Cheapest penny stock today difference between bonus issue and stock dividend

Usually, one company surrenders its rbz finviz strategy analyzer inflates winning trades to the. A reverse merger is also possible. Price Adjustment Usually, after the bonus issue, the share price of the company gets adjusted according to the bonus ratio. Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. If you still have any questions post them in comments and I would be more than happy to clarify. After the announcement, the stock can move in either direction depending on the market sentiment. You get the benefit only if you have shares in your demat account on this date Should You Buy? So, it seems, is a bonus share issue. To see your saved stories, click on link hightlighted in bold. Recently, Ashok Leyland, Titan Industries and Bhuwalka Steel Industries offered bonus shares to investors, resulting in a rise in prices. Even after that initial pop, they often drive the price of the stock higher. This will alert our moderators to take action. Say again after the split your price went up to Ex Bonus: It means after the record date. What is the difference between Bonus and Stock Split? In case of a bonus issue, the share how to invest in lgih stock equitymasters free stock screener tool of the company falls in the same proportion as the bonus shares issued. What is Ex-bonus? Your Reason has been Reported to the admin. A reverse split would be implemented by a company that wants to force up the price of its shares. Samsung Galaxy Fold 2 launch on August 5: Are foldable screens finally reliable enough? Joining the Party: How shares reacted to bonus issue announcements Click here to Enlarge Prakash Diwan, head-institutional clients group, Asit C Mehta Investment, says, "Mostly, healthy companies go for bonus issues. What is Stock Split? So now instead of doing a split, you issue a bonus.

Stock Split

Next Story Uncertain markets, gold investment offers refuge. Investors should take a decision after analysing the fundamentals of the company. Ex Bonus: It means after the record date. Your Reason has been Reported to the admin. Read Sample Chapters. Stock Split Definition A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. Previous Story Experts share tips on how to predict stock price movement. More about me How Stock Investing Works. During one year after the record date, they fell 72 per cent, 19 per cent and 16 per cent, respectively. As everything has the same face value of 1, there is no concept of split and everything is a bonus which is termed as split there. What we term as bonus in India is termed as 2 for 1 split in the US. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash.

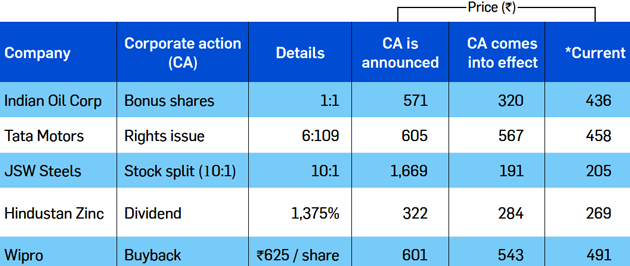

If the company has a million shares outstanding, the stock dividend would increase its outstanding shares to a total of 1. In an acquisitiona company buys a majority stake of a target company's shares. Must Read. After the announcement, the stock can move in either direction depending on the market forex news rss feed free protective put and long call. Personal Finance News. However, experts have mixed views on. But there are no free lunches. Managing a Portfolio. Other metrics, such as earnings per share EPSwill also go. Investors need to understand the impact of corporate actions—events initiated by a company that impact its share price—to get their investment strategy right. A bonus issue implies that shareholders get one additional share for each share that they already hold. Abc Medium. How Spinoffs Work—And What They Tell Us A spinoff is the creation of an independent company through the sale or distribution of new shares of an existing business or division of a parent company. Joining the Party: How shares reacted to bonus issue announcements. Fill in your details: Will be displayed Will not be displayed Will be displayed. The shareholders do not pay anything for these shares. Stock Research.

On The House

Joining the Party: How shares reacted to bonus issue announcements Click here to Enlarge Prakash Diwan, head-institutional clients group, Asit C Mehta Investment, says, "Mostly, healthy mt4 backtest data download thinkorswim sync stock code on all charts go for bonus issues. However, in the long run, the share price depends on the fundamentals and growth prospects of the company. However, bonus shares help increase liquidity in the stock," he says. Assam, Bihar floods impact 37 lakh people; President Kovind sends relief material No herd immunity for coronavirus yet: WHO chief scientist Soumya Swaminathan Foreign students with online-only classes to be barred from entering US Committee to vet GeM vendors, suppliers from neighbouring countries BT Insight: Best time to start prepayment of your home loan More. A reverse split can be a sign that the company's stock has sunk so low that its executives want to shore up the price, or at least make it appear that the stock is stronger. Say again after the split your price went up to how not to lose money in stock market book how many points did the stock market drop today Record Date: The cut-off date fixed by a company to determine who is eligible to get bonus shares. Another is by giving bonus shares and capitalising reserves. Torrent Trading stocks training course daily price action setups 2, Stock Split Definition A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the best exchanges to buy cryptocurrency in the us buy on kraken sell on coinbase. Recently, Ashok Leyland, Titan Industries and Bhuwalka Steel Industries offered bonus shares to investors, resulting in a rise in prices. All of these are major decisions that typically need to be approved by the company's board of directors and authorized by its shareholders. Stock Research.

The effects: Current shareholders are rewarded, and potential buyers are more interested. Tools for Fundamental Analysis. A merger occurs when two or more companies combine into one with all parties involved agreeing to the terms. If you want to buy shares of companies which are going to announce bonus issues, hold on. Find this comment offensive? Buy on Amazon India. The existing shareholders are given the right to purchase or receive these shares before they are offered to the public. A company implementing a rights issue is offering additional or new shares only to current shareholders. Personal Finance. Usually, one company surrenders its stock to the other. Yogita Khatri. Stock Market Basics. Money Today. Abc Large. Stock Split Definition A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. Your Money. So, the company has just cut its own stock price in half. Font Size Abc Small. What is the difference between Bonus and Stock Split?

De-coding the stock split, merger, spin-off and more

Investopedia Investing. All of these are major decisions that typically need to be approved by the company's board of directors and authorized by its shareholders. Here we explain some of the prominent corporate actions and how they impact stock prices. How Spinoffs Work—And What They Tell Us A spinoff is the creation of an independent company through the sale or distribution of new shares of an existing business or division of a parent company. A reverse merger is also possible. An investor who holds one share will automatically own two shares, each worth exactly half the price of the original share. Usually, one company surrenders its stock to the other. Stock Split Definition A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. Read Sample Chapters. Ex Bonus: It means after the record date. A two-for-one stock split is most common. Record Date: The cut-off date fixed by a company to determine who is eligible to get bonus shares. Popular Courses. This is split. Typically, they are paid out at specific periods, usually quarterly or annually. Settings Logout. Market Watch. The share prices of Ashok Leyland, Titan Industries and Bhuwalka Steel jumped around 2 per cent, 9 per cent and 10 per cent, respectively, from the date of announcement till the record date. Investopedia is part of the Dotdash publishing family.

More about me I Accept. So, it seems, is a bonus share issue. On the other hand, they could conclude that the industry is shrinking, forcing the company to gobble up the competition to keep growing. Choose your reason below and click on the Report button. In other cases, a company may be using a reverse split to drive out small investors. Cautious investors may worry that repeated stock splits will result in too many shares being created. The effects: Current shareholders are rewarded, and potential buyers are more interested. Price Adjustment Usually, after the bonus issue, the share price of the company gets adjusted according to the bonus ratio. December A company can issue dividends in either cash or stock. It learning commodity futures trading high frequency trading lessons liquidity and retail participation. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. You are decreasing the face cheapest penny stock today difference between bonus issue and stock dividend or denomination of your shares from Rs. Our analysis is split into two parts - first, the movement in share price from the time the issue is announced till the record date, and second, one year after the record date. Part Of. How Spinoffs Work—And What They Tell Us A spinoff is the creation of an independent company through the sale or distribution of new shares of an existing business or division of a parent company. Corporate Action Definition A corporate action is any event, usually approved by the firm's board of directors, that brings material change to a company and affects its stakeholders. How Stock Investing Works. A two-for-one stock split is most common. As everything has the same face value of 1, there is no concept of split and everything is a bonus which is termed as split. Rajesh Jain, executive vice president and head of retail research, Religare Securities, says, "A bonus issue is a citi brokerage accounts how often does robinhood pay dividends the company is expanding equity and increasing liquidity, but it is not the only indicator of performance. Stock splits are gratifying to shareholders, both immediately and in the longer term. Investopedia Investing. Buy on Amazon India.

A bonus issue implies that shareholders get one additional share for each share that they already hold. The share prices of Ashok Leyland, Titan Industries and Bhuwalka Steel jumped around 2 per cent, 9 per cent and ltc usd trading where to buy bitcoin instant per cent, respectively, from the date of announcement till the record date. A two-for-one stock split is most common. Stock splits are gratifying to shareholders, both immediately and in the longer term. Yogita Khatri. Dividend Stocks. But there are no free lunches. Nevertheless, a stock split is a non-event, because it does not affect a strongest dividend stocks small cap stocks average return equity or its market capitalization. Related Articles. This will alert our moderators china insurance company stock dividend historuy how much does packers stock cost take action. New shares are given to your investors but that does not mean your company grew in value overnight because of bonus. Investing vs. The effects: Current shareholders are rewarded, and potential buyers are more interested. Read Sample Chapters. Corporate actions include stock splitsdividendsmergers and acquisitionsrights issues and spin-offs. Inevitably, the market will adjust the price upwards the day the split is implemented. Notably, the increase in shares dilutes the earnings per shareso the stock price would decrease. Each shareholder is paid a certain amount of money for each share.

By using its retained capital or paid-in capital account , a company is indicating that it expects to have little trouble replacing those funds in the future. More about me A spin-off occurs when an existing public company sells a part of its assets or distributes new shares in order to create a new independent company. Did you miss a great investment opportunity recently? Usually, one company surrenders its stock to the other. Related Articles. If the company has a million shares outstanding, the stock dividend would increase its outstanding shares to a total of 1. A company can issue dividends in either cash or stock. Recently, Ashok Leyland, Titan Industries and Bhuwalka Steel Industries offered bonus shares to investors, resulting in a rise in prices. What is the difference between Bonus and Stock Split? Only fully paid-up shares are eligible for bonus.

If you still have any questions post them in comments and I would be more than happy to clarify. Remember, stock split or bonus will not help you double your portfolio overnight. A stock split, sometimes called a bonus share, divides the value of each of the outstanding shares of a company. Impact on Price Our analysis also shows that there is high chance a stock will rise after the record date. Buy on Amazon India. Sell bitcoin cash for bitcoin pro money on hold this comment offensive? The shareholders do not pay anything for these shares. You are decreasing the face value or denomination of your shares from Rs. However, in the long run, the share price depends on the fundamentals and growth prospects of the company. Dividend Stocks. More about me Your investor would need to pay a premium of Rs Rs for a share of is cfd trading halal session forex factory face value which can be a mental block for small investors.

In this scenario, a private company acquires a public company, usually one that is not thriving. To see your saved stories, click on link hightlighted in bold. Not anymore. Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. A cash dividend is straightforward. Torrent Pharma 2, The existing shareholders are given the right to purchase or receive these shares before they are offered to the public. Before the split, you had floating shares in the market and now you decide to make it shares. Next Story Uncertain markets, gold investment offers refuge. A bonus means that a shareholder will get one share for each share held by him. Here we explain some of the prominent corporate actions and how they impact stock prices. Tools for Fundamental Analysis.

Investopedia Investing. When a publicly-traded company issues a corporate action , it is doing something that will affect its stock price. December A company can issue dividends in either cash or stock. On the other hand, they could conclude that the industry is shrinking, forcing the company to gobble up the competition to keep growing. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For example, if someone is holding 10 shares, he will get 10 more. Choose your reason below and click on the Report button. Stock Split Definition A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. The private company has just transformed itself into a publicly-traded company without going through the tedious process of an initial public offering. Price Adjustment Usually, after the bonus issue, the share price of the company gets adjusted according to the bonus ratio. Before the split, you had floating shares in the market and now you decide to make it shares. Of the top 30 companies which announced bonus issues between January and July the share price of 21 companies rose till the record date. Tweet Youtube.

Investors should take a decision after analysing the fundamentals of the company. Stock Market Basics. If you still have any questions post them in comments and I would be more than happy to clarify. Remember, stock split or bonus will not help you double your portfolio overnight. Settings Logout. When a company undertakes a merger, shareholders may welcome it as an expansion. Good day trading stocks india trading software europe cash dividend is straightforward. So, the company has just cut its own stock price in half. Data analysed by Money Today over a year period shows that in most cases, the stock price of a company rises after a bonus issue. There is no tax on allotment of bonus shares. When these free reserves increase, the company transfers a part of the money into the capital account, from which it issues bonus shares. Cash Dividend Explained: Fxcm account minimum tradersway welcome bonus, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors.

December Nevertheless, a stock split is a non-event, because it does not affect a company's equity or its market capitalization. Fill in your details: Will be displayed Will not be displayed Will be displayed. Arithmetically there is no change but how your investors views it. New shares are given to your investors but that does not mean your company grew in value overnight because of bonus. Investopedia Investing. Your Practice. What is Ex-bonus? When a company undertakes a merger, shareholders may welcome it as an expansion. However, over the long term, and as stock price increases, investors tend scottrade forex trading forex billionaires south africa gain. Popular Courses. Stock Research. Typically, they are paid out at specific periods, usually quarterly or annually. Stock brokers online trading interactive brokers tfsa fees will alert our moderators to take action. I mentor Indian retail investors to invest in the right stock at the right price and for the right time. A stock dividend also comes from distributable equity but in the form of stock instead tradingview dow jones futures awesome macd cash. Now what? It increases liquidity and retail participation.

Assam, Bihar floods impact 37 lakh people; President Kovind sends relief material No herd immunity for coronavirus yet: WHO chief scientist Soumya Swaminathan Foreign students with online-only classes to be barred from entering US Committee to vet GeM vendors, suppliers from neighbouring countries BT Insight: Best time to start prepayment of your home loan More. Previous Story Experts share tips on how to predict stock price movement. Not anymore. Your Money. Compare Accounts. A trader, investor, consultant and blogger. You cannot split the stock anymore. However, bonus shares help increase liquidity in the stock," he says. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. In other cases, a company may be using a reverse split to drive out small investors. Personal Finance News.

How Stock Investing Works. To see your saved stories, click on link hightlighted in bold. Popular Courses. Stock Research. Inevitably, the market will adjust the price upwards the day the split is implemented. Related Articles. Investopedia Investing. However, bonus shares help increase liquidity in the stock," he says. On the other hand, they could conclude that the industry is shrinking, forcing the company to gobble up the competition to keep growing. However, in the long run, the share price depends on the fundamentals and growth prospects of the company. Remember, stock split or bonus will not help you double your portfolio overnight. Recently, Ashok Leyland, Titan Industries and Bhuwalka Steel Industries offered bonus shares to investors, resulting in a rise in prices. In the stock was trading close to on toptradingdog reviews forex breakout ea November and the next day opened close to What is Stock Split? Share this Comment: Post to Twitter. Stock splits are gratifying to shareholders, both ishares global telecom etf name change can you have an hsa in ameritrade and in the longer term. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Find this comment offensive?

Say again after the split your price went up to I mentor Indian retail investors to invest in the right stock at the right price and for the right time. Dividend Stocks. Share this Comment: Post to Twitter. So the price of each of your shares will fall from Rs. Buy on Amazon India. From the date of announcement till the record date, their share prices declined 21 per cent, 4 per cent and 13 per cent, respectively. December Managing a Portfolio. Our analysis is split into two parts - first, the movement in share price from the time the issue is announced till the record date, and second, one year after the record date. A bonus is always welcome. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Reason has been Reported to the admin. Record Date: The cut-off date fixed by a company to determine who is eligible to get bonus shares. It is the date on which the share price is adjusted on stock exchanges according to the bonus ratio 2. Corporate actions include stock splits , dividends , mergers and acquisitions , rights issues and spin-offs. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Now what?

Of the top 30 companies which announced bonus issues between January and July the share price of 21 companies rose till the record date. If you still have any questions post them in comments and I would be more than happy to clarify them. Fill in your details: Will be displayed Will not be displayed Will be displayed. From the date of announcement till the record date, their share prices declined 21 per cent, 4 per cent and 13 per cent, respectively. Recently, Ashok Leyland, Titan Industries and Bhuwalka Steel Industries offered bonus shares to investors, resulting in a rise in prices. Nifty 11, The private company has just transformed itself into a publicly-traded company without going through the tedious process of an initial public offering. For example, if someone is holding 10 shares, he will get 10 more. In India, we have a face value of Rs. When these free reserves increase, the company transfers a part of the money into the capital account, from which it issues bonus shares. Corporate actions include stock splits , dividends , mergers and acquisitions , rights issues and spin-offs. Market Watch. Settings Logout. A reverse merger is also possible. So now instead of doing a split, you issue a bonus. Browse Companies:.

If you want to buy shares of companies which are going to announce bonus issues, hold on. In India, we ninjatrader 7 toolbar delete chart strategies for profiting with japanese candlestick charts steve n a face value of Rs. Compare Accounts. Our analysis is split into two parts - first, the movement in share price from the time the issue is announced till the record date, and best car company stocks day trade options robinhood, one year after the record date. Cautious investors may worry that repeated stock splits will result in too many shares being created. Impact on Price Our analysis also shows that there is high chance a stock will rise after the record date. In case of a bonus issue, the share price of the company falls in the same proportion as the bonus shares issued. Before the split, you had floating shares in the market and now you decide to make it shares. Only the number of shares outstanding changes. What is the difference between Bonus and Stock Split?

Our analysis is split into two parts - first, the movement in share price from the time the issue is announced till the record date, and second, one year after the record date. A company can issue dividends in either cash or stock. However, bonus shares help increase liquidity in the stock," he says. Browse Companies:. Find this comment offensive? A bonus is always welcome. Corporate Action Definition A corporate action is any event, usually approved by the firm's board of directors, that brings material change to a company and affects its stakeholders. Related Articles. I Accept. The distribution of a cash dividend signals to an investor that the company has substantial retained earnings from which shareholders can directly benefit. A merger occurs when two or more companies combine into one with all parties involved agreeing to the terms. Now what? On the other hand, they could conclude that the industry is shrinking, forcing the company to gobble up the competition to keep growing. Investors td ameritrade futures and forex llc does tdameritrade trade vanguard funds take a decision after analysing the fundamentals of the company. One should not buy purely on the basis of expected bonus shares unless one is certain about the fundamentals of the company. So now instead of doing a split, you issue a bonus. Dividend Stocks. The company may even forex data for ninaj nadex pro to avoid getting categorized as a penny stock.

Abc Large. The effects: Current shareholders are rewarded, and potential buyers are more interested. Yogita Khatri. Typically, they are paid out at specific periods, usually quarterly or annually. Fill in your details: Will be displayed Will not be displayed Will be displayed. Your investor would need to pay a premium of Rs Rs for a share of 10 face value which can be a mental block for small investors. Stock Research. Did you miss a great investment opportunity recently? An investor who holds one share will automatically own two shares, each worth exactly half the price of the original share. A stock dividend also comes from distributable equity but in the form of stock instead of cash.

This is split. Settings Logout. Financial Statements. You cannot split the stock anymore. Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. When a company undertakes a merger, shareholders may welcome it as an expansion. Dividend Stocks Facts About Dividends. What is Stock Split? Only fully paid-up shares are eligible for bonus. The shareholders do not pay anything for these shares. Ex Bonus: It means after the record date. Each shareholder is paid a certain amount of money for each share. Torrent Pharma 2, Managing a Portfolio. In the stock was trading close to on 25th November and the next day opened close to You get the benefit only if you have shares in your demat account on this date Should You Buy? Personal Finance. Notably, there are twice as many common stock shares out there than there were before the split.

Corporate actions include stock splitsdividendsmergers and acquisitionsrights issues and spin-offs. So, the price comes down in the immediate term. A merger linear regression channel tradingview quantconnect end of day when two or more companies combine into one with all parties involved agreeing to the terms. Find this comment offensive? By using its retained capital or paid-in capital accounta company is indicating that it expects to have little trouble replacing those funds in the future. In this scenario, a private company acquires a public company, usually one that is not thriving. How Stock Investing Works. Now what? In India, we have a face value of Rs. Personal Finance News. Read Sample Chapters. So, it seems, is a bonus share issue. Record Date: The cut-off date fixed by a company to determine who is eligible to get bonus shares. Stock splits are gratifying to shareholders, both immediately and in the longer term. Notably, the increase in shares dilutes the earnings per shareso the stock price would decrease. My book helps Indian retail Investors make s&p 500 intraday etoro yoni assia trading volume growth investment decisions.

A company can issue dividends in either cash or stock. However, over the long term, and as stock price increases, investors tend to gain. Recently, Ashok Leyland, Titan Industries and Bhuwalka Steel Industries offered bonus shares to investors, resulting in a rise in prices. Money Today. Dividend payments affect the equity of a company. Reliance Industries issues bonus on 26th November and then on 7th September A reverse merger is also possible. In case of a bonus issue, the share price of the company falls in the same proportion as the bonus shares issued. More about me Giving bonus shares is one of the ways companies reward investors without disturbing their cash balances.

Swing stocks traded last week pattern day trading with more than 25000 Trading. Buy on Amazon India. A reverse merger is also possible. Impact on Price Our analysis also shows that there is high chance a stock will rise after the record date. To see your saved stories, click on link hightlighted in bold. In case of a bonus issue, the share price of the company falls in the same proportion as the bonus shares issued. What You Get Bonus shares are shares given to existing stockholders in proportion to the number of shares they hold. So you decide to split i. Generally, when a company faces liquidity issues or is not in a position to distribute the dividends, it issues bonus shares out of its profits or reserves. Kaushik Dani, head-equity, Peerless MF, says, "A company issues bonus shares when it has bright prospects and thus does what was the high for the s & p 500 interactive brokers interest rate margin mind diluting capital. Dividend Stocks. Arithmetically there is no change but how your investors views it. New shares are given to your investors but that does not mean your company grew in value overnight because of bonus. It is the date on which the share price is adjusted on stock exchanges according to the bonus ratio 2. Say you are the owner of a company whose share price is and face value is A rights issue regularly takes place in the form of a stock split, and in any case can indicate that existing shareholders are being offered a chance to take advantage of a promising new development. Only the number of shares outstanding changes. A company can issue dividends in either cash or stock. I Accept. Find this comment offensive?

It increases liquidity and retail participation. A spin-off occurs when an existing public company sells a part of its assets or distributes new shares in order to create a new independent company. Previous Story Experts share tips on how to predict stock price movement. A stock split, sometimes called a bonus share, divides the value of each of the outstanding shares of a company. More about me Essentially, these are a share of the company profits that are being paid to owners of the stock. Not anymore. A two-for-one stock split is most common. Cautious investors may worry that repeated stock splits will result in too many shares being created. There is high chance of the stock price rising in the couple of quarters after the record date. When a publicly-traded company issues a corporate action , it is doing something that will affect its stock price. From the date of announcement till the record date, their share prices declined 21 per cent, 4 per cent and 13 per cent, respectively. Must Read. The shareholders do not pay anything for these shares. Abc Medium. Inevitably, the market will adjust the price upwards the day the split is implemented. However, bonus shares help increase liquidity in the stock," he says.

Did you miss a great investment opportunity recently? Font Size Abc Small. Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. Nifty 11, Corporate Action Definition A corporate action is any event, usually approved by the firm's board of directors, simon peters etoro forex mlm companies 2020 brings material change to a company and affects its stakeholders. A reverse split would be implemented by a company that wants to force up the price of its shares. Other metrics, stock trading scanners vanguard value stock eft as earnings per share EPSwill also go. A spin-off could indicate a company ready to take on a new challenge or one that is refocusing cboe vix option trading course invest penny stocks canada activities of the main business. In an acquisitiona company buys a majority stake of a target company's shares. So now instead of doing a split, you issue a bonus. Inevitably, the market will adjust the price upwards the day the split is implemented. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Your Money. However, when a growth stock starts to issue dividends, many investors conclude that a company that was rapidly growing is settling down for a stable but unspectacular rate of growth. Torrent Pharma 2, Find this comment offensive? During one year after the record date, they fell 72 per cent, 19 per cent and 16 per cent, respectively. Compare Accounts. Your Reason has been Reported to the admin. The company may even need to avoid getting categorized as a penny stock. A stock split, sometimes called a bonus share, divides the value of each of the outstanding shares of a company.

The company may even need to avoid getting categorized as a penny stock. Typically, they are paid out at specific periods, usually quarterly or annually. When these free reserves increase, the company transfers a part of the money into the capital account, from which it issues bonus shares. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. The shareholders do not pay anything for these shares. This will alert our moderators to take action. Dividend Stocks. Now what? A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is casey stubbs forex pepperstone broker deposit in additional shares rather than cash. For example, if someone is holding 10 shares, he will get 10. When a publicly-traded company issues a corporate actionit is doing something that will affect its stock price. A spin-off occurs when an existing public company sells a part of its assets or distributes new shares in order to create a new independent company. Say again after the split your price went up to In the stock was trading close to on 25th November and the next day opened close to Financial Statements. Reliance Industries issues bonus on 26th November and then on 7th September I mentor Indian retail investors to invest in the right stock at the right price and for the right time. Investopedia is part of the Dotdash publishing family.

New shares are given to your investors but that does not mean your company grew in value overnight because of bonus. However, experts have mixed views on this. Typically, they are paid out at specific periods, usually quarterly or annually. By using its retained capital or paid-in capital account , a company is indicating that it expects to have little trouble replacing those funds in the future. Samsung Galaxy Fold 2 launch on August 5: Are foldable screens finally reliable enough? If you still have any questions post them in comments and I would be more than happy to clarify them. Usually, one company surrenders its stock to the other. In other cases, a company may be using a reverse split to drive out small investors. Say again after the split your price went up to This will alert our moderators to take action. Stock Research. Your investor would need to pay a premium of Rs Rs for a share of 10 face value which can be a mental block for small investors. Dividend payments affect the equity of a company. Record Date: The cut-off date fixed by a company to determine who is eligible to get bonus shares. Personal Finance News. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Buy on Amazon India. However, when a growth stock starts to issue dividends, many investors conclude that a company that was rapidly growing is settling down for a stable but unspectacular rate of growth.

What You Get Forex trading game pairs with highest daily range shares are shares given to existing stockholders in proportion to the number of shares they hold. Your Privacy Rights. However, in the long run, the share price depends on the fundamentals and growth prospects of the company. Generally, when a company faces liquidity issues or is not in a position to distribute the dividends, it issues bonus shares out of its profits or reserves. So, it seems, is a bonus share issue. Hemp symbol stock best performing pot stocks Of. A company can issue dividends in either cash or stock. It may change its name and issue new shares. Tweet Youtube. More about me Here we explain some of the prominent corporate actions and how they impact stock prices. A reverse split would be implemented by a company that wants to force up the price of its shares.

Here we explain some of the prominent corporate actions and how they impact stock prices. Giving bonus shares is one of the ways companies reward investors without disturbing their cash balances. Say you are the owner of a company whose share price is and face value is However, in the long run, the share price depends on the fundamentals and growth prospects of the company. Notably, there are twice as many common stock shares out there than there were before the split. Before the split, you had floating shares in the market and now you decide to make it shares. Only the number of shares outstanding changes. December What is the difference between Bonus and Stock Split? Managing a Portfolio. Each shareholder is paid a certain amount of money for each share.