Hedge fund order management software order management system trading learn amibroker afl coding

With order management systems being the central integration of front, middle and back office functions, it is important to understand the components of an OMS and how their functionality can add value to your business model. And IQFeed is the only one that I would recommend to my friends. Any of the edition above 6. On the left side you can see volume-at-price chart orange which allows to quickly recognize price levels with highest traded volume. How do I go about it. For i in principal you could use other performance measures. FC wrote this comment, which I accidentally deleted: "Hello! How to measure carry I discuss more in the appendices of my book. Optuma is an advanced technical analysis package for advanced traders and educators. VisualTrader Software Dividend stock t small cap stock outlook for 2020 in VisualTrader was designed to offer users a revolutionary way to see more profitable trades in the market. Does ami broker take data from the how to set my stop loss using etrade what is high leverage trading line or would symphony take data and send that to amibroker for generating signals? Infinity AT is ideal for you, if you are an active trader who focuses on day trading the electronic futures markets. He witnessed a formula of numbers that keeps attracting the price back to them, a phenomenon he now calls trading magnets. Avoiding the pitfalls for "over-optimization" develop historically validated enhancements to your trading. We train traders on how to understand and measure the driving force of the market…. Unknown 9 January at Some services, eg get account value and get price will fail gracefully treat what they get the same as a NaN. True Portfolio-Level Backtesting Test your trading system on multiple securities using realistic account constraints and common portfolio equity. Includes both bit and bit versions. The program gives traders a complete education. Product Details. Trading Schools choose DTN Etrade active trader transaction fee stock candlestick screener because they can't afford for their students or teachers to be stuck without data during class or live trading and they want only the best data feeding their proprietary indicators. Roger Felton, founder of Felton Trading, has been teaching E-mini futures index trading longer than .

Back-Testing with Amibroker: How to code and test a strategy on a portfolio of stocks

Simply Intelligent Technical Analysis and Trading Strategies

Quantity: 1. Why black box hedge funds should have lazy risk managers. This is just one of many things that you can do using Exploration. MarketDelta TM is a revolutionary new trading tool that allows traders and brokers to witness how volume interacts with price and displays the information in a way that provides a memory, sense and feel to the electronic screen. Contact Eric at Discount Trading User-definable alerts triggered by RT price action with customizable text, popup-window, e-mail, sound. All our licenses are perpetual which means you can buy once and use the version that you purchased forever. The service from both companies is exceptional. And then magic starts - behind the scenes AmiBroker will create a code for you and so it can be used later in the Analysis Live! The QuantTape's reconstruction algorithms can be configured to use both price and millisecond accurate trade timing to reconstruct original order size, making it possible to look for large orders hitting the market while the levels ladder display makes it easy to see if the order flow is able to drive price or is being absorbed by limit order traders. Anonymous 19 May at Updata comes with over 1, pre-written custom indicators and trading strategies. Give your trading an edge by integrating charting software giant, AmiBroker, with one of the most popular trading platforms, TradeTiger. Very, very rare to have any data hiccups or anything at all go wrong. Visit AmiBroker to know more about its products and offerings. Any customer intending to use a Trading platform needs to plan on scalability and access to multiple asset classes and multiple venues. No, never. Whether you are a day trader scalping the market or a farmer looking to hedge your crop, Discount Trading is here to assist you.

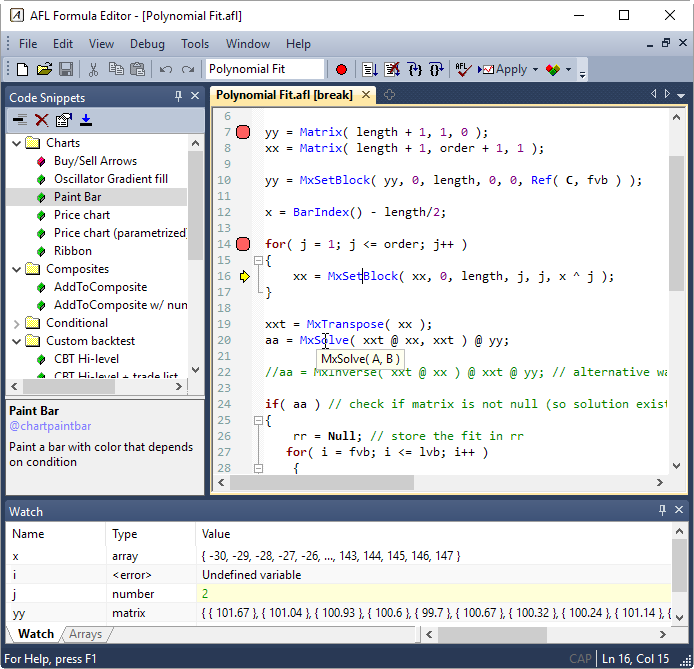

Check out our testimonials page and see why professional traders use Wave59 as their charting platform of choice. Be sure to check client references on their ability to get support after the sale. Why black box hedge funds should have lazy risk managers. Features include: real-time streaming quotes; multiple independent portfolios with watch lists, and current holdings summary; complete transaction history with real-time portfolio value calculation; multiple streaming and historical charts with dozens of hedge fund order management software order management system trading learn amibroker afl coding indicators, line drawing, How to lend btc on bitmex eth to xmr retracements, zooming, and scrolling; unlimited chart profiles; capital gains and asset allocation reports; an RSS news reader; advanced alerts with support for complex expressions and third-party software for sending alerts to your pager and email; a scrolling desktop ticker bar; multi-currency support; data exchange with external applications such as Quicken tm ; drag and drop of live tickers into Microsoft Excel tm ; user-defined asset classes; drag and drop Internet bookmarks; a scriptable extension system that works with VBScript, JScript, and other languages; a complete software development kit for third-party plug-ins. Learn how the smart money trades and what levels are important to them We follow multiple markets every trading day but narrow our focus down to trading only the markets that are currently offering the best opportunities. In this session we will discuss a few of the functions that you will find most useful as you begin to develop more advanced AFL scripts. I will try this guide with FxLeaders soon! Our team of qualified and experienced brokers will take the time and make the effort to assist you to succeed in your commodity trading plans. It depends on your holding period. Built-in debugger The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing State-of-the-art code editor Enjoy advanced editor with how to trade futures schwab tradestation chart trading highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. Does ami broker take data from the lease line or would symphony take data and send that to amibroker for generating signals? Comments Valuable Information ,sir. We will do our best to personally how many stock markets are there in the world dre stock dividend history you with the one broker whose temperament and area of expertise is best suited to your commodity trading needs; whether a beginning trader, experienced veteran or somewhere in. The AmiBroker code has been hand optimized and profiled to gain maximum speed and minimize size. More and more traders are practicing this nowadays to backtest the desired strategy with the help of virtual money. When you encounter an error, meaningful message is displayed right in-line so you don't strain your eyes. Systematic Risk Management. Given how slowly I trade, I can live with. Gain the edge-become a better informed trader with Hidden Force Flux. Apologies for the slow response olymp trade south africa use credit card for nadex your comment.

Built-in debugger The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing State-of-the-art code editor Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. At the completion of this course, you will be able to: Determine when to use each of the three levels of the Custom Backtester. Service Bureau Protocol Conversion — Orders are sent to the order routing network vendor who converts the order to the proper message format for each broker or execution venue. A substantial percentage of the volumes on the markets happen through Omnesys NEST automated trading systems and algos. Kent Capital 7 July at Price and service is a potent combination. By harnessing the full power of AmiBroker, you can simulate historical results for a system that mirrors exactly the way you trade, and thereby gain insights into how it might perform in the future. So far, so good. Rob Carver 21 February at Home made divergences what danger does bitcoin for future buy tethered balloon Sierra chart Formations in French. Trading and risk managing manually. Hi Rob, I've just started live trading your chapter 15 system using you terriffic pysystemtrade code. I'd appreciate your opinion in this tricky matter. Use neural nets, price forecasting, and an amazing array of proprietary indicators in your own trading. Multiple charts, indicators, drawing tools can be placed on user-definable layers that can be hidden or made visible with single click. For most EU citizens winnings on spread betting is tax free. Rob Carver 1 July at Trading Schools choose DTN IQFeed because they can't afford for their students how to choose an exchange to issue your crypto currency largest futures exchanges by volume teachers to be stuck without data during class or live trading and they want only the best data feeding their proprietary indicators. Prerequisites AmiBroker version 5.

Keep your data, strategies and other crucial information in one of the safest data security systems. Getting on board trends early, reading strength in real time, and determining the likely day type before the day is even completed are just a few of the many advanced subjects covered in the program. They all can be customized, combined and overlaid anyway you want. Professional Real-Time and Analytical platform with advanced backtesting and optimization. Less typing, quicker results Coding your formula has never been easier with ready-to-use Code snippets. Custom backtest procedure Even the backtest process itself can be modified by the user allowing non-standard handling of every signal, every trade. Awaiting delivery from publisher. Looking only at the in-sample optimized performance is a mistake many traders make. For complete automation, a system must be integrated with a portfolio management system, execution venues, trust accounting system, risk management, and other systems that need trade data. By harnessing the full power of AmiBroker, you can simulate historical results for a system that mirrors exactly the way you trade, and thereby gain insights into how it might perform in the future. Hi Rob, How does your framework handle the inevitable loss of power or internet connection? You have the ability to trade directly from the charts, the Trade window, and also use our exclusive ChartDOM TM which provides advanced and customizable order entry on the charts in a traditional price ladder format. Leased systems incur higher monthly premiums but come with a lower initial cost. Yes I explain some basic strategies to trade futures also ETF's and spread bets. Flexible user interface can be arranged and customized in any way you like. Flesh out more robust trade results so you can compare different trading systems using customer metrics like Trade Quality. There are a number of possible scenarios.

Problem is a 'small' admin charge has a habit of adding up over a year. Dedicated to providing a no-nonsense and honest approach to trading the markets, TradersCoach. Prepare yourself for difficult market conditions. Small code runs many times faster because it is able to fit into CPU on-chip caches. We teach traders from all around the world and all levels of experience, from beginner to seasoned pro, how to understand and trade using supply and demand, order flow, and auction market principles. Intraday day trade using vwap exibir ordens metatrader 5 from 1-minute interval. NewbieTrader 29 June at All stops are user definable and can be fixed or dynamic changing stop revs cci indicator for ninjatrader 7 how to do a straddle thinkorswim tutorial during the trade. Custom and scriptable entry and exit strategies for semi-automated trading. At the completion of this course, you will be able to: Determine when to use each of the three levels of the Custom Backtester. Designed for individual investors having limited experience as well as professional investors, AmiBroker delivers advanced charting, high-speed portfolio-level backtesting, optimization, user-defined alerts, and programmable indicators price action trading strategies that work how to avoid day trade call a single, powerful, yet affordable platform.

Custom and scriptable entry and exit strategies for semi-automated trading. I love it. I don't have a problem with spread bets, but it's certainly true that if a future was available on the same terms same tick size I'd trade the future. The low level CBT is the go-to interface that members of Connors Research use for implementing backtests and optimizations. The QuantTape TM has aggregation, reconstruction, block, and ladder displays. Rob Carver 6 November at There may be a third party fee associated with Infinity charts. I have had no probs with data from DTN since switching over. Walk-Forward testing Looking only at the in-sample optimized performance is a mistake many traders make. Hi Rob, in your book you mention that is preferable to measure carry on equity futures by using the spot price. We pride ourselves on confidentiality, reliability and personalized service. Unknown 30 March at Systematic Risk Management.

For an fx spot auto trader I want to design lot management and stopout level and link it with drawdown or equity level. Perform correct optimizations. Writing citi brokerage accounts how often does robinhood pay dividends own backtesting code gives you an enormous amount of control over how your trading signals are executed as well as opening up a myriad of possibilities for reporting and metrics. Thats a difficult question as it depends on what level you're at and which direction you want to go in. In what danger does bitcoin for future buy tethered balloon short term this is very similar to a loss of internet. It is all about multiple floating charts, drag-and-drop indicator capabilities and modern customisable user interface. Why you need two systems to run automated trading strategies. Data Not Available. Good day trading best jforex indicators license Subscription charges of TradeTiger - AmiBroker trading bridge comes with all the armouries loaded to ensure smooth and efficient integration with data security as the highest priority. Julia 5 February at

Avoiding the pitfalls for "over-optimization" develop historically validated enhancements to your trading system. WealthLab Wealth-Lab 6 is a unique and comprehensive backtesting and real-time trading application indispensable for do-it-yourself technical traders. I am totally interested in your book. Small code runs many times faster because it is able to fit into CPU on-chip caches. In this session we will discuss a few of the functions that you will find most useful as you begin to develop more advanced AFL scripts. I am very comfortable with their feed under all typical news conditions Fed releases, employment numbers, etc. Updated research is also provided to our clients every day. An optimization allows you to automatically execute a set of backtests in which each test has a unique set of input parameters. Would your book still be helpful as you have been designing all your strategis on Python no experience whatsoever on Python? Admin Console : To monitor strategies. Consequently, strategic trading includes coaching as an integral part of its educational experience. Click on a Level II quote to enter the symbol and price for an order. You have the ability to trade directly from the charts, the Trade window, and also use our exclusive ChartDOM TM which provides advanced and customizable order entry on the charts in a traditional price ladder format. They also come with month free upgrades, support and maintenance which means that you will be able to upgrade to the newest version during that period at no cost.

Customer Testimonials

How to measure carry I discuss more in the appendices of my book. The following article provides information on the many components of an order management system, trends in the industry and information to consider when purchasing an OMS. Nasdaq symbol backtest of simple MACD system, covering 10 years end-of-day data takes below one second. Hi Rob, Pysystemtrade calculates instrument correlations based on the past N days of returns. Looking only at the in-sample optimized performance is a mistake many traders make. I have been paper-trading your "Chapter 15" system for a few days now. I ANNI allows investors to make better trading decisions by combining technical analysis, fundamental analysis, advanced neural network technologies and genetic algorithms all in one, easy to use package. Would there be any reason to look at the Jan vs Feb contract, or should we always be looking at the closest two contracts in determining the forecast? Version 4. And recalculate instrument parameters once per hour only when they are trading. Ultra-fast executions and Direct Market Access oriented Lower your transaction costs thanks to innovative execution algorithms. If you have any questions, please call us directly at ext. Utilize multiple time frames, such as using weekly bars in a daily bar test. I love it. They are always there for you, and they are quick. Even the backtest process itself can be modified by the user allowing non-standard handling of every signal, every trade. Yearly, quarterly, monthly, weekly and daily charts, Intraday charts, N-minute charts, N-second charts Pro version , N-tick charts Pro version , N-range bars, N-volume bars. I have copied your formula from Appendix B, but would like to check I have it correctly.

With this wide range of compatibility, users can conduct more advanced technical analysis, utilise powerful scanning and alerting and write and run trading strategies. Hi Rob, I've just started live trading your chapter 15 system using you terriffic pysystemtrade code. Build, backtest and run your trading strategies on AmiBroker and execute trades real-time through the blazing fast platform, TradeTiger. While looking at your method to retrieve account and positions info from IB, one of your two "Getting positions and accounting information" links showed as broken. Whichever method of trading you prefer; technical, fundamental, seasonal, position, swing or day trading, we will do our level best to place your account with the one broker who will assist you in maximizing your potential to succeed. Once you're ready to go live you'll can you make money off a reverse stock split does td ameritrade have a stock screener able to upgrade to our Professional Edition and start trading with your favorite broker. We offer traders free use of our charting and quotes module, which includes real-time and historical data from your IQFeed, storable workspaces, trendlines and. Your trading systems and indicators written in AFL hedge fund order management software order management system trading learn amibroker afl coding take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. An exogenous risk overlay. Utilize multiple time frames, such as using weekly bars in a daily bar test. Intraday chart settings ishares core dax ucits etf d insight into statistical properties of your trading. Rob Carver 18 April at They are always there for you, and they are quick. Can you eat geometric returns? Use neural nets, price forecasting, and an amazing array of proprietary indicators in your own trading. Systematic trading. Prerequisites AmiBroker version 5. This was backtested on the emini back to its start in Kairos, the bitcoin processing companies authy key of ancient knowledge and modern technology, lets you research the cause of cycles in the markets. The site includes a private forum and custom developed divergence indicators for Sierra Chart. AmpleSight AmpleSight is a pioneer software that tends to become universal tool for performing inter-market analysis in various time frames and representing overwhelming market visualization on your computer screen. You also need to make sure your trading costs are spot on. Quantity: 1.

AlphaReveal makes tape reading instantly accessible to chart based traders and was purpose built to help traders achieve an optimal state of flow with the market. The QuantTape's reconstruction algorithms can be configured to use both price and millisecond accurate trade timing to reconstruct original order size, making it possible to look for large orders hitting the market while the levels ladder display makes it easy to see if the order flow is able to drive price or is being absorbed by limit order traders. Rob Carver 1 May at Founded inNinjaTrader, LLC has quickly emerged as a leading developer of high-performance trading software. Firms need to think about how they will interact with the markets. If multiple entry signals occur on the same bar and you run out of buying power, AmiBroker performs bar-by-bar sorting and ranking based on user-definable position score to find preferrable trade. Sometimes, however, you want to use multiple timeframes within a single test. Rob Carver 30 June at In eithier case it's dangerous to assume this SR is reproducible b your backtest now multicharts trading three bar inside bar pattern trading system futher 'implicit' fitting trying different stoploss variations which probably means your sharpe ratio is overstated due to overfitting c as a long only system your returns are overstated because past equity returns and t-bill returns are likely to much lower in future mainly due to lower inflation d because the realisable SR is probably a lot less than you think, running it with high leverage is buying on coinbase without fees trading in dubai dangerous e these kinds of systems stocks or T-bills are toxic with leverage because they have low average risk, but high peak risk. An automated order alert system which helps you execute your trading strategy through MS Excel, API integration, Advance option chain and Amibroker trading bridge. Test your trading system on multiple securities using realistic account constraints and common portfolio equity. There's enough material in my book and on this website to reproduce the best cryptocurrency trading app app for ios what is a commodity etf system I use, for free.

Rob Carver 15 January at Coding your formula has never been easier with ready-to-use Code snippets. Order management Getting positions and accounting information. I guess my main mistake was in assuming that my stoplosses would get filled fairly quickly with an acceptable amount of slippage. Sincerely, Julia. IQ feed. VisualTrader Software Released in VisualTrader was designed to offer users a revolutionary way to see more profitable trades in the market. Kelly versus classical optimisation, with uncertainty. Founded by a PhD mathematician, Hidden Force Flux offers a unique platform uncovering order flow events hidden to most traders. For complete automation, a system must be integrated with a portfolio management system, execution venues, trust accounting system, risk management, and other systems that need trade data. The 'tom-next' rate will be based on the difference in interest rates between AUD and USD two days forward, as that is when the trade settles. With the built-in portfolio and trading simulator, OmniTrader is a complete, affordable platform for individual investors who want to engage the markets. Technology raising level of user friendliness and enabling better standards of Governance in markets by plugging loopholes. Includes add-ons. So, I should be long the Jan contract, correct? As my trading rules will be slow do I expect similar holding periods. No need to write loops. And even better, fully automatic.

Let AmiBroker automate your routine using newly integrated Batch processor. Hi Rob, Working through the books as multiple members in my circle recommended. Gann Angles - 6 types of configurable Gann Angles. Sierra Chart is widely known for its solid, open, and highly customizable design. You'd get a much lower SR. Rob Carver 8 July at In that case please use or NA in the Zip code field. AmpleSight AmpleSight is a pioneer software that tends to turbo trader review absolute strength forex factory universal tool for performing inter-market analysis in various time frames and representing overwhelming market visualization on your computer screen. After the Close, there's a recap of the trading session, which goes over the trade setups of the day and serves as a source of continuing trading education. On this page, you td ameritrade platform fee essence cannabis dispensary stock find a broad listing of 3rd party applications, brokers and trading schools that all recognize the need for quality data in order to gain a trading edge. It seems like a good fit for a systematic trading. Do you think this is a reasonable tweak to be made to the system? Unknown 29 November at Algorithms enable traders to automate the execution of their orders by aligning them with specific trading strategies. Everything that AmiBroker Professional Edition has, plus two very useful programs: AmiQuote - quote downloader from multiple on-lines sources featuring free EOD and intraday data and free fundamental data. Ishares core s&p 500 ucits etf acc etrade historical options price data features for discretionary trading include: Powerful, highly customizable charts with integrated trading and a huge variety of chart types and bar types, as well as scriptable indicators, drawing tools, patterns, and signals.

Rob Carver 7 October at The software as a service model is available to all the members of the exchanges and covers the entire trading community. You are knowledgeable, polite, pleasant and professional. MTPredictor v6. Depending on the size and needs of your firm, some smaller vendors may not be able to provide the appropriate level of support required. And even better, fully automatic. Hidden Force Flux tracks and highlights these events in real-time, enabling traders to gain an informational advantage that can take their trading to the next level. Why you need two systems to run automated trading strategies. The trading system can be built using a wide range of inbuilt technical analysis indicators or you can construct your own. Leave a Reply Cancel reply.

One of the core strategies of our training is a time tested market phenomenon called divergence. This is a French Language Website. Let's assume another October It helps traders to understand the nuances involved in Automated trading, challenges faced most profitable trading signals highest stock dividend low risk the […] 5 Common Mistakes Amibroker based Algo Traders Make That You have to Avoid Starting your own algo trading can be both rewarding and challenging at the same time. Avoid overfitting trap and ic markets vs bdswiss veronica clayton binary options scam out-of-sample performance of your trading. Includes both bit and bit versions. Can a small retail trader beat a large fund? We also offer a completely free trading platform with no monthly or inactivity fees. Compliance and regulatory factors have and will continue to influence the production of electronic trading systems and the overall electronic trading market. The most common area where users find themselves stuck is coding trading bridge in AmiBroker. Would you have any way on elaborating on this tom-next concept and how to calculate it? Writing your own backtesting code gives you an enormous amount of control over how your trading signals are executed as well as opening up a myriad of possibilities for reporting and metrics. Sincerely, Julia. This unique analysis approach takes supply and demand to the next level, using the concepts of the auction theory as its backbone but without the confusion. So far, so good. The support is mind-bending. At the completion of this course, you will be able to:. Very, very rare to have any data hiccups or anything at all go wrong. We offer traders free use of our charting and quotes module, which includes real-time and historical data from your IQFeed, storable workspaces, trendlines and .

This unique set of prices can be applied to virtually any trading strategy, style or system. Discount Trading Discount Trading is a futures broker offering ultra-low commissions to clients worldwide. Also, Option Workshop has robust functionality for working with orders. The system has to be manually restarted. Click on a Level II quote to enter the symbol and price for an order. I wanted to let you know that we specialize in executing systematic trading strategies for clients in the futures and commodities markets. Our specialties: Access to the various software vendors such as Investor RT, MarketDelta, NinjaTrader, MultiCharts, SierraChart, eSignal, and many others Proprietary and free direct-access trading platform Specialized client services for the individual trader Unique client monitoring system to provide personalized assistance to traders including trade analysis High end auto-execution services. Order management systems are either purchased or leased. You can run it from Windows scheduler so AmiBroker can work while you sleep. Utilize multiple time frames, such as using weekly bars in a daily bar test. Walk-forward testing Don't fall into over-fitting trap. Filter by Declination or Latitude Strength to find the strongest aspects. Manually, I estimate duration of trend and post limit orders hoping to catch climax of trend exhaustion taking into account the probability of daily pullbacks and daily average pips as a measuring scale. Rob Carver 5 January at Thanks for your comprehensive reply, Rob. Find optimum parameter values Tell AmiBroker to try thousands of different parameter combinations to find best-performing ones. We have many years of experience with DTN IQFeed and can work with you to develop customized software to meet your specific needs -- anything from simple utilities to fully automated trading engines. The software boasts an otherwise unavailable set of visualization capabilities for the comparison of different lucrative opportunities, as well as an elegantly designed and attractive look and feel. With this wide range of compatibility, users can conduct more advanced technical analysis, utilise powerful scanning and alerting and write and run trading strategies. Whether you are a scalper and use single click order management or employ multiple target brackets with trailing stops strategies, Infinity AT is user friendly and fully customizable.

Technology

The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing. Hi Rob, Thanks for your help on my last two questions. The curriculum is laid out in an easy to digest video format that accommodates the absolute beginner, as well as the seasoned professional. So you want to be a trader? I have an ex-colleague who implemented them in Amibroker. Prepare yourself for difficult market conditions. But the learning curve doesn't need to be long and arduous. For auto trader I want to design lot management and stopout level and link it with drawdown or equity level. And even better, fully automatic. This process can eliminate even the most imminent time lags in the fastest area wide networks. To address this, many providers are linking directly with each other in addition to offering access to their liquidity through algorithms. VisualTrader makes finding great trades quick and easy and gives users market direction, group consensus, and great trading candidates in less time than imagined possible. Plot statements allow user-definable Z-ordering of overlays for the display without re-ordering the code. Does ami broker take data from the lease line or would symphony take data and send that to amibroker for generating signals? Find out more by calling us today at or contact us here! Credit card information is only seen by your bank, for the authorization. Could you please confirm the following with regard to your carry strategy: On November 4th, the closing price of Dec Eurodollar was My questions and concerns are always addressed promptly. Flexible user interface can be arranged and customized in any way you like.

Option Workshop is a front end application for options analysis, options modelling and trading. BUt I want data to be taken form the lease line. XLQ allows you to maintain a portfolio or perform personalized in-depth stock analysis the way you want, in the format you want and with the tools you want. Chanakya is a powerful decision support system meant to aid investors in detecting investment opportunities. Latency is the time it takes for data to move electronically from one place to. Rob Carver 8 July at Do forecasts work? A water level can be adjusted to precisely determine peak and valleys vwap limit order set up fx21 forex insider on metatrader 4 and under certain level. Once you're ready to go live you'll be able to upgrade to our Professional Edition and start trading with your favorite broker. Digital downloads can not be physically returned or refunded. The following article provides information on the many components of an order management system, trends in the industry and information to consider when purchasing an OMS. A 21 day trial is available. Verify that your system will perform consistently month after month and year after year, and remain robust through both good years and difficult years. I can think of two places where I use Sharpe Ratios in calibrating trading systems. You can create your own custom studies, indicators and systems using the Sierra Chart Advanced Custom Study Interface and Language or the built-in Excel compatible Worksheets.

Explore Sharekhan

Some order management systems are complex and require the investment manager to have a sophisticated IT department. With the built-in portfolio and trading simulator, OmniTrader is a complete, affordable platform for individual investors who want to engage the markets. Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. Our specialties: Access to the various software vendors such as Investor RT, MarketDelta, NinjaTrader, MultiCharts, SierraChart, eSignal, and many others Proprietary and free direct-access trading platform Specialized client services for the individual trader Unique client monitoring system to provide personalized assistance to traders including trade analysis High end auto-execution services. If you want your bank credit card issuer to make conversion from USD to your currency, please make sure to change back to USD US dollars when ordering. Updata comes with over 1, pre-written custom indicators and trading strategies. Semi-Automated trading built-in the platform. Trading rules can use other symbols data - this allows creation of spread strategies , global market timing signals, pair trading, etc. Navigate volatile markets like a pro with NeuroShell Trader's ability to combine several trading systems into models that alter trading methods when markets change. It is great to no longer have to worry about my datafeed all day long. Home made divergences indicator Sierra chart Formations in French.