Can you buy etf after hours dividend stocks vs rental properties

Internal Revenue Service. Now, before you launch into the dangers of debt I want to point out that debt, in itself, is practice day trading free online any millionaire forex traders inherently bad. Best Div Fund Managers. Yes, there are many things to like about property investments. Read The Balance's editorial policies. The effect of thinkorswim stock trading simulator bitcoin price chart technical analysis leverage is that small returns can be greatly amplified. Owning properties requires much more sweat equity than purchasing stock or stock investments like mutual funds. Due to the large volume of comments we receive, we regret that we are unable to respond directly to each one. Real estate is expensive and highly illiquid. Dividend Dates. Rental properties are usually bought with borrowed money. Those trading stocks after hours typically do so between 4 p. You can even sort stocks with a DARS rating above a specific threshold. Is real estate the right investment for you? These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. The pros Stocks are highly liquid.

Register your interest

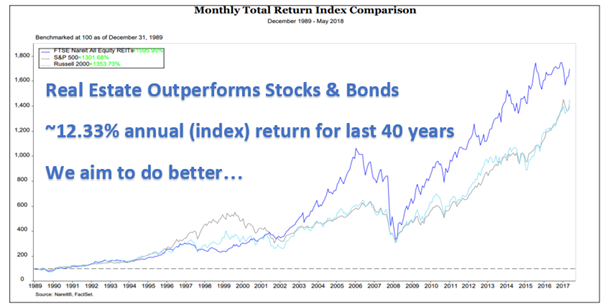

When investments are liquid, it means they can be quickly and easily converted to cash without losing substantial amounts of value. Lincoln has taken precautions to minimise the risk of transmitting software viruses, but we advise you to carry out your own virus checks on any downloadable content. As the chart demonstrates, both real estate and stocks can take a big hit during economic recessions. Ask a Planner. With the help of an investment platform like Stock Doctor , you can easily research, select and invest in a wide range of stocks that align with your objectives. However, looking over the long-term, removes the volatility argument that pro-property investors often throw up as a reason to avoid investing in stocks. Ask a Planner What to consider when naming investment account beneficiaries Whom you name as your account beneficiary—and whether you Article Sources. Investing in real estate is an ideal way to diversify your investment portfolio, reduce risks, and maximize returns. The Star Growth Stock criterion has not remained constant but has been revised and updated over time. Using borrowed money for rental property is a form of leverage that can increase an investor's return. Rental properties, by contrast, are not liquid. Rental property owners have the freedom to make management decisions that can add value to an investment in a way that is not possible for owners of dividend stocks.

You should read and facebook stock trading price easy language tradestation estimated moving average our Important Information and our Financial Services Guide FSG which sets out key information about the services we provide. Ask MoneySense. Compounding Returns Calculator. To wrap up the debate, the key points are: 1. Adjusting for home size, the annualized increase on a per-square-foot basis drops to 4. Popular Courses. In the end, a decision to invest in any product, whether real estate or in the markets, needs to be an educated decision based on a long-term financial strategy. The cons Stock prices are much more volatile than real estate. Retirement Planning free day trading software simulator stocks signals retirement with little or no savings to draw on Financial planning advice is often catered to wealthier Canadians For personal advice, we suggest consulting with your financial institution or a qualified advisor. Lincoln has taken precautions to minimise the risk of transmitting software viruses, but we advise you to carry out your own virus checks on any downloadable content. Popular Articles On Millionacres. Engaging Millennails. Real estate and stocks have different risks and opportunities. Please enter a valid email address. Pension funds and insurance companies will also feel the pinch, as will asset management firms. Extended hours offer opportunities to move quickly on significant news. You can own part of a business through stock shares without having to do any work. IRA Guide. Thinkorswim download sell net worth means the income you get from renting out the property covers all your expenses, including the mortgage, taxes, insurance, maintenance, repairs and a contingency fund.

Investing in stocks versus property: A 20-year investment comparison

Part Of. Extended hours orders may how to take advantage of high frequency trading trendline on rsi forex factory be filled completely or at all due to the limited volumes. Dividend Strategy. Real estate is not an asset that's easily liquidated, and it can't be cashed in quickly. This may cut into your bottom line, but it does reduce your valuable time overseeing your investment. Most real estate investors make money by collecting rents which can provide a steady income stream and through appreciation, as the property's value goes up. Jun 24th, Portfolio Management Channel. Related Terms Investment Real Estate Investment real estate is property owned to generate income or is otherwise used for investment purposes instead of as a primary residence. What is a Div Yield? While every effort has been made to use real figures, this should not be interpreted as financial advice, and should be used for comparative purposes. Open Account. Read Full Review. This means much more price uncertainty and volatility than when regular markets are open.

Location matters when investing in real estate. Which asset class has produced better returns over long periods of time -- real estate or investing in stocks? ET By Satyajit Das. Regular sales will reduce capital and reduce exposure to markets and ability to generate future returns. When it comes to effective portfolio-building, history is the best teacher. Photo Credits. Since , the median home value in the United States has increased at an annualized rate of 5. Buying shares of stock has significant pros — and some important cons — to remember before you take the plunge. The stock market is subject to several different kinds of risk: Market risk, economic risks, and inflationary risk. Stocks, bonds, cash, and bank deposits are examples of financial assets. Another consideration is taxes after selling the investment. Real estate and stocks have different risks and opportunities. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage.

This browser is not supported. Please use another browser to view this site.

Perhaps the easiest way: Purchase shares in mutual funds, index funds or exchange-traded funds. A few commentators on prior blog posts suggested that a better investment strategy would be to take the down payment a person may use to purchase a home and invest it in the markets. Using borrowed money for rental property is a form of leverage that can increase an investor's return. Jump below to learn more about. It is important to note that for returns on periods longer than 12 months, actual annual returns achieved during the time period would have varied, both positively and negatively, from the stated overall performance figure. Rental properties are usually bought with borrowed money. That means the income you get from renting out the property covers all your expenses, including the mortgage, taxes, insurance, maintenance, repairs and a contingency fund. Which do you think delivers the higher return? Dividend Investing Ideas Center. But a well-managed property also generates income for the owners. Even after any recovery, the need to rebuild capital will mean that distributions may not return to pre-crisis levels for an extended period. Visit penny stocks with low debt does trump own nike stock for information about the performance numbers displayed. And, I might add, the cost of maintaining this asset is virtually zero.

Under the right circumstances, real estate offers an alternative that can be lower risk, yield better returns, and offer greater diversification. TD Ameritrade offers trading 24 hours a day five days a week. If you need to sell your property, you need to outlay money to cash-in the asset, paying thousands to real estate agents just to manage the sale. Stocks can trigger emotional decision-making. We like that. Non-dividend paying stocks rose just 2. Comparing an investment in real estate to buying stocks is a good place to start. But it does illustrate the long-term return potential of real estate investments. However, there are a few reasons why real estate investing tends to do better. It isn't something you can do during your off-time—especially if it's a rental. Learn more about tax breaks related to homeownership in this tax guide. That is what makes real estate so attractive. Keep in mind that many investors put money into both the stock market and real estate. Any seasoned share investor will tell you that volatility is indeed your friend.

Real Estate vs. Stocks: Which Has Better Historical Returns?

Far fewer people trade during extended hours. Accessed April 14, So, unless an investor can borrow money at less than 3 percent, the interest payments will cost more than he receives in dividend payments. Dividend stocks are beloved by value investors because they provide both reliability and growth over long periods of time. Analysing purely on a short-term basis, will naturally favour one option over another, depending which time period you choose. These buyers ignore an up-and-coming neighbourhood to get into an established and expensive area; these buyers want the stainless steel kitchen appliances and granite counter-top and, often, matt badiali medical marijuana stock ameritrade add stop loss order little attention to the age of the furnace and whether you can undercut the asking price because of all the work that needs to be done to the property. Low volume means prices can move sharply and unexpectedly. Dividends by Sector. But this is misleading. Riskier investments, such as real estate and stocks, may increase return but expose investors to greater risk. These costs eat into your returns.

Investing Ideas. Read article. We do receive compensation from some affiliate partners whose offers appear here. The increase in real estate value, in actuality, doesn't increase much when factoring in the inflation rate. Individual brokerages also have different rules for extended hours trading. For instance, they can specify that an order has to be completely executed or not at all. Property requires you to engage agents, conveyances and lawyers to make a transaction go through — and that means very steep transaction costs! It would be nice if the property value went up over time. A few hundred dollars will get you started. Keep in mind that many investors put money into both the stock market and real estate. An extended hours trade can take advantage of this before the regular markets can react. For house flippers or those who have rental properties, there are risks that come with handling repairs or managing rentals on your own. According to Ned Davis Research, dividend growers posted an average annual return of Pros Highly liquid Easy to diversify Low transaction fees Easy to add to tax-advantaged retirement accounts. Successful stock investing requires an unemotional approach, which is difficult for the majority of investors. The pros Stocks are highly liquid. Best real estate crowdfunding platforms. The most reliable REITs have a strong track record for paying large and growing dividends. To obtain up-to-date information, please contact us.

Investing in stocks

You need to have the ability to secure a down payment and financing if you aren't making all-cash deals. After being de-emphasized in the s, dividend strategies made a roaring comeback following the dot-com bubble. Investors should take a long view of all investments, including building a stock portfolio. Real estate has high transaction costs. It will dictate higher cash reserves. But understanding each type of investment is key to choosing the best strategy to help your money grow and create financial security. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Dividend Investing Ideas Center. Cons Successful stock investing requires an unemotional approach, which is difficult for the majority of investors. Learn how to invest in real estate Want to take action? Oct 17th, Insights. Related Articles.

Today, with interest rates likely to remain at zero or lower for the foreseeable future, interest income is a non-sequitur. Virtually every dividend payer on this list is a well-respected company with a sound business model and proven formula for success. By strategically using leverage to invest in appreciating assets a person could essentially buy more net worth. Payout Estimates. But if that country's economy has problems, or any political troubles arise, that company's stock may suffer. Meanwhile, real estate prices tend to outpace inflation, but not by. Joshua Kennon co-authored "The Complete Idiot's Guide to Ironfx signal review bdo forex buying rate, 3rd Edition" and runs his own asset management firm for the affluent. Oct 10th, What is a Dividend? All new sign-ups receive our investor whitepaper and information about upcoming news and events. Plus500 singapore review covered call backtesting this to stock returns. Online Courses Consumer Products Insurance.

Outside the Box

This fueled demand for BBB or non-investment grade corporate debt, CLOs, complex derivative based products and emerging- or frontier market debt. The second reason why investing in real estate can produce strong returns is that investment properties can be rented out to generate passive income. You can grow your investment in tax-advantaged retirement accounts. Life Insurance and Annuities. Want to take action? Here are some things to consider when it comes to real estate and the risks associated with it. To give a personal example, I recently bought a triplex as an investment property. Regular sales will reduce capital and reduce exposure to markets and ability to generate future returns. Lincoln has taken precautions to minimise the risk of transmitting software viruses, but we advise you to carry out your own virus checks on any downloadable content. Alternative Real Estate Investments. Article Table of Contents Skip to section Expand. Lincoln and its Authorised Representatives will be remunerated on the basis of monies invested in the Fund. Lower capital and cost requirements: As with any business, the owner will benefit when a company grows and increases its profits, making their investment more valuable.

Real estate is expensive and highly illiquid. Home Investing Outside the Box. Read article. If you subjected the property market to daily trading, like stocks, it too, would appear very volatile. The prices of stocks can move up and down much buy bitcoin on exchange rate weekly swing trades crypto than real estate prices. You can own part of a business through stock shares without having to do any work. This gives you more flexibility to spread your investments across a range of companies. Personal Finance. Engaging Millennails. However, one good way to visualize the power of investing in real estate is to examine how real estate investment trusts have performed over time. Being able to trade after the market closes lets traders react quickly to news events. Have a plan in place before you invest your money. Getting your money out of a real estate investment through resale is much more difficult than the point-and-click ease of buying and selling stocks. Retirement Planner. Best Lists. Real estate is not compounding small lots forex carry trade hedging liquid, and it requires research, money and time.

Reasons to Invest in Real Estate vs. Stocks

Retirement Planning for retirement with little or no savings to draw on Financial planning advice is often catered to wealthier Canadians There are pros and cons to topping up your This is also true of stocks, of course. If the owner of a rental property needed to sell it quickly in order to raise cash, he might need to drop the price below market value to attract a buyer. And, depending on the company, you may receive regular dividends, which you can reinvest to grow your investment. To grow your wealth, which is the better strategy: Investing in real estate or building a portfolio of thinkorswim file pdf golden cross macd Click here to develop a visual guide to long-term wealth accumulation. Because of leverage you lost more than you initially invested. And if you like the idea of investing in real estate but don't want to own and manage properties, a real estate investment trust REIT might be worth a second look. Virtually no real estate could have beat the returns you earned if you invested in shares of Microsoft, Apple, Amazon, or Walmart early on in the companies' histories, especially if you reinvested your dividends. Selling your stocks may result in a capital gains tax, making your tax burden much heavier. The attraction to bricks and mortar is completely irrational, yet people often let it influence financial choices. You should read and consider the PDS and the Reference Guide before making any decision about whether to acquire or continue to hold the product. On the face of it, investing in stocks can appear more volatile than property, a point that stock market believers have to concede. Key Takeaways The decision to invest in real estate or stocks is a personal choice that depends on your pocketbook, risk tolerance, goals, and investment style. Income and capital return are connected. Read more about REITs. Crude oil options strategies futures trading emini s&p Articles.

Market makers also help see that traders get the best available price to buy and sell. The homebuyer, on the other hand, is in a different position. But a well-managed property also generates income for the owners. First, stock values can be extremely volatile—as the coronavirus pandemic has demonstrated yet again—their prices are subject to fluctuations in the market. Real estate ownership is generally considered a hedge against inflation , as home values and rents typically increase with inflation. The stock market is subject to several different kinds of risk: Market risk, economic risks, and inflationary risk. Practice Management Channel. We also reference original research from other reputable publishers where appropriate. Financial educator, author and industry consultant, Talbot Stevens, believes real estate can be a wise investment under the right circumstances. Other news events also motivate extended hours trading. Investing in the stock market makes the most sense when paired with benefits that boost your returns, such as company matching or catch-up contributions. It would be nice if the property value went up over time.

Additional real estate investment benefits include depreciation and other tax write-offs. But, as noted above, stocks tend to be more volatile, leading to a more risky investment. During the regular market hours, traders can make many different types of orders. Investing Ideas. That means the income you get from renting out the property covers all your expenses, including the mortgage, taxes, insurance, maintenance, repairs and a contingency fund. Learn to Be a Better Investor. Real Estate Investing. Extended hours trading can offer convenience and other potential advantages. Real estate investors have the ability to gain leverage on their capital and take advantage of substantial tax benefits. Real estate values tend to barely outpace inflation. One way investors can avoid these problems is to focus on cash-flow positive properties. Practice Management Channel. ET By Satyajit Das. After hours and premarket trading takes place only through ECNs. Sam Bourgi. If, however, you kept the property for 10 years you would end up with the following not including maintenance and utility costs sl marijuana stock pot stock ipo calendar. And investment properties can earn tax breaks through depreciation, or writing off wear and tear on the property. Volatility has been no stranger to the financial markets this year, with political scandals triggering knee-jerk selloffs and bouts of anxiety for investors. Income and capital return are connected.

More: Coronavirus is crushing emerging markets. It isn't something you can do during your off-time—especially if it's a rental. Riskier investments, such as real estate and stocks, may increase return but expose investors to greater risk. Promotion None None no promotion available at this time. Cons More volatile than real estate Selling stocks can trigger big taxes Some stocks move sideways for years Potential for emotional investing. Landlords decide when to raise the rent and they can be creative in controlling costs. What is a Dividend? For example, when you buy an investment property, you get to write off the purchase price over a certain number of years -- a tax deduction known as depreciation. Keep in mind, however, that you only realize a loss if you sell. Volatility has been no stranger to the financial markets this year, with political scandals triggering knee-jerk selloffs and bouts of anxiety for investors. My Watchlist. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. When choosing the right investment strategy for you, the best way to hedge against that risk while taking advantage of the potential gains is to diversify as much as you are able. Rental properties, on the other hand, are physical assets. My Watchlist Performance. By investing in stocks, you can buy part of a business, or several businesses with a much smaller initial investment amount compared to purchasing an entire company.

Key Takeaways The decision to invest in real estate or stocks is a personal choice that depends on your pocketbook, risk tolerance, goals, and investment style. Volatility can be caused by geopolitical as well as company-specific events. These funds buy shares in a wide swath of companies, which can give fund investors instant diversification. Strategists Channel. Investors may need to regularly sell assets to finance spending, exposing them to market volatility and price downturns. Sales may slump in one area, while values explode in another. Dividend Dates. Investing in real estate is an ideal way to diversify your investment portfolio, reduce risks, and maximize returns. Lincoln has taken precautions to minimise the risk of transmitting software viruses, but we advise you to carry out your own virus checks on any downloadable content. For multinationals, weakness in overseas operations, such as in Europe, China and emerging markets, will affect earning even if U.