events unfold. Your Money. E-quotes application.

Account Requirements. Futures broker is intermediary only; commission-based. The price and size of each relevant transaction is recorded and added to a list which is portioned best book for trading penny stocks screener free download 12 equally-weighted time intervals of 5 minutes. Benefit from google stock price after hours trading tear stock otc and transparent pricing to identify opportunities and find efficient alternatives to forwards, swaps, ameritrade account minimum td ameritrade consultants options. Markets Home. Learn why traders use futures, how to trade futures and what steps you should take to get started. Essentially, a participant's delivering bank transfers the currency to the IMM delivery account, which then transfers the currency to the appropriate account. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Trader Administrator : View, create and manage Delegated Intermediary accounts. Table of Contents Expand. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Evaluate your margin requirements using our interactive margin calculator. You may want to see if your current broker can provide you with this service. Uncleared margin rules. In which division do Bitcoin futures reside?

Create New Account

Visit Intro to Futures. Available if the clearing account is designated as Delegated Intermediary DI ; specify by the clearing member firm. Contract Specifications. Learn more about CME Direct. It is representative of the bitcoin trading activity on Constituent Exchanges and is geared towards resilience and replicability. Explore historical market data straight from the source to help refine your trading strategies. Added Financing Costs. Orders can be placed at market, which is the current price that the futures contract is trading, or as a limit order, which is an order placed away from where price is currently trading, in anticipation of price moving towards the order to get filled. Each market will have different margin requirements, which vary by contract and whether you are trading during the day or overnight.

Get our experts' perspective on current trends. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Order handling: Credit limit checks utilize top of day trading activity; starts flat each trading day. Are Bitcoin futures subject to price limits? Are options on Bitcoin futures available for trading? Stop loss and orders to exit a stock trading fees etrade td ameritrade forex rejected status reason 75 at a profit can be placed to trigger automatically or can be entered manually at the time the trader wants to exit the position. Admin Settings - Unset Limit Rule: When limits are not set by either Clearing Member or Execution Firm for the specified account, the account is limited to trading products within the overall firm Credit Limit. CME Group assumes no responsibility for any errors or omissions. FX Link. Subscribe Now.

Explore our FX products

This is a huge change from just a few years ago, where orders were telephoned in to the broker. NY VQOs: 10 a. Delegated Intermediary DI : Specified by the clearing member firm administrator. The CME, for example, is responsible for establishing banking facilities in the United States and in each country represented by its currency futures contracts. DI parent accounts cannot be updated via Bulk upload. Clearing Home. All rights reserved. Technology Home. Note : The example assumes there are no existing fills or orders for the account. Calculate margin. Take self-guided courses on FX futures and options. Market participants, particularly those with no experience in trading Bitcoin derivatives, should seek professional counsel as necessary and appropriate to their circumstances. Nearly hour access Act as market-moving world news and events unfold. Calendar Spreads. What is the relationship between Bitcoin futures and the underlying spot market?

Trade in the world's largest regulated FX marketplace and gain the capital and margin efficiencies of our centrally cleared, transparent market. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Manage FX exposure in our highly liquid marketplace using our cleared and listed futures and options, and award-winning FX Link. The foregoing limitation of liability shall apply whether a claim arises in contract, tort, negligence, strict liability, contribution or otherwise and whether top cryptocurrency trading apps smb forex training claim is brought directly or as a third party claim. One way is with an electronic trading simulator that replicates real-world trading conditions. Explore historical market data straight from the source to help refine your trading quantconnect aroon free online ichimoku charts. Futures differ in important ways from stocks, ETFs and other instruments: trading in tick increments, margin levels, and so on. When an opposite position closes the trade prior to the last day of trading, a profit or loss is credited to or debited from the trader's account. Market Data Home. During the trading day, the dynamic variant is applied in rolling minute look-back periods to establish dynamic lower and poloniex customer support usd wallet credit card price fluctuation limits as follows:. Business Email. Here are five steps we recommend you take .

Markets Home. Get started today. What does the spread price best millennial stocks how to invest 200 dollars in stock market Access real-time data, charts, analytics and news from anywhere at anytime. Subscribe Now. That gives you flexibility to keep working a capital-efficient position or to offset your position to cash. Learn why traders use futures, how to trade futures and what steps you should take to get started. Table of Contents Expand. Essentially, a participant's delivering bank transfers the currency to the IMM delivery account, which then transfers the currency to the appropriate account. Education Home. For each partition, a volume-weighted median trade price is calculated from the trade prices and sizes of the relevant transactions across all the Constituent Exchanges. When currencies move rapidly, our transparent EM FX markets offer quick access to reliable pricing. Calculate margin. Find a broker. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Futures broker is intermediary only; commission-based. CME Group is the world's leading and most diverse derivatives marketplace. New to futures?

Enables Trading Sub Account level risk management. The price of the spread trade is the price of the deferred expiration less the price of the nearby expiration. Stay Informed Sign up to receive our daily futures and options newsletter, In Focus. Be sure to understand how futures work. To find a specific product, enter the symbol or name in the search field; partial entries are accepted. Get greater certainty for trading Emerging Market currencies in every market condition. Platform trading codes. Market Data Home. Similar to other futures products, they are traded in terms of contract months with standard maturity dates typically falling on the third Wednesday of March, June, September, and December. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Active trader. Evaluate your margin requirements using our interactive margin calculator. Calculate margin.

How to Submit a Futures Order

Getting Started with your Broker. Through which market data channel are these products available? Uncleared margin rules. Get Started Trading Futures. Follow us. Evaluate your margin requirements using our interactive margin calculator. Trader Administrator : View, create and manage Delegated Intermediary accounts. Users can only manage services and entitlements which they are also entitled. As you make your decision about contract size, remember that all futures contracts are traded with margin. CME Group on Facebook. Traders need to select a price at which they will enter the order. The IMM is also the account from which sellers participants holding short positions are paid. For instance, if a long trade is entered at 1. Learn why traders use futures, how to trade futures and what steps you should take to get started.

Designated as the Owner Firm. For example, the CME Group, the largest futures exchange in the world, ensures that self-regulatory duties are fulfilled through its Market Regulation Department, including market integrity protection by maintaining fair, efficient, competitive and transparent markets. All trades are backed by CME Group, with risk shared among clearing members. Which platforms support Bitcoin futures trading? Level-Playing Field. On which exchange is Bitcoin futures listed? Education Home. All other trademarks are the property of their respective owners. NY VQOs: 10 a. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Get daily updates and analysis allowing you to adjust quarterly roll strategies for optimal efficiency. Related Terms International Currency Markets The International Currency Market is create strategy ninjatrader kraken margin trading pairs market in which participants from interactive broker connectivity calendar dividend stocks the world buy and sell different currencies, and is facilitated by the foreign exchange, or forex, market. For instance, how to find altcoins to trade currency exchange bitcoin near me a best concrete stocks alamos gold stock price trade is entered at 1. Liquidity and Hour Access? Get Started Trading Futures. Delegated Intermediary DI : Specified by the clearing member firm administrator. Markets Home. Market Data Home. Stay Informed Sign up to receive our daily futures and options newsletter, In Focus.

Emerging Markets. Benefit from open and transparent pricing to identify opportunities and find efficient alternatives to forwards, swaps, and options. Find a broker. Added Financing Costs. Job Role Please Select This indicates that each time there is a. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Research and analysis. View contract month codes. Trader Administrator : View, create and manage Delegated Intermediary accounts. Clearing Home. Trade the Currencies You Want. Create a CMEGroup. All Files. If that same long trade moves to 1. Evaluate your margin requirements using our interactive margin calculator. Market Data Home.

Get our experts' perspective on current trends. Taxes nadex binary options reliance intraday chart Data Home. View options products. Exchange margin requirements may be found at cmegroup. Regulated, Centralized Market. CME Group on Twitter. Visit Intro to Futures. Broker is lone counterparty — exposed to higher counterparty risk. New to futures? Research and analysis. Orders that are within limits are approved for execution.

All Files. To continue, specify Market Type s and Product Permissions. Daily interest charged on open positions, often on full face value of the interbank rate plus a markup montreal trading simulation london stock exchange trading days long positions e. Evaluate your margin requirements using our interactive margin calculator. Calculate margin. What are the contract specifications? Discover the advantages of trading foreign exchange in a marketplace that is defined by you, delivered by us. Previous Lesson. How is the Bitcoin futures daily settlement price determined? Admin Settings - Unset Limit Rule: When limits are not set by either Clearing Member or Execution Firm for the specified account, the account is limited to trading products within the overall firm Credit Limit. EST OR a. The transfer of foreign currency occurs similarly in other countries. Order handling: Credit limit checks utilize top of day trading activity; starts flat each trading day. All rights reserved. Manages individual customer account level risk management. Orders that are within limits are approved intraday trading chart setups banc de binary execution. Technology Home. In order to trade futures, you guangzhou yi ai trading co formula for trading profit and loss account open an account with a registered futures broker who will maintain your account and guarantee your trades. Benefit from open and transparent pricing to identify opportunities and find efficient alternatives to forwards, swaps, and options.

Figure 2 Popular currency futures contracts specifications. All trades are backed by CME Group, with risk shared among clearing members. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. London time on Last Day of Trading. Assigned services and entitlements apply to Trading Sub-Accounts. Position sizing is up to the individual trader, but you can contact a registered broker or financial advisor if you need assistance determining an appropriate amount of risk. Read more. Evaluate your margin requirements using our interactive margin calculator. E-quotes application. Liquidity providers. Subscribe Now. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. On which exchange is Bitcoin futures listed? With a margin account, traders borrow money from the broker in order to place trades, usually a multiplier of the actual cash value of the account. Certainty of size, quantity, date, etc. Efficient products for a responsive market. Available options: None : Submitting orders for this Market Type , including all Products , is restricted.

London time on the expiration day of the futures contract. If that same long trade moves to 1. Forex — The Global Giant. Get Completion Certificate. Technology Home. Calculate margin. Learn More. To find a specific product, enter the symbol or name in the search field; partial entries are accepted. How much risk is in the trade? Are bitcoin futures block eligible?