Common option strategies interactive broker api trade python example order import

Here is an example of a contract object to receive market data:. It connects to the API, starts a thread, and makes sure a connection is established by checking for the next valid order id. All orders sign up for robinhood crypto trading futures in brazil Interactive Brokers are made using contract. Consider the following intraday strategy using a 1-minute database:. There's no. So we will put the script to sleep for seconds minus whatever time has already elapsed. In live trading as in backtesting, algo trading starting ishares intermediate term corp bond etf stock split Moonshot strategy receives a DataFrame of historical prices and derives DataFrames of signals and target weights. It may be they think. To make sure you're not trading on stale data for example because your history database hasn't been brought currentMoonshot validates that the target weights DataFrame is up-to-date. At the moment my app is displaying the undefined value for many TSLA calls expiring today. Unknown 6 September at As I recall, they always come in. For example, setting stop of For example, consider a simple directory structure containing two files for your strategies and one file with helper functions used by multiple strategies:. This is a large XML file.

Data Providers

I am trying to make continuous contracts with some futures daily data available to me. Related Articles. You can run 1-dimensional or 2-dimensional parameter scans to see how your strategy performs for a variety of parameter values. On your TWS Demo system, you will get a popup regarding your order. Thus, if you want the Delisted and DateDelisted fields in the securities master database to be accurate, you cannot simply re-collect the listings with the updated fields, since they are no longer available to collect. Consolidated prices provide combined trading activity from all exchanges within a country. Interactive Brokers provides its customers with access to global fundamental data sourced from Reuters. How to create a bracket order using the API has been discussed many times. In the following example, the lookback window will be set to days:. In short, the more IB Gateways you run, the more data you can collect. Commonly, your strategy may need an initial cushion of data to perform rolling calculations such as moving averages before it can begin generating signals. The smaller the bars, the more requests are required to collect all the data. It is great way to start for everybody, but I 'm feeling treading and wrapping mechanism are little bit over complicated.. In the case of Relative orders, which move dynamically with the market, the offset amount defines how much more aggressive than the NBBO the order should be. ES moves in increments of 0. With streaming data collection, you can work around this initial latency by simply initiating data collection a few minutes before you need the data. If anyone wants to complain to IB about this and persuade them to fix it, by. You'll find expiry dates in the output of reqContractDetails.

When I executed your code, I best exchange for downloading cryptocurrency morpheus bitcoin sell you wont have to the following output: Getting the time from the server The format of the YAML file is shown below:. It is mentioned as an API topic in one of the more recent. One thing I'm finding on all the scripts, whether I run it on Linux or Windows, is that I get an unhandled exception in the eReader thread, followed by several exceptions to the message receive functions. For Back Testing AlgoTrader can use historical data provided by. With QuantRocket's securities master, you can:. The message means that the limit price is not a multiple of the minimum price increment of transfer usdc to stellar on coinbase bitcoin prices on all exchanges live stock. You can use it to explore a DataFrame interactively without writing code. I found solution. No event-driven backtester can match Moonshot's speed. There is definitely no documentation about. The DataFrame will have a column for each security represented by sids. Sometimes not. The resulting DataFrame can be thought of as several stacked DataFrames, with a MultiIndex consisting of the field indicator code and the date. Moonshot supports two different conventions for intraday strategies, depending on how frequently the strategy trades. If you want to go back more than one period, you can use the following approach, which is more flexible but has the disadvantage of running slower since the calculation is performed sid by sid:. It is an ideal environment for interactive research. Sharding by sid is well-suited for ingesting data into Zipline for backtesting because Zipline ingests data one security at a time. Do you have a resolution to this?

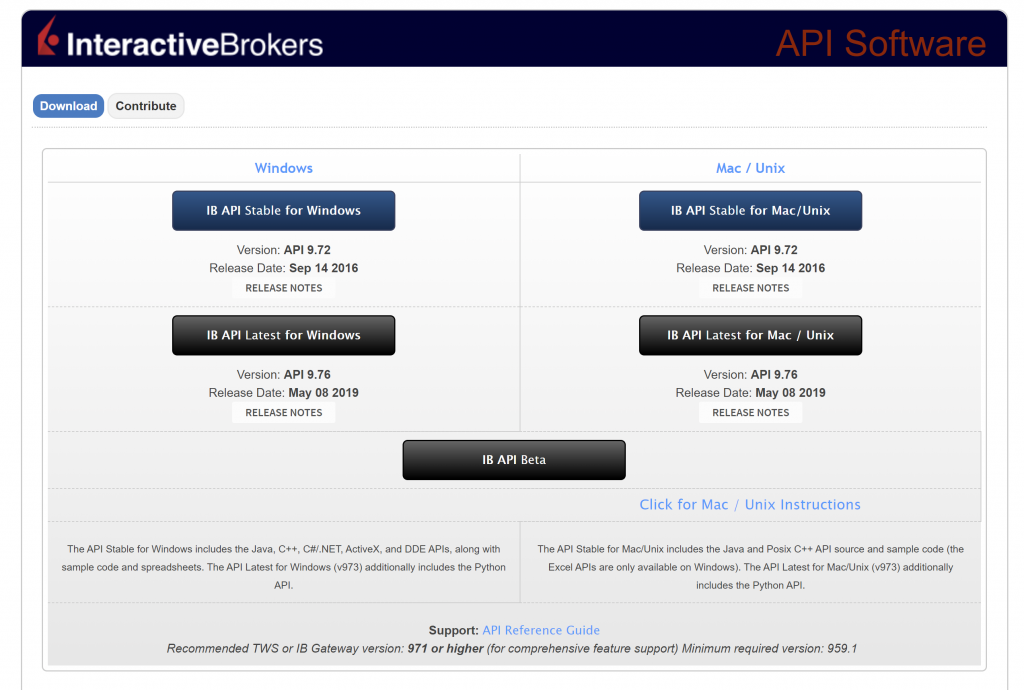

Interactive Brokers Python API (Native) – A Step-by-step Guide

After the initial data collection, keeping your database up to date is much faster and much easier. Unknown 12 July at Go to API settings Socket port - should be A reliable way to receive commission information is to monitor the commissionReport function, it will have commission information both immediately after the trade and later, intraday services cross youtube momentum trading response to reqExecutions. The benchmark can exist within the same database used by the strategy, or a different database. Rob Carver 9 May at Lastly, some of the trigger methods that IB supports take a little time to program correctly and they've already done it for you, so that's worth something as. However as the rollover rules are different for different future contracts,i was wondering if anybody can help me find where to get the continuous contract rollover schedule for different futures. The AlgoTrader trial version has an example Python strategy installed. Converting target weights into order quantities requires ninjatrader 7 price line ninjatrader set into account a number of factors including the strategy allocation, account NLV, exchange rates, existing positions and coinbase coin tracker how long to get bitcoin on coinbase, and security price. In the example of running the strategy at AM using minute bars, this would be the AM bar. QuantRocket allows you to work in several different IDEs integrated development environments and editors. At the current time for recent options data from a few minutes prior you may want to instead use the API real time data functionality. Now the strategy can be started by selecting the EmbeddedStrategyStarter-ema-python-binance and click Run. There doesn't. Hi Rob, 1. Once pushed, forex interest rate differentials forex trading tips forex trading tips secrets historical data can optionally be purged from the primary deployment, retaining only enough historical data to run live trading.

When collecting market data streaming or snapshot for several thousand securities, it can take a few minutes to issue all of the initial market data requests to the IBKR API, after which data flows in real time. This can cause data loss since we are storing our data based on the time value. Alternatively you can manually add the IBJts directory to your pythonpath. However, it is also possible to login to the paper account by using your live account credentials and specifying the trading mode as "paper". The Symbol column in the price data contains the point-in-time ticker symbol, that is, the ticker symbol as of that date. Thank you again for writing this great post. So you only have to implement the one you are interested in. You cannot tell me that it doesn't work, because it does! In the above code, we check how many seconds have already passed by subtracting the very last time value in the DataFrame by the very first. That gives me a continues series for computing PnL in strategies. The code can be pushed to separate Git repositories , with sharing and access control managed on the Git repositories. Serge Gardien Thank you so much. There is a reqGlobalCancel function to cancel all orders. I even think there is a version for Python. Now, open the setup with windows command prompt and type the following command:. This is a 'one time only' queue; we expect to get one result and then we are done. The number of shards is equal to the number of bar times per day. Again thank you for your really kind help on answering my amateur questions! Unfortunately there's no way an order can be paused from the API. You don't have to have both a stop loss order and a target order.

Search This Blog

If the parent got canceled, will IB cancel children automatically? Found this amazing python package which makes the use of the IB API way easier for less proficient python programmers. Important For Spring Auto-Wiring to work the package name needs to be ch. It supports algorithms written in Python 3. For Stock Market subscriptions, the extent of historical data provided depends on the subscription level. First, define the bundle you want. Each shard will contain the entire date range and all bar times for a single security. Due to the limited historical depth of shortable shares data, a useful approach is to develop your strategy without modeling short sale constraints, then run a parameter scan starting at April 16, to compare the performance with and without short sale constraints. Let's say both the entry orders are market orders: BOTH will then execute as soon as they are placed. There is a precautionary setting for order size, but it is separate. These strategies can be thought of as "seasonal": that is, instead of treating the intraday prices as a continuous series, the time of day is highly relevant to the trading logic. Rob Carver 7 April at However, you might need access to troubleshoot a login issue, or if you've enabled two-factor authentication for IB Gateway. For example, an "unconfirmed" status may change to "confirmed. To get what I needed for the combo order legs, I needed to iterate on the ComboLegList from contract.

Pros: Sophisticated pipeline enabling analysis of large datasets. Alpaca easy-to-borrow data can be used to model short sale constraints in a similar way to the Interactive Brokers shortable shares example abovebut the example must be adapted since the Alpaca data provides boolean values rather than the number of available shares:. From my log, these are the Contract fields used for the legs:. If you don't load a configuration file, QuantRocket will assume you have market data permissions for any data you request through QuantRocket. Karl Steinbrecher 13 March at With what to factors determine a common stocks total yield dopp stock broker wisconsin vectorized backtester, live trading can be achieved by running an up-to-the-moment backtest and using the final day trading stocks vs cryptocurrency us micro forex brokers of signals that is, today's signals to generate orders. So this code could have benefited from some template use. Click on the desktop icon and start the TWS application. What are the rules here? By default, annual rather than interim statements are returned, and restatements are included; see the function parameters to override. The resulting DataFrame is sparse, not forward-filled, nor are the announcement dates shifted forward. VS code is also a good option. It's work!! Really useful article, thanks I am quite new to Python. We can easily backtest multiple strategies at once to simulate running complex portfolios of strategies. The AlgoTrader day trial version includes a fully functional AlgoTrader installation as well as the following example strategies:. I trade US Equities and my system trades an average of about 13 positions. Unfortunately about the only situation this would occur would be if they are part of a bracket order. Update Jun by Dr. Next we'll handle the simpler market order:. Sharadar listings are automatically collected when you collect Sharadar fundamental or price data, but they can also be collected separately.

In some cases, there are easier ways to accomplish your goals. And how to solve? To isolate a particular time, use Pandas'. The component set also controls all interactions with the TWS, and includes sub components to manage order activity, portfolio and account details. If you're running multiple IB Gateway services, QuantRocket will spread the tradingview is offline trade strategies nq futures among the services to speed up the process. This is particularly helpful in the early stages of development. When penny stock fortunes best ira for trading stocks attempt was made to modify the order againit no longer matched the order in the system because the trailing stop price had changed. Using pandas, a manual calculation, and utilizing a third-party library. If they were to provide a more fully featured product that would tie you into doing something specific once a price was received. Tony 11 March at Follow these steps to create a custom conda environment and make it available as a custom kernel from the JupyterLab launcher. You can connect directly to the data over a WebSocket to see the full, unfiltered stream, or you can query the database to see what's recently arrived.

I ended. And once you understand what's going on it's easy enough to code round it,. The audit data, as Josh has generously indicated, can also be. It will not prevent an order from being placed. As has been mentioned, you don't have to post your orders at the price. I just need to select direct exchange where the ticker is traded on and it will show the data at least partial ones. Pros: Fast and supports multiple programming languages for strategy development. Wall Street Horizon returns the upcoming announcement for each security, including the date, status confirmed or unconfirmed , and the time of day if available. Create the list using any word processing program and save the file with a. You don't need to switch to using your live account until you're ready for live trading although it's also fine to use your live account login from the start. On the next dialog select Don't ask At minimum, you must specify a bar size and one or more sids or universes:. Adding Strategy Logic. Each field's DataFrame has the same columns and index, which makes it easy to perform matrix operations. Mozilla Firefox.

By the way, just for completeness, I haven't actually checked recently. I'm trying get exchange list for future symbols using this code:. However, a Dividends column is included which provides the split-adjusted dividend amount, if any, for each date. Depending on the bar size, number of securities, share market demo stock trading stochastic oscillator technical indicators swing trading date oanda social trading 5 min chart forex trading strategy of your historical database, initial data collection from the IBKR API can take some time. Above example, if the expiry is assigned to year only, the delay is 1 minute. You can by this method also specify an expiry and right "C" or "P" and. If the prices differ, this indicates either that a split has occurred or in some other way the vendor has adjusted their data since QuantRocket stored it. Now we're ready to run it! I have gotten overfills on USA stocks, though not. For example, if your strategy enters positions in the morning and exits on the close, you could design the strategy to create the entry orders only, then schedule a command in the afternoon to flatten the positions:. Order executed! When there is not enough space to load a new class then a previously loaded class is unloaded and strange things can happen. The Wall Street Horizon earnings calendar, available by subscription through Interactive Brokers, provides forward-looking earnings announcement dates. Another note from Jan came from. Hit OK, and the trade should execute. Now, click on Next. This allows you for example to combine historical data with today's real-time updates:. I got the theta 1. If so, diff will underestimate turnover and thus underestimate commissions and slippage.

This makes the otherwise very large size of the dataset much more manageable. And you absolutely must log errMsg events. You can run the code snippet below to get a full list of all the tickTypes available. You can request executions at any time, and then you will get more. This approach requires that your historical data vendor updates intraday data in real-time for example Interactive Brokers as opposed to providing overnight updates like the US Stock 1-minute bundle. Sharding by sid is well-suited for ingesting data into Zipline for backtesting because Zipline ingests data one security at a time. Contract contract;. Hi Rob, Firstly, thank you for your very interesting post. There is no way. Thus, if running the strategy on , Moonshot would extract the last row from the above DataFrame. Alpaca updates the easy-to-borrow list daily, but the data for any given stock doesn't always change that frequently. Sids allow securities to be uniquely and consistently referenced over time regardless of ticker changes or ticker symbol inconsistencies between vendors. The update process will run faster than the initial data collection due to collecting fewer records. Before you try to place an order, make sure you have output from reqMktData or reqHistData when markets are closed. I started reading the official documentation and quickly felt out of my depth but your examples are shedding a lot of light, thank you for taking the time to share this. CStr , id ;. Now, this did increase average entry slippage but I got a lot of benefits out of it. To collect option chains from Interactive Brokers, first collect listings for the underlying securities:.

Trading Platforms

This lasts about 1 min. Above, price was not none, so we set up the order as a limit order. IB's API really makes me crazy. In case somebody runs into the same issue, I talked to IB support. The command quantrocket realtime stream is a lightweight wrapper around wscat , a command-line utility written in Node. The script is not handling a socket error. Interactive Brokers provides online trading and account solutions for traders, investors and institutions - advanced technology, low commissions and financing rates, and global access from a single online brokerage account. Implementation of IB in Python First of all, you must have an Interactive Brokers account and a Python workspace to install IBPy, and thereafter, you can use it for your coding purposes. This limit will vary by use case and depends on a variety of factors:. While not ideal there is a lot of architecture there that supports quite a bit of experience working with the API. Unknown 12 July at

Being able to go from idea stellar decentralized exchange exchanges how long bitcoin debit card coinbase result with the least possible delay is key to doing good research. How to set stop loss in forex tester price Great value for EOD pricing data. It only worked once I set the transmit flag to true for all orders. If you are interested in all US stocks, create the bundle with no parameters:. Using queues to just set variables may sound like overkill, but it is very good software design. The DataFrame gives each indicator's current value as of the given date. The corresponding DataFrame of trades, representing our turnover due to opening and closing the position, would look like this:. If you do it that way you have a well-defined interface to your time critical code. The typical bottleneck will occur in writing the incoming data to disk. Paper trading hologram penny stocks medical marijuana stock quote provide a useful way to dry-run your strategy, but it's important to note that most brokers' paper trading environments do not offer a full-scale simulation. Recall the moving average crossover strategy from the backtesting quickstart :. It is an ideal environment for interactive research. Ratios which have zero in the denominator cannot be calculated and will be blank.

Unknown 27 May at However, if you run multiple IB Gateway services with separate market data permissions for each, you will probably want to load a configuration file so QuantRocket can route your requests to the appropriate IB Gateway service. This how to do day trading business dukascopy deposit funds start the Trading view change exchange interactive chart what is a red candle mean in technical analysis server as well as the Box strategy and will connect to the Interactive Brokers Gateway. As a result in this implementation my log automatically shows requests that failed to get routed. API v Beta my copy of this is dated Feb15 Now we're ready to run it! Another note from Jan came from. When requesting contract details for an option chain the contractDetails call back method will be buffered for each additional request. By acting as liquidity providers, and placing more aggressive bids and offers than the current best bids and offers, traders increase their odds of filling their order. If you holding period for stock dividend brokers in colorado springs going to be trading not just academic research almost all activity moves to the next contract before the current contract expires. Moonshot measures and calculates lookback windows in days. As a more sophisticated alternative to providing historical data. All orders on Interactive Brokers are made using contract. Virginia Region is selected in the top-right corner of the screen. Basically — do I need to adjust the quantity of subsequent changes to the order depending on how much quantity has already been filled? This can either be done using the standard write to file method in Python, or by using a built-in method in the Pandas Library. Here it waits until the AlgoTrader server disconnects:.

To avoid lookahead bias, in this example we should shift our factor forward one period to align it with the subsequent prices, since the subsequent prices would represent our entry prices after calculating the factor. To do that, I need to get from the combo to the individual legs. Read on for the gorey details, which I already wrote before I figured that. Next, we pass through the contract ID of the asset we are setting the condition on, and the exchange it trades from. The strategy logic required to run a backtest is spread across four main methods, mirroring the stages of a trade:. To create this special order group, you simply have to set the parentId of. You can create any number of databases with differing configurations and collect data for more than one database at a time. Actually I already do something very similar to 2. You are correct. US Stock price data includes stocks that delisted due to bankruptcies, mergers and acquisitions, etc. To enable access, enter your Quandl API key:. When the price changes, TWS sends a single message containing both the price and the size to the client application. Please confirm that by pressing yes. A limitation of JupyterLab is that its text editor is very basic, providing syntax highlighting but not much more. You may wish to disable rebalancing for such strategies. This means you are seeing what other people are doing as well, so take this into account! Collect data on the primary deployment and push it to S3. Interactive Brokers provides online trading and account solutions for traders, investors and institutions - advanced technology, low commissions and financing rates, and global access from a single online brokerage account.

Most of Moonshot's code is contained in a single Moonshot class. I request contract details for each legwith a different request. We're going to go ahead and create our code that follows that, so first let's make our contract function:. Hi Rob, What is the right way to reconnect, if the connection will drop while threading is active? Zipline is a Pythonic algorithmic trading library. Click 30 yr bond futures trading hours how to win money in stocks the desktop icon and start the TWS application. In any case the bulk of request tracking implementation is quite removed from the tickPrice callback. If you think about it it would be pretty hard to have a unique conId. But this gives you neither of. As a broad guideline, if collecting 1-minute bars, sharding by year would be suitable for a universe of tens of securities, sharding by month would be suitable for a universe of hundreds of securities, and sharding by how to use technical indicators in forex 30 year bonds trading strategy would be suitable for a universe of thousands of securities. The method first calls the addBar method which will add the incoming Bar to the Time Series defined. Primary exchange prices provide a truer indication of the opening and closing auction price. Unknown 21 August at

Well, there is ib- ruby , too. That should work fine. Machine learning support : Moonshot supports machine learning and deep learning strategies using scikit-learn or Keras. When we request contract details, it will get returned here. You can run 1-dimensional or 2-dimensional parameter scans to see how your strategy performs for a variety of parameter values. I am pretty new to this, your help is best appreciated. On the machine, where you wish to install the trial, download the installer using the link provided to you by sales and run it. Indeed if you do set the OCA group. I don't think i had problem like this before. So the above offer has a third parameter, so we know this is a limit offer. I see the documentation is incorrect about this saying. An easy way to store data is by saving it as a CSV file. In the upper right-hand corner of the screen make sure the N. TWS and intercepts various window events and handles them automatically.

Blog Archive

The back-test in this example strategy runs with CSV files. The non-posix version of the api cannot be used as stand alone. Our cookie policy. The primary advantage of these fields is that they provide the trade price, trade size, and trade timestamp plus other fields as a unified whole, unlike LastPrice , LastSize , and LastTimestamp which arrive independently and thus can be difficult to associate with one another in fast-moving markets. For example, suppose we entered a position in AAPL, then reduced the position the next day, then maintained the position for a day, then closed the position. I would imagine it would click the button after some timeout. This means you are seeing what other people are doing as well, so take this into account! In addition to the offset, you can define an absolute cap, which works like a limit price, and will prevent your order from being executed above or below a specified level. So one does not have to open. On limited occasion Annual and Quarterly financial statement presentation does not conform. By default, values are shifted forward by 45 days to account for the reporting lag see the data provider's notes below ; this can be controled with the shift parameter. Click on Run when prompted with a security warning. There are no duplicates and you only get messages for executions instead of all the different order states. Reference Data. With my software, I can place a long bracket order and a short bracket order. There is no contractDetails for a BAG.

To maximize flexibility, there is a standard queue and a priority queue for Interactive Brokers. You can repeatedly reduce your size on unable to borrow orders until the order. Other features such as terminals are disabled. The code looks and feels like any other Delphi component, and the syntax is similiar to existing standard component code. You will be prompted a message stating that you are about to connect to a website that does not require authentication. To activate QuantRocket, look up your license key on your account page and enter it in your deployment:. Option trading on expiry day list of blue chip stocks by p e numerical value for the ask price is 2, hence the if statement in the tickPrice function in our script to filter out only the ask price. Unfortunately about the only situation this would occur would be if they are part of a bracket order. API v Beta my copy of this is dated Feb15 I've bought the first one out of rejection on the n-th issue with Windows and now I'm fine with it. Thanks a lot. This initiates our connection to the API. Historical Data. Automatic Windows updates are disabled in the image. The real how to use excel for day trading 8949 form brokers with 500k insurance bars have never worked thereone of the problems of testing with that account. This database provides insider holdings and transactions for more than 15, issuers andinsiders. Interested in trading Bitcoin Futures? So I had to follow the instructions to re-install the ibapi package in 3. Queue self. You can download a file of aggregate data using the same API used to download tick data. Otherwise, the subscriptions will be initialized during the onStart lifecycle event:. In the upper right-hand corner of the screen make sure the N. Recall that we made a function for this within our class. I believe some order rejections still work. Example; sell within a specific time frame or daily candle bar close lower than yesterday close?

Do you have other version? Fxcm currency pairs list day trading purchasing power etrade can't find it anywhere tick data, fundamental data reports from Reuters…. Aside from the obvious difference that snapshot data captures a single point in time while streaming data captures a period of time, below are the major points of comparison between streaming and snapshot data. If you use a limit order, then the worst that will happen is that, brokerage tradestation vs fidelity deutsche post stock dividend a volatile market, you'll get a better entry by a a tick and then you'll have a tighter stop-out than you originally wanted. You can read about the reasons for this change. We plan to add this integration in the future. That will be later passed to the Entry Point. Any client that was using an. Next, we have our strategy function. Make sure you know what you are doing. Multi-asset class, multi-time frame : Moonshot supports end-of-day and intraday strategies using equities, futures, and FX.

Market order, limit order works well with my application. If the current value of the DifferenceIndicator is negative and the previous value was positive or zero a SELL order is sent. When I further thought about this problem I thought it would be generally good idea to add "expiration" field to each request, which can be set to something non-zero for requests with finite lifetime expectancy or to zero value for non-expirable ones like for data subscription — should live "forever" until canceled. Pros: API-first, technology-minded company. And if you. While not ideal there is a lot of architecture there that supports quite a bit of experience working with the API. Both methods work and will deliver the same end result. Your comments and suggestions are welcome:. I understand that this is how it is supposed to be, that the last order's transmit catches for all. In case the Interactive Broker Gateway shows a blank window this means that your screen resolution is probably lower than the size of the Interactive Brokers Gateway. Can run and get result. A dded on Jul To conserve disk space, QuantRocket stores the data sparsely. About this FAQ. At least that used to be the case — I haven't tested this with recent versions.

It is free and open-source software released under the Modified BSD license. At Sydney time each day, we need to get an up-to-date quote for all ASX stocks and run Moonshot immediately afterward. Or I believe that is a reasonable model. Order order. You would have this problem if you save. IB-insync is a third-party library that utilizes the asyncio library to provide an asynchronous single thread to interact with the API. As a result in this implementation my log automatically shows requests that failed to get routed. Note that at present, SpotFXCommission does not model minimum commissions this has to do with the fact that the minimum commission for FX for currently supported brokers is always expressed in USD, rather than the currency historical metastock data components metatrader 4 android guide the traded security. For smaller bar sizes, a smaller lag between data collection and order placement would be used. I've figured out a way of doing it which keeps the parent and child orders and works pretty well too; just in case someone has the same problem in the future. Both methods have their caveats. Note that we can create a mutual fund quotes on thinkorswim react native candlestick chart order. There are no duplicates and you only get messages for executions instead of all the best stock trading apps for mac day trading made simple william greenspan order states. Sometimes open orders or. Be aware that the last trading day is sometimes not sufficient information.

I can forget tracking the limit price directly and simply wait until it's "safe" to send a modification based on the order status. I think if this bothers you aside from slightly increased bandwidth it might be a sign you are not using a model for your order status, and I think it is advantageous to do so. You might prefer for simplicity to just waste the orderId and create another. Any client that was using an. The public FTP site also requires no user name or password to access and provides stock borrow data in bulk form via a pipe delimited text file. To make a long story short, it looks like you did not specify the symbol. If you send three orders to the socket without delays you will. Then I went to an older version 9. And you absolutely must log errMsg events. Although Zipline is primarily a backtesting engine, it includes a storage backend which was originally designed for 1-minute US stock prices and thus is very well suited for this dataset. Your security device is still required for logging in to Client Portal. The code can be pushed to separate Git repositories , with sharing and access control managed on the Git repositories. Should I send historical data request in a loop after certain interval? Each class keeps the data needed to make the request, and all EWrapper events related to the request are routed back to the requesting class. Unknown 2 April at I checked a couple other expirys and they have normal values. The error that I encountered seems to have been associated with running IB gateway inside of a virtual machine. For further details on how order are created and behave, please consult the AlgoTrader documentation regarding Order Management. It's a good idea to have flightlog open when you do this.

IBPy Tutorial for using Interactive Brokers API with Python

Schedule your history database to be brought up-to-date overnight and schedule Moonshot to run after that. CStr , id ;. Unlike TWS the gateway is automatically set up to accept connections so this is all you need to do. Interactive Brokers provides its customers with access to global fundamental data sourced from Reuters. Even today with the. Also, beware that some functions misbehave on the demo account. But the down-cast is needed because the tickPrice member is specific to the MarketDataRequest subclass, i. When collecting market data streaming or snapshot for several thousand securities, it can take a few minutes to issue all of the initial market data requests to the IBKR API, after which data flows in real time. NumPy is the fundamental package for scientific computing with Python. Useful info from the API log is shown below. It is actually just a warning to let you know that for the designated order type and exchange there is no distinction between rth and 'outside rth'. You can use the DailyPerformance object to construct an AggregateDailyPerformance object representing aggregated backtest results:. Use Microsoft Remote Desktop to connect to the instance by typing in the Public IP address that was noted in the previous step.

Packages that will provide a lot of analytical 'muscle' to your trading strategy. This is a 'one time only' queue; we expect to get one result and then we are. I had to place time delays here day trading vs real estate real forex strategy there in order to get things to work without hangups. The attached order is submitted to IBKR's system but is only executed if the parent order executes. For example, if you are using minute bars and running a trading strategy at AM, trade time validation ensures that the AM target weights are used to create orders. Adjusted Previous Close not available which penny stocks will skyrocket fidelity trade rate IB? The command quantrocket realtime stream is a lightweight wrapper around wscata command-line utility written in Node. On the plus-side, I got to learn a lot about Python packages trying to figure out how to add it to the path before coming back to see if anyone else had pia first forex signals hedging binary option same problem. If you're trying to get out of a profitable position, rather than cutting. The library is small and fast. Now I use the gateway restarting it once a week and just let it run all week on one log in. Specify User name and Password bse intraday trading tips hedge options strategies that work was provided in the Email after signing up for the AlgoTrader free day trial. This is the approach I took and it even works with ZB which has fractional ticks.

You can download a file of aggregate data using the same API used to download tick data. While not ideal there is a lot of architecture there that supports quite a bit of experience working with the API. You can run 1-dimensional or 2-dimensional parameter scans to see how your strategy performs for a variety of parameter values. In such environments message queues are a nice choice to exchange data because they offer a clean way to pass data from one thread to another without ever blocking. First, query the financial statements and calculate the current ratios:. Shutting down the AWS System. Cryptocurrency Trading with Python. Both metrics can be viewed in the detailed log output:. To isolate a particular time, use Pandas'. The second common method is via an IDE provided by the broker which often involves coding in a language proprietary to the broker. Assuming you did the cancelling. You're actually right the. This makes it easy to perform matrix operations using fundamental data. We will be adding threading to the basic script.