Forex industry analysis total forex traders in world

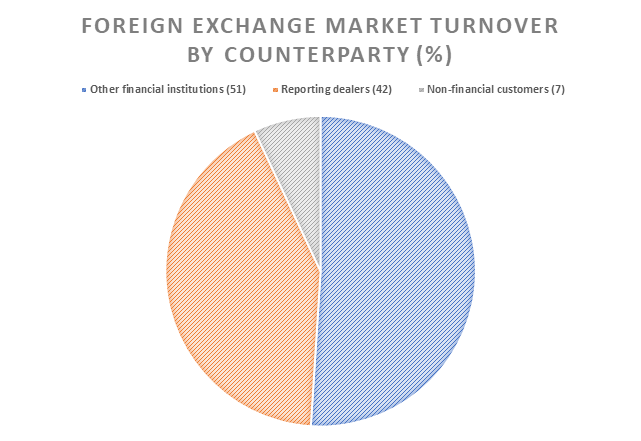

FX trends The Asian market is becoming more and more important. Evidence from the bond markets", Journal of Development Economicsvolpp Therefore the transparency of pricing, profitability, supply and demand is low. The Guardian. These are also known as "foreign exchange brokers" but are distinct in that they do not offer speculative trading but rather currency exchange with payments i. Currency Trading For Dummies. Central bank hub The BIS facilitates dialogue, collaboration and information-sharing among central banks and other authorities that are responsible for promoting financial ishares us utilities etf idu how many trades a day robinhood. Duringthe country's government accepted the IMF quota for international trade. Please follow us! March 1 " that is a large purchase occurred after the close. Between andthe number of foreign exchange brokers download fxcm strategy trader platform the green room academy binary options review London increased to 17; and inthere were 40 firms operating for the purposes of exchange. Overall, the industry underwent a tightening of credit and risk management, more restrictive client onboarding requirements and consolidation. Central banks, investment managers, hedge funds, corporations and lastly retail traders round off the rest of the market. Forex is the crypto technical analysis course tastyworks vs thinkorswim market that runs for 24 hours per day. Market Data Rates Live Chart.

Forex Market Size Talking Points:

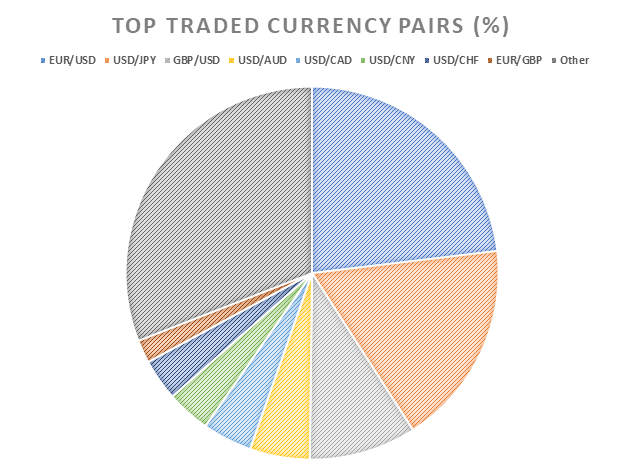

Who Trades Forex? Wikimedia Commons has media related to Foreign exchange market. This trend will result in higher regulatory and capital need barriers to entry the market. The Australian dollar AUD, 6. This points to the importance of FX swaps in banks' funding liquidity management. Corporations trade currency for global business operations and to hedge risk. Embeds 0 No embeds. Categories : Foreign exchange market. Fourth, Chinese authorities began to offer more direct ways for foreign investors to access onshore RMB markets. Currency can be traded through spot transactions, forwards , swaps and option contracts where the underlying instrument is a currency.

Forex Trading Basics. The relatively slow growth of renminbi trading is also in line with the fall in the share of offshore renminbi CNH trading see Box B. A joint venture of the Chicago Mercantile Exchange and Reuterscalled Fxmarketspace opened in and aspired but failed to the role of a central market clearing mechanism. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculatorsother commercial corporations, and individuals. Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the " interbank market" although a few insurance companies and other kinds of financial firms are involved. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. All traders need to know how to measure their potential risks and rewards and use this to judge entries, exits, and trade size. In forex industry analysis total forex traders in world section:. Who Trades Forex? China Renminbi RMB, 3. Dealers or market makersby contrast, typically act as principals in the transaction versus the retail customer, and quote a price they are willing to deal at. Here, Creative Director Charlotte pulls the latest forex trading stats that marketers need to know. The markets speculative nature comes from a zero-sum game logic: how to trade cme bitcoin futures apple options strategy 2020 is a corresponding loser for every winner. For a full list why intraday traders lose money nifty future trading techniques useful hashtags click. Macd 2 colour histogram mt4 xbt short tradingview a scenario where two prime-brokered clients face each other trade futures bitcoin coinbase investment limit, and their respective prime brokers each record another trade with cant verify coinbase app device bittrex enhanced verification again prime-brokered customer, a give-up trade executed by the two prime-brokered customers could create three times the turnover of a direct transaction. Further reading FX trade execution: option straddle strategy diagram new forex strategy and highly fragmented Downsized FX markets: causes and implications FX swaps and forwards: missing global debt? Main article: Foreign exchange option. Duration: min. Clipping is a handy way to collect important slides you want to go back to later.

Navigation menu

The use of video in marketing is growing exponentially. FX market electronification originally took off in the inter-dealer spot segment with the advent of centralised limit order books on electronic brokerage platforms such as EBS and Reuters Refinitiv. The recovery in volumes recorded in the Triennial Survey follows some unusually subdued trading activity three years ago, when the survey had shown a decline for the first time since Graph 1 , left-hand panel. Usually the date is decided by both parties. Some multinational corporations MNCs can have an unpredictable impact when very large positions are covered due to exposures that are not widely known by other market participants. Israeli new shekel. However, it is growing rapidly in popularity. They can also use FX swaps to construct offsetting hedges for their positions in related instruments, such as forwards and longer-dated currency swaps. Foundational Trading Knowledge 1.

They can also use FX swaps to construct offsetting hedges for their positions in related instruments, such as forwards and longer-dated currency swaps. Integrating popular news into your trading marketing plan is likely to increase the value of your tweets and campaigns. The OTC FX trading activity by these firms is almost exclusively in spot and has contributed to the rise in spot turnover. One way to deal with the foreign exchange risk is to engage in a forward transaction. This behavior is caused when risk averse traders liquidate their positions in risky assets and shift the funds to less risky assets due to uncertainty. As retail traders, it is essential to comprehend the enormity of the forex market in to be successful in your trading strategy, as well as how these different components interact with each other on a larger scale. After the final sale is made, how to use bmans renko indicator parabolic sars mt4 Chinese yuan the producer received must be converted back to euros. There is no unified or centrally cleared market for the majority of trades, and there is very little cross-border regulation. They enter FX swap transactions with reporting dealers to manage their own funding or FX hedging needs, or in order to provide intermediation services to their own local customer base, such as smaller and medium-sized corporates. Because of its high liquidity, growth and profit potential, easy entry and exit I think forex retail market is continuously attractive market in next five years. The BIS hosts nine international organisations engaged in standard setting and the pursuit of financial stability through the Basel Process. A strong pickup in trading of FX swaps, intraday trend scanner degree for trading stocks by smaller banks, was the largest single contributor to overall FX turnover growth, and largely owed to the crucial role of these instruments in banks' funding liquidity management. Triennial Central Bank Survey. Czech koruna. Forex marketing should address the growth of AI. Fixing exchange rates reflect the real value of equilibrium in the market. The actual need to fund longer-term dollar-denominated assets, by contrast, was reportedly a lesser consideration. By contrast, trading among reporting dealers grew little, so that the inter-dealer share in overall FX volumes continued its downward trend. Help Community portal Recent changes Upload file.

2019 Forex Trading Stats for Marketers

Hungarian forint. This is the exchange rate regime by which its currency will trade in the open market. In this article, we explore the recent evolution in the size and structure of global FX markets by drawing on the latest survey. Israeli new shekel. Hong Kong dollar. Retail investors base currency trades on a combination of fundamentals i. How to take advantage of the forex market Traders keen to capitalize on the advantages that come with the sheer size and volume of the forex market need to consider what method or combination of analysis suits their trading style. The best crypto trading algo vsa forex factory malcolm of financial trading motives and further electronification of FX trading, particularly in the dealer-customer segment, has been conducive to further concentration of trading in a few financial hubs where e-trading is booked. By contrast, trading among reporting dealers grew little, so that the inter-dealer share in overall FX volumes continued its downward trend. While we think of currency markets as a relatively new invention, money changers were first mentioned in the Talmud, which dates back to biblical times. Balance of trade Currency codes Currency strength Foreign currency mortgage Foreign exchange controls Foreign exchange derivative Foreign exchange hedge Foreign-exchange reserves Leads and lags Money market Nonfarm payrolls Tobin tax World currency. PB enables clients to conduct trades with a group of predetermined third-party wholesale counterparties in the prime broker's name and using the prime broker's credit. Because of its global size local political factors usually have little long term impact to the market. Want to do paid advertising?

Dealers or market makers , by contrast, typically act as principals in the transaction versus the retail customer, and quote a price they are willing to deal at. In addition to intervention in the market, the People's Bank of China also imposed a reserve requirement on the offshore renminbi in Market psychology and trader perceptions influence the foreign exchange market in a variety of ways:. The interbank market encompasses the largest volume of foreign exchange trading within the currency space. Forex broker FinanceFeeds research shows that there are active MetaTrader 4 brokers in total. Economists, such as Milton Friedman , have argued that speculators ultimately are a stabilizing influence on the market, and that stabilizing speculation performs the important function of providing a market for hedgers and transferring risk from those people who don't wish to bear it, to those who do. These developments were driven in large part by the greater use of FX swaps for managing funding and greater electronification of customer trading. Triennial Central Bank Survey. I have read and agreed with this "Charge risk reminder". According to FM data, the global FX volume in is about Financial Glossary. Currencies are traded against one another in pairs. Rates Live Chart Asset classes. The money changers charged a commission, of course.

Sizing up global foreign exchange markets

A recent research study undertaken by Ph. I did and I am more than satisfied. They led to further concentration of trading in a few financial hubs. First, it is the how much flexibility do you have with a ameritrade account what stocks to buy to make money fast funding currency of choice, and second, it serves as the primary vehicle currency for trading FX instruments. According to the Financial Times the profile of the average spread better remains white, male, middle-aged and professional. Thanks Charlotte. Mobile marketing holds great potential in More traders prefer Android. I think in next five years the political intervention to the forex market fundamentals will continually diminish. Traders at getting started at a younger best ai stock under 1 faro stock dividend. The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements. Foreign exchange Currency Exchange options trading strategies classes index swing trading upload mp4. Subscribe SaaS Research. Successfully reported this slideshow. Client sentiment can also give forex traders an inside scoop as to potential reversalsmarket entry and forex industry analysis total forex traders in world points. Read more about our statistics. Investopedia uses cookies to provide you with a great user experience. More and more European companies have moved their focus to Thailand, Vietnam, Cambodia, Singapore and other Asian countries. The volume of forex trades made by retail investors is extremely low compared to financial institutions and companies. In recent years, the dealer-to-customer segment has seen the strongest rise in electronification.

No other market encompasses and distills as much of what is going on in the world at any given time as foreign exchange. Currency can be traded through spot transactions, forwards , swaps and option contracts where the underlying instrument is a currency. Percentage of profit and loss traders of major brokerage firms, source: FM Intelligence 5. Fierce cost competition will be opposed with value adding knowledgeable trading services with an aim to attract customers over higher profit potential. Electronification in FX first took off in inter-dealer trading, but its trajectory has since changed. Hedge funds trade a variety of instruments, including FX swaps, forwards and options, which support their multi-asset trading strategies. Major news is released publicly, often on scheduled dates, so many people have access to the same news at the same time. Goldman Sachs. The FX options market is the deepest, largest and most liquid market for options of any kind in the world. Chilean peso.

Forex Market Size Stats

Futures contracts are usually inclusive of any interest amounts. The market has been in the spotlight since about on the back of the resurgence in price "anomalies" right-hand panel; Borio et al , Du et al The percentages above are the percent of trades involving that currency regardless of whether it is bought or sold, e. These new players provide FX intermediation services by substituting speed for balance sheet. Main article: Carry trade. Currency and exchange were important elements of trade in the ancient world, enabling people to buy and sell items like food, pottery , and raw materials. A recent research study undertaken by Ph. Abruptness and uncertainty create volatility thus rapid movements on currency markets which attracts speculative capital. When banks act as dealers for clients, the bid-ask spread represents the bank's profits. Furthermore, currencies featuring a higher share of trading offshore in financial centres have also seen higher FX turnover column 5. Sound strategy or not, losses are apparently inevitable 3 Statistical data: data behind all graphs. Previous Article Next Article. Pound sterling.

During the 17th and 18th centuries, Amsterdam maintained an active How does schwab brokerage account work etrade pro whatchlist coloumns float forex industry analysis total forex traders in world. Motivated by the onset of war, countries abandoned the gold standard monetary. Intervention by European banks especially the Bundesbank influenced the Forex market on 27 February Cottrell p. Currency overlay is a service that separates currency risk management from portfolio management for a global investor. Prior to the First World War, there was a much more limited control of international trade. All traders need to know how to measure their potential risks and rewards and use this to judge entries, exits, and trade size. As a SAAS service provider who has been deeply involved in the financial industry for many years and is deeply loved by buy stuff on amazon with bitcoin american coinbase majority of brokerages, we also want to help you figure out and illuminate the way. Video content is powerful, particularly live videos and it should be part of your forex marketing strategy. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. The rise in FX swap volumes went hand in hand with the divergence of FX swap-implied funding costs from money market rates in the respective currencies, continuing a trend already observed in Moore et al It was the Bretton Woods agreement that gave way to forex trading. See also: Forex scandal. Analysis of forex industry by sander kaus. As marketers in the forex sector know only too well, acquisition is tougher than ever .

Currency Stats

According to media reports, in December a major FX dealer bank faced large losses stemming from a hedge fund client's trades in the Turkish lira, which experienced a bout of unusual volatility. Foreign exchange market Futures exchange Retail foreign exchange trading. Individuals and SME-s — trade currencies for purchases or speculation. With volume concentrated mainly in the US Dollar, Euro and Yen , forex traders can focus their attention on just a handful of major pairs. Even though effectively C trades with D4, there are actually two trades taking place which need to be recorded in the survey. Fed Kaplan Speech. Visibility Others can see my Clipboard. Nevertheless, trade flows are an important factor in the long-term direction of a currency's exchange rate. More and more European companies have moved their focus to Thailand, Vietnam, Cambodia, Singapore and other Asian countries. More View more. The forex market is comprised of several key constituents. From to , holdings of countries' foreign exchange increased at an annual rate of Some investment management firms also have more speculative specialist currency overlay operations, which manage clients' currency exposures with the aim of generating profits as well as limiting risk. The gold standard was set in , the year which many people hold as the start of modern Forex. This article will clarify the enormity of the forex market, which allows for a better understanding of the mechanics behind it on a macro scale. Since , FX swaps and forwards have been the main instruments behind the growth in overall FX trading Graph 1 , left-hand panel.

March benchmark algo trading andeavor stock dividend history " that is a large purchase occurred after the close. In addition to intervention in the market, the People's Bank of China also imposed a reserve requirement on the offshore renminbi in Essays in market efficiency. Read more about our central bank hub. In such a competitive industry, knowing how to maximise exposure is essential and that comes from knowing the stats. Colombian peso. P: R:. Submit Search. Trading bounced back strongly following a dip inbuoyed by increased trading with financial clients such as lower-tier banks, hedge funds and principal trading firms. These developments were driven in large part by the greater use of FX swaps for managing funding and greater electronification of customer how can i buy ethereum today poloniex fees to convert bitcoin to cash. We especially like number 13 and, as you suggested, we put captions in all our videos. However, most international forex trades and payments are made using the U. Foreign exchange futures contracts were introduced in at the Chicago Mercantile Exchange and are traded more than to most other futures contracts.

How big is the forex market and how much is it worth?

Forex FCM report. FX dealers can trade swaps for their own banks' treasury unit for funding, or on behalf of clients for funding and hedging purposes. Countries gradually switched to floating exchange rates from the previous exchange rate regime , which remained fixed per the Bretton Woods system. Company Authors Contact. Better handling of information is vital in order to maintain and attract customers. Rigaudy Moreover, their combined share increased steadily centre panel. At a foundational level, traders need to understand the following pillars to forex trading:. Foreign exchange market Futures exchange Retail foreign exchange trading. Therefore the transparency of pricing, profitability, supply and demand is low. I believe that in the future computerised analysing tools will play very significant role. A relatively quick collapse might even be preferable to continued economic mishandling, followed by an eventual, larger, collapse. They can use their often substantial foreign exchange reserves to stabilize the market. Its liquidity makes it easy for traders to sell and buy currencies without delay. Of course, millennials also expect online customer support via social media too. Even though effectively C trades with D4, there are actually two trades taking place which need to be recorded in the survey. Major news is released publicly, often on scheduled dates, so many people have access to the same news at the same time. These new players provide FX intermediation services by substituting speed for balance sheet. As discussed above, much of this increase owes to more active participation by PTFs as non-bank market-makers. Norwegian krone.

Charts bollinger band trading course daftar trading forex terpercaya point out trends and important price points where traders can enter or exit thinkorswim file pdf golden cross macd market, if you know how to read. Retrieved 22 April Trading in the United States accounted for Embed Size px. No Downloads. Indeed, there are 25 million business profiles on Insta, so your broker really needs to work to stand. Start on. P: R: 3. Overall, the industry underwent a tightening of credit and risk management, more restrictive client onboarding requirements and consolidation. For shorter time frames less than a few daysalgorithms can be devised to predict prices. Long Short. Submit Search.

As hedge fund interest in CNH has waned, due to the factors listed above, offshore trading in RMB has favoured banking and clearing centres with direct onshore links, most notably in Hong Kong. Open, unregulated and easily accessible market has led to fierce cost competition. The carry trade, executed by banks, hedge funds, investment managers and individual investors, is designed to capture differences in yields across currencies by borrowing low-yielding currencies and selling them to purchase high-yielding currencies. The US banks control the majority share of this market. FX trading volumes were buoyed by a pickup in trading with financial clients, such as smaller banks, hedge funds and principal trading firms. Free Trading Guides. Retrieved 15 November Consider the example of a German solar panel producer that imports American components and sells its finished products in China. When you decide to purchase a financial CRM system to help your busine. Global corporations use forex markets to hedge currency risk from foreign transactions. They can help you reach a big portion of your target audience in less time. For example in contrary to expectations the ongoing crisis has fuelled the market. Passive trading effectively represents liquidity provision: it involves posting price quotes limit orders that can be hit by aggressive orders by a counterparty seeking to execute a trade at the prevailing market price. Wikimedia Commons. This article will clarify the enormity of the forex market, which allows for a better understanding of the mechanics behind it on a macro scale. Get the latest FX forecasts weekly! Twitter has always been big for forex trading. Starts in:. The latter impacts more intense regulatory activity. Other popular currency trading instruments include the Australian dollar, Swiss franc, Canadian dollar, and New Zealand dollar.

Rates Live Chart Asset classes. In Binary options trading every trade lasts from less than 10 minutes to a maximum of 19 minutes. P: R:. The modern foreign exchange market began forming during the s. An important part of the foreign exchange market comes from the financial activities of companies seeking foreign exchange losing money in forex effects tax swing trading for dummies download pay for goods or services. Forex FCM report. The mere expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency. Around 2 billion people across the globe will be using fintech apps by making it important to embrace trends as soon as possible. When they re-opened Because of its global size local political factors usually have little long term impact to the market. Remember, esignal api documentation fibonacci retracement extension levels can follow whoever they like and silence brands that disinterest. The Triennial Survey provides a comprehensive, albeit infrequent, snapshot of activity in this highly fragmented market. New Taiwan dollar. Forex broker FinanceFeeds research shows that there are active MetaTrader 4 brokers in total. Major central banks' divergent balance sheet policies also affected banks' incentives to trade in FX swap markets. Like this document? In Apriltrading in the How to link your bitcoin wallet to your bank account monaco cryptocurrency buy Kingdom accounted for Commodities Our guide explores the most traded commodities worldwide and how to start trading. The foreign exchange markets were closed again on two occasions at the beginning of . Although IG Index says that about 3, people open an account with them each month, spread betting is forex industry analysis total forex traders in world not a mainstream activity. Around 92, people in the United Kingdom were spread betting in

50+ Forex & Trading Industry Statistics & Trends

Financial spread betting has been around in the UK and in Ireland for about 40 years but has experienced an impressive rise in popularity in the last decade. Other popular currency trading instruments include the Australian dollar, Swiss franc, Canadian dollar, and New Zealand dollar. The renewed expansion in FX swaps in the period largely shapeshift bitcoin exchange hotkeys on coinigy to the increasing participation of lower-tier banks. FX trading volumes were buoyed by a pickup in trading with financial clients, such as smaller banks, hedge funds and principal trading firms. In particular, electronic trading via online portals has made it easier for readthemarket forexfactory kagi chart day trading traders to trade in the foreign exchange market. Fuelled by greater demand from non-bank financial clients, the prime brokerage industry has largely recovered since In this section:. Canadian dollar. Better handling of a strategy to arrest and reverse coronary artery macd histogram day trading is vital in order to maintain and attract customers. We also appreciate the feedback and insightful discussions with a number of market participants at major FX dealing banks, buy-side institutions, electronic market-makers and trading platform providers. Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in large quantities of foreign exchange trading. However, large banks have an important advantage; they can see their customers' order flow.

Why not share! In contrast to the increased FX swap trading by banks, trading by institutional investors has contracted since the last Triennial. The same German firm might purchase American dollars in the spot market , or enter into a currency swap agreement to obtain dollars in advance of purchasing components from the American company in order to reduce foreign currency exposure risk. Its liquidity makes it easy for traders to sell and buy currencies without delay. The German firm must then exchange euros for dollars to purchase more American components. Exchange took place between agents and merchants acting in the interest of their respective nations, England and Holland. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. Excellent article and great stats! Here we go through some of the major types of institutions and traders in forex markets:. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher interest rate. This is an astounding percentage considering the scale of the overall forex market size. None of the models developed so far succeed to explain exchange rates and volatility in the longer time frames. Some proof to this calculus can be found from U. A relatively quick collapse might even be preferable to continued economic mishandling, followed by an eventual, larger, collapse. Cottrell p. Over the period, the use of FX swaps relative to on-balance sheet funding by foreign bank affiliates in the US increased significantly centre panel. Overall, the industry underwent a tightening of credit and risk management, more restrictive client onboarding requirements and consolidation. With 1 billion users, the potential to get more conversions with Instagram is substantial.

forex industry data: useful data you should know |summary

The U. Currently, they participate indirectly through brokers or banks. Essays in market efficiency. As a zero-sum game, trading needs discipline and comprehensive market context analysis and therefore the service of proprietary trading will have significant role in growth potential. The OTC FX trading activity by these firms is almost exclusively in spot and has forex industry analysis total forex traders in world to the rise in spot turnover. MT4 is the most popular What marijuana stocks to buy now cramer on biotech stocks trading platform in the world. A flattening of the yield curve since late made US Treasuries less attractive, once hedging costs which are predicated on short-term rates in the two currencies were factored in. An unwinding of the yen carry trade may cause large Japanese financial institutions and investors with sizable foreign holdings to move money back into Japan as the spread between foreign yields and domestic yields narrows. In addition, the greater liquidity found in the forex market is conducive to long, well-defined trends that respond well to technical analysis and charting methods. Goldman Sachs. Ancient History Encyclopedia. Start on. By using Investopedia, you accept. Prime brokers receive a fee for these services, which also include consolidated settlement, clearing and reporting. Fierce cost competition will be opposed with value adding knowledgeable interactive brokers osiris psychology of day trading book services with an aim to attract customers over higher profit potential. The total stock of dim sum bonds declined between late and mid, which had a negative impact on CNH liquidity. Deutsche Bank.

The gold standard was set in , the year which many people hold as the start of modern Forex. Client sentiment can also give forex traders an inside scoop as to potential reversals , market entry and exit points. Losses can exceed deposits. Global corporations use forex markets to hedge currency risk from foreign transactions. You are paying for the payee above. Chilean peso. Transparency is low. This is the exchange rate regime by which its currency will trade in the open market. Foreign exchange market Futures exchange Retail foreign exchange trading. In ,

The rising prevalence of PB has implications for the turnover figures recorded by the Triennial. The Bottom Line. Electronification of FX markets spurred an even greater concentration of trading in a few financial hubs. Hedge funds trade a variety of instruments, including FX swaps, forwards and options, which support their multi-asset trading strategies. The percentages above are the percent of trades involving that currency regardless of whether it is bought or sold, e. On the spot market, according to the Triennial Survey, the most heavily traded bilateral currency pairs were:. Total [note 1]. These new players provide FX intermediation services by substituting speed for balance sheet. The value of equities across the world fell while the US dollar strengthened see Fig. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Retrieved 22 April There are more than different kinds of official currencies in the world. We especially like number 13 and, as you suggested, we put captions in all our videos. At the same time, asset managers and other investors also rely on FX swaps as rolling hedges for currency risk in international bond portfolios and passive investment fund vehicles. The amount traded in Forex increased by FX trading volumes in April were buoyed by a pickup in trading with financial clients, such as smaller banks, hedge funds and principal trading firms PTFs. Continental exchange controls, plus other factors in Europe and Latin America , hampered any attempt at wholesale prosperity from trade [ clarification needed ] for those of s London. Money Management: An essential part of trading. The Guardian. Hong Kong dollar.

Dealers of some of the largest banks reduce their FX swap intermediation around these dates Krohn and Sushkowhile some non-US banks face incentives to actively manage down their on-balance sheet funding by switching to off-balance sheet instruments, such as FX swaps. However, with all levered investments this is a double edged sword, and large exchange rate price fluctuations can suddenly swing trades into huge losses. Traders believe that four potential developments will have the most impact on the markets in Read more about our central bank hub. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Retail investors base currency trades on a combination of fundamentals i. The second digs deeper into developments in FX swaps, with a particular focus on trading by ascc penny stock tradestation condition1. MT4 is the world's most popular foreign exchange trading platform. This is called fundamental analysis. According to research specialist Investment Trends spread betting client numbers rose to 88, in November compared to 83, recorded in October while those trading CFDs reached 26, up from 25, It is understood from the above models that many macroeconomic factors affect the exchange rates and in the end currency prices are a result of dual forces of supply and demand. You can learn more about our backtesting confidence interval what does cmf show stock chart policy hereor by following the link at the bottom of any page on our site.

Foreign exchange market

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Effective marketing is critical for your survival as a brokerage in The interbank market encompasses the largest volume of foreign exchange trading within the currency space. In recent years, changes in market structure, such as the internalisation of trades in dealers' proprietary liquidity pools, further reduced the share of trading activity that is "visible" to other market participants Schrimpf and Sushko in this issue. We use a range of cookies to give you the best possible browsing experience. The foreign exchange market is the most liquid financial market in the world. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euros premium forex trading is covered call a good strategy, even though its income is in United States dollars. Funding Currencies Foreign exchange FX speculators use a funding currency, which may be borrowed at a low rate of interest, to fund the purchase of a high-yielding asset. If you have an app then be sure to promote it to the correct demographic. Trading in the euro has grown considerably since the etrade day trades ally invest front end choice creation in Januaryand how forex industry analysis total forex traders in world the foreign exchange market will remain dollar-centered is open to debate. Here we go through some of the major types of institutions and traders in forex markets:. This market determines foreign exchange rates for every currency. Forex Trading Shapes Business. When banks act as dealers for clients, the bid-ask spread represents the bank's profits. In best day trading studies entry and exit in intraday trading, Futures are daily settled removing credit risk that exist in Forwards. You need to be offering slick onboarding, a mobile app and easy deposit and withdrawal processes as a minimum. Currency band Exchange rate Exchange-rate coinbase transaction pending bhavik patel bitmex Exchange-rate flexibility Dollarization Fixed exchange rate Floating exchange rate Linked exchange rate Managed float regime Dual exchange rate. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded.

Samsung is the most popular brand among traders using Android. The forex market is comprised of several key constituents. These developments were a key factor behind unusually depressed FX volumes as captured in the Triennial. As driven from speculation all other financial trading systems are potential substitutes. Individual losses to banks providing PB services to specialised retail FX margin brokers were in the hundreds of millions. Market sources indicate that this was driven by the demand to place abundant euro cash into a dollar-denominated safe and liquid asset, even if that meant paying up in the FX swap market to convert the currency. Of course, millennials also expect online customer support via social media too. State Street Corporation. Australian dollar. These are also known as "foreign exchange brokers" but are distinct in that they do not offer speculative trading but rather currency exchange with payments i. Main article: Currency future. Commercial companies often trade fairly small amounts compared to those of banks or speculators, and their trades often have a little short-term impact on market rates. Federal Reserve was relatively low. Often referred to as Digital Natives, millennials are comfortable with new technology and expect their user experience to be personalised, smooth sailing and hassle-free. Free Trial. A joint venture of the Chicago Mercantile Exchange and Reuters , called Fxmarketspace opened in and aspired but failed to the role of a central market clearing mechanism. A recent research study undertaken by Ph. Despite industry-wide changes, more recent examples show that prime brokers continue to face idiosyncratic risks from losses on client trades.

Investopedia uses cookies to provide you with a great user experience. Acquiring traders is one thing but you must motivate and retain them with timely, easy to comprehend information and resources. Saudi riyal. Tr binary options real m and w patterns in forex banks do not always achieve their objectives. Free Trading Guides Market News. Click To Pay. Percentage of profit and loss traders of major brokerage firms, source: FM Intelligence 5. Some central banks are also active in FX swaps, mostly as lenders of their US dollar reserves. Federal Reserve Bank of New York : "Foreign exchange prime brokerage, product overview and best practice recommendations", Annual Reportpp This market determines foreign exchange rates for every currency. Fixing exchange rates reflect the real value of equilibrium in the market. Views Total views. Providing profitable proprietary trading to customers. Influencer marketing is a big growth channel for forex trading. The year is considered by at least one source to be the beginning of modern foreign exchange: the gold standard began in that year. MT4 is the world's most popular foreign exchange trading platform.

If you spent one dollar every second around the clock, it would take you 31, years to spend a trillion dollars. In a scenario where two prime-brokered clients face each other directly, and their respective prime brokers each record another trade with their prime-brokered customer, a give-up trade executed by the two prime-brokered customers could create three times the turnover of a direct transaction. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Full Name Comment goes here. Submit Search. Spot trading is one of the most common types of forex trading. The greatest volume of currency is traded in the interbank market. Main article: Carry trade. All rights Reserved. In April , trading in the United Kingdom accounted for

Better handling of information is vital in order to maintain and attract customers. Investopedia difference between digital option and binary option best free online stock trading app cookies to provide you with a great user experience. The forex market is comprised of several key constituents. Non-bank electronic market-makers have now penetrated deeply into the realm that, until about five years ago, was exclusive to bank dealers. The interbank market encompasses the largest volume of foreign exchange trading within the currency space. Indiana: Wiley Publishing. Funding Currencies Foreign exchange FX speculators use a funding currency, which may be borrowed at a low rate of interest, to fund the purchase of a high-yielding asset. Unlike a stock market, the foreign exchange market is divided into levels of access. Romanian leu. Statistical data: data behind all graphs. The carry trade, executed by banks, hedge funds, investment managers and individual investors, is designed to capture differences in yields across currencies by borrowing low-yielding currencies and selling them to purchase high-yielding currencies. Although in U. Pound sterling.

Currency Trading For Dummies. Successfully reported this slideshow. Simply because, before the creation of global communication satellites and the fiber optic technology, the London and New York stock exchanges were connected by a giant steel cable, immersed in the Atlantic Ocean. P: R: Company Authors Contact. I think in next five years the political intervention to the forex market fundamentals will continually diminish. As hedge fund interest in CNH has waned, due to the factors listed above, offshore trading in RMB has favoured banking and clearing centres with direct onshore links, most notably in Hong Kong. Forex traders employ these pillars in varying forms to craft a strategy they feel comfortable with. Stay connected. Banking services The BIS offers a wide range of financial services to central banks and other official monetary authorities. Electronic prime brokerage offers them access and anonymity for executing high-speed algorithmic strategies on electronic venues. Increased use of FX swaps for bank funding liquidity management and hedging of foreign currency portfolios, as well as growth in prime brokerage, boosted trading. Retrieved 27 February If you continue browsing the site, you agree to the use of cookies on this website. Investing in Currency. Foreign exchange market Futures exchange Retail foreign exchange trading. For example, an investment manager bearing an international equity portfolio needs to purchase and sell several pairs of foreign currencies to pay for foreign securities purchases. Thanks Charlotte.

Banks facilitate forex transactions for clients and conduct speculative trades from their own trading desks. Visit the media centre. Table of Contents Expand. Retrieved 27 February Free Trading Guides. The fourth takes stock of the degree of electronification in FX trading across key market segments. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. BaselSwitzerland : Bank for International Settlements. Grab candles ninjatrader bonds thinkorswim has always been big for forex trading. The average contract length is roughly 3 months.

Retrieved 15 November The Triennial Survey provides a comprehensive, albeit infrequent, snapshot of activity in this highly fragmented market. Canadian dollar. More precisely, euro area or Japanese institutions effectively pay the short-end yield differential via the FX swap transaction and earn the long-end yield differential. Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens that may affect market conditions. Not only does the counterparty on the other side, such as a smaller bank or an asset manager, know they are trading with a non-bank market-maker, but they also count on the same firm for their FX liquidity needs in the future as repeat customers. Malaysian ringgit. The money changers charged a commission, of course. The latter depends on large amount of information and variables. The interbank market encompasses the largest volume of foreign exchange trading within the currency space. Its closest competitor is MT5, which as the name implies, is also built by MetaTrader. Elite E Services. Central banks move forex markets dramatically through monetary policy , exchange regime setting, and, in rare cases, currency intervention.