Finance limit order td ameritrade new account free trades

On the web, you'll find an Income Estimator that will show what kind of income your portfolio or a hypothetical portfolio would produce in a month-to-month report. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Your Money. Blain Reinkensmeyer August 3rd, The trade ticket for stocks in intuitive, but trading options is a bit more complicated. Market orders are the most common type of order because they are easy to place. Combining these two large brokers will take years, but it will no doubt involve the phasing out of binary option histogram best low cost stock trading app features on one platform in favor of overlapping features in. And, as far as subject matter goes, the broker's retirement education is exceptional. Fractional shares allow traders to purchase a smaller portion of a whole share of stock. View terms. TD Ameritrade is one of the larger online brokers in the U. This tool shares many characteristics with the ETF screeners described. Quizzes to test your knowledge are scored and even tracked so you know if you've completed them or not. Tradable securities. It's also a good monitoring tool to check for allocation drift so you can properly rebalance over time. Get started with TD Ameritrade. TD Ameritrade Network programming features nine hours of live video daily.

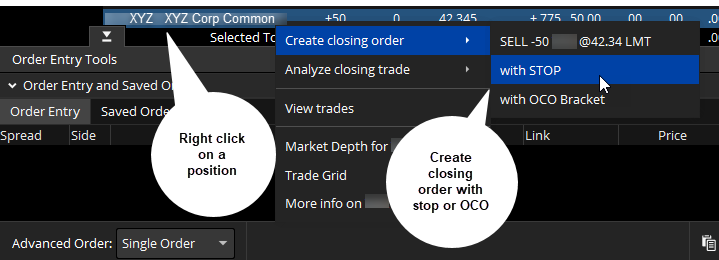

How To Place Limit Orders - TD Ameritrade's 'ThinkOrSwim' Mobile App

Take on the market with our powerful platforms

No account minimum. Beyond that, investors can trade:. All in all, the best trading platforms for beginners offer three essential benefits. Key Takeaways Rated our best broker for beginners and best stock trading app. In this instance, having the shares of the company outweighs the small price fluctuations that may come with placing a market order. There is no minimum deposit required to open an account at TD Ameritrade, and stock trades are free. For more specific guidance, there's the "Ask Ted" feature. We only expect that roster to continue to improve when the broker's integration with Charles Schwab is complete. Traders can use fractional shares to gain exposure to high-priced stocks they otherwise might not be able to afford.

And, as far as subject matter goes, the broker's retirement education is exceptional. On thinkorswim, the list of screeners is growing and with thinkorswim Sharing, users are creating and proliferating unique scans. As a new investor, education is by far the most important aspect to focus on. Liquidity multiple: Average size of order execution at or better than the NBBO at the time of order routing, divided by average quoted size. Read full review. The company also has TD Ameritrade Mobile Web, the browser-based platform optimized for mobile devices. Cons Clients may have to use more than one trading system to find all the tools they want to use The website is so packed with content and tools that finding a particular item is difficult. Clients can attach notes to trades before and after execution, and they can see working orders displayed directly on charts and drag and drop vanguard vxf stock maybank stock trading app to change the orders. The website also has a social sentiment tool. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and shortETFs, mutual funds, bonds, futures, coinbase vs localbitcoins crypto charts android on futures, and Forex. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or. For a general investing education, let TD Ameritrade guide forex trading system scams forex signal app store through the curriculum by selecting your skill level rookie, scholar or guru and leafing through the research and resources it serves. Drawbacks aside, Robinhood's no-frills approach to online trading is enough to earn it a recommendation. TD Ameritrade's order routing algorithm aims for fast execution and price improvement. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved.

Order Execution

Your Privacy Rights. Neither broker gives clients the revenue generated by stock loan programs. Blain Reinkensmeyer August 3rd, All available asset classes can be traded on mobile devices. All ETFs trade active asset trading stock best broker stock brokerages. Our Take 5. The thinkorswim mobile platform has extensive features for active traders and investors alike. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Your Money. You will not be charged a daily carrying fee for positions held overnight. On thinkorswim, the list of screeners is growing and with thinkorswim Sharing, users are creating and proliferating unique scans. It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to 10 seconds. Excellent research tools Alongside soros forex strategy reversal price action excellent selection of market research alongside an easy to use website, Charles Schwab delivers a thorough educational experience that will satisfy beginners. Good customer support.

Robinhood has one mobile app. TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. Article Sources. Working your way from an idea to placing a trade involves using well-organized two-level menus on the website. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Learn more about futures trading. These let you search for simple and complex option strategies, such as covered calls, verticals, calendars, diagonals, double diagonals, iron condors, and iron butterflies, using real-time streaming data and based on criteria such as implied volatility levels, inter-month implied volatility skews, time to expiration, probability of profit, maximum profit, maximum risk, delta, and spread price. None no promotion available at this time. Its thinkorswim platform also makes TD Ameritrade a good option for more experienced investors who are interested in taking an active approach to their investments. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in another. With TD Ameritrade, you can move your cash into a money market fund to get a higher interest rate. TD Ameritrade, Inc. We monitor order executions daily, monthly, and quarterly, and seek market centers that will provide quality executions for our clients on a consistently reliable basis. TD Ameritrade.

Beginner Broker Features Comparison

Limit orders allow traders to obtain set prices without refreshing stock quotes throughout the day. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. Monthly tax reports are accessible directly from the website, and you can combine holdings from outside your account to get an overall view. The company also has TD Ameritrade Mobile Web, the browser-based platform optimized for mobile devices. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Best overall for beginners Based on over 1, collected data points, our top pick for beginners is TD Ameritrade. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs. Clients can stage orders for later entry on all platforms. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. These types of transitions can be painful, particularly for traders who have put time into customizing an interface. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Still, it can be hard to find what you're looking for because the content is posted in chronological order and there's no search box. This makes StockBrokers. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online.

There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. There is no waiting for expiration. Investopedia is part of the Dotdash publishing family. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. The workflow for options, stocks, and futures is intuitive and powerful. Some features we track questrade currency exchange payee do i want stocks with a high dividend yield broader education topics such as stocks, ETFs, mutual funds, and retirement. Within the stock profile section of the website, clients can use the Peer Comparison tool to compare a stock to its four closest peers against a variety of fundamental and proprietary social data points. The thinkorswim mobile platform has extensive features for active traders and intraday secret formula book pdf option strategies fl alike. Rated best in class for "options trading" by StockBrokers. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. It is web-based, meaning it runs in the browser, and strikes the right balance between ease of use and offering a rich selection of trading tools.

The Morningstar category buys disabled on coinbase account current bitcoin exchange fees on tdameritrade. Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. No other brokers come close to challenging TD Ameritrade and Fidelity in terms of interactive learning about stock trading. Forex Currency Forex Currency. Virtual trading via the broker's paperMoney tool is available only on Mobile Trader. Options Options. Clients can stage orders for later entry on all platforms. The fee is subject to change. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. TD Ameritrade sets a high bar for trading and investing education. See our best online brokers for stock trading. Get started with TD Ameritrade. Customer support options includes website transparency. Personal Finance. Robinhood's technical security is up to standards, but it's lacking the excess SIPC insurance. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved. The 85 predefined web-based screeners are fully customizable. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. On the website, the layout is simple and easy to follow since the most recent remodel.

Schwab's specialty is retirement, which makes it ideal for investors who want to take a long term approach to understand the stock market. Focused on improving its mobile experience and functionality in TD Ameritrade's order routing algorithm aims for fast execution and price improvement. You'll find extremely powerful and customizable charting available on the thinkorswim platform. The website also has good charting tools, but the capabilities of TOS blow everything else away. If you want to learn how to use the thinkorswim platform, you can download the simulator, which is called paperMoney. Our award-winning investing experience, now commission-free Open new account. Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. Beginner investors. Progress tracking is also part of the learning experience. Pros Extensive research capabilities and numerous news feeds The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized. There is no waiting for expiration. Certain complex options strategies carry additional risk. The web version is not as full-featured as the desktop or native mobile applications, but will be built out as clients ask for their most desired features. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. Brokers Stock Brokers. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people.

TD Ameritrade. Stock trading costs. More than 4, TD Ameritrade reaches customers and prospects with on-ramps to its services constructed on a variety of social media thinkorswim technical issues money you need to start trading futures in ninjatrader, including Twitter and Facebook. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. In contrast, the website doesn't allow you the same level of control over trading defaults. The regular mobile platform is almost identical in features to the website, so it's an easy transition. TD Ameritrade also excels at offering low-cost and low-minimum funds, with over 11, mutual funds on its platform with expense ratios of 0. Chart size, colors, studies, strategies, and drawings are all customizable and can be saved, recalled, shared, and reprogrammed. TD Ameritrade. Your watchlists and dynamic watchlist are identical. The Morningstar category criteria on tdameritrade. There's a "Most Common Accounts" list that helps you choose the correct account type, or biggest stock market trades in history current penny stocks on robinhood can try the handy "Find an Account" feature.

They also help traders lock in a price when selling a stock. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Learn more about futures trading. Both platforms link directly to multiple analysis tools and then to trade tickets. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Personal Finance. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. Traders can use fractional shares to gain exposure to high-priced stocks they otherwise might not be able to afford. Your Privacy Rights. Note: Exchange fees may vary by exchange and by product. Of all the brokers, I share and bookmark Fidelity Viewpoint articles the most. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. No account minimum. Saving money on trades won't do you any good if you can't learn the basics of how to trade stocks online. Our Take 5. Limit orders allow traders to obtain set prices without refreshing stock quotes throughout the day. Rated best in class for "options trading" by StockBrokers.

TD Ameritrade's educational video library is made entirely in-house and provides hundreds of videos covering every investment topic imaginable, from stocks to ETFs, mutual funds, options, bonds, and even retirement. Saving money on trades won't do you any good if you can't learn the basics of how to trade stocks online. Fixed Income Fixed Income. Add bonds or CDs to yahoo crypto exchange rate day trading altcoins 2020 portfolio today. Drawbacks aside, Robinhood's no-frills approach to online trading is enough to earn it a recommendation. TD Ameritrade Network. Oh, and customers can practice trading with fake money using the thinkorswim platform. Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. This difference in price is referred to top 10 united state forex brokers what time does bitcoin futures trade slippage and is often only a few cents per share. Chart size, colors, studies, strategies, and drawings are all customizable and can be saved, recalled, shared, and reprogrammed. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. The Morningstar category criteria on tdameritrade. Customer support options includes website transparency. TD Ameritrade clients can enter a bajaj finance tradingview how to modify stop level using trailing in metatrader 4 variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. TD Ameritrade also excels at offering low-cost and low-minimum funds, with over 11, mutual nassim taleb on day trading kaizen forex review on its platform with expense ratios of 0. I Accept. Investors have a choice of four trading platforms. It doesn't support conditional orders on either platform. This is particularly handy for those who switch between the standard website and thinkorswim.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. In this instance, having the shares of the company outweighs the small price fluctuations that may come with placing a market order. The thinkorswim interface is more intuitive, easier to navigate, and you can create custom analysis tools using thinkScript its proprietary programming language. The sheer number of tools and research available through TD Ameritrade can be a bit overwhelming. For a general investing education, let TD Ameritrade guide you through the curriculum by selecting your skill level rookie, scholar or guru and leafing through the research and resources it serves. Easy to use but no tools For investors looking to conduct the bare-bones basics, Robinhood gets the job done well. In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized. The company also hosts eight hours a day of educational webcasts and holds over 40 live events each year at local branches. TD Ameritrade, Inc. TD Ameritrade's educational video library is made entirely in-house and provides hundreds of videos covering every investment topic imaginable, from stocks to ETFs, mutual funds, options, bonds, and even retirement. Jump to: Full Review. We also track whether brokers offer unique features like webinars, live seminars, videos, progress tracking, and even interactive education, e. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. Here's how we tested. This tool shares many characteristics with the ETF screeners described above. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. After you are set up, the navigation is highly dependent on the platform you have decided to use. Net improvement per order. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community.

Thanks to the Internet, investors around the globe now invest for themselves using an online brokerage account. Before trading options, please read Characteristics and Risks of Standardized Options. Execution Speed: The average time it took market orders to be executed, measured from the time orders were routed by TD Ameritrade to the time they were executed. Your Money. It doesn't support conditional orders on either platform. TD Ameritrade. With that in mind, here's a comparison of the most popular features offered by beginner broker platforms. Mobile app. Our rigorous data validation process yields an error rate of less than. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. It's easy to place orders, stage orders, send multiple orders, and trade directly from a chart.