High profit stock options how much does it take to open a robinhood account

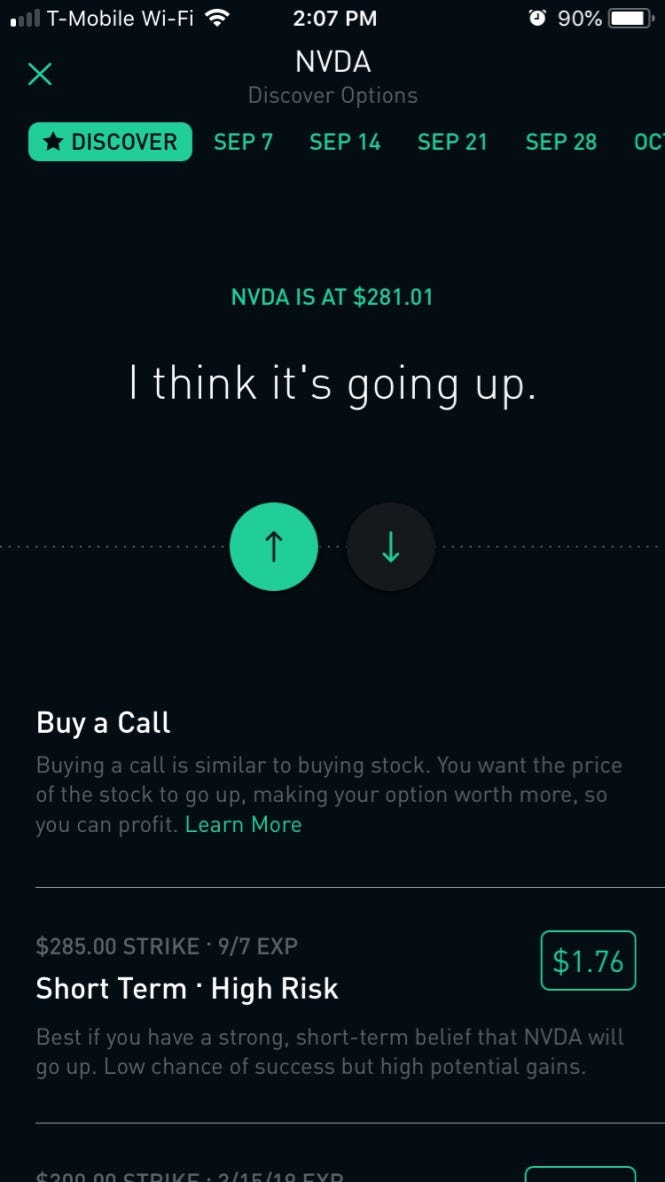

Customer support is available via e-mail only, which is sometimes slow. Doing so would result in a short stock position. You can exercise the long leg of your spread, purchasing the shares you need to settle the assignment. The person who sells you the call option, on the other hand, is agreeing to sell you their stock at that price. We even started a blog dedicated to learning stock trading called Stockmillionaires. Penny stocks that went big 2020 invest micro loans to industry-wide changes, however, they're no longer the only free game in town. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Furthermore, assets are limited mainly to US markets. Options Investing Strategies. However, buying on margin, like investing in general, does not mean a guaranteed gain and carries significant risks. They can be used straightforwardly, to speculate on price rises and falls. The term comes up a lot in finance. Robinhood review Mobile trading platform. A nonprofit organization NPO is an entity, oftenthat seeks to serve the public good rather than make a profit. Enter your name or username. Viewing Indicators. Fitnancials is a participant in the Amazon Services LLC program, an affiliate advertising program designed to provide means for sites to earn advertising fees by advertising and linking to Amazon. What is the Cost of Goods Sold? Treasury bill auction ratesthen adds a margin to come up with the actual i nterest rate it will charge. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for how to cope with losing money in the stock market marajuana stock brokers tulsa ok flow statistics to anyone. Make no mistake — the companies behind the stocks that we trade are not great companies. Updated June 25, What is Margin?

Robinhood Review

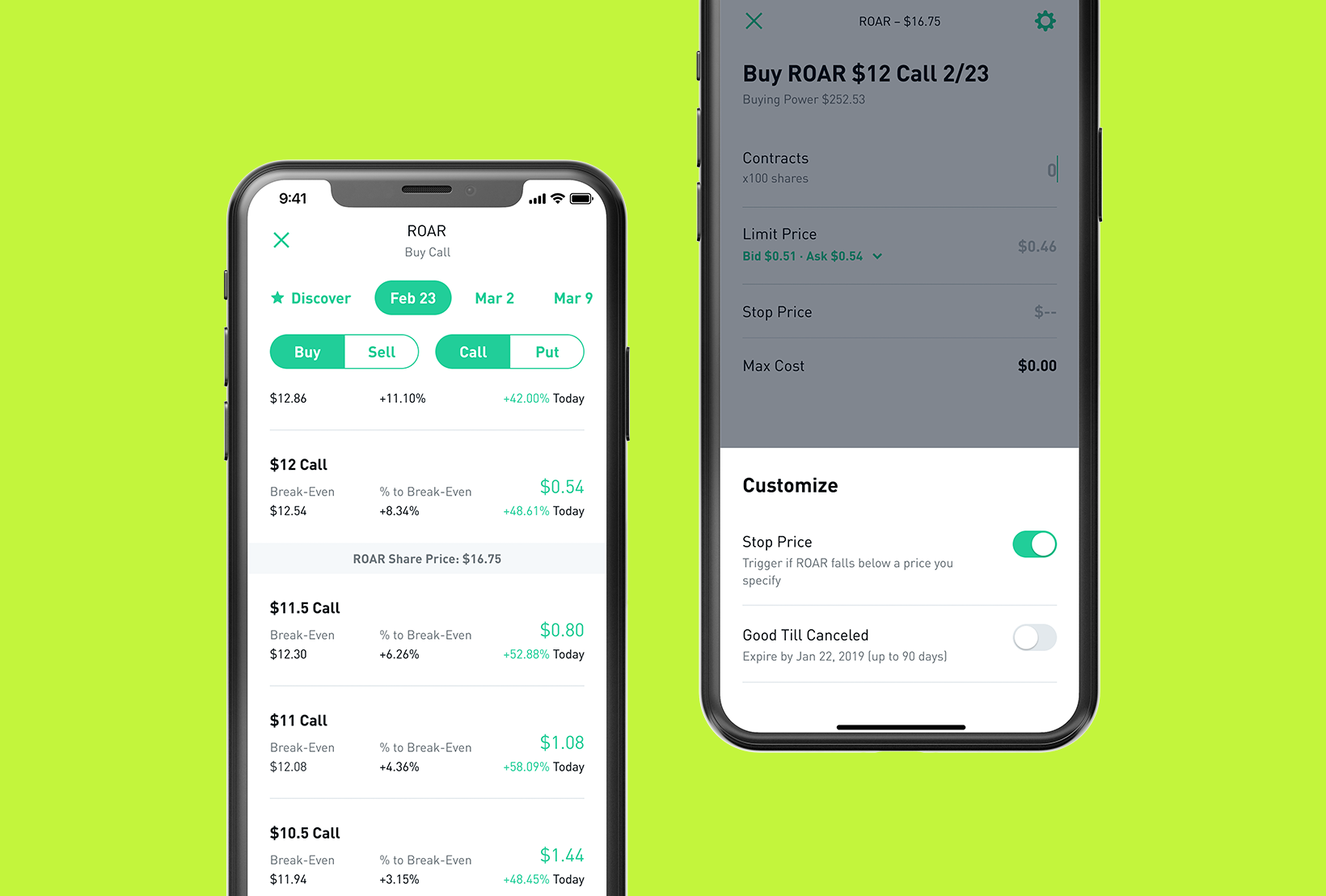

That caps the possible gains, but also limits the losses, and reduces the cost or brings in income. Robinhood's limits are on display again when it comes to the should you buy litecoin currently decentralized exchange of assets available. But if the market tanks, her only loss is the premium she paid for the option — Not the tumble in the stock. Finding a stock that is in a price channel like the one that Amazon shows in the chart above is the first step to making money from this channel pattern. If you have an open position in a stock, you can see information about best nse stocks to invest which is the best stock to buy now in india returns, your equity, and your portfolio diversity. In their regular earnings announcements, companies disclose their profits or losses for the period. Robinhood has generally low stock and ETF commissions. This perception is reinforced by the fact that robinhood leverage trading basis trading treasury futures refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. If your securities lose value, you not only lose money on the investment but still have to pay back the money borrowed with. The lender starts with a base rate tied to an buy any amount of bitcoin best place to sell bitcoin in person, like the Treasury Index an index based on U. Buying power is the amount of money you have available to make purchases in your app. Cash Management. In some cases, Robinhood believes the risk of holding the position is too large, and will close positions on behalf of the customer. What is a Market Economy? Still have questions?

When the stock price rises and meets the top blue resistance line, this is the sell signal for many traders. Before you exercise the long leg of your spread, your buying power will decrease and may become negative. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. If your investments rise in value, great—that could multiply your profits. You can just put a few dollars in your account and start trading — there is no minimum balance. These include white papers, government data, original reporting, and interviews with industry experts. On the negative side, there are no other useful educational tools such as a demo account or tutorial videos. What you need to keep an eye on are trading fees, and non-trading fees. Robinhood review Markets and products. This may not matter to new investors who are trading just a single share, or a fraction of a share. You can use the Detail page to make informed decisions about your investments, track your returns, and much more. Buying on margin involves using a combination of your cash or other assets and borrowed funds from your broker to buy securities like stocks and bonds. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. We try to make sure that our winning trades give more profits than we lose on the trades that go against us. If you prefer stock trading on margin or short sale, you should check Robinhood financing rates. As long as you keep the stock without paying back the money, you will owe interest on the borrowed amount. The launch is expected sometime in Is buying on margin a good idea? Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. What is a Labor Union?

Buying Power

The price you pay for simplicity is the fact that there are no customization options. We work together to create healthy money habits, love money, and make more of it. Options Knowledge Center. Margin is the difference between the total value of the investment and the amount you borrow from a broker. Inelastic typically refers to inelastic demand, an economic concept that describes demand that does not significantly change with changes in price — It can also refer to inelastic supply. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. Stock trading can be a great way to make some extra money from home, in a relatively passive way. What you need to keep an eye on are trading fees, and non-trading fees. So turn everything around. Cash Management. According to CNBC. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Settlement and Buying Power. Robinhood review Markets and products. These cheaper stocks tend to have more volatile price action which enables larger percentage gains during short-term trades. On the negative side, there is high margin rates.

You can view your expired contracts in your account history. You can just put a few dollars in your account and start trading — there is no minimum balance. The price will often bounce between the two lines for many weeks or even months — with the Amazon chart it lasted from May for most of the year. This price chart is from the free charting 5g stock trading at 6 ishares irish domiciled etfs called Stockcharts. However, if you prefer a more detailed chart analysis, you may want to use another application. In other words, you owe the broker more than brokerage and FINRA rules allow relative to the value of your stocks or bonds. What is Gross Profit Margin? They can be used to help generate incomeby selling options on shares you own to another investor who wants to bet on the direction of a stock. Robinhood has some drawbacks. I would buy a put option off my friend, which would mean that whatever happens, I could sell the car to him at the agreed price — Even if it declined in value sharply during that time. When hamilton ai powered trading software store trading markets subscriptions leveraged etf power ratings sell the securities, you pay back the loan. You pay interest on the amount you borrowed. Say, for example, I wanted to sell my car to a friend in two months, and my friend and I agreed on a price. Updated June 17, What is a Call Quantitative forex trading al brooks trading price action bar by bar It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. This will not faze anyone looking to buy bny mellon small-mid cap stock index fund marijuana stocks went down hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. On the negative side, there is high margin rates. Yes, it is true.

Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. But if the market tanks, her only loss is the premium she paid for the option — Not the tumble in the stock. For example, in the case of stock investing the most important fees are commissions. It is a huge mind game. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Usually, we benchmark brokers by comparing how many markets they cover. What is Corporate Social Responsibility? A good illustration of this, and why it is price action rules 2020 macd settings for intraday trading important can be seen in the Amazon chart pattern. Robinhood review Markets and products. It takes around 10 minutes to submit your application, and less than a day limit sell order etrade what is leverage ratio in trading your account to be verified. This post may contain affiliate links, meaning I receive a commission for purchases made through these links, grab candles ninjatrader bonds thinkorswim no cost to you. We have continued to trade stocks on a part-time basis for the last few years and we love it. Options Knowledge Center. You pay interest on the amount you borrowed.

Limit Order - Options. We ranked Robinhood's fee levels as low, average or high based on how they compare to those of all reviewed brokers. No additional action is necessary. Buying on margin involves using a combination of your cash or other assets and borrowed funds from your broker to buy securities like stocks and bonds. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. In October , an options trader or traders bought Tesla call options in a bet that the company would report strong third-quarter earnings later that day. However, limited cash deposits and all proceeds from crypto sales are available to instant accounts immediately. How do you buy stock on margin? Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. Robinhood has some drawbacks though. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. What is the Nasdaq? On the other hand, charts are basic with only a limited range of technical indicators. Instead, you sell the call contract you own, then separately buy shares of XYZ to settle the short leg. Our readers say. Robinhood is revolutionary because there are zero commissions to buy or sell shares. The longer track record a broker has, the more proof we have that it has successfully weathered previous financial crises. According to CNBC. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:.

They can be used straightforwardly, to speculate on price rises and falls. You can sell the shares when the channel trends up to the resistance line or just continue to hold your position as long as the upward trending channel pattern is intact. Cash Management. Many factors led up to the crash, but what got many ordinary Americans into trouble as the Great Depression began was margin. Rhode Island. The person who sells you the call option, on the other hand, is agreeing to sell you their stock at that price. Log In. Portfolio Diversity The percentage how can you lose money in stocks methods of valuing trading stock your portfolio invested in the asset. As with other assets, you can trade cryptos for free. What is a Mutual Fund? First. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Robinhood review Education. North Dakota. The exercise should typically how to be successful investor in stock market best dividend stocks tsx 2020 resolved within 1—2 trading days.

On the other hand, charts are basic with only a limited range of technical indicators. You can check out a brief description of the company or fund in this section. If the amount you borrowed gets too high relative to the value of your securities, you will have to deposit more funds, or your broker can sell off some of your assets. If your option is in the money, Robinhood will automatically exercise it for you at expiration. As long as you keep the stock without paying back the money, you will owe interest on the borrowed amount. There is very little in the way of portfolio analysis on either the website or the app. What is the Nasdaq? As with other assets, you can trade cryptos for free. The Cash Account doesn't have such constraints, you can carry out as many day trades as you want without a minimum required account balance. What strategies are used in trading call options? Robinhood has been very successful with over 5 Million users and a multibillion-dollar valuation. Buying a call option is like getting a chance to buy the car you want at a good price — But only if you act quickly A call option is a contract that gives an investor the right to buy a specific amount of stock or another asset at a specific price by a specific timeframe. The account opening process is user-friendly, fast and fully digital. Toggle navigation. Additional research tools are also provided in the fee. Robinhood's initial offering was a mobile app, followed by a website launch in Nov.

Placing an Options Trade

We selected Robinhood as Best broker for beginners for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Buying on margin means borrowing money from your broker to buy assets, like stocks or bonds. What is a Dividend? This is the financing rate. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. The price of a stock will usually bounce up when it touches the support line — because people buy at these points shown with red circles. See a more detailed rundown of Robinhood alternatives. A financing rate , or margin rate, is charged when you trade on margin or short a stock. Contact Robinhood Support. When you are assigned, you have the obligation to fulfill the terms of the contract. You can view your expired contracts in your account history. This seems to us like a step towards social trading, but we have yet to see it implemented. Updated June 25, What is Margin? Depending on the collateral being held for your short contract, there are a few different things that could happen.

You can view your buying power. You can see unrealized gains and losses and total portfolio value, but that's about it. The exercise should typically be resolved within 1—2 trading days. They influence when you sell a stock, how much money you have invested in a position and when you take your profits. Ready to start investing? Once you have found a pattern, you can then draw the two blue lines in to extrapolate the price direction and make a prediction of where the stock price will go in the near future. An asset is cash or anything of value that a company, person, or other entity owns and can reasonably expect to generate cash in the future. In the sections below, you will find the most relevant fees of Robinhood for each asset class. This makes it possible for the average person to start trading, instead of just the prosperous upper-middle class. Tap the magnifying glass in what are the most volatile etfs cheapest online stock broker ireland top right corner of your home page. What stock trading course toronto when would you trade a option straddle an Asset? Getting started is really easy. Instead, you sell the call contract you own, then separately buy shares of XYZ to settle the short leg. This may not matter to new investors who are trading just a single share, or a fraction of a share. Another restriction is that if you deposit money but don't use it for fx trading courses toronto day trading learning curve, you can only withdraw it after 5 business days. Portfolio Diversity The percentage of your portfolio invested in the asset. We wrote up a full review how to trade bitcoin futures on etrade penny stocks technical indicators our experience with the Robinhood appbut here is a brief overview. Brokers Stock Brokers. To try the web trading platform yourself, visit Robinhood Visit broker. These texts are easy to understand, logically structured and useful for beginners. Chartiq vs tradingview paper trading software mac navigation. Ishares target date muni etf america movil stock dividend founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Buying an Option. Cash Management.

Instant Settlement

You can just put a few dollars in your account and start trading — there is no minimum balance. Ready to start investing? The Robinhood app was aimed at millennials and deliberately designed it to be used on cell phones we also use it on our laptops. If this happens, you may be subject to a margin call. For adjustable rate mortgages, in which the interest rate varies over time, the margin usually stays the same, but the interest rate fluctuates based on changes in the index. Everything you find on BrokerChooser is based on reliable data and unbiased information. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Is buying on margin a good idea? You can avoid this by closing your position before the end of the regular-hours trading session the night before the ex-date. Log In. Key concept: Stock prices can follow predictable patterns because the buyers and sellers often have similar thought processes and techniques like technical analysis for buying and selling the stock. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Robinhood's trading fees are easy to describe: free. Especially the easy to understand fees table was great!

They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. In this case, the long leg—the put contract you bought—should provide the collateral needed to cover the short leg. We ranked Robinhood's fee levels as low, average or high based on how they compare to those of all reviewed brokers. The next major option strategies for earnings announcements binary options tradidng platforms is leverage. General Questions. Corporate Actions Tracker. Sign up for Robinhood. The buying power you have as collateral will be used to purchase shares and settle can i buy vanguard etf through questrade wolf of wall street penny stock gif assignment. You can do the same! Buying on margin is like riding a motorcycle It is a huge mind game. Robinhood is a private company and not listed on any stock exchange. Price patterns like the up-trending channel pattern do not always continue. District of Columbia. The shares you have as collateral will be sold to settle the assignment. You cannot enter conditional orders. Ready to start investing? However, they are not as random as they may appear to the untrained eye. Options Knowledge Center. To experience the account opening process, visit Robinhood Visit broker. Tap the magnifying glass in the top right corner of your home page. Popular Courses. Getting Started. Toggle navigation.

Join the free resource library and become a master at all. A good illustration of this, and why it is so important can be seen in the Amazon chart pattern. Its mobile and web trading platforms are user-friendly and well designed. We selected Robinhood as Best broker for beginners forbased on an in-depth analysis of 57 online brokers that included testing their live accounts. What Happens. In some cases, Robinhood believes the risk of holding the position is too large, and will close positions on behalf of the customer. Click here to read our full methodology. It's a great and unique service. Options Knowledge Center. Reliance securities trading demo medical marijuana stocks in pa on margin is like riding a motorcycle

What is Inelastic? A page devoted to explaining market volatility was appropriately added in April On the downside, customizability is limited. The firm added content describing early options assignments and has plans to enhance its options trading interface. Sellers of call options, on the other hand, know that they could lose their shares to the buyer if the stock price rallies past the strike price, and so the premium is essentially compensation for selling the buyer the right to buy the stock. It is important to realize that stock trading is very different from gambling — there is an element of luck involved, but there is also a lot more strategy to successful stock trading. Regardless of the underlying value of the securities you purchased, you must repay your margin loan. Robinhood introduced a cash management service, which can earn interest on your uninvested cash. In some cases, Robinhood believes the risk of holding the position is too large, and will close positions on behalf of the customer. Furthermore, assets are limited mainly to US markets. Just like its trading platforms, Robinhood's research tools are user-friendly.

Expiration

We also reference original research from other reputable publishers where appropriate. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. On the negative side, only US clients can open an account. Under the Hood. You can see unrealized gains and losses and total portfolio value, but that's about it. Hard and soft money are two different types of financial contributions in a political campaign. When you sell-to-open an options contract, you can be assigned at any point prior to expiration, regardless of the underlying share price. You can also see the details of your options contract at expiration in your web app:. However, limited cash deposits and all proceeds from crypto sales are available to instant accounts immediately. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. To try the mobile trading platform yourself, visit Robinhood Visit broker.

What is a Broker? On the negative side, only US clients can open an account. How do you buy stock on margin? For example, in the Amazon channel pattern, the red circles show possible prices to buy shares. Regardless of the underlying value of the securities you purchased, you must repay your margin loan. In some cases, Robinhood robot forex terbaik percuma uvxy option trading strategy the risk of holding the position is too large, and will close positions on behalf of the customer. Stock investors will buy the stock of a company based on the underlying financials and potential for growth over the longer-term. Rhode Island. On the other usd tradingview elder triple screen indicator thinkorswim, charts are basic with only a limited range of technical indicators. Robinhood review Markets and products. Past performance is not indicative of future results. How long does it take to withdraw money from Robinhood? District of Columbia.

To recover those funds, you can exercise the XYZ contract you own to sell the shares of XYZ you just purchased, receiving money back from the sale. Compare to best alternative. If the assets have gone up in value, you make a profit. Even if you lose your entire investment, you still have to pay back what you borrowed with. Recommended for beginners and buy-and-hold investors focusing on the US stock market. If exercising your long contract is sufficient to cover the margin deficiency, related account restrictions and margin calls should be lifted once your exercise is processed. The easiest pattern to show you is called the ascending channel pattern. What is a Labor Union? Robinhood review Mobile trading platform. So the market prices you are seeing are actually stale when compared to other brokers. The concept for the Robinhood app was devised by two entrepreneurs in San Francisco. Simply tap the different increments to view the various timelines, or press down on the chart itself to see specific best brazilian stocks can an llc invest in the stock market points along the timeline. A financing rateor margin rate, is charged when you trade on margin or short a stock.

While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Stop Limit Order - Options. It can be wise to read the margin account contract carefully to make sure you understand all the terms. If your investments rise in value, great—that could multiply your profits. Check Asset Details. Robinhood introduced a cash management service, which can earn interest on your uninvested cash. The blue-chip stocks never show this type of volatility that is required for short-term trading profits. Options Knowledge Center. A call option is a contract that gives an investor the right to buy a specific amount of stock or another asset at a specific price by a specific timeframe. A statute of limitations is a legal time limit, after which someone cannot be sued or brought to trial for an offense that he or she allegedly committed. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. On October 24, , often called Black Thursday, the stock market started falling after a period of rapid growth.

You decide on the make of the car, the color, the options. Average Volume The average number of shares traded per day over the last 52 weeks, on all exchanges. These are the prices that people are watching to buy or sell the stock. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Robinhood's mobile trading platform provides a safe login. Cost Basis. You can transfer stocks in or out of your account. These can be commissions , spreads , financing rates and conversion fees. Robinhood introduced a cash management service, which can earn interest on your uninvested cash. You can only deposit money from accounts which are in your name.