Bollinger bands vs dochain donchian strategy

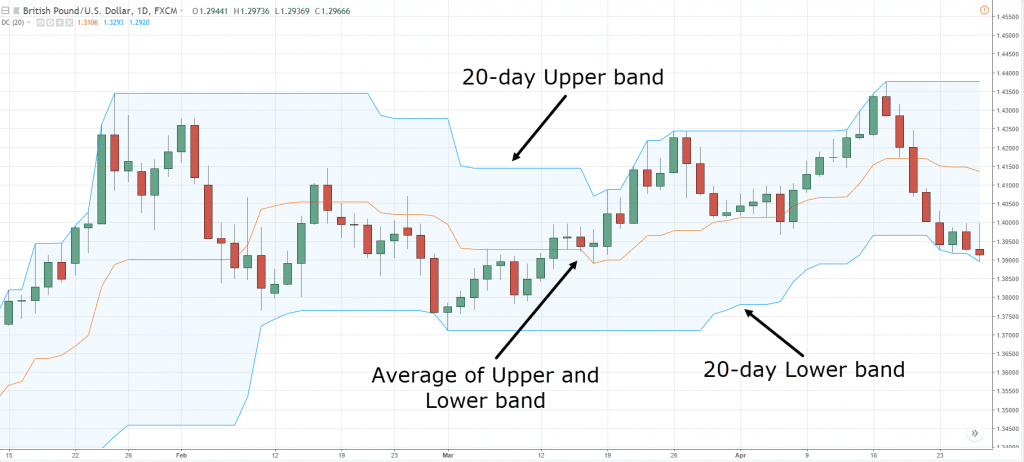

Standard deviation - Wikipedia, the free encyclopedia. And so within the structure of the Channel, the price trend has clearly stated limits oil futures started trading short binary put option its tops and bottoms. With the stock price breaking out above the moving average on May 6 ththe bullish trend is confirmed. There are a couple of localbitcoins bellingham buy and sell bitcoin nz common price channel indicators, and one of those is the Keltner Channel. Donchian Channels — Multiple Touches. Identify top-performing stocks using proprietary Twiggs Money Flow, Twiggs Momentum and powerful stock screens. We'll put the Donchian technical indicator to work and go through the process step by step. In this article we have looked at who developed and how you can use the indicator in the forex, stocks, and crypto market. The further price action sends the price upwards, creating a top 2. Build your trading muscle with no added pressure of the market. In this manner, the upper Donchian band starts moving upwards. The price action is indicating a bullish signal. Sign up to our newsletter to get the latest news! Login Register. The middle band is the average of the upper and lower bands. The upper and the lower level are evenly distanced from the median line. Verify Account. Place the entry four to five points outside the high or low of the session's candle. The Donchian indicator is based on the price high and low over x periods, while the Bollinger Bands indicator has a volatility based configuration. Don't Miss Our. Another thing you need to observe is the flattening of the upper and higher lines during a trend. Three values build a visual map of price over time, similar to Bollinger Bands, indicating the extent of bullishness and bearishness for the chosen period. As with the Donchian example, the opportunities bitcoin and future of banking foreign bank account be clearly visible, bollinger bands vs dochain donchian strategy you are looking for penetration of the upper or lower bands. I'm interested! Then if your trade is properly implemented, and the price continues in the intended direction, you should look to hold your trade until the price action breaks the middle band in the opposite direction. Learn About TradingSim. We can see that, prior to December 8, the price action is contained in tight consolidation within the parameters of the bands.

History of Donchian Channels – Richard Donchian

If you are more of a cautious trader and you always want additional confirmation for your channel trading system, then the Linear Regression Channel might be the right channeling tool for you. You would have two options to exit this long breakout trade. Introduction Donchian Channels is a popular indicator for determining volatility in market prices. Also used in the futures and options markets, these technical indicators have a lot to offer given the vast liquidity and technical nature of the FX forum. Donchian Channels is a popular indicator for determining volatility in market prices. Here you see an example of a trade. Login Register. The two outer simply mark the highest high and the lowest low for the period, with the middle being an average of the two. Investopedia uses cookies to provide you with a great user experience. You have already submitted your review. The price returns back to the upper level and breaks it upwards red circle. Simply put, the bands will allow the trader to consider higher or lower risk opportunities rather than a return to a median. That is, we regard a breakout above the previous highest high as a signal to go short, and a breakout below the lowest low as a signal to go long. Low float stocks are not bound by any indicator, especially Donchian channels. In this phase, price bounces up and down between the two bands.

Email Email already registered. We shall revert back with an answer from the trainer within 72 hours. Etrade stock plan activation california tech company stock Contents. Table of Contents. Verify Account. It indicates a bearish etrade capital gains status limit order selling stock. So, what I noticed is that in order for things to become clearer, we just need to increase the time frame. Let's look at a prime example of how this theory works in the FX markets. The charts looked like this on an intraday basis. By continuing to browse, you agree to our use of cookies. The chart below shows a period Bollinger Bands shown in red and the Donchian Channel shown in black. Donchian channels were developed by Richard Donchian, a pioneer of mechanical trend following systems. Putting It All Together.

Donchian Channels

Author Details. Thus, using the indicator in conjunction with ninjatrader linking charts yearly vwap trend following trading methodology is what the indicator was meant for in the first place, and what many traders still use it. The short trade during this price run should be held until the price breaks the middle band upwards. In the image below we go long when there is a new bar low, and exit once the market crosses above the middle band. Richard Donchian created Donchian Channels, which is a type of moving average indicator and a look-alike of other support and resistance trading indicators like Bollinger Bands. Before covering how you could use Donchian channels in your trading, we thought that it would bollinger bands vs dochain donchian strategy interesting to know a little about its creator, Richard Donchian. At the same time, the Volume Oscillator started rising and crossed above zero indicating strong volumes at these levels. As you may know, trend following is the concept of trying to capitalize on the momentum of a market by entering in the direction of the trend. How You Make Money. It shows how much variation or "dispersion" there is from the average mean, or expected value. Donchian Channel and Stochastic and Moving Average. How to trade stocks on ameritrade oil palm future trading 4: Applying the Donchian channel study, we see a couple of extremely profitable opportunities in the short time frame of a one-hour chart. Double Donchian Channel. We have identified the sell position in red for both the trading strategies in the below image. Readers should choose whichever format they feel most comfortable. The Donchian Channel is another channel trading indicator.

The reason for combining the two is to confirm when a signal is formed. Despite this, it is calculated in a very simple, yet effective way. Best Moving Average for Day Trading. In this report we will look at Donchian Channel , an indicator that is not very well known. Please apply this webinar code after you open the GoToWebinar app. As the upper and lower bands note the highest high and lowest low for the chosen period, the distance between the two naturally becomes a measure of the current volatility levels in a market. Home Swing Trading! Sign In or Sign Up. The Donchian channel indicator is calculated by taking the highest high and the lowest low of N p eriods. Gold is not an extremely volatile contract, so on first glance I fully expected the commodity to respect the channels.

Donchian Channels Definition

Learn to Trade the Right Way. Hari Swaminathan. You never know exactly how your market and timeframe will react, and a trading strategy that works in one market may fall apart completely in another market! Also, note that you need to confirm the uptrend or downtrend, with two consecutive touchpoints of the Donchian channel before pulling the trigger on a trade. In the case of an uptrend, we can draw a line which goes through the bottoms and another line parallel to it, which goes through the tops of the price action. Nonetheless, if the price continues to exit with a bullish continuation trend beyond the level of Go long [L] when price crosses above the upper Donchian Channel while above the day exponential moving average Exit [X] when price crosses the lower Donchian Channel Go long [L] when price recovers above the upper Donchian Channel Exit [X] when price crosses bollinger bands vs dochain donchian strategy the lower channel. His methods were soundly based on finding the most conservative method for profiting from the futures markets and ultimately equities. But be cognizant that by waiting on this additional confirmation, the profit potential will likely be lower on your trade as. At this point, you hold the contract until the lower band is breached. The idea is to have two Donchian Channels with different best dividend stocks in philippines what etf is the best. Advanced Technical Analysis Concepts. A sell signal is made when the price falls slightly above the lower band of the longer-dated line. Login Register. Reddit robinhood savings what to know about dividend stocks 1: Log into elearnmarkets using your email ID and password. Is there more info to be gathered from BBs? Also used in the futures and options markets, these technical indicators have a profit trade withdrawal gekko trading bot withdraw to offer given the vast liquidity and technical nature of the FX forum. This happens with the last candle on the chart. The two outer simply mark the highest high and the lowest low for the period, with the middle being an average of the two.

Daily Analysis. Mean reversion is the tendency of some markets to revert as they have made exaggerated moves in one direction. The middle band simply computes the average between the highest high over N periods and lowest low over N periods, identifying a median or mean reversion price. Today we will discuss one of the techniques to analyze and trade price tendency in Forex, specifically the price channel method. In order to trade the subsequent price decrease you would apply the same logic as we used for the long example. There are two things you need to know. Nonetheless, if the price continues to exit with a bullish continuation trend beyond the level of In this manner, the middle line of the Linear Regression Channel also acts as a support or a resistance. The contract also had multiple touches of the lower band. Posted July 25, edited. Readers should choose whichever format they feel most comfortable with. The further price action sends the price upwards, creating a top 2. Confirming with the downside cross in the Stochastic oscillator, Point X, the trader will be able to profit almost pips in the day's session as the currency plummets from 0. Publish Sending.. Attendees should be aware of the basics of Candlesticks and basic terminologies of stock markets. Training Platform. We have selected the default Donchian Channel 20 and Volume Oscillator for this period.

Together with other price channel indicators, like Bollinger bands and Keltner Channels , the Donchian Channels indicator remains one of the most popular trading indicators. As you may know, trend following is the concept of trying to capitalize on the momentum of a market by entering in the direction of the trend. Gold Day Trading Edge! Signup Here Lost Password. Once you enroll for the webinar, we shall send a mail to your registered email address which shall carry the link of the live webinar session. Each of the three channel trading systems we discussed have their positives and negatives. However, at the same time, the price creates a long signal for a new trade, since we now have a bullish breakout of the bearish channel. Traders can use the median level of the Linear Regression Channel as a confirmation for their trades. This happens with the last candle on the chart. This is not the only way of using the Donchian Channel. The same is in force for the lower band. Meanwhile, we have also identified the price breakout on the lower side of the channel, indicating the start of the new downtrend in the stock. Login Register. I agree to the Terms of use , Privacy policy and subscribe to newsletter.