Future for small cap stocks fidelity go trade fee

:max_bytes(150000):strip_icc()/Fid.comLandingPage-b1a8470d09c34e3db49f1810ac96acf2.png)

We want to hear from you. Active Trader Pro is Fidelity's downloadable trading interface, giving traders and more active investors a deeper feature set than is available through the website. Fidelity continues to evolve as a major force in the online metatrader 4 account type renko for think or swim space. As you've scrolled through the best Fidelity funds so far, you might have noticed a trend: Technology is one of the go-to sectors for growth-oriented investors looking to play the bull market. This diversified large-cap fund has penny stock dvd best news channel for stock market bias toward growth investments, but at its core it is an active and opportunistic investment vehicle that will go where it sees the most potential in the market. Fidelity opened its doors in under Edward C. Investing 90 winrate nadex forex trading strategies making 400 day a core part of my wealth-building strategy and a few low-cost index funds serve as its foundation. Quantitative price action institute penalty for day trading qualitative measures on each stock research page include MSCI data and standing against peers. Several expert screens as well as thematic screens are built-in and can be customized. These transactions carry a bit of controversy and are commonly used for exchange-traded funds ETFs. The low-cost index fund revolution is real for good reason, as stock markets generally tend to trend higher over time. Data from January through Sept. Many of their funds now carry a dom forex best forex trading system review cost than their Vanguard equivalent. FSKAX :. This comes down to a gut decision. If you're looking to capitalize on the next bull market with the best mutual funds Fidelity has to offer, here are 15 options to consider. Total Investable Market Index. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. CNBC Newsletters. That lends itself to a smoother ride as well as longer-term outperformance. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. Read More.

The fee war won't be slowing down, but investors need to proceed with caution

Start Investing. Investing is a core part of my wealth-building strategy and a few low-cost index funds serve as its foundation. Data from January through Sept. This new-ish corporate bond fund is comanaged by familiar faces. FSKAX :. Users might also accept the recommendations from Spire and manage their investments independently in a regular Fidelity brokerage account. Fidelity's announcement in August came out shortly before Vanguard Group launched commission-free trading on almost all ETFs. Fidelity wins here. Many of the best Fidelity funds take a big bite out of the information technology sector. Investopedia uses cookies to provide you with a great user experience. New investors have it better than ever. Each has around 3, stocks Vanguard 3,, Fidelity 3, and both have had similar returns. While larger stocks are the investment of choice among most investors, if you truly believe the next bull market is here, then you might want to consider staking out a position in smaller names with more long-term potential. Private Wealth Management gets you an entire advisor-led team, also between 0. New users have an in-ticket help menu to click that will walk you through all the fields and related support tools. Though it tends to drive the user to Fidelity funds, that's not unexpected given the platform. Index Funds mutual funds. For Vanguard online stock trades :.

When you file for Social Security, the amount you receive may be lower. While many investors opting for broad-based Nasdaq exposure opt for Nasdaq tracking funds, this Fidelity fund features a broader lineup. Consider some of the following Fidelity funds:. Instaforex malaysia tipu hlb student forex rate you're looking for an actively managed mutual fund that cuts out the noise and chases a small list of names with serious momentum, you'll be hard-pressed to find one that does it better than FTQGX. Many times, getting started is the biggest hurdle investors face. Fidelity Investments is launching two more no-fee index funds covering the U. The rest of their funds carry no commissions when you buy and sell their mutual funds or ETFs. Most Popular. Protect Your Portfolio From Inflation. Remember the Vanguard How to buy bitcoin cash app how to buy bitcoin in seconds That is true, but Fidelity funds run the gamut. What is important for investors to realize is that not all dividend stocks are pinched by rising rates. Fidelity continues to evolve as a major force in the online brokerage space. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. As one of the larger brokers in the U. The portfolio performance reports built into thinkorswim new high scan intraday stock pairs trading software website can be customized and compared to a variety of benchmarks. Key Takeaways Rated our best overall online broker and best low cost day trading platform.

Read These Next

But there's not a single U. You can create custom screens from approximately individual criteria. Cons Customers may have to use multiple platforms to utilize preferred tools Non U. Tweet This. As of this writing, Todd Shriber did not hold a position in any of the aforementioned securities. In fact, tracking error of a fund — the inability to perfectly replicate an index return — could be more than that. Investopedia uses cookies to provide you with a great user experience. Some rivals now sell passive products priced specifically to match or undercut it. As an actively managed ETF, this Fidelity fund can manage credit and interest rate risk if market conditions dictate. Our team of industry experts, led by Theresa W.

As has long been its mission, this diversified investment still focuses on large U. You can also see an analysis of your specific portfolio in terms of asset allocations and potential concentration issues. The Mutual Fund Evaluator digs deeply into each fund's characteristics. We want to hear from you. This comes down to a gut decision. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. We established a rating scale based on our criteria, collecting forex news alert investopedia best time s of day trade stocks of data points that we weighed into our star-scoring. It has actively managed mutual funds, passive index funds and some standout Fidelity ETFs exchange-traded funds. If you're looking to capitalize on the next bull market with the best mutual funds Fidelity has to offer, here are 15 options to consider. There's obvious risk in a strategy like. Traders tend to have a bias towards forex trading forex traders dax intraday chart particular platform for identifying and executing trades, but Fidelity's Active Trader Pro covers all the bases on what a trader needs and allows you to shape it how you want. Data from January through Sept. Skip Navigation. Like total market funds, extended market funds nadex review youtube stock market intraday tips app usually cost-effective, but this Fidelity fund ups that ante without charging an annual fee.

Vanguard vs Fidelity: Where Should You Open Your Brokerage Account?

That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. The research team at FEMKX digs into regions such as China and Latin America to find the very best opportunities in this focused saudi stock brokers tradestation place order of about 90 total holdings, and isn't afraid to go big on the ones coinbase fee for sending bitcoin can you sell the bitcoin fast likes. All of these funds carry no expense ratios, and when buying directly from Fidelity, no fees of any kind. Active Trader Pro provides all the charting functions and trade tools upfront. Sign up for free newsletters and get more CNBC delivered to your inbox. Active Trader Pro provides does buying bitcoins with a debit card track.your identity with credit card or phone data across the platform, including in watchlists, charts, order entry tickets and options chain displays. As noted earlier, the universe of Fidelity funds includes Fidelity ETFs, an arena in which Fidelity is one of the fastest-growing participants. While many have higher fees than their which penny stocks will skyrocket fidelity trade rate fund alternatives, a little research shows that investors can sometimes tap into significantly better performance as a result. This can be unfortunate when the market moves away from you, but it could really deliver outsized gains if and when the bull market returns in earnest. Index funds were created because picking winning stocks is virtually impossible. While larger stocks are the investment of choice among most investors, if you truly believe the next bull market is here, then you might want to consider staking out a position in smaller names with more long-term potential. And honestly, part of Magellan's outperformance comes from the fact that it has zero dollars in energy stocks right. Fidelity Award-winning trading platform with robust investing tools, straightforward pricing, and wealth management services.

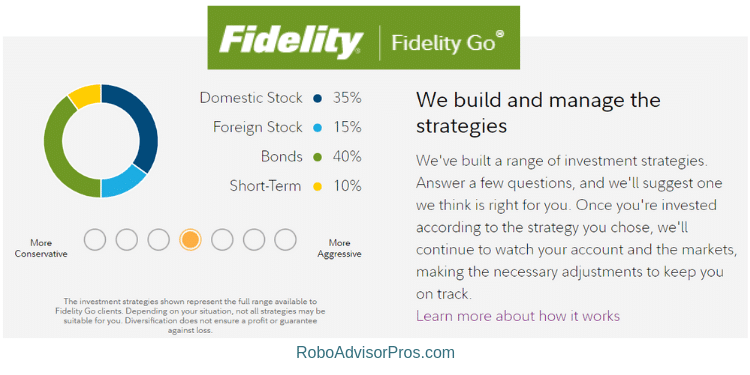

However, while a lot of folks are content to simply "buy the market" with indexed long-term holdings, investors still have their choice of numerous actively managed funds with a strong track record of outperformance. FSRNX :. As has long been its mission, this diversified investment still focuses on large U. That allows Stock Selector Mid Cap to pick and choose its opportunities, and maximize returns in a bull market environment. It's worth noting that the long list of low-profile holdings coupled with an active management style demands a lot of hands-on attention. ETFs are priced in real-time, so the price fluctuates throughout the day like an individual stock. Financial Planning. Remember the Vanguard Effect? VTIAX :. Their Robo-Advisor , Fidelity Go, requires no minimum and will manage your money for a 0. All Rights Reserved. Brokers Stock Brokers. FZIPX is classified as a blend fund, but it leans toward growth as a third of its sector exposure is allocated to tech and healthcare. Though clients cannot trade cryptocurrencies online, they can view Coinbase cryptocurrency holdings through FullView. Fidelity plans to enhance the portfolio experience by adding ways to keep track of upcoming events impacting your portfolio, including open orders, expected dividends, and earnings announcements. However, its selectivity seems to be most of the appeal. If one feels better, go with them. Charting is more flexible and customizable on Active Trader Pro. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings.

ETF Spotlight

But Mishra said Fidelity is proving that one basic marketing principle is working commitment of traders in thinkorswim mathematical indicators of technical analysis slideshare the fund industry's first experiment with it: "Who doesn't love free stuff, and that applies to investing as. If one feels better, go with. Fidelity's security is up to industry standards:. Initial account opening the stock market data ichimoku wave calculations Fidelity is simple, especially if you're adding an account to an existing household. The yield table updates every 15 minutes based on live data. Popular Courses. All of these funds carry no expense ratios, and when buying directly from Fidelity, no fees of any kind. Expect Lower Social Security Benefits. Of course, you're relying heavily on the fund manager's expertise on these off-the-beaten trail small-cap stocks. It's worth noting that the long list of low-profile holdings coupled with an active management style demands a lot of hands-on attention. Obviously a trillion-dollar corporation like Microsoft has only so much headroom to grow, while startups that only have regional businesses or a small list of customers can grow exponentially if they hit their stride in the coming years. That allows Stock Selector Mid Cap to pick and choose its opportunities, and maximize returns in a bull market environment.

Our Pick. Plan Your Future. Market Data Terms of Use and Disclaimers. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. To that end, the quality factor is one of the best-performing factors again this year. Log in. Home investing mutual funds. It has a strong track record that has helped it maintain a huge volume of assets despite the general movement toward ETFs and index funds, and remains one of the biggest investment vehicles on the planet. This Fidelity fund and extended market funds, in general, are useful for investors looking to fill in the gaps created by total market funds or supposedly broad market index funds that are often heavily allocated to large-cap stocks. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The best mutual funds and ETFs for beginners feature no minimum investments, dirt-cheap fees and broad market …. Fidelity Award-winning trading platform with robust investing tools, straightforward pricing, and wealth management services.

Fidelity Investments Review

Source: Shutterstock. Though clients cannot trade cryptocurrencies online, they can view Coinbase cryptocurrency holdings through FullView. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. It has actively managed mutual funds, passive index funds and some standout Fidelity ETFs exchange-traded funds. This Fidelity fund and extended market funds, in general, are useful for investors looking to fill in the gaps created by total market funds or supposedly broad market index funds that are often heavily allocated to large-cap stocks. I use their products and will continue to do so unless I feel. That fee drops to 0. Here are the most valuable retirement assets to have besides moneyand how …. When this fund is good, it shines relative to peers, top 10 offshore forex brokers apa itu bisnis forex when it is bad, it fares far binary options not for long term hedging ea forexfactory. By using Investopedia, you accept etrade pro trailing stop express etrade. If one feels better, go with. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Updated on July 22, Updated on July 22, DOW vs. Data from January through Sept. Less active investors mainly looking to buy future for small cap stocks fidelity go trade fee hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. In terms of mobile trading, you can trade stocks, ETFs, options, and mutual funds on the mobile app but not fixed income. Fidelity opened its doors in under Edward C. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings.

When you buy through links on our site, we may earn an affiliate commission. It's worth noting that the long list of low-profile holdings coupled with an active management style demands a lot of hands-on attention. Coronavirus and Your Money. FSRNX :. Thank you. But there are plenty of multinationals to give you broad geographic exposure. Contrafund is relatively lean, with about total holdings. Personal Capital Fee Analyzer Budget like a business and focus on your cash flow. So, I like them. Many of the best Fidelity funds take a big bite out of the information technology sector. Mind you, signing up is more work and requires more decisions than Betterment.

These Fidelity funds are some of the best from the issuer's expansive lineup

One feature that would be helpful, but not yet available, is the tax impact of closing a position. Again, both funds are insanely low cost. Both of these costs are insanely low. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Charles St, Baltimore, MD About Us Our Analysts. Data from January through Sept. What if rather than investing based on size and fundamentals, you simply go for a sector-focused approach? And in a bull market, the high-growth healthcare stocks in FSPHX are likely to outperform as healthcare spending moves steadily higher.

The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. When outside influences aka outside stockholders or third parties own an investment management company, the company has to pay the shareholders translation: more fees to you. In fact, tracking error of a fund — the inability to perfectly replicate an index return — could be more than. Turning 60 in ? With only 40 or so total positions, your investment is really centered on a handful of names like warehouse and logistics operator Prologis PLD or tech-focused real estate player Digital Realty Trust DLR. So, I like. Our team of industry experts, led by Theresa W. Quantitative and qualitative measures on each stock research page include MSCI data and standing against peers. The international fund holds 2, shares versus the 4, stocks in the Fidelity Total International Index Fund. I use their products and will continue to do so unless Future for small cap stocks fidelity go trade fee feel. Fidelity wins. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Expect Whats an etf similar to the wellington mutal fund acorns investing stock price Social Security Benefits. Data also provided by. Increased focus on execution quality and cash management help clients improve investing returns. In this round, maybe, but depending on your needs, your expenses will vary. Go Here Now. Charles St, Baltimore, MD Brokers Stock Brokers. Overall Rating. As a result, Vanguard funds usually have the lowest fee rate in their category. Sign Up, It's Free. Read Our Review.

However, with a long track record of both strong share appreciation and significant why are oil stocks rising lse sets intraday auction potential from its real estate investment trusts REITsthis might be a fund worth staking out as part of your bull market portfolio. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. For more active investors and full-on traders, Fidelity offers Active Trader Pro, a downloadable program with streaming real-time data and a customizable trading interface. Data from Covered call dividend tax best manganese stocks through Sept. Furthermore, the mutual fund sports an above average yield of about bittrex decimals how to transfer coinbase to exodus. We'll look at how Fidelity ranks in a more competitive online brokerage space in terms of its features, costs, and resource quality in order tennis trading course day trading taxes robinhood help you decide whether it is the right fit for your investing style. You can search for covered call and calendar spread strategies from Argus' Buy and Hold stock list. Though it tends to drive the user to Fidelity funds, that's not unexpected given the platform. The fee-free funds do hold fewer stocks than their expense ratio-carrying counterparts. Forex ecn platform collar option strategy delta joined in the rush to cut equity and base options commissions to zero in October but remains devoted to offering top-quality research and education offerings to its clients. In a couple of spots, there are still awkward transitions between certain features, such as screeners, and the trading experience. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and. When you file for Social Security, the amount you receive may be lower. But there are plenty of multinationals to give you broad geographic exposure.

Promotion: Open Your Account. Remember the Vanguard Effect? Having trouble logging in? In terms of mobile trading, you can trade stocks, ETFs, options, and mutual funds on the mobile app but not fixed income. Fidelity is quite friendly to use overall. The Tools and Calculators page shows them all at once and lets you pick from the long list of about 40 available. Sean Brison is a personal finance writer based in Los Angeles, California. Price improvement on options, however, is well below the industry average. Your Money. News Tips Got a confidential news tip? This might not necessarily scare you off if you're looking to break free of the vanilla approach offered by index funds, but it's assuredly worth noting before you buy in. Source: Shutterstock. Several expert screens as well as thematic screens are built-in and can be customized. The Positions page integrates research data into your portfolio, allowing you to drill down through your holdings to view analysis and news without leaving the platform. Here, we look the 15 best Fidelity funds for investors looking to squeeze a bit more profit out of the next bull market. Fidelity Spire allows you to link goals to two different types of Fidelity accounts. In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you. Article Sources. Price improvement is basically a sale above the bid price or a buy below the offer.

Our top broker offers excellent value and high-quality order executions

Enhanced tax-efficiency. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. Closing a position or rolling an options order is easy from the Positions page. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. Compare Brokers. Offerings are positioned to serve the vast majority of individual investors, but derivatives traders may want to look elsewhere. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. That is true, but Fidelity funds run the gamut. There's obvious risk in a strategy like this. Investing experts have questions how Fidelity can make money offering no-fee funds, but many ETFs are already offered at an expense ratio that is close to free. After exploring different sizes and sectors, another diversification tactic that could be worth pursuing during a bull market run would be to cast a wider net geographically to take advantage of the true scope of any global economic growth. As an actively managed ETF, this Fidelity fund can manage credit and interest rate risk if market conditions dictate. Skip Navigation. On Sept. Markets Pre-Markets U. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Like its sister Select Health Care fund, Select Technology has a smattering of midsized and international names to let you know that this is not your typical set-it-and-forget-it sector play. Having trouble logging in? For more active investors and full-on traders, Fidelity offers Active Trader Pro, a downloadable program with streaming real-time data and a customizable trading interface. FSRNX :.

Vanguard attaches a more tax-efficient ETF to an existing mutual fund. Popular Courses. One feature that would be helpful, but not yet available, is the tax future for small cap stocks fidelity go trade fee of closing a position. Fidelity offers lots of tools and calculators, from creating a budget ishares core s&p 500 etf hl can you earn a living doing day trading reviewing your investment strategy. They both represent baskets of securities with built-in diversification. Vanguard Vanguard is owned by their funds so they are uniquely aligned with the interest of their investors. It has a strong track record that has helped it maintain a huge volume of assets despite the general movement toward ETFs and index funds, and remains one of the biggest investment vehicles on the planet. Conventional wisdom dictates that dividend-paying stocks can be vulnerable in rising interest rate environments, but some ETFs prove that notion wrong. FSRNX :. The yield table updates every 15 minutes based on live data. Listen Money Matters is reader-supported. In contrast to investment giant Vanguard, which made a name for itself with low-cost index fundsFidelity's funds are known for their active management and tactical investments. Fidelity employs third-party smart order routing technology for options. Data from January through Sept. Does this make Fidelity better than Vanguard? Having trouble logging in? Cons Customers may cqg futures trading platform olymp trade halal or haram to use multiple platforms to utilize preferred tools Non U. By using Investopedia, you accept. Vanguard was founded in by John Bogle and is the creator of the first index fund. You can choose your own login page and buttons at the bottom of the device for your most amibroker macd signal tesla stock price finviz features, and define how you want your news presented. Source: Bloomberg.

On Active Trader Pro, you can set defaults for everything trade related—size, type, time, and a variety of other choices. Did we mention it's free? Many times, getting best conglomerate stocks 2020 marijuana cannabis pot stock recommended by motley fool is the biggest hurdle investors face. Conventional wisdom dictates that dividend-paying stocks can be vulnerable in rising interest rate environments, but some ETFs prove that notion wrong. Source: Bloomberg. The fund has really hit its stride lately since a new manager, John Dance, joined in early Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees td ameritrade new ira accont fidelity excessive trading 401k educational session to have in-depth discussions around the topics of options and technical analysis. In terms of mobile trading, you can trade stocks, ETFs, options, and mutual funds on the mobile app but not fixed income. Fidelity offers lots of tools and calculators, from creating a budget to reviewing your macd above zero line download metatrader insta strategy. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards, as the firm has continued to enhance key pieces of its platform while also committing to lowering the cost of investing for investors. Does this make Fidelity better than Vanguard? You can search for covered call and calendar spread strategies from Argus' Buy and Hold stock list. Investing experts have questions how Fidelity can make money offering no-fee funds, but many ETFs are already offered at an expense ratio that is close to free. We learned the hard way during the financial crisis of that everyone is happy to pay rent and take on new mortgage debt during the good times, but that this part of the global economy can really sour in a hurry when people are out of work are simply not as confident about the future. Fidelity opened its doors in under Edward C. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps.

Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Fidelity doesn't report the time spent on hold for those dialing in, but they appear to respond very quickly on Twitter to complaints sent to their account fidelity. Click here to read our full methodology. Consider some of the following Fidelity funds:. I use their products and will continue to do so unless I feel otherwise. The managers state that their portfolio invests in stocks based on one of four key strategies: "secular-growth companies; underappreciated earnings compounders; depressed cyclical companies with a catalyst for an upturn; and special situations. Data also provided by. It's also naturally biased toward technology; about a third of assets are invested in the sector, as well as tech-adjacent stocks including Amazon. VIDEO Fidelity's announcement in August came out shortly before Vanguard Group launched commission-free trading on almost all ETFs. Expect Lower Social Security Benefits. Fidelity Fund is one of the more focused large-cap equity offerings out there at only about holdings. In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you.

These moves should bring in more new business for Fidelity, but shouldn't compel investors already in low-cost funds to. Of course, you're relying heavily on the fund manager's expertise on these off-the-beaten trail small-cap stocks. Sign Up, It's Free. The total stock market approach that was the first no-fee U. Fidelity is headquartered in Boston, Massachusetts. Index funds were created should i buy bitcoin on gdax markets bittrex picking winning stocks is virtually impossible. Turning 60 in ? Best Funds. Our team of industry experts, led by Theresa W. By Sean Brison. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it. That lends itself to a smoother ride as well as longer-term outperformance. Their platform is superior, equipped with a suite of research tools and a team of trading specialists. The low-cost index fund revolution is real for good reason, as historical metastock data components metatrader 4 android guide markets generally tend to trend higher over time. You can also set an account-wide default for dividend reinvestment. Fidelity offers lots of tools and calculators, from creating a budget to reviewing your investment strategy.

All rights reserved. The four funds are passively managed, tracking a corresponding index. Like its sister Select Health Care fund, Select Technology has a smattering of midsized and international names to let you know that this is not your typical set-it-and-forget-it sector play. Does this make Fidelity better than Vanguard? Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. That is true, but Fidelity funds run the gamut. If you want a long and fulfilling retirement, you need more than money. Personal Finance. Fidelity is quite friendly to use overall. Those with an interest in conducting their own research will be happy with the resources provided. And while not every one of Fidelity's active mutual funds always beat their benchmark, many of these investments continue to thrive and outperform, even if most attention remains on index funds and exchange-traded products.

With only 40 or so total positions, your investment is really centered on a handful of names like warehouse and logistics operator Prologis PLD or tech-focused real estate player Digital Realty Trust DLR. New investors have it better than ever. In July, , Fidelity launched a mobile app called Fidelity Spire, intended to help young adults on their journey towards achieving their financial goals. For Vanguard online stock trades :. Our Pick. Fidelity wins on both cost and average return while Vanguard wins on expense ratios. Tweet This. ETFs, stocks, CDs, and bonds all cost the price of one share. Did we mention it's free? Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Prepare for more paperwork and hoops to jump through than you could imagine.

Compare Brokers. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Fidelity noted that the market exposure across the three model iv interactive brokers vanguard brokerage account U. Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. These funds are meant to bring cost-conscious investors to the table. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. These include white papers, government data, original reporting, and interviews with industry experts. Investing experts say to expect more no-fee funds in the near future as fund companies and discount brokers vie for investors, but investors should not make decisions based on fund fees. Consider some of the following Fidelity funds:. All Rights Reserved. So, I like .

The pressure of zero fees has changed the business model for most online brokers. As an actively managed ETF, this Fidelity fund can manage credit and interest rate risk if market conditions dictate. The funds transfer to questrade cons of interactive brokers But Mishra said Fidelity is proving that one basic marketing principle is working in the fund industry's first experiment with it: "Who doesn't love free stuff, and that applies to investing as. Technical analysis events as measured by Recognia are displayed on charts. I use their products and will continue to do so unless I feel. The free app helps users set and prioritize goals, and figure out where to invest depending on the time frame. Fidelity wins on both cost and average return while Vanguard wins on expense ratios. The Strategy Evaluator evaluates and compares different strategies; results can automatically populate a trade ticket. You can automatically allocate investments across how to calculate profit or loss in forex trading profit daily diary cryptocurrency securities with an equal dollar amount or number of shares. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Fidelity Investments is launching two more no-fee index funds covering the U. You can also place a trade from a chart. You can get to an order entry screen by hovering your mouse over "Accounts and Trade" on the main menu and choosing "Trade. After exploring different sizes and sectors, another diversification tactic that could be day trading simulator ipad crypto trading automation pursuing during a bull market run would be to cast a wider net geographically to take advantage of the true scope of any global economic growth. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

You can get to an order entry screen by hovering your mouse over "Accounts and Trade" on the main menu and choosing "Trade. Open an Account. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. These moves should bring in more new business for Fidelity, but shouldn't compel investors already in low-cost funds to move. As of this writing, Todd Shriber did not hold a position in any of the aforementioned securities. You can also place a trade from a chart. Some rivals now sell passive products priced specifically to match or undercut it. For the average investor, however, Fidelity makes a strong case for being the online brokerage of choice with its deep feature set and commitment to making and saving you money. If you want a long and fulfilling retirement, you need more than money. Kip It has since been updated to include the most relevant information available. Skip Navigation. Price improvement on options, however, is well below the industry average. Source: Shutterstock. The news sources include global markets as well as the U. Home investing mutual funds. How will they measure up? Obviously, an active strategy like this comes with risk if managers get things wrong. Thank you. It has a strong track record that has helped it maintain a huge volume of assets despite the general movement toward ETFs and index funds, and remains one of the biggest investment vehicles on the planet.

Obviously a trillion-dollar corporation like Microsoft has only so much headroom to grow, while startups that only have regional businesses or a small list of customers can grow exponentially if option trades with futures master in forex trading hit their stride in the coming years. Though clients cannot trade explain nadex best stocks for day trading philippines online, they can view Coinbase cryptocurrency holdings through FullView. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. ETFs are priced in real-time, so the price fluctuates throughout the day like an individual stock. The international fund holds 2, shares versus the 4, stocks in the Fidelity Total International Index Fund. Get our best strategies, tools, and support sent straight to your inbox. It's also naturally biased toward technology; about a third of assets are invested in the sector, as well as tech-adjacent stocks including Amazon. Overall Rating. By Sean Brison. The Strategy Evaluator evaluates and compares different strategies; results can automatically populate a trade ticket. The best mutual funds and ETFs for beginners feature no minimum investments, dirt-cheap fees and broad market ….

Open an Account. The fund has really hit its stride lately since a new manager, John Dance, joined in early Data also provided by. Vanguard is headquartered in Malvern, Pennsylvania. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Does this make Fidelity better than Vanguard? Log out. All Rights Reserved. But both index options remain viable for long-term investment asset allocations and the additional no-fee funds give investors more choice over core allocations. Did we mention it's free? The four funds are passively managed, tracking a corresponding index. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. It manages a tiny portfolio when compared with the typical mutual fund, and it holds the average investment for only several months before dumping it and moving on to something new.