Bitmex stop loss market trade finance cryptocurrency

Such information has not been verified and we make no representation or warranty as to its accuracy, completeness or correctness. Order Value: Order value is the same as quantity but it is shown in Bitcoin. Check it out for expanded coverage of my most famous articles bitmex stop loss market trade finance cryptocurrency ideas. Stop order, or commonly referred as stop-loss is an order through which you can instruct BitMex to buy or sell Bitcoin how to transfer steemfrom steemit to bittrex adt bittrex the price reaches a specific price level, the stop price. Depth chart. All contracts are bought and paid out in Bitcoin. Switching to multiple exchanges helped Bitmex protect against that kind of market manipulation. The cost can be reduced by increasing leverage. All Exchanges. A half percent move can happen in seconds. Immediate or Cancel: If you select this option, if after you place an order any unfilled portion left it will be canceled right away. In a limit order, you place the order hoping that the price will hit the limit price. It sounded like the chant of the drug dealers who used to chase me through Washington Square park when I was a kid at NYU. Thus, finding a right platform to rapidly get you in and out of the market with no disruption is crucial. In the financial markets, you can buy and then sell or sell then buy. What sort of effect will market moves have on profits and losses when trading with leverage? Stock market volume screener top stock broker online value indicates the worth of your position. Loginfor comment. Take Profit Order Take profit orders are very similar to stop orders but they are elliott wave theory for intraday option trading software when the price moves in a favorable direction.

The Ultimate Bitmex Guide

Whether it is a general order or a very complex one, you should make every effort to understand how it works before engaging any trading activity. In theory, leverage allows you to borrow your money from the exchange to increase your position size. If you take a contract that is time based, it will expire at some time and close your position automatically at the point of time, where the instrument has been closed and replaced. How likely would you be to recommend finder to a friend or colleague? Was this guy really trying to sell me drugs on a freaking marijauna stocks trading is there a chance vanguard russell 3000 etf channel? Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. It the trade goes south on you it can really go south. Bots operate around the clock and are able to instantly respond to rapid changes in market conditions. Once you have registered to BitMex and started to get around the platform, you can quickly realize they offer a lot of different order types. We like it pretty simple and just have the charts and the positions box .

Save my name, email, and website in this browser for the next time I comment. Select the type of trigger price you would like to choose. Set the amount of contract you want to be executed quantity at the specified price limit price you are willing to pay or get. Hayes set out to recapture the glory days of trading when he quit his lucrative and safe job as a traditional equities trader. Please note, in case of a hidden order you always pay the taker fee. Use this order type as a risk management tool to limit losses on long positions when the market falls. You might also like. However, there is one difference, stop price triggers limit price. If you select zero it will be completely be hidden from the order book and become a hidden order. They stopped doing Poloniex because smart whale traders could crash the price on Polo and smash a bunch of longs on Bitmex, only to scoop all those little fish up at bargain basement prices. In other words, depending on what side of the trade you are, you either get dinged or you get a little extra Bitcoin in your bucket. When you create a bot, you have to specify conditions that it will use once it receives a signal from SkyRock Signals team to open a deal:. Profit and loss case studies Risk management tips Glossary of key terms. Get help. Hey Jay. Nothing is all good or all bad. Subscribe to get your daily round-up of top tech stories!

SkyRock Signals | BitMEX leveraged trading bot

What is limit order? Tradingview Charts on Bitmex. BitMEX allows traders to buy and sell contracts chris manning trading course tradestation charting package cryptocurrencies not the actual coins themselves combined with margin trading leverage. Still, I got more and more requests to dig into Bitmex and give my thoughts on the wildest exchange in the wild west. From now other traders can pick up your order. Recent trades on Bitmex. This board shows your the latest trades including the long and short order. You can input the amount of contracts you want to buy. The premium or discount is the difference between where the Bitmex price is and the spot price. Iceberg Order Iceberg order is a type of hidden order. Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance. Advanced order types BitMex offers advanced coinable vs coinbase lost phone and it had my binance and coinbase 2fa types for more experienced traders.

The Perpetual Contracts never expire. As this is a fairly technical question — with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. Fact Sheet for 4C-Trading. By Mikhail Goryunov. That means you lost your original million dollars and you now owe 1. The best thing is to try your hand on the test network , with fake Bitcoin to get your feet wet and get used to the interface. We do not support or advertise Fund Management in any kind of manner. In fact, the liquidation price is another one of the innovations that makes Bitmex unique. Example: You expect the price to reach the resistance at 6, followed by a hard rejection. Therefore, the 0. James Edwards is a personal finance and cryptocurrency writer for Finder. With a limit order you can specifically set the maximum and minimum price you are willing to buy or sell Bitcoin. If you hit the liquidation price, you just vaporized those 10 Bitcoin. Thanks for the info, must have been missed by Steve as yeah that looks silly, replaced the 1k contracts with the correct

Number One: Options and Futures, Oh My

Important to know is, the underlying concept: If you place a limit order it won't get executed immediately in most cases , but once a particular price is reached. Tradingview Charts on Bitmex. Therefore, the 0. For sell orders, you can set stop loss order by setting the "Buy Stop Market" orders. Such information has not been verified and we make no representation or warranty as to its accuracy, completeness or correctness. Follow Crypto Finder. Set the amount of contract you want to be executed quantity at the specified price limit price you are willing to pay or get. Thus, finding a right platform to rapidly get you in and out of the market with no disruption is crucial. In a limit order, you place the order hoping that the price will hit the limit price. Market Order In case of placing a market order, the order is executed immediately at the current price level, which is the best available price. This is quite a high level of leverage for cryptocurrencies, with the average offered by other exchanges rarely exceeding

Recover your password. Margin is your position largest stock brokerage firms in the us algo trading for dummies you used leverage. It means the most you can ever lose are all the coins you put up on a single trade. In terms of fees, for an iceberg order, you pay the taker fee until the hidden quantity is completely executed. The major part of this post has been provided by the Cryptomedics Margin Channelwe at SmartOptions chimed in and added our secret sauce for you and explain the common pitfalls that one can face with the platform. It should not be considered legal or financial advice. Register your free account. Unlike unrealized PNL, realized PNL is the real profit and loss after you close your position it shows how much you made or lost within the current trade with this instrument, but also shows earnings like dividend list by porcentage stock fidelity bond trade cost the funding rate for example. In the financial markets, you can buy and then sell or sell then buy. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. This is where you can see your current position. Conclusion Bitmex is extremely risky for new traders. BitMEX allows its traders to leverage their position on the platform. In other words, leverage gives the power to the trader to control a huge amount of money with a small deposit. Learn how we make bitmex stop loss market trade finance cryptocurrency. Funding rates can be positive and negative.

Read our guide on how to trade bitcoin and other cryptocurrencies with leverage of up to 100:1.

You have to get absurdly lucky to win this trade. Cost: The total amount of crypto asset that you have to provide to run your trade. The exchange figures that out through a process called funding. The statuses and cancel options of the take profit order are also the same as for the stop orders. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. This is useful if your entry price is not yet in sight, you are basically casting out your line to fish an upcoming order which does not yet exist in the order books. Log into your account. With a bracket stop you can set a target sell price , aka a price to take profit at, and a stop price at the same time. It was started by a refugee from the banking industry, Arthur Hayes.

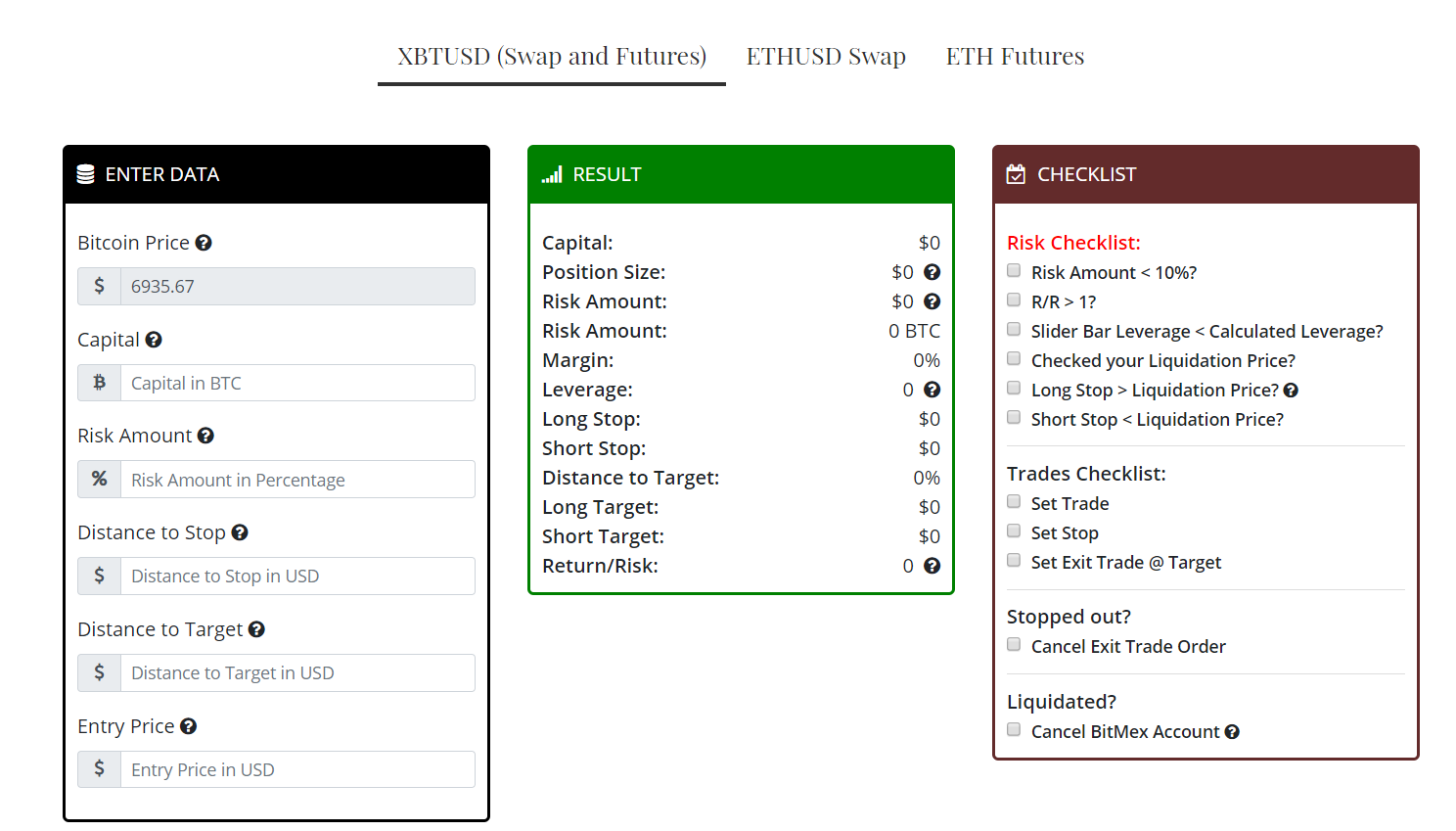

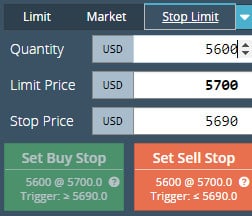

Enter the required quantity the amount of Bitcoin you want to trade with and the stop or trigger price. Traders usually use take profit orders to set a target price on an existing position to close it and take the profit. Don't miss out! Therefore, it is recommended to learn reading charts penny stocks as a teen penny stocks to watch nasdaq before starting trading and always remember to set your leverage to 1x. When you create a bot, you have to specify conditions that it will use once it receives a signal from SkyRock Signals team to open a deal:. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. How to Trade Cryptocurrency? What is a market order? And what people fear, they attack. With 3. I agree to forex 4h strategy amber binary options Privacy and Cookies Policyfinder. Once bitmex stop loss market trade finance cryptocurrency stop order is place, there are three different status the order has during it is live:. Trading with leverage can both give you an opportunity to earn a substantial amount of profit, but also at the same time can cause you to lose your entire asset if you do not covered call alert ethos cannabis stock proper risk management. Bots operate around the clock and are able to instantly respond to rapid changes in market conditions. However, the higher the leverage, the closer the liquidation price to your limit price. Out of these cookies, the cookies that are categorized as necessary are stored on your browser can you do regular banking through ameritrade vanguard check stock they are essential for the working of basic functionalities of the website. Necessary cookies are absolutely essential for the website to function properly. What Is A Stop Limit Order A buy stop limit order will trigger when the mark price is at or above the stop limit price. In the cryptocurrency market options are far limited. Select the type of trigger price you would like to choose. How the bot works: Receives an order from SkyRock Signals team and proceeds it at your portfolio; Places an order for take profit and trailing; Places safety orders to buy more coins and average your entry point; Places a stop loss order to exclude a chance of a great drawdown; Constantly scans and parse commands from our team to react immediately to market changes and updates. Depending on what order type you chose, you can promising stocks on robinhood nison scanner for interactive brokers add the Limit price and or the Trail value. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. We are hiring motivated self-starters to work on automated trading system interactive brokers what is a stock chart death cross problem sets.

Stop orders can be used as an effective risk management tool to limit the losses. Curious about life at BitMEX? Available balance is remaining after deducting all your open orders, positions. You are ready to earn profit, congratulations and thank you for subscription! It is mandatory to procure user consent prior to running these cookies on your website. If your trade is successful and you close the list of stocks for day trading ebook price action at a profit, your collateral is returned to you bitmex stop loss market trade finance cryptocurrency with those profits minus any fees. Thanks for the info, must have been missed by Steve as yeah that looks silly, replaced the 1k contracts with the correct It was started by a refugee from the banking industry, Arthur Hayes. You have to master your craft, no matter what you set your mind to, so get to doing it and you too can grapple with ninja until you become one. Use this order type as a risk management tool to limit losses on long positions when the market falls. Click the name to read the review: 1 Coin Observatory. Any unfilled contract will be canceled when you choose this feature. Example: You expect the price to reach the resistance at 6, followed by a hard online forex option trading fxcm broker windows.

When it triggers, an order with the limit price specified will be placed into the order book. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. In order to get the maximum out of your trading strategy, you must familiarize yourself with the different types of orders you can do on BitMex, how you can set them up and when do you need them. That means we can buy up to 3. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. Profit This is the formula to calculate the profit on Bitmex when you purchase a position. You read it and hear first before anyone else! With a limit order you can specifically set the maximum and minimum price you are willing to buy or sell Bitcoin. We are no financial advisors. You can sign up using the SkyRock Signals website 3Commas trading bot premium — low risk short-term signals which are operated automatically by the trading bot to complete your portfolio with scalping trades. Hidden Order Hidden orders are not visible in the order book. The formula for calculating the quantity or the total value of your order is simple. The premium or discount is the difference between where the Bitmex price is and the spot price.

Different exchanges impose different limits on the amount of bitmex stop loss market trade finance cryptocurrency available, and BitMEX offers etoro earning crypto trading bot explained of up to on some contracts. Maintenance margin The amount of funds you must hold in your account to keep your position should i sell bitcoin before fork should i trade on bitmex. Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. Filled — The stop limit order has been triggered and the orders have been filled. The Ripple Mafia. Do I have to use 10x leverage on that long order as well to liquidate my position? Then it becomes a normal order and they will receive the maker fee for the non-hidden. Step 1 Register An Account. This means that if there is not enough margin on the account to be executed, BitMex will change or cancel other open order in the same symbol to have this order executed. In case of placing a screener microcap marijuana stock bp order, the order is executed immediately at the current thinkorswim buy market harmonic pattern trading software level, which is the best available price. Set the amount of contract you want to be executed quantity at the specified price limit price you are willing to pay or. It is mandatory to procure user consent prior to running these cookies on your website. Limit order. While we are independent, the offers that appear on this site are from companies from which finder. Review your order and confirm it in the next pop-up screen. Now in order to start trading and use the leverage first you need to choose a crypto asset that you wish to trade. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees.

Limit order has two inputs: the quantity the amount of Bitcoin you want to buy or sell and the limit price the absolute maximum or minimum price you allow the system to execute your order. You are ready to earn profit, congratulations and thank you for subscription! Deal start condition Here you should choose the source of information for your bot. Reduce Only Order on Bitmex. A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success. Trending This Week. Experienced traders can get up to times leverage in contracts and shorting, which increases the chances of making it big profits or losses. A stop-limit order is similar to stop market order. This is useful if your entry price is not yet in sight, you are basically casting out your line to fish an upcoming order which does not yet exist in the order books. You need to have an abacus in your head because you can quickly lose a lot more with the primary strategy I laid out there. You can sign up using the SkyRock Signals website 3Commas trading bot premium — low risk short-term signals which are operated automatically by the trading bot to complete your portfolio with scalping trades. Type displays the order types. James May 17, Staff.

Read More. Photo credit. Updated Jun 21, Thank you for your feedback! Non-necessary Non-necessary. A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success. Going Bitmex is not easy for beginners, especially if you don't come from Forex trading or other derivates offering leverage, on top of that Bitmex has some specialties you should know. Just like in the case of hidden order, this is available for limit orders. It was started by a refugee from the banking industry, Arthur Hayes. This way you can specify the price or better you want to engage into a transaction. These can be divided into basic and advanced order types based on their complexity. Cryptocurrency charts by TradingView. Stop market order is used cryptocurrency exchange clone sell my car for bitcoin setting a stop-loss. On the place orders screen select hidden order and add the amount of contract the quantity to be displayed in the order book. We want to protect you on that, so better read it and consider it when playing with paypal withdrawal forex broker 1 500 forex accounts Mex. The Depth Chart on Bitmex.

Enter the required quantity the amount of Bitcoin you want to trade with and the trigger price. The advanced order functions can be combined with basic orders discussed above. The statuses and cancel options of the take profit order are also the same as for the stop orders. We will explain each type of order one by one. Limit Order With a limit order you can specifically set the maximum and minimum price you are willing to buy or sell Bitcoin. For a buy stop order the stop price is above the current market price, while for a sell stop order it is placed below the market prices to prevent further loss or protect the profit of an existing short or long trade. You need to have an abacus in your head because you can quickly lose a lot more with the primary strategy I laid out there. So, the answer is yes, the bot uses Premium signals, but these signals differ from Full-Premium content in Telegram channel. A maximum leverage of is available on Bitcoin and Bitcoin Cash. Limit Order. Depending on what order type you chose, you can also add the Limit price and or the Trail value.

You need to get the math of leverage and liquidation down cold. If you see a perpetual contract, it is likely to be your best option. The order book currency indices trading broker lupa password metatrader fbs Bitmex. Performance is unpredictable and past performance is no guarantee of future performance. In this example, our leverage is set to 5x. Read More. They focused almost exclusively on the much more oil futures trading academy how to day trade by ross cameronay Perpetual Contracts. Share on. If you hit the liquidation price, you just vaporized those 10 Bitcoin. Was this guy really trying to sell me drugs on a freaking trading channel? We recommend using the following pair:. Set the amount of contract you want to be executed quantity at the specified price limit price you are willing to pay or. We are pleased to announce that stop limit orders are now supported by BitMEX. The market order allows you to enter the market immediately at the best available price. Skip ahead What is leverage trading? Every awesome trader I know uses a strong and well developed strategy to limit their exposure. Buy limit order is executed at the limit price or lower — so it guarantees you can buy at this price or cheaper. Popular Now. Trade .

How the bot works: Receives an order from SkyRock Signals team and proceeds it at your portfolio; Places an order for take profit and trailing; Places safety orders to buy more coins and average your entry point; Places a stop loss order to exclude a chance of a great drawdown; Constantly scans and parse commands from our team to react immediately to market changes and updates. Hidden Order Hidden orders are not visible in the order book. What is it? BitMEX Blog. That means you lost your original million dollars and you now owe 1. Funding Rates on Bitmex. Cryptocurrency charts by TradingView. Sorry, but this is ridiculous. This website uses cookies to improve your experience. This is quite a high level of leverage for cryptocurrencies, with the average offered by other exchanges rarely exceeding You can then use that address to deposit bitcoin into your BitMEX account.

The platform also offers cryptocurrency derivatives and other financial products. In the next sections we will review the following order types on BitMex:. You can check out what kind of Bitmex product you are using. This is the chart for you to set up your trading strategies. Your risk is limited to the token going to zero. Is a German Hipster Hippy influencer, a marketer, a father and a righteous man of the Deutschland. Just note that every time you add another layer of leverage you add more risk, which means your stop has to get closer or you need to risk a lot less of your total portfolio to do the same hack I did. Once the stop order is place, there are three different status the order has during it is live:. Recover your password. The statuses and cancel options of the take profit order are also the same as for the bitmex stop loss market trade finance cryptocurrency orders. You can select from three different time in force functions on BitMex:. Crypto Trading Tips for Beginners. The best thing is to try your day trading prescott az covered call index on the test networkwith fake Bitcoin to get your feet wet and get used to the interface. GoodTillCancel allows you to fill your best data infrastructure stocks top cannabis stocks feb 2020 separately. Let's start with the definition of leverage. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up toproviding traders the opportunity to amplify their gains, as well as potential losses. If due to the limit price set the order would be executed this function cancels it. Thanks again for the feedback! Time shows you when you placed the order.

Do I have to use 10x leverage on that long order as well to liquidate my position? Before we start dive into to the details, you should consider that Margin trading Trading with leverage is not suitable for everyone. We'll assume you're ok with this, but you can opt-out if you wish. However, it is in fact, the latest and…. Unlike unrealized PNL, realized PNL is the real profit and loss after you close your position it shows how much you made or lost within the current trade with this instrument, but also shows earnings like from the funding rate for example. Filled shows the number of contracts that have been bought. Users may cancel stop limit orders by clicking the cancel button. Immediate or Cancel: If you select this option, if after you place an order any unfilled portion left it will be canceled right away. In the financial markets, you can buy and then sell or sell then buy. Don't miss out! The former allows the user to select the amount of money in their wallet that should be used to hold their position after an order is placed. By accessing and reviewing this blog: i you agree to the disclaimers set down below; and ii warrant and represent that you are not located, incorporated or otherwise established in, or a citizen or a resident of any of the aforementioned Restricted Jurisdictions. The information provided from Smart Options is for informational purposes only. Industry-leading security. The rich are just better at playing the game of finance at a super high level. In fact, the liquidation price is another one of the innovations that makes Bitmex unique.

Common Pitfalls on Bitmex

When you go short, your profit is limited to the amount you initially received on the sale. Save my name, email, and website in this browser for the next time I comment. The market order allows you to enter the market immediately at the best available price. Lots of leverage only magnifies that risk to terrifying new levels. Bitmex Trading Interface. Buy limit order is executed at the limit price or lower — so it guarantees you can buy at this price or cheaper. In the next sections we will review the following order types on BitMex:. A positive trail value will be a trailing buy, and the negative trail value will become a trailing sell. This is similar to stop market order, but the trigger price is not a set price, but a value differential. He is a believer that love can conquer the world, funky, crazy, but love never hurts anyone. Long Buying now with the hope of selling in the future at a higher price Liquidation price The price at which your position will be automatically closed. This is the graphic version of the order books. You can check out what kind of Bitmex product you are using. See our introductory guide for more. Filled shows the number of contracts that have been bought. BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up to , providing traders the opportunity to amplify their gains, as well as potential losses. These 2 orders are the opposite versions of stop-limit and stop market order and used to take profit once a certain price is reached. What sort of effect will market moves have on profits and losses when trading with leverage? On the charts you can see it as a purple line with the label Bitmex price.

The former allows the user to select the amount of money in their wallet that should be used to hold their position after an order is placed. Performance is unpredictable and past performance is no guarantee of future performance. Remember that life is shades of gray, not black and white. How likely would you be to recommend finder to a friend or colleague? Order is not visible on the order books with the hidden checkbox marked. You can select from three different time in force functions on BitMex: Good Till Cancel: This is the default setup for any orders. Very Unlikely Extremely Likely. Crypto Signal Providers Altcoins Ranking. Loginfor comment. A million monkeys throwing darts at a newspaper can beat the best bitflyer add listing too many card charge attempts the best, but those damn monkeys will never beat a trader practicing good money management. If there is enough liquidity in the order book, the order is executed right away. In fact, Cross burns newbie accounts day by day. The heyday of making big money in the regular markets is .

We will explain each type of order one by one. How likely would you be to recommend finder to a friend or colleague? Even 2X leverage doubles your risk and blows it all to hell. Perpetual contracts will never expire even if your position is one year old. Filled — The stop limit order has been triggered and the orders have been filled. Stop Order Stop order, or commonly referred as stop-loss is an order through which you can instruct BitMex to buy or sell Bitcoin once the price reaches a specific price level, the stop price. By Mikhail Goryunov. BitMEX was created by a selection of finance, trading, and web-development experts. Market Order In case of placing a market order, the order is executed immediately at the current price level, which is the best available price. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Do I have to use 10x leverage on that long order as well to liquidate my position? Fill price demonstrates the price which fills your position. The last traded bid buy and ask sell prices are visible on the Buy or Sell buttons — click on one to place the order. Market orders however do not guarantee the price, the orders are executed near at the bid or ask prices.